What is the Dental 3D Printing Market Size?

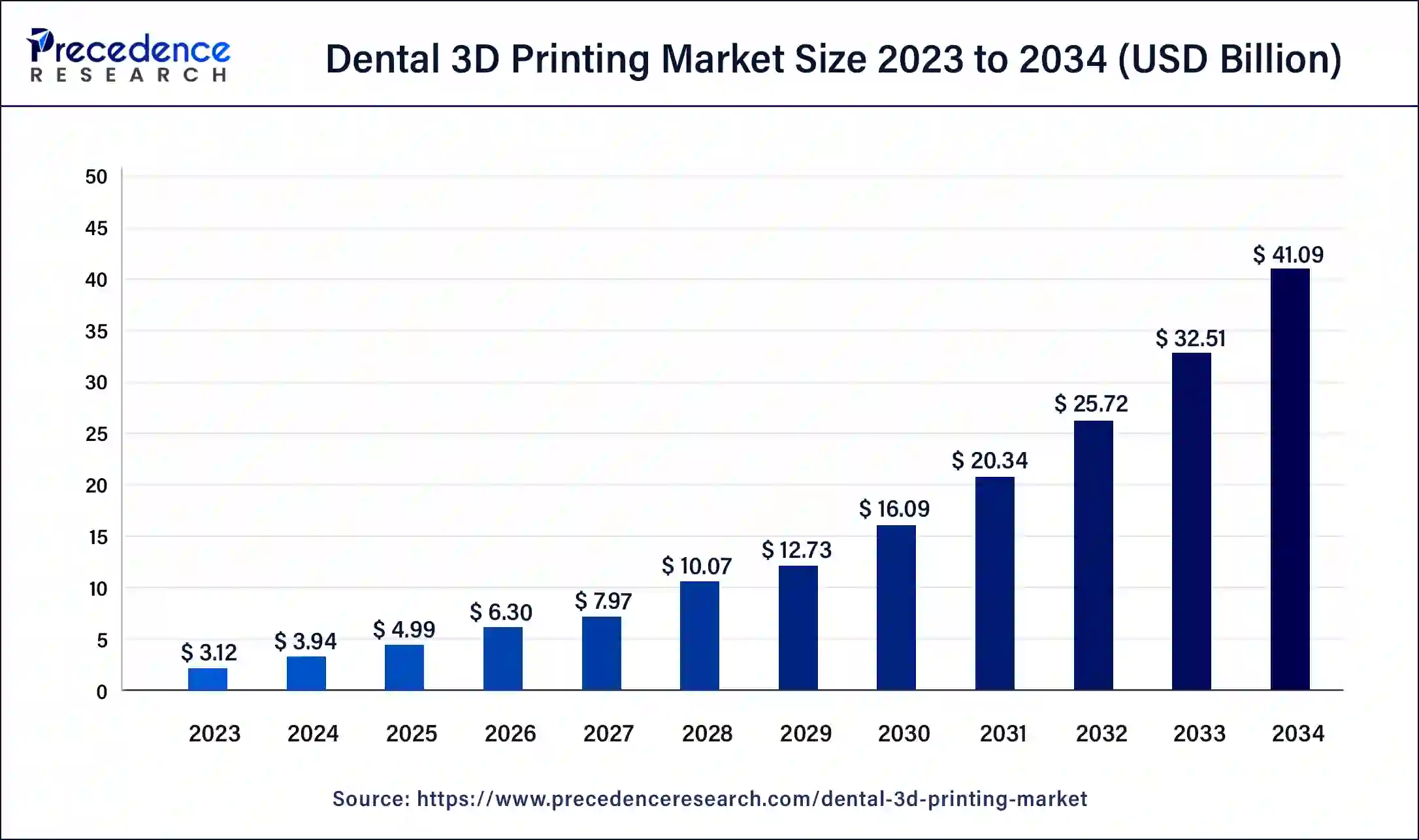

The global dental 3D printing market size is valued at USD 4.99 billion in 2025 and is predicted to increase from USD 6.30 billion in 2026 to approximately USD 41.09 billion by 2034, growing at a solid CAGR of 26.42% over the forecast period 2025 to 2034. The dental 3D printing market is driven by the quick uptake of digital dentistry and the rising need for individualized dental care.

Dental 3D Printing Market Key Takeaways

- The global dental 3D printing market was valued at USD 3.94 billion in 2024.

- It is projected to reach USD 41.09 billion by 2034.

- The dental 3D printing market is expected to grow at a CAGR of 26.42% from 2025 to 2034.

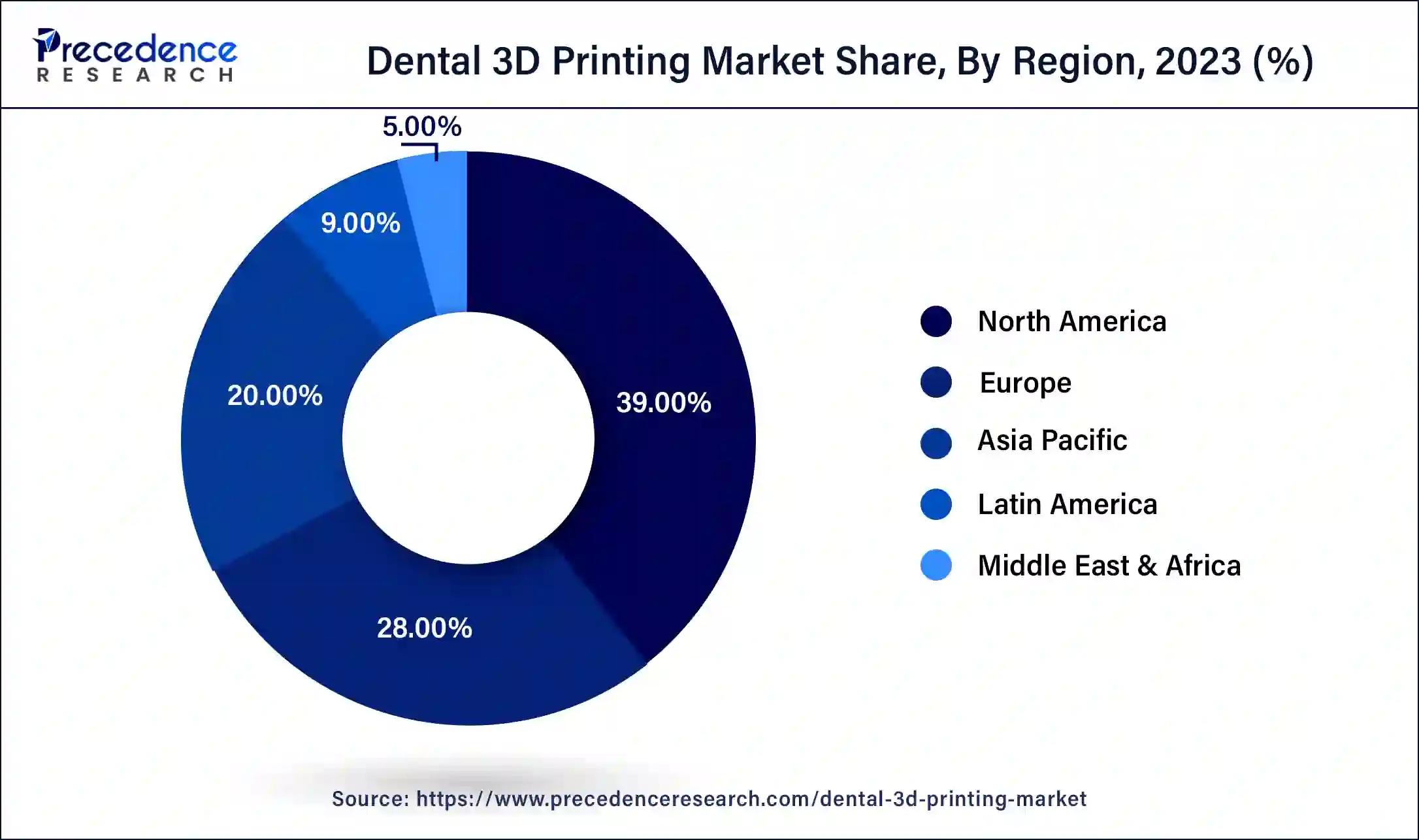

- North America dominated the dental 3D printing market of and contribute more than 39% of market share in 2024.

- Asia-Pacific is expected to grow at a notable CAGR of 27.1 1% during the forecast period.

- By application, the orthodontics segment generated the biggest market share of 40% in 2024.

- By application, the prosthodontics segment projected to grow at a significant CAGR of 26.92% during the forecast period.

- By technology, the vat photopolymerization segment dominated the dental 3D printing market in 2024.

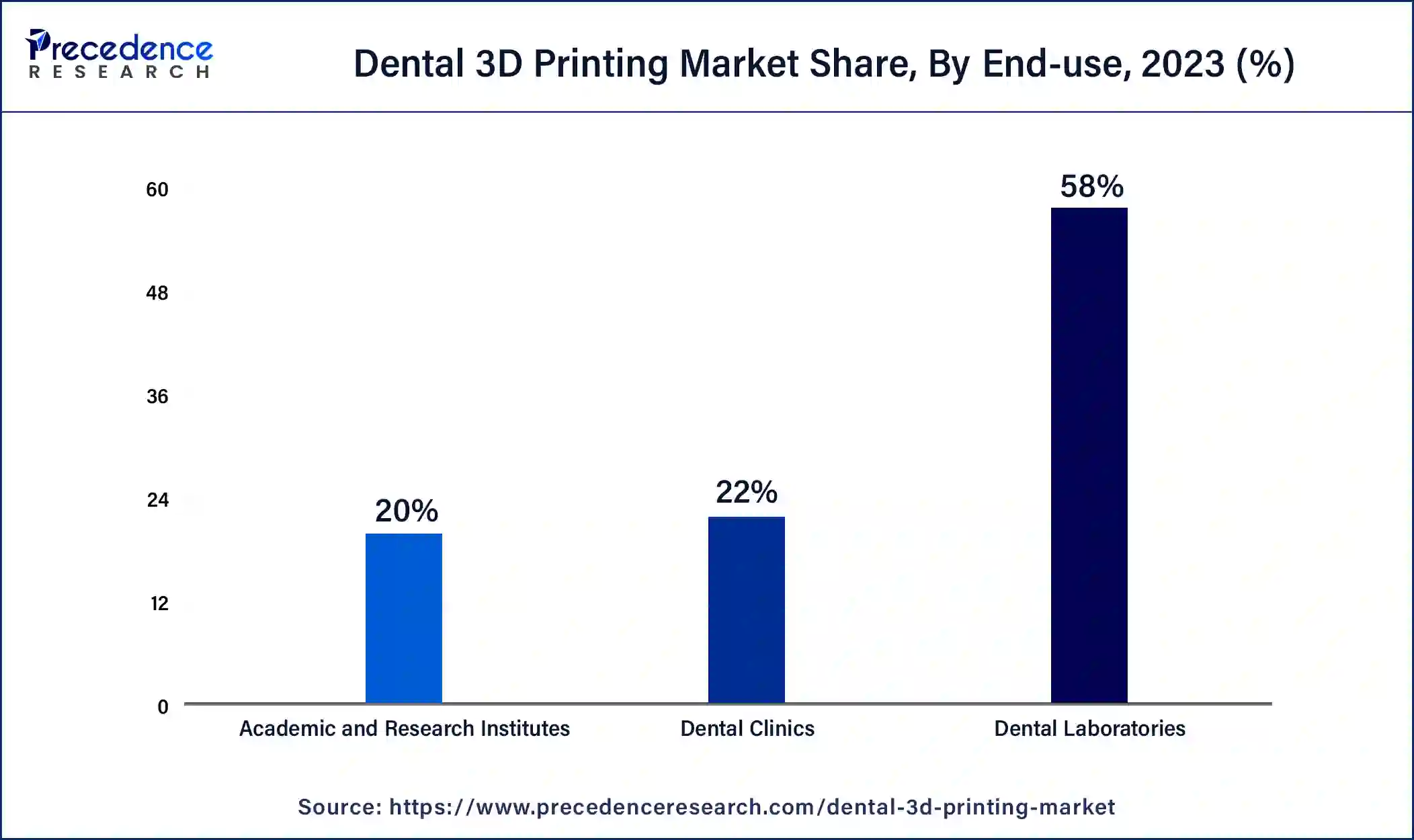

- By end-use, the dental laboratories segment recorded the highest market share of 58% in 2024.

- By end-use, the dental clinics segment is observed to be the fastest growing in the market during the forecast period.

How is AI helping the dental industry?

One of AI's most intriguing features is its potential to forecast future dental issues. AI can use data pattern analysis to anticipate possible problems and suggest preventive actions. This predictive capability can enhance long-term dental health and avoid invasive procedures. AI algorithms can identify issues that the human eye might miss. For instance, early indications of gum disease or cavities can be identified with greater accuracy, enabling prompt management. This accuracy guarantees that the appropriate treatment at the proper time improves dental health.

Even while AI and 3D printing are strong technologies separately, merging them can result in ground-breaking developments in dentistry. AI systems can expedite the design process by rapidly producing models and evaluating data.

Market Overview

The dental 3D printing market is the industry that develops and uses 3D printing technology, especially for dental applications. This includes using additive manufacturing techniques to make dental models, surgical guides, crowns, bridges, dentures, orthodontic devices, and implantable parts.

- According to the American Dental Association (ADA), approximately 17% of dentists adopted 3D printing technology in their practices in 2023. The ADA also stated that about 67% of dentists utilized this technology for a relatively short period. Specifically, less than two years implies the rising adoption of dental 3D printing in the United States.

Dental treatments can become more economical for both patients and practitioners when 3D printing is used, as it can reduce labor expenses and material waste. Additive manufacturing lowers the carbon footprint of dental production by reducing material waste and energy usage compared to traditional manufacturing methods. High precision and consistency in the production of dental items are made possible by 3D printing technology, which is essential for effective treatments.

- Align Technology has finalized the 79 million euro acquisition of Austrian polymer 3D printing startup Cubicure. To "support and scale" its "strategic innovation roadmap," it has taken the step to purchase Cubicure. Align has used 3D printing technology to create the molds for its Invisalign precise aligner products for around 20 years. But in recent years, it has begun investigating product printing directly.

Dental 3D Printing Market Growth Factors

- Highly tailored appliances, implants, and dental restorations are made possible by 3D printing, which enhances patient outcomes and comfort.

- Ongoing developments in 3D printing technology, software, and materials drive the industry ahead.

- The dental manufacturing process can be streamlined with 3D printing to cut expenses and production time.

- The need for dental treatments, particularly those made possible by 3D printing, is driven by the aging of the world population and rising awareness of oral health.

- Dental practitioners are utilizing 3D printing technology in their practices and are becoming increasingly accustomed to it.

Market Outlook

- Industry Growth Overview: The dental 3D printing industry is experiencing significant growth as clinics and laboratories increasingly adopt digital workflows to deliver faster, more precise, and more customized dental restorations. Advancements in printing technologies, expanding applications in prosthetics, orthodontics, and implants, and rising patient demand for efficient, personalized dental care are driving market expansion.

- Global Expansion: The market is expanding worldwide, fueled by increasing demand for custom, patient-specific restorations and shorter treatment durations, wider adoption of digital dentistry, an aging population needing prosthetics, and the rising popularity of cosmetic and orthodontic dental services.

- Major Investors: Major investors in the market include venture capital firms and corporate backers supporting startups and established players, such as SprintRay and Carbon, funding innovations in printers, materials, and digital dental workflows globally.

- Startup Ecosystem: The market's startup ecosystem is rapidly evolving, as emerging firms are launching chair‑side and lab-based solutions that deliver faster, affordable, patient‑specific prosthetics, aligners, and surgical guides. These startups leverage advances in biocompatible resins, AI-driven design automation, and compact 3D printers to reduce turnaround time and broaden access across clinics and labs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 41.09 Billion |

| Market Size in 2025 | USD 4.99 Billion |

| Market Size in 2026 | USD 6.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 26.42% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Technology, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing adoption of digital dentistry

Digital dentistry decreases the time required for diagnosis, planning, and treatment implementation. When equipped with digital scans and designs, 3D printers can create dental components (crowns, bridges, dentures) more quickly than conventional procedures. This efficiency may result in improved patient turnover and shorter appointment times. Conventional dental procedures can cause less discomfort when digital instruments and 3D printing are used. Referrals and patient loyalty may rise because of this development.

Increasing awareness and training

Educational establishments and dental associations are incorporating 3D printing technology into their curricula as dental practitioners grow increasingly conscious of the advantages and uses of this technology. Dentists and technicians can better grasp 3D printing's capabilities and advantages over conventional procedures by participating in workshops, webinars, and certification programs. Dental professionals can share knowledge more easily through social media groups, professional associations, and online forums. By enabling practitioners to exchange best practices, talk about their experiences, and learn from one another, these platforms raise awareness and provide more possibilities for training.

Restraint

Technological complexity

Complex software is frequently needed for dental 3D printing to create and construct dental structures. Software platform compatibility problems may cause inconsistencies and mistakes. Dental businesses are subject to strict regulations, and 3D-printed goods have to meet safety and health requirements. Navigating these regulations might take a lot of effort and complexity. Standards for quality and safety are expected to change as the market develops, making it challenging for practices to stay up to date without ongoing investments in equipment and training.

Opportunity

Development of biocompatible and highly durable materials suitable for dental applications

The newest materials for 3D printing, like ceramics and high-performance thermoplastics, have improved mechanical qualities. These materials are long-lasting and dependable in dental applications because they can endure the stresses applied during chewing. Due to new materials, patient happiness is greatly impacted by the ability to create aesthetically beautiful dental treatments that closely resemble natural teeth in both appearance and function. Digital dentistry is becoming increasingly popular, which is pushing dentist offices to include 3D printing in their daily operations.

Application Insights

The orthodontics segment dominated the dental 3D printing market in 2024. Advancements have improved the functionality and aesthetics of orthodontic devices in biocompatible materials, such as dental resins explicitly created for orthodontic uses. These materials are perfect for personalized orthodontic solutions since they are strong, flexible, and appropriate for long-term intraoral use. With the ability to graphically display patients' treatment progress, orthodontists can improve patient involvement and communication. Patient loyalty and trust have increased due to being able to provide faster, more accurate treatments.

The prosthodontics segment shows a significant growth in the dental 3D printing market during the forecast period. Dental prosthesis including veneers, crowns, bridges, and dentures are designed and fitted by prosthodontists. High degrees of customization and customization are made possible by 3D printing technology, which is essential in the field of prosthodontics. In contrast to conventional techniques, 3D printing enables the production of personalized prosthetics that are anatomically suited to each patient, improving functioning, fit, and comfort.

Technology Insights

The vat photopolymerization segment dominated the dental 3D printing market in 2024. Vat photopolymerization technology, which includes stereolithography (SLA), digital light processing (DLP), and continuous digital light manufacturing (CDLM), can produce high-resolution dental structures with great precision. Photopolymer resin is cured layer by layer using a laser or other light source. This technology enables remarkably fine resolutions and complex geometries perfect for dental applications.

Dental labs and clinics can swiftly fabricate personalized dental goods, decreasing patient wait times and streamlining workflow within dental practices due to the capacity to produce parts on demand without requiring extensive setup times.

End-use Insights

The dental laboratories segment dominated the dental 3D printing market in 2024. Dental laboratories are at the forefront of innovation When creating personalized dental prostheses, including crowns, bridges, dentures, and implants. There is a great demand for individualized solutions, and 3D printing technology makes it possible to precisely customize, fit, and create patient-specific designs that are difficult to accomplish with conventional techniques. High production quantities can be achieved by printing many parts at once, which is very useful for large laboratories that handle a significant number of cases regularly. Because of its scalability, labs can produce dental restorations faster than ever without sacrificing quality.

- In July 2024, Stratasys launched the DentaJet XL, a new high-speed 3D printer designed to improve dental lab productivity further and reduce costs.

The dental clinics segment is observed to be the fastest growing in the dental 3D printing market during the forecast period. The dentistry sector is experiencing a transition to digital operations, with 3D printing at its center. Digital dentistry improves patient care by allowing a smooth transition from diagnostic to treatment planning and creation. Insurance companies' reimbursement policies have been gradually improving as they become aware of the advantages of 3D-printed dental items. This assistance encourages clinic adoption by lowering costs and increasing patient access to 3D-printed treatments.

Regional Insights

U.S. Dental 3D Printing Market Size and Growth 2025 to 2034

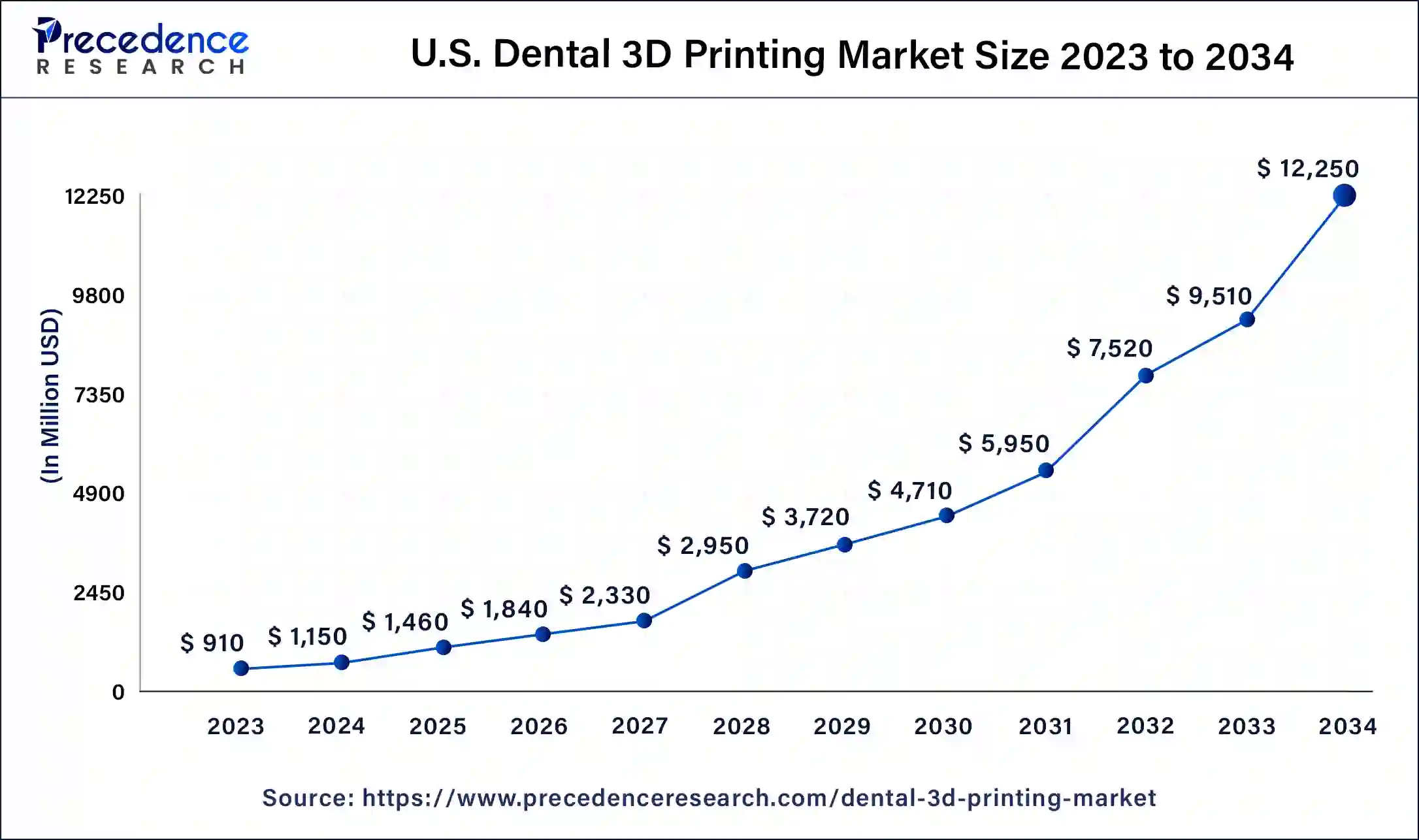

The U.S. dental 3D printing market size is exhibited at USD 1.46 billion in 2025 and is projected to be worth around USD 12.25 billion by 2034, poised to grow at a CAGR of 26.69% from 2025 to 2034.

North America dominated the dental 3D printing market in 2024. Dentists and technicians proficient in using cutting-edge technologies are widely available in the United States and Canada. Adopting and integrating 3D printing in dental practices is contingent upon having a skilled workforce. North American dentists had an early advantage in the market since they were among the first to use 3D printing for dental implants, crowns, bridges, dentures, and orthodontic products.

Top Companies in North America Deal with Dental 3D Printing

- Stratasys specializes in 3D printing technologies and solutions in Rehovot, Minnesota, United States. It offers a broader range of products and services for various industries, enabling customers to create prototypes, manufacturing tools, and end-use parts using additive manufacturing.

- SprintRay Inc. in Los Angeles, California, United States. It offers professional 3D printing solutions for digital dentistry. It provides fully integrated dental appliance design for its SprintRay 3D printers and a range of products, such as desktop 3D printers, printing materials and post-processing systems. Its advanced cloud software system, SprintRay Cloud Design, connects users with top designers worldwide and provides live monitoring and resin usage predictions.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is observed to be the fastest growing in the dental 3D printing market during the forecast period. Growth is being promoted by increased investments in 3D printing technology research and development from the public and private sectors. Japan and South Korea are two nations making significant investments in 3D printing for dentistry and other medical fields. As people become more aware of their appearance,cosmetic dentistry is becoming more and more popular in the area. To provide accurate, visually beautiful dental restorations, 3D printing technology is essential.

How Big is the Success of Europe in the Market?

Europe is making significant progress in the dental 3D printing market due to its advanced healthcare and dental laboratory infrastructure, widespread adoption of digital dentistry workflows, and strict regulatory standards for biocompatible materials. High demand for personalized restorations among aging and cosmetic-conscious populations, along with strong dental tourism and academic-industry innovation ecosystems, further boost the adoption of 3D-printed crowns, aligners, and prosthetics.

How Crucial is the Role of Latin America in the Dental 3D Printing Market?

Latin America plays a vital role in market growth as demand increases for affordable, customized dental care across countries like Brazil and Mexico. The adoption of digital dentistry by clinics and labs, more dental schools training in 3D technologies, expanding private clinic networks, and growing patient interest in orthodontics, implants, and cosmetic dentistry all drive this expansion. Widespread growth of dental services, rising disposable incomes, and improved healthcare infrastructure strengthen the region's potential for large-scale 3D-printed dental solutions across various care segments.

How Big is the Opportunity for the Growth of the Market in the Middle East & Africa?

The Middle East & Africa presents significant opportunities for the dental 3D printing market, driven by expanding healthcare infrastructure, rising consumer demand for aesthetic dental treatments, and growing dental tourism in countries like the UAE and Saudi Arabia. Increasing investments in clinics and hospitals, rising affordability among middle‑income populations, and the adoption of digital dentistry support the use of 3D‑printed crowns, dentures, and orthodontic devices, while capacity-building in training and service networks further strengthens market expansion.

The UAE significantly contributes to the Middle East & Africa dental 3D printing market, driven by several ongoing trends. There is widespread adoption of digital dentistry, including intraoral scanners, CAD/CAM, and 3D printing, which is modernizing clinics across the country. Strong medical tourism inflows are driving demand for high-end, cosmetically focused dental treatments such as same-day crowns, veneers, and aligners. Government support for healthcare infrastructure and incentives for adopting advanced equipment further boost growth. All these factors make the UAE a leading hub for dental 3D printing in the region.

Value Chain Analysis

- Research & Development: Companies design and test novel 3D printers, biocompatible resins, and digital workflows for precise, patient-specific dental restorations.

Key Players: SprintRay, EnvisionTEC, Carbon, Formlabs, DWS Systems. - Clinical Trial and Regulatory Approval: Dental 3D printing materials and devices undergo clinical validation, safety assessments, and compliance reviews in accordance with FDA, CE, and other regional regulations.

Key Players: T�V S�D, SGS SA, Eurofins Scientific, Intertek Group, BSI Group. - Patient Support and Services: Providers offer training, maintenance, and digital workflow support to clinics and labs, ensuring optimal printer use, software integration, and patient care efficiency.

Key Players: Straumann, Dentsply Sirona, Align Technology, 3Shape, Prodways Dental.

Top Companies in the Dental 3D Printing Market & Their Offerings

- 3D Systems, Inc.- Provides stereolithography (SLA) and resin‑based 3D printers, as well as biocompatible materials, for precise production of models, aligners, surgical guides, and dentures.

- Stratasys Ltd.- Supplies polymer‑based additive manufacturing systems (e.g. PolyJet and resin printers) and dental‑specific materials for high‑accuracy dental models, prosthetics, and monolithic dentures.

- Formlabs Inc.- Offers affordable resin‑based SLA 3D printers tailored for dental labs and clinics, along with a portfolio of dental‑grade resins for models, surgical guides, aligners, night guards, and dentures.

- Renishaw plc- Specializes in metal additive manufacturing solutions for dental implants, frameworks, and implant‑supported prostheses, using laser-based metal printing technologies.

- Prodways Group- Provides DLP and MOVINGLight 3D printing technologies with a range of dental‑specific resins and materials, enabling production of aligners, models, surgical guides, and prosthetics.

- Dentsply Sirona- Integrates 3D‑printing within its digital dentistry offering, supplying printers, materials, and CAD/CAM workflows for dental restoration, prosthetics, models, and lab‑clinic use.

Dental 3D Printing Market Companies

- Roland DG

- Planmeca

- SLM Solutions

- EnvisionTec

- Straumann

[Source: https://www.precedenceresearch.com/dental-3d-printing-market ]

Recent Developments

- In September 2024, three post-processing tools and two new resin materials were among the many new products that Formlabs launched for SLA and SLS parts. The company now offers over 45 materials in its range, including the two new materials, Clear Cast Resin and the third-party Certified Material BEGO VarseoSmile TriniQ Resin.

- In May 2024, in addition to announcing a partnership with Ivoclar and revealing the Pro 2, the newest desktop 3D printer in the company's lineup, SprintRay also revealed plans to validate Ivoclar resins with the SprintRay 3D printing ecosystem, thereby increasing access to a wide range of restorative materials. Due to these advancements, orthodontists and dentists can provide care more quickly and conveniently.

Segments Covered in the Report

By Application

- Orthodontics

- Prosthodontics

- Dentures

- Temporary Tooth

- Permanent Tooth

- Dentures

- Implantology

By Technology

- Vat Photopolymerization

-

- Stereolithography

- Digital Light Processing

-

- Polyjet Technology

- Fused Deposition Modelling

- Selective Laser Sintering

- Others

By End-use

- Dental Clinics

- Dental Laboratories

- Academic and Research Institutes

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting