What is the Chemical Gas Sterilizers Market Size?

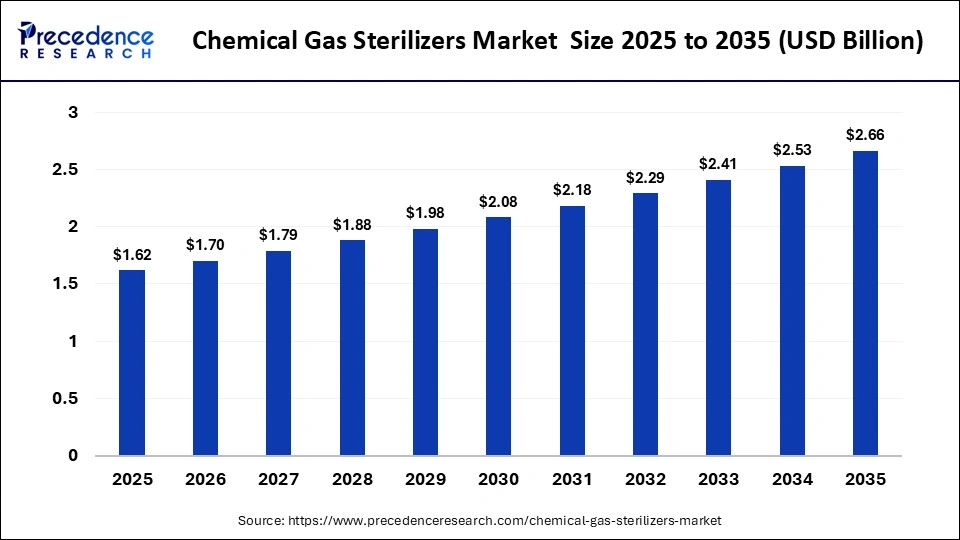

The global chemical gas sterilizers market size was calculated at USD 1.62 billion in 2025 and is predicted to increase from USD 1.70 billion in 2026 to approximately USD 2.66 billion by 2035, expanding at a CAGR of 5.10% from 2026 to 2035.The market growth is attributed to rising demand for safe and efficient sterilization of heat- and moisture-sensitive medical devices across hospitals and manufacturing facilities.

Market Highlights

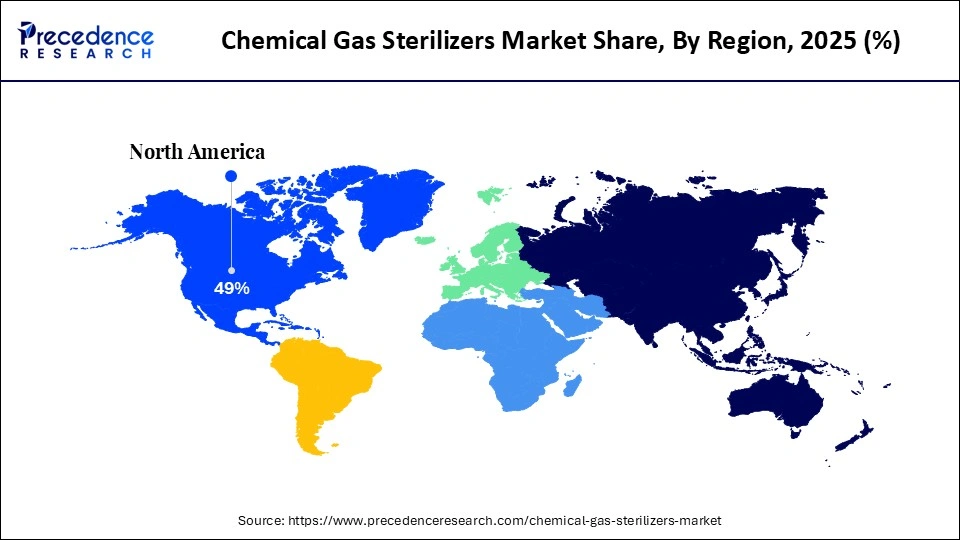

- North America dominated the market with the largest market share of 49% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By product type, the hydrogen peroxide sterilizers segment contributed the highest chemical gas sterilizers market share in 2025.

- By product type, the ethylene oxide sterilizers segment is expected to grow at a strong CAGR between 2026 and 2035.

- By end-user, the hospital & specialty clinics segment held a major market share in 2025.

- By end-user, the pharmaceutical & medical device manufacturers segment is expected to expand at the fastest CAGR from 2026 to 2035.

What are Chemical Gas Sterilizers?

The chemical gas sterilizers market refers to the preparation, manufacturing, and supply of chemical-based and gas-based sterilizers for the sterilization of medical, food, and pharmaceutical products. Sterilization is an essential procedure to prevent infection in patients undergoing surgical procedures and other medical treatments. The market is driven by the critical need for safe and reliable sterilization of heat- and moisture-sensitive medical devices.

In the U.S., about 50% of all sterile medical devices, or over 20 billion items annually, are sterilized using ethylene oxide (EtO). This is due to its broad material compatibility and penetration capabilities. Investments in emissions controls, continuous monitoring, and alternative sterilant research have accelerated between 2024 and 2026 as facilities' demand for chemical gas sterilizers in the coming years.

Impact of AI on the Chemical Gas Sterilizers Market

Artificial intelligence (AI) is reshaping the market by enabling smarter, faster, and more precise sterilization processes. AI-based predictive maintenance is used by manufacturers to evaluate sterilization chambers and identify potential equipment failures before they cause any form of disruption. Companies use AI-based quality monitoring solutions to process data in real-time and adjust the deviation, providing identical results. Furthermore, the AI adoption lowers operational costs, enhances productivity, and ensures high safety standards for sensitive medical equipment.

Chemical Gas Sterilizers MarketGrowth Factors

- Rising Adoption of Outpatient Surgical Centers: Growing numbers of ambulatory and specialty clinics are boosting demand for reliable chemical gas sterilization solutions.

- Expansion of Pharmaceutical Manufacturing Hubs: New drug and device production facilities are propelling the need for validated sterilization processes in Asia Pacific and North America.

- Surge in Complex Medical Device Production: Manufacturing of catheters, implants, and heat-sensitive instruments is propelling demand for chemical gas sterilization over alternative methods.

- Enhanced Focus on Environmental Safety: Investments in emissions reduction and eco-friendly sterilization practices are fuelling expansion and upgrades in existing facilities.

North America Chemical Gas Sterilization Infrastructure and Investment Landscape

- As of 2024 2025, the U.S. and Canada host the largest operational base of chemical gas sterilization systems globally, supported by over 100 EPA-permitted ethylene oxide sterilization facilities, concentrated across Illinois, Texas, California, and the Northeast, with continued system upgrades and capacity expansions reported by leading sterilization service providers through 2026.

- In the U.S. in 2024 2026, ethylene oxide (EtO) is used to sterilize approximately 50% of all sterile medical devices accounting for an estimated ~20 billion to ~25 billion devices annually across major manufacturing hubs such as Southern California, Illinois, Georgia, and New Jersey.

- In 2024, Life Science Outsourcing (LSO) announced a significant expansion of its ethylene oxide sterilization capacity in the U.S., adding multiple 3M Steri Vac GS8X chambers at its California and New Hampshire facilities effectively doubling in-house EO sterilization throughput for medical devices.

STERIS plc reported a notable increase in capital equipment revenues in fiscal 2024, with capital equipment revenue growing approximately 17.9 % compared to fiscal 2023, indicating increased investment in capital-grade sterilization equipment, including low-temperature systems. - Getinge AB's 2024 financial disclosures indicate continued strategic investment in sterile reprocessing solutions, including low-temperature sterilizers, representing a sustained capital allocation toward product innovation and expanded solutions for hospital and life science customers.

Chemical Gas Sterilizers Market Trends

- Emission Neutral Sterilization Systems Deployment: Manufacturers and service providers are rolling out next-gen sterilizers designed to operate with near-zero EtO emissions. These systems incorporate high-end catalytic converters and closed-loop abatement units to ensure high 2026 stipulated environmental requirements. This trend facilitates plants to use such technologies, making it easier to comply with EPA and local air quality regulations.

- Integration of IoT Sensors with Sterilization Equipment: Internet of Things (IoT) sensors in sterilizers improve awareness of chamber conditions, aeration efficiency, and operator interactions. Such intelligent sensors notify teams about deviations as soon as possible and help to plan proactive maintenance. The use of IoT-enabled sterilization units by facilities is on a steep increase in 2026, thus facilitating this trend in the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.62 Billion |

| Market Size in 2026 | USD 1.70 Billion |

| Market Size by 2035 | USD 2.66Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Chemical Gas Sterilizers Market?

The hydrogen peroxide sterilizers segment dominated the market in 2025 due to the widespread use of this sterilization method, as supported by regulatory agencies such as the FDA. They officially labeled vaporized hydrogen peroxide (VH2O2) as an established sterilization technique in January 2024. This makes its implementation by manufacturers easier when it is guided by the regulatory authority.Such acknowledgement is likely to expand industry usage since VH2O2 sterilizes most heat-sensitive equipment without leaving residues.

Hydrogen peroxide sterilization systems are environmentally safe, as they are low-temperature and produce nontoxic byproducts. Furthermore, hydrogen peroxide sterilization is increasingly being taken as a likely cause of adoption trends in the years to come, especially in devices that are sterilized using the oxidizing effect.

The ethylene oxide sterilizers segment is expected to grow at the fastest CAGR in the coming years, as the FDA and EPA continue to acknowledge its critical role in sterilizing complex medical devices that cannot be treated with other low-temperature methods. Additionally, manufacturers and providers of contract sterilization are expected to keep expanding or updating EtO facilities to comply with regulations and the continued demand for devices that need its special sterilization measures.

End-User Insights

Which End-User Segment Dominated the Chemical Gas Sterilizers Market?

The hospital & specialty clinics segment held the largest revenue share in the market in 2025, because clinicians operate high volumes of surgical and sterile processing activities. These departments involve regular sterilization of heat and moisture-vulnerable apparatus. In 2025, ANSI/AAMI ST58:2024 and other AAMI standards of sterilization were recognized by the FDA.

Hospitals follow these standards to validate and control sterilization processes consistently. The FDA recommends the use of EtO to treat approximately 50% of sterile medical devices in the U.S. Furthermore, the increase in surgery and the growth of healthcare infrastructure also led to the rise in the demand for in-house and outsourced sterilization services in the coming years.

The pharmaceutical & medical device manufacturers segment is expected to expand rapidly in the chemical gas sterilizers market in the coming years, as they depend heavily on certified sterilization processes for products that enter clinical markets worldwide. These manufacturers rely on robust sterility validation frameworks, such as ISO 11135 and recognized consensus standards, integrated into FDA premarket review pathways. This helps to streamline regulatory approvals and reduce compliance uncertainty.

The increasing volume of production, accompanied by the tightening of environmental and safety controls, is leading to the faster implementation of improved sterilization systems. Manufacturers are building in-house sterilization, or are long-term contracting sterilizers. This minimizes turnaround and also provides uniform quality in product lines.

Regional Insights

How Big is the North America Chemical Gas Sterilizers Market Size?

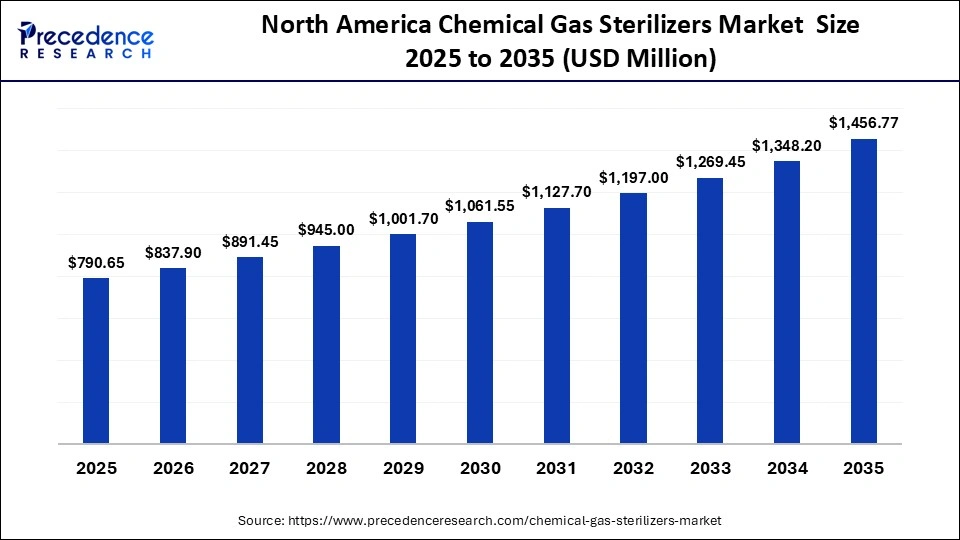

The North America chemical gas sterilizers market size is estimated at USD 790.65 million in 2025 and is projected to reach approximately USD 1,456.77 million by 2035, with a 6.30% CAGR from 2026 to 2035.

Why North America Led the Chemical Gas Sterilizers Market?

North America led the market, capturing the largest revenue share in 2025, due to its dense healthcare infrastructure. Hospitals and specialty clinics have high workloads on surgical and diagnostic operations. Many of these facilities use chemical gas sterilization of heat-sensitive and moisture-sensitive instruments. In March 2024, the U.S. EPA finalized new standards for EtO emissions that involve continuous monitoring of emissions, thus demanding advanced sterilization technologies.

- In January 2025, the agency announced a preliminary determination to reduce worker and community exposure but still maintain the need to supply devices. Most sterilization OEMs and service providers, such as STERIS plc, Sotera Health/Sterigenics, Getinge AB, and Advanced Sterilization Products (ASP), have large installed capacities and support networks across the region. Additionally, the Strict EPA and FDA requirements through 2025-2026 increase the improvement of sterilization chambers, abatement systems, and monitoring systems, strengthening the leading role of North America in the market.

What is the Size of the U.S. Chemical Gas Sterilizers Market?

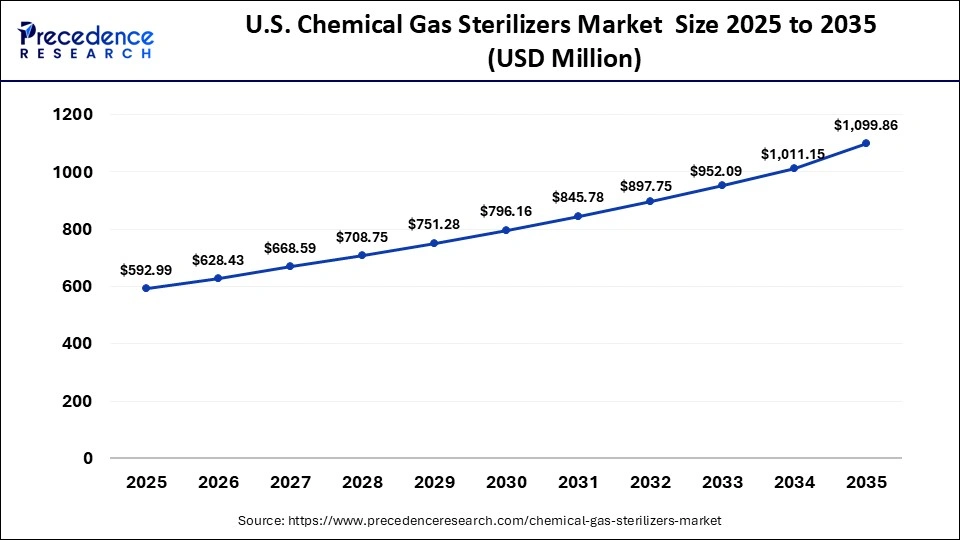

The U.S. chemical gas sterilizers market size is calculated at USD 592.992 million in 2025 and is expected to reach nearly USD 1099.86 million in 2035, accelerating at a strong CAGR of 6.37% between 2026 and 2035.

Powerhouse of Sterilization Excellence: The U.S. Driving Advanced Chemical Gas Solutions

U.S. leads the market in North America, supported by stringent EPA and FDA regulatory actions that balance emissions control with device supply continuity. The FDA has continued its series of Sterilization Town Halls through 2025, focusing on collaborative solutions for EtO reliance and supply chain resilience for critical sterile devices. Furthermore, these combined forces ensure that the U.S. continues to lead regionally while evolving its safety, compliance, and sterilization technology practices.

Why is Asia Pacific Growing Rapidly in the Chemical Gas Sterilizers Market?

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period, owing to the high healthcare and industrial growth across major economies. Medical devices are also manufactured, exported, and sterilized in large volumes, which are increasing in China and India. There is an increasing demand to sterilize complex equipment such as catheters, implants, and state-of-the-art surgical equipment, which demands quality chemical treatment of gases.

Major service providers and OEMs such as Getinge AB, STERIS plc, Fortive/ASP, Bocon Group, Belimed AG, and Cantel Medical are setting up or building facilities in China, India, Japan, and South Korea to facilitate this expansion. Contract sterilization services are expanding to satisfy hospital and manufacturing demands to increase throughput and quality uniformity. Furthermore, governments in the Asia-Pacific emphasize emissions controls and worker safety, prompting facilities to upgrade legacy EtO units with modern abatement and monitoring technology.

China's Rapid Rise: Transforming Chemical Gas Sterilization Across the Asia-Pacific

China is leading the charge in the Asia-Pacific region, due to the fast growth in healthcare services, medical equipment production, and congruence to international sterilization standards. The intensive growth of hospitals and the increase in operations stimulate the overall use of gas sterilization for complex equipment and delicate medical products. Additionally, this environment makes China a key regional leader and a primary driver for sterilization uptake in the Asia-Pacific.

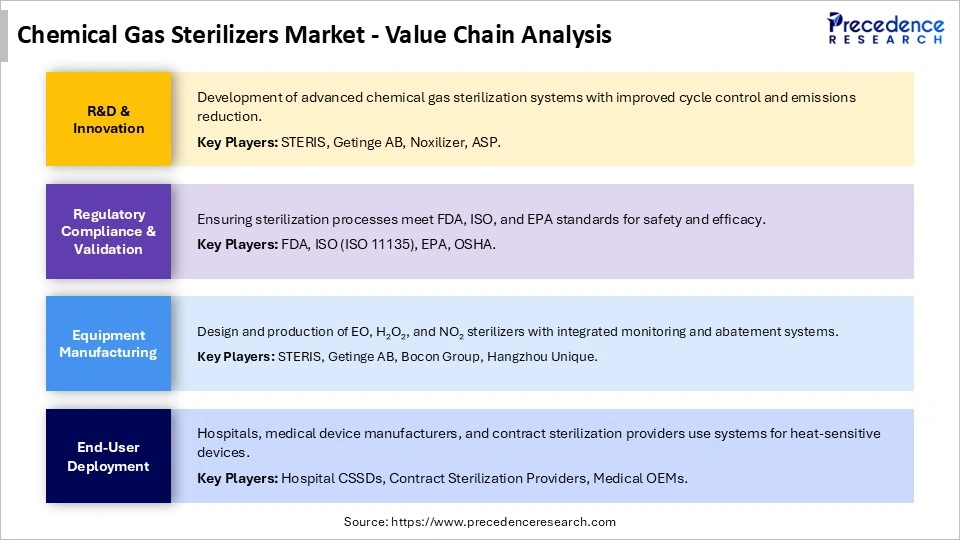

Chemical Gas Sterilizers MarketValue Chain Analysis

Who are the Major Players in the Global Chemical Gas Sterilizers Market?

The major players in the chemical gas sterilizers market include Andersen Sterilizers, ASP (Fortive), DE LAMA S.P.A., ERNA Medical, Getinge, Noxilizer Inc., STERIS, Stryker, Instech Systems, Pernix Bio-Med, Abster Equipment

Latest Announcements by Industry Leaders

Genist Technocracy launched its Low-Temperature Plasma Sterilizer, designed to meet the dynamic needs of modern healthcare facilities, research laboratories, and diagnostic centers. This launch marks a significant step forward in delivering gentle, sustainable, and high-performance sterilization solutions, said a company spokesperson. Our Low-Temperature Plasma Sterilizer is engineered to redefine sterilization standards in India and across global healthcare markets, combining innovation with safety and environmental responsibility.

Recent Developments

- In September 2025, ClorDiSys Solutions, LLC announced a significant expansion of its processing capabilities and workforce to meet rising customer demand. The company added multiple chlorine dioxide sterilization chambers, doubling its throughput capacity to 12 14 pallets within 24 hours and reinforcing ClorDiSys's position in the U.S.(Source:https://www.prnewswire.com)

- In June 2025, Solventum announced the launch of its Attest Super Rapid Vaporized Hydrogen Peroxide (VH2O2) Clear Challenge Pack. The test pack, approved by the FDA, can monitor across multiple sterilizer brands, models, and cycle types, offering convenience, accuracy, and simplification.(Source: https://www.prnewswire.com)

- In May 2025, ClorDiSys Solutions Inc. received U.S. Patent No. 12,201,738 B2 for its innovative system that converts existing ethylene oxide vacuum sterilizers into chlorine dioxide vacuum sterilizers. This breakthrough technology is expected to accelerate the adoption of ClO2 gas sterilization in the medical device sector by allowing manufacturers to leverage existing EO infrastructure efficiently.(Source: https://www.chemanalyst.com)

Segments Covered in the Report

By Product Type

- Ethylene Oxide Sterilizers

- Hydrogen Peroxide Sterilizers

- Nitrogen Dioxide Sterilizers

- Others

By End-User

- Hospital & Specialty Clinics

- Pharmaceutical & Medical Device Manufacturers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting