What is the Data Center Security Market Size?

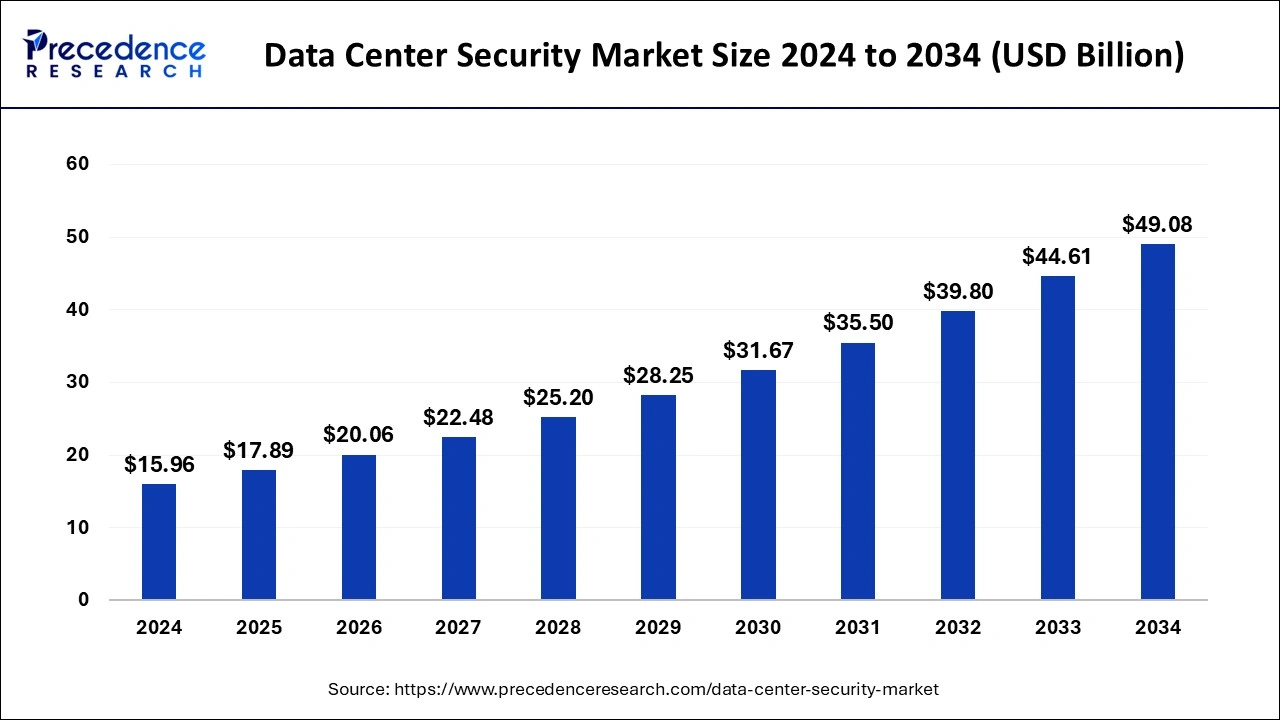

The global data center security market size is calculated at USD 17.89 billion in 2025 and is predicted to increase from USD 20.06 billion in 2026 to approximately USD 49.08 billion by 2034, expanding at a CAGR of 11.89% from 2025 to 2034.

Data Center Security MarketKey Takeaways

- The global data center security market was valued at USD 15.96 billion in 2024.

- It is projected to reach USD 49.08 billion by 2034.

- The data center security market is expected to grow at a CAGR of 11.89% from 2025 to 2034.

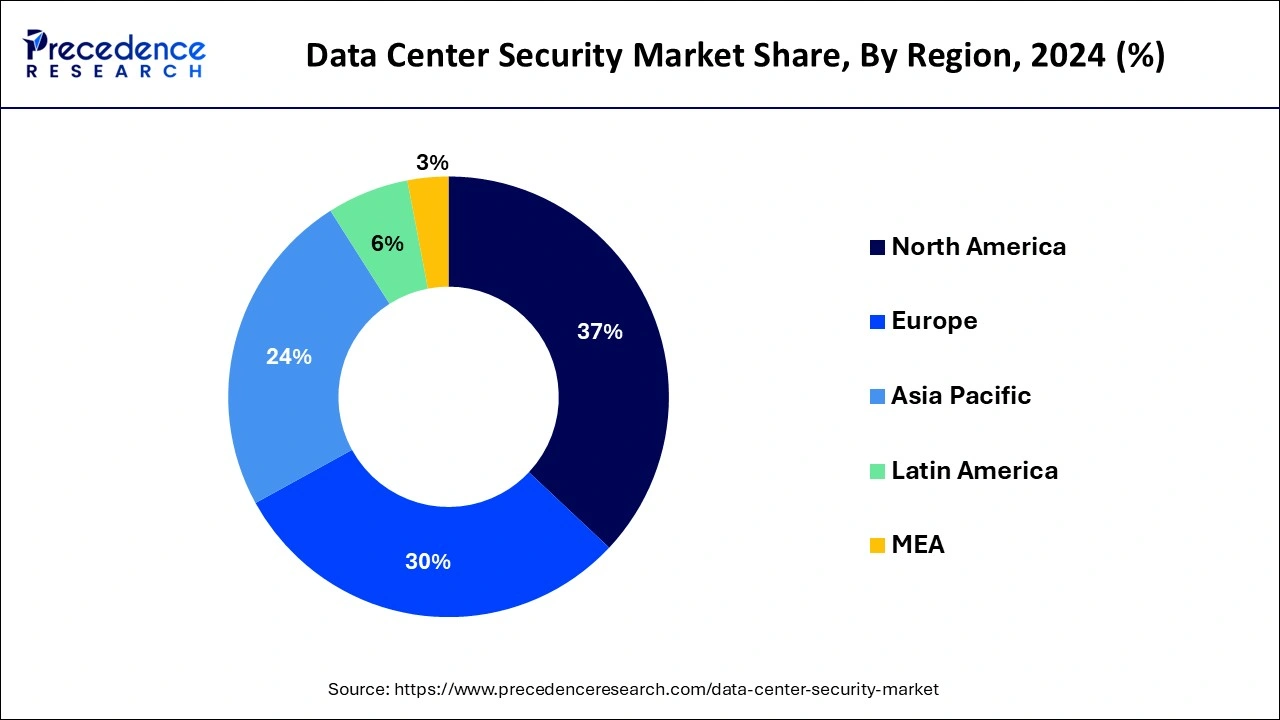

- North America contributed more than 37% of the market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By component, the solution segment has held the largest market share of 76% in 2024.

- By component, the service segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By data center type, the small data center segment has generated over 46% of market share in 2024.

- By data center type, the large data center segment is expected to expand at the fastest CAGR over the projected period.

- By industry vertical, the BFSI segment has accounted over 21% of market share in 2024.

- By industry vertical, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

The New Protection Trends

Data center security involves implementing measures to protect the physical and digital assets housed within data centers. It encompasses a range of technologies, processes, and protocols designed to safeguard against unauthorized access, data breaches, and cyber threats. These security measures include physical security controls such as access controls, surveillance systems, and environmental monitoring to protect against physical threats like theft, vandalism, and natural disasters.

On the digital front, data center security involves deploying firewalls, intrusion detection and prevention systems, encryption technologies, and endpoint security solutions to defend against cyber-attacks, malware, and data exfiltration attempts.

Additionally, comprehensive security policies, regular audits, and employee training are essential components of data center security to ensure compliance with regulatory requirements and maintain the integrity and confidentiality of sensitive data. Overall, data center security is crucial for ensuring the reliability, availability, and confidentiality of data and applications housed within data centers.

Data Center Security Market Data and Statistics

- According to a report by Risk Based Security, there were over 36 billion records exposed in data breaches in the first half of 2021 alone.

- In June of 2021, Equinix unveiled its ambitious strategy to construct 32 hyperscale data centers across key global markets.

- The National Security Agency's (NSA) staggering $1.5 billion data center in Bluffdale, Utah, stands out for its immense scale within the realm of government facilities. However, its design and purpose closely align with that of typical off-premise enterprise data centers.

- Research conducted by The Institution of Electronics and Telecommunication Engineers (IETE), CyberPeace Foundation (CPF), and Autobot Infosec Private Limited revealed approximately 51 million recorded attack events targeting Data Centers Network-based Threat Intelligence sensors network in India between April and December 2021.

- The same report indicates a looming surge in DDoS cyberattacks. Cisco's projection suggests a doubling of DDoS attacks by 2023, reaching a staggering figure of over 15.4 million.

- The International Data Corporation (IDC) predicts that by 2025, over 50% of all IT spending will be on cloud-based technologies.

- The Verizon Data Breach Investigations Report (DBIR) 2021 found that 85% of breaches involved human elements, highlighting the need for comprehensive security protocols.

Data Center Security Market Growth Factors

- With the increasing frequency and sophistication of cyber-attacks, data centers face significant security challenges. As a result, organizations are investing in robust security solutions to protect their critical infrastructure, driving the demand for data center security solutions.

- Compliance with regulations such as GDPR, HIPAA, PCI-DSS, and others necessitates stringent security measures within data centers. Companies are compelled to invest in security solutions to ensure compliance, thereby driving the growth of the data center security market.

- The rapid adoption of cloud computing and the proliferation of cloud-based services have led to the expansion of data centers. As more businesses migrate their operations to the cloud, the need for robust security measures to safeguard data stored in data centers becomes paramount, thereby fueling the expansion of the data center security market.

- Advancements in technologies such as artificial intelligence (AI), machine learning (ML), and automation have enhanced the capabilities of data center security solutions. These technologies enable real-time threat detection, rapid incident response, and proactive security measures, driving the adoption of advanced security solutions in data centers.

- Heightened awareness of data privacy and the increasing frequency of data breaches have made data security a top priority for organizations. Data center security solutions play a critical role in protecting sensitive information from unauthorized access, theft, and manipulation, driving market growth.

- The proliferation of IoT devices and the adoption of edge computing are expanding the attack surface for cyber threats. Data centers supporting IoT and edge computing applications require robust security measures to protect data and infrastructure from evolving cyber threats, driving the demand for data center security solutions.

Data Center Security Market Outlook: Emerging Opportunities

- Industry Growth Overview: The growing cyber threats, rapid expansion of cloud computing, AI technologies, and stringent regulations are driving the industrial growth in the market.

- Sustainability Trends: The sustainability trend involves ensuring energy-intensive security systems and management of equipment lifecycle to minimize e-waste.

- Global Expansion: The growing data generation, cyber attacks, and strict regulatory compliance are driving the global expansion of the market.

- Major Investors: Large private equity firms, infrastructure firms, and major institutional investors are the major investors in the market.

- Startup Ecosystem: The startup ecosystem is developing AI-driven solutions to tackle the growing complexity of modern data center architectures.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.89% |

| Market Size in 2025 | USD 17.89 Billion |

| Market Size in 2026 | USD 20.06 Billion |

| Market Size by 2034 | USD 49.08 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Data Center Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing frequency and sophistication of cyber threats

The rise in cyber threats, such as malware, ransomware, and hacking attempts, has created a pressing need for robust data center security solutions. As cybercriminals become more sophisticated in their techniques, organizations face higher risks of data breaches and system compromises. This heightened threat landscape has compelled businesses to invest significantly in enhancing the security of their data centers to protect sensitive information and critical infrastructure from unauthorized access and malicious attacks. To mitigate the risks posed by cyber threats, companies are deploying advanced security measures, including intrusion detection systems, firewalls, encryption technologies, and security analytics tools within their data centers.

These solutions help organizations detect and respond to threats in real-time, fortifying their defenses against evolving cyber-attacks. As the frequency and complexity of cyber threats continue to escalate, the demand for data center security solutions is expected to surge further, driving market growth as businesses prioritize safeguarding their digital assets and maintaining the integrity of their operations.

Restraint

Compliance requirements leading to resource constraints

Compliance requirements, such as GDPR, HIPAA, and PCI-DSS, impose strict guidelines on data protection and security measures within data centers. While these regulations are essential for safeguarding sensitive information, they often result in resource constraints for businesses. Meeting compliance standards demands significant investments in security technologies, personnel training, and audit procedures, diverting resources away from other critical areas of operation. This allocation of resources can strain budgets and limit the capacity of organizations to invest in comprehensive data center security solutions.

Moreover, compliance requirements may introduce complexities in the implementation and management of security measures, further exacerbating resource constraints. The need to continually adapt to evolving regulatory frameworks adds to the operational burden, potentially hindering the adoption of advanced security technologies. Consequently, while compliance is vital for maintaining trust and regulatory adherence, the associated resource constraints may impede organizations' ability to fully address the complex and dynamic security challenges within data centers, thereby restraining demand for comprehensive data center security solutions.

Opportunity

Expansion of hyper-scale data centers

The expansion of hyperscale data centers presents significant opportunities for the data center security market. As hyperscale data centers grow in size and capacity to accommodate vast amounts of data and processing power, the need for robust security measures becomes paramount. These large-scale facilities house critical information for numerous organizations, making them lucrative targets for cyber-attacks. Consequently, there is a heightened demand for advanced security solutions tailored to the unique requirements of hyperscale environments.

Moreover, the expansion of hyperscale data centers often involves the deployment of cutting-edge technologies and architectures, such as cloud-native applications and distributed computing platforms. This creates opportunities for security vendors to develop innovative solutions that can seamlessly integrate with these infrastructures to provide comprehensive protection against evolving cyber threats. By addressing the security challenges specific to hyperscale environments, vendors can capitalize on the growing demand for data center security solutions and establish themselves as key players in this rapidly expanding market segment.

Component Insights

The solution segment held the highest market share of 75% in 2024. In the data center security market, the solution segment comprises various offerings aimed at safeguarding data center infrastructure and assets. This includes firewall and intrusion detection systems, encryption solutions, access control systems, and security management software. A notable trend in this segment is the increasing adoption of integrated security platforms that offer comprehensive protection against a wide range of cyber threats. Additionally, there is a growing emphasis on solutions incorporating advanced technologies like artificial intelligence and machine learning for real-time threat detection and response.

The service segment is anticipated to witness rapid growth at a significant CAGR during the projected period. In the data center security market, the service segment encompasses offerings such as consulting, implementation, training, and support services. Service providers assist organizations in designing, deploying, and managing effective security solutions tailored to their specific needs. An emerging trend in this segment is the increasing demand for managed security services, where third-party providers offer continuous monitoring, threat detection, and incident response capabilities. This trend reflects a growing preference among organizations to outsource security operations to experts, enabling them to focus on their core business activities.

Data Center Type Insights

The small data center segment held a 46% market share in 2024. Small data centers typically serve the needs of small to medium-sized businesses or specific departments within larger organizations. These facilities house a limited number of servers and networking equipment, often with less than 100 racks. Despite their size, small data centers face similar security concerns as larger facilities, including cyber threats and regulatory compliance. Trends in the Data Center Security market for small data centers include the adoption of integrated security solutions, cloud-based security services, and the use of automation to streamline security operations.

The large data center segment is anticipated to witness rapid growth over the projected period. Large data centers are facilities that typically span tens of thousands of square feet and house extensive computing and storage infrastructure. In the data center security market, trends indicate a heightened focus on advanced threat detection and prevention measures, encryption technologies, and robust access controls within large data centers. As these facilities store vast amounts of sensitive data, securing them against cyber threats and unauthorized access is paramount, driving the adoption of sophisticated security solutions tailored to their scale and complexity.

Industry Vertical Insights

The BFSI segment has held a 21% market share in 2024. The BFSI (Banking, Financial Services, and Insurance) segment encompasses institutions involved in financial transactions, including banks, credit unions, insurance companies, and investment firms. In the Data Center Security market, BFSI organizations prioritize safeguarding sensitive financial data, customer information, and transactional records from cyber threats and data breaches. Key trends in this segment include the adoption of advanced encryption techniques, real-time threat detection systems, and regulatory compliance measures to ensure the security and integrity of financial operations.

The healthcare segment is anticipated to witness rapid growth over the projected period in the data center security market. In the healthcare industry vertical, data center security refers to safeguarding electronic health records (EHRs), patient information, and critical medical systems from cyber threats. Trends in this segment include the adoption of advanced encryption techniques, robust access controls, and stringent compliance measures such as HIPAA. Healthcare organizations are increasingly investing in data center security solutions to protect sensitive data from breaches and ensure regulatory compliance, given the growing frequency of cyber-attacks targeting the healthcare sector.

Regional Insights

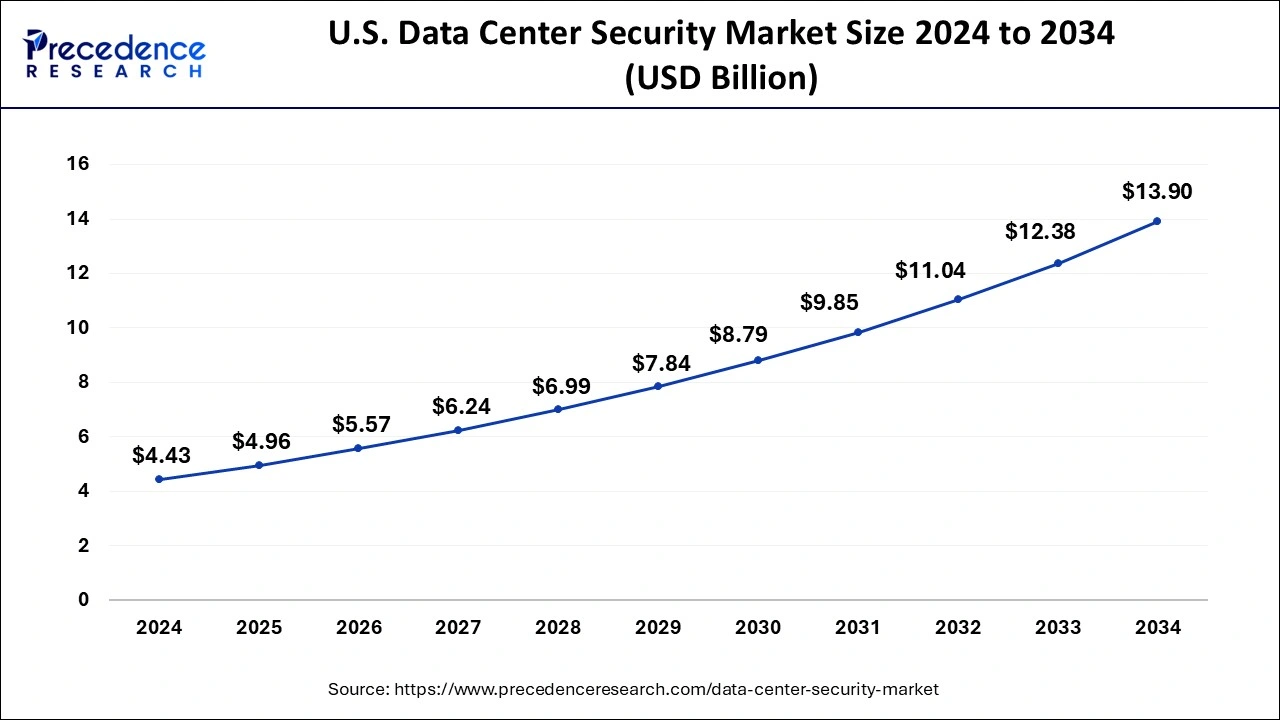

U.S.Data Center Security Market Size and Growth 2025 to 2034

The U.S. data center security market size is estimated at USD 4.96 billion in 2025 and is projected to surpass around USD 13.90 billion by 2034 at a CAGR of 12.11% from 2025 to 2034.

Well-Developed Infrastructure Drives North America

North America held a share of 37% in the data center security market in 2024 due to several factors. The region boasts a high concentration of large enterprises, technology companies, and financial institutions that heavily rely ondata center infrastructure. Moreover, North America has stringent regulatory requirements for data protection and security, driving the adoption of advanced security solutions. Additionally, the region's strong cybersecurity ecosystem, coupled with significant investments in research and development, further reinforces its dominance in the data center security market.

Growth In Cloud Computing Boosts the Asia Pacific

Asia-Pacific is experiencing rapid growth in the data center security market due to several factors. This growth is driven by theincreasing adoption of cloud computing, digital transformation initiatives, and the proliferation of data-driven technologies across various industries. Additionally, rising cyber threats and stringent regulatory requirements are compelling organizations in the region to prioritize data center security investments. The expanding digital infrastructure and growing awareness about cybersecurity risks further contribute to the surge in demand for robust security solutions in Asia-Pacific.

Europe Driven by Stringent Regulations

Meanwhile, Europe is experiencing notable growth in the data center security market due to several factors. Stricter data protection regulations, such as GDPR, have compelled organizations to bolster their security measures to safeguard sensitive information. Additionally, the increasing adoption of cloud computing and digital transformation initiatives has fueled the demand for robust data center security solutions. Moreover, the region's proactive approach towards cybersecurity and rising awareness of cyber threats has further stimulated investments in advanced security technologies, contributing to the market's growth trajectory.

Rising Cyberattacks Fuel U.S.

Due to the increasing incidence of cyber attacks in the U.S, the use of data center security is increasing. The presence of advanced IT infrastructures is driving the generation of complex and large datasets, which is increasing the demand for their protection. The growing importance and regulatory compliance are encouraging their adoption.

Rapid Digitalization Transforms India

The rapid digitalization in India is increasing the use of various online platforms, which is increasing the demand for data protection. Additionally, the increasing cyberattacks are increasing the development of various security solutions, which are backed by innovations and regulations. The growth in IT services is also increasing the development of data security solutions.

Growing Alertness Expands the UK Market

The growth in cyber attack awareness is increasing the reliance on data center security in the UK. The growing digital infrastructure, cloud computing adoptions, and stringent regulations are encouraging their adoption. The companies are developing advanced products and services, which are increasing their adoption across various sectors.

Digital Growth Powers South America

South America is expected to grow significantly in the data center security market during the forecast period, due to rapid digitalization. The growth in cyber-attacks is increasing their use, where these centres are offering cloud services and SaaS platforms to protect the data. Additionally, the growing government regulations, expanding smart cities, and investments are driving their adoption, promoting the market growth.

Brazil's Data Security Boom

The data center security market in Brazil is experiencing robust growth, driven by digital transformation and stricter data protection laws like the LGPD. This expansion reflects increasing investments in sophisticated security measures to protect critical infrastructure and sensitive data.

The Security Giants: Key Players' Offering

- Cisco Systems, Inc.: Cisco SecureX, Duo Security, application-centric infrastructure (ACI), and Cisco Umbrella are provided by the company.

- Palo Alto Networks, Inc.: The company provides products like Prisma Cloud, Cortex SOAR, and next-generation firewalls.

- Fortinet, Inc.: FortiGate and FortiAnalyzer are the products provided by the company.

- IBM Corporation: The company provides products like IBM Security QRadar, IBM Cloud Satellite, IBM Guardium, and X-Force Red.

- Trend Micro Incorporated: Trend Cloud One workload security is provided by the company.

Data Center Security Market Companies

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Trend Micro Incorporated

- McAfee, LLC

- Juniper Networks, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Development LP

- Broadcom Inc.

- FireEye, Inc.

- Symantec Corporation

- F5 Networks, Inc.

- VMware, Inc.

Recent Developments

- In August 2022, NVIDIA unveiled a novel data center solution in collaboration with Dell Technologies, tailored for the AI era. This innovation integrates Dell PowerEdge servers with NVIDIA BlueField DPUs and GPUs, along with NVIDIA AI Enterprise software. The comprehensive offering extends cutting-edge capabilities in AI training, inference, data processing, and data science, complemented by robust zero-trust security features, catering to enterprises worldwide. The solution is finely tuned for VMware vSphere 8 enterprise workload platform, promising enhanced performance and efficiency.

- In November 2023, Schneider Electric, renowned for its leadership in energy management and automation, announced a substantial $3 billion multi-year agreement with Compass Datacenters. This agreement extends their ongoing partnership, leveraging synergies between their supply chains to manufacture and deliver prefabricated modular data center solutions, bolstering scalability and agility in data center deployments.

- In March 2023, Cisco, a prominent provider of networking, cloud, and cybersecurity solutions, unveiled ambitious plans to strengthen its commitment to India. This initiative includes establishing a new data center in Chennai, introducing advanced risk-based capabilities across its security portfolio for hybrid and multi-cloud environments, and launching enhanced features for its Duo Risk-Based Authentication solution.

- In October 2023, leading cybersecurity firm Fortinet announced the establishment of two dedicated data centers in Pune and Bengaluru to expand its Universal SASE, AI-powered Security Services, and FortiCloud offerings across India and SAARC regions. This strategic move underscores Fortinet's unwavering dedication to fortifying its presence and support infrastructure in India, complementing its existing investments in development and support centers in the country.

Segments Covered in the Report

By Component

- Solution

- Service

By Data Center Type

- Small Data Center

- Medium Data Center

- Large Data Center

By Industry Vertical

- BFSI

- IT and Telecom

- Healthcare

- Retail and E-commerce

- Media and Entertainment

- Government

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content