Brazil Industrial Absorbent Market Size and Forecast 2025 to 2034

The Brazil industrial absorbent market size was estimated at USD 156.14 billion in 2024 and is predicted to increase from USD 164.52 billion in 2025 to approximately USD 279.47 billion by 2034, expanding at a CAGR of 6.10% from 2025 to 2034. Brazil's industrial absorbent market is driven by the increased consciousness regarding environmental laws and the necessity of efficient spill control measures.

What is the Role of AI in the Brazil Industrial Absorbent Market?

Artificial intelligence (AI) based systems are transforming the industrial absorbent by improving productivity efficiency, material design, and quality control. AI can be used to improve scalability, long term integrity, synthesis and development, and effectiveness of fiber technology as a pharmaceutical delivery system.

The benefits of artificial intelligence include improves personalization in user experiences, increases efficiencies and automation, works 24/7 without fatigue, improves decision making, automation, reduction in human error, accelerates research and development, fast and accurate infinite availability, reduce repetitive tasks, and reduce human error. It also includes benefits like predictive analytics, medical advances, innovation, improved monitoring, improved business efficiency, cost savings, quality control, and product development.

Brazil Industrial Absorbent Market Key Takeaways

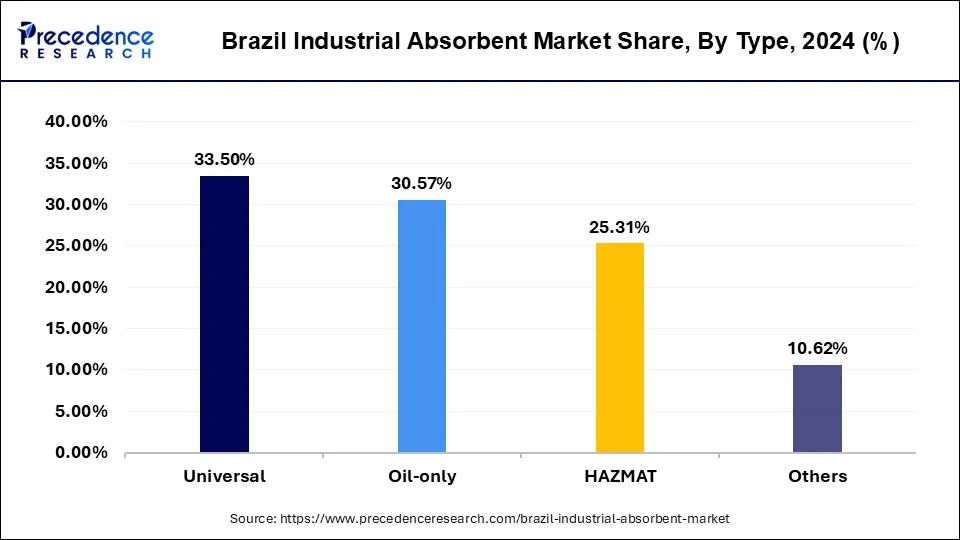

- By type, the universal segment dominated the market with the largest revenue share of 33.50% in 2024.

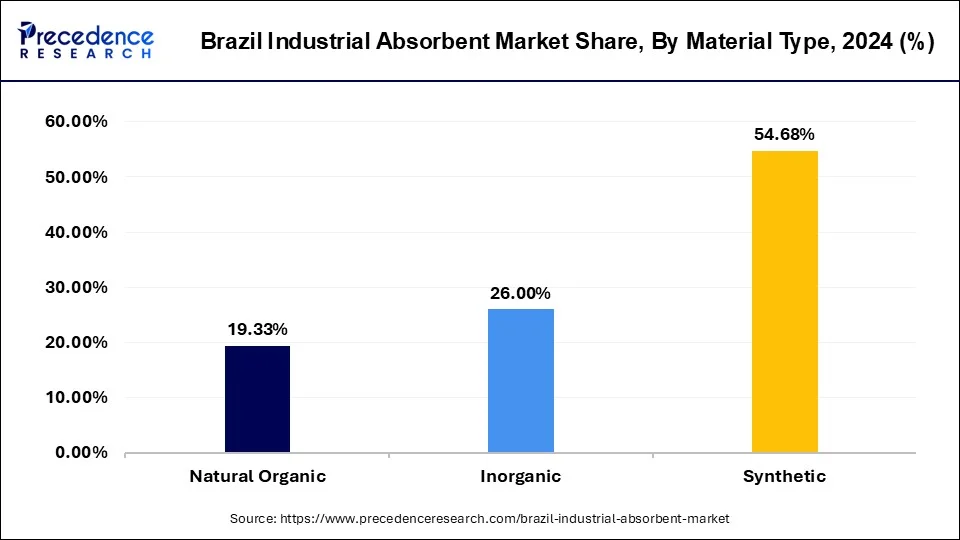

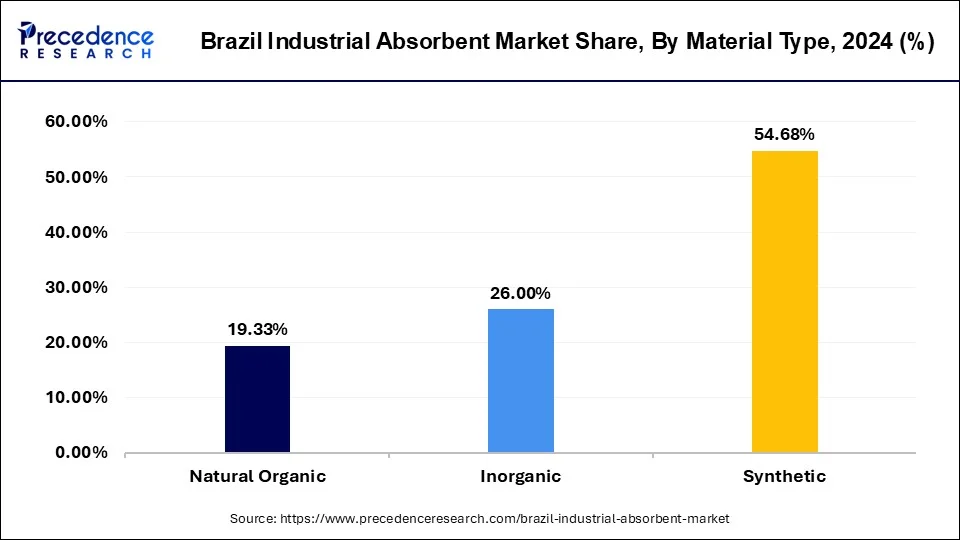

- By material type, the synthetic segment held the largest revenue share of 54.68% in 2024.

- By product type, the rolls segment has generated the biggest revenue share of 39.09% in 2024.

- By end-user, the oil and gas segment has contributed a major revenue share of 32.15% in 2024.

Market Overview

Brazil's industrial absorbent market is the industry that produces, distributes, and uses materials intended to absorb liquids, especially in industrial settings. In various sectors, including manufacturing, oil and gas, automotive, and chemical processing, these absorbents are essential for handling spills, leaks, and other fluid-related problems. A setting that is safe to work in requires absorbents. By rapidly absorbing spilled liquids, they help to avoid slips, trips, and falls, which lowers the risk of accidents and injuries in industrial facilities.

In industrial environments, spills and leaks are unavoidable, but the costs associated with cleanup, repair, and possible fines from the authorities can be high. By reducing the extent and impact of accidents, investing in high-quality absorbents helps offset these costs and ultimately results in long-term.

Brazil Industrial Absorbent Market Growth Factors

- Stricter environmental laws governing the handling of dangerous materials and spills.

- Worker safety in industrial environments is receiving more attention.

- Growing consciousness of the effects of spills and leaks on the environment.

- Demand for sustainable and environmentally friendly absorbent materials.

- Expansion in essential sectors such as petrochemicals, manufacturing, oil and gas, and automobiles.

- Industrial absorbents play a significant role in spill response and compliance for these sectors.

- Creation of very effective absorbents that are both reusable and have excellent absorbency.

- The goal of manufacturers is to provide comprehensive solutions for a range of industrial needs.

Market Scope

| Report Coverage | Details |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.10% |

| Market Size in 2024 | USD 156.14 Billion |

| Market Size in 2025 | USD 164.52 Billion |

| Market Size by 2034 | USD 279.47 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material Type, Product Type, and End-user |

Market Dynamics

Driver

Growing awareness about environmental conservation

Brazil, known for its abundant natural riches and incredible biodiversity, is experiencing growing strain from industrialization on its fragile ecosystems. Consequently, there is a greater need for sustainable practices in industrial sectors due to increased government restrictions and social expectations. The detrimental impacts of industrial accidents and leaks on the environment are becoming more widely recognized. Contamination incidents involving chemicals, oil, or other dangerous materials have highlighted the need for efficient containment and cleanup techniques. Such accidents have far-reaching effects on human health and the economy, posing immediate hazards to nearby ecosystems and species.

Apart from adhering to regulations, stakeholders and customers are examining businesses' environmental performance more closely, which affects investment and purchase decisions. In Brazil's competitive industrial landscape, organizations prioritizing ecological conservation and responsible resource management are better positioned to garner support and investment.

Restraint

Lack of awareness about the importance of using industrial absorbents

Industry stakeholders do not fully understand the importance of industrial absorbents. Many businesses, especially those in the petrochemical, automotive, and manufacturing sectors, might not be completely aware of the dangers that could arise from spills, leaks, or other dangerous situations inside their buildings. As a result, the significance of using efficient absorbents to reduce these dangers is still disregarded or undervalued.

Ingrained traditions and cultural considerations within sectors may also hamper the use of industrial absorbents. Conventional perspectives on environmental stewardship and risk management may prioritize immediate financial savings over long-term sustainability and safety precautions. This kind of thinking can stifle attempts to encourage the use of absorbent solutions and breed aversion to change, even in cases where the advantages are amply apparent.

Opportunity

Innovations in absorbent materials technology

Technological advancements in absorbent materials offer substantial potential for Brazil's industrial absorbent industry. The market includes several sectors, including manufacturing, oil & gas, chemicals, healthcare, and automobiles. These industries frequently deal with spills, leaks, and other liquid waste types that need effective and efficient absorption solutions to reduce environmental risks, guarantee worker safety, and adhere to legal requirements.

The high surface area-to-volume ratio and increased porosity of nanomaterials, such as nanoparticles and nanofibers, improve absorbent materials' absorption capacity and efficiency. These materials are useful for various industrial applications because they can efficiently absorb different liquids, such as oils, chemicals, and solvents. Crosslinked polymers, known as superabsorbent polymers (SAPs), can absorb and hold significant amounts of liquid about their mass. New developments in SAP technology have produced superabsorbent polymers with improved swelling capabilities, absorption kinetics, and leaching resistance. These materials are used in many industries, such as environmental remediation, hygiene goods, and agriculture.

Type Insights

The universal segment

- In January 2023, Universal Absorbent Pads, an extraordinary solution designed to meet diverse cleaning and absorption needs across industries and households, was introduced by Samridhhi Creation, a trailblazer in innovative products.

Samridhi Crreation - Universal Absorbent Pads: A Revolution in Cleanliness and Efficiency

The oil-only segment

- In February 2022, an agreement with the Gas Monkey brand for the launch of the Sustainable Hemp Hurd Spill Absorbent Product Line was announced by Generation Hemp.

Brazil Industrial Absorbent Market Revenue, By Type 2022-2024 (USD Billion)

| Type | 2022 | 2023 | 2024 |

| Universal | 47.76 | 49.90 | 52.31 |

| Oil-only | 43.32 | 45.40 | 47.74 |

| HAZMAT | 35.71 | 37.51 | 39.51 |

| Others | 15.19 | 15.84 | 16.58 |

Material Type Insights

The synthetic segment

The inorganic segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- In April 2022, a new hemp-based line for period care products was launched by Rif Care. This adds another body and an Earth-friendly option to the growing natural hygiene market.

Rif Care Launches Hemp-Based Period Products | Nonwovens Industry

The inorganic segment held the second largest share of 26% in the Brazil industrial absorbent market in 2024. In comparison to organic options, inorganic absorbents frequently provide a more affordable solution for spill treatment. Because of its effective absorption capabilities, spills may be cleaned up with less product, lowering companies' cleanup expenses. Because of their affordability, they are the go-to option for businesses looking to improve their spill management procedures without sacrificing effectiveness. Because inorganic absorbents usually have a longer shelf life than their organic equivalents, firms can store them in anticipation of future usage without worrying about spoiling or degradation. This feature makes them more appealing to businesses operating in distant areas with potentially limited supply access or sporadic spill management requirements.

Brazil Industrial Absorbent Market Revenue, By Material Type 2022-2024 (USD Billion)

| Material Type | 2022 | 2023 | 2024 |

| Natural Organic | 27.41 | 28.72 | 30.18 |

| Inorganic | 37.13 | 38.76 | 40.59 |

| Synthetic | 77.43 | 81.17 | 85.37 |

Product Type Insights

The rolls segment

The pads segment

- In April 2023, the launch of the new PetroPad Smart Polymer Spill Pad was announced by Justrite, a global leader in industrial safety products.

Brazil Industrial Absorbent Market Revenue, By Product Type, 2022-2024 (USD Billion)

| Product Type | 2022 | 2023 | 2024 |

| Pads | 46.84 | 49.07 | 51.57 |

| Rolls | 55.26 | 57.98 | 61.03 |

| Pillows | 27.31 | 28.57 | 29.98 |

| Granules | 12.56 | 13.03 | 13.55 |

End-user Insights

The oil and gas segment

The chemicals segment is anticipated to grow with the highest CAGR in the market during the studied years.

- In July 2025, the first private diaper brand in the world to be awarded a Utility patent for its 100% Totally Chlorine Free (TCF) Absorbent Core, a breakthrough that sets a new global standard in diaper safety, transparency, and innovation, was reported by Malaysian baby wellness brand Applecrumby.

Applecrumby Launches Chlorine-Free Diaper | Nonwovens Industry

Brazil Industrial Absorbent Market Revenue, By End-user, 2022-2024 (USD Billion)

| End-User | 2022 | 2023 | 2024 |

| Chemical | 40.45 | 42.38 | 44.55 |

| Oil and Gas | 45.43 | 47.68 | 50.19 |

| Food Processing | 29.44 | 30.79 | 32.30 |

| Others | 26.65 | 27.81 | 29.10 |

Country Insights

The need for industrial absorbents has surged due to Brazil's expanding manufacturing, automotive, petrochemical, and mining sectors. Absorbents are necessary in these industries to control oil, chemical, and other hazardous material spills and leaks and maintain worker safety and environmental compliance. More people are choosing environmentally friendly absorbents produced from renewable resources as ecological sustainability becomes a concern. In line with sustainable practices, Brazilian businesses are funding R&D to create absorbents made of natural fibers, recyclable materials, and biodegradable polymers.

Brazil Industrial Absorbent Market Companies

- Pilão Industrial

- Absorbentex

- EcoAbsorb

- Absorventes Brasil

Recent Developments

- In October 2024, a hybrid-style diaper in Brazil was introduced by Kimberly-Clark. The product includes a reusable diaper in adjustable sizes from small to extra-large, made from 100% washable fabric, and also a disposable absorbent pad.

Kimberly-Clark Introduces Hybrid Style Diaper In Brazil | Nonwovens Industry - In May 2025, Industrial Absorbent Solutions (IAS), a service provider based in Lancaster, was acquired by ITU AbsorbTech Inc., a provider of launderable, reusable oil absorbents under the SorbIts Brand.

ITU AbsorbTech acquires IAS to expand in South Carolina - GSA Business Report

Segments Covered in the Report

By Type

- Universal

- Oil-only

- Hazmat

- Others

By Material Type

- Natural Organic

- Inorganic

- Synthetic

By Product Type

- Pads

- Rolls

- Pillows

- Granules

By End-user

- Chemicals

- Oil and Gas

- Food Processing

- Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content