What is the Carbon Credit Market Size?

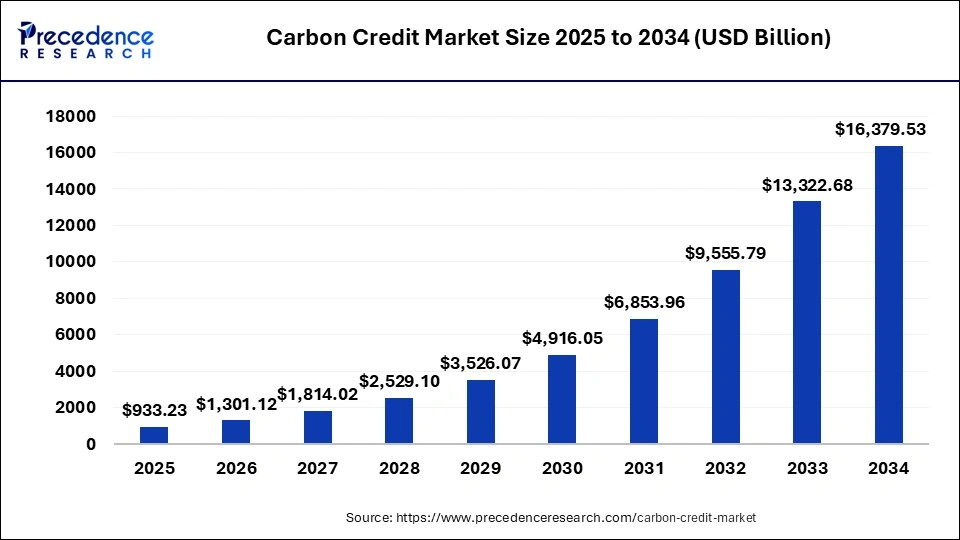

The global carbon credit market size was estimated at USD 933.23 billion in 2025 and is predicted to increase from USD 1,301.12 billion in 2026 to approximately USD 16,379.53 billion by 2034, expanding at a CAGR of 37.68% from 2025 to 2034. Awareness about reduction of greenhouse gas emissions by major player along with governments stringent policies and regulations to trade the carbon credit are the major driving factor of the market on a wider scale.

Carbon Credit Market Key Takeaways

- Europe has held a largest revenue share in 2025.

- North America is anticipated to witness the fastest growth with increasing CAGR in the region during foreseeable period.

- By type, the compliance segment has contributed more than 98% of revenue share in 2025.

- By project type, the avoidance\reduction segment has generated more than 67% of revenue share in 2025.

- By end use, the power segment has held the a major revenue share of 32% in 2025.

Market Overview

A carbon credit market is a system where, carbon credit can be sold or bought by organizations or individuals. These both are able to use their carbon credit to compensate for their greenhouse gas emission with the help of entities that are in the market to reduce carbon footprints by various natural-based techniques and technological innovations. One tonne of carbon dioxide or the same amount of various greenhouse gases is equivalent to one tradable carbon credit. When this credit is once used to avoid emissions then it becomes an offset which is no longer tradable thereafter.

Due to their efficiency, the importance and demand for carbon credit has been raised during past recent years. This demand has risen owing to the reasons such as government regulations and updating in policies to reduce greenhouse gas emission. Companies that are major sources to producing a greenhouse gas as a byproduct may need to purchase these carbon credits to sustain their existence in the global market and become responsible for reducing their carbon emission. For instance, the Indian government has granted a bill in 2022 for energy conservation which has clears the path for strengthening the carbon credits market in the Asian region.

Carbon Credit Market Growth Factors

- Increasing inclination towards nature-based solution like reforestation.

- Emergency to protect biodiversity for balanced climate cycle.

- Governments initiatives to reduce carbon footprints.

- Technological advancement in data analytics and blockchain to achieve traceability and transparency in carbon trading.

- Cabon pricing techniques like cap-and-trade systems fuelling the market growth globally.

- Companies' strict regulations to associate with compliance by authorities.

- Company's alliances to develop carbon vanishing programs and raising fund for it.

- Multifaceted approach of projects such as preservation of forestry and land use projects to avoid carbon absorption.

- The combination of voluntary programmes and state level programs aimed at reducing carbon footprints by giant techs.

- Recognition of rapidly changing climatic conditions due to the emission of GHG and its further side effects, underscores the importance of carbon credit.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 933.23 Billion |

| Market Size in 2026 | USD 1,301.12 Billion |

| Market Size by 2034 | USD 16,379.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 37.68% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Project Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Government policies

The significant key driver of the carbon credit market is governments regulations to reduce the carbon footprints by major firms impacting on overall environmental system all along. Recently, a fresh report card is released by intergovernmental panel on climate change which shows how world progress is forwarding towards carbon emission. To combat this challenge many government authorities came forward and established an ETS- emissions trading systems. In this case, if polluters have exceeded a pollution limit, then they must-have to buy a permit which is available to sale.

The intent behind this was, if cost of greenhouse emission would be higher enough then companies will invest less in such capitals which need to produce carbon dioxide, monoxide as a byproduct after combustion in industrial practises. For instance, energy conservation bill has been permitted by the Indian government in 2022 which further helps in establishment of carbon credit market.

Furthermore, the dynamics of the carbon credit market can be influence by voluntary markets and state level programmes like cap-and-trade programmes which set a limit on overall carbon emission allowed within state which aids in mitigating the hazardous emissions by industrial processes. For instance, a cap-and-trade program known as, RGGI- regional greenhouse gas initiative is implemented by nine northeastern states of the US.

Restraint

Volatile prices

One of the major restraints for the carbon credit market is volatility of the prices offered to buy and sold the carbon credits due to the fluctuations in the market in the context of demand and supply along with political status in the particular country. An everchanging dynamics of the market could led the carbon credit market at stake due to sudden changes in the transactions for carbon credits. Such a changes creates barrier for companies to plan and implements their action plan to reduce carbon emission as a responsibility.

Although, growing concerns about climate changes and its significant impacts have stirred the marketers and they have started realizing the importance of reducing their carbon footprints from environment, still it becomes challenging to ensure the profitability of carbon credits and its financial benefits to the companies due to the volatility of the market globally.

Opportunity

Carbon credit with blockchain

The major opportunity for the acceleration of carbon credit market is trading record of carbon credit by using highly advanced technological systems such as blockchain. Despite of innumerable benefits of carbon credits, its necessary to uphold the standard of integrity and transparency while trading it, hence blockchain technology will be future opportunity to expand the carbon credit market as it helps achieve such a transparency while keeping every record of trading including a minute detail which in turn helps eliminating the fraudulent activities by creating immutable or unchangeable records with the help of data analytics too. Hence, blockchain and data analytics are the technologies that holds potential to augments the carbon credit market's growth globally while creating job opportunities as well in the domain of data analytics.

Furthermore, the increasing inclination towards nature-based solutions such as reforestation, afforestation including sustainable land management programs are gaining popularity as they provide assurance towards preservation of biodiversity and healthy environment while capturing the excessive carbon emission automatically without any technological giant structure to mitigate the adverse climatic conditions on the earth.

Type Insights

The compliance segment registered the largest market share in 2025 in the carbon credit market globally. Based on type of credit, the market is segmented into voluntary and compliance. The compliance of carbon credit market means organizations that are governed by or falls under any kind of government of particular authority are mandatorily needed to offset or compensate their carbon emission by purchasing carbon credits which is measurement of total reduction of greenhouse gases by that organization.

To reduce the GHG – greenhouse gases governments around the world are bound to implement policies and various rules to fight against climatic conditions. Hence, by purchasing a carbon credit, companies can gain incentives with low carbon technologies and projects. Companies can reduce taxes on carbons and other extra expenses around it further fuelling the markets growth globally due to the increasing demand for compliance credit.

Project Type Insights

The avoidance\reduction segment accounted for the largest market share in 2025 and thus, dominated the carbon credit market globally. Removal or avoidance project refer to the system where renewable energy sources are used to reduce the GHG. This includes offset by renewable energy projects and techniques to capture methane gas. For instance, to generate a carbon credit by using natural base solutions such as, conservation forest project by protecting that area to avoid emission. Another example would be wind farm to avoid the emissions which will be produced by using coal-fired powered project. Thus, such remaining credits can be sold to other enterprises who wants to compensate their emissions.

End-use Insights

The power segment estimated as the dominating segment in the carbon credit market in 2025. The power sector is significant emitter, hence, uses lesser emission of GHG technologies so that to adopt with carbon reducing projects and schemes. By end use, market is again separated into energy, power, aviation, buildings, transportation, industrial and others. Carbon offset is technique to reduce greenhouse gases emissions. Carbon offset allows organizations to fund the emission reduction projects out there, so that to compensate their own emission. While energy sector can incorporate with projects based on methane element or wind and solar projects. Furthermore, in the industrial sector, carbon emission can be reduced by improving energy efficiency and implementing the technology which is clearer and carbon capturing as well.

- For instance, by upgrading the production processes to use clean energy steel manufacturing companies are able to reduce their GHG emission on a larger scale. If such emissions can meet certain standards, then the respective organization can earn carbon credit which in turn can be sold by organization into the market independently which will again benefit the organization.

Regional Insights

Europe has accounted for the largest share in the carbon credit market in 2025. The regional market is depending upon EU's European trading system ETS as it is considered as the largest carbon market across the globe. The ETS has solely covered more than 11,000 installations in the power as well as industrial market within 31 European countries under it. These installations have the responsibility for 45% of the greenhouse gas emission across the European regions.

The price of these carbon credits by the ETS in EU can be decided on the basis of current statement for supply and demand, therefore it is volatile in nature and easily fluctuates due to the changes in the global market such as economic status of country, climate regulations and policies and overall energy prices like price of fossil fuels and low carbon technology advancement.

While North America is anticipated to witness the fastest growth with increasing CAGR in the region during foreseeable period. North American governments have also participated in the mitigation of greenhouse gas emission due to the rising awareness about cleaner environment and its possible benefits. Though, carbon credit in the north American region is also subject to the fluctuations happening right now in the dynamics of market like price of fuels, total supply and demand ratio and governments regulations including rapidly changing technological advancements in the context of GHG reduction. Additionally, to encourage the overall development of cleaner technologies and to strengthen the root of renewable energy sources, the establishment of California cap-and-trade system helps prominently in the carbon credit market for North American region.

- In November 2024, EKI Energy Services Ltd. (EKIESL), a global leader in carbon credit development and sustainability services, announced a new partnership with U.S.-based FBO Resource Group, Inc., also known as Aviation Resource Group International (ARGI). This partnership aims to expand EKI's carbon credits trading and sustainability services across North America, with a particular focus on the aviation sector.

To boost India's green hydrogen exports and encourage energy-intensive sectors to adopt the emerging fuel, the Centre has introduced a certification scheme under the National Green Hydrogen Mission and notified rules for claiming emission offsets under the Carbon Credit Trading Scheme (CCTS). In April 2025, the Union Minister of New and Renewable Energy launched the green hydrogen certification scheme of India (GHCI). He also states that the scheme is a foundational step towards creating a robust framework for certifying green hydrogen production and ensuring transparency, traceability, and market credibility.

Carbon Credit Market Companies

- 3Degrees Group, Inc.

- Carbon Care Asia Ltd.

- CarbonBetter

- ClearSky Climate Solutions

- EKI Energy Services Limited

- Finite Carbon

- NativeEnergy

- South Pole Group

- Torrent Power Limited

- WGL Holdings Inc.

Recent Developments

- In April 2025, PRESPL (Punjab Renewable Energy Systems Private Limited), APChemi Private Limited have partnered with Intellecap to set up Biochar India Private Limited (BiocharIND), with a view to being India's largest biochar-based carbon credit platform, which will sequester CO2, increase soil carbon, benefit farmers through improved soil health, increased crop yield, and remunerative prospects through biomass utilisation, mitigating open field agriculture residues burning.

- In March 2025, Singapore signed an agreement with Bhutan for carbon credits cooperation. The agreement sets out the framework for the transfer of carbon credits generated from climate mitigation projects in Bhutan to Singapore. The agreement aims for a greener and more sustainable future for both nations.

- In April 2025, the French Minister for Ecological Transition, Biodiversity, Forests, the Sea, and Fisheries, Agnès Pannier-Runacher, unveiled a new charter for Paris-aligned and high-integrity use of carbon credits. France accounted for 12.4% of the EU's total greenhouse gas (GHG) emissions.

- In October 2023, blue carbon a Dubai-based company made a partnership with Zimbabwe for a joint business which will be impactful in preserving a clean environment with the help of carbon credit partnership. It serves as a testament to the rising recognition as a powerful tool to mitigate the carbon footprint which influence the climate change for betterment of economy and overall resilience of ecological system.

- In October 2023, a strategic agreement was established by Abu Dhabi bank with Masdar and blue carbon to provide carbon credits which will in turn boost the trading of emission in the UAE.by taking this responsibility to facilitate the trading of emissions permits, the UAE is developing strong foundation to address climate change on a global scale.

Segments Covered in the Report

By Type

- Compliance

- Voluntary

By Project Type

- Avoidance / Reduction Projects

- Removal / Sequestration Projects

- Nature-based

- Technology-based

By End-use

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content