What is the Calcineurin Inhibitors Market Size?

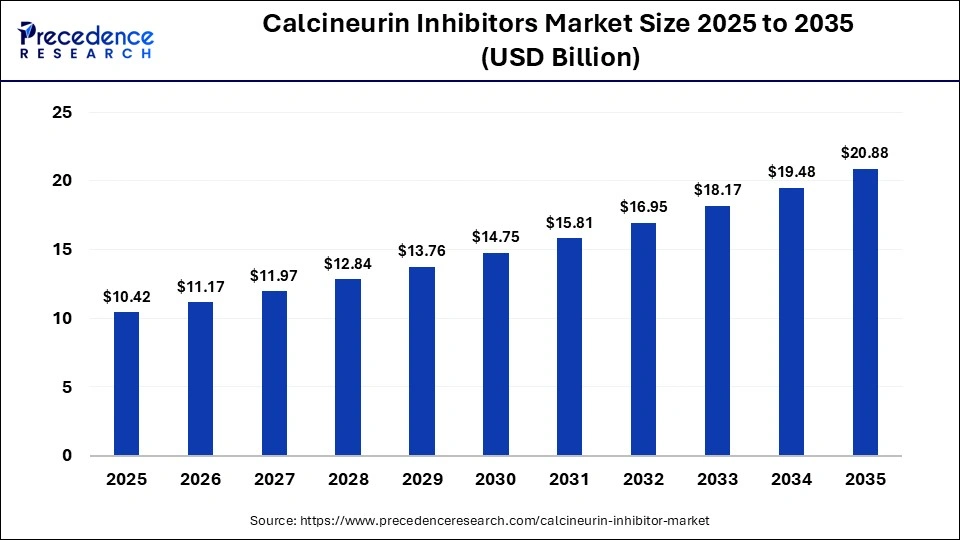

The global calcineurin inhibitors market size was calculated at USD 10.42 billion in 2025 and is predicted to increase from USD 11.17 billion in 2026 to approximately USD 20.88 billion by 2035, expanding at a CAGR of 7.20% from 2026 to 2035.The market growth is attributed to rising organ transplant procedures, increasing prevalence of autoimmune disorders, and expanding adoption of long-term immunosuppressive therapies.

Market Highlights

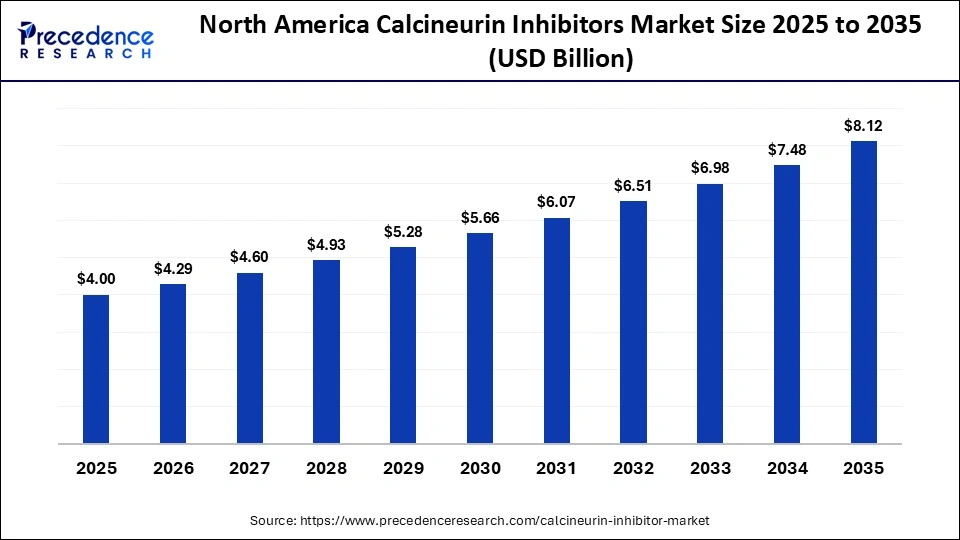

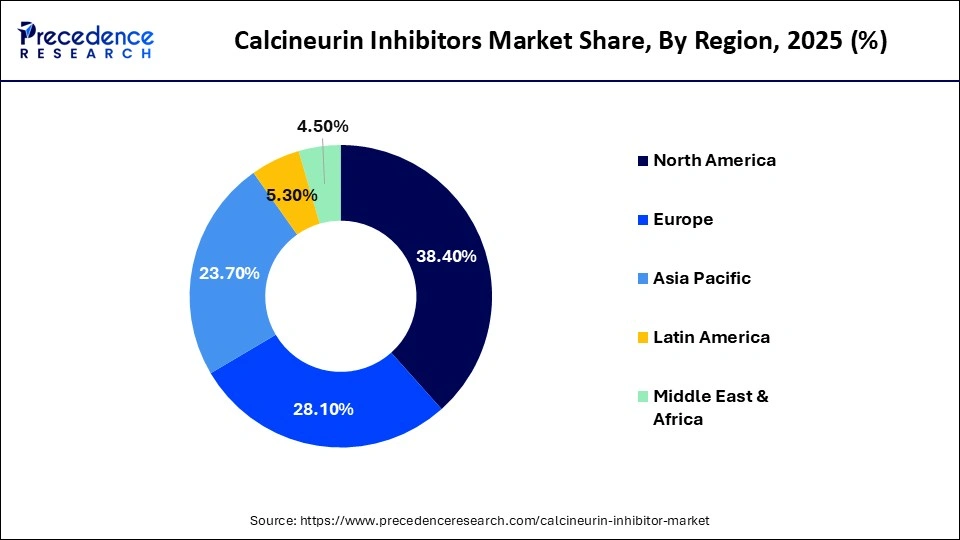

- North America dominated the market with 38.4% of the market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 7.6% between 2026 and 2035.

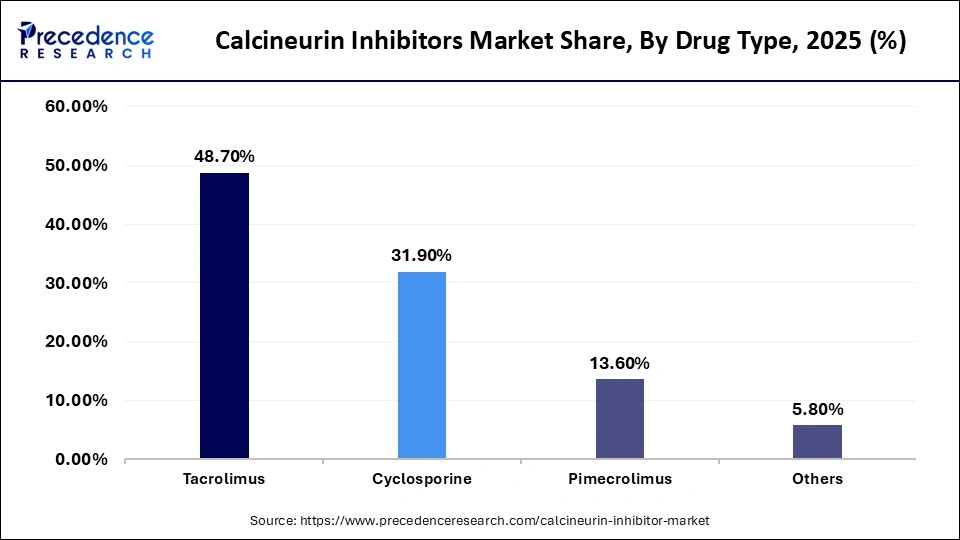

- By drug type, the tacrolimus segment contributed the highest market share of 48.7% in 2025.

- By drug type, the pimecrolimus segment is growing at a strong CAGR of 7.2% between 2026 and 2035.

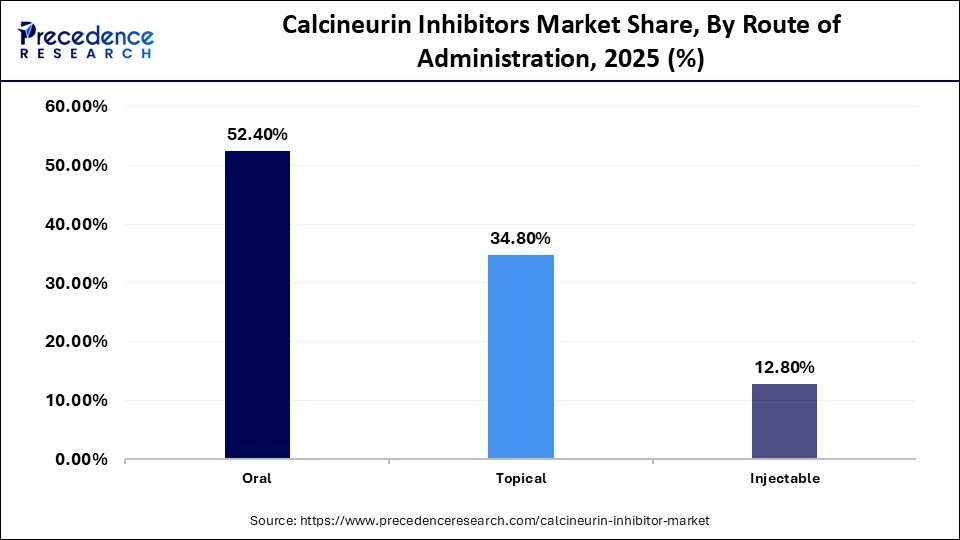

- By route of administration, the oral segment held a major market share of 52.4% in 2025.

- By route of administration, the topical segment is expected to expand at a notable CAGR of 7.4% from 2026 to 2035.

- By application, the organ transplantation segment captured the highest market share of 46.3% in 2025.

- By application, the atopic dermatitis segment is poised to grow at a healthy CAGR of 7.9% between 2026 and 2035.

- By distribution channel, the hospital pharmacies segment generated the biggest market share of 49.6% in 2025.

- By distribution channel, the online pharmacies segment is expanding at the fastest CAGR of 8.9% between 2026 and 2035.

- By end user, the hospitals segment accounted for the largest market share of 55.8% in 2025.

- By end user, the homecare settings segment is projected to grow at a solid CAGR of 7.5% between 2026 and 2035.

Market Overview

The calcineurin inhibitors market is being strongly propelled by a continued increase in global organ transplant procedures. The Global Observatory on Donation and Transplantation (GODT) 2026 report demonstrated that over 173,000 solid organ transplants take place across the globe every year. In such procedures, cornerstone immunosuppressants would be calcineurin inhibitors that include tacrolimus and cyclosporine.

They help to avoid graft rejection as they inhibit the activation of T-cells that depend on calcineurin and prevent the development of an immune response. Furthermore, the market for calcineurin inhibitors remains on a robust growth trajectory, supported by ongoing transplant needs and rising autoimmune disease burdens as key long-term drivers of both clinical demand and technology adoption.

Impact of Artificial Intelligence on the Calcineurin Inhibitors Market

The calcineurin inhibitors market is being actively changed by AI that enhances the efficacy of drug development, clinical decision-making, and long-term care of patients. With the help of AI-based molecular simulation tools, companies are able to design next-generation tacrolimus and voclosporin analogs that have greater selectivity and lower nephrotoxicity. Machine learning systems are used to predict interactions in calcineurin pathways by analyzing large biochemical datasets to help scientists reduce the preclinical timeline.

Artificial Intelligence on the Calcineurin Inhibitors MarketGrowth Factors

- Growing Adoption of Generic Formulations: Expanding availability of cost-competitive tacrolimus and cyclosporine generics is boosting treatment accessibility across developing healthcare systems.

- Rising Investment in Immunology Research Pipelines: Increasing clinical development activity in transplant immunology and autoimmune modulation is fuelling broader therapeutic integration.

- Boosting Digital Health Integration in Chronic Care: Growing use of remote monitoring and adherence tracking platforms is driving sustained long-term therapy management.

Market Trends

- Rise of Outpatient Transplant Management Models:Healthcare systems are shifting stable post-transplant care from inpatient to structured outpatient programs to reduce hospitalization costs. The mobile therapeutic drug monitoring clinics assist this model by means of providing frequent monitoring of tacrolimus levels at the community locations. This shift increases patient opportunities and enhances adherence to immunosuppressive therapy.

- Integration of Digital Therapy Support Platforms:Increasing use of adherence and symptom-tracking applications that are specific to long-term immunosuppressive therapy is expected. These platforms are connected to the pharmacy refill data and lab results, which alert the clinicians about the risk of non-adherence. Improved digital support promotes the long-term outcome in chronic transplant and autoimmune cohorts.

- Clinical Expansion and Rising Transplant: Activity Strengthening Demand in the Calcineurin Inhibitors MarketAccording to the Global Observatory on Donation and Transplantation (GODT) 2024 report, there were 111135 kidney transplants performed globally in 2023, reflecting continued year-on-year growth in renal transplant activity that drives tacrolimus use in maintenance immunosuppression.

- Aurinia Pharmaceuticals reported total LUPKYNIS (voclosporin) net product revenue of $210.4 million in FY2023, reflecting continued prescription growth in the U.S. lupus nephritis population. This revenue growth directly supports expanding commercial penetration of calcineurin inhibitors in the lupus nephritis treatment market.

- Approximately 1.7 million people globally live with systemic lupus erythematosus (SLE), with up to 40% developing lupus nephritis, according to major rheumatology and nephrology clinical data. This high progression rate sustains long-term demand potential for targeted calcineurin inhibitor therapies in LN management.

- Mayo Clinic reported a record 2,065 transplants in 2025, exceeding its 2,006 procedures in 2024. Such ultra-high annual transplant volumes at a single center directly translate into sustained institutional demand for calcineurin inhibitors as lifelong maintenance immunosuppressive therapy.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.42 Billion |

| Market Size in 2026 | USD 11.17 Billion |

| Market Size by 2035 | USD 20.88 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Type, Route of Administration, Application, Distribution Channel, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Drug Type Insights

Why Did Tacrolimus Capture the Largest Share of the Calcineurin Inhibitors Market?

Tacrolimus segment dominated the calcineurin inhibitors market in 2025, accounting for an estimated 48.7% market share. Due to the established clinical preference for tacrolimus in solid organ transplantation. Organ Procurement and Transplantation Network noted that over 48,000 organ transplants were conducted in the U.S. in 2024, a steady increase in the maintenance immunosuppressive need. Furthermore, continued innovation in bioequivalent and modified-release versions is expected to fuel the market in this segment.

The pimecrolimus segment is expected to grow at the fastest rate/fastest CAGR in the coming years, owing to the rising prevalence of inflammatory skin disorders and increasing dermatology consultations globally. Additionally, the rising paediatric dermatology cases are estimated to further strengthen the segment's growth in the coming years.

Route of Administration Insights

Why Does the Oral Route Dominate the Calcineurin Inhibitors Market?

Oral route segment held the largest revenue share in the calcineurin inhibitors market in 2025, accounting for 52.4% of market share, due to its long-term maintenance needs after an organ transplantation. The oral variations in long-acting forms increase compliance and decrease the dose rate burden. These operational and clinical benefits are propelling the oral segment during the forecast period.

Topical segment is expected to grow at the fastest rate in the coming years, owing to the increasing diagnosis of inflammatory skin conditions and demand for steroid-sparing dermatology therapies. Topical tacrolimus and pimecrolimus are widely used by dermatologists in the management of atopic dermatitis, especially in paediatric and facial dermatitis. The use of non-steroidal immunomodulation helps in long-term management without the atrophy of the skin that is linked with corticosteroids.

Application Insights

Why Does Organ Transplantation Remain the Core Application Driving the Calcineurin Inhibitors Market?

Organ transplantation segment dominated the calcineurin inhibitors market in 2025, which held a market share of about 46.3%, due to the increasing number of solid organ transplant procedures in the world. Kidney and liver transplants are the most frequent types of procedures, and both need lifelong maintenance immunosuppression using calcineurin. Furthermore, the Expanding transplant infrastructure in Asia-Pacific and Latin America is likely to enlarge the treated population base, thus creating demand for calcineurin inhibitors.

Atopic dermatitis segment is expected to grow at the fastest rate in the coming years, owing to the rising incidence of chronic inflammatory skin conditions and the growing popularity of steroid-sparing treatment. Urbanization, exposure to pollution, and lifestyle modification are estimated to lead to an increase in inflammatory skin conditions in emerging markets. Additionally, the Dermatology consultations have increased in recent years, strengthening diagnosis rates and treatment adoption, thus facilitating the segment growth.

Distribution Channel Insights

Why Do Hospital Pharmacies Command the Largest Share in the Calcineurin Inhibitors Market?

Hospital pharmacies segment held the largest revenue share in the calcineurin inhibitors market in 2025, accounting for 49.6% market share, due to the critical need for controlled dispensing and therapeutic drug monitoring in transplant and severe autoimmune patients. Moreover, the high inpatient procedure volumes and post-operative follow-ups continue to drive repeat hospital dispensing. These structural clinical workflows are expected to keep hospital pharmacies at the forefront of distribution.

Online pharmacies segment is expected to grow at the fastest CAGR in the coming years, owing to the expansion of digital health platforms and growing patient preference for home-based medicine delivery. Furthermore, the structural shift in healthcare access models is projected to elevate online pharmacies as the leading growth engine within the distribution channel segment.

End User Insight

Why Do Hospitals Continue to Anchor Demand in the Calcineurin Inhibitors Market?

Hospital segment dominated the calcineurin inhibitors market in 2025, accounting for an estimated 48.7% market share, due to the high concentration of transplant surgeries and complex autoimmune case management within tertiary care institutions. Moreover, the Ongoing investment in specialty care infrastructure is likely to consolidate hospital-based therapy management. These coordinated clinical systems position hospitals as the primary end-user segment.

The homecare segment is expected to grow at the fastest CAGR in the coming years, owing to the rising shift toward outpatient transplant follow-up and chronic dermatology management. The stable transplant patients are moving progressively towards home-based maintenance therapy following the high-risk phase. Additionally, the growth of home care is also due to chronic immunosuppressive therapy needs long-term follow-up treatment as opposed to close inpatient management.

Regional Insights

How Big is the North America Calcineurin Inhibitors Market Size?

The North America calcineurin inhibitors market size is estimated at USD 4.00 billion in 2025 and is projected to reach approximately USD 8.12 billion by 2035, with a 7.34% CAGR from 2026 to 2035.

How Does North America Dominate the Calcineurin Inhibitors Market Landscape?

North America led the calcineurin inhibitors market, capturing the largest revenue share in 2025, accounting for an estimated 38.4% market share. Due to its established transplant ecosystem and strong autoimmune treatment infrastructure.

In the U.S. alone, the United Network for Organ Sharing documented over 46,000 organ transplants in 2023. High transplant volumes directly sustain long-term tacrolimus and cyclosporine utilization. Furthermore, the aging population and growing chronic kidney disease rates are likely to increase the eligibility for transplantations and the permanent need for immunosuppressive therapy.

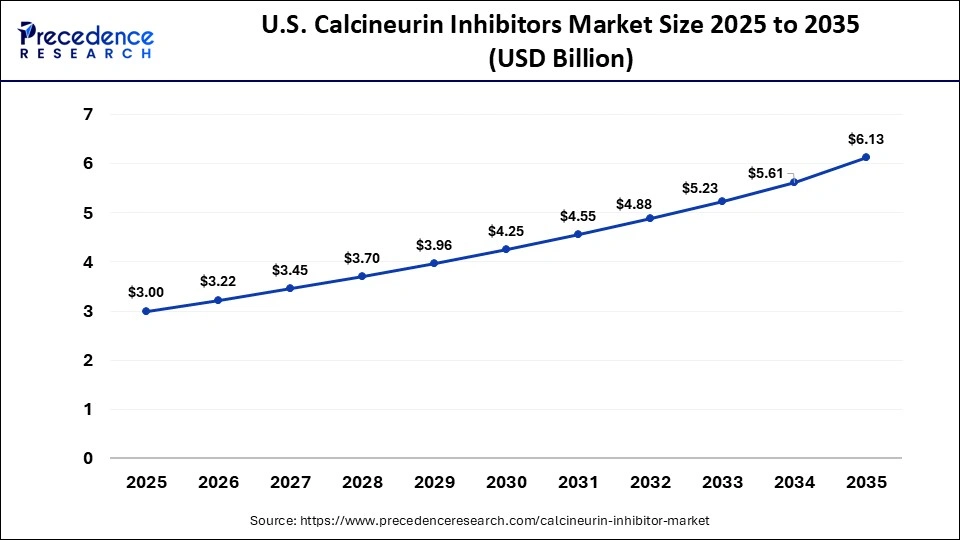

What is the Size of the U.S. Calcineurin Inhibitors Market?

The U.S. calcineurin inhibitors market size is calculated at USD 3.00 billion in 2025 and is expected to reach nearly USD 6.13 billion in 2035, accelerating at a strong CAGR of 7.41% between 2026 and 2035.

U.S.: Leading National Contributor in North America

U.S. leads the market in North America owing to the high number of solid organ transplants and well-developed immunosuppressive care facilities. The United Network for Organ Sharing stated that in recent years, tens of thousands of transplants were being carried out in the U.S., which supports the long-term demand of systemic tacrolimus and cyclosporine regimens. Additionally, the Dermatology specialists in the U.S. also document rising outpatient prescriptions for topical tacrolimus in chronic inflammatory skin conditions, which expands usage beyond transplant settings.

Is Asia Pacific Emerging as the Fastest-Growing Regional Force in the Calcineurin Inhibitors Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the increased kidney and liver transplant activity in China, India, South Korea, and Japan. Governments are heavily investing in tertiary care hospitals and nephrology, which elevates the use of systemic calcineurin inhibitors. Additionally, the Local pharmaceutical companies like Sun Pharma, Dr. Reddy, Lupin, and Astellas Pharma enhance local production of generic and branded tacrolimus. This enhances the affordability of treatment and facilitates the market growth in this region.

China – Fastest-Growing National Market in Asia Pacific

China is leading the charge in the Asia Pacific market, due to rapid healthcare infrastructure development and a growing surgical transplant ecosystem. The Chinese Medical Association and affiliated transplant societies endorse tacrolimus-based immunosuppression as a foundational post-transplant regimen, consistent with global clinical practice guidelines. Expanding tertiary care networks and nephrology services have increased the number of patients receiving structured therapeutic monitoring and long-term calcineurin inhibitor therapy.

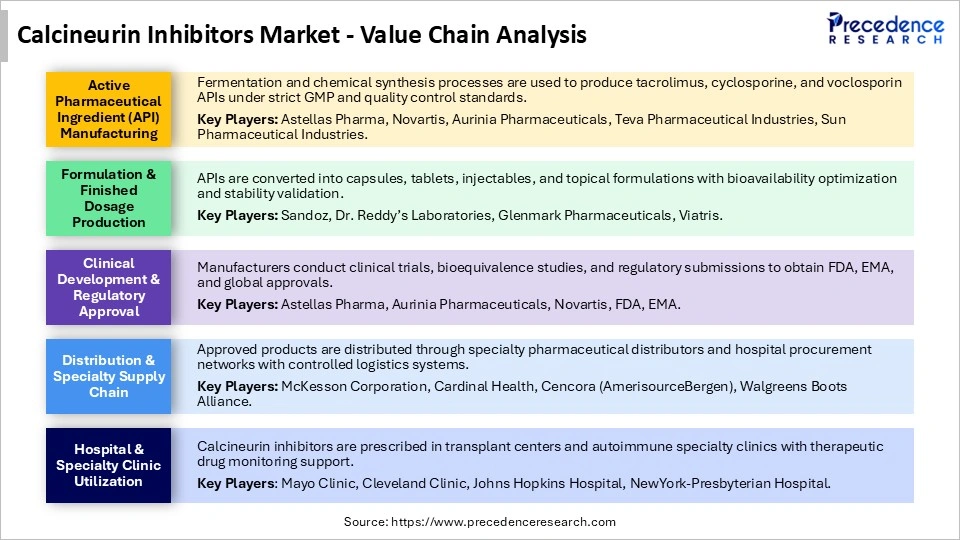

Calcineurin Inhibitors Market Value Chain Analysis

Who are the Major Players in the Global Calcineurin Inhibitors Market?

The major players in the calcineurin inhibitors market include AbbVie Inc., Astellas Pharma Inc., Dr. Reddy's Laboratories Ltd., Fresenius Kabi AG, GlaxoSmithKline plc, Mylan N.V. (Viatris Inc.), Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd.

Recent Development

- In January 2026, after reporting positive COAST 1 results (NCT06130566) in September 2025, additional global Phase 3 trials — SHORE (NCT06224348) and COAST 2 (NCT06181435)- further strengthened the clinical profile of amlitelimab for moderate-to-severe atopic dermatitis in patients aged 12 years and older. Amlitelimab, a fully human monoclonal antibody targeting OX40-ligand (OX40L) without depleting T cells, demonstrated consistent efficacy and maintained a favorable safety and tolerability profile aligned with earlier findings. (Source: https://www.sanofi.com)

- In April 2025, LifeMine Therapeutics initiated dosing in a first-in-human Phase 1 clinical trial of LIFE-001, a novel calcineurin inhibitor developed using digital genomic discovery technology sourced from fungi. The study is assessing safety, tolerability, pharmacokinetics, and T-cell suppression activity as groundwork for potential applications in immune-mediated disorders and transplant rejection. Preclinical data indicate that LIFE-001 may offer improved safety and administration convenience compared to traditional calcineurin inhibitors, while demonstrating strong efficacy in validated models of inflammatory bowel disease.(Source: https://www.galderma.com)

Segments covered in the report:

By Drug Type

- Cyclosporine

- Tacrolimus

- Pimecrolimus

- Others

By Route of Administration

- Oral

- Topical

- Injectable

By Application

- Organ Transplantation

- Atopic Dermatitis

- Autoimmune Disorders

- Other Inflammatory Skin Conditions

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End User

- Hospitals

- Specialty Clinics

- Homecare Settings

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting