Data Center Transformation Market Size and Growth 2025 to 2034

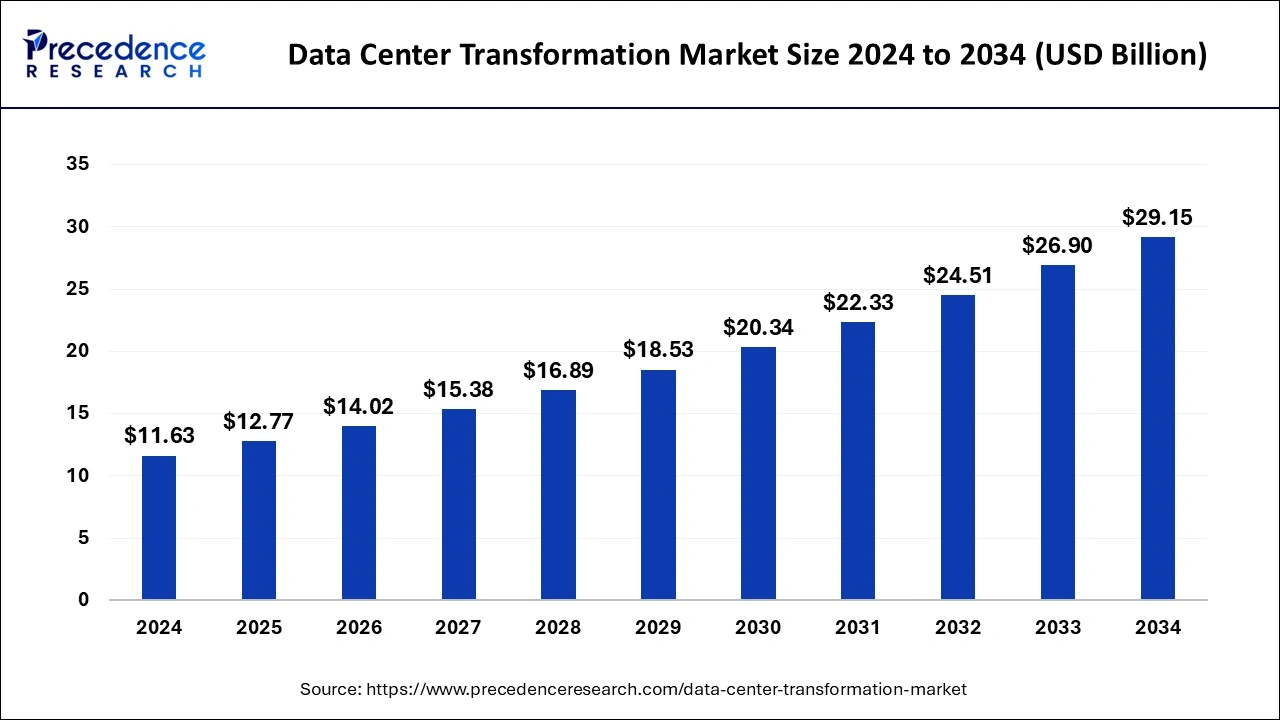

The global data center transformation market size was valued at USD 11.63 billion in 2024 and is anticipated to reach around USD 29.15 billion by 2034, growing at a CAGR of 9.62% from 2025 to 2034. The data center transformation market is experiencing significant growth due to the rising usage of cloud computing.

Data Center Transformation Market Key Takeaways

- The global data center transformation market was valued at USD 11.63 billion in 2024.

- It is projected to reach USD 29.15 billion by 2034.

- The data center transformation market is expected to grow at a CAGR of 9.62% from 2025 to 2034.

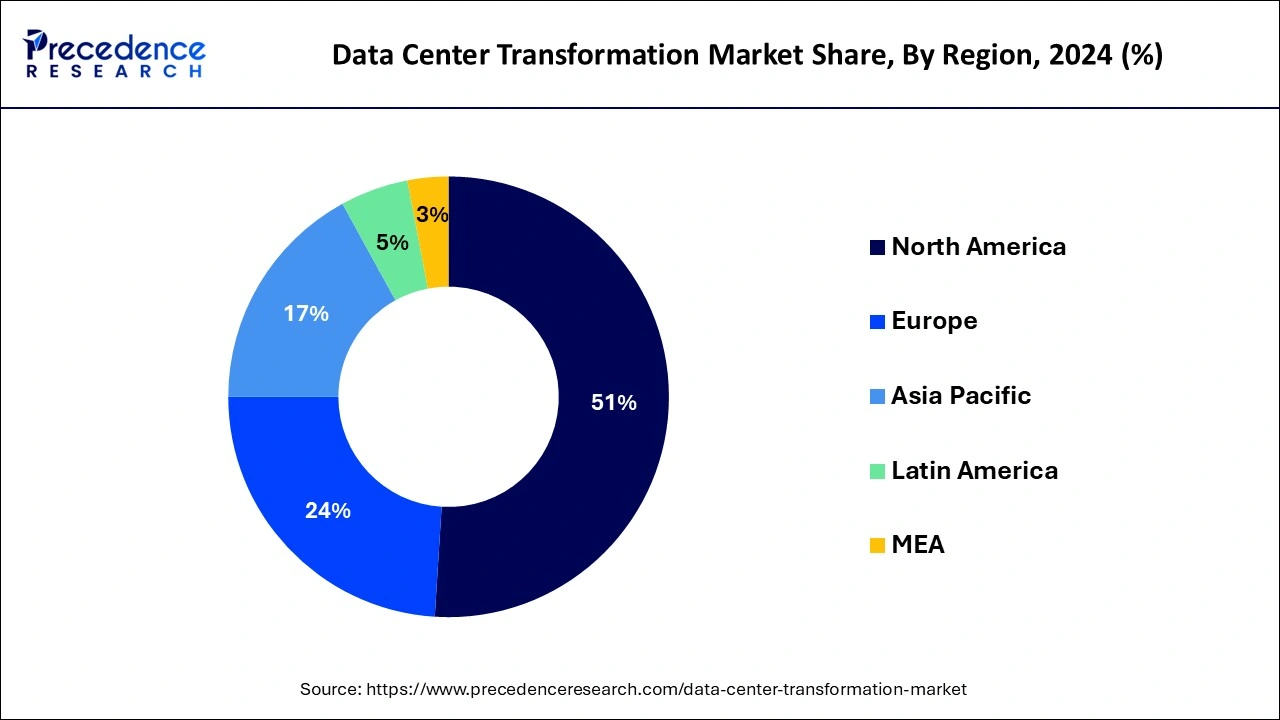

- North America dominated data center transformation market with revenue share of 51% in 2024.

- By service, the consolidation segment has dominated the market in 2024 with revenue share of 36.5%.

- By end-user, the cloud service providers services segment dominated the data center transformation market in 2024 with revenue share of around 48%.

- By vertical, the IT & telecommunications segment dominated the market in 2024.

How does AI impact the Data Center Transformation Market?

The landscape of data center operations is undergoing a significant transformation, majorly due to the increasing adoption of artificial intelligence (AI) technologies. One of the key benefits of AI in this sector is its ability to allocate power resources intelligently. By analyzing the workloads of various servers, AI can prioritize power to those handling the most demanding tasks while simultaneously reducing energy supply to underutilized servers. In some cases, AI can even power down hardware that is not in use, thereby optimizing energy consumption. Furthermore, many data centers are integrating renewable energy sources into their power infrastructure. AI can manage the seamless integration of these green energy sources, enhancing sustainability and reducing overall operational costs.

U.S. Data Center Transformation Market Size and Growth 2025 to 2034

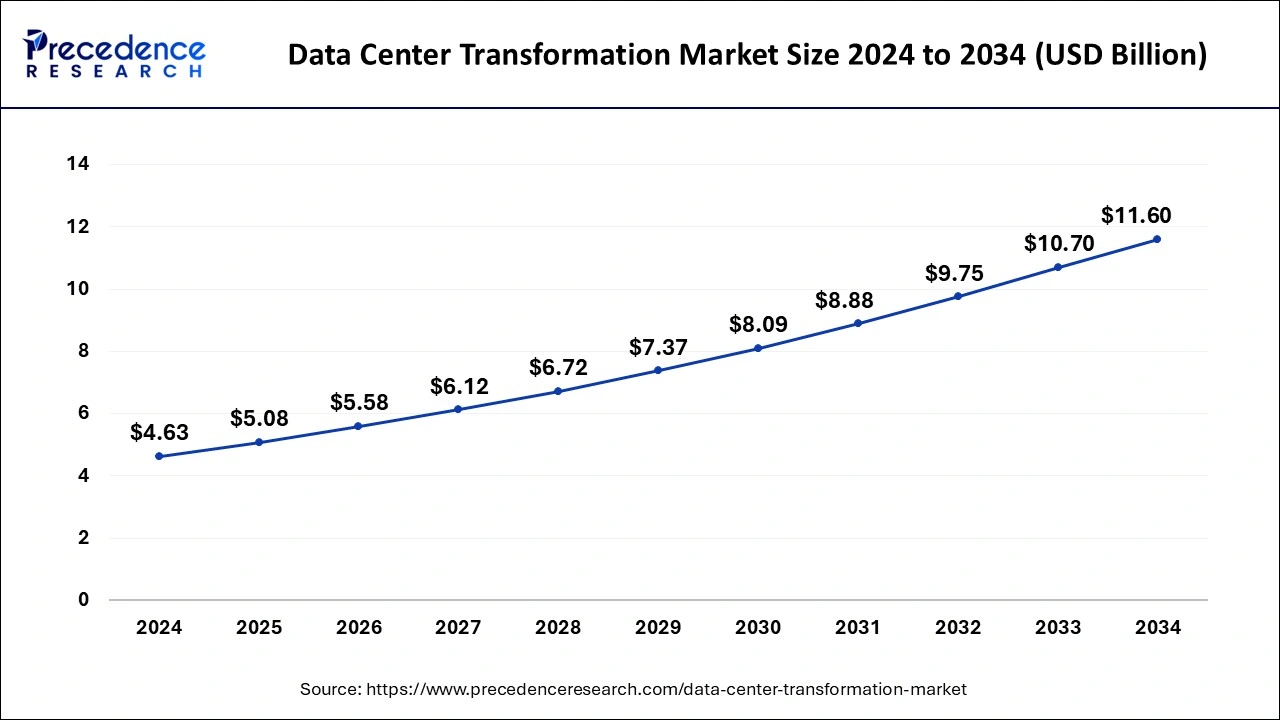

The U.S. data center transformation market size was estimated at USD 4.63 billion in 2024 and is projected to surpass around USD 11.60 billion by 2034 at a CAGR of 9.62% from 2025 to 2034.

North America had the largest market share in 2024 in the data center transformation market throughout the predicted timeframe. The area has a robust digital economy, with sectors including IT, finance, e-commerce, and entertainment leading the way. These industries' heavy reliance on data centers for processing, storing, and analyzing enormous volumes of data fuels the need for updated and effective data center infrastructures. North America boasts a highly skilled workforce in fields such as information technology, engineering, and data science. This pool of talent contributes to the development and deployment of advanced data center solutions, including virtualization, automation, and artificial intelligence-driven optimizations.

North America has made significant investments in telecommunications and internet infrastructure, laying the foundation for robust data center networks. This infrastructure supports the expansion of data center facilities and enables high-speed connectivity, which is essential for efficient data processing and storage. Many of the leading data center service providers and technology vendors based in North America have a global presence. Their expertise, coupled with extensive networks of data centers worldwide, allows them to cater to the needs of clients across different regions, further consolidating North America's dominance in the data center transformation market.

Asia-Pacific is observed to be the fastest growing in the data center transformation market during the forecast period. Adequate data privacy and security precautions are required as digital activities increase. Modern data centers with cutting-edge security features like encryption, biometric access controls, and threat detection systems are becoming increasingly expensive for businesses and government organizations. Several regional governments are promoting the construction of data center infrastructure through financial contributions, tax breaks, and legislative initiatives. These programs seek to guarantee data security and compliance, encourage digital innovation, and draw in foreign investment.

Market Overview

The data center transformation market offers services for altering an organization's IT infrastructure to enhance its functionality, effectiveness, and efficiency. Some examples of this process are data center migration, significant hardware modifications, the addition of virtualization and software-defined components, and the automation of business procedures. Integrating virtualization and cloud computing into an existing data center is a common step in transformation. The data center must be upgraded or redesigned to accommodate remote access, network virtualization, and other cloud computing characteristics because traditional data centers are not designed to use cloud computing.

- India is observed to have 183 new facilities totaling almost 24 million square feet and at least 1,752 MW of IT capacity with the addition of new data centers in the upcoming year. Over 69% of the total anticipated IT capacity, 51 percent of which is in Mumbai alone, will be centered in two cities, Mumbai and Chennai.

Data Center Transformation Market Growth Factors

- The architecture of data centers is being strained by the growing use of technologies like big data analytics, cloud computing, and the Internet of Things (IoT).

- To manage the increasing volume of data and guarantee effective processing, businesses must modernize their data centers.

- The antiquated data center infrastructure that many firms are stuck with is costly to maintain and ineffective.

- They can modernize their systems for increased cost savings, security, and efficiency with the aid of data center transformation.

- The need for transformation services is increased by the emergence of edge computing, which processes data closer to its source and calls for modifications to data center equipment and design.

- By streamlining data flow and improving network infrastructure, transformation solutions solve these problems.

Data Center Transformation Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.62% |

| Global Market Size in 2025 | USD 12.77 Billion |

| Global Market Size by 2034 | USD 29.15 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service, By End-user, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

A vast pool of skilled labor

Adopting new technologies like software-defined networking (SDN), cloud computing, edge computing, and hyper-converged infrastructure (HCI) is a standard part of data center transformation. To properly examine these technologies, determine whether they are appropriate for the organization's objectives, and install them in a data center setting, skilled manpower is required. Within data centers, skilled personnel fosters innovation by investigating new technologies, trends, and industry best practices. They pinpoint areas where data center infrastructures can be made more resilient, scalable, and optimized for the future. In the quickly changing digital landscape, this proactive strategy aids firms in maintaining their agility and competitiveness.

Surging data storage demands

Big data has completely changed how businesses function and make choices. Companies in various sectors use big data analytics to spur innovation, increase operational effectiveness, and obtain insightful knowledge. Data storage designs are now more complicated due to the emergence of edge computing, which places data processing closer to the point of data generation. Edge sites need storage solutions that can manage sporadic connectivity, low-latency access, and data synchronization across dispersed settings. Efficient storage solutions support real-time applications and services at the network's edge in data centers and computing infrastructure.

Restraint

Difficulty in managing the Complex infrastructure

Complexity raises the possibility of service interruptions, downtime, and performance bottlenecks. Ensuring fault tolerance, disaster recovery, and high availability in a complex infrastructure calls for proactive maintenance plans, strong architecture designs, and monitoring systems. Because managing sophisticated infrastructure requires specialized tools, software licenses, maintenance, and employee training, operating expenses may rise. Managing costs and optimizing performance through resource allocation is a persistent challenge for the data center transformation market.

Opportunity

Progressive government policies

Governments prioritizing digital infrastructure development can create opportunities for the data center industry. This includes initiatives to expand high-speed internet access, promote cloud computing adoption, and support emerging technologies like Internet of Things (IoT) and artificial intelligence (AI). As businesses and consumers increasingly rely on digital services, a growing demand for robust data center infrastructure to support these services creates a favorable market environment.

Service Insights

The consolidation services segment dominated the data center transformation market in 2024. Data center consolidation helps companies reduce the number of physical data centers by reducing or merging servers, storage systems, networking systems, and locations. The aim is to build a more centralized and adequate infrastructure. To reduce inefficiencies and increase efficiency, businesses combine several data centers into fewer, larger spaces.

As a result, companies that decide to move workloads to more productive virtual platforms, made possible by the growing acceptance of virtualization and cloud computing, resort to data center consolidation services. Presently, vendors of data center consolidation services include hybrid and multi-cloud services. These manuals assist businesses with cloud platform selection, migration management, and seamless integration upkeep.

End-user Insights

The cloud service providers services segment dominated the data center transformation market in 2024. Data centers have undergone substantial evolution from conventional on-premises facilities to contemporary, incredibly efficient, and scalable infrastructures. In the past, businesses were responsible for maintaining on-site networking, storage, and physical servers. However, as digital technologies and data volumes increased, maintaining this infrastructure became more difficult and expensive.

- In January 2023, State Street Corporation declared that, as part of its multi-year digital transformation journey, it has appointed Microsoft and Amazon Web Services (AWS) as key cloud and infrastructure solutions providers.

The colocation providers segment is observed to be the fastest growing segment in the data center transformation market during the forecast period. Data centers are essential to organizations running in our increasingly interconnected society. These cutting-edge facilities manage, process, and safeguard the enormous volumes of data that businesses produce and depend on. Due to the growth of big data analytics, cloud computing, and digital transformation, data centers are now an essential component of IT plans. However, data centers have played a crucial role in company operations since the early days of computers; thus, their position is not new.

They have changed and evolved to satisfy the increasing need for effective and safe data management and storage. Colocation data centers provide efficient data handling and seamless connection and have emerged as significant players in this growth. India has become a notable market in this fast-paced global business, significantly increasing colocation services.

Vertical Insights

The IT & telecommunications segment dominated the data center transformation market in 2024. With the introduction of various technologies such as 5G, IoT, virtual reality & augmented reality, and AI/ML, the telecommunications sector is adapting to meet the demands of extensive data processing and low latency.

The telecom data centers are undergoing change to meet the demands of low latency and high data volume. With the arrival of the data revolution and the emergence of smart cities, automation in homes and businesses, over-the-top (OTT) services, and intelligent transportation, consumer and corporate landscapes are changing quickly. A recurring motif emerges as data is pervasive and rapidly expanding. First-generation networks were analog and limited to voice; digital communication was introduced by 2G; mobile data and video were added by 3G; high-speed access was made possible by 4G; and vast bandwidth and low latency were brought about by 5G.

The BFSI segment is observed to witness a notable rate of growth during the forecast period in the data center transformation market. BFSI companies are undergoing digital transformation initiatives to improve customer experience, streamline operations, and stay competitive in the market. This involves the adoption of cloud computing, mobile banking, digital payment systems, and other innovative technologies that require agile and scalable data center infrastructure. Data center transformation enables BFSI organizations to modernize legacy systems, migrate to cloud-based platforms, and deploy hybrid IT architectures to support digital initiatives effectively.

Data Center Transformation Market Companies

- IBM Corporation

- Cisco Systems, Inc.

- Dell EMC

- HCL Technologies

- Cognizant

- Accenture

- Atos

- Wipro

- Microsoft Corporation

- Schneider Electric SE

Latest Announcement by Industry Leader

- In January 2025, NTT DATA, a global leader in digital business and IT services, announced a transformative year of global expansion and innovation within its Global Data Centers division, further accelerating its leadership in the data center industry. With more than US$ 10 billion, the company is expanding its data center business in North America, Europe, and Asia by 2027. As AI and digital transformation reshape industries, we're investing heavily to power and accelerate this transformation, said Doug Adams, CEO and President, Global Data Centers, NTT DATA.

Recent Developments

- In April 2024, Sify, One of the leading data center companies in India, announced investment plans of INR 3,000 crore to expand its data center capacity across India over the next five years.

Segments Covered in the Report

By Service

- Consolidation Services

- Optimization Services

- Automation Services

- Infrastructure Management Services

By End-user

- Cloud Service Providers

- Colocation Providers

- Enterprises

By Vertical

- BFSI

- IT & Telecommunications

- Government & Defense

- Energy

- Manufacturing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting