What is the Low Carbon Building Market Size?

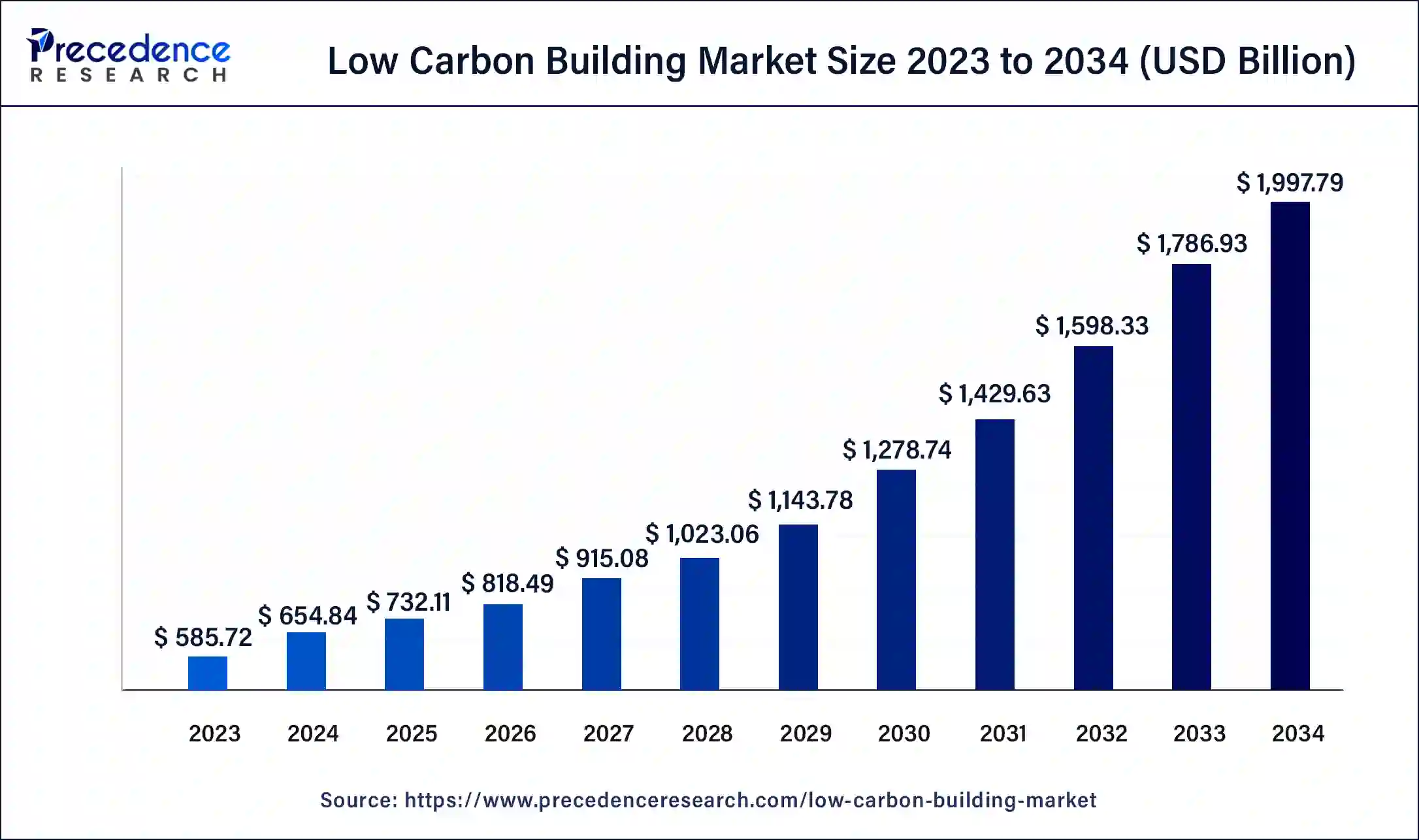

The global low carbon building market size is accounted at USD 732.11 billion in 2025 and predicted to increase from USD 818.49 billion in 2026 to approximately USD 2,208.65 billion by 2035, representing a CAGR of 11.67% from 2026 to 2035.

Market Highlights

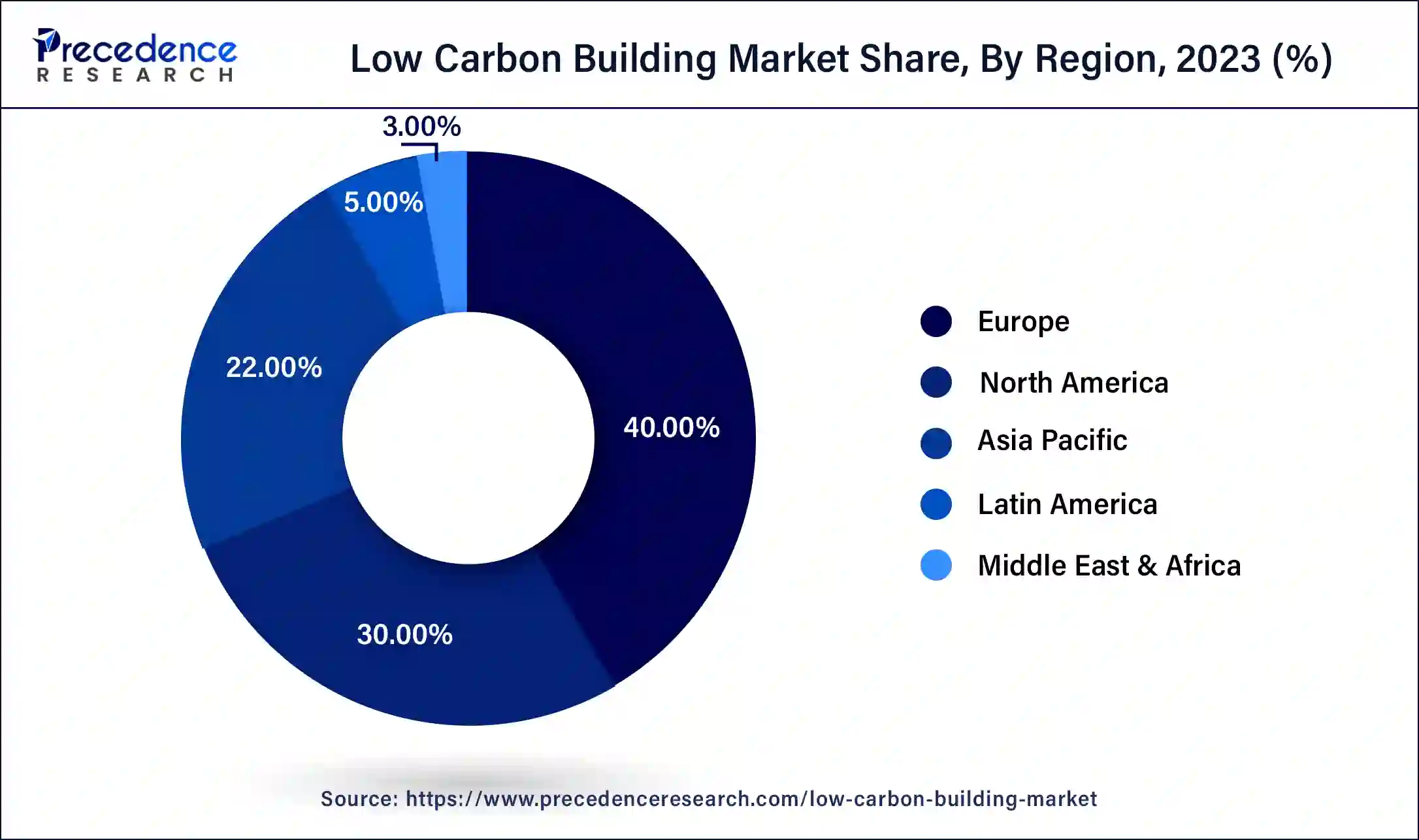

- Europe contributed more than 40% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By type, the energy-efficient materials segment has held the largest market share of 48% in 2025.

- By type, the renewable energy systems segment is anticipated to grow at a remarkable CAGR of 16.1% between 2026 and 2035.

- By application, the commercial segment generated over 51% of revenue share in 2025.

- By application, the residential segment is expected to expand at the fastest CAGR over the projected period.

- By component, the structural components segment had the largest market share of 42% in 2025.

- By component, the energy systems segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The low carbon building market encompasses the global industry dedicated to creating environmentally sustainable and energy-efficient structures. It involves the integration of eco-friendly materials, renewable energy systems, and advanced technologies to reduce carbon emissions and enhance overall energy performance. This market responds to the increasing demand for sustainable construction practices driven by environmental concerns and regulatory initiatives. Key components include energy-efficient materials, renewable energy solutions, smart building technologies, and green certifications. It caters to various sectors, including residential, commercial, and industrial, offering a holistic approach to constructing buildings that minimize environmental impact while meeting the evolving needs of a green-conscious world.

Low Carbon Building Market Growth Factors

- Rising awareness and concerns about climate change propel the demand for low carbon building practices that reduce carbon footprints and environmental impact.

- Stringent government regulations and financial incentives drive the widespread adoption of green building standards, encouraging developers and businesses to invest in sustainable construction.

- Long-term cost benefits associated with energy-efficient buildings, including reduced operational expenses and resource efficiency, incentivize stakeholders to embrace low carbon construction for economic sustainability.

- Continuous advancements in construction technologies and materials foster innovation in low carbon building solutions, attracting interest and investment from industry.

- The integration of Internet of Things (IoT) and automation to optimize energy consumption and enhance overall building management efficiency.

- Increasing focus on creating buildings that generate as much energy as they consume, aligning with the broader sustainability goals.

- A burgeoning opportunity exists for firms providing expertise in sustainable construction practices, guiding stakeholders through the transition to low carbon building.

- Companies engaged in developing and supplying renewable energy systems, such as solar panels and wind turbines, find a growing market in the low carbon building sector.

- Opportunities arise for businesses offering a range of eco-friendly construction materials and products, meeting the rising demand for sustainable alternatives.

- A niche opportunity lies in assisting developers and builders in obtaining and verifying green building certifications, addressing the increasing importance of environmental credentials in the industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 732.11 Billion |

| Market Size in 2026 | USD 818.49 Billion |

| Market Size by 2035 | USD 2,208.65 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.67% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By Component, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Environmental awareness and regulatory initiatives

The surge in market demand for the low carbon building market is significantly propelled by heightened environmental awareness on a global scale. The desire to mitigate climate change, reduce carbon footprints, and preserve natural resources fuels the adoption of eco-friendly materials, energy-efficient systems, and sustainable construction methods. Environmental awareness acts as a catalyst, encouraging developers, businesses, and homeowners to embrace low carbon building practices as a responsible and ethical choice in creating structures that align with broader environmental sustainability goals.

Stringent regulatory initiatives play a pivotal role in surging market demand for the low carbon building market. Governments worldwide are implementing and enforcing strict regulations and incentives to promote green building standards.

These initiatives mandate the adoption of low carbon construction practices, influencing developers to incorporate sustainable materials and energy-efficient technologies. Financial incentives, tax credits, and certification programs further incentivize the construction industry to adhere to these standards. The combination of environmental awareness and supportive regulatory frameworks creates a compelling market environment where the demand for low carbon building solutions experiences a substantial upswing, driven by a collective commitment to building a more sustainable future.

Restraints

Limited industry expertise and standardization challenges

Limited industry expertise poses a significant restraint on the low carbon building market as stakeholders, including architects, builders, and developers, may lack the necessary knowledge and skills to effectively implement low carbon practices. Sustainable construction demands a nuanced understanding of eco-friendly materials, renewable energy systems, and green certifications. The shortage of expertise can result in suboptimal decision-making, hindering the seamless integration of low carbon solutions. To address this challenge, there is a pressing need for educational initiatives, training programs, and knowledge-sharing platforms to empower industry professionals with the expertise required to navigate the complexities of sustainable construction.

The absence of standardized practices and certifications globally presents a formidable challenge for the low carbon building market. Without universally accepted benchmarks, the industry faces difficulties in establishing consistent criteria for low carbon building practices. This lack of standardization hampers interoperability creates confusion among stakeholders and poses barriers to widespread adoption. Efforts to develop international standards and harmonize green building certifications are crucial to overcoming these challenges, fostering a more cohesive and accessible framework for implementing low carbon solutions across diverse regions and construction projects.

Opportunity

Renewable energy solutions and green materials supply

The market demand for the low carbon building market experiences a notable surge due to the prominence of renewable energy solutions. Buildings incorporating solar panels, wind turbines, and other sustainable energy sources not only contribute to reduced carbon emissions but also align with the global push towards renewable energy adoption. The integration of these solutions empowers buildings to generate clean energy, reducing dependence on traditional power sources and fostering a more sustainable energy ecosystem. As environmental concerns escalate, the demand for Low Carbon Buildings equipped with renewable energy solutions rises, driven by the desire for energy independence and reduced reliance on fossil fuels.

The supply of green materials emerges as a pivotal factor in surging market demand in the low carbon building sector. From sustainable insulation to eco-friendly construction materials, the emphasis on green materials addresses the need for environmentally responsible construction practices. Developers and builders opt for these materials to reduce the ecological impact of construction, promoting circular economy principles. As demand grows for structures with lower embodied carbon, the market witnesses an upswing, driven by the availability and adoption of green materials, ultimately contributing to the development of more sustainable and energy-efficient buildings.

Segment Insights

Type Insights

According to the type, the energy-efficient materials segment held 48% revenue share in 2025. In the low carbon building market, energy-efficient materials encompass a range of construction elements designed to minimize energy consumption. These materials include advanced insulation, energy-efficient windows and doors, and eco-friendly roofing. The trend in this segment involves a shift towards innovative materials with enhanced insulating properties, such as aerogel-based insulation and phase-change materials. Sustainable alternatives like recycled steel and engineered wood are gaining popularity, reflecting the market's emphasis on reducing the environmental impact of construction materials.

The renewable energy systems segment is anticipated to expand at a significantly CAGR of 16.1% during the projected period. In the low carbon building market, renewable energy systems encompass the incorporation of solar panels, wind turbines, and geothermal systems to sustainably power buildings. A noteworthy trend is the rising popularity of solar photovoltaic (PV) technology, leading to a greater prevalence of building-integrated solar solutions. Advancements in compact wind turbines and geothermal heat pump systems further drive the market's push towards achieving net-zero energy buildings. This trend reflects an increasing dedication to producing on-site renewable energy, contributing to a decreased dependency on traditional power sources.

Application Insights

Based on the application, the commercial segment is anticipated to hold the largest market share of 51% in2025. In the low carbon building market, commercial applications encompass sustainable construction practices in offices, retail spaces, and industrial buildings. The trend in commercial low carbon buildings involves a focus on energy-efficient designs, smart building technologies, and green certifications. Businesses are increasingly adopting eco-friendly materials, renewable energy systems, and advanced HVAC solutions to reduce carbon footprints and operational costs while aligning with corporate sustainability goals.

On the other hand, the residential segment is projected to grow at the fastest rate over the projected period. In residential applications, low carbon building trends focus on creating energy-efficient and environmentally conscious homes. This includes the integration of solar panels, energy-efficient appliances, and eco-friendly construction materials. The emphasis on smart home technologies, coupled with green certifications for residences, reflects a growing demand for sustainable living spaces. Homeowners are increasingly prioritizing eco-friendly features to reduce energy consumption and contribute to a more sustainable future.

Component Insights

In2025, the structural components segment had the highest market share of 42% on the basis of the end user. In the low carbon building market, structural components encompass eco-friendly building materials and construction methods designed to minimize environmental impact. This includes the use of sustainable materials such as recycled steel, bamboo, and engineered wood. A trend in this segment involves innovative designs that prioritize energy-efficient structures, emphasizing modular construction and the incorporation of green roofs and walls for enhanced insulation and reduced energy consumption.

The energy systems segment is anticipated to expand at the fastest rate over the projected period. Energy systems in the low carbon building market focus on integrating renewable energy sources and energy-efficient technologies. Solar panels, wind turbines, and geothermal systems are prevalent trends, contributing to the generation of clean energy. The market sees a growing emphasis on smart energy management systems, enabling real-time monitoring and optimization of energy consumption within buildings, aligning with the broader trend of creating net-zero energy structures.

Regional Insights

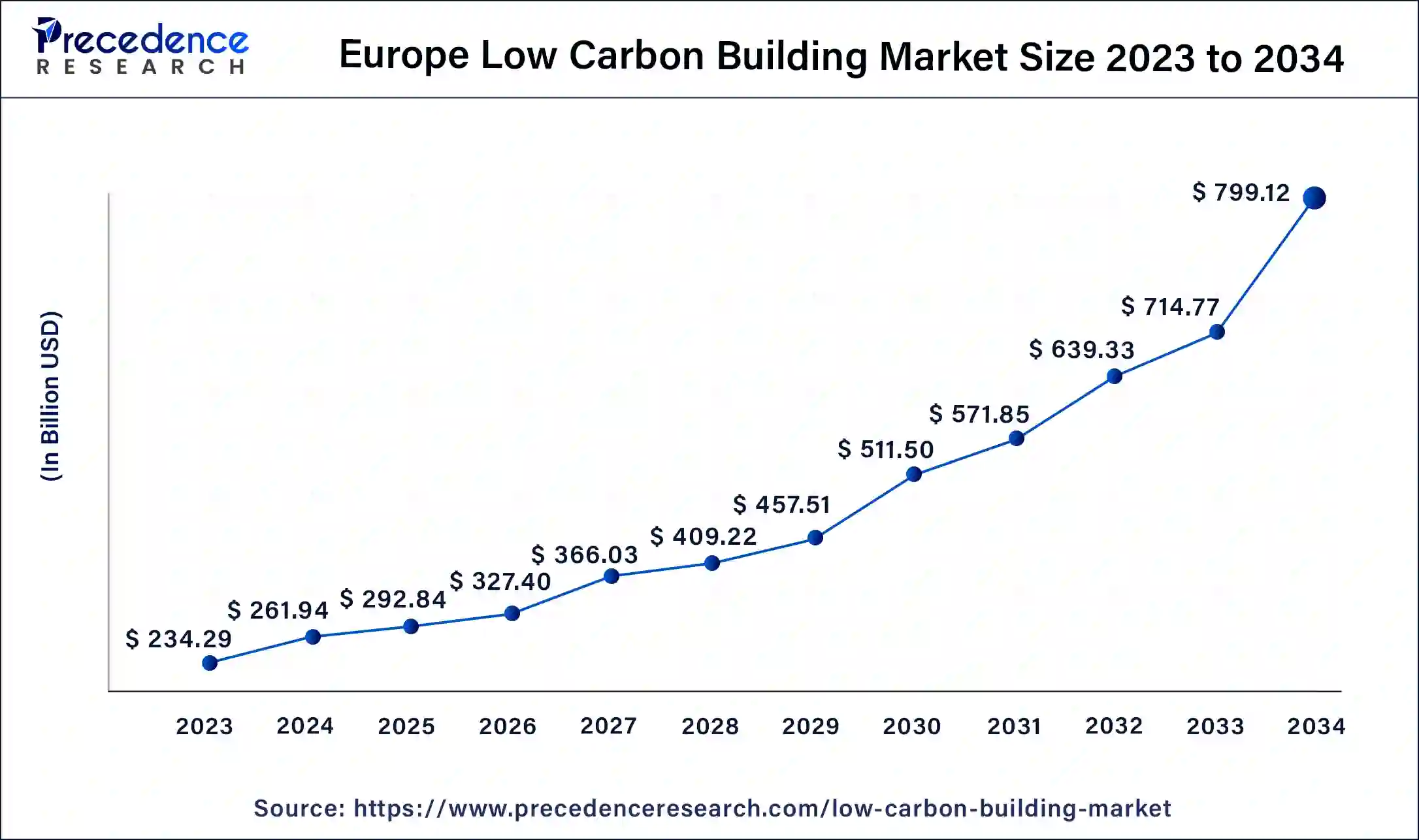

Europe Low Carbon Building Market Size and Growth 2026 to 2035

The Europe low carbon building market size is exhibited at USD 292.84 billion in 2025 and is projected to be worth around USD 883.47 billion by 2035, poised to grow at a CAGR of 11.68% from 2026 to 2035.

Europe held the largest revenue share of 46% in 2025. In Europe, the low carbon building market is witnessing a surge in sustainable construction practices driven by stringent environmental regulations. Green building certifications, such as BREEAM and Passivhaus, are gaining prominence. There is a notable emphasis on circular economy principles, promoting the use of recycled and locally sourced materials. Governments and corporations alike prioritize energy-efficient structures, fostering a growing demand for low-carbon buildings across residential, commercial, and industrial segments.

UK Low Carbon Building Market Analysis

The UK is a major contributor to the European market. The market in the UK is growing due to strict climate regulations, net-zero targets, and rising energy costs. Government incentives, strong adoption of green certifications like BREEAM, and increasing demand for energy-efficient, sustainable buildings across residential and commercial sectors further accelerate market growth in the country.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific is experiencing a rapid evolution in low carbon building trends. Governments are incentivizing sustainable construction with financial benefits and regulatory support. The region sees a rise in innovative designs incorporating renewable energy sources and smart technologies. Urbanization and infrastructure development initiatives prioritize eco-friendly buildings, reflecting a shift towards greener practices. Asia Pacific low carbon building market is dynamic, driven by a combination of environmental awareness, economic considerations, and forward-looking urban planning strategies.

India Low Carbon Building Market Analysis

The market in India is expanding due to rapid urbanization, rising emphasis on energy efficiency, and strong government initiatives promoting sustainable construction. Policies supporting energy-efficient buildings, increased adoption of green certifications, cost savings from reduced energy consumption, and growing environmental awareness among developers are driving market growth across the country.

What Influences the Market in North America?

In North America, the low carbon building market is characterized by a growing emphasis on energy efficiency and sustainable construction. Green building initiatives, such as LEED certification, play a pivotal role in promoting eco-friendly practices. The region witnesses an increasing integration of renewable energy systems, smart technologies, and energy-efficient materials in construction projects, reflecting a commitment to environmental stewardship and advancing low carbon building solutions.

U.S. Low Carbon Building Market Analysis

The market in the U.S. is growing due to stringent energy-efficiency standards, federal and state incentives, and corporate sustainability commitments. Rising energy costs, widespread adoption of green certifications such as LEED, and growing integration of renewable energy and smart building technologies are further contributing to the market growth.

Top Companies Operating in the Market & Their Offerings

- Johnson Controls International plc – Provides smart, energy-efficient building solutions, including HVAC systems, digital energy management via OpenBlue, net-zero advisory services, retrofits, renewable integration, and performance-based decarbonization to cut emissions and optimize operations.

- Schneider Electric SE – Offers EcoStruxure™ smart building platforms, energy management software, building automation, and connected power distribution systems that improve efficiency, reduce energy use, and support sustainability goals across buildings.

- Trane Technologies plc – Delivers building decarbonization solutions combining high-efficiency HVAC, smart controls, energy planning, and electrification services, plus low-carbon steel use to lower the carbon footprint of climate systems.

- Mitsubishi Electric Corporation – Supplies energy-efficient HVAC (VRF/heat pumps) and advanced building management systems that optimize energy use and lower consumption, contributing to greener, high-performance buildings.

- ABB Ltd – Provides electrical automation and control systems that enhance energy efficiency and power management in buildings, supporting reduced energy waste and integration of sustainable technologies.

- Kingspan Group plc – Specializes in high-performance insulated panels, advanced insulation materials, and building envelopes that significantly reduce energy demand and carbon emissions in construction.

- Skanska AB – Focuses on sustainable design and construction using low-carbon materials like low-carbon concrete, circular economy practices, refurbishment, and innovative building techniques to cut embodied emissions.

Other Low Carbon Building Market Companies

- Siemens AG

- Honeywell International Inc.

- Lendlease Corporation Ltd

- Green Building Councils (USGBC, UKGBC, etc.)

- Turner Construction Company

- Saint-Gobain

- Legrand SA

- Interface, Inc.

Recent Developments

- In 2023, Kingspan Group plc, a global leader in advanced insulation and building solutions, announced the acquisition of Troldtekt A/S. This strategic move adds to Kingspan's portfolio by incorporating the expertise of Troldtekt, known for manufacturing sustainably produced wood-based acoustic boards

- In January 2024, Heidelberg Materials introduced evoBuild, a global brand focused on low-carbon and circular construction materials. Each product must meet strict, standardized sustainability benchmarks, making the company the first in heavy building materials to adopt global eco-labelling criteria. The evoBuild portfolio will be progressively launched worldwide, aligning regional offerings with Heidelberg Materials' sustainability strategy.(Source: https://www.heidelbergmaterials.com)

Segments Covered in the Report

By Type

- Energy-Efficient Materials

- Renewable Energy Systems

- Low Carbon HVAC Systems

- Green Building Certifications

- Others

By Application

- Commercial

- Residential

- Industrial

By Component

- Structural Components

- Energy Systems

- HVAC Systems

- Lightning Solution

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting