Colorectal Cancer Diagnostics Market Size and Forecast 2025 to 2034

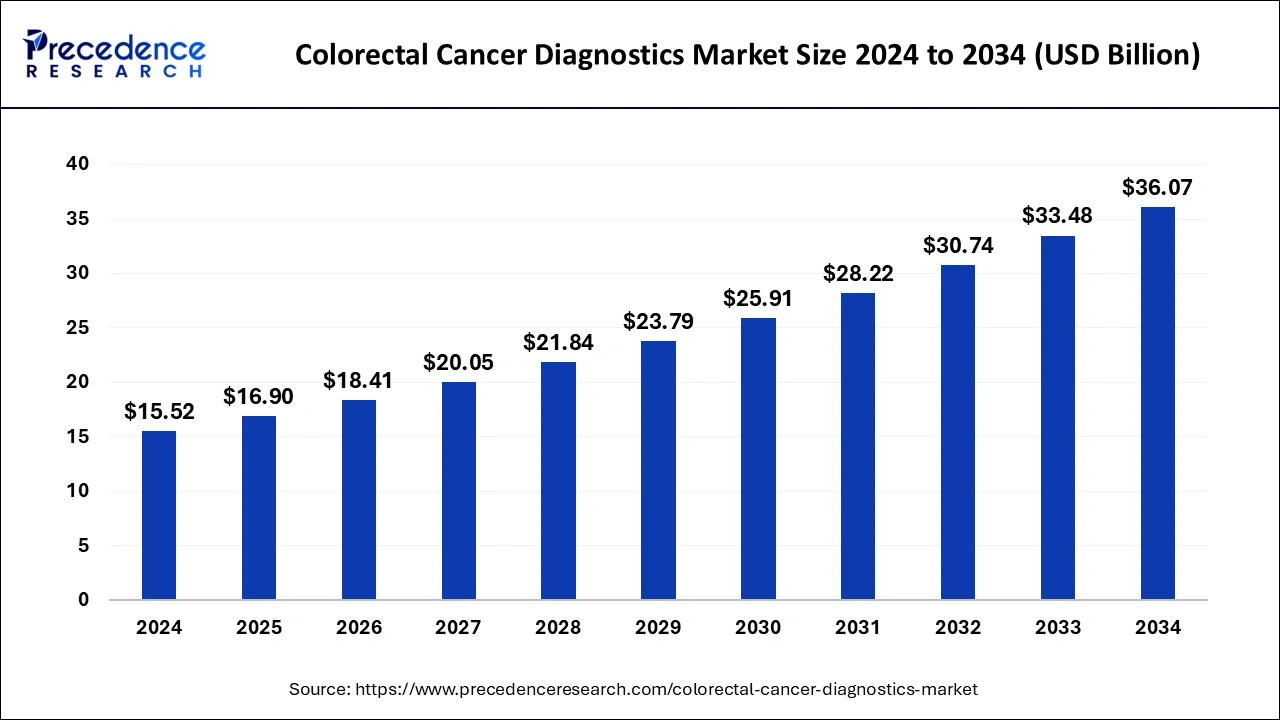

The global colorectal cancer diagnostics market size was estimated at USD 15.52 billion in 2024 and is predicted to increase from USD 16.90 billion in 2025 to approximately USD 36.07 billion by 2034, expanding at a CAGR of 8.80% from 2025 to 2034. The colorectal cancer diagnostics market is driven by the increasing focus on screening and early detection initiatives.

Colorectal Cancer Diagnostics Market Key Takeaways

- The global colorectal cancer diagnostics market was valued at USD 15.52 billion in 2024.

- It is projected to reach USD 36.07 billion by 2034.

- The market is expected to grow at a CAGR of 8.80% from 2025 to 2034.

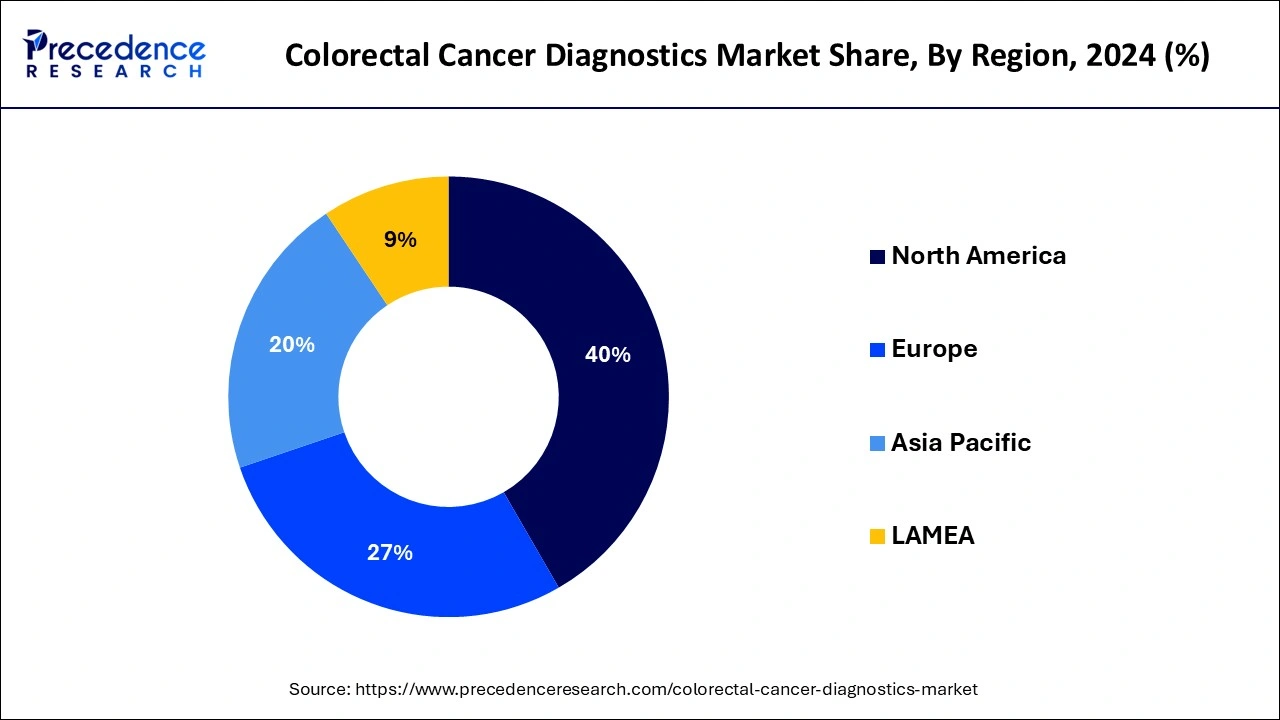

- North America dominated the market with the largest revenue share of 40% in 2024.

- Asia- Pacific is observed to be the fastest growing market during the forecast period.

- By test type, the imaging test segment has contributed more than 49% of market share of 2024.

- By test type, the blood test segment is observed to be the fastest growing market during the forecast period.

- By end-use, the hospitals segment has held the major revenue share of 42% in 2024.

- By end-use, the diagnostic imaging centers segment is observed to be the fastest growing in the market during the forecast period.

U.S.Colorectal Cancer Diagnostics Market Size and Growth 2025 to 2034

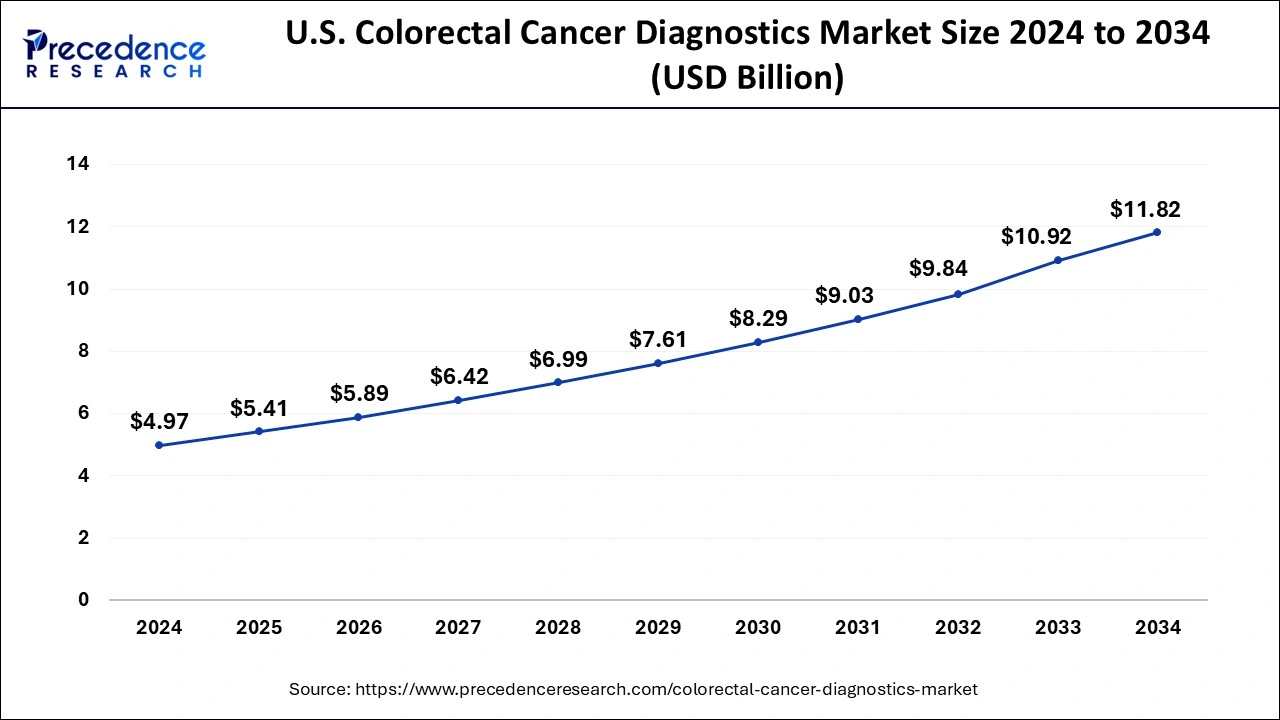

The U.S. colorectal cancer diagnostics market size was estimated at USD 4.97 billion in 2024 and is predicted to be worth around USD 11.82 billion by 2034 at a CAGR of 9.05% from 2025 to 2034.

North America had the largest market share in 2024 in the colorectal cancer diagnostics market. In North America, both the public and healthcare professionals are becoming more aware of colorectal cancer and the value of routine screening. Governments, healthcare organizations, and advocacy groups aggressively promote screening programs. This results in a rise in diagnostic procedures such as colonoscopies, fecal occult blood tests (FOBT), and fecal immunochemical tests (FIT). Research institutes, pharmaceutical companies, and diagnostic businesses frequently work together in this region on R&D projects to enhance colorectal cancer detection. These partnerships increase market penetration, promote innovation, and quicken the creation of new diagnostic instruments.

- An estimated 153,020 Americans will receive a CRC diagnosis in 2023, and 52,550 will pass away from the illness.

Asia-Pacific is observed to be the fastest growing colorectal cancer diagnostics market during the forecast period. The incidence of colorectal cancer in the region is rising, mainly due to aging populations, altered eating patterns and changing lifestyles. Several factors, including sedentary lifestyles, a high intake of processed foods, and little physical activity, are linked to the rising incidence of colorectal cancer in Asia-Pacific nations. Healthcare spending is rising in line with the continued growth of the economies in the Asia-Pacific region. Spending on preventive healthcare measures, such as routine colorectal cancer screenings, is increasing among individuals. The region's colorectal cancer diagnostics market is also growing due to government programs and insurance coverage for cancer screening and treatment.

- The incidence of colorectal cancer (CRC), both left and right, is the same in China. 49.2% of CRC patients have the condition on the right side, and 49.4% on the left. CRCs of the adenocarcinoma type are still the most prevalent.

- 5%–10% of all instances of CRC are caused by genetic disorders associated with the disease, such as Lynch syndrome and familial adenomatous polyposis. Lynch syndrome, which accounts for 4% of all incidences of colorectal cancer, is an autosomal dominant genetic disease, according to retrospective research from China.

Market Overview

The area of the healthcare business dedicated to creating, manufacturing, and distributing diagnostic instruments and tests to identify and track colorectal cancer is known as the colorectal cancer diagnostics market. One of the most common and dangerous types of cancer in the world is colorectal cancer, which also encompasses tumors of the colon and the rectum. Patient outcomes and survival rates are greatly enhanced by early identification of colorectal cancer. Colonoscopies, stool DNA testing, fecal occult blood tests (FOBT), imaging methods, and other diagnostic procedures are vital in detecting colorectal cancer in its early stages when therapy is most successful.

The colorectal cancer diagnostics market comprises a sizeable portion of the more significant oncology diagnostics industry. Market expansion is facilitated by ongoing technology developments, such as creating non-invasive and more accurate diagnostic techniques. Furthermore, the accuracy and dependability of colorectal cancer diagnostics are improved by introducing innovative biomarkers and molecular diagnostic methods.

Colorectal Cancer Diagnostics Market Data and Statistics

- With 10% of all cancer cases worldwide, colorectal cancer is the third most common type of cancer overall and the second most significant cause of cancer-related deaths globally.

- It primarily affects elderly people; those 50 and older account for most cases.

- About 153,020 people will receive a CRC diagnosis in 2023, and 52,550 people will pass away from the illness, of which 19,550 cases and 3,750 fatalities will affect people under the age of fifty.

- A sedentary lifestyle, smoking, excessive alcohol use, obesity, a poor intake of fruits and vegetables and a high intake of processed meats, are some of the lifestyle factors that contribute to the development of colorectal cancer.

Colorectal Cancer Diagnostics Market Growth Factors

- Growing consciousness and early detection screening initiatives.

- Creation of novel, more precise diagnostic methods.

- Rising worldwide costs for healthcare.

Colorectal Cancer Diagnostics Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.80% |

| Market Size in 2025 | USD 16.90 Billion |

| Market Size by 2034 | USD 36.07 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Test Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising prevalence of colorectal cancer

Spending more on healthcare, especially in industrialized nations, makes modern colorectal cancer diagnostics and therapies more accessible. Patients gain better access to screening programs and diagnostic centers as governments and healthcare institutions devote resources to cancer prevention, detection, and management. The growing expenditure on healthcare infrastructure is driving the growth of the market for colorectal cancer diagnostics. Thereby, the rising prevalence of colorectal cancer is observed to act as a driver for the colorectal cancer diagnostics market.

Growing preference for non-invasive diagnostic methods

The market for colorectal cancer diagnostics is driven by consumers' increasing demand for non-invasive diagnostic techniques, altering how this common cancer is identified and treated. One of the most common malignancies detected worldwide, colorectal cancer, has historically been linked to invasive diagnostic procedures, including sigmoidoscopies and colonoscopies. However, the development of non-invasive diagnostic methods has changed how medical practitioners approach this disease's detection and surveillance.

Restraints

Lack of awareness among the general population regarding the importance of colorectal cancer screening

Despite the availability of efficient screening techniques, including sigmoidoscopy, colonoscopy, and fecal occult blood tests (FOBT), many people do not regularly engage in screening programs because they are unaware of their significance. This hesitation could be brought on by false beliefs about the difficulty of screening tests, anxiety over being diagnosed with cancer, or ignorance of the possible advantages of early detection. Despite people's awareness of the significance of colorectal cancer screening, several obstacles may keep them from utilizing screening services.

These obstacles include the absence of health insurance, budgetary limitations, travel time to screening locations, and linguistic or cultural hurdles. Insufficient knowledge worsens these obstacles by making impacted populations feel that screening is not as important or urgent.

Limitations in the accuracy and reliability of certain tests

Sampling errors can occur in certain diagnostic tests, especially tissue or stool samples. The diagnostic process's reliability can be threatened by erroneous test results resulting from inadequate sampling or inappropriate sample handling. Due to various genetic alterations and molecular subtypes, colorectal cancer is heterogeneous. The biological variability among tumors might impact diagnostic tests' performance to target specific biomarkers or molecular signatures, resulting in inconsistent test results and diagnostic accuracy.

Opportunities

Growing opportunity for personalized medicine approaches

Personalized medicine empowers Patients to participate more actively in their healthcare journeys. A patient-centric style of care that puts efficacy, safety, and quality of life first is fostered by personalized medicine, which customizes diagnostic and therapeutic techniques to everyone's distinct biology and preferences. Individualized strategies help patients with colorectal cancer not only increase their chances of survival but also improve their general health and level of satisfaction with their medical care.

Innovations in imaging technologies

High-resolution images of the colon and rectum are provided by imaging technologies like CT, MRI, and PET scans, which enable medical practitioners to spot abnormal growths like polyps or cancers early on. To allow timely intervention and increase the chance of effective treatment, early identification is essential in the management of colorectal cancer. The potential for enhancing colorectal cancer diagnosis by integrating artificial intelligence (AI) and machine learning algorithms with imaging technology is enormous. AI-based image analysis can help radiologists analyze imaging data more effectively and precisely, resulting in quicker diagnosis and more targeted therapy suggestions.

Test Type Insights

The imaging test segment dominated in the colorectal cancer diagnostics market in 2024. Unmatched ability to identify anomalies in the colon and rectum is provided by imaging procedures, including computed tomography (CT), magnetic resonance imaging (MRI), and positron emission tomography (PET). By detecting worrisome growths, polyps, or tumors in their early stages, these tests can significantly enhance patient outcomes by facilitating early management. A thorough evaluation of the degree and dissemination of colorectal cancer is possible with imaging testing.

They include comprehensive details regarding the size, location, invasion of surrounding tissues, and involvement of distant organs or neighboring lymph nodes. Accurately diagnosing the disease and choosing the best course of treatment depends on this thorough evaluation.

The blood test segment is observed to be the fastest growing in the colorectal cancer diagnostics market during the forecast period. Both people and medical professionals find blood tests to be a non-invasive way to diagnose colorectal cancer. Blood testing offers a relatively easy and practical alternative to more intrusive and uncomfortable traditional screening techniques like colonoscopies. Because it is non-invasive, more people are encouraged to get screened, raising market demand. One of the main reasons why blood tests are so popular with patients is their ease. Unlike colonoscopies, blood tests are usually quick and require little preparation, which may involve intestinal preparation and downtime.

More people follow screening recommendations due to this convenience, especially those who might not otherwise want to have intrusive procedures done. Consequently, blood test recommendations from healthcare professionals as part of standard screening procedures are more likely, which propels market expansion.

End-use Insights

The hospitals segment dominated the colorectal cancer diagnostics market in 2024. A multidisciplinary team of oncologists, surgeons, radiologists, pathologists, and other experts is frequently involved in treating colorectal cancer. Hospitals give these specialists a place to work together, resulting in more precise diagnoses and individualized treatment regimens catered to each patient's requirements. Hospitals employ skilled medical personnel with a focus on the diagnosis and treatment of colorectal cancer. These experts have received substantial training and experience in interpreting diagnostic tests and identifying subtle indicators of colorectal cancer, which enables prompt intervention and better patient outcomes.

The diagnostic imaging centers segment is observed to be the fastest growing in the colorectal cancer diagnostics market during the forecast period. One of the most common diseases in the world, colorectal cancer is becoming more common, especially in affluent nations. There's a growing need for better diagnostic services to control the disease burden as the world's population ages, and lifestyle factors, including poor diet and sedentary behavior, contribute to the rising incidence of colorectal cancer. With their cutting-edge imaging equipment, diagnostic imaging facilities can provide prompt and precise diagnosis, which makes them essential in the fight against colorectal cancer.

Colorectal Cancer Diagnostics Market Companies

- Abbott Laboratories

- BioMerieux SA

- Dickinson and Company

- GE Healthcare

- Qiagen N.V

- Thermo Fischer Scientific

- Hologic Inc

- Epigenomics AG

- F-Hoffmann-La Roche Ltd

- Siemens Healthineers

- Sysmex Corporation

Recent Developments

- In January 2024, A novel minimal residual disease (MRD) assay called Mx has been released by the technology company Tempus. It is intended for use in research on colorectal cancer (CRC). The xM assay is a plasma-based, tumor-naïve test that finds circulating tumour DNA (ctDNA) in blood samples from individuals who have had surgery for early-stage colorectal cancer. The xM assay, which is only now accessible for research purposes, is a liquid biopsy method of evaluating MRD that does not require baseline tumor tissue. Using methylation and genetic variation classifiers yields a binary MRD result.

- In November 2023, Leading precision oncology business Guardant Health, Inc. said it has introduced ShieldTM, a blood-based colorectal cancer screening test, in association with Samsung Medical Center in South Korea.

- In March 2023, With great pleasure, BGI Genomics announced the introduction of COLOTECTTM 1.0 in Slovakia, working with local partner Zentya. Zentya is a Slovak provider of healthcare solutions committed to giving patients access to cutting-edge genetic screening technology to help diagnose and expedite the treatment of hereditary illnesses.

Segments Covered in the Report

By Test Type

- Blood Test

- Stool Test

- Fecal Occult Blood Test (FOBT)

- Fecal Biomarker Test

- CRC DNA Screening Test

- Imaging Test

- Computed Tomography (CT) scan

- Ultrasound

- Magnetic Resonance Imaging (PET) scan

- Positron Emission Tomography (PET) scan

- Colonoscopy

- Other Imaging Tests

- Biopsy

- Other Test Types

By End-use

- Hospitals

- Diagnostic Imaging Centers

- Cancer Research Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting