What is the Commercial Printing Market Size?

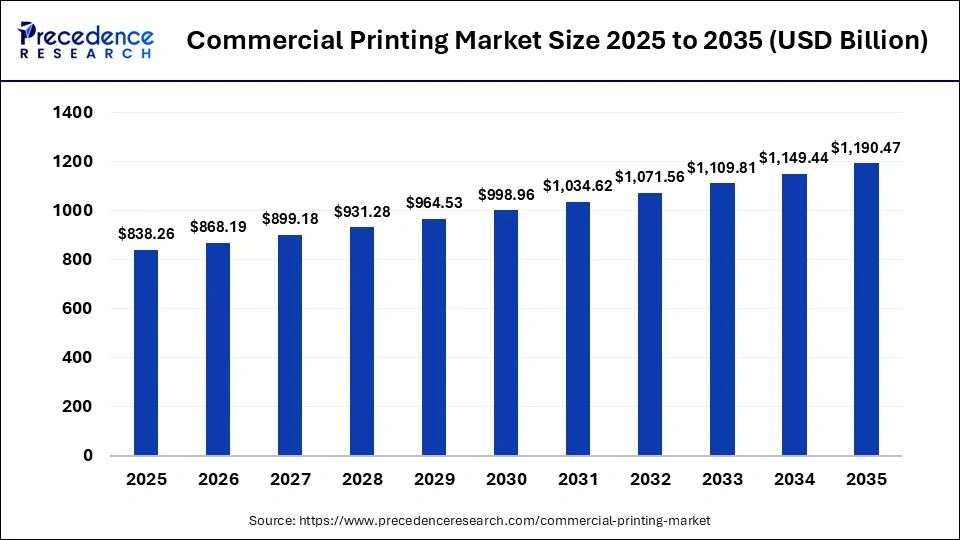

The global commercial printing market size is calculated at USD 838.26 billion in 2025 and is predicted to increase from USD 868.19 billion in 2026 to approximately USD 1190.47 billion by 2035, expanding at a CAGR of 3.57% from 2026 to 2035. The commercial printing market encompasses the large-scale production of printed materials such as brochures, packaging, catalogs, magazines, labels, and marketing collateral, serving a wide range of industries from retail and healthcare to education and manufacturing.

Market Highlights

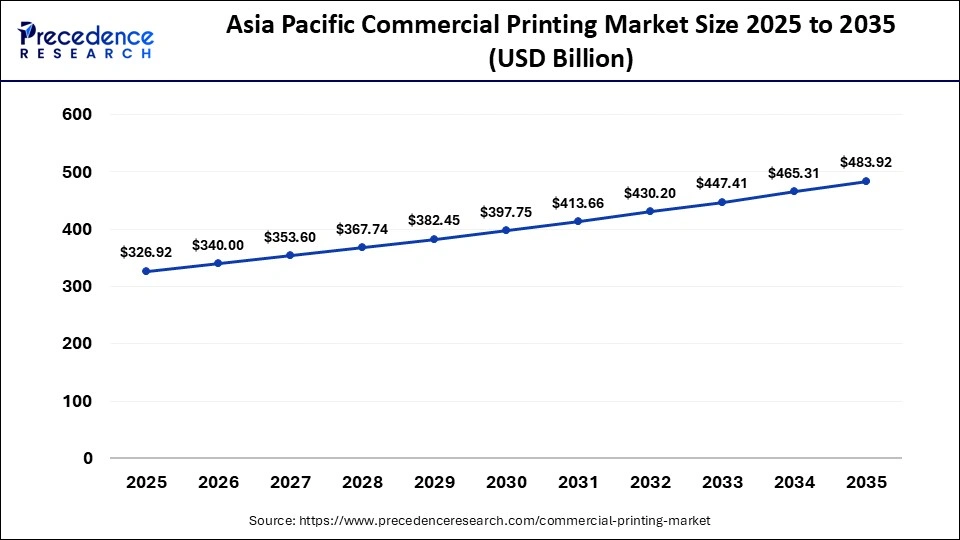

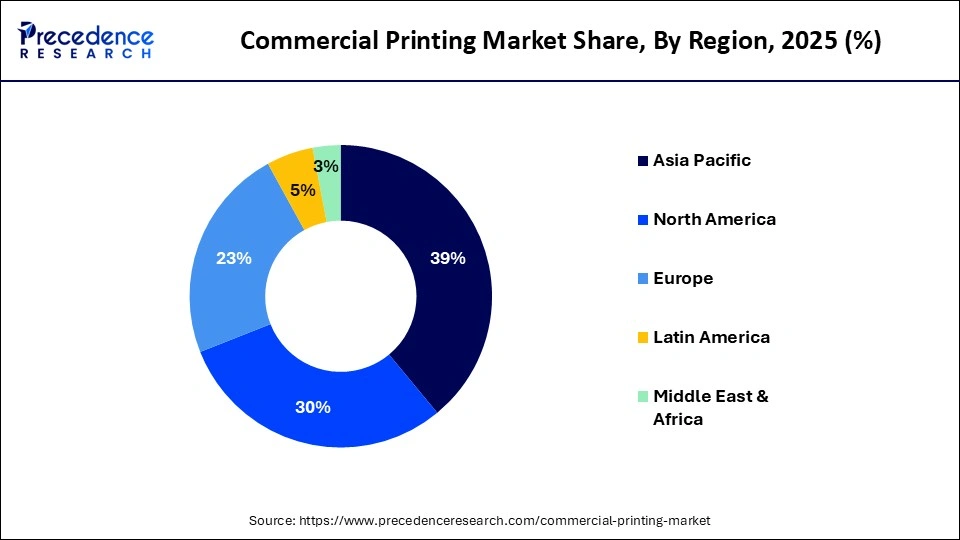

- Asia Pacific dominated the market with an approximately 39% share during 2025 and is expected to grow at a CAGR of 4% from 2026 to 2035.

- North America is set to see notable growth in the coming years in the commercial printing market.

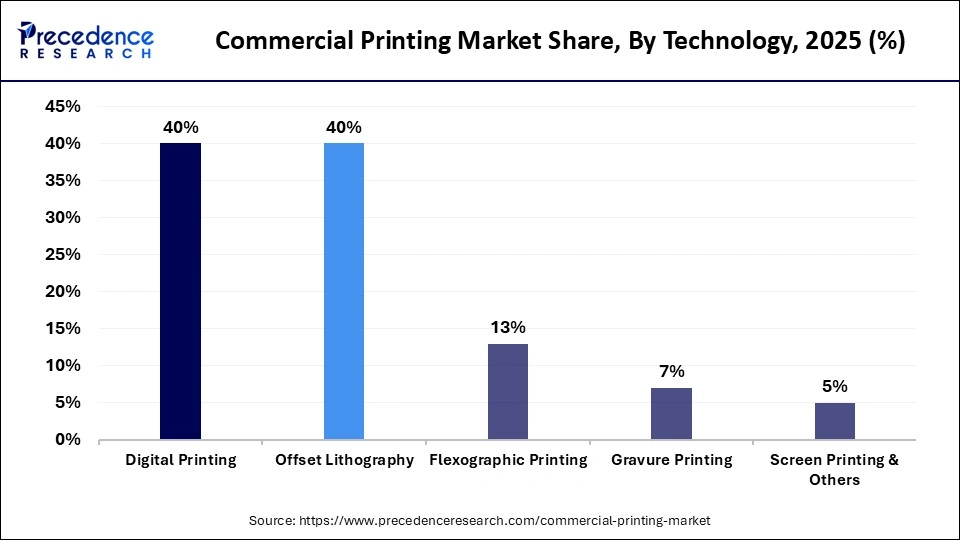

- By technology, the digital printing segment led the market with a 40% share in 2025 and is also set to be the fastest-growing with a 3.5% CAGR in the forecasted period.

- By application, the packaging segment dominated the market with a 51% share in 2025.

- By application, the labels segment is expected to be the fastest growing, with a 3.2% CAGR in the period between 2026 and 2035.

- By ink type, the aqueous segment dominated the market with a 25% share in 2025.

- By ink type, the UV-cured segment is set to be the fastest growing with a 3.4% CAGR during the forecasted period.

- By end-use, the food & beverage segment led the commercial printing market with a 35% share in 2025.

- By end-use, the pharmaceutical segment is set to be the fastest growing in the market with an expected 3.3% CAGR.

What is Commercial Printing?

The commercial printing market involves printing services for business purposes, producing materials like packaging, advertising, publishing, and labels using technologies such as digital, offset lithography, flexographic, gravure, and screen printing. It serves diverse industries, including retail, healthcare, and automotive, driven by demand for high-quality print solutions and e-commerce packaging. Technological advances in digital and on-demand printing, customization, and sustainable practices enable growth.

Rising demand for short-run and variable data printing is enabling brands to execute targeted marketing and personalized packaging at scale. Growth in e-commerce and direct-to-consumer models is increasing demand for corrugated packaging, labels, and inserts with faster turnaround times. Sustainability pressures are driving adoption of water-based inks, recyclable substrates, and energy-efficient printing equipment. In parallel, workflow automation and print management software are improving operational efficiency and cost control across commercial printing operations.

Key Technological Shifts in the Commercial Printing Market

Digital printing is a basic technology that allows short print runs, quick turnaround response, and high customization rates, and it is therefore suitable in targeted and on-demand printing. The use of offset lithography still prevails in high-volume printing because it offers better color consistency, low cost on a large scale, and it supports a variety of substrates. Flexographic printing is widely applied to packaging and labeling purposes since it is fast and long-lasting when applied to flexible material. Inkjet technology has also improved considerably, with great resolution of output, variable data printing, and better ink formulas that can be used in textile, packaging, and industrial usage. Electrophotography is still significant in the case of office and transactional printing because it is still the most precise and reliable in shorter runs.

What Are the Key Commercial Printing Market Trends?

- Sustainability Is Becoming a Core Priority: The concept of sustainability has become a priority area, and the use of environmentally friendly inks, recyclable papers, and printing devices that consume less energy has been adopted. Printers are also responding to regulatory and brand-led sustainability targets by reducing waste, lowering carbon footprints, and improving material efficiency across print operations.

- Rising Demand for Customization and Variable Data Printing: The market is also increasing in demand for customized and variable data printing, especially when used for marketing and promotional purposes, where brands are demanding a more personalized consumer experience. Advances in digital printing technologies are enabling cost-effective short runs, faster turnaround times, and data-driven personalization at scale.

- Convergence of Print and Digital Media: The print and digital media convergence is changing the market, and QR codes, augmented reality, and smart packaging are increasing the level of interactivity. These features allow brands to connect physical print materials with digital content, enhancing customer engagement, traceability, and marketing analytics.

- Growth of Outsourcing and Print-on-Demand Models: Print services are also being outsourced, and print-on-demand business models are picking up, minimizing inventory cost to end users. This shift is improving supply chain flexibility, reducing storage requirements, and enabling faster response to changing market and customer demands.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 838.26Billion |

| Market Size in 2026 | USD 868.19 Billion |

| Market Size by 2035 | USD 1190.47Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.57% |

| Dominating Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, Ink Type, End-Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Insights

Why Digital Printing Market in the Commercial Printing Market?

Digital printing is dominating and the fastest growing in the commercial printing market, holding a share of 40%, as it allows for short print runs and high turnover rates. Variable data printing, among other applications, offers the technology high rates of personalization and is therefore appealing in marketing and transactional applications. Low- and medium-volume jobs are cost-efficient because of less time required to set up and lower levels of waste. The inkjet and electrophotographic systems have undergone continuous development that has improved the quality of print and compatibility of substrate.

Application Insights

Why Is Packaging Dominating in the Commercial Printing Market?

The packaging is dominating the commercial printing market, holding the share of 51%, thanks e-commerce and the branding of retailers. Visual appeal, display of information, and brand identity are the benefits of using printed packaging in terms of product differentiation. There is a high demand for flexible packaging, cartons, and corrugated boxes that need excellent graphics. The printing technology facilitates shorter print runs and quick design transitions, which is in favor of brand agility. The use of recyclable materials and environmentally friendly inks in packaging printing is being affected by sustainability. Since the packaging demand is still on the increase, commercial printers still depend on this as a major growth driver.

The label is the fastest-growing in the commercial printing market, holding a share of 3.2%, driven by being durable and being able to work with various substrates and adhesives. Increased demand in food, beverage, and pharmaceutical products is enhancing demand for quality and compliant labels. Digital label printing aids in customization, versioning, and brief production cycles. Smart labels and labels with QR codes and tracking capabilities are becoming popular. Label printing is a high-value market as product differentiation and compliance requirements continue to rise.

Ink Type Insights

Why Are Aqueous Inks Dominating the Commercial Printing Market?

The aqueous ink is dominating the commercial printing market by holding a share of 25%, because it has less environmental impact and is compatible with paper-based substrates. They are mainly aqueous, and, therefore, the emission of volatile organic compounds is reduced. These inks provide reasonable color vividness, and they are usually applied in digital inkjet printing jobs. Its drying time may be higher than with other types of ink, affecting the rate of production. Aqueous inks are also used where safety and sustainability are the key factors. Their performance and life cycle is improving due to constant formulation upgrades.

The UV-cured is the fastest growing in the commercial printing market, holding a share of 3.4%, driven by its capability of printing on non-porous surfaces. The inks dry immediately when they are exposed to ultraviolet light, thus allowing high-speed production and immediate finishing. They offer high durability, scratch resistance, and color consistency. UV-cured ink is used to accommodate printing on plastics and films as well as on specialty materials applied in packaging and labels. Their growing adoption can be attributed to energy efficiency and less wastage. Due to the growing demand in high-performance printing, UV-cured inks are gaining more ground in the market.

End-Use Insights

Why Is Food & Beverage Dominating the Commercial Printing Market?

The food and beverage industry is dominating the commercial printing market by holding a share of 35%, as it requires printing mainly in packaging and labeling. Printed materials are vital in brand communication, nutritional information, and compliance with regulations. There is a high demand for long-lasting and quality prints that will be able to withstand handling and storage conditions. The ink and material options within this industry are being affected by sustainability issues. Seasonal and promotional items are now being customized and short-run printed. Since the consumption of food and beverages is increasing, this segment is a stable one as a demand factor.

The pharmaceutical industry is the fastest growing in the commercial printing market, holding a share of 3.3%, thanks to its accuracy, readability, and strict adherence to the high requirements expected in this segment. Good printing will guarantee the availability of the right dosage, safety reminders, and traceability. The increase in medical coverage and drug production contributes to the stable demand for print media. The value of anti-counterfeiting properties and safe printing technology is also gaining more significance. Pharmaceuticals are therefore a high-value, compliance-based end-user category in the market.

Regional Insights

What is the Asia Pacific Commercial Printing Market Size?

The Asia Pacific commercial printing market size is expected to be worth USD 483.92 billion by 2035, increasing from USD 326.92 billion by 2025, growing at a CAGR of 4.00% from 2026 to 2035.

Why Is Asia Pacific Dominating and Fastest Growing in the Commercial Printing Market?

Asia Pacific is the dominant and fastest-growing commercial printing market, holding a share of approximately 39%, driven by a huge number of consumers, a high rate of urbanization, and powerful packaging, publishing, and advertising industries. The growth of e-commerce and organized retail is driving the demand for labels, corrugated materials, and promotional print materials. The area has a bilateral system with the high level of digital printing use in developed economies, as well as the high level of conventional printing used in developing markets.

China Commercial Printing Market

China dominates the regional commercial printing market due to its extensive manufacturing base, large-scale packaging demand, and strong presence of export-oriented industries that require high-volume and cost-efficient print solutions. The country's well-developed printing infrastructure supports widespread adoption of offset, flexographic, and gravure printing for packaging, labels, and industrial applications. Rapid growth of e-commerce and consumer goods manufacturing is further increasing demand for corrugated packaging, inserts, and branded print materials. In parallel, continued investment in digital printing technologies is enabling faster turnaround times and short-run customization for domestic brands. Strong integration between printing services, packaging converters, and logistics networks reinforces China's leading position in the regional commercial printing landscape.

Commercial PrintingMarket Value Chain Analysis

- Raw Material Sourcing: Raw material sourcing primarily includes paper, paperboard, inks, toners, plates, chemicals, and substrates such as plastics, textiles, and specialty films. Printers increasingly prioritize suppliers that offer consistent quality, sustainable certifications, and stable pricing.

Key players: Quad, Cimpress, RR Donnelley,

- Material Processing and Conversion: Material processing and conversion involve prepress activities, printing, coating, binding, and finishing operations that transform raw materials into finished printed products. Advances in digital printing and automated finishing systems have significantly improved speed, precision, and flexibility.

Key players: Dai Nippon Printing (DNP), and Toppan

- Logistics and Distribution: Logistics and distribution encompass storage, inventory management, packaging, and transportation of printed materials to end users or distribution hubs. Just-in-time production and print-on-demand models are reducing warehousing requirements and associated costs.

Key players: RR Donnelley

- Recycling and Waste Management: Recycling and waste management form the final stage of the value chain, addressing paper waste, ink residues, chemicals, and packaging materials. Commercial printers are increasingly adopting waste reduction strategies, including material optimization and the reuse of by-products.

Key players: Quad

Who are the Major Players in the Global Commercial Printing Market?

The major players in the commercial printing market include R.R. Donnelley & Sons Company, Quad/Graphics, Inc, Cimpress plc (including Vistaprint), Canon Inc., HP Inc., Xerox Corporation, Ricoh Company Ltd., Toppan Holdings Inc., Dai Nippon Printing Co., Ltd., WestRock Company, Transcontinental Inc, ACME Printing Inc, Taylor Corporation, Multi-Color Corporation, Printful (on-demand)

Recent Developments

- In January 2025, this Brother laser printer is well suited to fast-paced offices that prioritize efficiency and consistent performance. Its quick printing speeds, automatic double-sided output, and sharp text quality support everyday document needs with ease. Installation is simple, and the physical control panel is functional and user-friendly. It is an ideal choice for teams with high monochrome printing requirements. While overall durability is solid, sporadic hardware issues suggest that buyers should consider basic contingency planning

Segment Covered

By Technology

- Digital Printing

- Offset Lithography

- Flexographic Printing

- Gravure Printing

By Application

- packaging

- Advertising

- Publishing

- Labeling

By Ink Type

- UV-cured

- Aqueous

- Solvent-based

- Others

By End-Use

- Food & Beverage

- Retail

- Pharmaceutical

- Automotive

- Electronics

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting