What is the Cord Blood Banking Services Market Size?

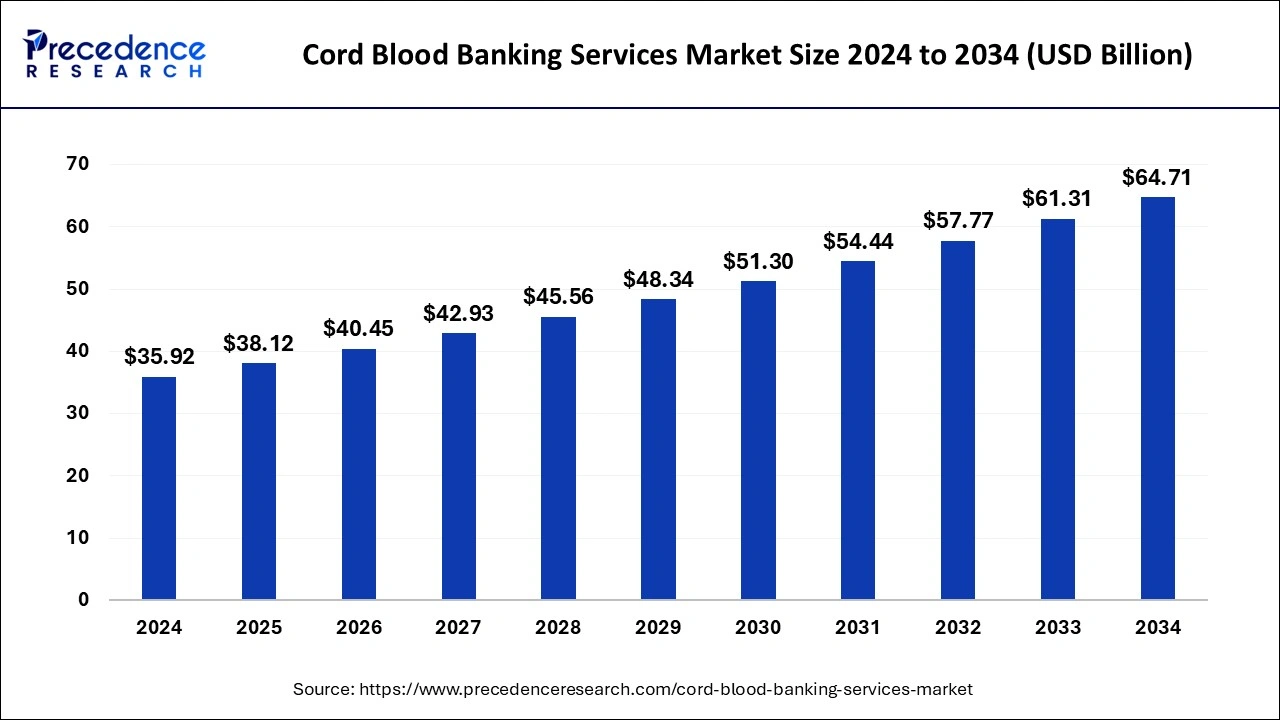

The global cord blood banking services market size was estimated at USD 3.27 billion in 2025 and is predicted to increase from USD 3.46 billion in 2026 to approximately USD 6.17 billion by 2035, expanding at a CAGR of 6.55% from 2026 to 2035. The simplicity and safety of cord blood for harvesting stem cells are growing the demand for cord blood banking services in the market.

Cord Blood Banking Services Market Key Takeaways

- The global cord blood banking services market was valued at USD 3.27 billion in 2025.

- It is projected to reach USD 6.17billion by 2035.

- The market is expected to grow at a CAGR of 6.55% from 2026 to 2035.

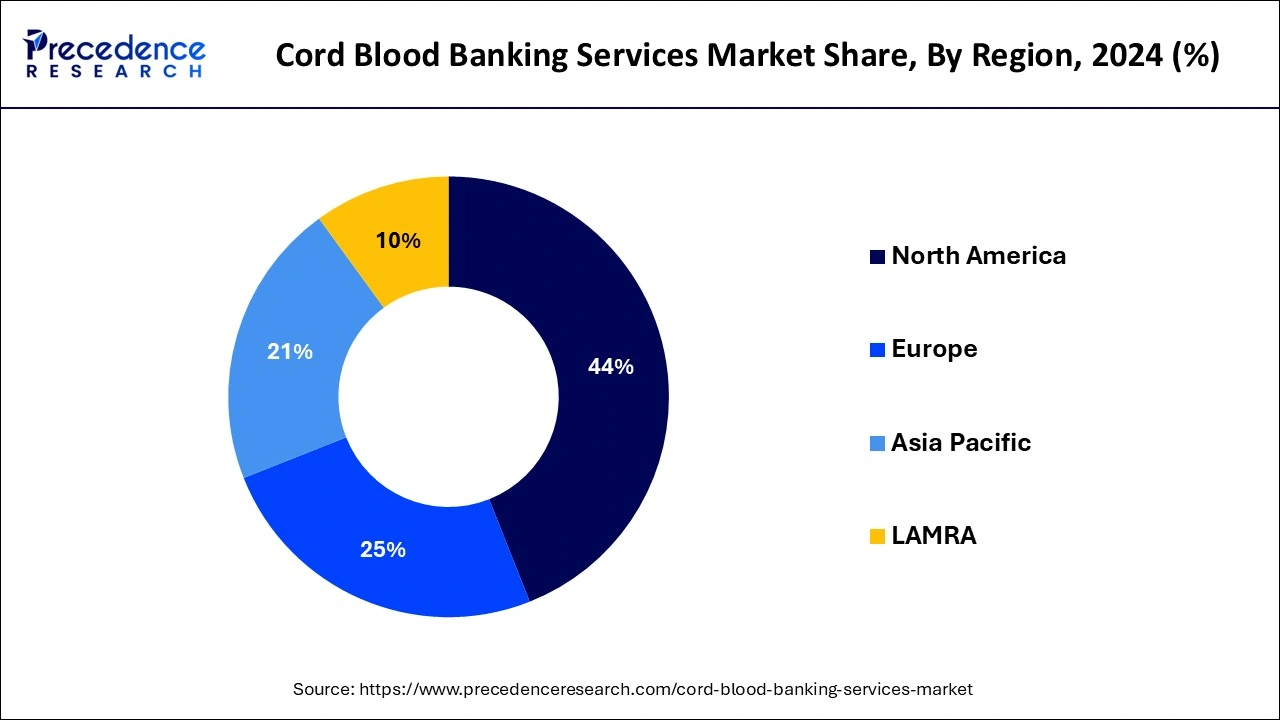

- North America dominated the market with the largest revenue share of 36.28% in 2025.

- Asia Pacific is expected to grow at the highest CAGR during the forecast period.

- By storage services, the private cord blood banks segment is expected to hold the major market share in 2025.

- By storage services, the public cord blood banks segment is expected to grow rapidly during the forecast period.

- By component, the cord tissue segment dominated the market in 2025.

- By component, the cord blood segment is expected to grow rapidly during the forecast period.

- By application, the diabetes segment will dominate the market in 2025.

- By application, the cancer disease segment is expected to grow at a significant CAGR during the forecast period.

What is Cord Blood Banking?

The cord blood banking services market refers to the collection and storage for potential medical use through a procedure called cord blood banking. Rich in stem cells, umbilical cord blood can be utilized to treat a wide range of illnesses and conditions, including leukemia, lymphoma, and several genetic abnormalities. Parents can store these priceless stem cells for their kids' or other family members' possible future usage by preserving them through cord blood banking. The market is driven by the simplicity and safety of cord blood in harvesting stem cells and the rising awareness about cord blood banking services.

The cord blood banking services market is fragmented with multiple small-scale and large-scale players, such as California Cryobank Stem Cell Services LLC, Global Cord Blood Corporation, CBR Systems Inc., PerkinElmer Inc. (ViaCord LLC), Cord Blood Foundation (Smart Cells International), Cryo-Cell International, Cordlife Group Limited, AlphaCord LLC, ATCC, CSG-BIO, Singapore Cord Blood Bank, FamiCord.

How is AI contributing to the Cord Blood Banking Industry?

AI enhances cord blood banking by automating, conducting quality checks, and providing insights ahead of time. It enhances the human leukocyte antigen matching accuracy. It speeds up the testing schedules. Conditions of storage remain optimum. The vitality of the stem cells is better. The results of transplants are made more predictable. The processes become effective, adherent, and data-dependent.

Cord Blood Banking Services Market Growth Factors

- The rising awareness about cord blood banking services can be the opportunity to boost the cord blood banking services market.

- The simplicity and safety of cord blood for harvesting stem cells are growing the demand for cord blood banking services in the market.

Market Outlook

- Industry Growth/Overview: Regenerative medicine awareness and the growing stem cell therapies maintain market momentum.

- Sustainability Trends: Attention is paid to long-term storage stability, energy-saving cryopreservation, and electronic records.

- Major Investors: ACON Investments, Generate Life Sciences, FamiCord Group, and Cordlife are the major sources of the consolidation activity.

- Startup Ecosystem: Young companies put their attention on AI-based processing, enhanced collection, and advanced tissue engineering.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.55% |

| Market Size in 2025 | USD 3.27 Billion |

| Market Size by 2035 | USD 6.17Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Storage Services, Component, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Simplicity and safety of cord blood to harvest stem cells

The simplicity and safety of cord blood for harvesting stem cells are growing the demand for cord blood banking services in the market. As a result, it is simple and safe to isolate stem cells from cord blood. The importance of saving their child's cord blood as a possible source of stem cells for upcoming medical procedures is becoming more known to parents. Because cord blood is a desirable alternative for families desiring to save for their future health, this can grow the cord blood banking services market.

Restraint

Unawareness of cord blood banking services among clinicians

The unawareness of cord blood banking services among clinicians may slow down the market. Potential consumers might not be aware of the benefits of cord blood banking services. As a result, fewer people choose to bank their cord blood, which lowers the demand for cord blood banking services market.

Opportunity

Rising awareness about cord blood banking services

The rising awareness about cord blood banking services can be the opportunity to boost the cord blood banking services market. As more pregnant parents become aware of the possible advantages for the future health of their unborn child. The demand that rises with knowledge may spur innovation and growth of the market.

Segment Insights

Storage Services Insights

The private cord blood banks segment dominated the cord blood banking services market by storage services in 2025. This is mainly because they offer parents the choice to keep their baby's cord blood for potential further use. This provides families access to their own stem cells in case they are later required for medical procedures. Additionally, parents who have concerns about the future of their kids may find specialized services and storage alternatives offered by private banks.

The public cord blood banks segment is expected to grow to the highest CAGR in the cord blood banking services market by storage services during the forecast period. The public banks saved their own cord blood, and anybody in need of a stem cell transplant can get donated cord blood units from public banks. Many people who want to improve the health of others find this ethical quality desirable.

Component Insights

The cord tissue segment dominated the cord blood banking services market by component in 2025. Because of its abundant supply of mesenchymal stem cells (MCSs), which have been demonstrated in regenerative medicine for the treatment of a variety of illnesses and injuries, cord tissues have become the leader of the market. Compared to mesenchymal stem cells from other sources, those produced from the cord tissues have the benefit of simple accessibility, immunomodulatory capabilities, and decreased risk of rejection. There will probably be an increase in demand for cord tissue banking as regenerative medicines research.

The cord blood segment is expected to grow to the highest CAGR in the cord blood banking services market by component during the forecast period. Due to developments in stem cell research and regenerative medicine, as well as growing public awareness of the potential advantages of cord blood stem cells in treating a range of illnesses and disorders, the cord blood segment of the market is anticipated to expand. In addition, an increasing number of parents are choosing to bank their child's cord blood in case they require medical attention down the road.

Application Insights

The diabetes segment dominated the cord blood banking services market by application in 2025. There are a number of reasons why the diabetes market dominates the cord blood banking services industry. First, via the use of regenerative medicine techniques, cord blood stem cells have demonstrated encouraging promise in the treatment of diabetes. Second, the need for novel treatment alternatives is being driven by the rising global prevalence of diabetes. The treatment of diabetes with cord blood stem cells has also been the subject of research and clinical studies that have attracted a lot of interest and funding, which has further fueled the expansion of this market.

The cancer disease segment is expected to grow to the highest CAGR in the cord blood banking services market by application during the forecast period. Because cord blood includes stem cells that can be employed in therapies for some forms of cancer, such as stem cell transplants, the rise in cancer disorders may fuel demand for cord blood banking services. The need for these services may rise in tandem with the prevalence of cancer.

Regional Insights

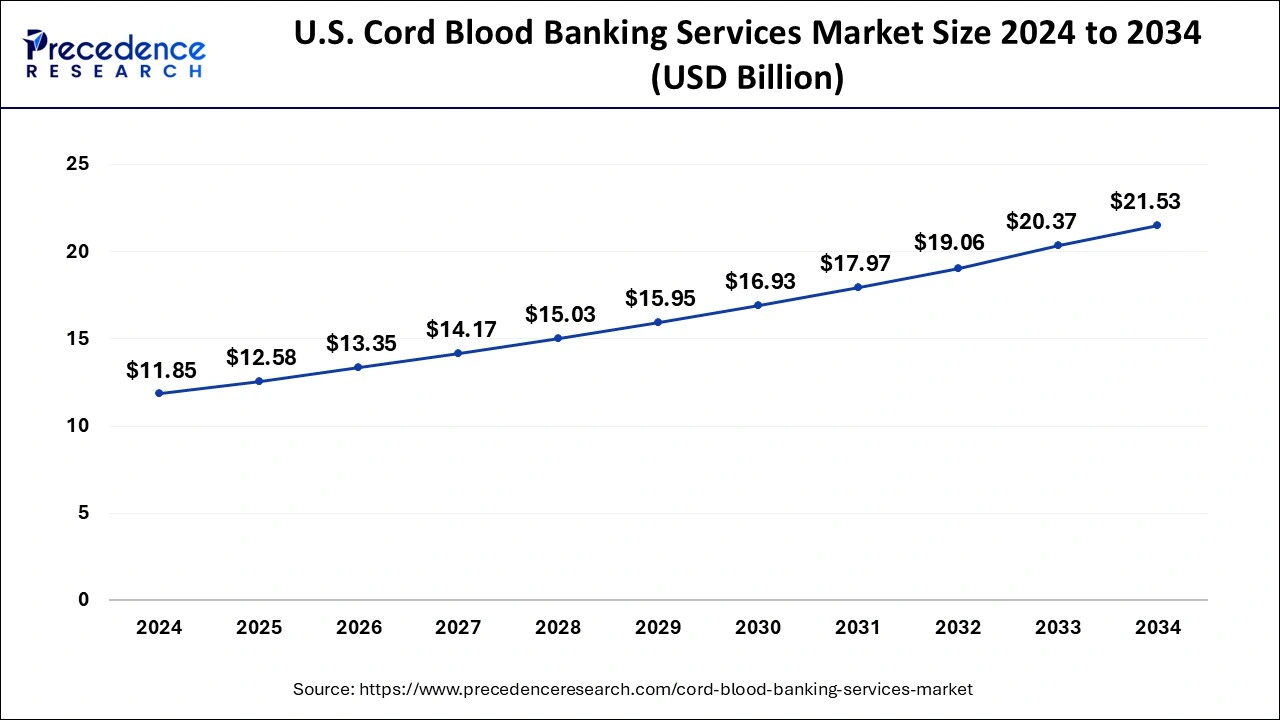

What is the U.S. Cord Blood Banking Services Market Size?

The U.S. cord blood banking services market size was estimated at USD 1.12 billion in 2025 and is predicted to be worth around USD 1.79 billion by 2035 at a CAGR of 4.52% from 2026 to 2035.

North America dominated the cord blood banking services market by region, in 2025. There is a strong healthcare system in the area, and expectant parents are well-informed about the advantages of cord blood banking. North America is also home to a number of top research institutes,biotechnology firms, and cord blood banks, all of which contribute to the market's expansion. The North American cord blood banking market is mostly driven by sophisticated technology, regulatory backing, and a high birth rate.

- In the United States, our donors' registry is called Be The Match. Patients who have a rare genetic type are more likely to receive cord blood transplants. In order for parents to donate cord blood to a public bank, their baby must be born at a hospital that accepts donations. Public cord blood banking is highly recommended by both the American Academy of Pediatrics (AAP) and the American Medical Association (AMA).

Asia Pacific is expected to grow to the highest CAGR in the cord blood banking services market by region during the forecast period. Because of the region's high birth rate and large population, there is a considerable need for cord blood banking services. The market expansion in the area is also being driven by growing awareness of the potential advantages of using cord blood stem cells to treat a range of illnesses and ailments.

- In Japan, there are 11 public cord blood banks, which form a network by communicating with each other and exchanging information. Comprehensive clinical summaries of UCB transplantation demonstrate that it is as effective as bone marrow transplantation and without serious adverse events.

U.S Cord Blood Banking Services Market Trends

In 2024, the U.S. cord blood banking services emerged as a frontrunner, capturing a significant market. The growth in the number of service providers has resulted in an increase in access and competition with higher service provisions and affordability of the services provided by public and private cord blood banks. There is also a strong research and development environment in the U.S., and there are many medical and academic research centers pursuing new medical applications of cord blood and stem cells, including the fields of regenerative medicine and personalized medicine. The reliability and the attractiveness of cord blood banking services are also reinforced through new advances of cryopreservation technology, storage structures, and quality assurance standards. The market size is also promoted by supportive government measures and supportive regulatory systems.

China Cord Blood Banking Services Market Trends

The China cord blood banking services market held the largest market share in 2024. The increase in incidences of chronic diseases like cancer and diabetes in China has also contributed to the need to use stem cell-based cures or medicines. There are also a good number of advanced facilities of cord blood banks, both public and privately run, which form a well-developed network that strengthens the market. Government and the private sector have invested heavily in these facilities to grow stem cell research and biobanking facilities. China has been the most adaptable country in terms of accepting the new medical practices, which is why it is now a leader in the region in terms of innovative medical practices. Moreover, the high level of genetic diversity in Asia and specifically in China further adds value to its cord blood units in the global market. China will be in a position to continue playing a significant role in the global cord blood banking services market due to the increasing healthcare demands, technological advancement, and a strategic approach toward regenerative medicine.

Europe Cord Blood Banking Services Market Trends

The Europe cord blood banking services market held a significant market share in 2024 as the number of chronic illnesses, including cancer, diabetes, and genetics, is on the rise. It also has one of the most advanced healthcare systems with effective cord blood bank facilities that are public and privately owned. The partnerships between research institutions and health services also helped to produce ongoing innovation and clinical research on regenerative medicine, which verifies the worth of cord blood as an important source of future treatment applications.

Germany has also been one of the main pillars in the European market. Germany has a favourable environment for biobanking, beneficial governmental setups which favour investment in biotechnology and regenerative medicine. The rising health expenditure, the advanced level of prenatal care, and the increasing shift to precision medicine also contribute to the cord blood banking practice. With the strong development of the public health awareness programs and international stem cell registries, Germany will have a leading impact in determining the course of the European cord blood banking service market.

Value Chain Analysis of the Cord Blood Banking Market

- R&D: Investigations and laboratory confirmation of stem cell remedies to form initial biological prospects.

Key players: Gamida Cell, Duke University, StemCyte, Cord Blood Registry - Clinical Trials and Regulatory Approaches: Human trials guarantee safety, effectiveness, as well as official gender approval of therapeutic use.

Key Players: FDA, AABB, FACT, StemCyte (RegeneCyte), and Gamida Cell - Formulation and Final Dosage Preparation: Raw biological products are transformed into patient-administerable medical formulations.

Key Players: Thermogenesis (AXP AutoXpress), Sepax (Cytiva), Cryo-Cell International - Packaging and Serialization: Unique coded sterile containment provides integrity, traceability, and security of the supply chain.

Key players: Cordlife, LifeCell, Cryo-Save - Hospitals/Pharmacies: Therapies are supplied through a controlled cold-chain logistics to the healthcare providers safely.

Key players: National Cord Blood Program, Cord Blood Registry

Cord Blood Banking Services Market Companies

- Thermo Fisher Scientific: Provides workflow solutions, automated processing, cryogenic freezers, consumables, and laboratory solutions that help in cord blood preservation procedures.

- Merck KGaA: Provides superior cell culture media, growth factors, and reagents that support the growth and processing of stem cells.

- Lonza Group: Lonza offers GMF-compatible stem cell growth through the availability of CDMO services, isolation kits, and serum-free media.

- STEMCELL Technologies: Provides media, separation, and storage standardized products for the use of stem cells in clinics and research.

Other Major Key Players

- Global Cord Blood Corporation

- CBR Systems Inc.

- PerkinElmer Inc. (ViaCord LLC)

- Cryo-Cell International

- Cordlife Group Limited

- AlphaCord LLC

- ATCC

- CSG-BIO

- California Cryobank Stem Cell Services LLC

- Cord Blood Foundation (Smart Cells International)

- Singapore Cord Blood Bank

- FamiCord

Recent Developments

- In February 2024, CooperSurgical, a global leader in fertility and women's health, and Fulgent Genetics, Inc., a technology-based company with a well-established clinical diagnostic business and a therapeutic development business, announced that they have partnered to offer families of Cord Blood Registry (CBR) exclusive newborn genetic screening panels.

- In February 2023, Americord, a leading private stem cell bank, announced the release of cord blood stem cells to a client's grandmother in India for the treatment of motor neuron disease. Motor neuron disease is a progressive neurological disorder that poses immense challenges for patients and families.

- In September 2023, CooperSurgical, a global leader in fertility and women's health announced that Cord Blood Registry (CBR) played a key role in the Cord Blood Connect meeting, which was held from September 8th – 11th, the annual meeting of the Cord Blood Association. The Cord Blood Association is an international nonprofit organization that promotes both public and family newborn stem cell preservation and accelerates the use of cord blood and birthing tissues to benefit patients and advance medicine.

- In July 2023, Cell Genesis announced the launch of CEXCI Cord Protein Banking, a groundbreaking initiative that marks a new era in the field of stem cell research and personalized medicine. This innovative approach harnesses the power of umbilical cord stem cell protein to unlock a world of possibilities for improved health outcomes and transformative medical treatments.

Segment Covered in the Report

By Storage Services

- Public Cord Blood Banks

- Private Cord Blood Banks

By Component

- Cord Blood

- Cord Tissue

By Application

- Cancer Disease

- Diabetes

- Blood Disease

- Immune Disorders

- Metabolic Disorders

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting