Colorectal Cancer Therapeutics Market Size and Forecast 2025 to 2034

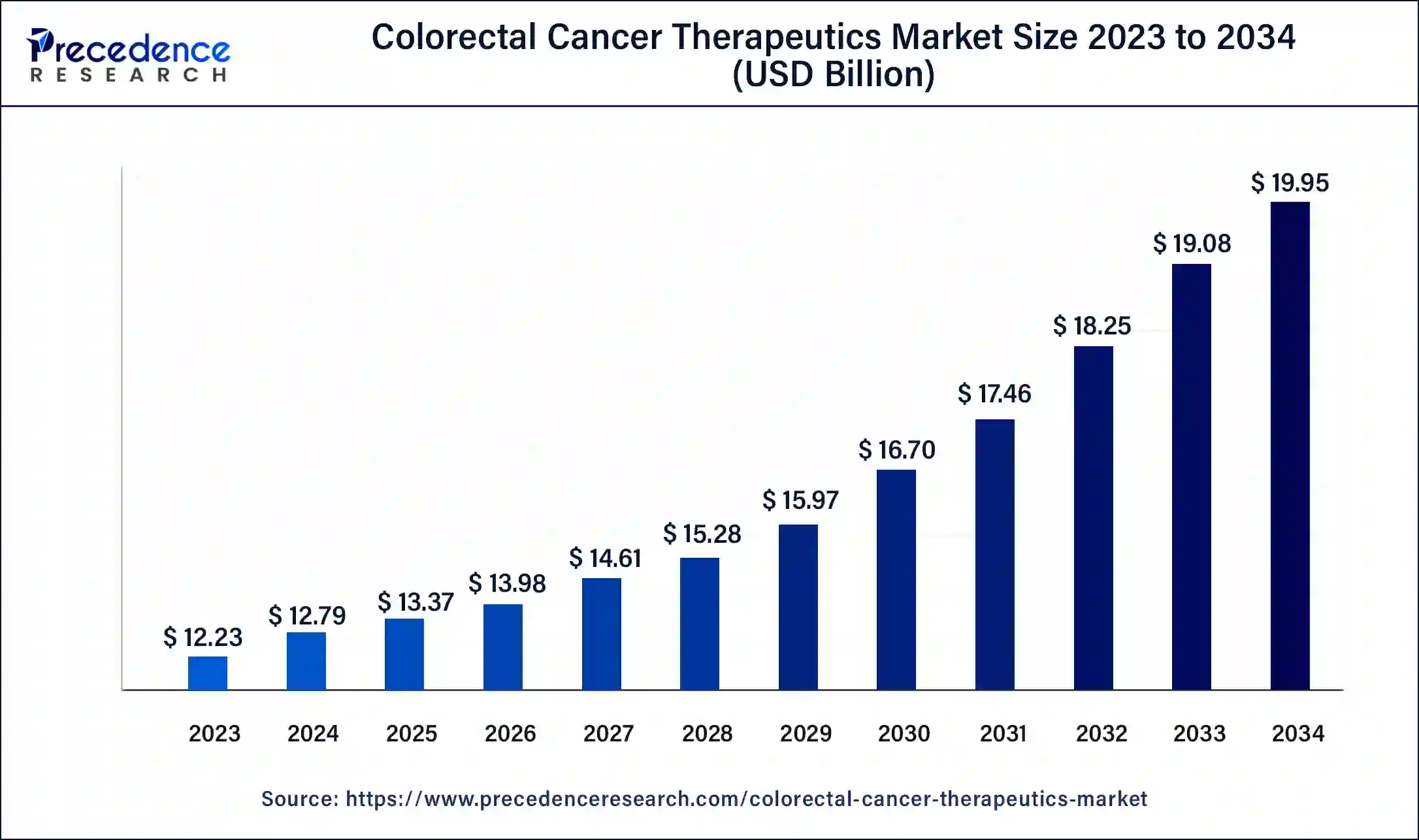

The global colorectal cancer therapeutics market size accounted at USD 12.79 billion in 2024 and is expected to be worth around USD 19.95 billion by 2034, at a CAGR of 4.55% from 2025 to 2034.

Colorectal Cancer Therapeutics Market Key Takeaways

- The global colorectal cancer therapeutics market was valued at USD 12.79 billion in 2024.

- It is projected to reach USD 19.95 billion by 2034.

- The colorectal cancer therapeutics market is expected to grow at a CAGR of 4.55% from 2025 to 2034.

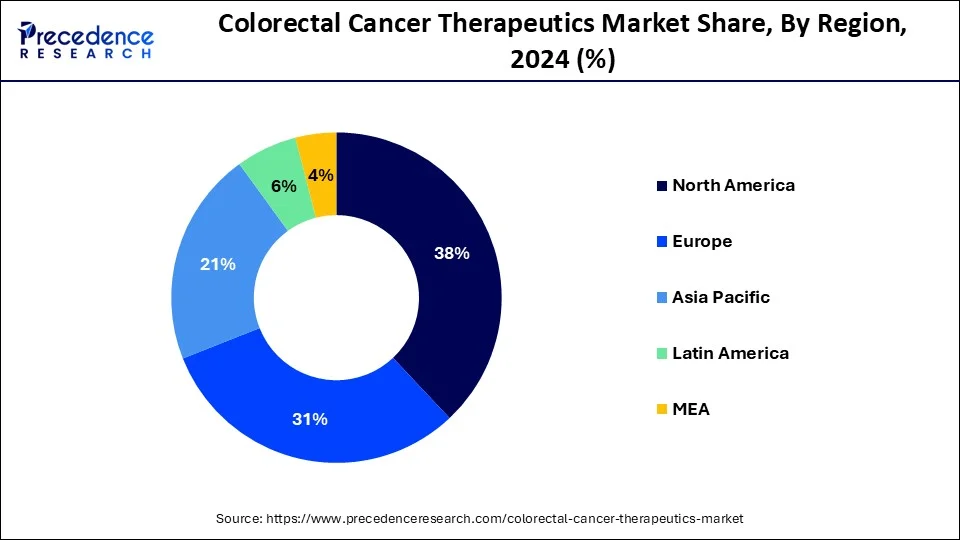

- North America contributed the highest market share of 38% in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By therapy, the immunotherapy segment has held the largest market share of 49% in 2024.

- By therapy, the targeted therapy segment is anticipated to grow at a remarkable CAGR of 6.9% between 2025 and 2034.

- By cancer type, the colorectal adenocarcinoma segment has held the largest market share of 47% in 2024.

- By distribution channel, the hospital pharmacies segment has held the largest market share of 45% in 2024.

- By distribution channel, the retail pharmacies segment is anticipated to grow at a remarkable CAGR of 7.4% between 2025 and 2034.

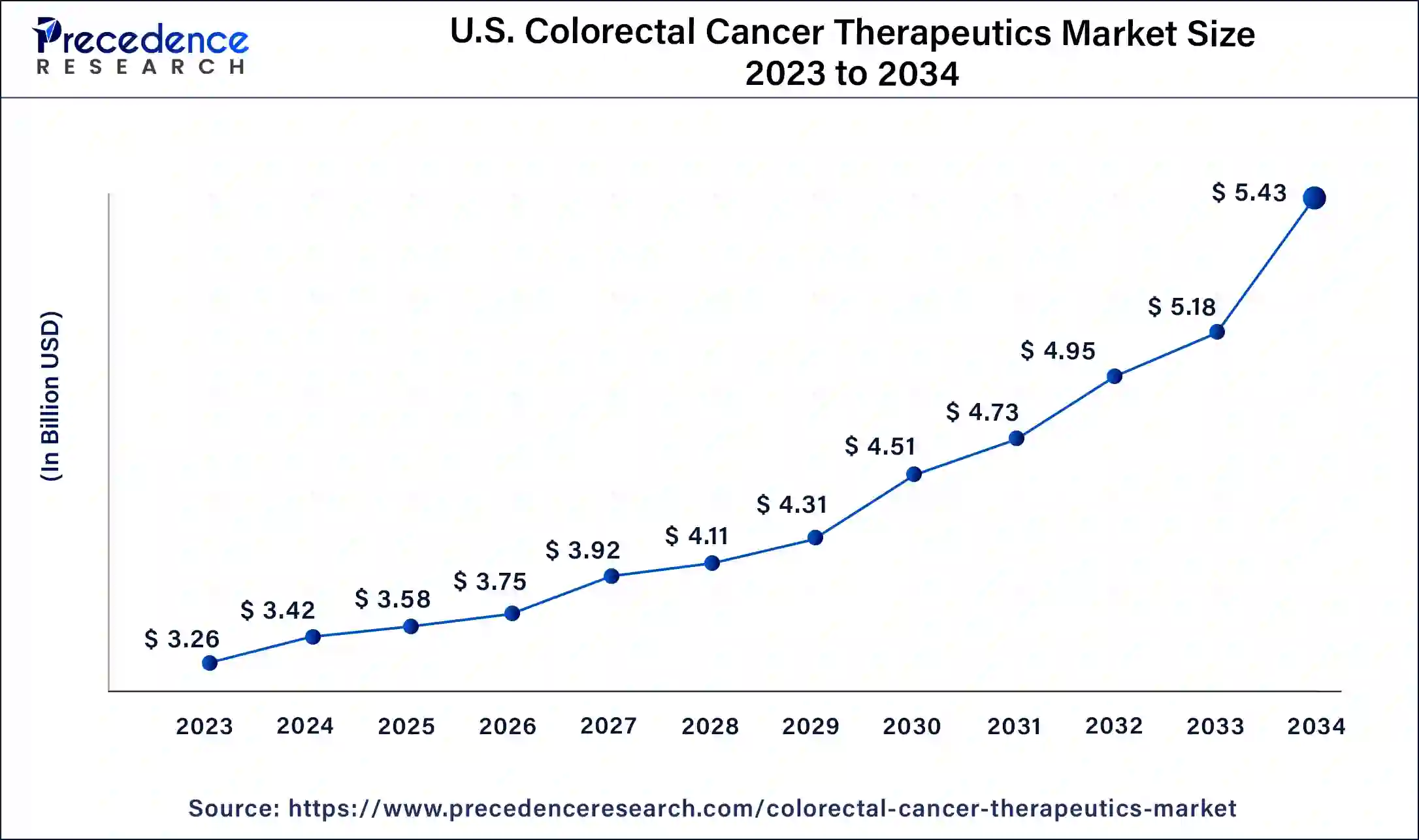

U.S. Colorectal Cancer Therapeutics Market Size and Growth 2025 to 2034

The U.S. colorectal cancer therapeutics market size was estimated at USD 3.42 billion in 2024 and is predicted to be worth around USD 5.43 billion by 2034, at a CAGR of 4.73% from 2025 to 2034.

North America has held largest market share of 38% in 2024. North American, including the United States and Canada has witnessed steady growth, driven by factors such as a high prevalence of colorectal cancer, advanced healthcare infrastructure, and a robust research and development landscape. Colorectal cancer is a prevalent form of cancer in North America, and its incidence rates contribute to the demand for therapeutic interventions. Furthermore, factors such as lifestyle, dietary habits, and an aging population contribute to the high prevalence of colorectal cancer in the region.

- The Centers for Disease Control (CDC), based in the United States supports the colorectal cancer control program (CRCCP), which provides funding to states, tribes, and territories to increase colorectal cancer screening rates among men and women aged 50-75. The program focuses on screening, follow-up, and tracking activities.

Asia Pacific is estimated to observe the fastest expansion. The Asia-Pacific region, comprising countries such as China, Japan, India, Australia, and others, is experiencing significant growth in the colorectal cancer therapeutics market. Factors contributing to this growth include a rising prevalence of colorectal cancer, an aging population, and improving healthcare infrastructure. Access to innovative colorectal cancer therapies, including targeted therapies and immunotherapies, is expanding in the Asia-Pacific region.

- A study report by Delhi State Cancer Institute stated that the occurrence of colon cancer in India is shifting to young adults (age group 31-40 years). According to the study, 59% of colon cancer patients are below the age of 50.

Europe holds a substantial share in the global colorectal cancer therapeutics market. The market has witnessed steady growth, driven by factors such as a high prevalence of colorectal cancer, advancements in healthcare infrastructure, and ongoing research and development activities. European countries have access to advanced treatment modalities for colorectal cancer, including targeted therapies, immunotherapies, chemotherapy, and surgical interventions. The adoption of innovative treatment approaches contributes to improved patient outcomes.

Market Overview

Colorectal cancer therapeutics is a treatment and intervention designed to manage and combat colorectal cancer, a type of cancer that starts in the colon or rectum. These therapeutics aim to prevent the growth, spread, and recurrence of colorectal cancer cells, and they may be administered through different modalities. The selection of a specific therapeutic approach depends on factors such as the stage of the cancer, the overall health of the patient, and the presence of specific molecular markers. Colorectal cancer therapeutics are often used in combination to optimize treatment outcomes and address the complexity of the disease. Ongoing research and clinical trials continue to explore new and improved therapeutic options for colorectal cancer patients.

The market for colorectal cancer therapeutics refers to the pharmaceutical and biotechnology industry segment dedicated to the development, manufacturing, and commercialization of drugs and therapeutic interventions specifically designed for the treatment of colorectal cancer. It is also known as bowel cancer, a type of cancer that originates in the colon or rectum. The therapeutics market for colorectal cancer involves a range of products aimed at preventing, managing, or curing this type of cancer. These products may include chemotherapy drugs, targeted therapies, immunotherapies, and other medications that are designed to inhibit the growth of cancer cells, induce apoptosis (programmed cell death), or target specific molecular pathways involved in the progression of colorectal cancer.

Colorectal Cancer Therapeutics Market Data and Statistics

- According to American Cancer Society, colorectal cancer is the third most common cancer in the United States. The organization also estimated 106,970 new cases of colon cancer in the country in 2023. Whereas the number of rectal cancer was estimated to be 46,050 in 2023.

- Eisai, headquartered in Japan, is processing Phase III the clinical development of Lenvatinib Mesylate for colorectal cancer.

- In January 2024, Merck announced a licensing deal for ompenaclid (RGX-202), a first-in-class oral inhibitor of the creatine transport channel SLC6A8, and follow-on drugs that target SLC6A8 with Inspirna, Inc. (New York, NY). In Phase II research, omepenaclid is presently being considered as a second-line treatment for metastatic or advanced RAS-mutant colorectal cancer (mCRC).

Colorectal Cancer Therapeutics Market Growth Factors

- The exploration and development of combination therapies, involving the use of multiple treatment modalities (chemotherapy, targeted therapy, immunotherapy), contribute to improved treatment outcomes and overcoming resistance.

- The introduction of biosimilars for biologic drugs used in colorectal cancer treatment can increase competition and potentially lower treatment costs, providing more affordable alternatives.

- The growing prevalence of colorectal cancer worldwide is a primary driver for the market, necessitating the development and adoption of effective therapeutic interventions.

- Rising healthcare expenditure and improved access to healthcare services contribute to increased diagnosis and treatment of colorectal cancer, driving the demand for therapeutics.

- Timely approvals by regulatory authorities for new drugs and therapeutic interventions encourage market growth by making innovative treatments available to patients.

- Immunotherapeutic approaches, including immune checkpoint inhibitors, have shown promise in colorectal cancer treatment.

- Advances in understanding the genetic and molecular profile of individual tumors enable the development of personalized treatment strategies. Tailoring therapies to the specific characteristics of a patient's cancer can enhance efficacy and reduce side effects.

- Awareness campaigns and screening programs for colorectal cancer lead to early detection, enabling timely intervention and treatment. Early-stage diagnosis often results in better treatment outcomes.

- The development of targeted therapies that specifically address molecular and genetic abnormalities associated with colorectal cancer is a significant driver. Targeted drugs, such as EGFR inhibitors and angiogenesis inhibitors, enhance treatment precision.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 12.79 Billion |

| Market Size in 2025 | USD 13.37 Billion |

| Market Size by 2034 | USD 19.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.55% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Therapy, By Cancer Type, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Timely regulatory approvals for new drugs and therapies

Timely regulatory approvals for new drugs and therapies play a pivotal role in driving the demand for the colorectal cancer therapeutics market. The regulatory green light signifies a crucial endorsement of the safety and efficacy of innovative treatments, instilling confidence among healthcare professionals, patients, and investors. Rapid approvals not only expedite the availability of advanced therapies but also address the urgent medical needs posed by colorectal cancer, ensuring that patients have access to cutting-edge treatments without unnecessary delays.

- For instance, in June 2021, the European Commission (EC) announced the approval of Bristol Myers Squibb's Opdivo plus Yervoy to cure adult patients with MSI-H (microsatellite instability-high) metastatic colorectal cancer (mCRC). It has received marketing authorization to be used in all EU member states and Iceland, Liechtenstein, and Norway.

Regulatory provision promotes an encouraging environment for pharmaceutical and biotechnology companies to invest in research and development initiatives, supporting a continuous cycle of innovation in the field of colorectal cancer therapeutics. As new drugs receive approval, they enrich the market landscape, offering diverse treatment options that cater to varying stages and molecular profiles of colorectal cancer.

Furthermore, swift regulatory processes encourage competitive dynamics within the market, driving companies to vie for approval and market entry with novel and differentiated therapeutic solutions. This competition, in turn, can lead to increased affordability and accessibility of colorectal cancer therapeutics, benefiting a broader patient population. Ultimately, timely regulatory approvals serve as a catalyst, propelling the colorectal cancer therapeutics market forward, and ensuring that groundbreaking treatments reach those in need with expediency and efficacy.

Restraint

High development costs

The formidable challenge of high development costs casts a looming shadow over the overall growth trajectory of the colorectal cancer therapeutics market. The intricate process of researching, developing, and bringing novel therapeutics to market is accompanied by substantial financial investments, creating a barrier for both established and emerging players in the pharmaceutical landscape. The extensive journey from preclinical research to clinical trials and eventual regulatory approvals demands significant resources, spanning laboratory experiments, patient recruitment, and compliance with stringent regulatory standards.

For smaller pharmaceutical companies and research institutions, the burden of these exorbitant costs poses a particularly daunting obstacle, potentially limiting their capacity to contribute innovative solutions to colorectal cancer treatment. The financial risks associated with the lengthy and uncertain development process, coupled with the inherent complexities of cancer research, can deter investment and stifle the introduction of groundbreaking therapies. The consequences of this financial strain extend beyond individual companies, impacting the industry's ability to rapidly innovate and deliver diverse treatment options for colorectal cancer patients.

Efforts to alleviate this constraint necessitate collaborative initiatives, innovative funding models, and perhaps a reevaluation of regulatory processes to streamline and expedite the development pathway. Balancing the imperative for stringent safety and efficacy standards with the need for a more financially sustainable development environment is crucial to ensuring the continued growth and accessibility of the colorectal cancer therapeutics market.

Opportunity

Integration of digital health tools and telemedicine

The integration of digital health tools and telemedicine stands as a transformative opportunity for the colorectal cancer therapeutics market. As technological advancements redefine healthcare delivery, the fusion of digital solutions and telemedicine offers a multifaceted approach to enhance patient care and treatment outcomes in colorectal cancer. Telemedicine facilitates remote consultations, allowing patients to access specialized oncological expertise irrespective of geographical constraints. This not only fosters greater convenience for patients but also enables healthcare providers to monitor treatment progress and manage side effects in real-time.

Digital health tools play a pivotal role in patient engagement and adherence to treatment plans. Mobile applications, wearable devices, and remote monitoring tools enable continuous tracking of vital health parameters, facilitating personalized care. These tools can provide patients with valuable insights into their treatment journey, fostering a sense of empowerment and proactive participation in their healthcare.

Moreover, the integration of artificial intelligence (AI) and data analytics in digital health platforms presents opportunities for more precise and timely decision-making. AI-driven tools can analyze vast datasets to identify patterns, predict treatment responses, and optimize therapeutic strategies tailored to individual patient profiles. In essence, the synergy between digital health tools and telemedicine not only improves accessibility to colorectal cancer therapeutics but also revolutionizes the continuum of care by incorporating data-driven insights and personalized interventions. This dynamic integration aligns with the evolving landscape of patient-centric healthcare, marking a significant opportunity for advancements within the colorectal cancer therapeutics market.

Therapy Insights

The immunotherapy segment has held the highest revenue share of 49% in 2024. Immunotherapy harnesses the body's immune system to recognize and destroy cancer cells. Immune checkpoint inhibitors, such as anti-PD-1 and anti-CTLA-4 antibodies, are examples of immunotherapeutic agents used in colorectal cancer treatment. It aims to enhance the immune response against cancer, offering a novel and promising avenue for treating colorectal cancer.

The targeted therapy segment is anticipated to expand at a CAGR of 6.9% over the projected period. Targeted therapies focus on specific molecules or pathways involved in the growth and survival of cancer cells. Examples include drugs that target the epidermal growth factor receptor (EGFR), vascular endothelial growth factor (VEGF), and other signaling pathways. It aims to block the abnormal signaling that drives cancer growth while minimizing damage to normal cells. They play a crucial role in personalized treatment approaches.

Cancer Type Insights

The colorectal adenocarcinoma segment has held the highest market share of 47% in2024 and is anticipated to expand fastest over the projected period. Colorectal adenocarcinoma is the most common type of colorectal cancer, originating in the glandular cells lining the inner surface of the colon and rectum. It typically develops from adenomatous polyps, and the majority of colorectal cancers fall into this category. Targeted therapies, chemotherapy, and immunotherapy are commonly employed in the treatment of colorectal adenocarcinoma, reflecting the need for comprehensive and personalized therapeutic strategies.

Distribution Channel Insights

The hospital pharmacies segment had the highest market share of 45% in2024. Hospital pharmacies are integral components of healthcare institutions, directly linked to hospitals and medical centers where patients receive diagnosis and treatment for colorectal cancer. They dispense medications prescribed by healthcare providers as part of inpatient or outpatient care. It plays a crucial role in ensuring that patients have immediate access to prescribed colorectal cancer therapeutics, often in conjunction with other hospital-based treatments.

The retail pharmacies segment is anticipated to expand at a CAGR of 7.4% over the projected period. Retail pharmacies, commonly found in community settings, serve as accessible outlets where patients can obtain prescription medications and over-the-counter drugs. They are part of local drugstores or retail chains. Retail pharmacies provide a convenient and community-based option for patients to fill their colorectal cancer prescriptions, offering accessibility and support for ongoing medication management.

Colorectal Cancer Therapeutics Market Companies

- Bayer AG

- Bristol Myers Squibb

- Eli Lilly and Company

- Genentech, Inc.

- Ipsen Biopharmaceuticals, Inc.

- Merck Sharp & Dohme Corp.

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- Taiho Pharmaceutical (Otsuka Pharmaceutical Co., Ltd.)

- Novartis AG

Recent Developments

- November 2023: U.S. FDA (Food and Drug Administration) announced that it has approved Takeda's oral targeted therapy for adults with metastatic colorectal cancer (mCRC), FRUZAQLA (fruquintinib). According to the company, FRUZAQLA is a chemotherapy-free treatment option and provide a considerable survival help to patients without much impacting their quality of life.

- August 2023: U.S. Food and Drug Administration (FDA) has approved Taiho Pharmaceutical Co., Ltd. and Taiho Oncology, Inc., LONSURF (trifluridine/tipiracil), to treat adult patients with metastatic colorectal cancer (mCRC) as a single agent or in combination with bevacizumab.

- June 2023: Enzene Biosciences has launched its cheaper drug for treatment of metastatic colorectal cancer, Bevacizumab. It is a biosimilar substitute to the more expensive Avastin.

Segments Covered in the Report

By Therapy

- Targeted Therapy

- Immunotherapy

- Chemotherapy

- Others

By Cancer Type

- Colorectal Adenocarcinoma

- Gastrointestinal Carcinoid Tumors

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting