Circuit Breaker and Fuse Market Size and Forecast 2025 to 2034

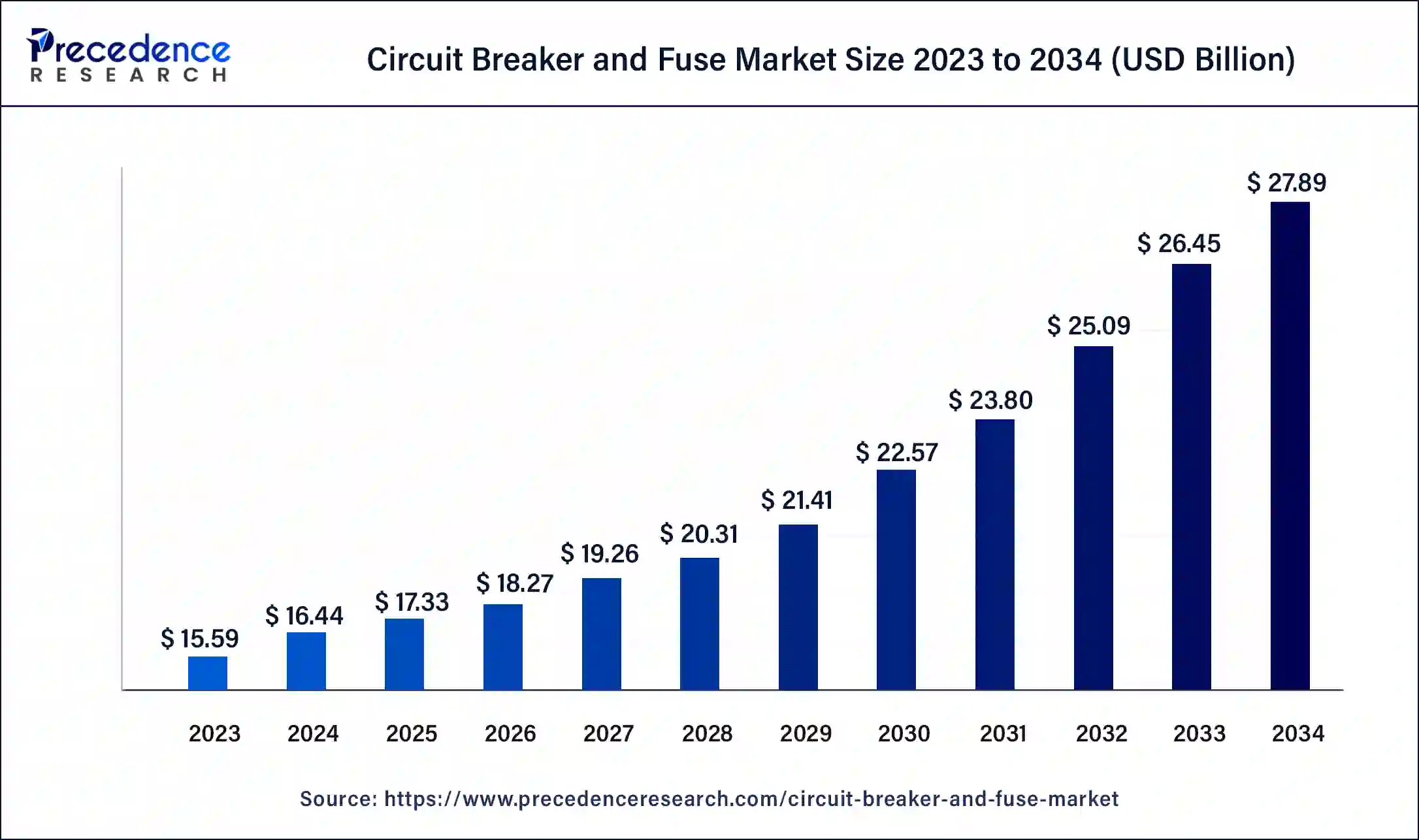

The global circuit breaker and fuse market size was calculated at USD 16.44 billion in 2024, and is projected to be worth around USD 27.89 billion by 2034, at a CAGR of 5.43% from 2025 to 2034. The rising focus on electrical safety standards is anticipated to boost the growth of the circuit breaker and fuse market. The rapid urbanization and industrialization are the major factors promoting the growth of the market in the upcoming years.

Circuit Breaker and Fuse Market Key Takeaways

- In terms of revenue, the market is valued at $17.33 billion in 2025.

- It is projected to reach $27.89 billion by 2034.

- The market is expected to grow at a CAGR of 5.43% from 2025 to 2034.

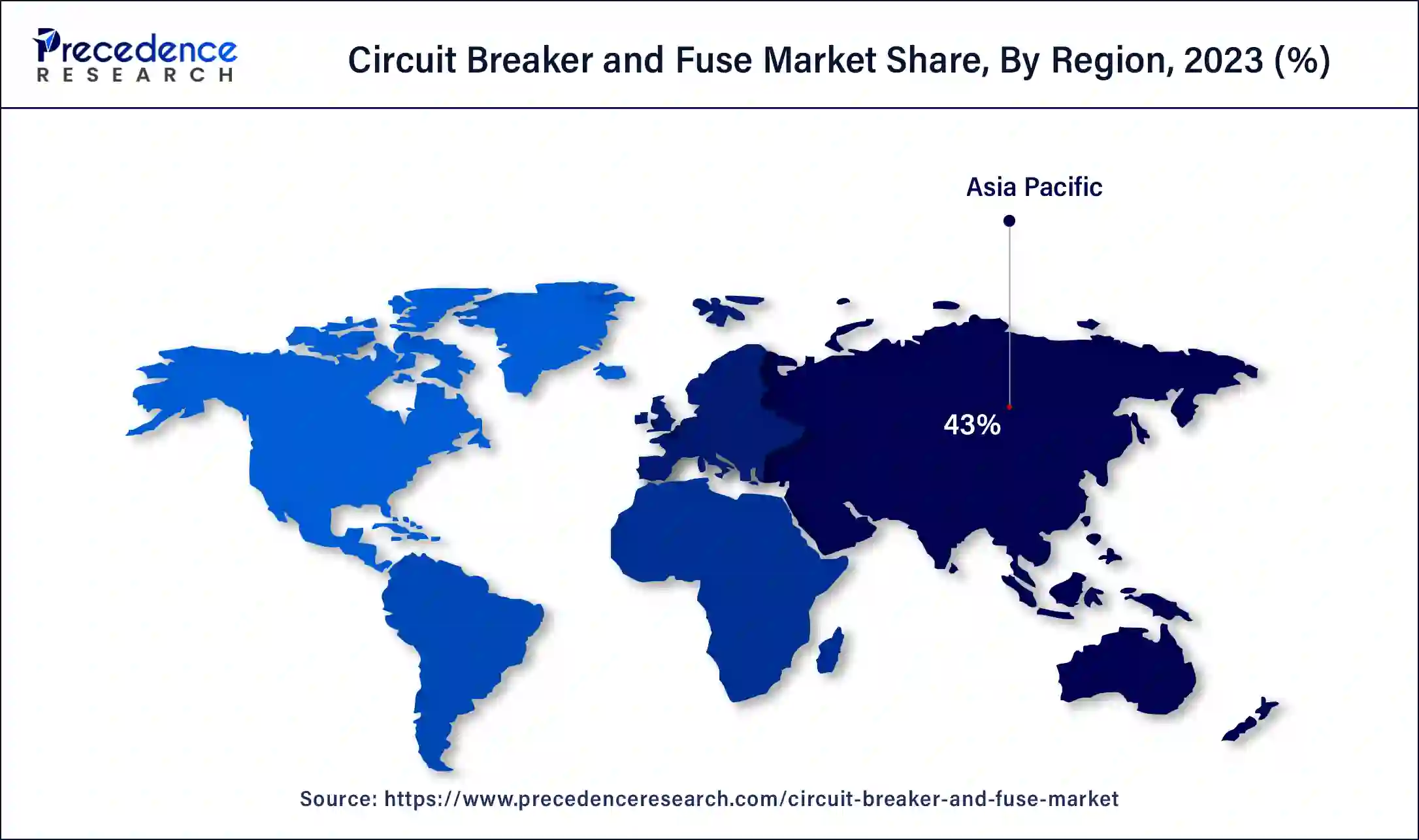

- Asia Pacific dominated the circuit breaker and fuse market with the largest market share of 43% of in 2024.

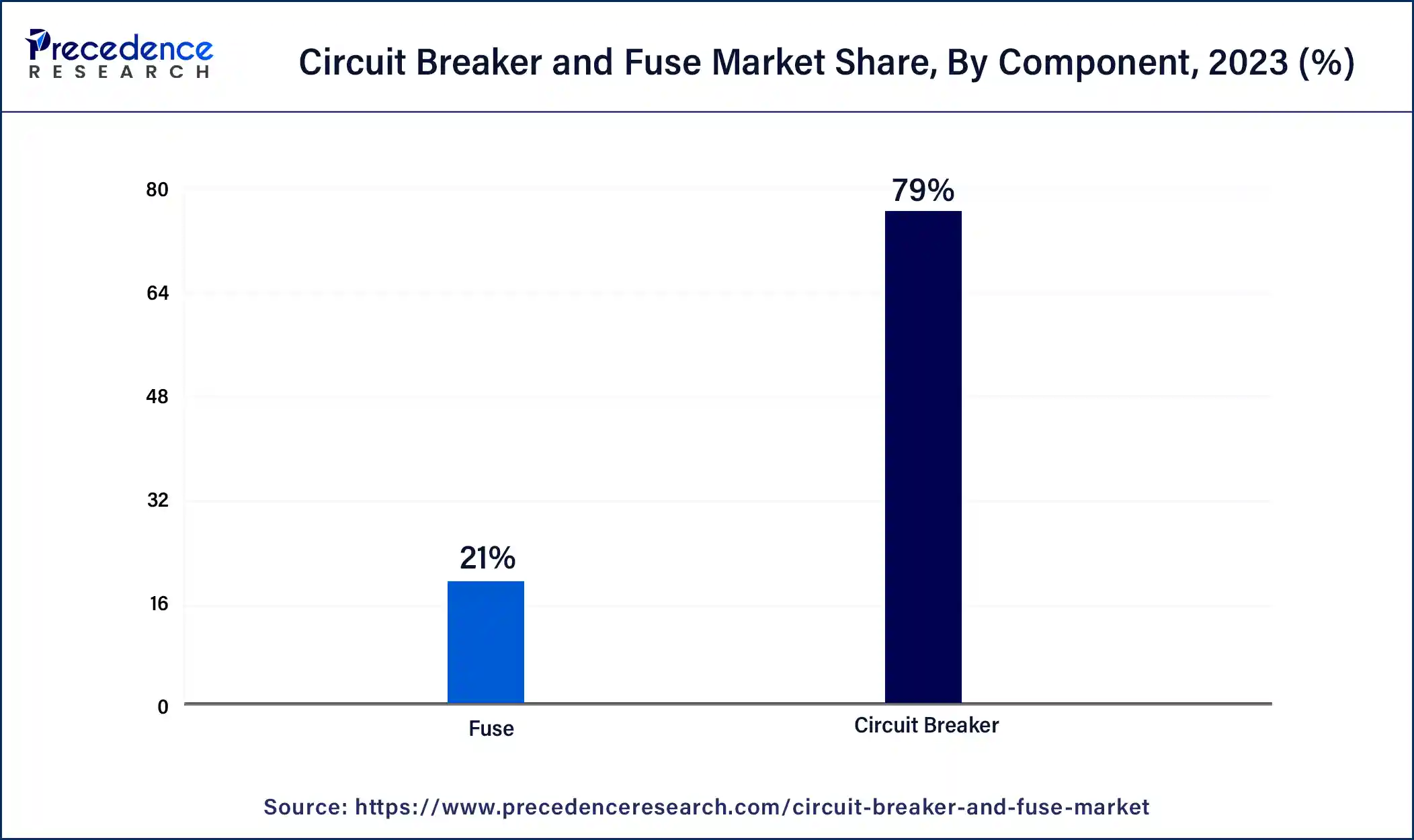

- By component, the circuit breakers segment accounted for the highest market share of 79% in 2024.

- By component, the fuses segment is expected to witness a significant share during the forecast period.

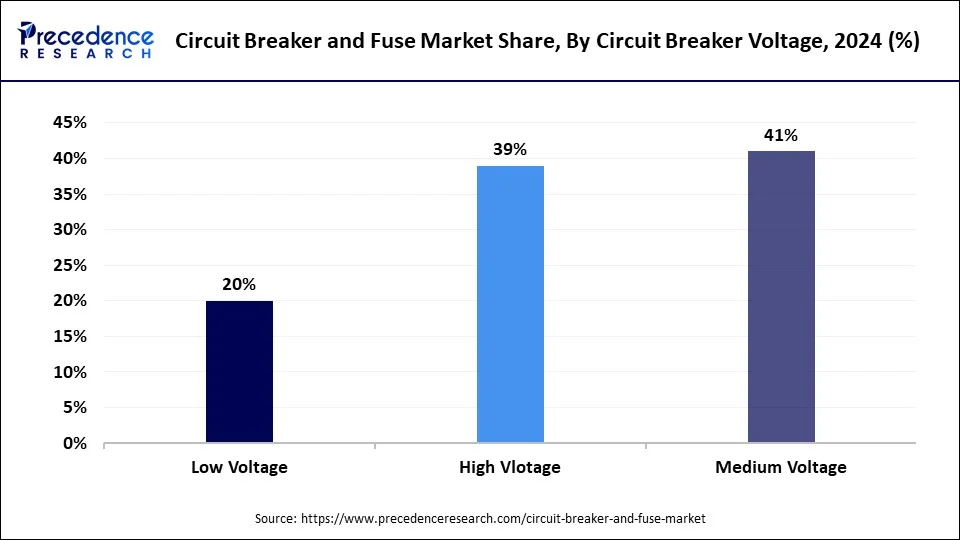

- By circuit breaker voltage, the medium voltage segment held a biggest market share of 41% in 2024.

- By circuit breaker voltage, the low-voltage is projected to grow at a notable CAGR of 7.04% over the forecast period.

- By circuit breaker technology, the air blast circuit breakers segment registered its dominance over the global circuit breaker and fuse market in 2024.

- By circuit breaker technology, the vacuum circuit breakers segment is projected to expand rapidly in the market in the coming years.

- By fuse voltage, the high voltage segment contributed more than 63% of market share in 2024.

- By application, the power generation segment accounted for the highest market share of 31% in 2024.

- By application, the construction segment is expected to grow at the solid CAGR of 7.03% rate during the forecast period of 2025 to 2034.

How AI is improving protective electrical devices?

The integration of AI is significantly improving the design of protective electrical devices. Electrical circuit design is both a complex and challenging task, it can be time-consuming, costly, and prone to errors while using traditional methods of circuit design. However, the potential of artificial intelligence (AI) can enhance and automate the process of electrical circuit design. There are several benefits associated with the use of AI in electrical circuit design, such as faster and streamlined design processes, more innovative and creative solutions, better integration and collaboration among different tools, and contribution to more sustainable and ethical design.

Artificial Intelligence (AI) is also transforming the energy sector, revolutionizing how power is generated, distributed, and consumed. From smart grid management to renewable energy forecasting, AI is changing the way the energy industry operates, making it more efficient and sustainable. In the renewable energy sector, Artificial intelligence is widely being to increase efficiencies and reduce costs.

Asia Pacific Circuit Breaker and Fuse Market Size and Growth 2025 to 2034

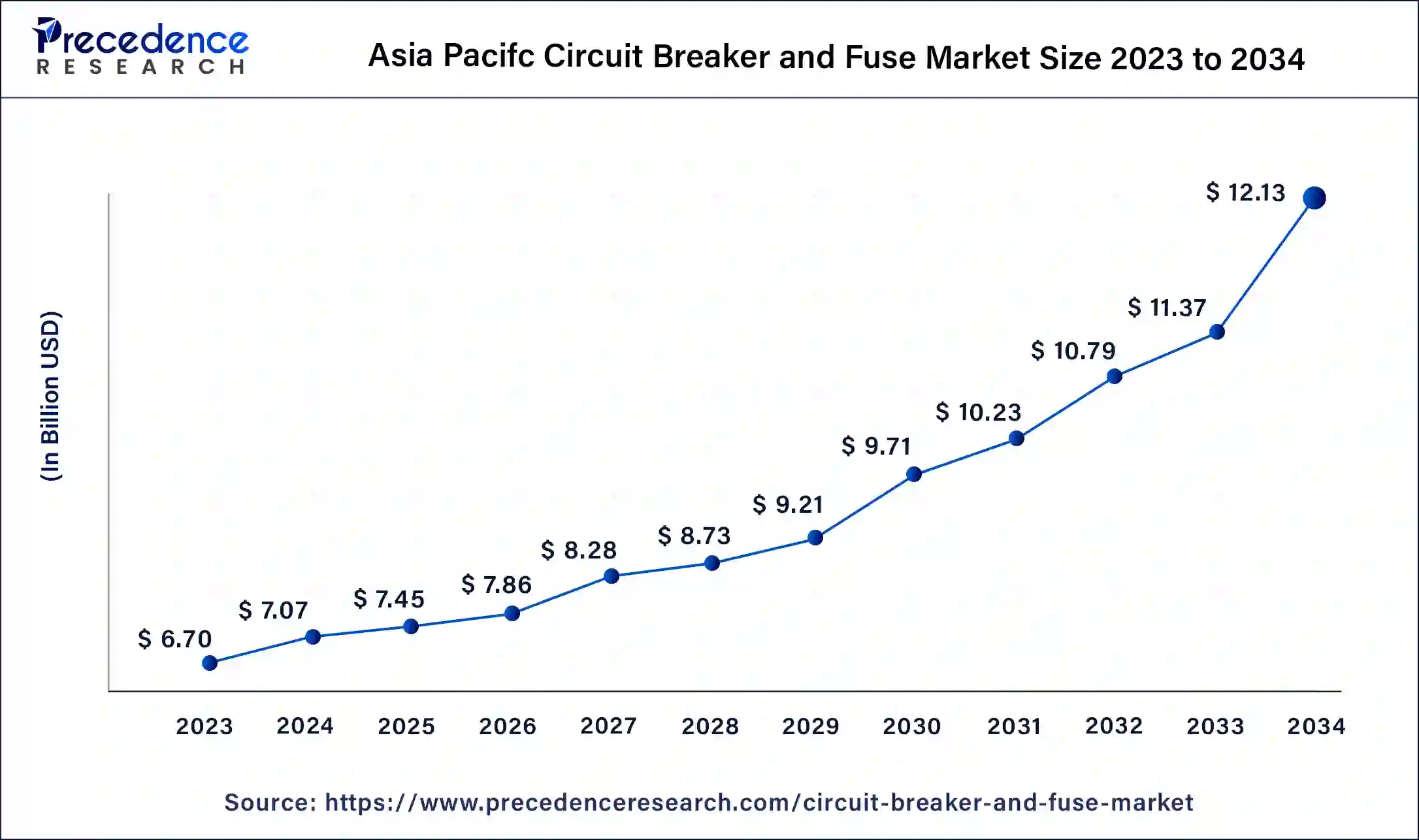

The Asia Pacific circuit breaker and fuse market size is exhibited at USD 7.45 billion in 2025 and is projected to be worth around USD 12.13 billion by 2034, poised to grow at a CAGR of 5.54% from 2025 to 2034.

Asia Pacific held the largest share of the circuit breaker and fuse market in 2024. The growth of the region is attributed to rising urbanization & industrialization, a rise in economic growth, an increasing population, the rapid expansion of the construction industry, the presence of stringent safety regulations, the increasing electricity demand, the growing demand from the automotive sector, and the growing adoption of alternative energy generation sources including solar and wind.

Countries such as China, Japan, India, South Korea, Indonesia, and other emerging economies are the major contributors to the market. The governments in these countries actively participate in the development of electricity networks, which further fuels the growth of the circuit breaker and fuse market in the APAC region. Moreover, the robust growth of the commercial and industrial sectors in developing nations countries is expected to spur the demand for circuit breakers and fuses, as these sectors require a seamless and reliable power supply. Furthermore, the rising adoption of advanced technologies and smart grids is anticipated to boost the demand for circuit breakers and fuses in the region.

What Is Driving the Growth of the Circuit Breaker and Fuse Market in the U.S.?

North America is also expected to lead the global circuit breaker and fuse market due to the high growth in the infrastructure system and the increase in the usage of electricity. The U.S. also experiences heightened demand for efficient, reliable electrical systems due to the new or upcoming home developments, as well as to counter the inefficient older grid infrastructure. With the increasing tendency towards single-family houses and distant living, there is a sharp increase in the number of residential construction projects, and all of them must be provided with circuit protection systems.

The investments made by the government in the development of the power grid and in renewable energy-building also stimulated the market growth. As the U.S. slowly majors on the elimination of its conventional sources of energy, including coal and natural gas, the dependence on renewable installations is increasing as well, and all such installations use updated circuit protections.

What Makes Europe a Competitive Region in the Global Circuit Breaker and Fuse Market?

The European circuit breaker and fuse market is expected to witness significant growth over the forecast period. The need to transform its power infrastructure and shift towards renewable power is propelling the demand for advanced circuit protection devices by the UK government. Due to the shift towards clean energy and the abandonment of fossil sources of energy, the demand for circuit breakers with high performance and efficiency has soared as the shift towards clean energy takes place in the country.

There is a growing demand for the use of circuit breakers in homes and in apartments with urbanization and increasing residential construction in the UK. The trend of innovating in transmission and distribution technology is extremely important and is supported by the R&D spending of the manufacturers based in the UK. The UK strategy to reach net-zero emissions by 2050 is establishinglong-term business opportunities for market players, especially those that sell energy-efficient and digitally empowered circuit breakers.

Market Overview

Circuit breakers and fuses play a critical role in delivering seamless electricity and protecting electrical circuits against faults. They are widely used in residential, commercial, and some industrial settings, protecting against overcurrents, short circuits, and other electrical faults. They are available in various sizes and types in the market according to the usage of different applications and system requirements. To protect the electric circuit and appliances from damage due to abnormalities in the circuit, a fuse and circuit breaker are used in the circuit as protecting devices. Fuses and circuit breakers are designed to protect from an electrical fire that could be caused by an overload or another malfunction, providing essential protection for everyday electrical usage.

Circuit Breaker and Fuse Market Growth Factors

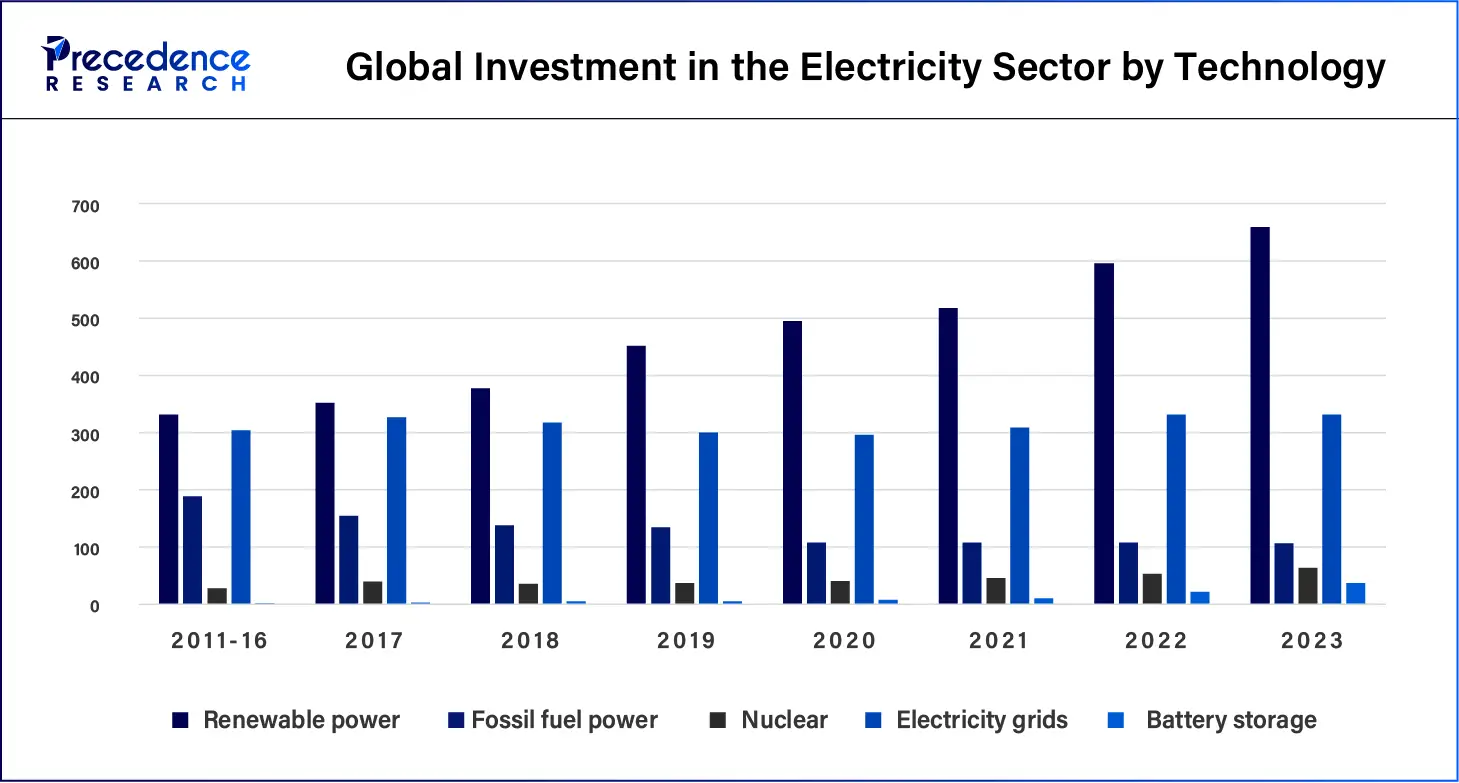

- The favorable government policies along with the rising investments in power infrastructure, including transmission networks, smart grids, and the integration of renewable energy sources are expected to boost the demand for global circuit breakers and fuses.

- The rise in residential and commercial projects is expected to spur the demand for fuses and circuit breakers during the forecast period.

- The rising electrification around the world coupled with increasing demand for reliable power supply systems is expected to contribute towards the growth of the global circuit breaker and fuse market during the forecast period.

- The rising demand from the automotive industry is expected to accelerate the growth of the global circuit breaker and fuse market in the coming years. Automotive circuit breakers and fuses are designed and provide overload protection and prevent power current surge from damaging critical electrical components.

- Government initiatives are crucial for the market as they promote safety and support sustainable electrical infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 27.89 Billion |

| Market Size in 2025 | USD 17.33 Billion |

| Market Size in 2024 | USD 16.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.43% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Circuit Breaker Voltage, Circuit Breaker Technology, Fuse Voltage, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rise in the number of real estate and construction projects

The significant increase in the number of real estate and construction projects particularly in the residential sector is expected to boost the growth of the global circuit breaker and fuse market. For Instance, an estimated 1,595,100 housing units were started in 2021, or a 15.6% increase from the 2020 figure of 1,379,600, according to the final new residential construction report of 2021 from the U.S. Census Bureau and the Department of Housing and Urban Development. The demand for circuit breakers and fuses has substantially increased as protective electrical devices in apartments or homes.

The use of these devices reduces and manages the electric load on home appliances and protects them from unforeseen power fluctuations that arise from situations such as overload, overvoltage, and short circuits. A fuse provides protects devices and homes against power overloads only whereas circuit breakers protect against both power overloads and short-circuiting. Additionally, rising government investment in the construction industry has led to an increasing demand for circuit breakers and fuses to ensure reliable power supply and protect against hazard incidents.

- According to the data published in the IBEF report 2024, in India's Budget 2023-24, capital investment outlay for infrastructure is being increased by 33% to Rs.10 lakh crore (US$ 122 billion), which would be 3.3 percent of GDP and almost three times the outlay in 2019-20.

- According to the IBEF report 2024, FDI in construction development (townships, housing, built-up infrastructure, and construction development projects) and construction (infrastructure) activity sectors stood at US$ 26.42 billion and US$ 32.08 billion, respectively, between April 2000-September 2023.

Restraint

Fluctuation in raw material prices

The volatility in raw material prices is anticipated to hamper the growth of the market. Fluctuations in raw material prices can adversely impact the overall cost of the circuit breaker and fuse as well as the profitability of manufacturers as they find it difficult to pass on the increased costs to potential customers due to severe competitive pressures. In addition, strict environmental & safety regulations for the SF6 circuit breaker may restrict the expansion of the global circuit breaker and fuse market during the forecast period.

Opportunity

Increasing awareness of electrical safety

The rising focus and increasing awareness of electrical safety devices are projected to create lucrative growth opportunities for the prominent market players. Fuses or circuit breakers are widely used as electrical safety devices in commercial and residential areas. During an occurrence of an electrical fault, the circuit breaker will trip or the fuse will blow and the power in that area of the property will be automatically shut off to prevent overloading and fires.

Fuses and circuit breakers aim to create a safer operating environment. Both protect against electrocution and assist in preventing electrical currents from creating a power surge. Therefore, fuses or circuit breakers are highly effective at mitigating the risk of electrical overflow and protecting from damage to other devices or appliances in several scenarios, driving the growth of the global circuit breaker and fuse market in the coming years.

Component Insights

The circuit breakers segment accounted for the dominating share in 2024. A circuit breaker is designed to protect an electrical circuit from damage caused by overload, overcurrent, or short circuit. The main benefits offered by the circuit breakers are that they are reusable devices and just need to be reset manually whereas fuses are designed to be one-time-use only if a fuse blows, it needs to be replaced. Thereby, driving the growth of the segment.

On the other hand, the fuses segment is expected to witness a significant share during the forecast period. Fuses protect against overloading whereas circuit breakers protect against overloading and short circuits. The fuse wire melts and breaks the circuit in case of any fault in an electric circuit in which the fuse is connected and the flow of over-current takes place through the circuit. Thus, boosting the segment's growth in the coming years.

Circuit Breaker Voltage Insights

The medium voltage segment held a dominant presence in the market in 2024. A medium voltage circuit breaker generally handles the voltage between 10 and 35 kilovolts. Compared with high-voltage breakers, medium-voltage breakers have several benefits such as being more cost-effective, less hazardous to the environment, easier to use, and easier to install. Medium-range circuit breakers generally find application in distribution substations, power generation stations, urban infrastructure, airports, nuclear power, data centers, commercial and industrial buildings, and other major engineering projects. Such factors are driving the growth of the segment.

On the other hand, the low voltage segment accounted for considerable growth in the global circuit breaker and fuse market over the forecast period. The voltage rating of low-voltage circuit breakers is generally at 1000V or lower. The growth of the segment is driven by the rising urbanization rate in smart cities. They are widely used in residential, and some commercial settings. A low-voltage circuit breaker interrupts the flow of electrical current in a circuit during an occurrence of abnormal conditions. Low-voltage circuit breakers are specifically electrical devices that are designed to protect low-voltage electrical systems from short circuits, overcurrents, and other electrical faults. Therefore, are considered the most crucial component of electrical distribution systems which ensure the reliable and smooth operation of electrical equipment.

In March 2024, Schneider Electric announced the launch of the MasterPacT MTZ Active low-voltage air circuit breaker. A new low-voltage air circuit breaker designed to set new benchmarks for efficiency and sustainability.

Circuit Breaker Technology Insights

The vacuum circuit breakers segment registered its dominance over the global circuit breaker and fuse market in 2024. Vacuum Circuit Breakers (VCBs) have gained immense popularity in the electrical industry owing to their superior operating mechanism and several benefits. VCBs are extensively used in commercial, industrial, and residential applications. VCBs offer high durability, low maintenance requirements, and long operational life compared to other types of circuit breakers. VCBs have significantly smaller and lighter designs than air circuit breakers (ACBs). Vacuum Circuit Breakers are a more environmentally friendly option for medium-voltage applications as they align with the global efforts to lower carbon emissions and combat climate change. Vacuum Circuit Breakers (VCBs) do not use sulfur hexafluoride gas like SF6 circuit breakers which is a potent greenhouse gas. Such supportive factors are driving the growth of the segment.

On the other hand, the air blast circuit breakers segment is projected to expand rapidly in the circuit breaker and fuse market in the coming years. An Air Circuit Breaker (ACB) uses air to protect an electrical circuit from damage that may be caused by excess current from a short circuit or overload. Its main purpose is to interrupt current flow after a fault is detected. ACB interrupts current by increasing arc voltage through various methods such as cooling the arc or extending the arc path. This circuit breaker generally operates in air at atmospheric pressure. Thereby, bolstering the segment's growth.

- In July 2023, Siemens launched two new additional versions of its innovative Sentron 3WA Power Circuit Breakers, alternatively known as air circuit breakers (ACBs).

- In March 2024, Schneider Electric unveiled the MasterPacT MTZ Active, a new low-voltage air circuit breaker designed to set new benchmarks for efficiency and sustainability.

Fuse Voltage Insights

The high voltage segment held the largest share of the circuit breaker and fuse market in 2024, the segment is expected to sustain the position throughout the forecast period. A high-voltage fuse is designed and rated for use in electrical systems with voltages above 1,000 volts AC. Most industrial and commercial end-users highly prefer high voltage fuse. High voltage fuse is highly efficient in offering protection against power fluctuations and short circuits.

On the other hand, the low voltage fuse segment is expected to grow significantly during the forecast period. The low-voltage fuse is highly preferred by residential customers. The low-voltage fuses have limited current ratings and breaking capacities which makes them suitable for several low voltage applications.

Application Insights

The power generation segment accounted for the largest share in the circuit breaker and fuse market in 2024. Fuses and circuit breakers play an integral role in power generation facilities by protecting transformers, generators, and other electrical equipment. These protective devices help in managing the flow of electricity within power plants and ensure the safety of equipment and personnel. Circuit breakers are extensively used in distribution boards as they help in preventing electrical fires and other hazards. The demand for these protection devices is expected to increase due to the rising need for efficient power generation as a result of an increase in the electricity demand.

On the other hand, the construction segment is expected to grow at the fastest rate during the forecast period of 2024 to 2034. Circuit breakers and fuses are widely used in commercial, residential, and industrial buildings, coupled with the development of smart. These devices protect appliances from power surges, reduce the chance of electrocution, and prevent metal cases from becoming electrified. Moreover, increasing investments in construction projects in countries such as China, India, the United States, Indonesia, Spain, Japan, and others are likely to boost the market demand. Therefore, the ongoing infrastructure development projects around the world are expected to propel the demand for circuit breakers and fuses, driving the segment's growth in the coming years.

Asia Pacific Circuit Breaker and Fuse Market Trends

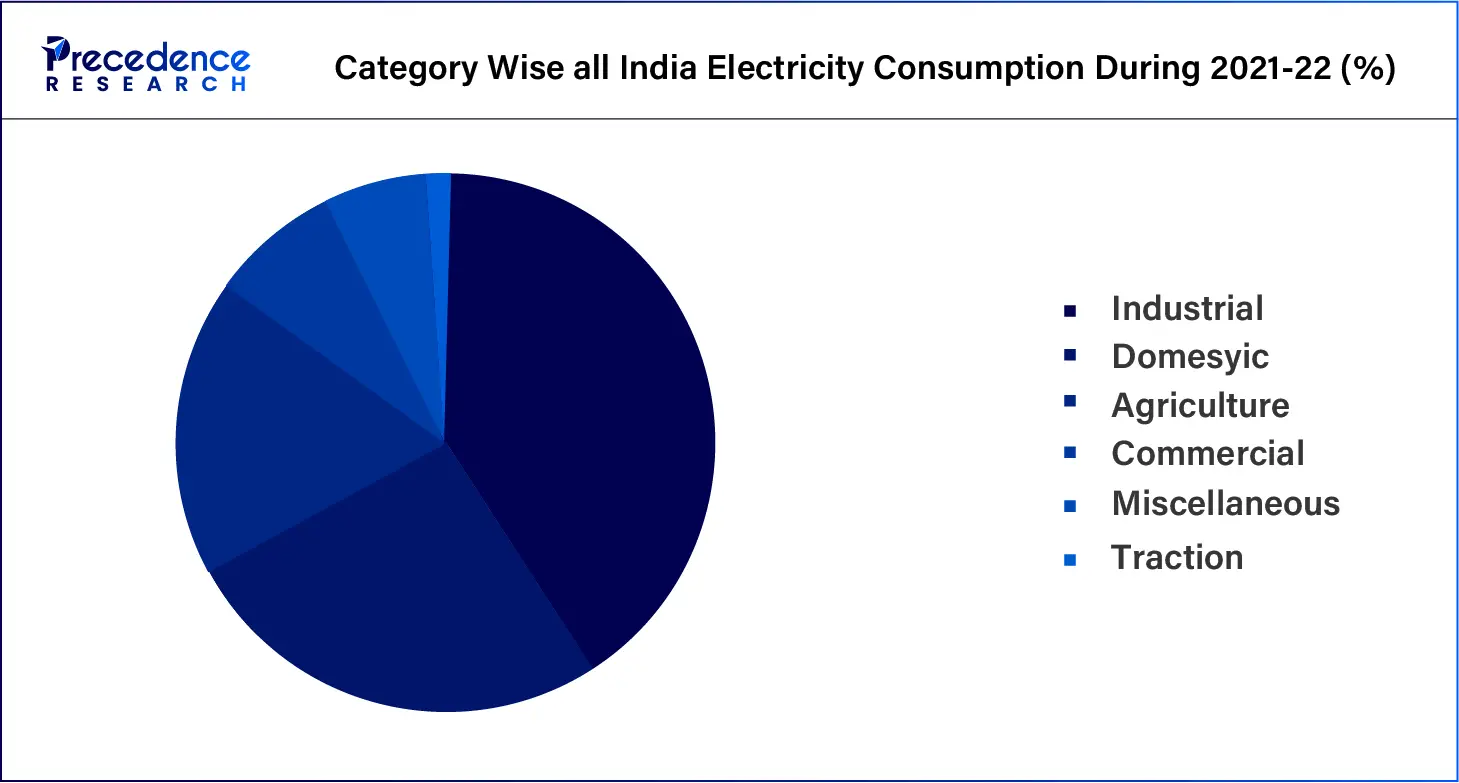

- As per the report published by India Brand Equity Foundation, India is the third-largest producer and consumer of electricity globally, with an installed power capacity of 416.59 GW as of April 30, 2023. The Indian Government's initiative to provide electricity to each village and every household through various schemes of electrification including DDUGJY, RAPDRP, IPDS, and Saubhagya has significantly increased the demand for circuit breakers and fuses all over India.

- According to the report published by IEA, China provides the largest share of global electricity demand growth in terms of volume, but India posts the fastest growth rate through 2026 among major economies. Following a 7% increase in India's electricity demand in 2023, expect growth above 6% on average annually until 2026.

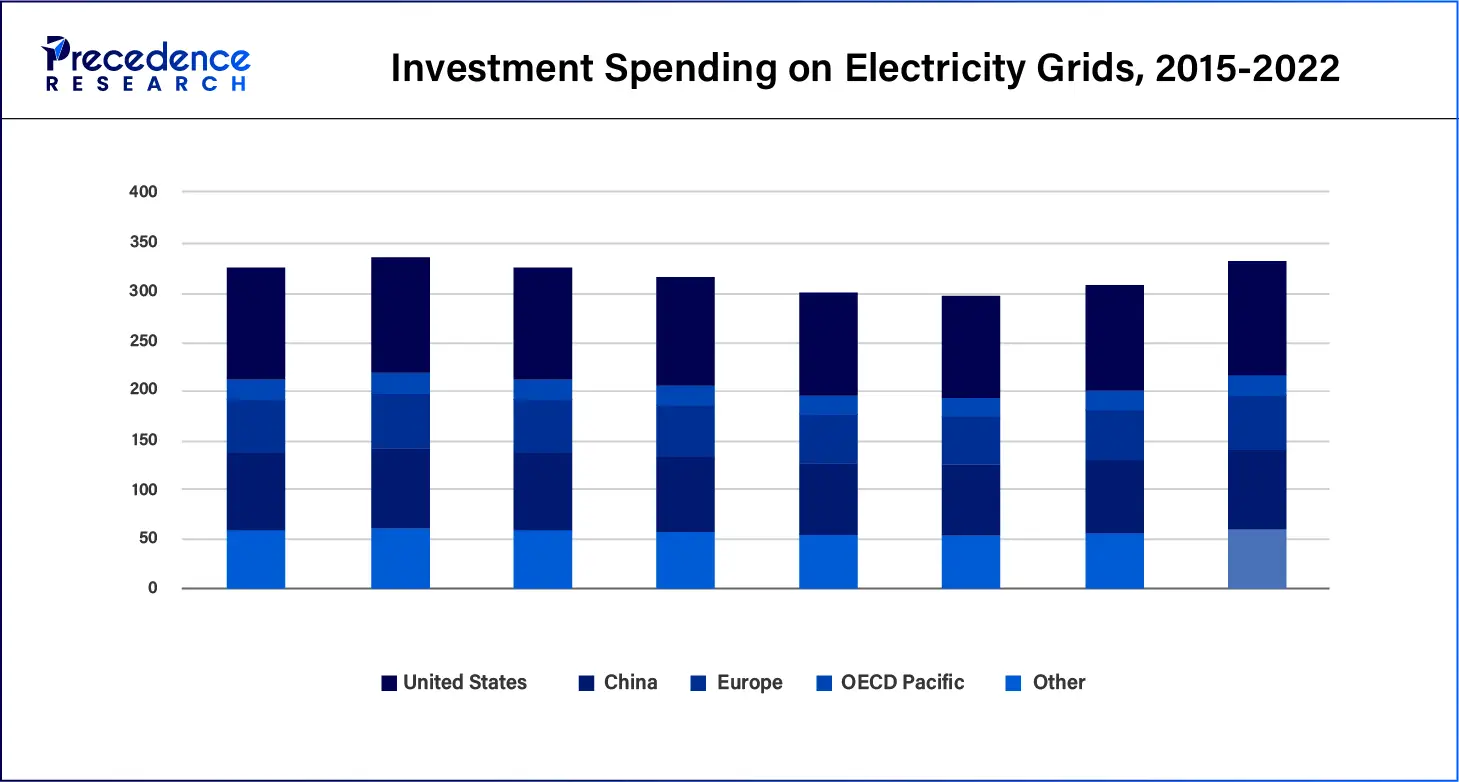

- State Grid already invested $73 billion in 2016 and $74 billion in 2022, but a rapid yearly growth can be expected due to the accelerated scale of renewable energy development. According to Xin Baoan, chairman of China's State Grid Corporation, one-quarter of electricity consumed in the country is traded across provincial boundaries. However, now a large fraction of new capacity is being built in the desert, which includes almost all of the 455 GW wind and solar to be constructed by 2030, as a part of the large-scale base project scheme.

- In June 2022, China published its 14th Five-Year Plan for Renewable Energy, which includes an ambitious target of 33% of electricity generation to come from renewables by 2025 (up from about 29% in 2021) and, for the first time, a target for renewable heat use.

- In 2022, Japan announced the creation of a USD 155 billion fund to encourage investment in new power grid technologies, energy-efficient homes, and other carbon footprint-reduction technologies, with a focus on smart grids as well as better connections between regional power grids.

- On the other hand, Europe is anticipated to grow at the fastest rate in the market during the forecast period owing to the presence of robust industrial infrastructure, integration of renewable energy sources, a significant rise in the construction sector, expansion of the automotive sector, growing focus on electrical safety standards, and increasing investments in renewable energy and smart grid technology. In addition, the European government has taken several supportive initiatives including the European Electricity Grid Initiative (EEGI) is anticipated to stimulate the innovation and rapid development of electricity networks. Thus, driving expansion of the circuit breaker and fuse market in the region.

- In May 2022 the European Commission proposed to increase the European Union's renewable energy target for 2030 to 45% as part of the REPowerEU Plan (which would require 1236 GW of total installed renewable capacity).

- In the European Union, the REPowerEU plan, released in 2022, proposes additional investment of EUR 29 billion in distribution and transmission grids by 2030, to support the increasing elecrrcity production, including the development of interconnectors.

- The European Union action plan published at the end of 2022 envisages investment of about EUR 584 billion (USD 633 billion) in the electricity grid by the end of 2030, of which around EUR 400 billion (USD 434 billion) are earmarked for the distribution grid, including EUR 170 billion (USD 184 billion) for digitalisation.

Circuit Breaker and Fuse Market Companies

- General Electric Company

- Rockwell Automation, Inc.

- SCHURTER Holding AG

- Sensata Technologies Holding PLC

- Texas Instruments Incorporated

- Mitsubishi Electric

- Eaton Corporation Inc

- Alstom SA

- ABB Ltd

- General Electric Company

- Maxwell Technologies Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Pennsylvania Breaker LLC

- Siemens AG

- Toshiba Corporation

- TE Connectivity Ltd

- Larsen & Toubro Limited

Recent Developments

- In July 2024, WAGO unveiled its latest innovation: the slimmest multi-channel electronic circuit breakers (ECBs) on the market. It is designed to meet the evolving needs of modern industrial and commercial applications; these cutting-edge ECBs offer unparalleled space-saving and advanced monitoring capabilities.

- In November 2022, Siemens launched a highly customizable generator circuit breaker. Siemens is expanding its generator circuit-breaker portfolio with a new compact version - the HB1-Compact (HB1-C). The versatile and highly customizable solution uses maintenance-free vacuum switching technology and addresses the most challenging of constraints.

Segments Covered in the Report

By Component

- Circuit Breaker

- Fuse

By Circuit Breaker Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Circuit Breaker Technology

- Air Blast Circuit Breakers

- Vacuum Circuit Breakers

- Oil Circuit Breaker

- SF6 Circuit Breaker

- Others

By Fuse Voltage

- Low voltage

- High voltage

By Application

- Construction

- Consumer Electronics

- Industrial

- Power Generation & Distribution

- Transport

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting