Coated Fabrics for the Defense Market Size and Forecast 2025 to 2034

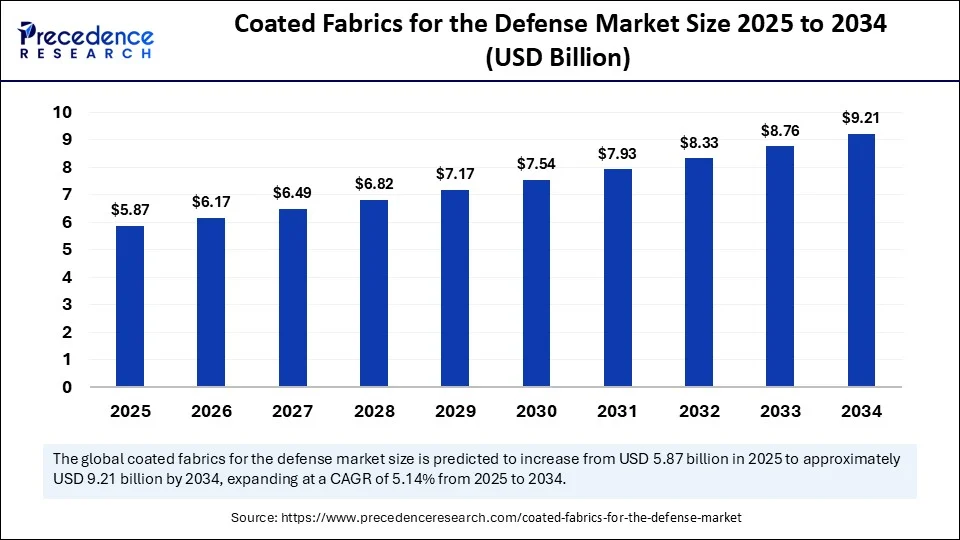

The global coated fabrics for the defense market size accounted for USD 5.58 billion in 2024 and is predicted to increase from USD 5.87 billion in 2025 to approximately USD 9.21 billion by 2034, expanding at a CAGR of 5.14% from 2025 to 2034. The increasing defense budget boosts the growth of the market. Furthermore, many countries are proactively advancing their military capabilities, which is expected to boost the growth of the market during the forecast period.

Coated Fabrics for the Defense MarketKey Takeaways

- In terms of revenue, the global coated fabrics for defense market was valued at USD 5.58 billion in 2024.

- It is projected to reach USD 9.21 billion by 2034.

- The market is expected to grow at a CAGR of 5.14 % from 2025 to 2034.

- North America dominated the coated fabrics for defense market with the largest share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By application, the tents and shelters segment held the biggest market share in 2024.

- By application, the body armor and protective clothing segment is expected to grow at the fastest CAGR in the coming years.

- By material, the Kevlar segment led the market in 2024.

- By material, the nomex segment is expected to grow at the fastest CAGR in the upcoming period.

- By end use, the military segment captured the highest market share in 2024

- By end use, the law enforcement segment is expected to expand at the fastest CAGR during the projection period.

- By coating, the polyurethane segment contributed the highest market share in 2024.

- By coating, the fire-retardant coatings segment is expected to grow at the fastest CAGR in the coming years.

- By form, the sheets segment generated the major market share in 2024.

- By form, the rolls segment is expected to grow at the fastest CAGR during the forecast period.

Impact of AI on the Coated Fabrics for Defense Market

Artificial Intelligence significantly impacts the coated fabrics for defense market in several ways. Firstly, it helps improve material design and development. AI algorithms can analyze vast datasets to identify new materials and optimize coating formulations for enhanced performance, durability, and protection. AI-powered systems can optimize manufacturing processes, reduce waste, and improve efficiency in coating application, leading to cost savings and higher-quality products. Secondly, AI systems can detect defects and ensure consistent quality in coated fabrics, improving reliability and reducing failure rates. Moreover, AI is enabling the development of smart textiles with integrated sensors and communication capabilities, enhancing situational awareness and providing real-time data for soldiers.

Market Overview

The coated fabrics for defense market is experiencing substantial growth due to the rising demand for durable and high-performance materials in military applications, with water resistance and flexibility being essential. Coated fabrics' lightweight and durable properties make them ideal for applications where weight is crucial, such as military suits. Increased defense spending fuels the procurement of coated fabrics for various military purposes. Continuous technological development, innovation in material sciences, and increased production efficiency contribute to sustainability and cost-effectiveness. The increased focus on environmentally friendly materials in fabrication shows significant demand, driven by stringent environmental regulations. In addition, the rising demand for protective gear, vehicle armor, and shelter systems boosts market growth.

Coated Fabrics for the Defense Market Growth Factors

- Rising global defense budgets, driven by geopolitical tensions and the need for advanced military capabilities, are boosting the growth of the market.

- The rising need for improved protection boosts the growth of the market. Coated fabrics offer significant protection against chemical, biological, radiological, and nuclear agents, fire, and extreme weather conditions, making them an innovative choice for military personnel.

- The rising demand for lightweight, durable, and flexible materials that enhance soldier mobility and operational effectiveness, contributing to market growth.

- Innovations in coating materials, such as nanotechnology and advanced polymers, lead to the development of more effective and versatile coated fabrics, boosting the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.21 Billion |

| Market Size in 2025 | USD 5.87 Billion |

| Market Size in 2024 | USD 5.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Material, End-Use, Coating, Form and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Protective Clothing

The major factor driving the growth of the coated fabrics for defense market is the rising demand for coated fabrics, driven by the increased need to ensure the safety of military personnels against hazardous and various weather conditions. These personnels regularly encountered by chemical, biological, radiological, and ballistic threats, creating the need for protective clothing. Consequently, coated fabrics are indispensable for producing sophisticated military suits, ensuring protection and resistance against hazardous materials while maintaining safety and durability. In fabricating coated fabrics, specialized polymers are often used as a barrier layer to effectively block toxic chemicals like biological agents and radioactive particles. Modern warfare spans diverse battlefields, including deserts, arctic regions, and high-altitude grounds. These conditions require robust, high-quality protective gear developed using military-grade coated fabrics, significantly driving market growth.

Restraint

High Production Cost

Producing coated fabrics for defense necessitate high-quality raw materials like advanced polymers and specialized coatings. However, these materials are subject to price fluctuations, which significantly impacts the production costs. This can limit the adoption of coated fabrics, especially in cost-sensitive markets. Moreover, dependency on specific raw materials and complex manufacturing processes can make the supply chain vulnerable to disruptions, hampering the growth of the coated fabrics for defense market.

Opportunity

Rising Modernization of Armed Forces

Governments worldwide continuously emphasizing upgrading their armed forces by adopting highly advanced and superior military equipment and gear. Rising global tensions create an inevitable demand for technology adoption by security forces. Warfare conditions have evolved, spanning high mountains, hot deserts, and arctic regions, necessitating substantial preparation for dynamic weather. A significant opportunity in coated fabrics for defense applications lies in integrating embedded sensors, transforming suits into defense equipment by providing various security and monitoring features. Moreover, the rising development of innovative materials like self-healing coatings, smart textiles, and materials with enhanced multi-functional properties opens new growth avenues for the market.

Application Insights

What Made Tent and Shelters the Dominant Segment in the Coated Fabrics for Defense Market in 2024?

The tents and shelters segment dominated the market with the highest share in 2024. The dominance of the segment stems from their essential role in providing accommodation and operational facilities for military personnel across diverse locations. Shelters made from coated fabrics offer a critical balance of durability, weather resistance, and ease of deployment, making them indispensable for military operations and routine applications. Their versatility extends to various uses, including basic accommodation, training, communication, and the establishment of command centers, leading to their widespread utilization.

The body armor and protective clothing segment is expected to grow at the fastest rate in the upcoming period. The growth of the segment is attributed to rising security concerns and the increasing need for lighter, more effective protective materials for security forces. The use of materials like polyethylene and Kevlar composites, along with enhanced head protection, significantly contributes to this growth. Moreover, law enforcement agencies are also increasingly adopting these protective measures to address domestic security challenges.

Material Insights

Why is Kevlar Dominating the Coated Fabrics for Defense Market?

The Kevlar segment dominates the coated fabrics for defense market due to its exceptional strength-to-weight ratio, high tensile strength, and durability, making it ideal for protective applications like body and vehicle armor. Kevlar's lightweight properties, despite its strength, make it popular in military suits and essential items, aiding agility in combat. Kevlar-based coated fabrics are durable and wear-resistant, increasing demand due to their long-term usability even in harsh conditions.

The Nomex segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to the rising demand for protective equipment. The exceptional heat and flame resistance properties offered by Nomex are crucial for protective gear used in military applications. In addition, advancements in fiber technology, ongoing technological innovation, and a focus on developing survivability-related equipment are contributing to the increasing demand for Nomex-coated fabrics.

End Use Insights

How Does the Military Segment Dominate the Coated Fabrics for the Defense Market in 2024?

The military segment dominated the market with the largest share in 2024, primarily due to the increased demand for high-durability protective suits. Military applications necessitate coated fabrics with superior characteristics, including durability, flame resistance, and chemical protection. Coated fabrics are integral to a wide array of military gear, such as uniforms, shelters, and protective armor, all of which rely on advanced materials for optimal protection and functionality. The military also utilizes coated fabrics in applications such as shelters, tents, and parachutes, which require specialized materials. Coated fabrics provide high durability, resistance, and long-term usability. Moreover, comfort and moisture resistance properties, like those of COOLMAX, are increasingly important in military applications. The use of these sophisticated materials significantly boosts soldier performance and effectiveness in critical scenarios.

The law enforcement segment is expected to grow at the fastest rate during the projection period. The growth of this segment is attributed to rising global security concerns, coupled with rising crime rates and an increased focus on the safety and protection of law enforcement personnel. The rising demand for advanced protective equipment, including body armor, helmets, and protective clothing, further drives segmental growth. This segment is anticipated to continue its significant growth trajectory, driven by the need to establish robust law enforcement capabilities and ensure regional security stability.

Coating Insights

What Factors Contribute to the Dominance of the Polyurethane Segment?

The polyurethane segment dominated the coated fabrics for defense market by holding the largest share in 2024. This dominance is due to its versatile applications. Polyurethane coatings offer excellent flexibility, allowing them to be used on a wide range of fabrics and applications. Polyurethane is widely used in protective clothing, resistant apparel, aircraft components, parachutes, and even in constructing military shelters and tents. Its high performance drives continuous demand in the market. The material's flexibility is highly beneficial for various protective clothing and military gear, enhancing convenience and effectiveness.

The fire-retardant segment is expected to grow at the fastest rate in the upcoming period. This segment's growth is primarily driven by the increasing need for fire-resistant and fireproof protective gear in military operations. Governments and defense organizations enforce strict fire safety standards, mandating the use of fire-retardant materials in military applications, which fuels demand for these coatings. Coating technology has advanced significantly in recent times, resulting in lighter, more durable fabrics with enhanced fire-retardant properties, meeting essential requirements for military applications.

Form Insights

Why Did the Sheets Segment Dominate the Market in 2024?

The sheets segment dominated the coated fabrics for defense market, accounting for the largest revenue share in 2024. Sheets possess inherent properties that make them well-suited for various defense-related applications. These sheets are characterized by high strength, durability, and resistance to environmental conditions. Their lightweight, flexible, and cost-effective nature contributes to their dominance in the market, with numerous applications in the defense sector. Sheets offer a versatile form that can be easily tailored for various defense applications, including protective gear, tents, and vehicle covers.

The rolls segment is likely to grow at the fastest rate in the coated fabrics for defense market. Rolls are relatively convenient to manufacture, which allows manufacturers to produce them on a large scale. They often provide a cost-effective solution for defense applications, as they can be purchased in bulk and cut to size as needed. Rolls can be used in various defense applications, such as protective gear, tents, and vehicle covers. Moreover, they can be easily cut and fabricated to meet specific requirements, making them suitable for various defense applications.

Regional Insights

What Made North America the Dominant Region in the Coated Fabrics for Defense Market?

North America registered dominance in the market, capturing the largest revenue share in 2024. The region's dominance is mainly attributed to significant defense spending, especially in the U.S. There is increased investment in research and development of defense equipment, and driving innovation in coated fabrics tailored for military use. A strong manufacturing base supports North America's growth, serving both domestic and international markets. The region's advanced technology and robust tech ecosystem emphasize the development of coated fabric suits with embedded sensors and AI integration. This leads to technically advanced suits that integrate with other equipment, providing data on threats, and offering safety and warmth through electronically heated features. The U.S. is a major player in the market. The U.S. military prioritizes innovative protective gear and materials, propelling the demand for coated fabrics.

What Opportunities Exist in the European Coated Fabrics for Defense Market?

Europe is expected to witness notable growth during the forecast period. The European Union is consistently investing in the modernization of defense equipment on a significant scale, primarily focusing on research and innovation in advanced fabric materials. Supportive monetary policies from the government are also increasing investment in this sector. The market's growth is further driven by structural reforms aimed at enhancing resilience. A strong focus on sustainable material development is observed in Europe, considering growing environmental concerns and stringent government policies. Germany, France, and the UK are the primary markets in Europe, with a substantial industrial base and extensive spending on defense equipment.

What Factors are Contributing to Asia Pacific's Growth in the Coated Fabrics for Defense Market?

Asia Pacific is expected to grow at the fastest CAGR in the upcoming period due to the rising defense budgets. There's a strong push to adopt technology and advanced fabrics for defense purposes, such as fire-resistant and nanotechnology-integrated materials, to enhance the protection provided by military suits. Governments have enforced stringent regulations on the safety of military personnels, creating the need for coated fabrics. The rising demand for protective gear also supports regional market growth. Countries like China, India, and Japan are increasing their defense budget. Governments of various Asian countries are focusing on advancing their military capabilities and modernizing defense force, contributing to market growth.

Recent Developments

- In January 2025, Milliken & Company launched the first of its kind, a non-PFAS material for every layer of firefighter turnout gear. The Global player Millikan and Company announces that they are going to offer non-PFAS material for all three layers of firefighter turnout gear. Even the outer layer will include a thermal liner and moisture barrier. This will be the only single US-based supplier allowing access for all three layers.

(Source: https://www.texdata.com) - In May 2024, at the recent Techtextil 2024 in Frankfurt, the UK's Heathcoat Fabrics introduced a range of new developments for the military, including its new Drytec surface-to-surface moisture-wicking spacer fabric. Drytec has been designed to actively draw perspiration from the skin, allowing the moisture to be dispersed through the textile to the outer fabric surface, ultimately improving the thermo-physiological comfort of the user.

(Source: https://www.innovationintextiles.com)

Coated Fabrics for the Defense Market Companies

- Miliken

- Verseidag

- Glen Raven

- Taiyo Kogyo

- Texelis

- Ferrari

- Gore

- Serge Ferrari

- Huafang Industrial

- Mehler Huntelaar

- Astrup

- Hyosung

- Seaman Corporation

- Fabrene

Segments Covered in the Report

By Application

- Camouflage and Deception

- Tents and Shelters

- Body Armor and Protective Clothing

- Vehicle and Equipment Covers

- Inflatable Structures

By Material

- Nylon

- Polyester

- Kevlar

- Nomex

- Gore-Tex

By End-Use

- Military

- Law Enforcement

- Security and Emergency Services

- Defense Contractors

- Aerospace

By Coating

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Teflon

- Silicone

- Fire-Retardant Coatings

By Form

- Sheets

- Rolls

- Laminates

- Fabrics

- Composite Materials

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting