Bulk Explosives Market Size and Forecast 2025 to 2034

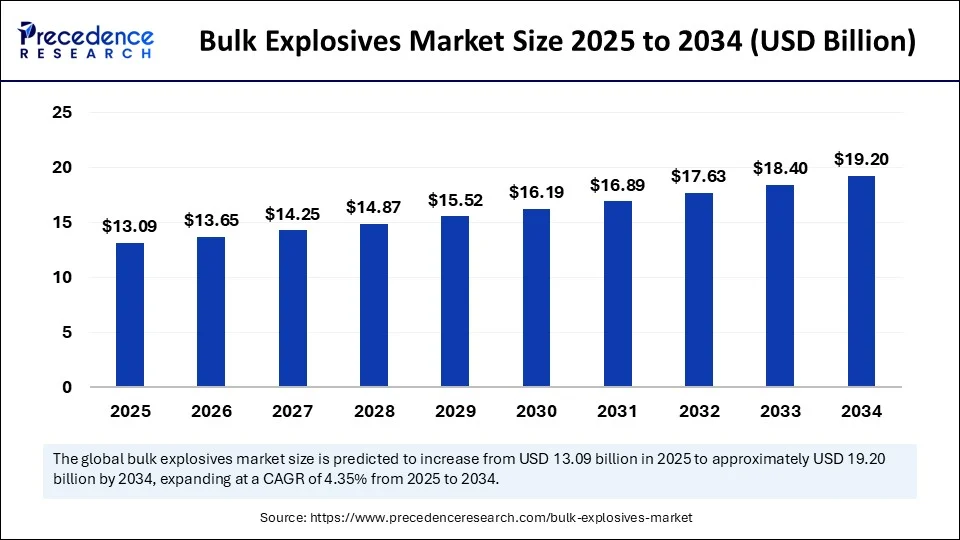

The global bulk explosives market size was estimated at USD 12.54 billion in 2024 and is predicted to increase from USD 13.09 billion in 2025 to approximately USD 19.20 billion by 2034, expanding at a CAGR of 4.35% from 2025 to 2034. The market is growing due to increasing mining and infrastructure development activities worldwide.

Bulk Explosives Market Key Takeaways

- In terms of revenue, the global bulk explosives market was valued at USD 12.54 billion in 2024.

- It is projected to reach USD 19.20 billion by 2034.

- The market is expected to grow at a CAGR of 4.35% from 2025 to 2034.

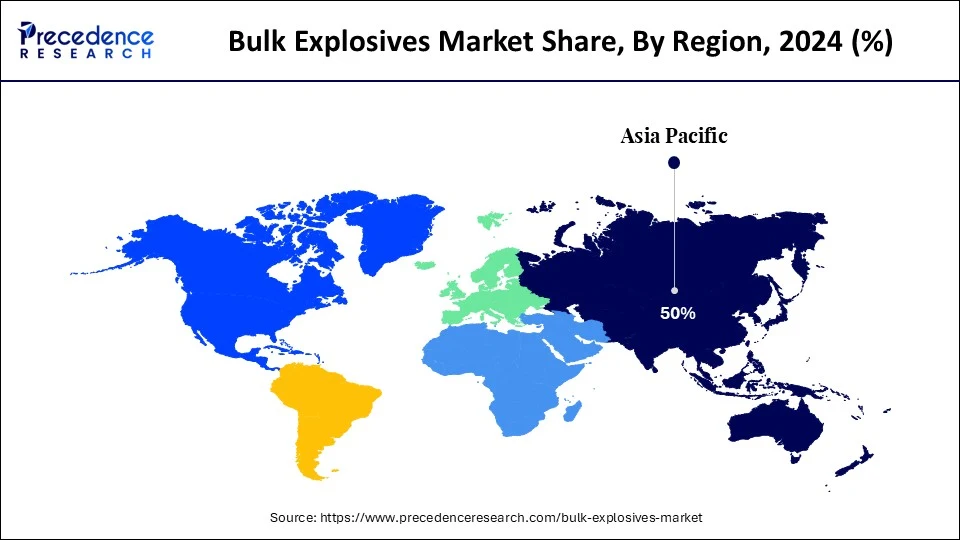

- Asia Pacific dominated the market with the largest market share of 50% in 2024.

- Africa & Latin America are expected to grow at the fastest rate during the forecast period.

- By product type, ammonium nitrate fuel oil (ANFO) held the biggest share of the market at 45% in 2024.

- By product type, the emulsion explosives are expected to grow at the fastest rate during the forecast period.

- By application, the mining segment captured the highest share at 55% in 2024.

- By application, the construction & infrastructure segment is projected to grow at the fastest CAGR in the bulk explosives market.

- By end-user industry, the mining & minerals coal segment contributed the highest market share of 40% in 2024.

- By end-user industry, the metal mining (copper, gold) segment is emerging as the fastest-growing.

- By delivery method, bulk trucks/MMUs held the major share at 60% in 2024.

- By delivery method, the on-site mixing systems segment is expected to grow at the fastest rate during the forecast period.

How Is AI Improving Blast Design Optimization in the Bulk Explosives Industry?

By analyzing enormous datasets such as geological surveys, drill hole data, and historical blast performance AI AI-powered systems are transforming blast design optimization and in turn the bulk explosives market. Algorithms using machine learning can forecast the results of rock fragmentation and suggest the best timing, charge distribution, and blast patterns. Mining and construction firms can achieve consistent fragmentation, increase the efficiency of the downstream processing, and reduce the use of excess explosives with this data-driven approach. Predictive models powered by AI can also replicate different blast scenarios, enabling engineers to select the most economical and secure course of action before implementation.

Artificial Intelligencein blast design offers substantial safety and sustainability advantages beyond technical optimization. AI helps minimize fly rock incidents, vibration levels, and dust emissions by precisely predicting the impact of a blast, guaranteeing adherence to environmental regulations. In addition to reducing labor costs and human error, automated analysis speeds up the design process. Additionally AI AI-driven blast planning reduces resource waste, which lowers the carbon footprint and operating costs. In addition to improving operational performance, these developments help the sector transition to safer, more environmentally friendly, and more effective blasting techniques.

Asia Pacific Bulk Explosives Market Size and Growth 2025 to 2034

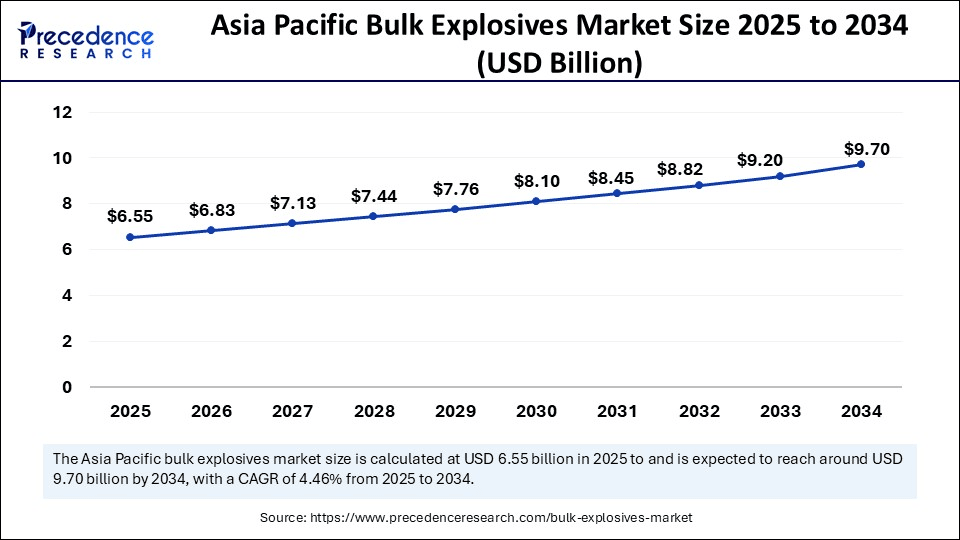

The Asia Pacific bulk explosives market size is exhibited at USD 6.55 billion in 2025 and is projected to be worth around USD 9.70 billion by 2034, growing at a CAGR of 4.46% from 2025 to 2034.

Asia Pacific is dominating the market, bolstered by its extensive mining industry, growing investments in mineral exploration, and massive infrastructure projects. The regions' plentiful coal, iron ore, and other mineral reserves, along with supportive government regulations for resource extraction, have contributed to the long-term demand for bulk explosives.

Africa & Latin America are growing rapidly, driven by the growth of metal mining projects, rising foreign direct investments, and unexplored mineral resources. These areas are drawing international players due to growing copper, gold, and rare earth exploration as well as supportive mining laws. The use of bulk explosives is further increased by the construction of infrastructure to support mining logistics.

Market Overview

How Are Sustainability Trends and Eco-Friendly Product Innovations Shaping the Bulk Explosives Market?

A move toward formulations and technologies that reduce environmental impact while preserving performance is being driven by sustainability trends and eco-friendly product innovations, which are reshaping the bulk explosives market. To meet the sustainability goals of mining and construction companies and adhere to stricter environmental regulations, manufacturers are increasingly creating water-based emulsions, low-toxicity chemicals, and reduced-fume products. In environmentally sensitive areas, controlled blasting methods are becoming more popular because they reduce vibration and dust emissions. Furthermore, advancements in delivery technologies like on-site mixing and precision charging minimize waste and maximize explosive use, which further reduces the carbon footprint. Along with improving brand reputation and regulatory compliance, these green initiatives also create new opportunities for projects that prioritize environmental stewardship.

The bulk explosives market covers large-scale explosive materials supplied in bulk form for use in mining, quarrying, tunnelling, and construction blasting operations. Unlike packaged explosives, bulk explosives are delivered directly to the blasting site and loaded into boreholes using specialized trucks or bulk delivery systems. Common types include ammonium nitrate–based explosives (ANFO), emulsions, slurries, and blends, designed for high energy output, controlled detonation, and cost efficiency. The market is driven by demand from the mining, infrastructure development, and quarrying industries.

Bulk Explosives Market Growth Factors

- Rising demand from mining and quarrying due to increasing consumption of minerals and aggregates.

- Expansion of infrastructure and construction projects, especially in developing economies.

- Growing coal mining activities for power generation and cement production.

- Advancements in bulk explosives delivery systems, such as on-site mixing and mobile manufacturing units.

- Adoption of automated blasting systems and AI-driven optimization for improved efficiency and safety.

- Favorable government policies and increased private investment in mining.

- Rising demand for controlled blasting techniques to reduce environmental impact.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 19.20 Billion |

| Market Size in 2025 | USD 13.09 Billion |

| Market Size in 2024 | USD 12.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.35% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Africa & Latin America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-User Industry, Delivery Method, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expanding Infrastructure Development

For large-scale projects like metro rail networks, bridges, and highways, extensive blasting is necessary for excavation and tunneling. The precise fragmentation provided by bulk explosives eliminates the need for secondary breaking and lowers construction costs overall. Demand in the bulk explosives market is anticipated to remain high due to the drive for upgraded connectivity and modernized infrastructure. More contractors are turning to bulk explosives as a result of quicker project completion times brought about by effective blasting. In civil engineering projects, the application of sophisticated blasting designs is also raising safety and speed requirements.

Technological Advancements in Delivery Systems

Explosives handling is becoming safer and more effective thanks to innovations like automated loading equipment, mobile manufacturing units, and real-time monitoring systems. By allowing for on-site formulation customization, these systems reduce waste and enhance blast quality. Improved delivery technology further increases end users' cost effectiveness by reducing labor needs and operational downtime. Explosives can be placed precisely thanks to the integration of GPS and data analytics in delivery systems, which improves blast control and lowers operational risks.

Restraints

Stringent Environmental Regulations

The bulk explosives market must adhere to stringent environmental regulations, particularly those about noise pollution, vibration control, and dust emissions. As businesses invest in safer and cleaner blasting methods, these regulations frequently result in increased operating costs. Non-compliance with environmental regulations may lead to project setback fines or shutdown. Moreover, compliance necessitates ongoing reporting and monitoring, which raises administrative workloads. Profitability for producers and suppliers is further impacted by the additional expense of creating environmentally friendly explosives.

High Operational and Transportation Risks

Bulk explosives pose serious safety risks during handling, storage, and transportation due to their hazardous nature. For businesses, strict safety regulations and training requirements raise operating costs. Serious injuries, property damage, and damage to one's reputation can arise from any handling or transport mishap. High insurance premiums for operations involving explosives further increase the financial strain. Project timelines and supply chains may be affected by delays resulting from safety inspections or accident investigations.

Opportunities

Rising Demand for Controlled and Eco-Friendly Explosives

Bulk explosives with reduced vibration, dust, and emissions are becoming increasingly popular as environmental concerns grow. A quickly growing market is available to producers creating environmentally friendly formulations such as water-based emulsions and low-toxicity substances. Customers seeking sustainability certifications are drawn to eco-friendly solutions because they not only adhere to stringent regulations but also offer benefits such as reduced energy consumption and lower carbon footprint. This change also enables businesses to take part in more projects in areas that are sensitive to the environment.

Expansion of Mining Activities in Untapped Reserves

The discovery and development of new mineral deposits presents significant growth opportunities. Large-scale blasting is frequently needed to develop untapped reserves, which results in high explosive consumption. Businesses will be more likely to land contracts for these projects if they have sophisticated bulk delivery systems and a solid operational safety record. Establishing alliances with mining companies early in the planning process can also guarantee long-term supply contracts.

Product Type Insights

Why Did the ANFO Segment Dominate the Bulk Explosives Market in 2024?

ANFO segment dominated the bulk explosives market in 2024 because of its high detonation velocity, affordability, and ease of manufacturing, making it ideal for extensive blasting operations. There is a well-established worldwide supply chain and simple on-site preparation techniques that support its extensive use in mining and quarrying. ANFO is a popular option for bulk applications due to its versatility in a range of geological conditions and its comparatively low sensitivity, which guarantees steady demand from both established and emerging mining sectors.

The emulsion explosives segment is expected to grow at the fastest rate during the forecast period, motivated by their enhanced safety profile, high energy output, and superior water resistance in comparison to conventional products. The fact that they can remain stable in wet boreholes makes them especially appropriate for intricate blasting conditions like underground and underwater mining. Emulsions that provide better handling qualities and less fume generation are being pushed toward industries by stricter safety and environmental regulations.

Application Insights

Why Did the Mining-Surface Mining Segment Dominate the Market?

Mining-surface mining segment dominated the bulk explosives market in 2024 due to its large-scale consumption of blasting agents in operations such as coal mining, iron ore extraction, and quarrying. The sector's reliance on high-volume, continuous blasting has sustained strong demand for bulk explosives, with many operators employing advanced delivery systems to optimize fragmentation and minimize operational downtime. The ongoing expansion of open-pit mines in resource-rich regions further cements surface mining as the primary application segment.

Construction & infrastructure are the fastest-growing, bolstered by extensive infrastructure projects, tunneling operations, and global urbanization. The demand for controlled blasting methods that use precisely engineered bulk explosives is rising due to governments' increased spending on metro rail systems, road networks, and hydropower dams. The adoption rate in this market is also being accelerated by the move toward safer, more effective blasting solutions in densely populated areas.

End User Industry Insights

Why Did the Mining & Minerals Coating Segment Dominate the Market in 2024?

The mining & minerals segment is dominating the market because bulk explosives are essential to the processes of rock fragmentation and ore extraction. High production volumes, long-term mining contracts, and investments in automated blasting and drilling processes guarantee steady demand in this sector. The industry's growing mining of ferrous and non-ferrous minerals supports its leading position in the market.

The metal mining (copper, gold) segment is anticipated to grow at the highest CAGR due to rising global demand for copper in renewable energy infrastructure and gold, as both are fueling exploration and production activities. Increased capital flows into new mining projects and expansions, especially in Africa and South America, are creating strong growth prospects for bulk explosives in this niche.

Delivery Method Insights

Why Did the Bulk Trucks/MMUs Segment Dominate the Market in 2024?

The bulk trucks / MMUs segment dominated the market by providing effective explosives mixing, transportation, and charging on-site. By facilitating direct delivery into boreholes, these systems lower handling risks, increase safety, and boost blasting efficiency. Because they can manage high-volume demands with consistent quality, they are widely used in large-scale mining operations.

On-site mixing systems are growing rapidly because they make it possible to create customized, flexible explosive formulations that can be adjusted to different rock types. These systems reduce the dangers of pre-made explosives being transported and help ensure that strict safety rules are followed. Their increased use is being driven by the growing need for cost control and precision blasting in difficult or remote mining locations.

Bulk Explosives Market Companies

- Orica

- MAXAM

- AEL

- IPL (Dyno Nobel)

- ENAEX

- Sasol

- Yunnan Civil Explosive

- Solar Explosives

- Gezhouba Explosive

- EPC Groupe

- Anhui Jiangnan

- Poly Permanent Union Holding Group

- Nanling Civil Explosive

- BME Mining

- NOF Corporation

- IDEAL

- Sichuan Yahua

- AUSTIN

- Kailong Chemical

Recent Developments

- On 1 April 2025, Dyno Nobel unveiled what it believes is the world's first electric bulk explosive mobile processing unit (MPU) (the DYNOBULK Electric MPU). It features a 390 kWh lithium-polymer battery, regenerative braking, and fast-charging (650 kWh) via renewable energy. The unit is currently being trialed to enhance sustainability, reduce emissions, and improve health and safety in blasting operations.(Source: https://www.dynonobel.com)

- On 8 August 2025, Times of India (Nagpur) reported that explosives exporters from Vidarbha remain largely unaffected by recent U.S. tariff hikes, thanks to continued strong global demand for military-grade materials like RDX, HMX, and TNT. In FY 2024-25, Vidarbha exported approximately ₹130 crore worth of prepared explosives to the U.S. This resilience underscores the sector's robustness amid shifting trade policies.(Source: https://timesofindia.indiatimes.com)

Segments Covered in the Report

By Product Type

- Ammonium Nitrate Fuel Oil (ANFO)

- Emulsion Explosives

- Slurry Explosives

- Heavy ANFO & Blends

By Application

- Mining

- Surface Mining

- Underground Mining

- Quarrying

- Construction & Infrastructure

- Road Construction

- Tunneling & Dams

- Oil & Gas Exploration

By End-User Industry

- Mining & Minerals

- Coal Mining

- Metal Mining (Iron, Copper, Gold, etc.)

- Construction & Infrastructure

- Quarry Operators

- Oil & Gas Industry

By Delivery Method

- Bulk Trucks / Mobile Manufacturing Units (MMUs)

- On-Site Mixing Systems

- Pre-Mixed Bulk Supply

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting