What is Carbon Fiber Tapes Market Size?

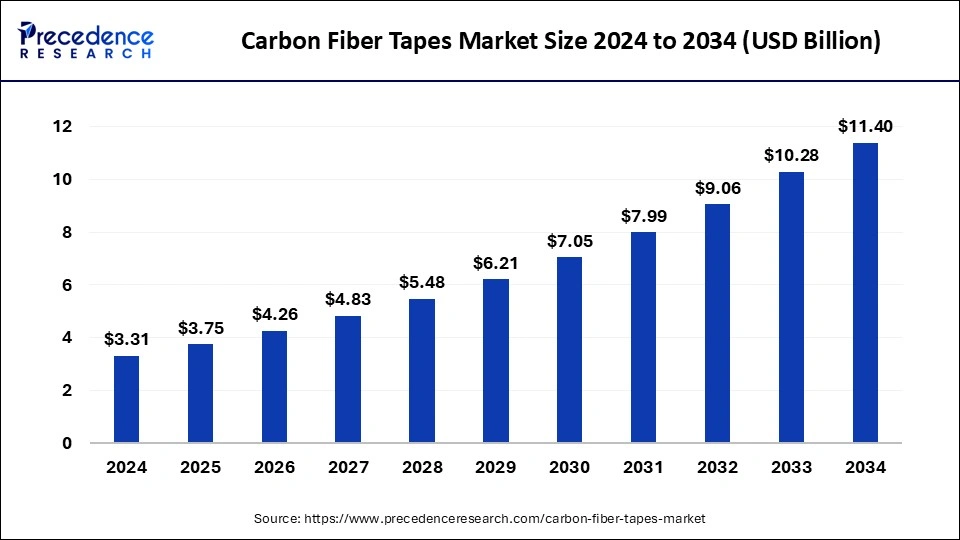

The global carbon fiber tapes market size accounted for USD 3.75 billion in 2025 and is predicted to increase from USD 4.26 billion in 2026 to approximately USD 12.58 billion by 2035, expanding at a CAGR of 12.87% from 2026 to 2035. The rising trend for supercars and hypercars worldwide is driving the growth of the carbon fiber tapes market.

Market Highlights

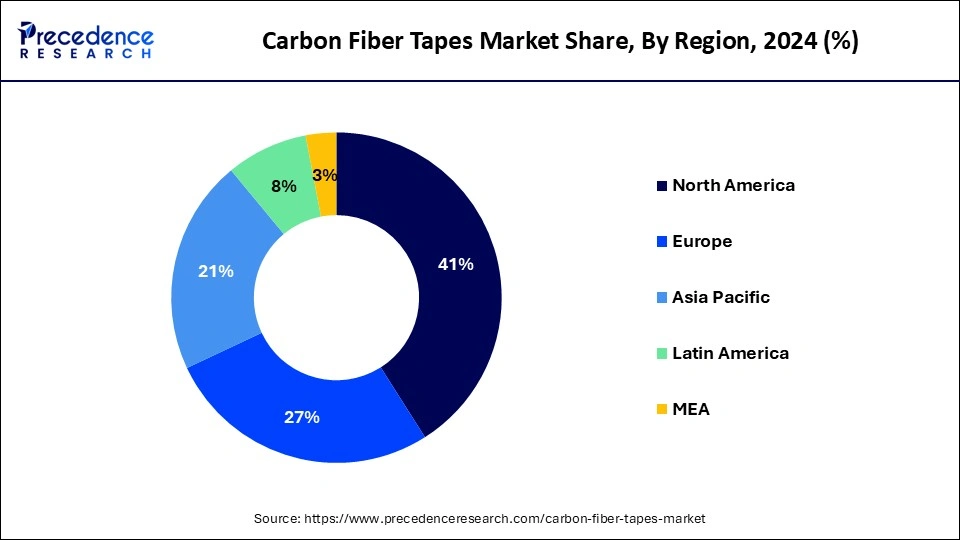

- North America led the global carbon fiber tapes market with the largest revenue share of 41% in 2025.

- Europe is expected to grow at a solid CAGR of 27% during the forecast period.

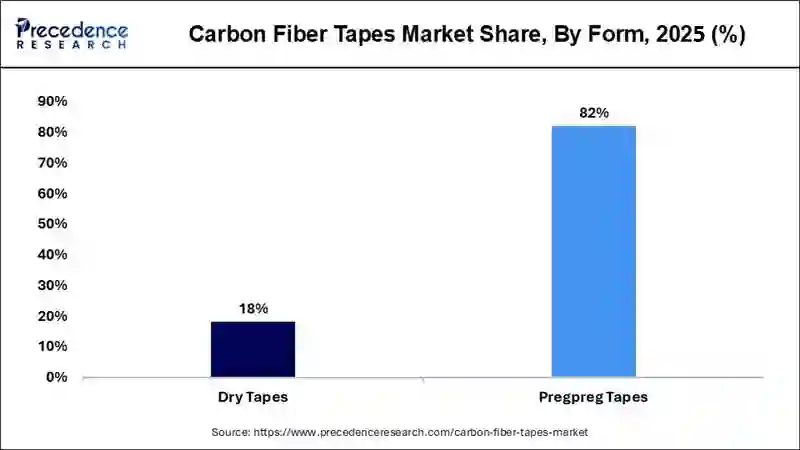

- By form, the prepreg tapes segment has contributed more than 82% of revenue share in 2025.

- By form, the dry tape segment is projected to grow at the fastest CAGR of 18% in the market during the forecast period.

- By end-use, the aerospace and defense segment has held a major revenue share of 53% in 2025.

- By end-use, the automotive segment is expected to expand at a notable CAGR of 13.96% during the forecast period.

What is the Carbon Fiber Tape?

The carbon fiber tapes market has grown rapidly with the developments in the chemical industry. This industry deals in the manufacturing and distribution of carbon fiber tapes for numerous end-users. Carbon fiber tape is a flat material that is ideal for selective reinforcement of sleeve winding, lap joining, carbon fiber fabrications, and repairs of cracks on graphite surfaces. There are different forms of carbon fiber tapes, including prepreg tapes and dry tapes. Carbon fiber tapes find applications in various end-user industries such as aerospace and defense, automotive, and sports & leisure. This industry is expected to grow exponentially with the growth in the automotive and aerospace industries.

- In March 2024, Arkema announced a partnership with Hexcel. This partnership is done to develop a thermoplastic composite using Arkema's Kepstan PEKK resin and Hexcel HexTow AS7 and IM7 carbon fibers.

How is AI contributing to the Carbon Fiber Tapes Industry/Process?

Artificial Intelligenceaccelerates the carbon fiber tapes market by designing materials, forecasting mechanical behavior, automating production, defect detection, and achieving high curing rates. It also helps in minimizing waste, facilitating recycling, strengthening supply chains, and sustainable production due to data-driven, adaptive, and intelligent processes and decisions.

Carbon Fiber Tapes Market Growth Factors

- The growing developments in the chemical industry are expected to drive the growth of the carbon fiber tapes market.

- The rising demand for carbon fiber tapes from the sports industry has driven the market growth.

- The increasing demand for dry tapes across the world fosters the growth of carbon fiber tapes in the market.

- The growing investments from public and private sector entities for developing the carbon fiber tapes industry propels the carbon fiber tapes market.

- The rising demand for prepreg tapes from the industrial and medical sectors boosts the carbon fiber tapes market growth to some extent.

- Increasing adopting of carbon fiber tapes for marine activities across the world is expected to boost the market growth.

- The growing use of carbon fiber tapes in several medical applications across the world boosts market growth.

- The ongoing research and development activities related to the production of carbon fiber tapes have impacted the carbon fiber tapes market growth positively.

- The rising application of carbon fiber tapes in luxury cars to reduce weight and improve driving experience is likely to boost the market growth.

- The growing demand for carbon fiber tapes in aerospace manufacturing and maintenance drives the carbon fiber tapes market growth.

Market Outlook

- Industry Growth Overview: Significant growth is expected due to increased demand for lightweight, high-strength materials in the aerospace and automotive manufacturing industries.

- Sustainability Trends: There is more emphasis on recyclable tapes, bio-based matrices, and energy-conserving composite production processes.

- Global Expansion: North America and Europe are the fastest adopters, and Asia-Pacific is catching up by developing industrial manufacturing.

- Major Investors:Toray Industries, Hexcel Corporation, Teijin Limited, SGL Carbon, and Solvay, whose market investment power.

- Startup Ecosystem: Startups develop recycling systems, material science, and automated composite production platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.75 Billion |

| Market Size in 2026 | USD 4.26 Billion |

| Market Size by 2035 | USD 12.58 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.87% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Form, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing demand for EVs across the world

The demand for EVs has increased rapidly due to the rising awareness of reducing emissions along with rising prices of fossil fuels. The rising government initiatives to promote EVs have also transitioned people's interest in electric vehicles. Also, several EV manufacturers are manufacturing EVs with high driving ranges to grab maximum attention from customers. Thus, with the rising demand for EVs, the demand for carbon fiber tapes also increases as these tapes are used in EVs to make lightweight and strong components, including chassis, body panels, and suspension components. Thereby driving the growth of the carbon fiber tapes market.

- In March 2024, BMW launched the electric vehicle named as ‘iX xDrive50' in India. This car comes with superior features that ensure a smooth driving experience and standard adaptive 2-axle air suspension for a comfortable ride, along with a driving range of up to 635 km.

- In May 2024, the U.S. government announced that it would invest around 1.3 billion USD to develop the EV infrastructure across the country.

- In December 2022, Asahi Kasei launched CFRTP-UD tape. This tape is manufactured using recycled continuous carbon fiber and Leona polyamide resin, which are found to be applicable in automotive frames and bodies.

Restraint

High cost and manufacturing complexities

The application of carbon fiber tapes has increased significantly in recent times. Although the advantages of carbon fiber tapes are noteworthy, there are several problems in this industry. Firstly, the cost of manufacturing carbon fiber tape is very high as the raw materials involved come with high costs. Secondly, there are several manufacturing complexities, such as mechanical breakdowns and shortage of raw materials. Thus, the rising cost of carbon fiber tapes, along with complexities in manufacturing, is likely to restrain the growth of the carbon fiber tapes market during the forecast period.

Opportunity

Growing developments in fiber-reinforced polymers (FRPs) technology

The carbon fiber tapes market has grown rapidly with the developments in chemical sciences and its related fields. The rising developments in FRPs have gained traction in recent times as they are found to be highly suitable for architecture, mass transit, consumer electronics, aerospace, construction, and infrastructure. Thus, the rising development in carbon fiber-reinforced plastic is expected to create ample growth opportunities for the market players in the upcoming future.

Segment Insights

Form insights

The prepreg tapes segment led the carbon fiber tapes market in 2025. This segment is generally driven by the rising development of prepreg tape production. Also, the rising applications of prepreg in several industries, such as infrastructure, industrial, recreation, and medical facilities, drive the market growth. Moreover, the rising demand for thermoplastic prepreg tapes for petroleum production, aviation, marine, wind energy, and sports industries boosts market growth.

- In January 2024, Cygnet Texkimp launched the direct melt production line. It is a high-volume manufacturing line for thermoplastic composite prepreg tapes that uses standard polymers from PP to PEEK as raw materials for producing high-quality thermoplastic prepregs on an industrial scale.

The dry tape segment is expected to grow at the fastest rate in the carbon fiber tapes market during the forecast period. This segment is generally driven by the rising demand for dry tapes from the aerospace sector in applications such as seat frames and luggage compartments. The dry tapes also come with added advantages such as high strength, density, tenacity, thermal and electrical conductivity, and corrosion resistance properties that make them suitable for pipe & tank industries, thereby driving the growth of the carbon fiber tapes market. Moreover, these dry tapes offer flexibility in resin selection, which makes them preferable for applications demanding unique material characteristics and is likely to boost the market growth.

End-use insights

The aerospace & defense segment dominated the carbon fiber tapes market in 2024. The rising use of prepreg tapes in the aerospace industry due to superior strength-to-weight capability, high strength, stiffness, and other features that makes them suitable for manufacturing aircraft parts that improve the aerodynamic performance of any aircraft, thereby boosting the market growth.

- In January 2023, Victrex launched the VICTREX AE 250. VICTREX AE 250 is a thermoplastic carbon fiber tape that is approved by the National Center for Advanced Materials Performance (NCAMP) for application in aerospace programs.

The automotive segment is expected to grow with the highest CAGR in during the forecast period. The use of carbon fiber tapes has increased in the automotive sector due to its application in the manufacturing of chassis components, sealing materials, body shell components, and materials for temperature management. Also, the use of prepreg carbon fiber tape in automobiles for high-performance applications in automobiles has driven market growth. Moreover, technological developments in the automotive industry related to the production of supercars to improve vehicle performance are likely to boost the growth of the carbon fiber tapes market.

- In February 2024, Alpine launched a car named ‘A524'. A524 is a Formula1 racing car designed for the upcoming French brand's World Endurance Championship.

- In July 2022, Teijin Group announced a partnership with Envision Racing. This partnership is done to support Envision's racing team with carbon fiber components required for participation in ABB's FIA Formula E World Championship electric-vehicle racing

Regional Insights

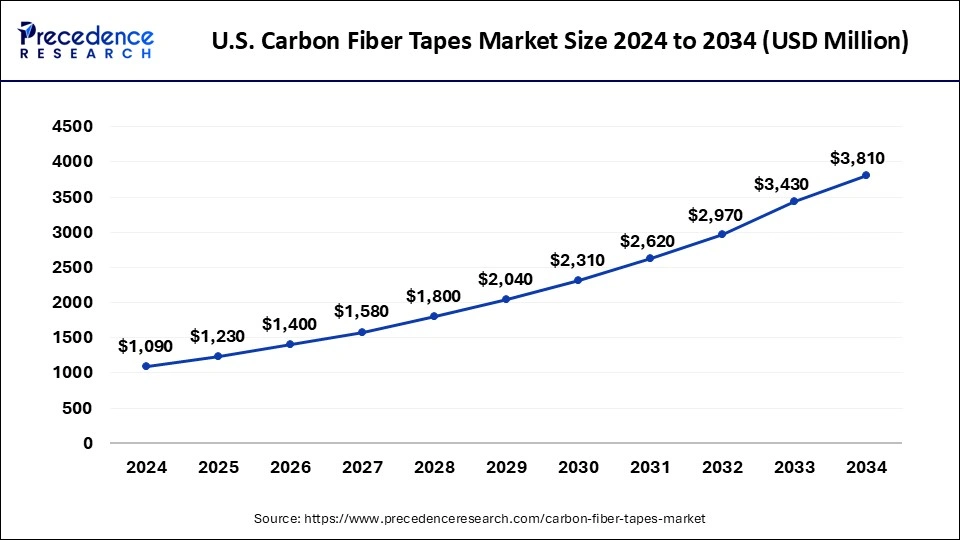

U.S Carbon Fiber Tapes Market Size and Growth 2026 to 2035

The U.S. carbon fiber tapes market is exhibited at USD 1,090 million in 2025 and is projected to be worth around USD 4,240 million by 2035, growing at a CAGR of 14.55% from 2026 to 2035

North America led the global carbon fiber tapes market in 2025. The growing demand for carbon fiber tapes from the sports industry in countries such as the U.S., Canada, Mexico, and others drives the market growth. Also, the rising application of prepreg tapes for the production of lightweight components in defense industries is driving the market growth in this region.

The aerospace industry in North America is well-established, with several companies such as Boeing, Lockheed Martin, Northrop Grumman, Collins Aerospace, Space X, Honeywell, and some others launching new aircraft that increase the demand for carbon fiber tapes for different applications, which in turn is expected to drive the growth of the carbon fiber tapes market.

The automotive sector of the U.S. is highly developed, with the presence of several automotive manufacturers and OEMs that are launching new vehicles to gain public interest. Thus, with the increasing demand for vehicles, the demand for carbon fiber tapes also increases in the production of hoods, dashboards, trunks, mirrors, roofs, gauges, interiors, amplifiers, and rear bumpers of vehicles, thereby driving the carbon fiber tapes market growth.

The demand and supply chain of North America is maintained by online and offline channels. There are several companies in this industry, including Celanese Corporation, Hexcel Corporation, Fortecarbon, and others. These companies are continuously engaged in the R&D of carbon fiber tapes and are launching new products, which in turn boosts the carbon fiber tapes market growth.

- In December 2023, SpaceX launched a U.S. military spaceplane. This spaceplane is named Space Force X-37B and is expected to conduct technology experiments in outer space.

- In January 2024, Tesla announced the launch of the all-new Model 3 in North America. This vehicle supports level 2 autonomy and comes with an electric drivetrain that provides a driving range of up to 341 miles on a single charge.

- In March 2024, Hexcel announced a partnership with Arkema. This announcement is made to develop and launch a high-performance thermoplastic composite structure using HexPly thermoplastic tapes that find applications in the aerospace sector.

Europe is expected to attain the fastest rate of growth in the carbon fiber tapes market during the forecast period. The developments in the chemical industry, along with increased investment from the public and private sectors for developing the carbon fiber tapes industry, are likely to drive the market growth. Moreover, the rising number of sporting activities in Europe has increased the demand for carbon fiber tapes for numerous applications, thereby driving market growth.

The medical devices industry in Europe is well-established, which, in turn, increases the demand for carbon fiber tapes for manufacturing sandwich panels, accessories, holders, fixing devices, and others, which boosts the carbon fiber tapes market growth to some extent. Moreover, the growing trend of tennis tournaments among people in the region increases the demand for carbon fiber tapes during the production of tennis rackets due to several features such as lightweight, durability, and enhanced power and control.

The automobile industry in Germany, Italy, and the UK is highly developed, with the presence of global market players such as Audi, BMW, Range Rover, Porshe, and others. With the increasing demand for cars, the demand for the carbon fiber tapes market is also increasing due to numerous applications, which in turn drives the market growth. In Europe, there are numerous carbon fiber tape companies such as Evonik Industries, SABIC, Solvay, Royal Tencate, SGL Group, Solvay, BASF SE, and some others, which are developing new products to cater to the automotive and aerospace industries.

- In September 2022, Solvay launched LTM 350. LTM 350 is a next-generation carbon fiber epoxy prepreg tooling material designed for aerospace and automotive.

- In June 2023, Volkswagen launched a new SUV named ‘Tiguan' in Europe. This SUV comes with several superior features such as a modern cockpit design, Car2X warning system, side assist (lane change assist), front assist (emergency braking system), and some others, along with eight different mild hybrids (eTSI), turbocharged petrol (TSI), plug-in hybrid (eHybrid), and turbocharged diesel (TDI) drives.

How is Asia-Pacific Performing in the Carbon Fiber Tapes market?

The Asia-Pacific is expected to grow at a significant rate during the forecast period because of the growth in industries. Electrification in the automobile industry heightens the demand for lightweight materials. Reinforcement applications are based on infrastructure projects. The wide usage of manufacturing favors tapes in transportation, building, sporting goods, and high-tech industries, with emerging domestic manufacturing.

China Carbon Fiber Tapes Market Trends:

The regional demand is controlled by China due to intense industrialization and production of automobiles. The electric vehicle development boosts the use of lightweight materials. Composite usage is aided by infrastructure investment. Government-manufactured programs consolidate carbon fiber production in the country, speeding up its use in transportation, energy storage, and reinforcement construction.

Value Chain Analysis of the Carbon Fiber Market

- Feedstock Procurement: procurement of PAN or pitch materials of the necessary purity and performance.

Key players: Toray Industries, Teijin Limited, Hexcel Corporation - Chemical Synthesis and Processing: the conversion of feedstock to precursor fibers by controlled spinning and carbonization.

Key Players: BASF, Solvay, Mitsubishi Chemical - Compound Formulation and Blending: the combination of carbon fibers and polymer matrices to make prepregs or composite tapes.

Key Players: Hexcel Corporation, Solvay, Teijin Limited - Quality Testing and Certification: making sure that the mechanical performance is valid, consistent, and meets industry standards.

Key Players: UL Solutions, Kiwa, NSF International - Packaging and Labelling: working on carbon fiber tapes with protective wrappings and correct technical instructions.

Key players: Amcor, Mondi, DS Smith, Smurfit Kappa

Carbon Fiber Tapes Market Companies

- Evonik Industries: Provides high-performance polymers such as PEEK and PA, which are being used in advanced carbon fiber composite tape applications.

- SABIC:Supply continuous carbon fiber composite tapes using thermoplastic resin, including ULTEM and NORYL.

- Solvay: It produces carbon fiber reinforced thermoplastic tapes in aerospace, automotive, and high-performance structuring materials.

Other Carbon Fiber Tapes Market Companies

- Royal Tencate

- SGL Group

- Celanese Corporation

- Hexcel Corporation

- Teijin Limited

- BASF SE

- Victrex

- Cristex

- Eurocarbon

- PRF Composite Materials

- TCR Composites

- Sigmatex

Recent Developments

- In November 2025, Teijin Carbon and A&P Technology have introduced IMS65 PAEK Bimax biaxial fabric. Utilizing Tenax TPUD IMS65 PAEK UD tape, this innovation supports high-speed composite production for aerospace and defense sectors, featuring a minimal crimp design that optimizes tape properties across a 65” wide fabric.(Source:https://www.jeccomposites.com)

- In June 2025, AGY and A+ Composites partnered to launch ultra-lightweight thermoplastic tapes for composite applications. Utilizing AGY's S2 Glass roving and LM PAEK/PEI resins, these tapes offer exceptional strength, stiffness, and impact resistance for aerospace, defense, and industrial uses. (Source:https://www.businesswire.com)

- In March 2024, Toray Advanced Composites launched Toray Cetex TC915 PA. Toray Cetex TC915 PA is a carbon fiber-based tape that finds applications in sporting goods, automotive structure high-performance industrial applications, energy (oil/gas & hydrogen), urban air mobility (UAM), and unmanned aerial systems (UAS).

- In March 2024, Hexcel launched HexTow IM9 24K. HexTow IM9 24K is a carbon fiber tape that finds application in the aerospace and industrial sectors.

- In January 2024, Celanese Corporation collaborated with Under Armour. This collaboration is being done to develop a new fiber for performance stretch fabrics named' Neolast.'

- In December 2023, Teijin Limited launched Tenax. Tenax is a carbon fiber-based tape that finds applications in several end-user industries.

- In August 2023, PRF Composite Materials launched Reepreg composite. This material is composed of recycled carbon fiber prepreg waste and finds applications in several end-user industries.

Segments Covered in the Report

By form

- Dry tapes

- Prepreg tapes

By End-use

- Aerospace and Defense

- Sports and Leisure

- Automotive

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting