What is the Cardiovascular Genetic Testing Market Size?

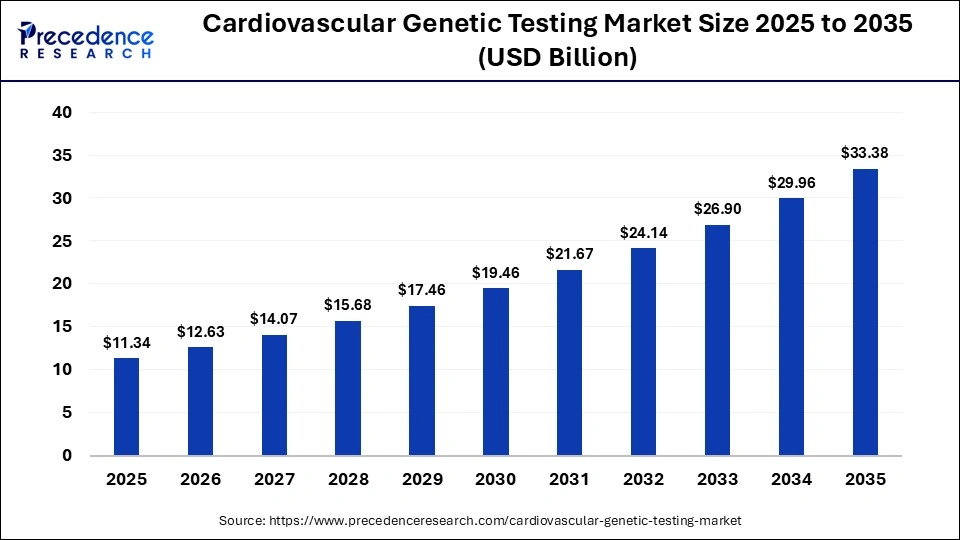

The global cardiovascular genetic testing market size was calculated at USD 11.34 billion in 2025 and is predicted to increase from USD 12.63 billion in 2026 to approximately USD 33.38 billion by 2035, expanding at a CAGR of 11.4% from 2026 to 2035.The increased focus on advancing precision public health and updating clinical guidelines has led to personalized disease management, early detection, risk prediction, and cascade screening for families.

Market Highlights

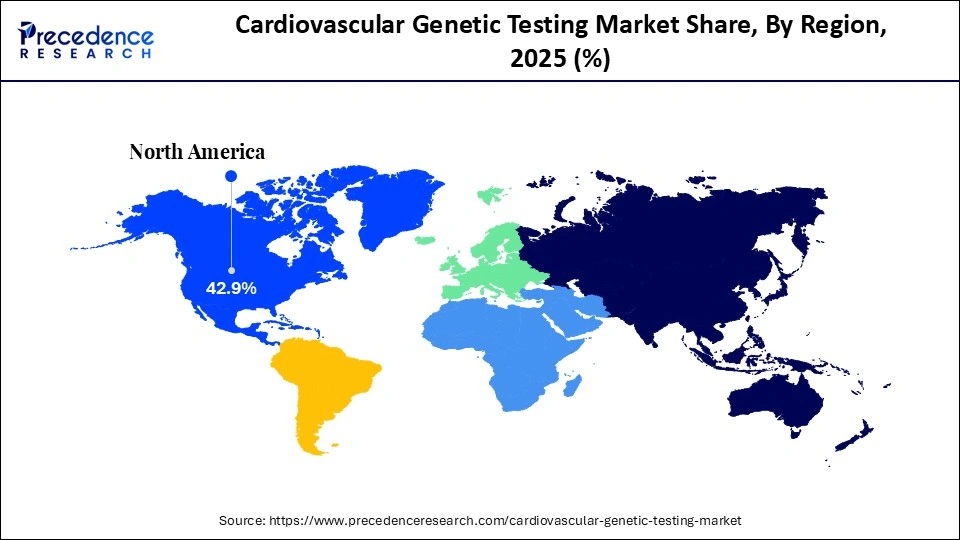

- North America dominated the market in 2025, with a revenue share of approximately 42.9%.

- Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

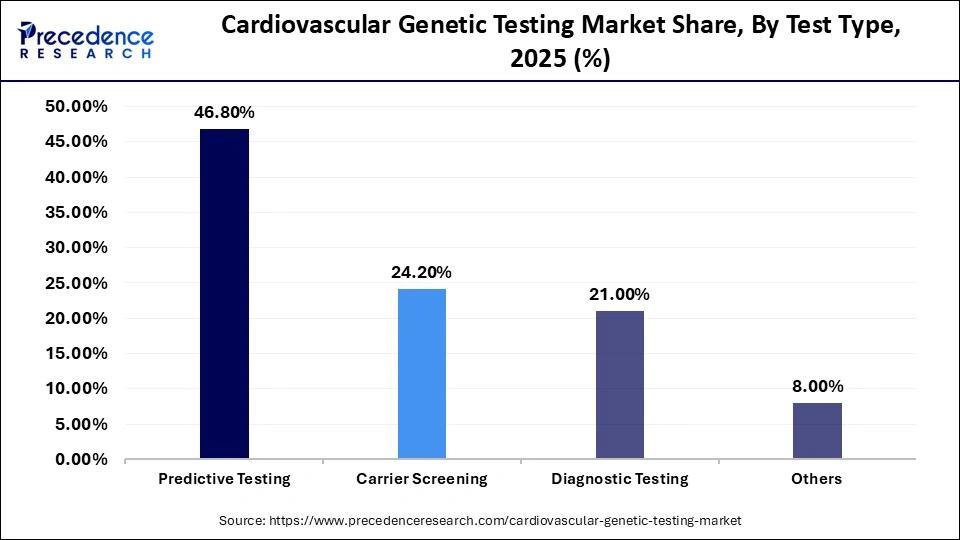

- By test type, the predictive testing segment dominated the market in 2025, with a revenue share of approximately 46.8%.

- By test type, the carrier screening segment in the market is expected to grow at the fastest CAGR from 2026 to 2035.

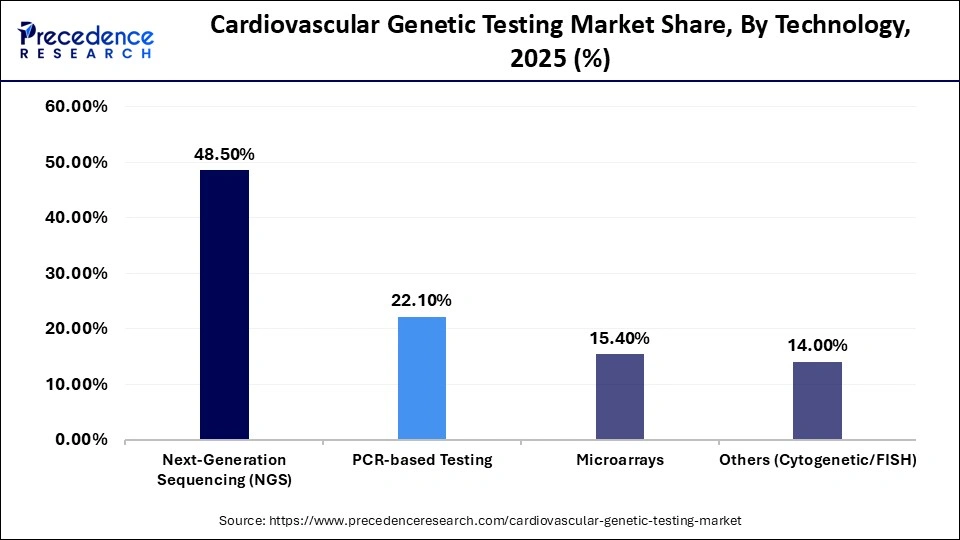

- By technology, the next-generation sequencing segment dominated the market in 2025, with a revenue share of approximately 48.5%.

- By technology, the microarrays segment is expected to grow at a notable rate in the market in 2025.

- By disease application, the inherited cardiomyopathies segment dominated the market in 2025, with a revenue share of approximately 42.3%.

- By disease application, the arrhythmia & channelopathies segment is expected to grow at the fastest CAGR from 2026 to 2035.

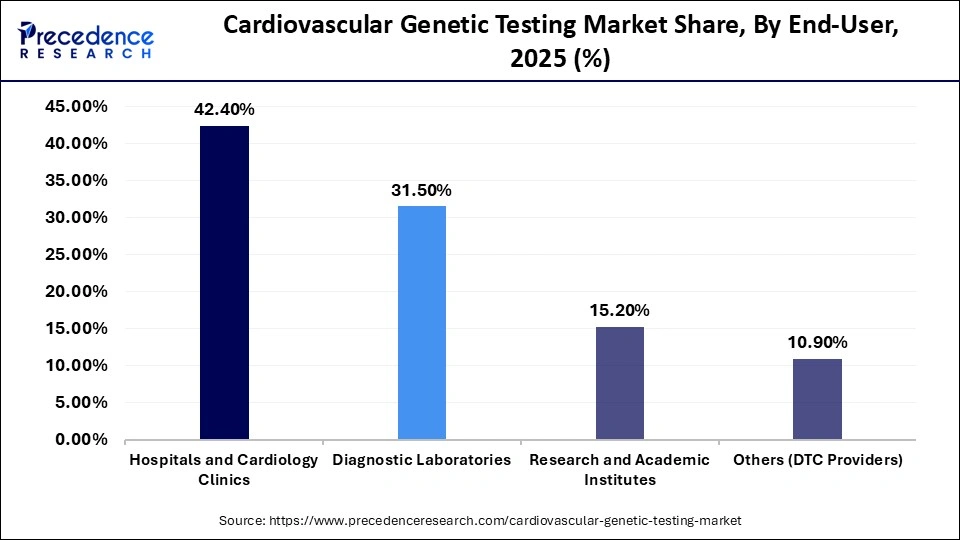

- By end-user, the hospitals & cardiology clinics segment dominated the market in 2025, with a revenue share of approximately 42.4%.

- By end-user, the research & academic institutes segment is expected to grow at the fastest CAGR from 2026 to 2035.

Cardiovascular Genetic Testing: Revolutionized Patient Care

The global cardiovascular genetic testing market comprises specialized laboratory assays, ranging from single-gene tests to multi-gene panels and whole-exome sequencing, used to identify inherited heart conditions. In recent years, the market is primarily driven by the integration of precision medicine into cardiology, allowing for early risk stratification and the management of hereditary conditions like hypertrophic cardiomyopathy and familial hypercholesterolemia. The future of genetic testing in disease prevention and treatment lies in advances in predictive genomics, genetic predisposition testing, DNA health screening, and advances in sequencing technologies and bioinformatics. It is expected that these emerging trends and advancements will enhance the precision and affordability of genetic tests.

How does AI Revolutionize the Cardiovascular Genetic Testing Market?

AI has wide applications in cardiology, including deep learning models applied to ECG analysis, which have high diagnostic accuracy. Moreover, deep neural networks help in the detection of arrhythmias and perform better than human cardiologists. AI models predict coronary artery stenosis with high accuracy. AI-based models require annotated and large datasets for training. The integration of AI in cardiovascular care presents many opportunities in the cardiovascular genetic testing market to personalize treatment strategies, improve diagnostic accuracy, and enhance patient monitoring.

Cardiovascular Genetic Testing Market Trends

- Multi-Gene Panel testing: It is ideal for the diagnosis of hereditary cardiomyopathy and inherited arrhythmic disorders or cardiomyopathy. This genetic testing is proven and medically important in people with a confirmed or suspected diagnosis of cardiomyopathy. This testing is done based on family history, with relatives having any of the related conditions.

- Genetic Testing Services and Technologies: The various technologies are used in the cardiovascular genetic testing market for genetic testing of coronary artery disease and cardiac syndromes. These tests include chromosome microarray analysis and next-generation sequencing that evaluate variations in genes. The gene expression arrays and microRNA analysis assess gene products. The results obtained from these tests help healthcare providers and people in the diagnosis, prognosis, and identification of appropriate clinical interventions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.34Billion |

| Market Size in 2026 | USD 12.63 Billion |

| Market Size by 2035 | USD 33.38Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.4% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Test Type, Technology, Disease Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Test Type Insights

How Does the Predictive Testing Segment Dominate the Cardiovascular Genetic Testing Market?

The predictive testing segment dominated the market in 2025 with a revenue share of approximately 46.8%, owing to the potential of different genetic tests, such as panel testing, single-gene and single-variant testing, whole-exome and whole-genome sequencing, direct-to-consumer genetic testing, and polygenic risk scores to predict risks of cardiovascular conditions. Predictive genetic testing is useful for diagnosis, management, and cascade screening. It allows for appropriate genetic counselling before and after tests for patients and their families.

The carrier screening segment is expected to grow at the fastest CAGR in the cardiovascular genetic testing market during the forecast period due to the available genetic screening tests to identify carriers of a severe and inherited condition. The carriers are allowed to receive appropriate genetic counselling and education. The single-gene tests or small gene panels and high-throughput identification of sequence variants through large gene panels have evolved screening technologies.

Technology Insights

What Made Next-Generation Sequencing the Dominant Segment in the Cardiovascular Genetic Testing Market in 2025?

The next-generation sequencing segment dominated the market in 2025 with a revenue share of approximately 48.5%, owing to its ability to identify causative mutations in families affected by genetic diseases. It allows clinical practitioners to identify rare and frequent genetic variants to detect pathogenic variants. The NGS is becoming a routine diagnostic standard to diagnose inherited heart conditions like dilated cardiomyopathy, hypertrophic cardiomyopathy, and channelopathies.

The microarrays segment is estimated to grow at the fastest rate in the cardiovascular genetic testing market during the predicted timeframe due to the cost-effective alternative to NGS, which is preferred to develop polygenic risk scores. The increased use of microarrays in a hybrid workflow and the rising adoption of molecular screening for chronic diseases are driving the growth of diagnostic laboratories. Microarrays are improving diagnostic accuracy and delivering high-throughput results.

Disease Application Insights

How Did the Inherited Cardiomyopathies Segment Dominate the Cardiovascular Genetic Testing Market in 2025?

The inherited cardiomyopathies segment dominated the market in 2025 with a revenue share of approximately 42.3%, owing to the emergence of genetic testing as a powerful tool for familial risk assessment, early diagnosis, and personalized management. The next-generation sequencing is useful to detect hereditary cardiac mutations. The cardiovascular genetic testing has wide applications in detecting cardiomyopathies, arrhythmias, and familial hypercholesterolemia.

The arrhythmia & channelopathies segment is anticipated to grow at a notable rate in the cardiovascular genetic testing market during the upcoming period due to a rapid shift from broad screening to high-precision diagnostic and management tools. Genetic testing allows clinicians to precisely manage and prevent sudden cardiac death. The technological innovations, like polygenic risk scores, structural variant detection, and digital integration, enable researchers to identify mutations. The leading companies, like GeneDx, have launched their pediatric offering that includes AI-enhanced exome sequencing for infants with unexplained arrhythmias.

End-User Insights

Why Did the Hospitals & Cardiology Clinics Segment Dominate the Cardiovascular Genetic Testing Market in 2025?

The hospitals & cardiology clinics segment dominated the market in 2025 with a revenue share of approximately 42.4%, owing to their importance in clinical diagnosis and management, prevention of family risks, and implementation of technologies. Clinics are moving towards pharmacogenomics and genetic testing to select optimal dosages for drugs like statins, warfarin, etc. They focus on developing polygenic risk scores as tools for complex diseases like atrial fibrillation and coronary artery disease.

The research & academic institutes segment is predicted to grow at a rapid rate in the cardiovascular genetic testing market during the studied period due to the increased focus of research institutes on precision public health and equity research to improve genomic datasets for populations. They provide specialized training programs and new certification courses to empower non-geneticists to interpret variants. The academic centers provide multidisciplinary genome boards to unite cardiologists, geneticists, and bioinformaticians on complex case interpretations.

Regional Insights

How Big is the North America Cardiovascular Genetic Testing Market Size?

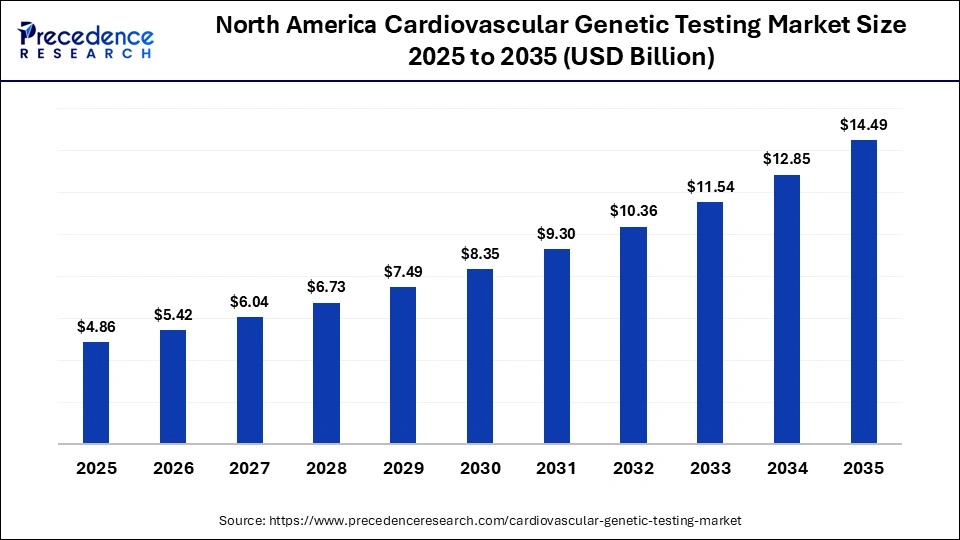

The North America cardiovascular genetic testing market size is estimated at USD 4.86 billion in 2025 and is projected to reach approximately USD 14.49 billion by 2035, with a 11.54% CAGR from 2026 to 2035.

How Does North America Dominate the Cardiovascular Genetic Testing Market in 2025?

North America dominated the market in 2025 with a revenue share of approximately 42.9%, owing to a shift to preventive care, favorable government, regulatory, and reimbursement support for genetic tests, reduced testing costs, and improved diagnostic accuracy.

According to the American College of Cardiology, the emerging trends in cardiovascular medicine are anti-obesity drugs, AI revolution driving precision diagnostics and predictive care, inflammation, CRISPR, gene editing, and amyloidosis. These trends are shaping the understanding of cardiovascular diseases and opening doors for research and innovation in the expanding cardiovascular genetic testing market. The World Heart Federation reported that high BMI is the root cause of 10% of cardiovascular deaths that are happening globally.

- In January 2026, the Association for Diagnostics & Laboratory Medicine provided guidance and laboratory support for emergency department drug testing. This initiative will advise emergency physicians and laboratorians on urine toxicology testing for drugs of misuse.

What is the Size of the U.S. Cardiovascular Genetic Testing Market?

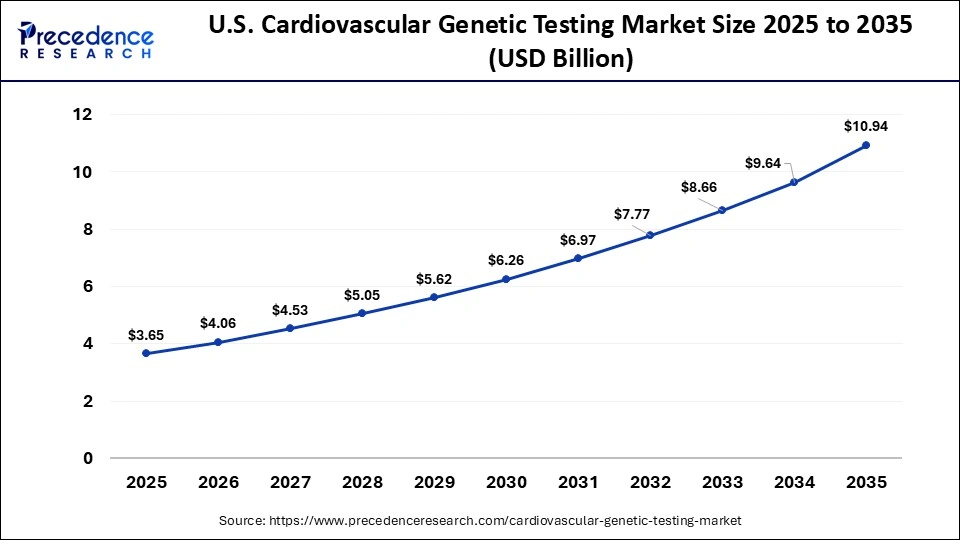

The U.S. cardiovascular genetic testing market size is calculated at USD 3.65 billion in 2025 and is expected to reach nearly USD 10.94 billion in 2035, accelerating at a strong CAGR of 11.6% between 2026 and 2035.

U.S. Cardiovascular Genetic Testing Market Analysis

The U.S. industry is shaped by accessible and centralized data provided by a cloud-based research workbench. The All of Us Research Program of the National Institutes of Health (NIH) established genetic data repositories, including participants in biomedical research.

- In September 2025, Broad Clinical Labs and Mass General Brigham Laboratory for Molecular Medicine launched a genetic test to predict risk across eight cardiovascular conditions. This newly launched tool has the potential to assess the genetic predisposition of an individual to several common and serious health conditions. These chronic cardiovascular conditions include type 2 diabetes mellitus, atrial fibrillation, elevated lipoprotein, coronary artery disease, hypertension, hypercholesterolemia, thoracic aortic aneurysm, and venous thromboembolism.

What is the Potential of the Cardiovascular Genetic Testing Market in the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035. due to government-led precision medicine initiatives, the growing demand for predictive and diagnostic screening, and the national research projects. The Thailand Ministry of Public Health-Department of Medical Services (MOPH-DMS), the Asia-Pacific Cardiovascular Disease Alliance, and the National Health Security Office (NHSO) organized the inaugural Asia-Pacific Heart Summit with an urgent call for action on health equity and cardiovascular disease. According to the Asia Pacific Cardiovascular Disease Alliance (APAC CVD Alliance), about 32 million people in this region live with heart failure, and it has released a white paper to tackle the rising burden of heart failure in the Asia Pacific.

India Cardiovascular Genetic Testing Market Trends

The early diagnosis, expanding follow-up and long-term care, and improved access to innovative diagnostics and therapies have expanded the Indian cardiovascular genetic testing market. India is renowned as the ‘cardiac capital of the world' because cardiovascular diseases are the leading cause of death globally. The leading medical device companies, like Philips, have introduced image-guided therapy to improve patient outcomes through minimally invasive procedures and fewer post-operative complications.

- In September 2025, Heartnet India launched a women's heart health screening campaign across five states, which aims to provide affordable ECG screening through gynaecologists. It also aims to improve the early detection of cardiovascular diseases among women.

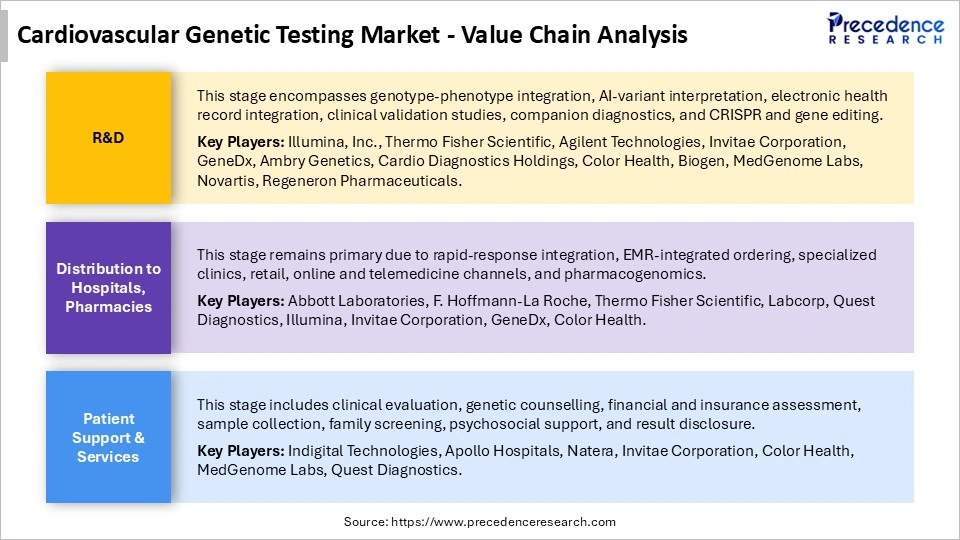

Cardiovascular Genetic Testing Market Value Chain Analysis

Who are the Major Players in the Global Cardiovascular Genetic Testing Market?

The major players in the cardiovascular genetic testing market include Illumina, Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc. Abbott Laboratories , Myriad Genetics, Inc., Danaher Corporation (Beckman Coulter), QIAGEN N.V,. Invitae Corporation, Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (Labcorp), Centogene N.V.

Recent Developments in the Cardiovascular Genetic Testing Market

- In April 2025, Illumina, Inc. and Tempus AI, Inc. made a partnership to accelerate the adoption of AI to shape the future of precision medicine and improve patient care through innovation in genomic AI. This collaboration aims to drive the enhanced clinical adoption of next-generation sequencing tests through novel evidence generation.(Source: https://investor.illumina.com)

- In July 2024, Thermo Fisher Scientific Inc. planned new strategies to help accelerate research into new treatments for Myelodysplastic Syndrome (MDS) and Acute Myeloid Leukemia (AML), while advancing myeloid cancer clinical research and treatment by utilizing next-generation sequencing technology. For this purpose, Thermo Fisher Scientific Inc. made a partnership with the National Cancer Institute (NCI), a part of the National Institutes of Health (NIH).(Source: https://ir.thermofisher.com)

Segments Covered in the Report

By Test Type

- Predictive Testing

- Carrier Screening

- Diagnostic Testing

- Others (Prenatal/Pharmacogenomic)

By Technology

- Next-Generation Sequencing (NGS)

- PCR-based Testing

- Microarrays

- Others (Cytogenetic/FISH)

By Disease Application

- Inherited Cardiomyopathies

- Arrhythmia & Channelopathies

- Aortopathies & Connective Tissue Disorders

- Familial Hypercholesterolemia (FH)

- Others

By End-User

- Hospitals & Cardiology Clinics

- Diagnostic Laboratories

- Research & Academic Institutes

- Others (DTC Providers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting