Blood Transfusion Diagnostics Market Size and Forecast 2025 to 2034

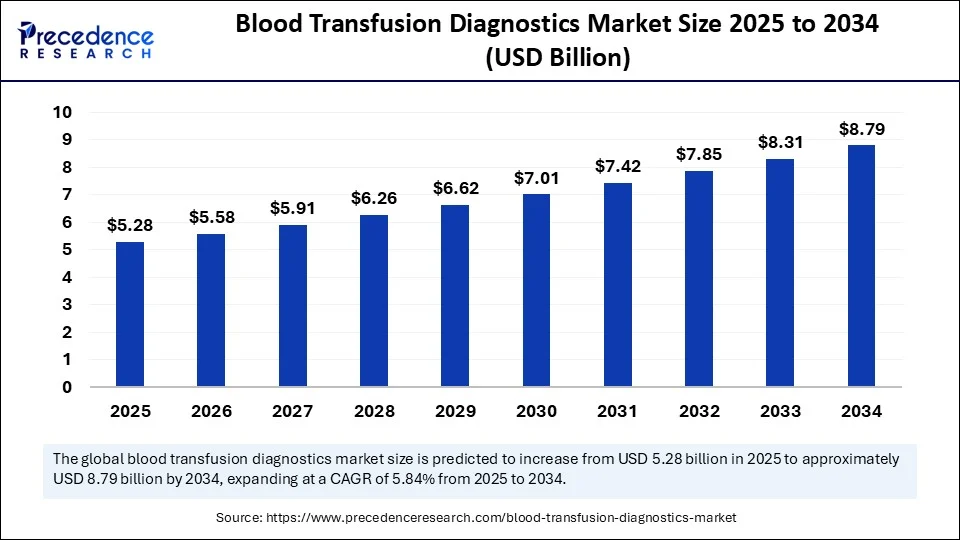

The global blood transfusion diagnostics market size accounted for USD 4.98 billion in 2024 and is predicted to increase from USD 5.28 billion in 2025 to approximately USD 8.79 billion by 2034, expanding at a CAGR of 5.84% from 2025 to 2034. The growth of the blood transfusion diagnostics market is driven by the increasing number of chronic blood disorders and more blood transfusion procedures. Improvements in high-sensitivity screening methods, such as NAT, PCR, and AI, alongside global blood safety campaigns and better healthcare infrastructure, are contributing to market expansion.

Blood Transfusion Diagnostics Market Key Takeaways

- In terms of revenue, the global blood transfusion diagnostics market was valued at USD 4.98 billion in 2024.

- It is projected to reach USD 8.79 billion by 2034.

- The market is expected to grow at a CAGR of 5.84% from 2025 to 2034.

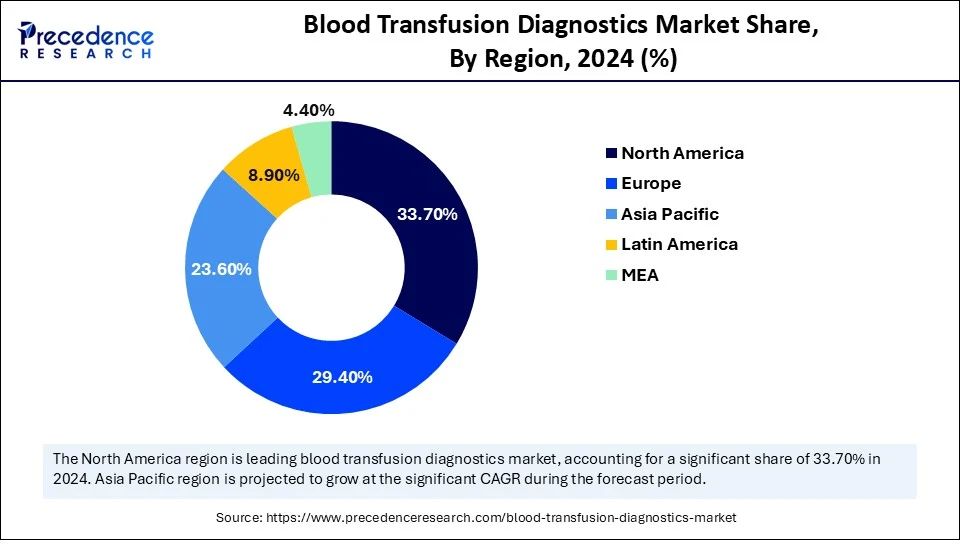

- North America dominated the blood transfusion diagnostics market with the largest market share of 33.7% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the reagents & kits segment held the biggest market share of 52.8% in 2024.

- By product type, the instruments segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By test type, the disease screening segment captured the biggest market share of 45.1% in 2024.

- By test type, the molecular testing segment is expected to expand at a notable CAGR over the projected period.

- By technology, the serology-based testing segment contributed the major market share of 48.6% in 2024.

- By technology, the molecular-based testing segment is expected to expand at the highest CAGR over the projected period.

- By end user, the hospitals segment generated the major market share of 42% in 2024.

- By end user, the plasma fractionation centers segment is expected to expand at a notable CAGR over the projected period.

How is AI Redefining Blood Transfusion Diagnostics

Artificial intelligence (AI) is greatly improving blood transfusion diagnostics through predictive modeling, quality assessment, and decision support. Integrating AI algorithms in blood transfusion diagnostics automates lab processes, speeds up test results, and reduces manual errors. AI also predicts potential risks, such as transfusion reactions, allowing for proactive intervention. In January 2025, researchers at Emory University developed an AI model trained on over 72,000 ICU patients. This model can predict transfusion needs within 24 hours with an AUROC of 0.97 and 93% accuracy.

(Source: https://www.news-medical.net)

Similarly, teams from McGill and Yale introduced a trajectory flow matching AI system at DDW 2025. This system forecasts transfusion requirements and mortality risk in acute GI bleeding patients with 93.6% accuracy, outperforming traditional models. Canadian researchers at UBC use deep learning on microfluidic-sorted red blood cell images to assess RBC deformability for better matching and storage strategies. AIDA Diagnostics offers a smart assistant tool that combines neural networks and expert systems. This tool recommends optimal transfusion volumes tailored to individual patients, reducing waste and improving outcomes. These AI innovations are creating safer, more precise, and efficient blood transfusion practices.

(Source: https://www.medscape.com)

U.S. Blood Transfusion Diagnostics Market Size and Growth 2025 to 2034

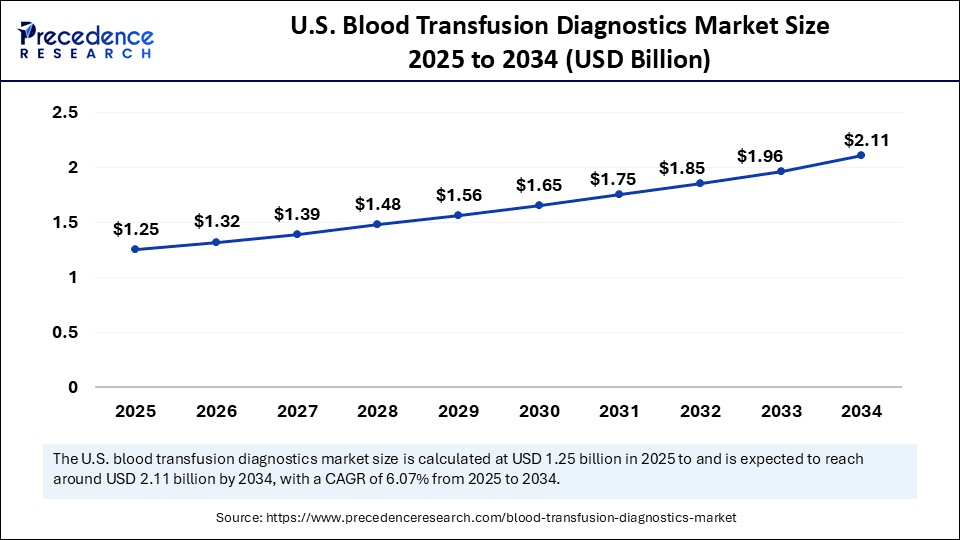

The U.S. blood transfusion diagnostics market size was exhibited at USD 1.17 billion in 2024 and is projected to be worth around USD 2.11 billion by 2034, growing at a CAGR of 6.07% from 2025 to 2034.

What Made North America the Dominant Region in the Blood Transfusion Diagnostics Market in 2024?

North America registered dominance in the market by holding a major share in 2024, thanks to its robust healthcare infrastructure, effective public health programs, and widespread use of precise testing methods such as nucleic acid testing (NAT) and chemiluminescent immunoassays. A well-established network of blood banks and diagnostic labs in the region supports large-scale and routine screening for infectious diseases and blood typing. Additionally, supportive regulations, an increase in surgical procedures, and an aging population with chronic conditions boost the region's demand for diagnostics. The presence of well-known companies and academic institutions also promotes innovation and quality assurance.

The U.S. is a major contributor to the market. This is mainly due to its extensive network of over 2,400 blood collection centers and advanced diagnostic facilities. There is a high demand for blood products. This leads to more activities in hospitals and laboratories. Furthermore, stringent FDA regulations regarding the safety of blood products and high usage of next-generation diagnostics are contributing to market growth.

(Source: https://www.ncbi.nlm.nih.gov)

Why is Asia Pacific Considered the Fastest-Growing Market for Blood Transfusion Diagnostics?

Asia Pacific is experiencing the fastest growth due to rising healthcare expenditure, increased awareness about transfusion safety, and a growing population that needs medical help. Countries in the region are using better diagnostic techniques to lower the risk of infections from transfusions and to improve blood compatibility screening. The demand for efficient transfusion services is also rising because of a significant increase in surgeries, road accidents, and chronic conditions like thalassemia and cancer. Additionally, regional efforts to promote voluntary blood donations and collaborations between countries are increasing testing capacities, especially in rural and semi-urban areas that lack resources.

India is becoming a major player in the market in Asia Pacific. This is mainly due to an increase in the number of government and private blood banks and diagnostic labs. The National Blood Transfusion Council has also launched digital tracking systems to improve donor management and ensure traceability. These advancements, along with increased investments in blood screening technologies, are helping India become a key hub for transfusion diagnostics in the region.

What Factors Contribute to the Growth of the Blood Transfusion Diagnostics Market in Europe?

Europe is expected to experience significant growth due to its strong focus on blood safety, increasing prevalence of chronic illnesses, and a growing elderly population that often needs transfusions. The region benefits from solid healthcare reimbursement policies, widespread access to modern diagnostic technologies, and an increasing demand for personalized medical procedures. Efforts by the European Blood Alliance and national health agencies are streamlining blood collection, storage, and testing practices. Rising investments in pathogen reduction technologies also enhance Europe's role in developing safe and effective transfusion diagnostics.

Germany is expected to have a stronghold on the market in Europe. This is due to its extensive network of blood donation centers and diagnostic labs. The German Red Cross, one of the largest blood service organizations in Europe, plays a key role in ensuring safe and adequate blood supplies. The country has strict quality standards for blood products. There is a high adoption of advanced nucleic acid amplification tests to detect infectious agents in donated blood quickly. Germany's focus on digitalization in healthcare, particularly in data-driven diagnostics, is speeding up its efforts to improve transfusion workflows and reduce risks related to mismatched or contaminated blood.

Market Overview

The blood transfusion diagnostics market encompasses a range of diagnostic products, instruments, and technologies used to ensure the safety, compatibility, and efficacy of blood and blood products for transfusion. It includes immunohematology testing, infectious disease screening, molecular assays, and HLA typing that are essential for identifying blood group antigens, screening for transfusion-transmissible infections (TTIs), and ensuring compatibility between donor and recipient. The market serves blood banks, hospitals, transfusion centers, and diagnostic laboratories and plays a vital role in managing safe blood supplies and minimizing transfusion-related risks.

Blood Transfusion Diagnostics Market Growth Factors

- Increase in Surgical Procedures: The growth in complex surgeries, trauma care, and organ transplants is creating a need for pre-transfusion testing. This testing helps prevent adverse reactions and ensures patient safety during procedures.

- Advancements in Diagnostic Technologies: The use of molecular typing, nucleic acid testing, and automated platforms improves detection accuracy and processing speed. This progress enhances safety and efficiency in transfusion services.

- Stringent Safety Regulations: Regulatory bodies are enforcing strict blood screening protocols to prevent transfusion-transmitted infections (TTIs). This push is leading healthcare providers to adopt better diagnostic solutions worldwide.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.79 Billion |

| Market Size in 2025 | USD 5.28 Billion |

| Market Size in 2024 | USD 4.98 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Test Type, Technology, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Blood Disorders and Transfusion Needs

A major factor driving the growth of the blood transfusion diagnostics market is the growing prevalence of chronic blood disorders, such as anemia, hemophilia, and cancer-related blood loss. This, in turn, boosts the demand for precise transfusion diagnostics. These diagnostics are essential for safe and compatible blood transfusions. For instance, the American Cancer Society projects 66,890 new leukemia cases in the U.S. for 2025, many of which require transfusions during treatment. Additionally, the UNAIDS report stated that nearly 40.8 million people globally were living with HIV in 2024, highlighting the need for thorough screening to ensure safe donor blood.(Source: https://www.cancer.org)

With the rising incidence of chronic kidney diseases, hemophilia, sickle cell, and anemia, the need for blood transfusion diagnostics is increasing. Healthcare providers are increasingly seeking sensitive diagnostic tools, such as nucleic acid testing and automated immunoassays, to confirm blood compatibility and prevent transfusion-transmitted infections. These trends emphasize the important role of effective diagnostics, including blood transfusion diagnostics, in ensuring patient safety. (Source: https://www.unaids.org)

Restraint

Regulatory Challenges and High Costs

One of the major factors hampering the growth of the blood transfusion diagnostics market is the regulatory oversight of laboratory-developed tests (LDTs) by the Food and Drug Administration (FDA). As of May 2024, the FDA started requiring many LDTs, including those used to detect infectious agents in donated blood, to meet regulatory standards. This includes premarket review, quality system compliance, and mandatory reporting of adverse events.

While these regulations aim to improve test reliability, they create a significant burden for smaller clinical and academic labs that often lack the resources to meet FDA requirements. Consequently, the launch of innovative and tailored diagnostic tools may take longer, especially for detecting new pathogens. This added complexity could limit access to faster and more accurate screening technologies in blood safety. Moreover, advanced diagnostic techniques, including blood transfusion diagnostics, are expensive, limiting access to patients, especially in low-income countries.

Opportunity

Could Expanding Pathogen Reduction Systems Transform Blood Transfusion Diagnostics?

A major opportunity for the blood transfusion diagnostics market lies in scaling pathogen reduction technologies (PRTs), especially riboflavin and UV light systems, to eliminate transfusion-transmitted infections in donated blood components. A global health review shows that PRT significantly reduces risks from HIV, HBV, HCV, Zika, dengue, and malaria, even during emerging outbreaks. In 2024, the FDA-cleared Intercept Blood System for plasma uses amotosalen and UV light to inactivate viruses like West Nile, hepatitis viruses, and HIV.

In low- and middle-income countries, combining PRT with rapid diagnostics could greatly reduce transmission events. One modeling study estimated complete elimination for HIV and significant drops for HBV and HCV. As governments and blood services worldwide focus on safer transfusion practices, broad adoption of PRT provides diagnostic manufacturers with a strong growth path. This approach improves blood safety, increases compliance, and addresses important screening gaps.

Product Type Insights

Why Did the Reagents & Kits Segment Contribute the Largest Share in the Market in 2024?

The reagents & Kits segment dominated the blood transfusion diagnostics market while holding a 52.8% share in 2024. The dominance of reagents & Kits stems from their essential role in identifying blood group antigens and checking for infections that can be passed through transfusions. Hospitals, blood banks, and diagnostic labs use these products for effective and trustworthy testing. Their ease of use, low cost, and ability to work with various testing platforms help maintain their top position in the market.

On the other hand, the instruments segment is expected to grow at the fastest CAGR during the forecast period. The rising demand for automation and high-volume testing has driven the need for instruments like immunohematology analyzers, nucleic acid amplification systems (NAT), ELISA readers, and PCR systems. These systems provide greater accuracy and faster results, making them increasingly important in large blood screening programs.

Test Type Insights

What Made Disease Screening the Dominant Segment in the Market in 2024?

The disease screening segment dominated the blood transfusion diagnostics market in 2024. This is mainly due to the growing focus on preventing the spread of infectious diseases like HIV, hepatitis B and C, and syphilis through blood transfusions. Regulatory guidelines and required screening protocols have increased the demand for disease screening tests in hospitals and blood banks.

Meanwhile, the molecular testing segment is likely to experience the fastest growth in the coming years. This is mainly due to its high sensitivity and accuracy in finding viral genomes and bacterial DNA, even in the early stages. The increasing use of nucleic acid testing (NAT) technologies in transfusion medicine is driving this segment's growth. The increasing demand for personalized treatment plans further boosts the demand for molecular testing. This testing enables the identification of genetic mutations and antibiotic resistance, improving patient outcomes by enabling targeted interventions.

Technology Insights

How Does the Serology-Based Testing Segment Dominate the Blood Transfusion Diagnostics Market in 2024?

The serology-based testing segment dominated the market, holding the largest share in 2024. The dominance of serology-based testing stems from its high usage in detecting blood group antigens, antibodies, and infectious diseases. The low cost, simplicity, and proven effectiveness of this technology continue to encourage its use in blood banks and diagnostic labs around the world.

The molecular-based testing segment is expected to grow at the fastest CAGR during the forecast period. This is primarily due to its high sensitivity and accuracy in spotting transfusion-transmissible infections, even in the early stages. As the need for safe and accurate blood screening rises, particularly in developed healthcare systems, molecular diagnostics are gaining traction thanks to improvements in PCR and nucleic acid testing technologies.

End User Insights

Why Did the Hospitals Segment Dominate the Market in 2024?

The hospitals segment dominated the blood transfusion diagnostics market, holding the largest share in 2024. This is due to their essential role in conducting pre-transfusion tests, screening for diseases, and assessing compatibility for various medical procedures, including surgeries, trauma care, and cancer treatments. Their market leadership is further supported by the presence of in-house diagnostic labs and an increase in patient volumes undergoing diagnostic procedures. Rising government funding for improving healthcare facilities further bolsters segmental growth.

The plasma fractionation centers segment is expected to expand at the fastest CAGR during the forecast period. The growth of the segment is driven by the rising demand for plasma-derived therapies and biologics, which need thorough testing for infectious agents. As the global need for immunoglobulins, clotting factors, and albumin increases, these centers are expanding their testing capabilities and adopting new diagnostic technologies.

Blood Transfusion Diagnostics Market Companies

- Grifols, S.A.

- Ortho Clinical Diagnostics

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Siemens Healthineers AG

- Immucor, Inc.

- Thermo Fisher Scientific Inc.

- Quotient Limited

- Danaher Corporation (Beckman Coulter)

- Becton, Dickinson and Company (BD)

- HemoCue AB

- BioMérieux SA

- DiaSorin S.p.A.

- Sysmex Corporation

- Bag Health Care GmbH

- Fresenius Kabi AG

- Gen-Probe Incorporated (Hologic)

- Agena Bioscience, Inc.

- Tulip Diagnostics (P) Ltd.

Recent Developments

- In February 2025, HC1 and Accumen launched next-generation Clinical Excellence Solutions to optimize blood use and diagnostics. The platform uses AI and lab insights to improve transfusion decision-making, enhance patient outcomes, and help hospitals reduce unnecessary blood usage.

(Source: https://www.businesswire.com) - In October 2024 Terumo Blood and Cell Technologies began the U.S. rollout of Reveos, an automated blood processing system. It allows for efficient separation of blood components, cutting down on manual steps and improving diagnostic accuracy for transfusion services in clinical laboratories and blood centers.

(Source: https://healthcaredealflow.com)

Segments Covered in the Report

By Product Type

- Instruments

- Immunohematology Analyzers

- Nucleic Acid Amplification Systems (NAT)

- Microarray Platforms

- ELISA Readers

- PCR Systems

- Others

- Reagents & Kits

- ABO/Rh Typing Reagents

- Antibody Screening Reagents

- NAT Reagents

- HLA Typing Kits

- ELISA Kits

- Others

- Software & Services

- Blood Bank Management Software

- Laboratory Information Systems (LIS)

- Testing Services

- Others

By Test Type

- Blood Group Typing

- ABO Typing

- Rh Typing

- Antibody Screening

- Disease Screening

- HIV

- Hepatitis B & C

- Syphilis

- Malaria

- Other

- Molecular Testing

- NAT (Nucleic Acid Testing)

- Genotyping & HLA Typing

- Pathogen Inactivation Detection

- Crossmatching & Compatibility Testing

- Major Crossmatch

- Minor Crossmatch

By Technology

- Serology-based Testing

- Molecular-based Testing

- Microarray

- Next-generation Sequencing (NGS)

- Enzyme-linked Immunosorbent Assay (ELISA)

- Rapid Diagnostics

- Others

By End User

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Plasma Fractionation Centers

- Academic & Research Institutes

Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting