What is Cord Blood Banking Market Size?

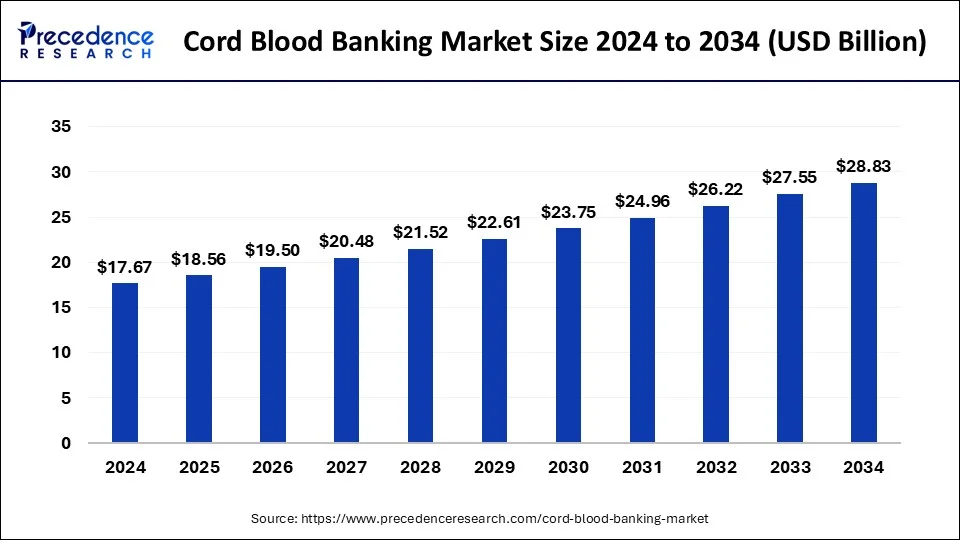

The global cord blood banking market size is calculated at USD 18.56 billion in 2025 and is predicted to increase from USD 19.50 billion in 2026 to approximately USD 30.14 billion by 2035, expanding at a CAGR of 4.97% from 2026 to 2035.

Market Highlights

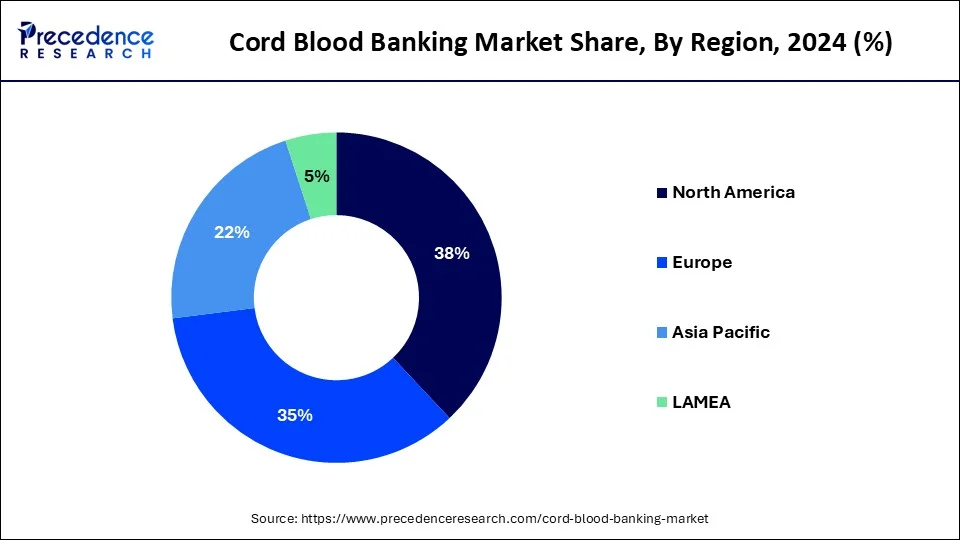

- North America dominated the global market with the largest market share of 38% in 2025.

- By type of bank, the cord blood banking market's private bank segment is expected to grow significantly during the forecast period.

- By services, the processing segment contributed the highest market share in 2025.

- By application. The cancer segment significantly contributes to the market and is anticipated to grow at a notable CAGR during the forecast period.

- By end-use, the hospital segment captured the biggest market share in 2025.

Market Overview

The cord blood banking market revolves around offerings that involve extracting stem cells and immune system cells from the umbilical cord and preserving them through cryogenic storage for potential medical applications. Despite its small volume, cord blood is a rich source of stem cells, presenting a promising treatment option for over 80 hereditary diseases such as cancer, blood disorders, diabetes, and immunological conditions. Collected from hospitals and nursing homes, these cells are stored in cord blood banks, ensuring their viability for an average of 20-25 years to meet future medical needs. The interest and investment from healthcare businesses in cord blood stem cell therapies have increased due to government support for research and clinical trials, leading to the establishment of both private and public cord blood banks.

Recent Trends in Cord Blood Banking Market

- Growing Demand for Stem Cell Therapies: Increased use of stem cells for treating chronic and genetic diseases is driving growth in cord blood banking services.

- Rising Awareness Programs: Government and healthcare organizations are spreading awareness about the benefits of cord blood preservation for future medical use.

- Expansion of Public Cord Blood Banks: Public banks are expanding globally to increase donor diversity and support broader access to stem cell transplants.

- Private Banking Growth: Parents are increasingly choosing private banks for personalized stem cell preservation, boosting market revenues.

- Technological Advancements in Storage: Innovations in cryopreservation and stem cell processing techniques are improving the long-term viability of stored cord blood.

- Increased Clinical Trials: Ongoing research and trials exploring new disease treatments using cord blood-derived cells are strengthening market potential.

Growth Factors

- The global cord blood banking market is anticipated to grow, driven by the rising prevalence of chronic illnesses, advancements in therapeutic applications, increasing awareness, and the evolving field of regenerative medicine.

- Various government organizations and programs bolster the growth of the Umbilical Cord Blood (UCB) banking sector.

- Growing awareness about stem cell treatment and the rising utilization of cord blood cells for treating various diseases are vital factors encouraging expectant parents to opt for cord blood banking, propelling the growth of the cord blood banking market.

- The umbilical cord blood banking market experiences growth due to advancements in storage technology and notable progress in cord blood processing.

- Leading companies like Covis Group S.a.r.l and Americold Registry LLC have implemented product acquisitions to enhance their product portfolios, ensuring competitiveness in the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 18.56Billion |

| Market Size in 2026 | USD 19.50 Billion |

| Market Size in 2035 | USD 30.14Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.97% |

| Base Year | 2026 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type of Bank, Services, Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing awareness of stem cell therapeutics

Global awareness of the therapeutic potential of stem cells is on the rise, supported by a growing body of clinical evidence. Stem cells have proven effective in treating over 80 diseases and conditions, including cancer, immunodeficiency diseases, metabolic disorders, and degenerative neuromuscular disorders. Over the forecast period, an increase in public awareness and adoption of stem cell therapies and banking services is expected, driven by rising per capita disposable income in developing countries and anticipated cost reductions associated with these treatments.

Cord blood banking market has expanded rapidly in developed nations like the U.S. and Europe, driven by increased awareness among expectant parents. However, customers need help with high prices and complex banking procedures. Various public and private organizations are launching awareness campaigns in Brazil, China, and India to address this.

- In February 2022, an article published by Weill Cornell Medicine reported a potentially cured HIV infection in a patient. The individual, who underwent a blood stem cell transplant for high-risk acute myeloid leukemia, has remained free of the virus for 14 months after discontinuing HIV antiretroviral drug treatment. The physician-scientists at Weill Cornell Medicine, who conducted the transplant and oversaw the patient's care, suggest the possibility of a cure.

Restraint

Stringent rules & regulations and high cost

Cord blood banking is known for painless procedures for both mothers and children, the expenses factor associated with the procedures acts as a major restraint for the cord blood banking market. Strict regulations associated with cord blood banking services also create a significant hampering factor for businesses to expand. Moreover, the approval process for establishing stem cell banks is critical. Thereby, the factor is observed to limit the growth of the cord blood baking market.

Opportunities

Rise in government funding

Cord blood banking services are primarily utilized for treating hereditary diseases, particularly various cancers. The market is expected to expand due to the increasing incidence of cancers like lymphoma, leukemia, immune disorders, and sarcoma in countries such as the United States, China, India, and Europe. The World Health Organization reports many new cases and deaths related to non-Hodgkin lymphoma. The rising demand for cord blood banking services is directly linked to the growing number of cancer patients. Additionally, increased government funding, such as the thirty-eight million dollars invested by the National Institutes of Health in cord blood cell research, is a crucial factor driving growth of the cord blood banking market during the anticipated period.

- For instance, in July 2022, updates from the National Heart, Lung, and Blood Institute highlighted that sickle cell disease is a group of genetic abnormalities affecting red blood cells. These abnormalities lead to the impairment of hemoglobin, the protein crucial for oxygen transport in the body. The condition annually affects over 100,000 individuals in the United States and impacts approximately 20 million people (about the population of New York) worldwide.

Rising emphasis on treating hematological disorders

The growth of the cord blood banking market in the forecast period is driven by factors such as government funding, increased investments in public storage, a rise in fatal chronic disease incidences, ongoing research for diverse cord blood applications, and growing public awareness of advanced therapeutics. Hematological disorders related to blood and blood-producing organs, including Sickle cell anemia, thalassemia, leukemia, lymphoma, hemophilia, and others. Are on the rise globally. The increasing incidence of leukemia contributes to the demand for cord blood cells.

- For instance, in March 2022, Fred Hutchinson Cancer Research Center's Cell Processing Facility technicians prepared blood stem cells for transplant in advanced leukemia patients. Researchers at Fred Hutch initiated clinical trials across various cancer institutions in the United States, enrolling individuals living with HIV and facing advanced leukemia.

Segment Insights

Bank Type Insights

The private bank segment in the cord blood banking market is expected to grow at a significant rate during the forecast period. Agents are charged a substantial fee for collecting and storing cord blood (CB) units, contributing to the dominance of the private banking service segment in the global market. Private players attract more customers through effective marketing strategies. Factors expected to boost public banks' growth include increased chances of finding a compatible match for patients' blood and the potential risk of stored blood units in private banks being unusable.

Service Type Insights

The processing segment dominated the cord blood banking market in 2024. Cord blood processing involves separating and extracting stem cells from red blood cells. This process utilizes automated systems and technicians employing sedimentation and centrifugation methods. The dominance of the processing segment is attributed to the growing clinical trials and research on cord blood, coupled with an increase in the prevalence of hematological disorders, contributing to industry revenue growth.

Application Insights

The cancer segment significantly contributed to the cord blood banking market and is anticipated to grow at a significant rate during the forecast period. Cord blood stem cell transplants have proven effective in treating adult and pediatric cancer patients, with over 35,000 global transplants conducted. Most of these transplants have been performed to address conditions like leukemia and other blood abnormalities. It's important to note that donors other than the child's cord blood are utilized for cord blood transplants in children with leukemia or blood disorders.

- For instance, In July 2022, key figures in childhood cancer research are spearheading a study on cord blood's potential in preventing childhood leukemia. This research initiative, ReCord, is backed by a five-year grant from the National Institutes of Health (NIH).

End-user Insights

The hospital segment dominated the cord blood banking market in 2025. The increasing awareness of the applications of cord blood banking is expected to boost the demand for cord blood banking processing in hospitals, thereby driving market expansion. The development of the storage infrastructure for cord blood in public and private healthcare settings is slated to accelerate the industry value.

Regional Insights

U.S. Cord Blood Banking Market Size and Growth 2026 to 2035

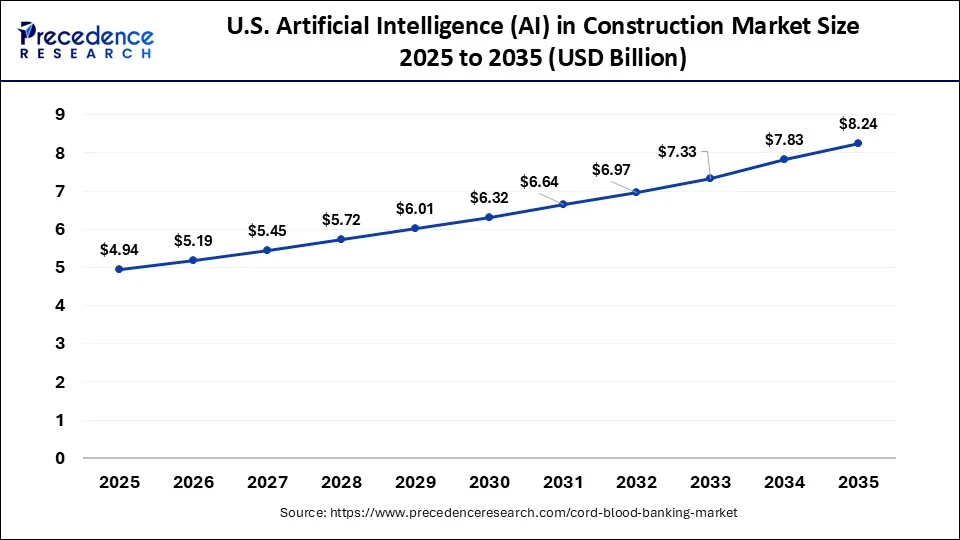

The U.S. cord blood banking market size is estimated at USD 4.94 billion in 2025 and is predicted to be worth around USD 8.24 billion by 2035 at a CAGR of 5.25% from 2026 to 2035.

North America held the largest market share of 38% in 2024 and is projected to sustain the position during the forecast period. Increased awareness of the benefits of banking cord blood and cells, especially with advancing therapeutic applications, contributes to the growth. Expansion of the stem cell banking services network, ongoing approval of stem cell lines for disease treatment, technological advancements in collection and preservation techniques, and substantial public-private investments in stem cell research are key factors driving the expansion of the North American stem cell banking market. Government funding for research and development initiatives, particularly in clinical trials involving cord blood stem cells, further supports this growth.

- For instance, as per the January 2022 estimates from the American Cancer Society, approximately 60,650 new cases of leukemia and 24,000 deaths from leukemia occurred in the United States in the same year. Among these, around 11,450 deaths were attributed to acute myeloid leukemia. These statistics predominantly affect the adult population, emphasizing the need for proper medical treatment to enhance life expectancy.

What Makes Europe the Fastest-Growing Region in the Market?

Europe is the fastest-growing region for the cord blood banking market during the projected period. The recommendations outlined in the UK Stem Cell Strategic Forum report are set to be implemented with substantial government funding to improve stem cell services in the UK. The government is actively working toward establishing a cost-effective and strategic approach to achieve its goal of a cord blood bank with 50,000 units. Moreover, the rising number of solid organ transplant recipients facing long-term immunosuppression and post-transplant lymphoproliferative diseases is pressuring the government to enhance healthcare services, further supporting the growth of cord blood banking services in the European region.

How is the Opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is emerging as a significant region in the cord blood banking market. This region's market growth is attributed to various factors such as increasing healthcare expenditure, rising awareness regarding stem cell therapies, and a growing population of expectant parents. Countries like China and India are leading players due to their continuously expanding healthcare infrastructure and a rising number of private banking options that effectively cater to local demand. The competitive landscape of the regional market is evolving rapidly, with both local and international players driving the market forward.

What Potentiates the Market in Latin America?

The cord blood banking market in Latin America is expected to grow at a lucrative rate in the upcoming period. This growth is attributed to factors such as rising awareness of regenerative medicine and stem cell therapies among healthcare providers and consumers, and the increasing prevalence of genetic and hematological disorders. The region is also witnessing a growing adoption of private cord blood banking as a preventive healthcare measure. Advancements in industry-specific innovations, such as improved cryopreservation techniques and smart storage solutions, are also gaining traction. Favorable regulatory shifts and supportive government initiatives also help in promoting cord blood banking services in the region.

What Opportunities Exist in the Middle East & Africa (MEA)?

The Middle East & Africa (MEA) presents significant opportunities for the market. These opportunities arise from the increasing healthcare investments, rising awareness of the benefits of cord blood banking, and a rapidly growing population. Countries like South Africa and the UAE are leading the regional market, as they are seeing a rise in private banking services. The region is home to a limited number of players, but emerging companies are looking to establish themselves in this growing market. The region's regulatory frameworks are also evolving gradually, with governments recognizing the importance of stem cell banking for future healthcare advancements.

Cord Blood Banking Market Companies

- Thermo Fisher Scientific (US)

- Merck KGaA (Germany)

- Lonza Group (Switzerland)

- STEMCELL Technologies (Canada)

- Takara Bio (Japan)

- FUJIFILM Cellular Dynamics (US)

- Sartorius AG (Germany)

- GE Healthcare (UK)

- Charles River Laboratories International (US)

- Cynata Therapeutics (Australia)

- Mesoblast (Australia)

- Cellular Dynamics International (US)

- Organogenesis (US)

- Osiris Therapeutics (US)

- Gamida Cell (Israel)

- Pluristem Therapeutics (Israel)

- Athersys (US)

- Brainstorm Cell Therapeutics (Israel)

- Cellectis (France)

- Ncardia AG (Germany)

Recent Developments

- In August 2025, Cord Blood Registry announced a partnership with a leading biotechnology firm to develop advanced processing techniques for cord blood. This collaboration is expected to enhance the viability and therapeutic potential of stored stem cells, positioning Cord Blood Registry as a leader in innovation within the sector. The strategic importance of this partnership lies in its potential to attract more customers who are increasingly seeking cutting-edge solutions for stem cell storage.(Source: https://www.bing.com )

- In September 2025, Viacord launched a new mobile application designed to facilitate the cord blood collection process for parents. This digital transformation initiative aims to streamline communication and provide real-time updates, thereby enhancing customer experience. The significance of this move is underscored by the growing trend towards digital solutions in healthcare, which could lead to increased customer loyalty and retention.(Source: https://www.bing.com )

- In April 2022, Aspen Neuroscience, Inc. commenced a groundbreaking patient screening study, the Trial-Ready Cohort Study, in collaboration with multiple clinical screening sites across the United States. This study marks a crucial initial step toward submitting an Investigational New Drug (IND) application to the United States Food & Drug Administration. Aspen Neuroscience's objective is to explore the potential of ANPD001, an iPSC-derived cell replacement therapy, for treating Parkinson's disease.

- In April 2022, TreeFrog Therapeutics introduced The Stem Cell SpaceShot Grant, a grant program offering USD 100,000 in research funding exclusively dedicated to advancing the field of stem cell biology and regenerative medicine. This initiative supports innovative research projects, fostering progress and breakthroughs in understanding and applying stem cells.

- In September 2022, ExCellThera aimed to enhance patients' access to cord blood transplants. Cord blood transplants, characterized by not requiring exact HLA matching, offer a significant advantage over adult sources of stem cells. The company's efforts contribute to improving the accessibility and efficacy of this medical intervention.

- In March 2022, Cryo-Cell International, Inc. reported its purchase agreement for a newly constructed 56,000 sq ft facility within the Regional Commerce Center in the Research Triangle, NC. This facility is anticipated to expand Cryo-Cell's cryopreservation and cold storage business, introducing a new service called ExtraVault. The closure is subject to customary conditions.

Segments Covered in the Report

By Type of Bank

- Public

- Private

By Services

- Processing

- Storage

- Others

By Application

- Cancer

- Blood Disorders

- Bone Marrow Failure Syndrome

- Immuno-deficiency Disorders

- Metabolic Disorders

By End Use

- Hospital

- Research Institutes

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting