Life Science Chemical and Instrumentation Market Size and Forecast 2025 to 2034

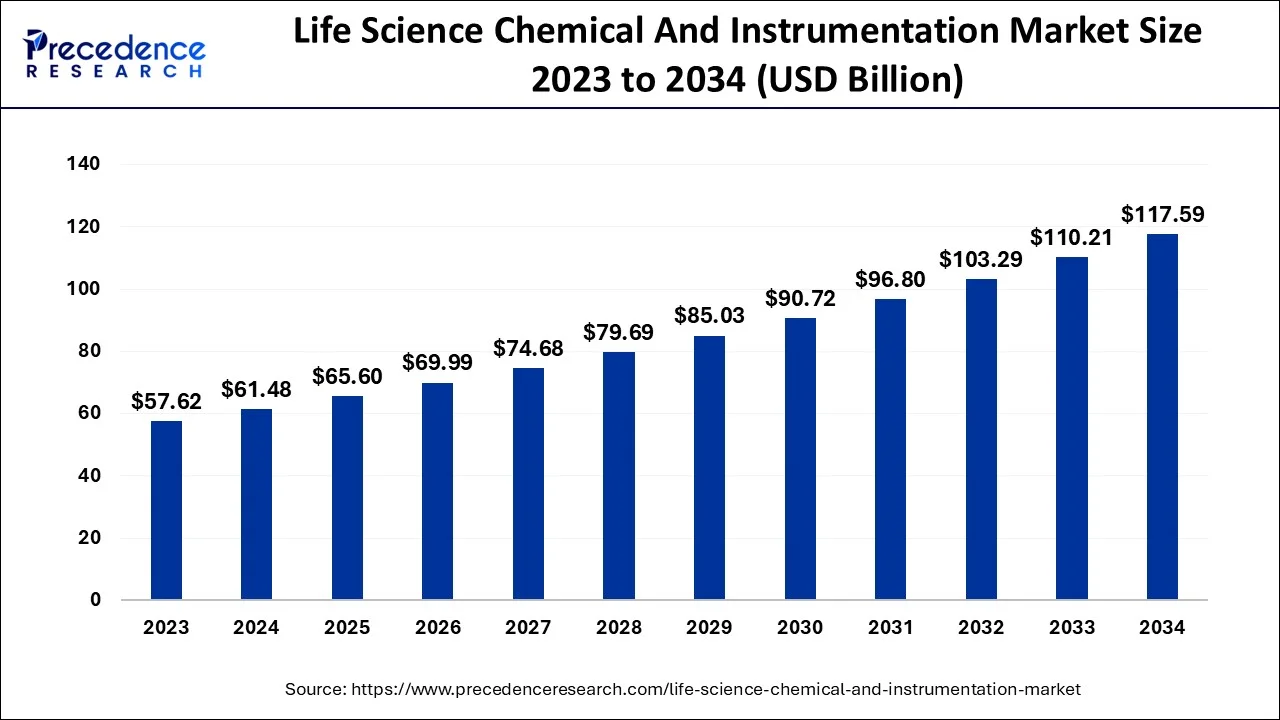

The global life science chemical and instrumentation market size was estimated at USD 61.48 billion in 2024 and is anticipated to reach around USD 117.59 billion by 2034, expanding at a CAGR of 6.70% between 2025 and 2034.

Life Science Chemical and Instrumentation Market Key Takeaways

- In terms of revenue, the market is valued at $65.60 billion in 2025.

- It is projected to reach $117.59 billion by 2034.

- The market is expected to grow at a CAGR of 6.70% from 2025 to 2034.

- North America dominated the global market in 2024

- The chromatography technology segment dominated the global market in 2024.

- The pharmaceutical and biotechnology companies segment dominated the market in 2024.

Rising pharmaceutical research and development activities and increased food safety concerns. Raised in private and public funding from crucial players, technological advancement in instruments, rising drug development regulations, and expandedclinical trials in emerging countries influence the global life science and chemical instruments market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 65.60 Billion |

| Market Size in 2024 | USD 61.48 Billion |

| Market Size by 2034 | USD 117.59Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.70% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

High prevalence of infectious and chronic diseases driving the market growth

The high prevalence of infectious and chronic diseases and technological advancements influence the industry's growth. According to HIV.gov statistics from June 2021, approximately 1.2 million people in the United States had HIV (Human Immunodeficiency Virus), with an incidence rate of 12.6 percent (per 100,000 population). This implies that a high prevalence of HIV will increase demand for these instruments and chemicals for drug manufacturing and it results in boosting the industry growth. Furthermore, the launch of various devices by market participants promotes market growth. For example, Thermo Fisher Scientific will release the Invitrogen Attune CytPix Flow Cytometer in June 2021, a tomography-enhanced flow cytometer that mixes acoustic focusing flow cytometry technology with a superior-speed camera.

Opportunities

Increasing public-private investment provides lucrative opportunities

The market for life science instruments and chemicals is driven by rising public-private investments in life science research and technological advancements in analytical instrumentation and tools. For example, according to an article published by the United Kingdom Parliament in October 2022, the total spending on R&D in the United Kingdom in 2022 was EUR 37.1 billion. Furthermore, according to OECD data, Bulgaria had the highest pharmaceutical expenditure as a percentage of GDP in 2021, with around 32.4% spent on medications. As a result, rising pharmaceutical R&D spending is expected to drive market growth during the forecast period.

Life sciences chemical and instrumentation trends

Smaller samples

Labs are keeping a more comprehensive range of costly chemicals and reagents in lesser quantities to save money. They are pressuring their instrument manufacturers to reduce the cost of possession of this equipment, which is leading to the processing of smaller samples from test-tube size down to the tiny wells in microtiter trays. Miniature positioners can precisely place pieces in these trays. Furthermore, automated analyzers can use valves that withstand higher pressures, allowing for smaller samples and reagent amounts. Pressures here are typically 30 psi, but this should rise to 50 to 80 psi as piezo devices replace solenoid coils in actuators. Piezo devices generate more force than solenoids, allowing more pressure flows and throughput.

Robotic Analyzers

The robotic equipment being developed to dispense and handle laboratory samples is smaller and eliminates the need for complex networks of tubing and connection points. Manifolds with integrated piping have taken their place. When it comes to critical samples, clinical laboratories, and hospitals cannot afford to have an instrument fail, so less tubing means less chance of failure. The manifolds reduce the possibility of leakage and eliminate the work required for an employee at a test bench to integrate 30 pieces of tubing.

Technology Insights

The chromatography segment dominated the market in 2024. Chromatography is an analytical method that measures the concentration of analytes in the present sample and, in many cases, aids in quantifying the analyte. Chromatography is mainly used to analyze liquid compounds, and in the case of gas chromatography (GC), the analytes can be vaporized without decomposition.

It is commonly used to determine the purity of substances or to separate a mixture into their constituents. Many pharmaceutical applications use chromatography, such as assessing the number of chemicals in drugs. According to MDPI Journal data published in April 2022, chromatography analysis of any medication aims to validate and identify the drug, provide quantitative data, and monitor the drug.

Furthermore, market participants focus on introducing superior liquid chromatography systems and components. Waters Corporation will launch its innovative high-performance liquid chromatography (HPLC) system, the Waters Arc Premier System, in June 2021. According to the company, the new liquid chromatography system could be used for routing testing in various end-use areas, including the pharmaceutical industry and academic and materials markets. Furthermore, Shimadzu launched its i-Series Plus integrated chromatography system in July 2022, which covers conventional to ultra-fast liquid chromatography analysis. As a result, all the above factors are likely to drive segment growth over the forecast period.

End User Insights

Pharmaceutical and biotechnology companies dominated the market in 2024. An increase in research and development activity as well as the increase in drug manufacturing and clinical trials results in increasing the instrumentation market. The segment is expected to lead its dominance in the forecast period due to increase pharmaceutical manufacturing to maintain the quality of drugs.

Regional Insights

North America dominated the life science chemical market due to its application in various fields of study. Life science chemicals are used in the development of biology-based products and pharmaceuticals. The North American region highly invests in research and development due to this; the North American area has shown enormous growth. North America's robust infrastructure facilitates and research-based activities, resulting in increased investment in this segment.

According to OECD data, pharmaceutical spending in North America accounts for approximately 1.9% of GDP. The region accounts for more than 40% of global pharmaceutical sales. Factors such as the aging population have aided in the growth of this market. Furthermore, people are becoming more susceptible to diseases, driving the need to new heights. The use of therapeutics such as biologics and precision medicines are also propelling this market's growth. The United States accounted for roughly 47.2% of all pharmaceutical sales in North America. Because of per capita health expenditure, the North American pharmaceutical sector is expected to grow at 5-7%. On a global scale, the oncology sector is expected to increase the most within the pharmaceutical industry.

Furthermore, the number of cancer fatalities per 100,000 people in the United States is 178.3, higher than the OECD average. As a result, the use of life sciences in the oncology department promotes the growth of this segment even further. Aside from healthcare, chemicals are also used in agriculture. Some biotechnological processes to improve crop quality include stem cell therapy and plant tissue culture. Botanicals are expected to proliferate in this market due to the increased use of herbal medicine in the United States and Canada.

Health spending in the EU accounts for roughly 10-12% of the total GDP, and the United Kingdom is one of the largest markets in this segment. However, the EU's biotech and pharmaceutical clusters have received less investment on average than NA and APAC. One of the primary reasons is the United Kingdom's "Brexit," or exit from the European Union. Furthermore, strict regulations have been imposed on the manufacture and distribution of drugs in this region. Environmental protection is addressed by laws such as REACH within the EU. Because plant effluents contain a variety of toxins, these ecological standards are issued as part of the safety regulations.

Asia Pacific is expected to grow significantly in the life science chemical and instrumentation market during the forecast period. Asia Pacific is experiencing an expansion in the healthcare sector due to growing research and development, adoption of advanced technologies, as well as growing investments. This promotes the market growth.

China

The industries in China are utilizing advanced technologies such as mass spectrometry, flow cytometry, etc, for the development of new diagnostic and treatment approaches. Moreover, the growing development is personalized medications is also increasing their use.

India

The advancing industries in India are focusing on the development of new diagnostic and treatment approaches to deal with the rising diseases. This, in turn, increases the demand for life science chemicals and instrumentation.

Competitive intelligence and key players present in the life science chemical market

The industry is expanding rapidly as a result of multiple strategic initiatives by key players. Waters Corp., for example, announced a collaboration with 50 leading industry partners and researchers from the Plant Protein Innovation Center at the University of Minnesota in July 2022. Waters researchers will collaborate with PPIC scientists to develop a workflow for quantitative analysis of plant-based proteins using the ACQUITY Premier UPLC System. Life science and chemical instrumentation market players are focusing on expanding their product portfolios through inorganic growth strategies such as acquisitions, mergers, and partnerships. Agilent Technologies Inc., Becton, Dickinson & Company, Bio-Rad Laboratories Inc., Bruker Corporation, Danaher Corporation, and F. Hoffmann-La Roche Ltd. are some of the market's key players.

Life Science Chemical and Instrumentation Market Companies

- Agile Technologies Inc

- PerkinElmer Inc

- Bruker Corporation

- Thermo Fisher Scientific Inc

- Water Corporation

Recent Development

- In June 2025, the establishment of the U.S. headquarters of Dxcover, which is a UK-based company enhancing early cancer detection with its AI-powered multiomic technology, in Nashville, Tennessee, was announced. Thus, to commercialize the PANAROMIC™ cancer test in the world's biggest life sciences market, this move of Dxcover highlights its commitment. Moreover, its main goal is to expand its leadership in cancer diagnostics innovation, where the facility will serve as a research and development hub, as well as the manufacturing of its novel infrared spectroscopy platform will be enhanced by forming new collaborations with local healthcare and biotech organizations.

(Source: https://finance.yahoo.com) - In May 2025, the launch of AmberChrom™ TQ1 chromatography resin was announced, which can be used for the purification of peptides and oligonucleotides, along with providing support for a wide range of biopharma applications and expanding the DuPont bioprocessing portfolio. Moreover, according to Global Bioprocessing Market Leader for DuPont Water Solutions, Shane Kendra, it can accelerate the development and commercialization of peptides and oligonucleotide therapeutics.

(Source: https://www.morningstar.com) - In 2022,MGI's HotMPS is a new commercial sequencing chemistry. This novel sequencing chemical was developed for MGI's DNBSEQ-G400 sequencer and will be available in select countries starting in April 2022.

- In 2022,Agilent, the National University of Singapore, and the National University Hospital have established a new $38 million translational research and development unit to improve clinical diagnostics and testing through biochemical invention and methodologies.

- In 2022,TeselaGen Biotechnology released the Community Edition of its popular DESIGN Module, which is part of the TeselaGen Biotechnology Operating System. The free cloud-based software provides users with previously unavailable tools for constructing DNA constructs or DNA assembly, designing primers, and viewing and editing DNA plasmids.

Segments Covered in the Report

By Technology

- Spectroscopy

- Chromatography

- Flow Cytometry

- NGS

- PCR

- Microscopy

By End User

- Hospital and Diagnostic centers

- Pharmaceutical and Biotechnology companies

- Contract Research Organizations and Research institutes

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting