What is the Commerce Cloud Market Size?

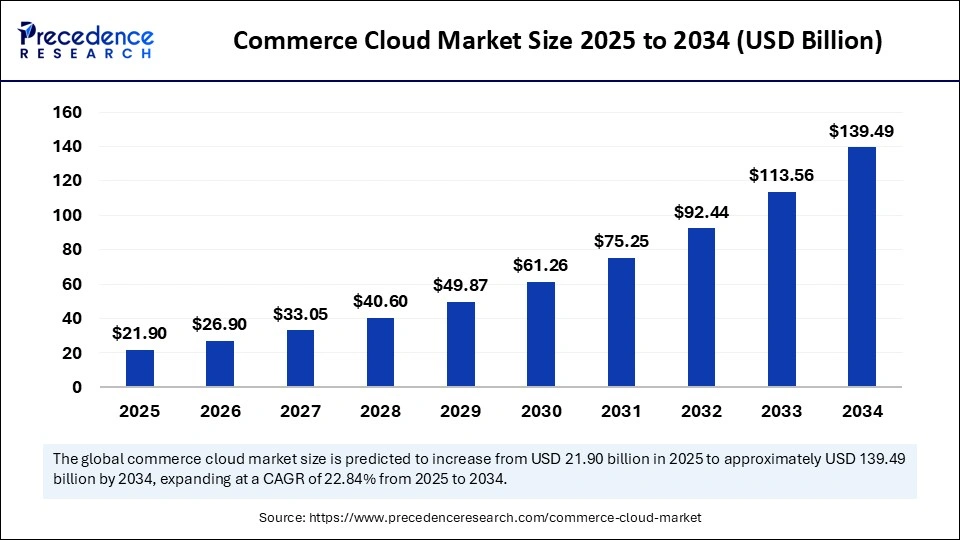

The global commerce cloud market size is calculated at USD 21.90 billion in 2025 and is predicted to increase from USD 26.90 billion in 2026 to approximately USD 139.49 billion by 2034, expanding at a CAGR of 22.84% from 2025 to 2034. Increasing penetration of internet services, smartphone usage, and businesses leveraging cloud-based platforms, along with rapid digitalization, are key factors of the market's growth on a large scale.

Market Highlights

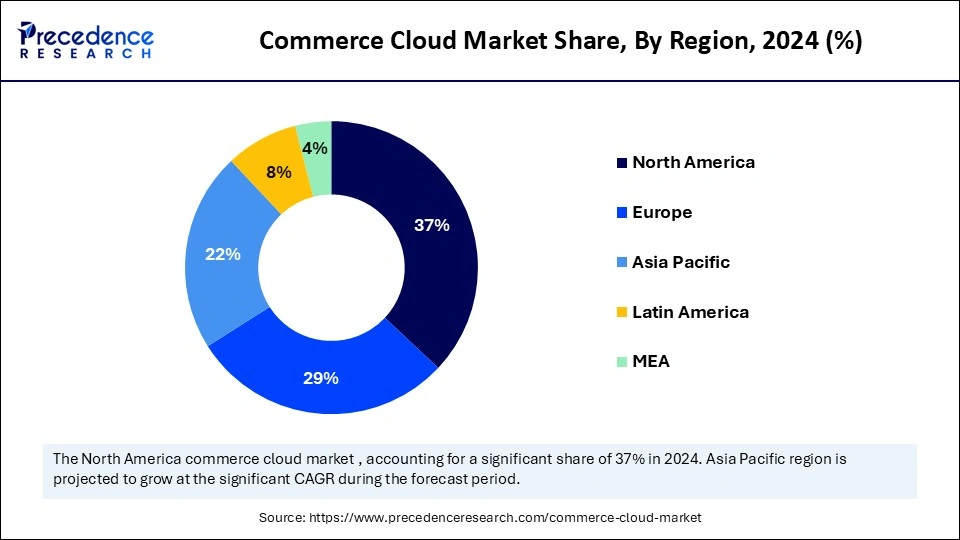

- North America dominated the commerce cloud market with the largest market share of 37% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By deployment model, the public cloud segment held the biggest market share of 60% in 2024.

- By deployment model, the hybrid cloud segment is expected to witness the fastest CAGR during the foreseeable period.

- By core solution component, the e-commerce platform captured the biggest market share of 28% in 2024.

- By core solution component, the personalization and recommendation engine segment is expected to witness the fastest CAGR during the foreseeable period.

- By business model served, the B2C segment contributed the highest market share of 46% in 2024.

- By business model served, the marketplaces segment is expected to witness the fastest CAGR during the foreseeable period.

- By organization size, the large enterprise segment held the largest market share of 52% in 2024.

- By organization size, the small and medium businesses (SMBs) segment is expected to witness the fastest CAGR during the foreseeable period.

- By industry vertical, the retail and e-commerce segment accounted for the significant market share of of 34% in 2024.

- By industry vertical, the food and grocery segment is expected to witness the fastest CAGR during the foreseeable period.

- By pricing model, the subscription/SaaS segment generated the major market share of 55% in 2024.

- By pricing model, the usage-based segment is expected to witness the fastest CAGR during the foreseeable period.

What is Cloud Commerce?

A commerce cloud is basically a suite of cloud-based platforms that is offered by Salesforce and SAP, which facilitates businesses with the tools. These tools are helpful to build and manage their online stores and support for better experience for both business-to-business and business-to-consumer sales. AI chatbots and virtual assistance can handle consumers' questions while guiding them about product specifications, and even help deal with the transaction process is a plus point, fueling the market's growth.

How is AI Transforming the Commerce Cloud Market?

Commerce clouds, by integrating with Artificial Intelligence, can offer remarkable benefits from enhanced consumer experience to data-driven decisions. AI can analyze past purchases by browsing history and landing pages to recommend relevant pages and products, in turn, decreasing bounce rate and increasing consumers' engagement and potential to purchase products frequently. AI-powered search can better understand user intent and context behind it, offering more precise results even for improper queries or grammatical mistakes. AI can further segregate consumers by analyzing their behavior and searching patterns so as to offer tailored promotions and marketing campaigns related to these groups of people.

What are the Key Trends in the Commerce Cloud Market?

- Unified Commerce: Many retailers are trying to offer a unified experience of shopping across all access points, like online, smartphones, social, and physical stores, which need a single platform able to provide real-time data with every detail. As mobile devices are a major platform to gain e-commerce traffic, the majority of retailers are prioritizing strategies for mobile pages and optimized websites to be mobile-friendly for a seamless and convenient shopping experience. Moreover, selling directly by using social media platforms like Instagram and other apps has become a mainstream strategy for business expansion. Also, conversational commerce utilizes AI-based chatbots for highly interactive and real-time consumer support.

- Business Expansion owing to Digitalization: The business-to-business sector is transforming due to rapid digital adoption, along with buyers anticipating a similar and personalized online experience as B2C customers. It encompasses various features for managing complicated orders, contract pricing with custom catalogs. The continued expansion of the direct-to-consumer business model and the emergence of innovative online marketplaces are creating direct selling channels.

Commerce Cloud Market Outlook

- Market Overview: As organizations move their commerce capabilities to a cloud-first environment, commerce-cloud platforms are becoming essential to a digital-first commerce strategy. This is a result of the increase of e-commerce adoption, an increase in mobile-first commerce, and the growing need for scalable, flexible commerce infrastructure.

- Global Expansion:Areas like Asia-Pacific are increasing adoption of commerce cloud solutions driven by increasing Internet access, mobile-first buying consumers, and cross-border digital commerce trade frameworks. This is enabling commerce-cloud vendors to tap into and scale globally beyond North America and Europe.

- Vendor & Service Models: Subscription-based, Software as a Service (SaaS) commerce-cloud offerings are becoming the preferred model, allowing emerging commerce vendors to convert previously large upfront capital costs to flexible operational spend - allowing companies to deploy faster, respond to market changes, and reduce vendor lock-in on legacy platforms.

- Channel Disruption:The emergence of Omni channel commerce from mobile native applications, social selling, marketplaces, to physical retail, linked to back-end cloud applications – is disrupting retail commerce and companies need to migrate to commerce-cloud models which ultimately position them to manage the full customer lifecycle across all channels.

How Governments Worldwide Are Powering the Next Wave of Commerce Cloud Innovation

Governments around the world are increasingly backing the expansion of the commerce cloud sector, primarily through digital transformation and procurement initiatives or projects. For instance, in the public sector, the U.S. federal government's General Services Administration to Commercial Platforms Program is specifically designed to foster cloud-based e-commerce as a way to simplify federal purchasing and enhance vendor transparency in the process regardless of federal regulatory aspects.

Similarly, China's increased focus on a "digital platform economy" aligns with itsIndustry 4.0 initiative to incorporate cloud technologies to improve productivity in its .ndustries and to enhance smart manufacturing capabilities ONDC is a transformative initiative by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce & Industry, Government of India.These governmental efforts not only improve operational efficiency and data interoperability, but also lead to a faster shift to more resilient, cloud-based commerce ecosystems that will allow both public sector and private sector organizations to enter at-scale in global digital services markets.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.90 Billion |

| Market Size in 2026 | USD 26.90 Billion |

| Market Size by 2034 | USD 139.49 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Model, Core Solution Component, Business Model Served, Organization Size, Industry Vertical, Pricing Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rapid expansion of e-commerce

A significant driving factor for the commerce cloud market is expanding access of internet access and rapid adoption of e-commerce based on this scenario, supportive of the explosive growth of the commerce cloud market. A user-friendly, easily accessible application presented by smartphones with affordable prices makes online shopping easy and accessible in every region, with affordability to nearly every group of people, which is a critical driver of the commerce cloud. Also, cloud technology offers businesses a strategy by offering a large volume of data about consumers' recent choices, trends, and behavior of shopping behavior with every detail, enabling businesses to stay prompt by understanding patterns and helping them grow exponentially.

Restraint

Dependency and lack of personal touch

Despite having many benefits from commerce cloud platforms, some drawbacks, like dependency on its vendor and products, make it difficult to integrate with other tools that are not part of the Salesforce tool suite. Also, being a completely cloud-based solution presents limitations by applying conditional working based on a stable internet connection, and the platform's functionality is solely depending on how the internet is working. This creates a barrier to adopting these platforms where internet connection is disrupted, especially in underserved and remote areas. It also lacks a personal touch due to automation, which is valuable for many consumers to build trust.

Opportunity

Emergence of omnichannel commerce

A commerce cloud market represents a significant opportunity by creating a potential to build a unified and omnichannel commerce platform with various tools and features at the same time, which excellently deals with the confusion of product choices and financial transactions. It gives a consistent and seamless experience to consumers across every digital and physical touchpoint, showcasing potential offerings by cloud commerce. Cloud platforms further enable the unification of online and offline channels, including point-of-sale systems that offer a comprehensive view of the consumer's behavior, purchasing habits, and inventory management.

Segment Insights

Deployment Model Insights

Why is public cloud preferable in the cloud commerce market?

The public cloud segment held the largest market share of 60% in 2024. The public cloud platform offers the ability to scale rapidly, which is crucial for businesses in the land of expanding digitalization, as per demand. Fluctuations in e-commerce traffic and seasonal highs and lows in demand need to be handled skillfully without overprovision or lacking. This is excellently handled by public cloud, fueling the segments and, in turn commerce cloud market's growth largely. It also enables retailers to integrate their online and offline sales channels, facilitating a more unified experience for consumers and retailers as well.

The hybrid cloud segment is expected to witness the fastest CAGR during the foreseeable period. A hybrid cloud segment provides a balanced approach for public cloud flexibility and scalability, along with high security and private cloud control. It allows businesses to keep their confidential data and crucial applications within their infrastructure.

Core Solution Component Insights

How are e-commerce platforms fueling the commerce cloud market?

The e-commerce platform segment held the largest market share of 28% in 2024. The e-commerce platforms provide excellent flexibility for businesses to scale up or down their products by knowing demand from organic traffic, making it invaluable for businesses to stay competitive in the global market. E-commerce platform further helps to lower upfront costs and easy integration with third-party tools like CRM and payment gateways, which is critical for agility and personalization.

The personalization and recommendation engine segment is expected to witness the fastest CAGR during the foreseeable period. The segment's growth is attributed to factors like intuitive discovery of products with a highly tailored experience that saves time and agitation to find expected products in a large pool of diverse products.

Business Model Served Insights

How is the B2C business model supporting the growth of the commerce cloud market?

The B2C segment held the largest market share of 46% in 2024. The segment is largely influenced due to massive consumer demand who are seeking integrity and cost-effective products, the largest potential audience, and an increasing shift to mobile commerce. Also, the B2C business model runs on a personalized and convenient shopping experience along with diverse features like easy finance transactions with high security, targeted advertising, and consumer consumer-centric approach, appealing to various business owners.

The marketplaces segment is expected to witness the fastest CAGR during the foreseeable period. Many businesses are rapidly adopting marketplaces to offer a consistent and seamless consumer experience across every channel, like web, social media platforms, and mobile applications.

Organization Size Insights

How do large enterprises leverage the benefits of cloud commerce?

The large enterprise segment held the largest market share of 52% in 2024. Large businesses have huge capital in terms of finance and investors' support, so that they can heavily invest in the highly scalable commerce cloud platforms that are helpful and beneficial for everyone working jointly in the market. These businesses often work internationally, and it has become essential to have a unified platform that can handle multiple currencies. Languages and the global supply chain, with logistics as well.

The small and medium businesses (SMBs) segment is expected to witness the fastest CAGR during the foreseeable period. A cloud commerce platform offers support to SMEs without the need for high initial investment and enables digital transformation for SMEs. Also, high penetration of the internet and mobile applications with the rise of direct-to-consumer models further fueled the segment's growth.

Industry Vertical Insights

Why does the retail and e-commerce industry dominate the commerce cloud market?

The retail and e-commerce segment held the largest market share of 34% in 2024. The retail and e-commerce industry requires robust, highly scalable, and flexible cloud solutions to manage huge datasets at the same time, along with financial transactions and inventory management. This is all achievable by using the commerce cloud platform excellently, supporting the segment's growth on a large scale.

The food and grocery segment is expected to witness the fastest CAGR during the foreseeable period. The segment is expanding due to increasing consumer need for a convenient lifestyle, due to hectic schedules, and growth in online shopping, along with internet penetration and use of smartphones, making it accessible for everyone to leverage an online shopping experience.

Pricing Model Insights

How is the subscription/SaaS model helpful in the commerce cloud market growth?

The subscription/SaaS segment held the largest market share of 55% in 2024. This pricing model offers significant benefits to both consumers and providers and allows enterprises to predict recurring financial profits for businesses on a large scale, making businesses highly stable. It is further cost-effective and scalable for SMEs and new enterers in the market without the requirement of substantial capital investment.

The usage-based segment is expected to witness the fastest CAGR during the foreseeable period. The usage-based pricing model aligns with the value of providers and makes it easier for consumers to grow their service usage. This model provides a greater level of authenticity and transparency, which is crucial to building stable consumers in the global market for several businesses.

Regional Insights

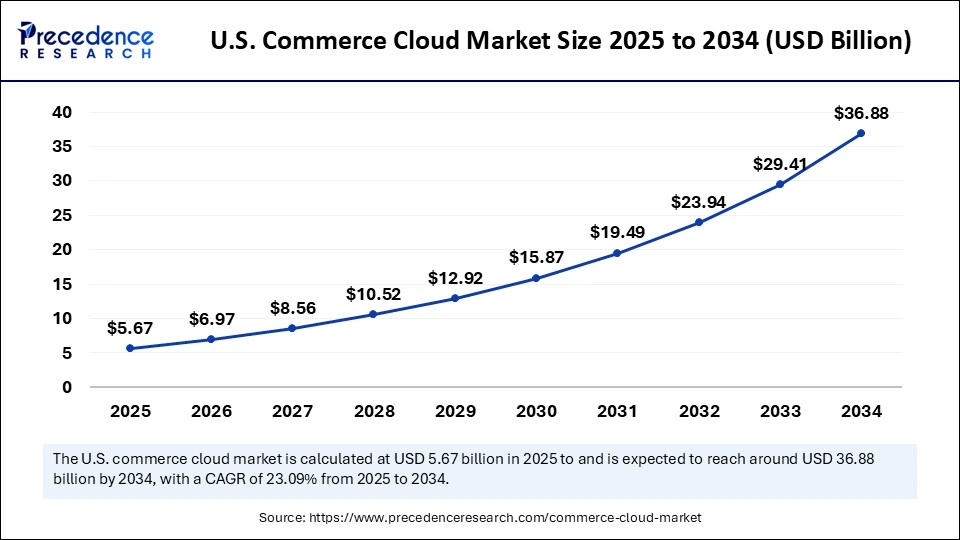

U.S. Commerce Cloud Market Size and Growth 2025 to 2034

The U.S. commerce cloud market size is evaluated at USD 5.67 billion in 2025 and is projected to be worth around USD 36.88 billion by 2034, growing at a CAGR of 23.09% from 2025 to 2034.

Why does North America's commerce cloud market dominate globally?

North America held the largest market share of 37% in 2024. North America boasts a highly advanced digital infrastructure, easy and fast adoption of cloud technologies, and its integration with various end users, along with the active involvement of major leaders, are some of the key factors that are fueling the region's growth. Leading commerce cloud vendors like Salesforce, IBM, and Oracle are actively presenting innovative solutions for cloud-based technologies and ways to integrate them with their platforms. Businesses are focused on providing highly personalized solutions to gain consumers' attention and fulfill their expectations. The region has a highly developed e-commerce ecosystem with strong support of the government, and various policies are key reasons why the region is proliferating and dominating globally.

Which factors support the growth of the Asia Pacific commerce cloud market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The region is expanding hugely due to leading factors like growing population adopting cloud-based solutions and services, rapid digitalization, increasing internet penetration with smartphone usage, and a well-developed digital payment system in the leading countries like Japan, India, and China. Increasing disposable income and a middle-class population are other drivers for the region's growth. Also, integration of technologies like 5G, IoT, and AI/ML across several platforms is enabling businesses to adopt various strategies to reach maximum consumers.

- In July 2025, a leading provider of enterprise intelligence, Flipkart Commerce, Cloud Achieve Award for their AI initiative. They got this award in the India category at the Retail Asia Award 2025. FCC's Retail Media platform integrates seamlessly within e-commerce ecosystems, distinguishing itself from conventional advertising platforms through the utilisation of first-party data for hyper-personalised targeting.

Is Europe Making Greater Progress in the Commercial Cloud?

The commerce cloud sector is experiencing significant growth in Europe, primarily due to the region's investment in digital transformation and omnichannel retail strategies. Increased e-commerce activity, which is being supported by strong IT infrastructure and high internet penetration, is enabling companies to look to cloud-based commerce solutions. As a result, companies are utilizing more scalable cloud platforms to better enable personalization, data security, and seamless integration with AI-enabled analytics. In addition, supportive data privacy regulations and the increasing prevalence of cross-border online commerce are bolstering the expansion of the European market.

Is Latin America Emerging as a Future Growth Frontier?

Latin America is emerging as an active and developing region in the commerce cloud space due to expanding digital connectivity and the fast-tracking of online retail. Increasingly, small and mid-sized enterprises are utilizing cloud platforms to lower operational costs and support online customer satisfaction. Governments are investing in digital infrastructure and start-up fintech, thus supporting market growth. The accelerating utilization of mobile commerce and a growing acceptance of regional e-payment systems are also increasing commerce cloud adoption across diverse industries.

Value Chain Analysis

- Technology Development and Infrastructure

The segment focuses on developing the core components needed for commerce cloud solutions, including storage, servers, and networking, to ensure the security and scalability of infrastructure.

Key players: AWS, Microsoft Azure, Google Cloud Platform, Alibaba Cloud, Salesforce, SAP, and Adobe.

- Commerce Platform Development

The stage encompasses designing and developing functionalities for the core platform and building features for specific use cases like B2B, D2C, and B2C. It further involves the development of mobile-optimized features.

Key players: Adobe, Salesforce, Shopify, SAP, and BigCommerce.

- Service and Support

This stage involves continuous support, maintenance, and optimization of commerce cloud solutions, ensuring smooth operation of the platform and increasing the value of investments for commerce cloud.

Key players: Salesforce, SAP, Adobe, and others

Commerce Cloud Market Companies

- Salesforce Commerce Cloud

- Adobe Commerce (Magento)

- SAP Commerce Cloud

- Oracle Commerce Cloud/NetSuite Suite Commerce

- Shopify Plus

- BigCommerce

- commerce tools

- Elastic Path

- VTEX

- Mirakl

- Spryker

- Kibo Commerce

- HCL Commerce

- IBM Digital Commerce

- OroCommerce

- Optimizely (Episerver) Commerce

- Intershop

- Shopware

- Shift4Shop

- Sitecore Experience Commerce

Recent Developments

- In November 2024, for the 10th time, SAP is recognized as a global leader in the 2024 Magic Quadrant by Gartner. SAP remains the single vendor that has continuously stayed as a leader since 2014. Businesses across industries are using the solution to boost profitability and achieve sustainable growth(Source: https://news.sap.com)

- In September 2025, leading marketers Google and PayPal launched a multiyear strategic partnership aiming to propel advancement in several commerce solutions. This collaboration will provide innovative solutions that will change how consumers and businesses collectively transact across platforms and devices.

(Source: https://newsroom.paypal-corp.com)

Segments Covered in the Report

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Core Solution Component

- E-Commerce Platform (storefront, catalog, cart, checkout)

- Order Management System (OMS)

- Product Information Management (PIM)

- Customer Data Platform (CDP)

- Payment and Checkout Services

- Pricing and Promotions Engine

- Inventory and Fulfilment Management

- Content Management System (CMS for commerce)

- Personalization and Recommendation Engine

- Analytics and Business Intelligence

- Loyalty and Rewards Management

By Business Model Served

- B2C

- B2B

- D2C

- Marketplaces

By Organization Size

- Small and Medium Businesses (SMBs)

- Large Enterprises

By Industry Vertical

- Retail and E-Commerce

- Fashion and Apparel

- Consumer Electronics

- Food and Grocery/CPG

- Wholesale and Distribution

- Manufacturing

- Healthcare and Pharma

- BFSI

- Telecom and Media

- Travel and Hospitality

- Automotive

- Education

- Government

By Pricing Model

- Subscription/SaaS

- Transaction-based

- Usage-based

- Perpetual License

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting