Cardiac Ablation Market Size and Forecast 2025 to 2034

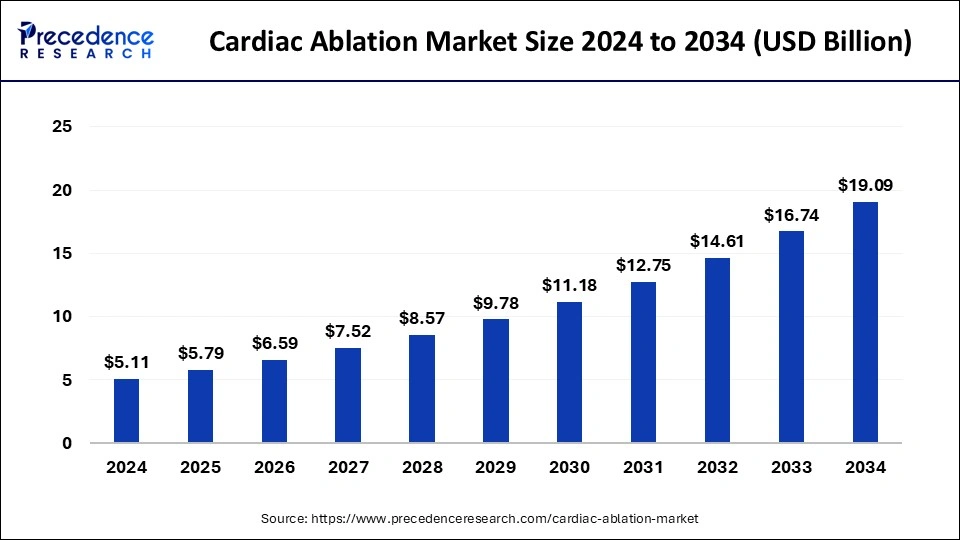

The global cardiac ablation market size was calculated at USD 5.11 billion in 2024 and is predicted to increase from USD 5.79 billion in 2025 to approximately USD 19.09 billion by 2034, expanding at a CAGR of 14.20% from 2025 to 2034.

Cardiac Ablation Market Key Takeaways

- The global cardiac ablation market was valued at USD 5.11 billion in 2024.

- It is projected to reach USD 19.09 billion by 2034.

- The cardiac ablation market is expected to grow at a CAGR of 14.20% from 2025 to 2034.

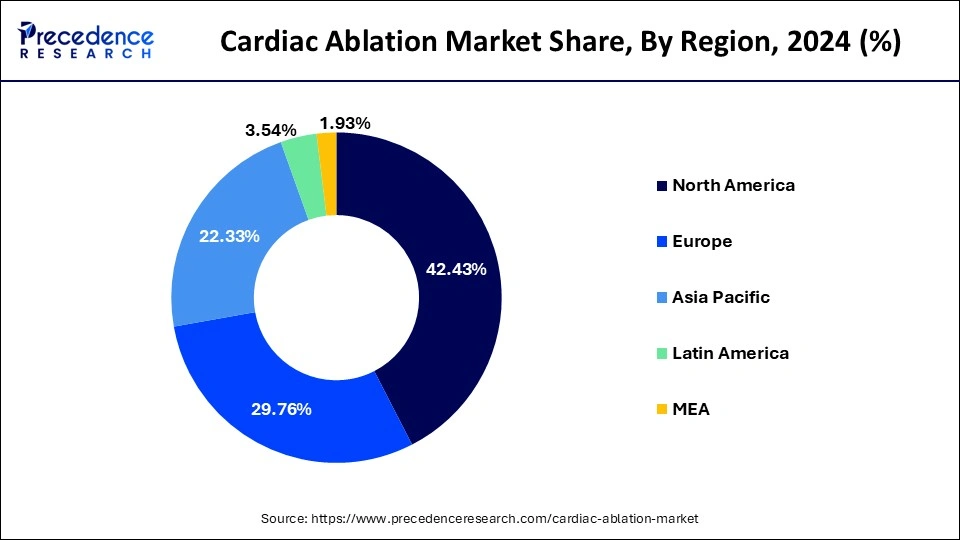

- North America led the global market with the highest market share of 42.43% in 2024.

- Europe is expected to witness significant growth during the forecast period.

- By product, the electrical ablators segment is projected to show significant growth during the forecast period.

- By approach, the catheter-based segment dominated the market in 2024 and is expected to maintain its dominance throughout the forecast period.

- By approach, the open/surgical segment is expected to show significant growth over the forecast period.

- By application, the atrial fibrillation & flutter segment dominated the market in 2024 and is expected to maintain its dominance throughout the forecast period.

- By application, the tachycardia segment will show notable growth in the cardiac ablation market.

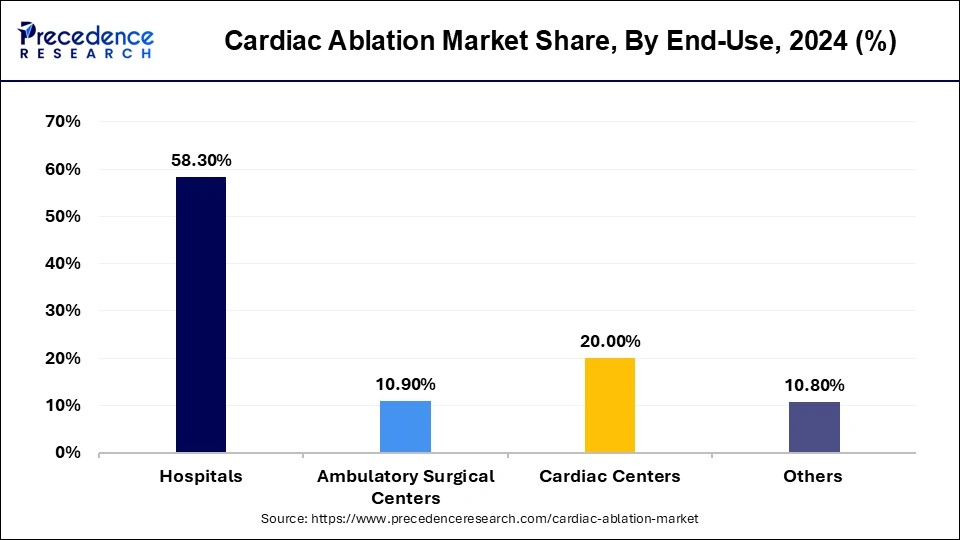

- By end use, the ambulatory surgical centers segment is projected to witness considerable growth in the upcoming years.

U.S. Cardiac Ablation Market Size and Growth 2025 to 2034

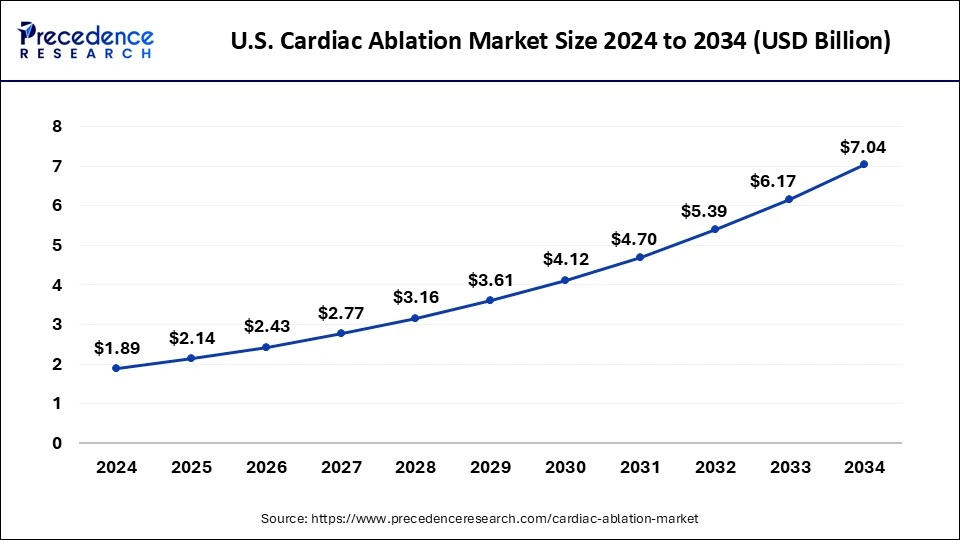

The U.S. cardiac ablation market size was exhibited at USD 1.89 billion in 2024 and is projected to be worth around USD 7.04 billion by 2034, growing at a CAGR of 14.15%

North America led the market with the biggest market share of 42.43% in 2024. This dominance is supported by the growing prevalence of cardiac conditions in the region. The rising senior population, at a higher risk for heart disease combined with changing trends in the U.S., preferring unhealthy diets and sedentary lifestyles, creates a population prone to numerous health conditions. Additionally, increasing disposable income in the majority of the population allows a greater expense on the healthcare sector.

In the cardiac ablation market, Europe is expected to witness significant growth during the forecast period, driven by the rapid evolution of clinical electrophysiology (EP) and catheter ablation procedures in recent years. With over 50,000 catheter ablations performed annually in Europe, the demand for high-quality EP personnel, equipment, and facilities is on the rise.

The European Heart Rhythm Association (EHRA) conducted a survey to assess the practice requirements for EP personnel, equipment, and facilities across the region. The findings revealed that a significant proportion of EP nurses operate independently of cardiac interventional departments, with a notable portion participating in night shifts. Additionally, a considerable number of hospitals integrate EP and cardiac intervention services, highlighting the convergence of these subspecialties in daily practice.

Physicians primarily oversee critical components such as the ablation generator and stimulator, while company representatives and trained nurses manage the 3D mapping system and EP recording system, respectively. However, despite the growing complexity of ablation procedures, only about 26% of cardiology departments in Europe are led by physicians specialized in EP, indicating a potential gap in specialized leadership within the field. It is remarkable that EP consultants in Europe often maintain skills for coronary interventions, underscoring the multidisciplinary nature of EP practice and the diverse skill sets required to address evolving patient needs effectively.

- By February 2023, Abbott had secured approvals in both the U.S. and Europe for new technologies supporting the treatment of abnormal heart rhythms.

- By March 2023, Medtronic had obtained the CE mark for its ablation device and made strategic investments in a heart failure monitoring company, strengthening its position in the market.

Market Overview

Cardiac ablation is a cutting-edge medical procedure designed to address irregular heartbeats, medically known as arrhythmias. This innovative treatment involves the precise application of heat or cold energy to create minuscule scars within the heart. These scars play a pivotal role in obstructing faulty heart signals, thereby restoring a normal, healthy heartbeat rhythm.

The procedure is primarily carried out using specialized catheters and thin and flexible tubes, which are inserted into the body through a blood vessel. This minimally invasive approach is favored due to its effectiveness and reduced recovery time. However, in certain cases, cardiac ablation can also be performed during traditional heart surgery.

The duration of a cardiac ablation procedure typically ranges from 3 to 6 hours, contingent upon the specific type of irregular heartbeat being addressed. Over the years, catheter ablation has emerged as a highly efficient treatment strategy for rhythm control in patients suffering from conditions such as atrial fibrillation (AF).

- In February 2023, J&J, Medtronic, and Boston Scientific initiated new trials, gearing up for competition in the U.S. cardiac ablation market.

Cardiac Ablation Market Growth Factors

- Cardiac ablation procedures have demonstrated significant benefits for patients suffering from arrhythmias, leading to improved quality of life. The sustained relief observed at the one-year follow-up from the initial three-month assessment has bolstered patient confidence and contributed to the expansion of the cardiac ablation market.

- The utilization of catheter ablation in patients with atrial fibrillation and heart failure has shown notable reductions in mortality rates and occurrences of heart failure-related hospitalizations. This positive impact on patient health outcomes has stimulated market growth.

- Atrial fibrillation ablation, utilizing innovative techniques involving heat or cold energy to create precise heart tissue scars, has emerged as a significant treatment option for irregular heartbeats. This technological advancement has propelled market expansion by offering patients effective solutions for managing their condition.

- The combination of medication and surgical procedures aimed at stabilizing heart rates and mitigating clot formation has widened the scope of treatment for cardiac arrhythmias. This comprehensive approach has spurred the growth of the cardiac ablation market by addressing diverse patient needs and preferences.

- Ongoing advancements in catheter ablation technologies have revolutionized the procedure, making it faster, more efficient, and safer for patients. The integration of new technologies has been a key driver in expanding the market by enhancing procedural efficacy and safety standards.

- Historically, radiofrequency catheter ablation (RFCA) was deemed challenging in patients with mechanical heart valves due to perceived risks and technical complexities. However, recent studies showcasing the feasibility and safety of RFCA in this patient cohort have broadened the cardiac ablation market by expanding the eligible patient population for such procedures.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.20% |

| Market Size in 2025 | USD 5.79 Billion |

| Market Size by 2034 | USD 19.09 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Approach, Application, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Radiofrequency innovation

Radiofrequency ablation has emerged as the forefront treatment for tachyarrhythmias, supplanting older methodologies over the past two decades. This advancement, driven by its efficacy and safety, has reshaped the landscape of non-pharmacological management of refractory cardiac arrhythmias. Technical enhancements in catheter design and imaging modalities have optimized procedural precision, while indications for radiofrequency ablation span a wide array of arrhythmias, including atrial fibrillation and ventricular tachycardia. Emerging technologies, such as cryoablation and robotic-assisted navigation, promise further improvements in efficacy and patient outcomes, positioning the cardiac ablation market for continued growth and innovation.

- In February 2024, Adagio Medical commenced trading on Nasdaq through a business combination with ARYA Sciences Acquisition Corp IV, paving the way for further commercial and clinical development of innovative cardiac ablation technologies.

Advancements in minimally invasive surgical techniques

The emergence of minimally invasive surgical ablation represents a significant stride toward achieving outcomes comparable to the traditional Cox-Maze procedure. Among the innovative modalities, cryoablation stands out for its ability to create precise, full-thickness lesions through rapid tissue freezing, leading to cell death and consistent lesion formation. Additionally, high-intensity focused ultrasound offers a promising approach by utilizing ultrasound waves to generate thermal energy, effectively heating tissue within the targeted focal volume.

The conventional microwave and laser techniques have waned in popularity due to decreased clinical efficacy and the inability to reliably produce transmural lesions on a beating heart. These advancements in minimally invasive surgical ablation techniques not only enhance treatment precision but also contribute to the expansion of the cardiac ablation market by offering safer, more effective alternatives for patients with cardiac arrhythmias.

- In May 2023, the FDA granted approval to Abbott for its TactiFlex Ablation Catheter, facilitating the treatment of abnormal heart rhythms.

Restraint

Risks associated with the procedure

Even with the advancements in cardiac ablation techniques, the cardiac ablation market faces constraints due to the inherent risks associated with the procedure. These risks vary depending on the type of ablation and the underlying reasons for its implementation. Potential complications include bleeding or infection at the catheter insertion site, damage to blood vessels or heart valves, and the development of new or exacerbated irregular heartbeats.

Additionally, patients may experience a slow heart rate necessitating pacemaker placement, blood clots leading to pulmonary embolism or stroke, and pulmonary vein stenosis. Moreover, there is a risk of kidney damage from contrast agents used during the procedure. These risks not only impact patient outcomes but also act as a deterrent to the broader adoption of cardiac ablation techniques, thereby constraining the growth potential of the market.

Technique-dependent complication risks

Despite the overall safety profile of most ablation procedures, the cardiac ablation market encounters limitations due to varying occurrences of complications associated with specific techniques. These procedure-specific complication rates, while infrequent, pose constraints on market growth by instilling apprehension among healthcare providers and patients regarding the safety of cardiac ablation procedures.

Serious complications such as death, myocardial infarction, or stroke are rare (0.05–0.01%), and the risk is slightly elevated for curative atrial fibrillation (AF) ablation procedures. Moreover, approximately 0.5% of cases may require a permanent pacemaker due to heart block, with risks influenced by the proximity of ablated tissue to the atrioventricular (AV) node. Although other forms of thromboembolism, including systemic and pulmonary embolism, are exceedingly rare, complications related to vascular access are more prevalent (2–4%). Additionally, cardiac trauma or perforation leading to tamponade may occur in 1–2% of cases.

Opportunities

Pulsed field ablation (PFA) techniques

Pulsed field ablation (PFA) is a groundbreaking technology offering immense promise within the cardiac ablation market. Unlike traditional thermal tools, PFA utilizes non-thermal mechanisms to induce irreversible micropores at cell membranes, leading to cell death. With its origins in cancer treatment for solid tumors, PFA demonstrates unique potential as a safe modality for atrial fibrillation (AF) ablation, notably minimizing collateral tissue damage.

PFA is particularly significant as cardiomyocytes exhibit the lowest threshold to pulse electric fields. Recent human trials, including IMPULSE and PEFCAT, have yielded highly promising data regarding both efficacy and safety. Notably, PFA isolation boasts ultra-rapid application, with a remarkable 100% durability of pulmonary vein isolation observed over a three-month period. This breakthrough technology not only enhances treatment outcomes but also presents a compelling opportunity for growth within the cardiac ablation market, paving the way for improved patient care and expanded treatment options.

- In January 2024, Boston Scientific received FDA approval for its FARAPULSE Pulsed Field Ablation System, further expanding treatment options for abnormal heart rhythms.

- In December 2023, Clarivate unveiled an optimistic outlook for the pulsed-field ablation market, forecasting potential revolutionary changes in the treatment landscape.

Integration with AI and machine learning

In the cardiac ablation market, the integration of artificial intelligence (AI) and machine learning (ML) has emerged as a pivotal force in reshaping cardiovascular medicine, particularly within cardiac electrophysiology (EP). This intersection offers multifaceted opportunities that significantly enhance the landscape of ablation therapies. AI capabilities enable the identification of successful ablation sites and the prediction of patient response to ablative treatments, optimizing therapeutic outcomes.

Advanced imaging and mapping techniques, empowered by AI, facilitate the precise identification of ablation targets, thereby improving both invasive and noninvasive arrhythmia treatment modalities. Central to this transformative potential is the necessity for centers to collaborate and pool data, enabling the training of expert AI systems. Integration of comprehensive patient data, including demographic information (age, sex, race, and comorbidities), center practices (multiple practices and operators), and equipment specifications (mapping systems, recording systems, and catheters), fuels the development of robust AI algorithms.

By leveraging collective insights and expertise, AI-driven systems can refine their predictive capabilities and optimize treatment strategies tailored to individual patient profiles. This collaborative approach not only enhances the efficacy and precision of cardiac ablation procedures but also presents lucrative opportunities for market expansion. As healthcare institutions embrace AI-enabled technologies and foster data-sharing initiatives, the cardiac ablation market stands poised to capitalize on the transformative potential of AI and ML, delivering improved patient outcomes and driving innovation within the field.

Product Type Insights

The electrical ablators segment is projected to show significant growth during the forecast period, fueled by innovative advancements in intraoperative technologies. One such advancement includes the utilization of an intraoperative endocardial array of electrodes, allowing for simultaneous recordings from multiple sites in the intact ventricle. This approach presents a compelling opportunity to explore electrical ablation as a viable alternative to standard surgical ablative techniques, which typically require ventriculotomy.

A pivotal study conducted on seven dogs evaluated a variation of the electrical ablative procedure designed for intraoperative use, assessing its long-term electrophysiological and structural effects on ventricular myocardium. Notably, electrical ablation (EA) distinguishes itself as a non-thermal ablation technique, minimizing damage to surrounding tissue compared to conventional thermal methods. As the market continues to embrace technological innovations and explore new therapeutic avenues, electrical ablators are poised to maintain their dominance and drive further growth within the cardiac ablation landscape.

EA demonstrates potential synergies with cancer immunotherapy through its induction of immunogenic cell death (ICD). This dual benefit underscores the versatility and therapeutic potential of electrical ablators, positioning them as valuable assets in both cardiac ablation procedures and potentially broader applications in oncology. With its ability to offer precise tissue targeting while minimizing collateral damage, electrical ablation represents a compelling solution for healthcare practitioners seeking safer and more effective ablation techniques.

Cardiac Ablation Market Revenue, By Product Type (2022-2024)

| Product Type | 2022 | 2023 | 2024 |

| Radiofrequency (RF) Ablators | 2,322.4 | 2,620.1 | 2,963.6 |

| Electrical Ablators | 393.5 | 444.7 | 503.9 |

| Cryoablation Devices | 126.4 | 145.3 | 167.2 |

| Ultrasound Ablators | 68.4 | 78.0 | 89.1 |

| Others | 1,084.1 | 1,222.5 | 1,382.5 |

Approach Insights

The catheter-based segment dominated the market in 2023 and is expected to maintain its dominance throughout the forecast period. The growth of this segment is primarily driven by the preference for non-invasive and semi-invasive techniques in the healthcare sector, especially in surgical procedures. This is further supported by innovations and technological advancements in catheter-based methods.

The open/surgical segment is expected to show significant growth over the forecast period, commanding the largest share due to its established efficacy and widespread adoption. Surgical ablation procedures, while more complex than their minimally invasive counterparts, offer a comprehensive solution for correcting abnormal electrical rhythms in the heart. A notable example is the maze procedure, which involves a surgical approach wherein the doctor makes an incision down the center of the chest and separates the breastbone. This procedure often necessitates the use of a heart-lung bypass machine to maintain blood flow. Alternatively, for other types of surgical ablation, one or more small incisions are made on the chest to access the heart for ablation instrument placement.

Surgical ablation encompasses various techniques, including radiofrequency ablation (or catheter ablation) and cryoablation, each offering distinct advantages in addressing cardiac arrhythmias. Radiofrequency ablation utilizes heat energy to destroy problematic tissue, while vryoablation employs cold temperatures for the same purpose. A typical surgical radiofrequency ablation procedure lasts approximately two to four hours and is conducted in a hospital electrophysiology (EP) lab or catheterization lab. During the procedure, a small puncture is made in the skin at the groin area to facilitate access.

Cardiac Ablation Market Revenue, By Approach, 2022-2024 (USD Million)

| Approach | 2022 | 2023 | 2024 |

| Catheter-based |

3,001.2 | 3,400.7 | 3,863.3 |

| Open/Surgical |

993.5 | 1,109.9 | 1,243.0 |

Application Insights

The atrial fibrillation & flutter segment dominated the market in 2023 and is expected to maintain its dominance throughout the forecast period. Growing cases of fibrillation driven by the rising geriatric population create a steady demand for the growth of the segment. This growth and prevalence are further potentiated by unhealthy sedentary lifestyles in developed economies. Key market players are engaging in lucrative business opportunities in this field in response to the growing demand.

The tachycardia segment will show notable growth in the cardiac ablation market, driven by the prevalence of ventricular tachycardia (VT) and the efficacy of VT ablation procedures. Ventricular tachycardia ablation, also known as VT ablation, utilizes either cold or heat energy to create small scars within the heart, effectively blocking aberrant signals responsible for rapid and erratic heartbeats. This specialized form of cardiac ablation is particularly indicated for individuals experiencing ventricular tachycardia, a condition characterized by a fast and irregular heartbeat originating in the heart's lower chambers. Notably, for patients with an implantable cardioverter-defibrillator (ICD), VT ablation may significantly reduce the frequency of shocks delivered by the device, thereby improving overall quality of life.

VT ablation procedures can be performed either from inside or outside the heart, with treatment occasionally administered at both locations for optimal efficacy. Despite the presence of an ICD, recurrent VT occurs in a significant percentage of patients, ranging from 40% to 60%, following an episode of spontaneous sustained VT. This underscores the importance of VT ablation as a viable therapeutic option for managing this challenging condition and reducing the burden of recurrent arrhythmias. As the tachycardia segment continues to drive growth in the cardiac ablation market, the application of VT ablation techniques holds immense potential for addressing the needs of patients with ventricular tachycardia, offering improved symptom management and enhancing overall cardiac health outcomes.

Cardiac Ablation Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Atrial Fibrillation & Flutter |

2,307.7 | 2,606.3 | 2,951.3 |

| Tachycardia |

364.5 | 415.0 | 473.7 |

| Others |

1,322.5 | 1,489.4 | 1,681.3 |

End-Use Insights

The ambulatory surgical centers segment is projected to witness considerable growth in the upcoming years. This growth is propelled by the feasibility and safety of catheter ablation procedures for atrial fibrillation (AF) in this setting. Recent evidence suggests that catheter ablation for AF conducted in ambulatory settings is not only feasible but also safe, based on extensive single-center experiences.

This innovative approach represents a significant advancement in the field of cardiac ablation, offering patients a convenient and efficient alternative to traditional hospital-based procedures. As ambulatory surgical centers continue to play a pivotal role in delivering high-quality cardiac care, their adoption of catheter ablation procedures for AF represents a significant milestone in advancing patient-centric treatment options and reshaping the landscape of the cardiac ablation market.

The shift towards ambulatory settings for catheter ablation procedures for AF holds promise as the next frontier in cardiac ablation, with the potential to streamline healthcare delivery, enhance patient satisfaction, and optimize resource utilization. Further studies are warranted to validate and confirm the efficacy and safety of catheter ablation for AF in ambulatory settings, ensuring that this emerging trend continues to drive growth and innovation within the cardiac ablation market.

Cardiac Ablation Market Revenue, By End-use, 2022-2024 (USD Million)

| End-use | 2022 | 2023 | 2024 |

| Radiofrequency (RF) Ablators | 2,326.5 | 2,627.7 | 2,975.5 |

| Electrical Ablators | 437.4 | 493.3 | 557.7 |

| Cryoablation Devices | 796.8 | 901.7 | 1,023.2 |

| Ultrasound Ablators | 434.1 | 487.9 | 549.8 |

Recent Developments

- In September 2022, Biosense Webster introduced the OCTARAY Mapping Catheter with TRUEref Technology, enhancing capabilities in cardiac ablation procedures.

- In August 2022, Medtronic plc concluded the acquisition of Affera, Inc., broadening its cardiac ablation portfolio with a comprehensive mapping and navigation platform.

Cardiac Ablation Market Companies

- Abbott Laboratories

- Medtronic

- Biosense Webster (Johnson &Johnson)

- Angiodynamics

- Boston Scientific Corporation

- Atricure

- Japan Lifeline

Segments Covered in the Report

By Product Type

- Radiofrequency (RF)

- Ablators

- Electrical Ablators

- Cryoablation Devices

- Ultrasound Ablators

- Others

By Approach

- Catheter-based

- Open/Surgical

By Application

- Atrial Fibrillation & Flutter

- Tachycardia

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Cardiac Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting