What is the Corneal Implants Market Size?

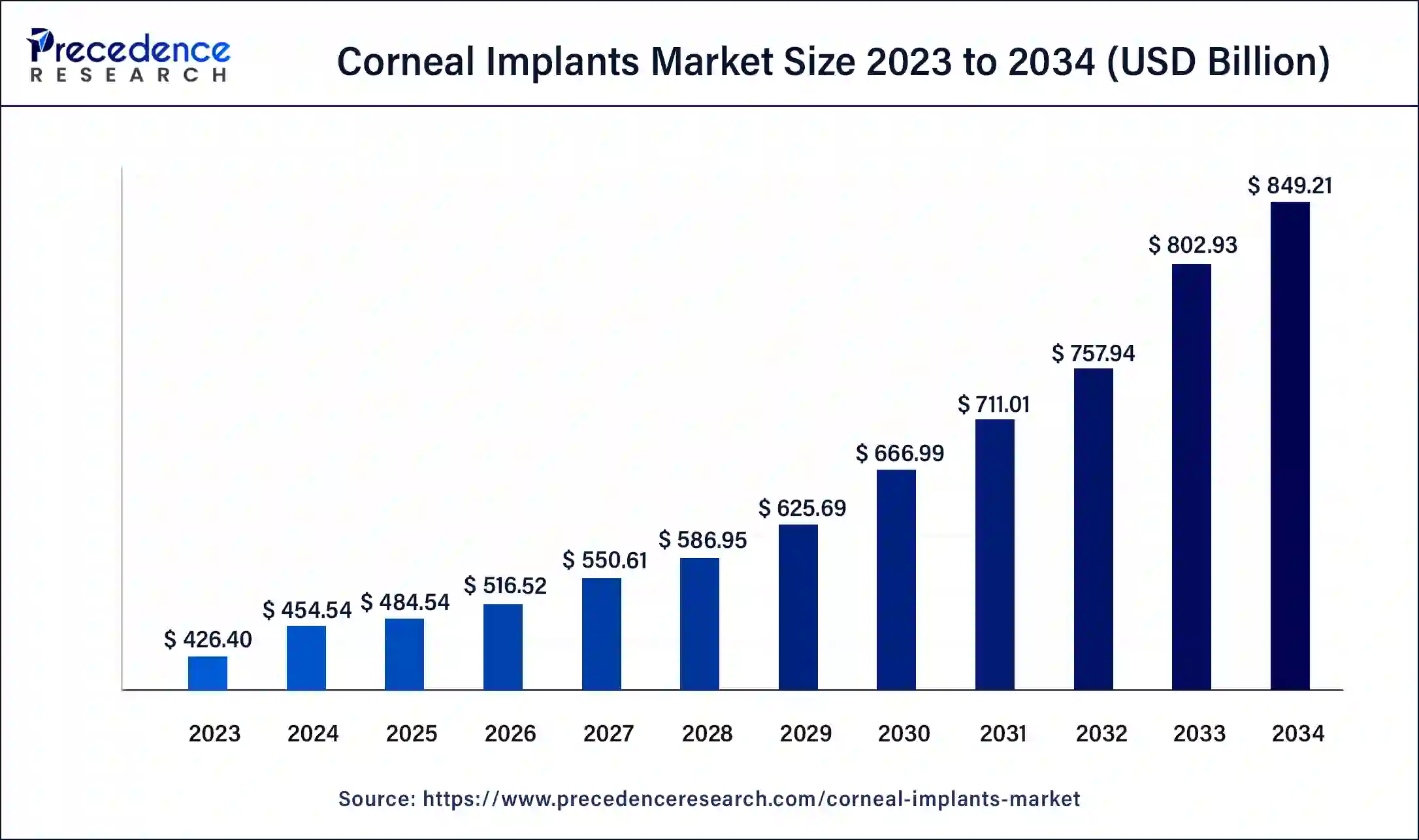

The global corneal implants market size is accounted at USD 484.54 billion in 2025 and predicted to increase from USD 516.52 billion in 2026 to approximately USD 895.49 billion by 2035, representing a CAGR of 6.4% from 2026 to 2035.

Corneal Implants Market Key Takeaways

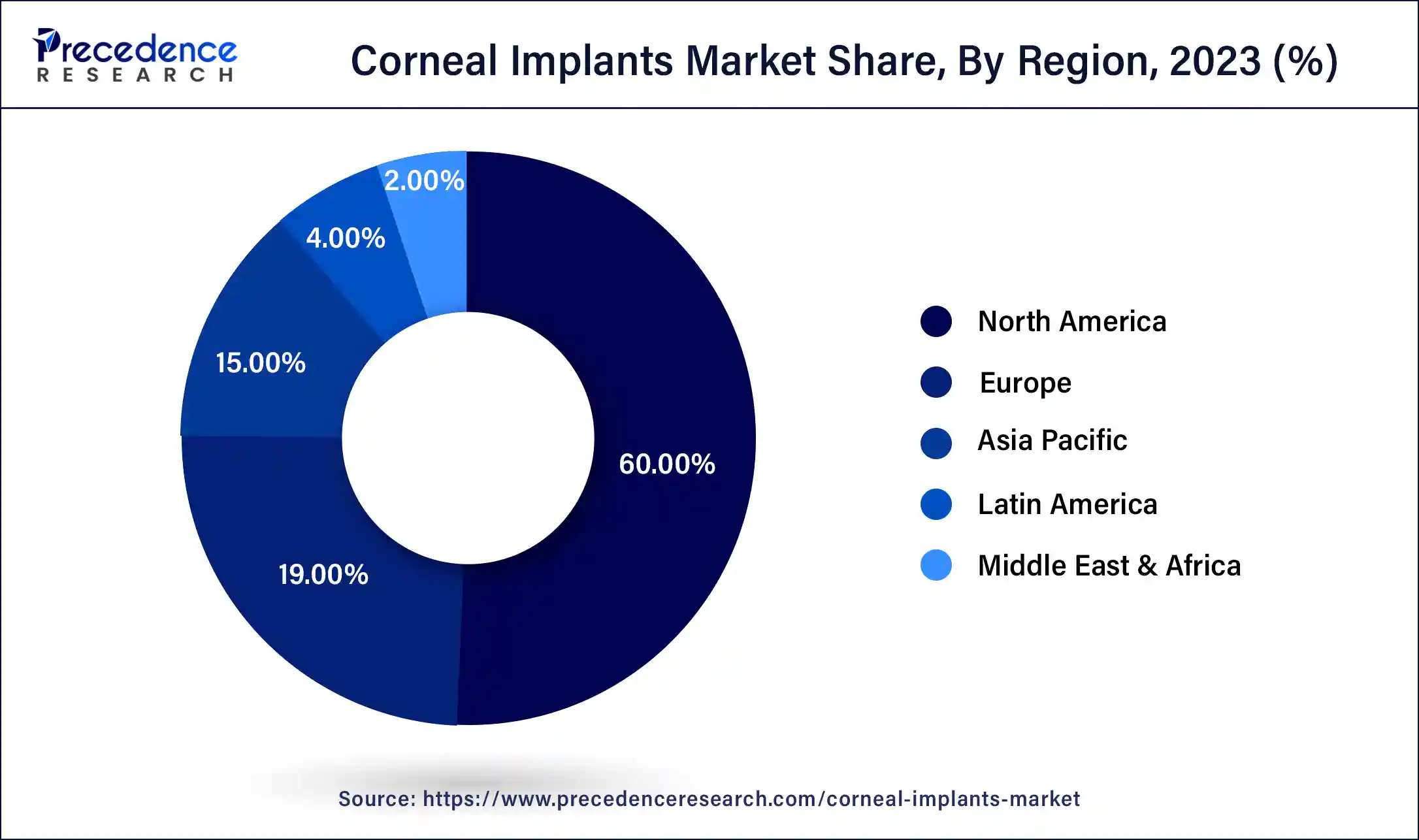

- North America dominated the market with the largest market share of 60% in 2025.

- By Type, the human cornea segment dominated the market with the largest market share of 91% in 2025.

- By Type, the synthetic segment is anticipated to grow significantly.

- By Surgery Method, the penetrating keratoplasty segment led the market with the highest market share of 54% in 2025.

- By Surgery Method, the endothelial keratoplasty segment is anticipated to boost at a significant CAGR.

- By Application, the fuchs dystrophy segment contributed more than 54% of revenue share in 2025.

- By Application, the keratoconus segment is projected to grow rapidly.

What are Corneal Implants?

A corneal implant, also known as a corneal graft, is a surgical procedure that involves replacing a damaged cornea with a healthy one from a donor. The cornea is the clear, dome-shaped outer layer of the eye responsible for focusing light onto the retina, making it crucial for vision.

Corneal implants are typically recommended when the cornea becomes cloudy, scarred, or distorted due to conditions like keratoconus, Fuchs' dystrophy, corneal injury, or infections. Vision impairment, discomfort, and light sensitivity often accompany these conditions, necessitating intervention.

There are many kinds of corneal transplants, including partial-thickness (lamellar) and full-thickness (penetrating) transplants that target distinct layers of the cornea. The patient's state and medical advice influence the type of transplant selected. Around 185,000 corneal transplants are carried out annually in 116 nations. At the same time, 284,000 corneas are obtained in 82 nations. 1 in 70 of the world's demands for corneal transplantation are met, with an estimated 12.7 million persons on the waiting list.

How is AI contributing to the Corneal Implants Market?

Artificial intelligence plays a crucial role in the enhancement of corneal implants through a variety of means, namely, better patient selection, surgical planning, outcome prediction, donor tissue assessment, and postoperative monitoring. In the meantime, machine learning is used to analyze corneal imaging, which allows for the early detection of risks, optimization of implant placement, prediction of graft survival, support for cell-based therapies, and the like.

Corneal Implants Market Growth Factors

- The market for corneal implants is primarily being driven by the rise in the frequency of corneal diseases. Conditions include keratoconus, Fuchs dystrophy, keratitis, corneal scarring, corneal ulcers, and corneal edema, which can lead to the necessity for corneal transplantation. For instance, the Corneal Research Foundation of America estimates that 50 to 200 persons out of every 100,000 people have keratoconus.

- According to research, there are 54.5 cases for every 100,000 persons in the US. As a result, the business of corneal implants is expanding as corneal problems become more common. Moreover, the requirement for treatments for corneal blindness promotes the market's expansion.

Market Outlook

- Industry Growth Overview: The corneal implants market is experiencing significant growth, as these implants restore vision and lower pain from corneal disease. It treats various conditions such as Fuchs' dystrophy and keratoconus.

- Global Expansion: The market expanded globally because of the limited supply of donor corneas, joined with notable development in surgical processes and biomaterial technology. North America is dominant in the market due to its well-established healthcare infrastructure and high healthcare expenditure.

- Major investors: Major investors in the corneal implants industry include a combination of large, established eye care organizations, novel biomedical startups, and non-profit eye banks and research institutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 895.49 Billion |

| Market Size in 2025 | USD 484.54 Billion |

| Market Size in 2026 | USD 516.52 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.4% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Surgery Method, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Increasing incidence of corneal diseases

The increasing incidence of corneal diseases significantly drives the growth of corneal implant market. Corneal diseases encompass a range of conditions that affect the transparent front surface of the eye, known as the cornea. These conditions can result from genetic factors, eye injuries, infections, or degenerative changes. Some of the common corneal diseases include keratoconus, Fuchs' endothelial dystrophy, and corneal injuries due to accidents or infections. Lifestyle changes are one key factor contributing to the rising incidence of corneal diseases. Modern lifestyles often involve prolonged screen time, exposure to environmental pollutants, and increased use of contact lenses, all of which can increase the risk of corneal problems. Factors like genetic predisposition and age-related changes can also contribute to the development of corneal diseases.

As the incidence of these diseases continues to rise, there is a growing need for effective treatments to restore vision and improve the quality of life for affected individuals. Corneal implants, such as artificial corneas or keratoprostheses, offer a viable solution for patients with advanced corneal diseases that cannot be managed with conventional treatments like glasses or contact lenses.

Moreover, corneal transplant procedures have become more accessible and less invasive. Techniques like Descemet's Stripping Automated Endothelial Keratoplasty (DSAEK) and Descemet's Membrane Endothelial Keratoplasty (DMEK) have gained popularity because they are minimally invasive, reducing the risk of complications and improving patient outcomes.

Restraint

Regulatory approval

Corneal implants' development and regulatory approval are subject to stringent processes and regulations. These regulations are essential to ensure the safety and efficacy of medical devices, but they also present challenges to manufacturers and researchers in the corneal implant industry. Corneal implants are classified as medical devices, and their development typically involves a series of phases, including preclinical testing and clinical trials. These trials are conducted to establish the implant's safety and effectiveness in treating specific eye conditions. The regulatory authorities, such as the U.S. Food and Drug Administration (FDA) in the United States or the European Medicines Agency (EMA) in Europe, require extensive data to support claims of safety and efficacy.

Obtaining regulatory approval involves substantial time and financial investments. The process can take several years, and the associated costs can cost millions. Companies must meticulously document their research, conduct rigorous testing, and adhere to regulatory guidelines. Even with these efforts, there is no approval guarantee, as regulators prioritize patient safety. Once approved, companies may need to continue post-market surveillance and reporting to monitor their implants' long-term safety and performance. Any adverse events or safety concerns must be promptly reported to regulatory authorities.

Opportunity

Technological advancements in corneal implants

The development and expansion of the corneal implant market have been accelerated by technological breakthroughs. With the ultimate objective of enhancing patient outcomes and extending the reach of this game-changing medical treatment, these developments include various corneal implant research areas, including materials, manufacturing processes, and design. For instance, in 2023, polymer researchers at the University of Melbourne worked with medical experts to develop a new patented technique that could enhance results for patients undergoing corneal transplant surgery.

Creating synthetic corneas is a significant area of scientific advancement in corneal implants. Traditionally, donor corneas have been used in corneal transplants, but these corneas are scarce and sometimes have compatibility problems. Contrarily, synthetic corneas provide a number of benefits. They may be mass-made, which lessens reliance on the availability of donor tissue. They may also be made to be biocompatible and tailored to the demands of each patient, which may increase success rates and lower the possibility of rejection. Another promising avenue is 3D printing technology, which has been applied to create corneal implants with intricate and patient-specific designs. This approach allows for the precise replication of corneal tissue, including its complex curvature and structure. 3D-printed corneal tissue can offer a more natural fit, potentially enhancing visual outcomes and reducing complications.

Segment Insights

Type Insights

The human tissue segment accounted for the largest share in 2023 and is expected to maintain its dominance during the forecast period. The market for corneal implants is benefiting from this expansion. Age-related illnesses and ailments are more prevalent as the world's population ages. Age-related vision problems, including cataracts and corneal degeneration, are addressed using corneal implants, which are in greater demand as people age.

Technological developments have revolutionized the fields of tissue engineering and regenerative medicine. Artificial corneas and other tissues may now be produced due to technological advancements like 3D bioprinting and tissue engineering, eliminating the need for traditional donor sources and increasing the accessibility of corneal implants.

Due to factors including increasing screen time and environmental stresses, eye illnesses like glaucoma and keratoconus are becoming more common. The need for corneal implants as a therapy option is growing as these disorders become more widespread.

The synthetic segment is growing at the quickest rate on the worldwide market. Technology advances, increased demand for alternatives to corneal transplantation, and an increase in the frequency of corneal disorders may all be roughly categorized as drivers driving segment's expansion. The constant improvement in surgical methods and material technology is one of the main factors driving growth in the market for synthetic corneal implants. Synthetic corneas that nearly resemble the transparency and biomechanical characteristics of the real cornea have been created because of advancements in biocompatible materials like polymers and hydrogels.

Surgery Method Insights

The penetrating keratoplasty segment had the largest share in 2025, which is anticipated to continue dominating over the projection period. A number of factors influence the development and expansion of penetrating keratoplasty (PKP). As knowledge of eye donation and eye banking procedures has improved. As a result, a bigger pool of corneal donors will be available for transplantation, which will shorten the waiting period and improve patients' access to PKP. The success of PKP has been greatly influenced by the training and expertise of corneal surgeons. With improvements in training and knowledge exchange, surgeons can now better complete complicated surgery with few problems.

This knowledge improves patient outcomes and fosters confidence in the operation. The likelihood of graft rejection following PKP has decreased because of the discovery of potent immunosuppressive drugs. These drugs aid in the immune system's acceptance of the recipient's cornea from the donor, improving the transplant's long-term success rate.

- According to the data report from the 2022 Eye Bank Association of America (EBAA), Endothelial keratoplasty (EK) surgeries totled 30,812 in the US in 2022, almost twice as many as photokeratomileusis (PK) procedures (15,835). Recent years have seen a tremendous increase in demand for endothelial keratoplasty, driven by a number of important reasons that have altered the landscape of corneal transplantation and eye care. This innovative surgical procedure involves the replacement of damaged or diseased corneal endothelial cells with healthy donor tissue, typically using techniques like Descemet's stripping endothelial keratoplasty (DSEK) or Descemet's membrane endothelial keratoplasty (DMEK). Endothelial keratoplasty offers superior clinical outcomes compared to traditional full-thickness corneal transplantation (penetrating keratoplasty or PK), with faster visual recovery and reduced risk of graft rejection.

Application Insights

The Fuchs dystrophy segment carried the dominating share of the market in 2025. Fuchs dystrophy is a progressive eye condition characterized by the gradual deterioration of the corneal endothelium, the cornea's innermost layer. This condition can lead to vision impairment and discomfort, and its prevalence has increased in recent years. Several key factors are contributing to the growth of the Fuchs dystrophy market. Modern lifestyles often involve prolonged exposure to factors that can exacerbate Fuchs's dystrophy, such as excessive screen time, UV radiation, and pollution. These factors can accelerate the progression of the disease, leading to a higher demand for treatments. Improved diagnostic techniques, including specular microscopy and corneal imaging, have enhanced the ability to detect Fuchs dystrophy at an earlier stage. This early diagnosis has led to an increased demand for interventions and treatments.

The Keratoconus segment is also growing rapidly. It is a progressive eye disorder characterized by the thinning and bulging of the cornea, leading to distorted vision. Several factors contribute to the growth and prevalence of keratoconus. Genetic predisposition plays a significant role in keratoconus. Individuals with a family history of the condition are at a higher risk. Specific corneal structure and stability genes have been identified, indicating a hereditary component.

Environmental factors, such as chronic eye rubbing, can exacerbate keratoconus. Rubbing the eyes vigorously can weaken the cornea and contribute to its distortion over time.

Hormonal fluctuations during puberty and pregnancy may influence the development of keratoconus. It is more common in teenagers and young adults, which aligns with the hormonal changes occurring during these stages of life.

Regional Insights

What is the U.S. Corneal Implants Market Size?

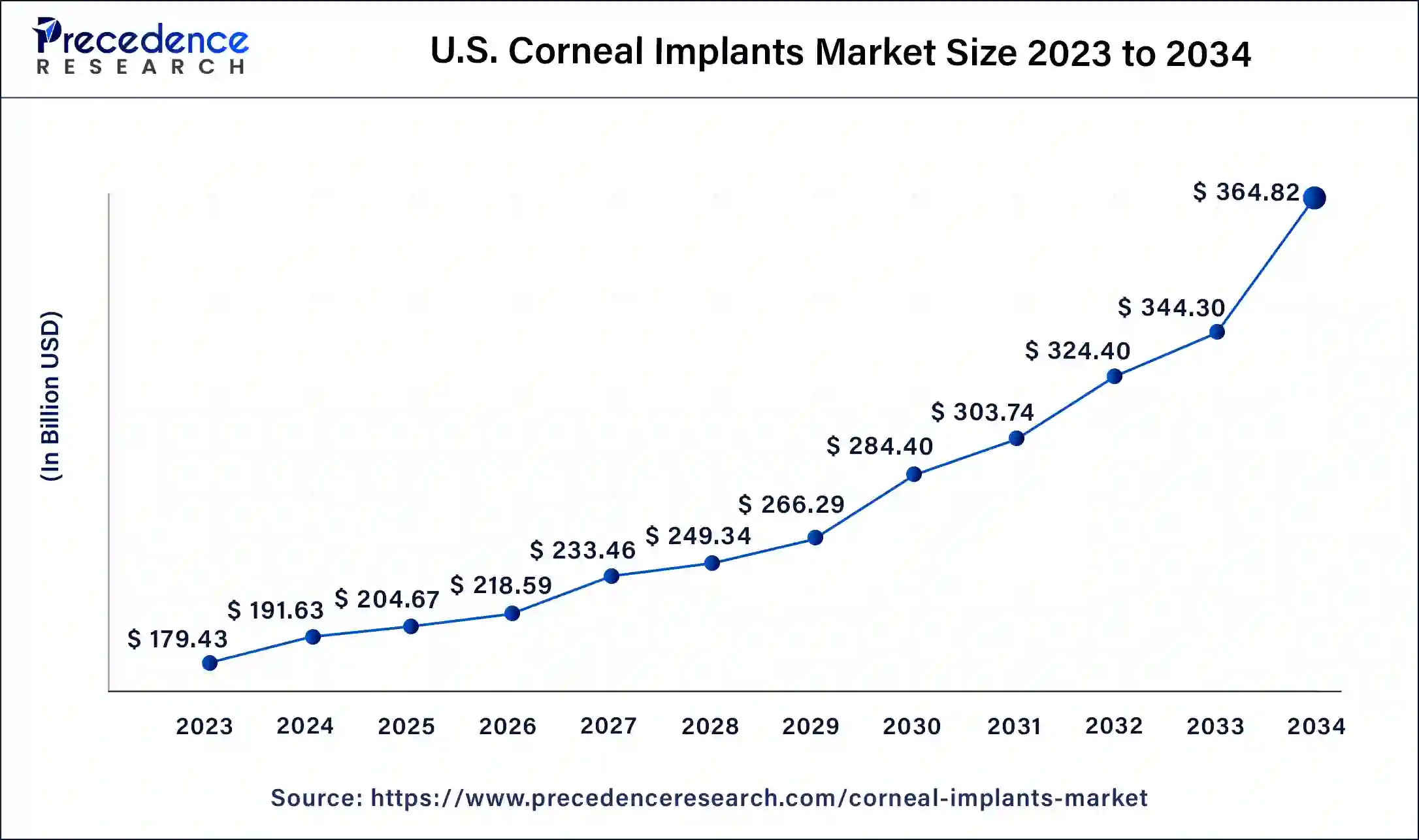

The U.S. corneal implants market size reached USD 204.67 billion in 2025 and is expected to be worth around USD 385.34 billion by 2035, growing at a CAGR of 6.6% from 2026 to 2035.

North America: Increasing Prevalence of Corneal Diseases

The corneal implants market in North America has experienced significant growth in recent years, driven by a combination of factors that reflect both technological advancements and evolving healthcare trends. The rising prevalence of corneal diseases, such as keratoconus, dystrophies, and corneal scarring, has spurred the demand for corneal implants. These conditions can severely impair vision and require surgical intervention, creating a substantial patient pool for corneal implant procedures. The continuous evolution of corneal implant technologies has improved the safety and efficacy of procedures. Innovations such as synthetic corneas and better biocompatible materials have enhanced surgical outcomes, making these implants more attractive for patients and physicians.

U.S. Corneal Implants Market Trends

The U.S. healthcare system, the world's best healthcare system, offers expedient access to a highly skilled network of physicians who work at the forefront of advancing and utilizing new, advanced-edge procedures and medicines. Advancements in slightly invasive surgical processes are influencing implant design. Implants are becoming increasingly efficient and flexible to smaller incisions, driving faster recovery and lower patient trauma.

The aging demographic in North America is a major factor in expanding corneal implants. Older people are more likely to need surgery to repair or improve their eyesight as the chance of getting corneal disorders rises with age. The changing demographics are a factor in the growing market.

Several important elements that worked together to foster a supportive environment are responsible for expanding the European corneal implants market. These include increased knowledge of and access to healthcare, increasing prevalence of corneal illnesses, and advances in medical technology.

Europe: Advancement in Medical Technology

The European corneal implant market has grown dramatically due to advances in medical technology. Corneal transplants are now safer and more successful because of advancements in surgical methods, materials, and the design of more complex implanted devices. This has prompted corneal implants to be considered as a viable therapy option by both patients and medical experts. There has been an increase in European knowledge of eye health and better access to healthcare services. As a result, corneal diseases are diagnosed and treated sooner, increasing the demand for corneal implants.

The UK Corneal Implants Market Trends

The UK has well-developed healthcare systems and dedicated hospitals, such as Moorfields Eye Hospital in London, with skilled ophthalmic surgeons can perform complex corneal transplant procedures and adopt advanced technologies. The National Health Service (NHS) Blood and Transplant (NHSBT) achieves a national organ and tissue donation system and monitors transplant results.

How Is Asia-Pacific Performing in the Corneal Implants Market?

Asia Pacific is the fastest-growing market, and it is mainly supported by factors like the large number of people getting older, high prevalence of corneal blindness, and increasing healthcare spending and awareness among people. The focus of the opportunities is on the development of affordable, locally made synthetic corneal implants that will help to improve accessibility, solve the problem of donor shortages, and support the advanced methods of treatment.

India Corneal Implants Market Trends:

India is a country showing good growth because of widespread corneal blindness, increasing access to healthcare services, and innovations in the field of corneal solutions. The production of bioengineered and 3D-printed corneas in the country would make them more affordable, it would also reduce the demand for donors, and thus, improve the treatment availability of the entire population in the country.

Corneal Implants Market-Value Chain Analysis

- R&D: The department is dedicated to the innovative creation of new corneal implant materials and technologies via research activities.

Key Players: CorneaGen, Linkoping University, EyeYon Medical - Clinical Trials and Regulatory Approvals: It is the department that performs human tests to prove that the implant is safe and effective and to get regulatory approvals in different countries.

Key players: AURO-AI, CorneaGen, Presbia - Formulation and Final Dosage Preparation: This is the step where the raw materials are made into the finished sterile corneal implants that meet the quality standards and are therefore reliable.

Key Players: CorneaGen, BioTissue, Inc., San Diego Eye Bank - Packaging and Serialization: The sterile implants are put in packages, and there is a unique serial number on each package for tracking, controlling inventory, and being compliant with the regulations.

Key players: Cormed II, LLC, CorneaGen

Top Companies in the Corneal Implants Market & Their Offerings:

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Florida Lions Eye Bank |

United States |

Expansion of Research Facilities |

Lions World Vision Institute is the largest integrated eye bank, tissue recovery, and ocular research center in the world. |

|

Alcon Inc. |

United States |

Comprehensive service portfolio |

This organization provides services that promise to accelerate time to manufacturing while driving greater efficiencies, from target identification to targeted patient treatment. |

|

CorneaGen |

United States |

Innovation in tissue processing |

In 2025, CorneaGen's significant focus in the corneal implant space has been the continued expansion and acceptance of its ground-breaking Corneal Tissue Addition for Keratoplasty (CTAK) procedure for keratoconus action. |

Corneal Implants Market Companies

- Aurolab

- AJL Ophthalmic S.A.

- DIOPTEX

- Massachusetts Eye and Ear

- San Diego Eye Bank

- KeraMed, Inc.

- Presbia PLC

Recent Developments

- In December 2025, Mauritius President Dharambeer Gokhool inaugurated the Corneal Transplant and Pinhole Pupilloplasty Centre at Ebene, established by Dr Agarwal's Eye Hospital. The centre aims to provide advanced corneal surgeries for regional patients. (Source:https://health.economictimes.indiatimes.com)

- In June 2025, SKIMS Medical College & Hospital's Post-Graduate Department of Ophthalmology completed its first two corneal transplants. The procedures restored vision for two blind patients. (Source: https://www.greaterkashmir.com)

Segments Covered in the Report

By Type

- Human Cornea

- Synthetic

By Surgery Method

- Penetrating Keratoplasty

- Endothelial Keratoplasty

By Application

- Keratoconus

- Fuchs Dystrophy

- Infectious Keratitis

- Corneal Ulcers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting