What is Clinical Data Management Market Size?

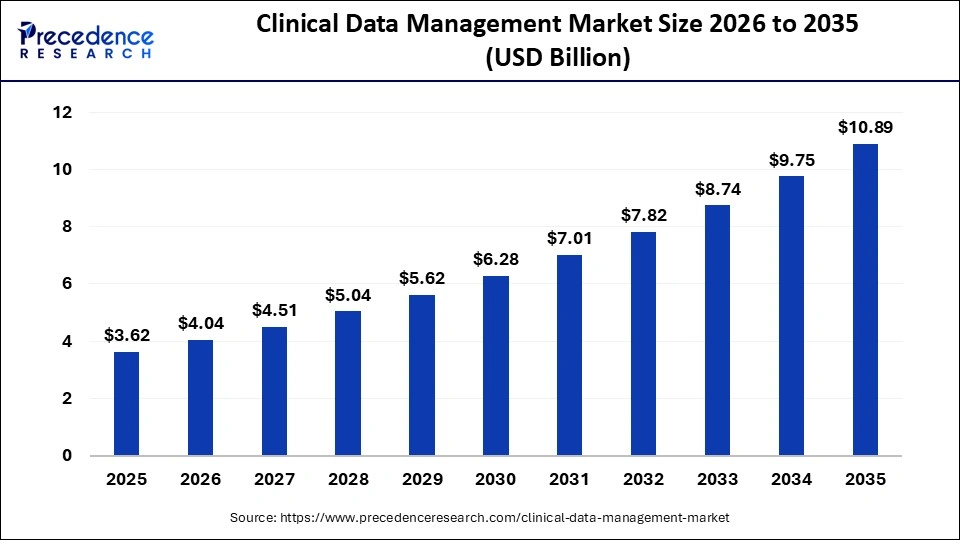

The global clinical data management market size is calculated at USD 3.62 billion in 2025 and is predicted to increase from USD 4.04 billion in 2026 to approximately USD 10.89 billion by 2035, expanding at a CAGR of 11.64% from 2026 to 2035. This market is growing as digital platforms are increasingly adopted to streamline data collection, analysis, and regulatory compliance in clinical trials.

Market Highlights

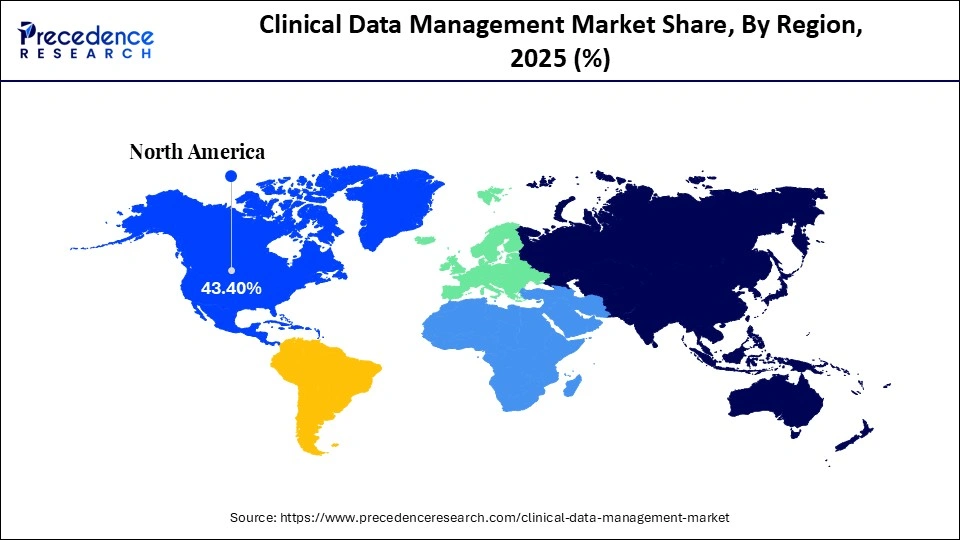

- North America dominated the market, having the biggest market share of 43.40% in 2025.

- The Asia Pacific is expected to grow at a notable CAGR of 12.5% between 2026 and 2035.

- By component, the services segment contributed the highest market share of 68.50% from 2026 to 2035.

- By component, the software segment is growing at a solid CAGR of 11.2% between 2026 and 2035.

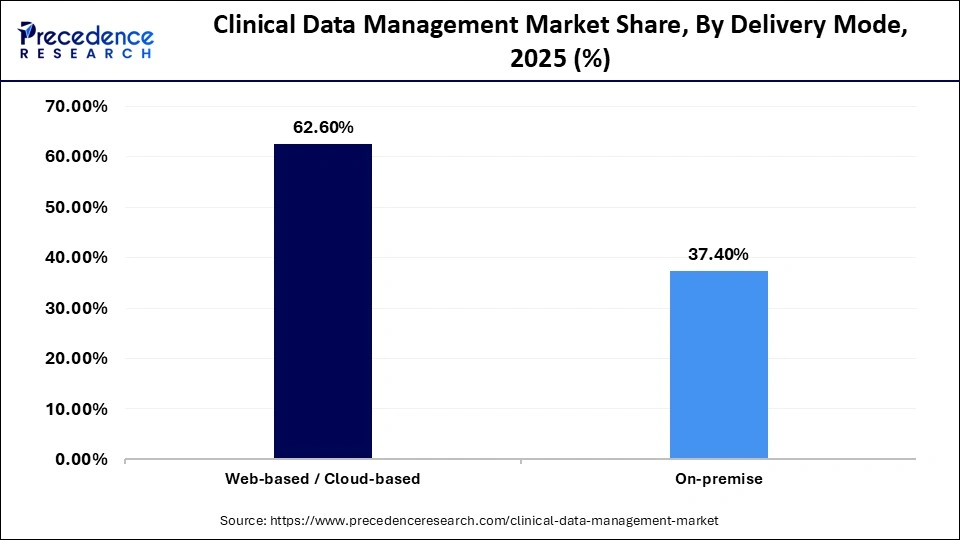

- By delivery mode, the web-based/cloud-based segment generated the largest market share of 62.60% in 2025.

- By delivery mode, the on-premise segment is expanding at a healthy CAGR of 11.1% between 2026 and 2035.

- By tool/platform, the EDC systems segment captured the biggest market share of 43.3% in 2025.

- By tool/platform, the ECOA/ePRO segment is projected to grow at a strong CAGR of 10.9% between 2026 and 2035.

- By end-user, the pharmaceutical and biotechnology companies segment recorded the biggest market share of 42.4% in 2025.

- By end-user, the CROs segment will grow at a notable CAGR of 11.5% between 2026 and 2035.

Market Overview

Is Smarter Data the Secret Fuel Behind Faster Drug Approvals?

The clinical data management market is experiencing steady growth, driven by the need for faster, more accurate decision-making as the volume and complexity of clinical trial data continue to rise. Pharmaceutical and biotechnology companies are investing heavily in advanced electronic data capture platforms, AI-enabled cleaning tools, and unified data warehouses to improve trial efficiency, reduce manual errors, and comply with stringent regulatory requirements set by authorities such as the FDA and EMA. The rapid shift toward decentralized and hybrid clinical trials is further accelerating demand for scalable cloud-based solutions that can integrate data from multiple sources, including wearables, ePRO systems, remote monitoring devices, and telehealth platforms.

Sponsors and CROs are also adopting real-time analytics dashboards that provide continuous oversight of patient safety, protocol adherence, and site performance, improving the speed of interim analyses and risk-based monitoring. Integration of electronic health records, genomic datasets, and imaging files into clinical workflows is driving the market toward more interoperable, AI-assisted systems. Overall, the industry is moving toward fully integrated, real-time clinical data management environments that enhance operational visibility, streamline regulatory submissions, and shorten the overall drug development timeline.

Market Trends

- Industry Growth Overview: The clinical data management industry is growing as clinical trials become more complex and data-heavy, driving increasing demand for cutting-edge digital platforms. Adoption of cloud-based AI-enabled solutions that improve speed and accuracy is accelerating due to increased R&D spending and the growth of decentralized trials.

- Sustainability Trends: Digital transformation is improving sustainability as businesses cut back on paper use, site visits, and manual labor. Automation and cloud systems are cutting waste and operational costs while supporting more efficient, environmentally responsible trials.

- Startup Ecosystem: New players in the startup ecosystem are providing quick, inexpensive AI-driven tools for data collection, validation, and decentralized trials. Competition is rising, and industry modernization is accelerating due to growing investment and innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.62 Billion |

| Market Size in 2026 | USD 4.04 Billion |

| Market Size by 2035 | USD 10.89 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Formulation, Application, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emerging Opportunities in the Clinical Data Management Market

|

Emerging Opportunity |

What it Enables |

Why it Matters |

|

AI & automation for data processing |

Automated data cleaning, validation, and anomaly detection |

Reduces workload, increases data accuracy, and shortens trial timelines |

|

Decentralized & hybrid trial platforms |

Remote patient data capture through mobile and wearables |

Expands patient reach, improves retention, and supports flexible trial models |

|

Real-world data (RWD) integration systems |

Integration of EHR, claims data, and patient-reported outcomes |

Strengthens clinical outcomes evidence and supports value-based approvals |

|

Cloud-based interoperable platforms |

Centralized data access with secure, scalable infrastructure |

Reduces IT costs, enables global collaboration, and supports multi-site trials |

|

Real-time analytics & performance dashboards |

Continuous tracking of trial status, patient safety, and compliance |

Enables faster decision-making and early detection of issues in ongoing trials |

|

Automated compliance & audit tools |

Standardized reporting, audit trails, and automated documentation |

Minimizes regulatory risk, reduces manual errors, and accelerates submissions |

|

Patient-centric engagement platforms |

Digital tools for consent, communication, and feedback |

Enhances patient experience and reduces dropout rates in long trials |

Clinical Data Management Market Segmental Insights

Component Insights

Services: The services segment dominates the clinical data management market, accounting for 68.5% of total market share, driven by the growing need for outsourced clinical data management services that help biotech and pharmaceutical firms effectively manage complex trial data while maintaining regulatory compliance. Data entry, validation, monitoring, and reporting are among the end-to-end solutions that service providers are increasingly offering, bolstering their market presence.

Software: The software segment is the fastest-growing component, registering a CAGR of 11.2%, driven by the increasing use of cloud-based data management solutions, AI-enabled analytics, and electronic data capture systems. Companies are investing in advanced software tools to streamline data collection, reduce errors, and accelerate clinical trial timelines.

Delivery Mode Insights

Web-based/Cloud-Based: The segment dominated the market, holding a market share of 62.6% It is the best option for multi-site and international clinical trials because of its advantages of remote accessibility, real-time data updates, and lower IT infrastructure costs. Furthermore web web-based solutions facilitate collaboration among international teams, enhancing overall trial efficiency.

On-Premise: This delivery mode is the fastest-growing segment, with a 11.1% CAGR, because on-premise solutions offer greater control over data security and compliance with stringent regional regulations. Some organizations, particularly those that handle extremely sensitive data, prefer them.

Tool/Platform Insights

Electronic Data Capture (EDC) Systems: The segment dominates the market with a 43.3% share, as they provide better accuracy, more efficient workflows, and improved regulatory compliance, and are frequently used for real-time data collection, management, and monitoring in clinical trials. The continuous technological upgrades in EDC platforms, such as AI-assisted validation, further strengthen their market leadership.

eCOA / ePRO Tools: ECOA/ePRO tools are the fastest-growing segment, with a 10.9% CAGR, driven by a growing focus on patient-centric trials and the use of mobile devices to record patient-reported outcomes. Moreover, rising demand for remote patient monitoring solutions is accelerating the adoption of eCOA/ePRO platforms.

End User Insights

Pharmaceutical & Biotechnology Companies: Pharmaceutical & biotechnology companies dominate the market with a 42.4% share, using CDM systems to expedite drug management and regulatory filings. Large-scale clinical trials and extensive R&D pipelines are what keep the demand for cutting-edge CDM systems high. Collaborations with CROs and technology vendors further reinforced their leadership in adopting CDM platforms.

Contract Research Organizations (CROs): CROs' fastest-growing end-user segment is the fastest-growing, with a 11.5% CAGR. CDM platforms are becoming increasingly necessary for CROs to provide numerous clients with flexible, scalable, and affordable data management services, which is driving their quick uptake. Strong demand for advanced CDM solutions is being driven by the growth of CRO operating in emerging markets.

Clinical Data Management Market Regional Insights

North America dominates the clinical data management market with a 43.4% share in 2025 because the region benefits from early adoption of advanced digital platforms, high R&D spending, and the presence of the world's largest pharmaceutical andbiotechnology companies. The United States and Canada maintain a highly mature clinical research ecosystem supported by extensive site networks, leading academic medical centers, and contract research organizations that rely on sophisticated electronic data capture and real-time analytics systems to manage complex trials. The region also benefits from a strong regulatory framework led by the FDA, which enforces stringent data integrity, electronic recordkeeping, and validation standards that encourage continuous investment in high-performance data management technologies.

Additionally, North America has a well-established alliance structure between pharmaceutical companies, CROs, and technology providers, enabling rapid deployment of cloud-based clinical data platforms, AI-enabled cleaning tools, and integrated monitoring dashboards. Widespread adoption of decentralized and hybrid trial models further reinforces the need for interoperable systems that can handle data from ePRO devices, wearables, remotesensors, and electronic health records. These structural advantages collectively strengthen North America's leadership in the global clinical data management market.

The U.S. dominates the clinical data management market, supported by high R&D spending, advanced trial infrastructure, and widespread use of EDC and cloud-based platforms. Its leadership position is further strengthened by the FDA's strict regulations and emphasis on expedited drug development. The U.S. also benefits from a dense network of academic research centers, CROs, and biopharmaceutical innovators that conduct a large share of global Phase II and Phase III trials. Continuous integration of real-time analytics, AI-driven data validation, and remote monitoring tools enhances trial efficiency and clinical transparency. These factors collectively create a highly mature environment that drives sustained demand for sophisticated clinical data management platforms.

Asia Pacific is the fastest-growing region, registering a 12.5% CAGR, fueled by increasing clinical trial activities, rising investments in digital health technologies, and expanding healthcare infrastructure. Additionally, the region's supportive policies and government incentives are speeding up market adoption. Countries such as China, India, Japan, and South Korea are developing advanced trial ecosystems that rely heavily on digital data capture and integrated eClinical platforms. Regional growth is also supported by large patient pools and lower operational costs, making the Asia Pacific a preferred location for multinational sponsor-led studies. As decentralized and hybrid trials expand, demand for interoperable platforms is rising sharply across major APAC sites.

India Clinical Data Management Market Trends

India is one of the fastest-growing markets for clinical data management, driven by growing investments in digital health technologies, rising clinical trial activity, and the development of healthcare infrastructure. Market adoption is also being accelerated by the region's supportive policies and government incentives. India has a rapidly expanding CRO sector that manages complex global trials across oncology, metabolic disorders, and infectious diseases, requiring advanced data capture tools. The introduction of national digital health frameworks and increased cloud availability is enabling faster adoption of EDC, ePRO, and integrated trial management systems. Strong technical talent and cost advantages further enhance India's role as a preferred destination for CDM outsourcing.

The Middle Eastern countries are also witnessing growing demand for clinical data management solutions. Adoption of cloud-based and AI-enabled CDM platforms is being encouraged by investments in healthcare infrastructure, growing clinical trial initiatives, and regulatory modernization, positioning the region as an emerging market for biotech and pharmaceutical companies. Countries such as Saudi Arabia, the UAE, and Qatar are expanding clinical research clusters and enabling digital trial models that require secure and scalable data systems. Regional health authorities are increasing alignment with global quality standards, which raises the need for validated data management platforms. These developments are positioning the Middle East as a rising participant in international clinical research.

UAE Clinical Data Management Market Trends

The UAE is emerging as a key growth market for clinical data management, driven by the adoption of cutting-edge digital health technologies, growing clinical trial activities, and rising healthcare investments. Supportive government initiatives and world-class healthcare infrastructure are attracting global CDM solution providers to establish and expand their operations in the country.

Clinical Data Management Market Value Chain

The main goals of R&D efforts are to create AI-enabled platforms, enhance interoperability, and make decentralized patient-centered trials possible. Companies are investing in automation, predictive analytics, and secure cloud infrastructures to reduce trial timelines and enhance data quality. Key Players: Medidata Solutions, Oracle Health Sciences

Retail style commercialization strategies are emerging, focusing on SaaS subscription models, modular services, and cross-vertical integration. Vendors are marketing pharma, biotech and CROs with faster deployment, cost savings, and compliance-ready workflows. Key Players: Oracle Health Sciences, Veeva Systems

By doing away with paper-based documentation, reducing rework, and eliminating unnecessary site visits, digital transformation is cutting waste. Businesses are using automation, cloud hosting, and virtual trial models to promote environmentally friendly processes. Key Players: Oracle health sciences, medidata solutions, IBM watson health

Clinical Data Management Market Companies

Provides cloud-based software for clinical trials and drug safety.

Dassault Systems: Offers an end-to-end cloud platform for clinical development and data capture.

Leverages advanced analytics and technology to accelerate clinical development and commercialization.

A global contract research organization (CRO) for clinical development and regulatory affairs.

Provides IT services and consulting for digital transformation in life sciences R&D.

Offers cloud-based software for commercial content and clinical data management.

Specializes in clinical trial data collection technology for cardiac safety and eCOA.

Provides IT and digital solutions to optimize R&D, clinical trials, and compliance.

Offers consulting, technology, and outsourcing services to drive innovation and improve patient outcomes.

An integrated biopharmaceutical solutions organization offering clinical development and commercialization services.

A leading global CRO providing comprehensive drug development services from early to late stage.

Recent Developments

- In August 2025, IQVIA and Veeva Systems announced a long-term global clinical and commercial partnership, along with the complete resolution of all pending legal disputes. The agreement allows customers to use software, data, technology, and services from both companies together, promoting seamless integration across platforms. (Source: https://www.iqvia.com)

- On 20 March 2025, Medidata Solutions unveiled its new Patient, Study, and Data Experiences during the NEXT London 2025 event, an AI-powered platform designed to unify clinical trial workflows, reduce costs, and accelerate therapy development by leveraging anonymized historical trial data. (Source: https://www.medidata.com)

Clinical Data Management Market Segments Covered in the Report

By Component

- Software

- Services

By Delivery Mode

- Web-based / Cloud-based

- On-premise

By Tool / Platform

- Electronic Data Capture (EDC) Systems

- Clinical Trial Management Systems (CTMS)

- Clinical Data Integration Platforms

- eCOA / ePRO Tools

- Coding & Dictionary Management (MedDRA, WHO-DD)

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Medical Device Companies

- Academic/Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content