What is the Contraceptive Drugs Market Size?

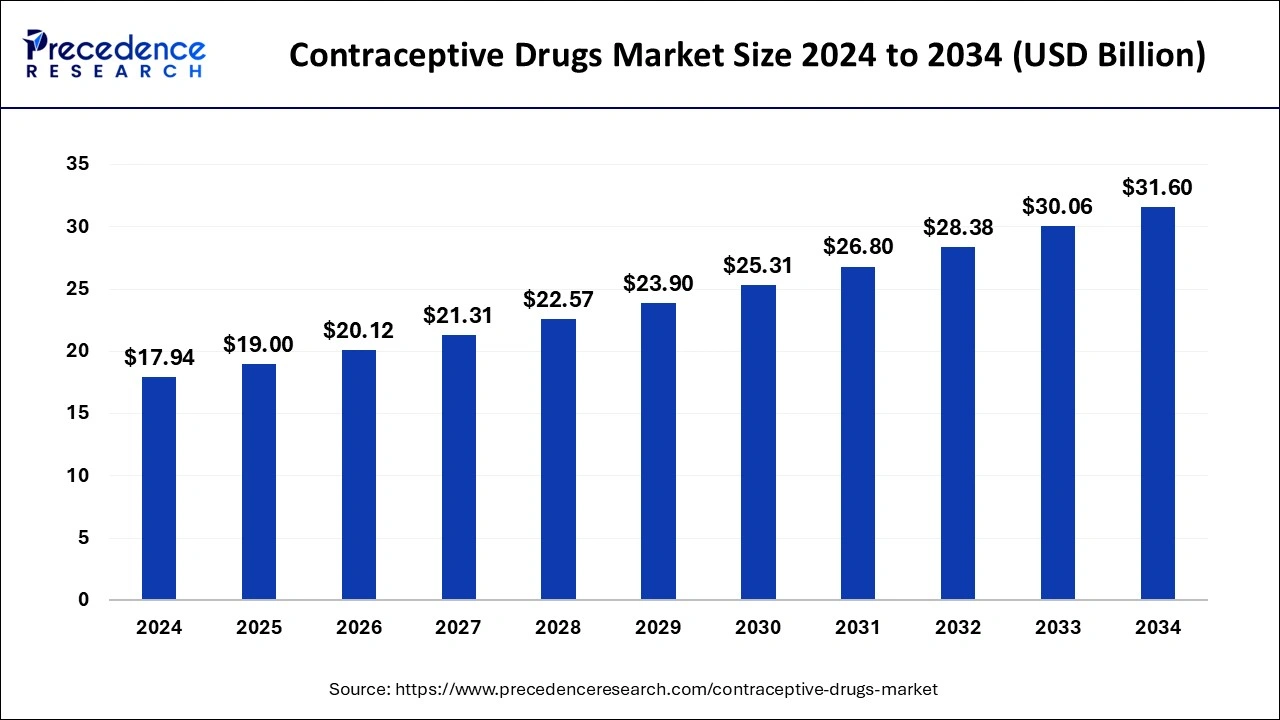

The global contraceptive drugs market size is valued at USD 19.00 billion in 2025 and it is expected to hit around USD 31.60 billion by 2034, poised to grow at a CAGR of 5.82% from 2025 to 2034.The rising number of unwanted pregnancy cases and sexually transmitted diseases fuel the development of the contraceptive drugs market.

Market Highlights

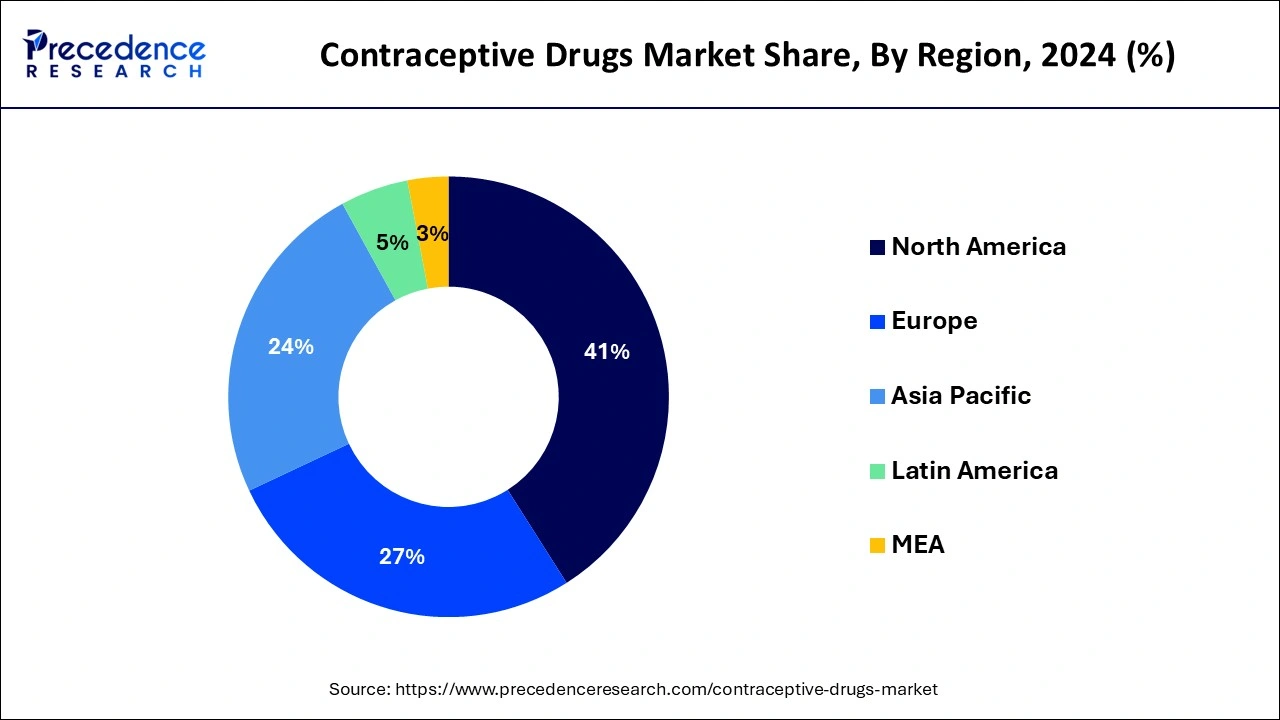

- North America led the global market with the highest market share of 40.14% in 2024.

- Asia Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By Product, the oral contraceptive drugs segment has held the largest market share in 2024.

- By Product, the vaginal ring segment is expected to expand at the fastest CAGR over the projected period.

- By Distribution Channel, the retail pharmacy segment captured the biggest revenue share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 19.00 Billion

- Market Size in 2026: USD 20.12 Billion

- Forecasted Market Size by 2034: USD 31.60 Billion

- CAGR (2025-2034): 5.82%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Artificial Intelligence: The Next Growth Catalyst in Contraceptive Drugs

The role of AI in medicine development is significant, as it is crucial in revolutionising the pharmaceutical industry. AI can monitor drug preparation and predict effectiveness, which increases the market's demand. The process of discovering drugs and developing new medicines is complex and consumes a lot of time and labour when following traditional methods. With the incorporation of artificial intelligence techniques such as natural language processing and machine learning this process becomes easy and complete within less time. Deep learning technology helps to predict the efficiency of medicines which ultimately increases the market demand and boosts the market development.

Contraceptive Drugs Market Growth Factors

- The rising number of unwanted births is a primary factor driving demand for contraceptive drugs, resulting in global contraceptive drugs market expansion. As a result of these figures, the global demand for contraceptive tablets is increasing, leading to the growth of the global contraceptive drugs market.

- The main driver enhancing the global contraceptive drugs market's growth is the increased focus of leading industry players and healthcare organizations on promoting awareness through public programs to expand access to contraceptive drug options.

- During the projection period, the growth of the global contraceptive drugs market is likely to be driven by the approval, development, and commercialization of novel and long-lasting techniques.

- The global contraceptive drugs market's rivalry is expected to heat up as several major competitors focus on expanding their product portfolios through collaborations and acquisitions. The contraceptive drugs market is likely to provide new market players as well as established market leaders with several chances.

- Furthermore, joint ventures, mergers, and partnerships aid in boosting the presence of companies in the global contraceptive drugs market, thus assisting in improving the contraceptive drugs market's growth rate.

Market Outlook

- Market Growth Overview: The Contraceptive Drugs market is expected to grow significantly between 2025 and 2034, driven by the rising awareness in the public, supportive government policies and funding for reproductive health, innovation in research and developments in drugs, and digital health integration.

- Sustainability Trends: Sustainability trends involve the adoption of greener manufacturing processes and eco-friendly packaging materials to reduce waste and carbon footprint. Product innovation also plays a role, with increased R&D into non-hormonal and plant-based alternatives that address both health concerns and environmental impact.

- Major Investors: Major investors in the market include Bayer AG, Pfizer Inc., Organon Group of Companies, and The Cooper Companies (via CooperSurgical).

- Startup Economy:The startup economy in the market is focused on non-hormonal and novel drug development, digital health and telehealth integration, and innovative delivery systems.

Contraceptive Drugs Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.00Billion |

| Market Size in 2026 | USD 20.12Billion |

| Market Size by 2034 | USD31.60 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, Age Group, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising awareness about contraceptives

The growing awareness around contraception and women's reproductive health as a result of widespread sex education and government family planning programs has led to substantial growth in the contraceptive drugs market. With the growing global population, more individuals are becoming aware of the need for contraceptives. Contraceptive drugs offer an effective way to undertake family planning and manage fertility. The increasing focus on women-centric health is also leading to higher demand for contraceptive drugs.

Restriction

Regulatory restrictions and social stigma around contraception

Despite significant growth in the demand for contraception, there are several regulatory hurdles players in the space need to cross to get these drugs out in the market. Contraception deals with the production and suppression of sensitive hormones, which can have a crucial effect on an individual's health. Thus, several strict mandates around the use and prescription of these drugs hinder market growth.

Opportunity

Expansion into emerging markets

As global awareness of contraceptives continues to grow, markets in underserved regions such as Asia Pacific, Africa, and the Middle East are seeing ramped-up demand for contraceptive drugs. The substantial expected demand for over-the-counter (OTC) contraceptives, now widely available due to the advent of biomedical research, is also expected to significantly boost demand in emerging economies for contraceptive drugs. As consumers seek more convenience and autonomy in managing their reproductive health, further growth is expected in the contraceptive drug market.

Segments Insights

Product Insights

The oral contraceptive drugs segment has the largest revenue share in 2024. The oral contraceptive drugs demand and acceptance are gradually increasing, particularly in developing markets. This is owing to the clinical advantages of oral contraceptive drugs over other traditional techniques, as well as the reduced cost of these medications compared to other modern contraceptive drugs options. The number of women of reproductive age who use birth control tablets has climbed from roughly 97 million in 1994 to 151 million in 2019.

The vaginal ring segment is expected to reach remarkable growth from 2024 to 2033. The factors such as long product life cycle as well as cost effectiveness are driving the growth of the segment. The introduction of new products and the ease of use of vaginal rings are projected to boost demand for these birth control techniques. Annovera, a reusable silicone ring that protects against unplanned pregnancy for up to a year, received Food and Drug Administration approval and five-year market monopoly as a novel chemical entity in September 2018 and will be commercially introduced in the 1st quarter of 2020.

Distribution Channel Insights

The retail pharmacy segment accounted largest revenue share in 2024. This is attributed to rising demand for contraceptive pills among the general public as well as increased awareness of various contraceptive drugs options. Birth control tablets are sold over the counter in various nations. As a result, customers are increasingly turning to retail pharmacies to obtain birth control tablets. Furthermore, favorable regulations have contributed to the expansion of the segment.

The online distribution channel segment is projected to grow at fastest rate during the forecast period. The increased usage of over-the-counter solutions, coupled with numerous online discounts and offers to entice clients, is ascribed to the larger growth of online channels.

Age Group Insights

By age, the 25–34-years segment led the global market. Women from this age group are choosing to manage their reproductive health earlier in life due to a shift in lifestyle leading to a rise in premarital physical relations. The growing awareness around healthcare and the need for menstrual regulation is also leading to higher demand from this age group for contraception.

By age, the 15–24 years segment is the fastest growing. The widespread use of contraceptive drugs among women and teenagers in developed economies is the reason there is significant demand in the market from this age range. Early maturity among women and teenagers of this age group is increasing the demand for contraceptives.

Regional Insights

U.S. Contraceptive Drugs Market Size and Growth 2025 to 2034

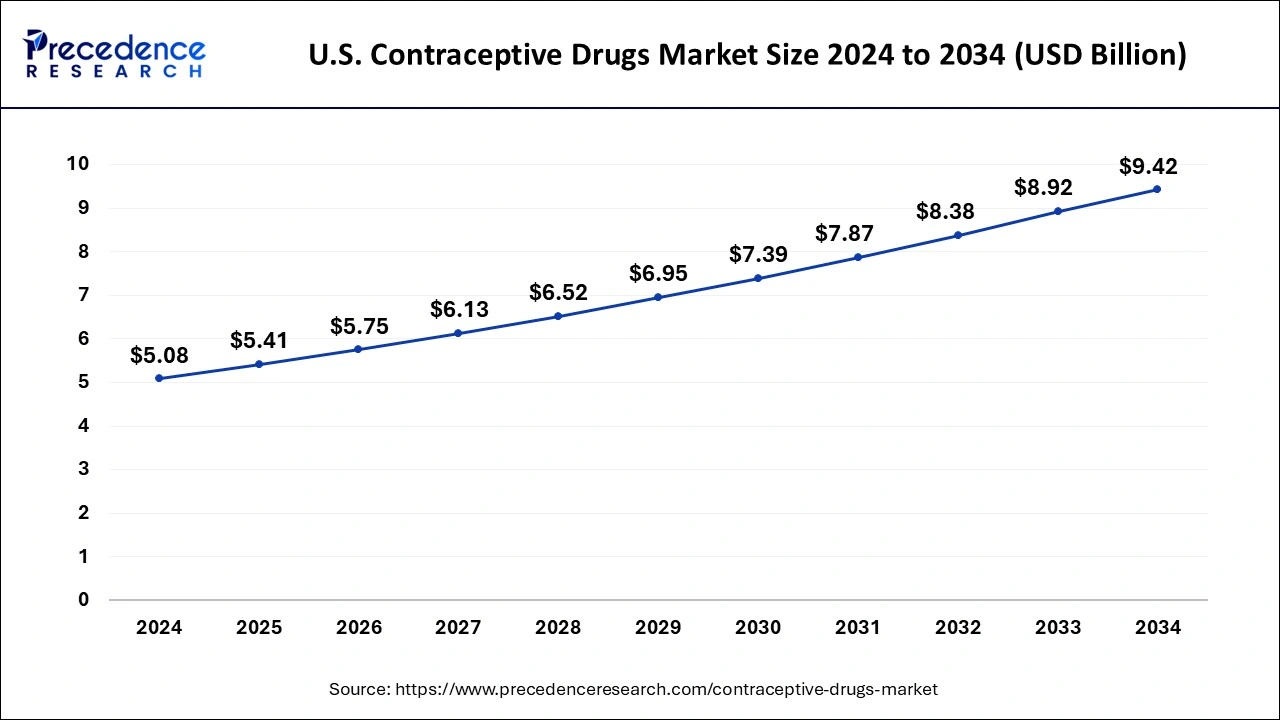

The U.S. contraceptive drugs market size is estimated at USD 5.41 billion in 2025 and is predicted to be worth around USD 9.42 billion by 2034, at a CAGR of 6.37% from 2025 to 2034.

U.S. Contraceptive Drugs Market Trends

The U.S. landmark approval and distribution of the first non-prescription daily oral contraceptive, Opill, is set to dramatically expand access. Driven by increasing concerns over side effects from hormonal options, demand for non-hormonal solutions and the expansion of telehealth services are also shaping the market. Publicly funded programs, insurance mandates, and ongoing R&D into male contraceptives further contribute to the market's dynamic landscape

North America dominated the contraceptive drugs market in 2024. The growth of contraceptive drugs market in North America region is being driven by growing awareness about contraceptive pills among patients. According to Centers for Disease Control estimates, 14% of women aged 15 to 49 will be using contraceptive drugs in 2020. In addition, different strategies adopted by market players are also driving the growth of North America contraceptive drugs market. According to data published by the Bill & Melinda Gates Foundation in 2022, the foundation plans to invest $280 million per year from 2025 to 2034 in developing innovative and latest contraceptive technologies, supporting family planning programs that reflect local community preferences.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The Asia-Pacific contraceptive drugs market growth is attributed to the growing reimbursement policies. In addition, the rising childbearing population is also driving the growth of contraceptive drugs market in Asia-Pacific region. As per the report released by the United Nations Department of Economic and Social Affairs, the population was over 163 million in 2019. More than 56% of women in this category utilize contraception. As a result, the expansion of contraceptive drugs market in this region is expected in near future.

China Contraceptive Drugs Trends

China's evolving government population policies and a cultural preference for long-acting devices like IUDs. The rising awareness of reproductive health and increasing female workforce participation drives demand for effective family planning options. Online distribution channels are gaining traction for convenience and discretion.

How is Europe Rising in the Contraceptive Drugs Market?

Europe's high consumer awareness of reproductive health, proactive government initiatives promoting family planning, and a strong preference for highly effective, convenient options like Long-Acting Reversible Contraceptives (LARCs). The market benefits from continuous innovation in lower-dose and non-hormonal solutions, alongside the integration of telehealth services for improved accessibility and discretion.

United Kingdom Contraceptive Drugs Trends

The U.K. regions' rising accessibility via pharmacies, while oral pills are widely used, particularly among young women, contraceptive devices, increasing digital health platforms, and government initiatives and awareness campaigns. Increasing demand for low-dose and non-hormonal options.

Contraceptive Drugs Market Value Chain Analysis

- Research and Development (R&D)

This foundational stage involves pharmaceutical companies investing heavily in discovering new hormonal and non-hormonal compounds, as well as optimizing drug delivery methods (pills, patches, injectables).

Key Players: Bayer AG, Pfizer Inc., Merck & Co., Inc., and Johnson & Johnson.

- Manufacturing and Production

This stage focuses on the large-scale production of the active pharmaceutical ingredients (APIs), formulation into final dosage forms, and packaging.

Key Players: Teva Pharmaceutical Industries Ltd.

- Distribution and Logistics

This stage involves storing and transporting products through complex national and international supply chains to wholesalers, hospitals, clinics, and pharmacies. Efficient logistics are crucial to ensure product availability and integrity, especially for products that may require specific temperature control or secure handling.

Key Players: McKesson Corporation, AmerisourceBergen Corporation, and Cardinal Health.

Key Players in Contraceptive Drugs Market & Their Offerings

- Church & Dwight Co., Inc.: This company contributes significantly through its ownership of the Trojan brand, a market leader in condoms and related products, which are a non-drug form of contraception. They also offer a range of emergency contraceptives and vaginal health products, catering to various aspects of reproductive health and protection.

- Reckitt Benckiser Group Plc: A major global consumer goods company that contributes to the market through its Durex brand, one of the most recognized and widely available condom brands worldwide. They focus on expanding access to effective barrier methods of contraception and promoting sexual health education globally.

- Veru, Inc.: Veru is a biopharmaceutical company focused on developing novel, non-hormonal drugs for men's and women's health. Their primary contribution is in R&D for a potential male "contraceptive on demand" pill, aiming to diversify options in the market and shift toward shared responsibility for family planning.

- Organon Group of Companies: Spun off from Merck & Co., Organon is a dedicated women's health company with a broad portfolio of contraceptive products, including the NuvaRing vaginal ring and other oral contraceptives. They are focused on addressing unmet needs in women's health globally and increasing access to a variety of family planning options.

- Pfizer, Inc: Pfizer contributes to the contraceptive market through a range of products, including injectables and oral pills, that are part of its broader pharmaceutical portfolio. Their significant R&D capabilities allow for ongoing innovation in drug formulations and their vast distribution network ensures wide access to their products.

- Teva Pharmaceutical Industries Ltd.: Teva is a leader in generic pharmaceuticals, providing cost-effective generic versions of various oral contraceptives and other hormonal medications. They play a critical role in increasing the affordability and accessibility of contraceptive drugs, which is crucial for public health and family planning initiatives.

- The Cooper Companies, Inc: This company is a major player in the contraceptive devices segment through its subsidiary CooperSurgical, which produces a wide range of intrauterine devices (IUDs) and other LARC (long-acting reversible contraceptives) options. Their contribution focuses on providing highly effective, long-term, non-daily contraceptive solutions.

- Mayer Laboratories, Inc: This company specializes in a range of personal care and sexual health products, including non-latex condoms and lubricants. Their contribution is primarily in providing alternative, non-drug barrier contraceptive methods, catering to individuals with specific sensitivities or preferences.

- Agile Therapeutics: Agile is a women's health pharmaceutical company focused on developing and commercializing a new generation of low-dose, non-daily contraceptive options. Their key product is Twirla, a weekly contraceptive patch that offers a new method of hormone delivery and user convenience.

- TherapeuticsMD, Inc: This company focused on women's health, including a range of hormone therapy and contraceptive products like a vaginal ring and a daily oral contraceptive. They contribute by offering innovative, patient-centric solutions to meet diverse female health needs and preferences.

- Bayer AG: Bayer is a dominant player in the global contraceptive market, known for blockbuster products like the Mirena (hormonal IUD) and Yasmin (oral contraceptive) brands. They invest heavily in R&D and global marketing, offering a wide array of options and driving innovation in IUD technology.

- Afaxys, Inc: Afaxys focuses on providing affordable pharmaceuticals and contraceptives, including oral pills, injectables, and IUDs, to public health clinics and community health centers. Their unique business model supports the public sector by streamlining procurement and ensuring cost-effective access for underserved populations.

- Mithra Pharmaceuticals: A Belgian biotech company focused on women's health, Mithra has developed innovative products like Estelle (a next-generation oral contraceptive) and a hormonal ring. They contribute to the market through R&D in novel, potentially safer estrogen components and new delivery methods for hormonal contraception.

- AbbVie: AbbVie's contribution to the women's health market includes products that address conditions often managed with contraceptives, but its direct role in the contraceptive drugs market is more limited following divestments. Their primary focus has been on other therapeutic areas like immunology and oncology.

Recent Development

- In February 2024, Bayer announced the launch of a hormone-free monthly contraceptive. The company collaborated with Daré Bioscience to expand its current offering of contraceptive methods by developing this monthly device. The contraption is inserted into the woman, providing contraception for more than three weeks, without any further action required by the user during intercourse.

- In March 2024, Perrigo announced the launch of the nonprescription birth control pill Opill. The United States Food and Drug Administration approved Opill for over-the-counter use for people of all ages back in July 2023. It will be the first contraceptive pill available without a prescription.

Segments Covered in the Report

By Product

- Oral

- Pills

- Intrauterine Devices (IUD)

- Hormonal IUD

- Nonhormonal IUD

- Condoms

- Male Condoms

- Female Condoms

- Vaginal Ring

- Subdermal Implants

- Injectable

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Clinics

- Online Channel

- Public Channel & NGOs

- Others

By Age Group

- 15–24 years

- 25–34 years

- 35–44 years

- Above 44 years

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting