Dental Implantology Software Market Size and Forecast 2025 to 2034

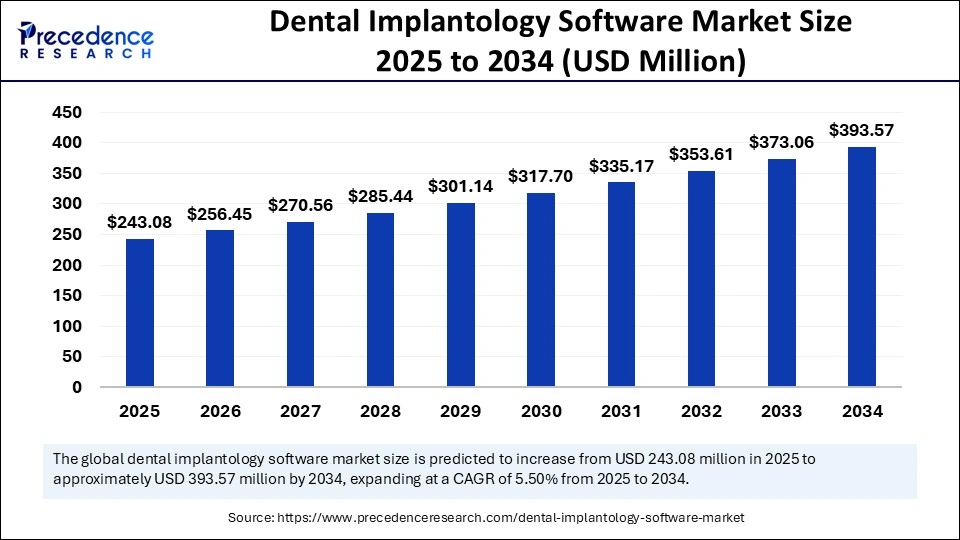

The global dental implantology software market size accounted for USD 230.41 million in 2024 and is predicted to increase from USD 243.08 million in 2025 to approximately USD 393.57 million by 2034, expanding at a CAGR of 5.50% from 2025 to 2034. The excellent features driven by dental implantology software with accuracy, precision, and efficiency in clinical performance, ensuring promising surgical outcomes.

Dental Implantology Software Market Key Takeaways

- North America dominated the dental implantology software market in 2024.

- The U.S. is led the North America with the highest market share of 93% by 2034.

- Asia Pacific is estimated to grow at the fastest CAGR in the market between 2025 and 2034.

- By solution, the complete integrated solutions segment held the biggest market share of 45% in 2024.

- By solution, the stand-alone implant planning segment is anticipated to expand rapidly in the coming years.

- By imaging, the 3D imaging segment contributed the highest market share of 36% in 2024.

- By imaging, the 2D imaging solutions segment is expected to grow rapidly during the forecast period.

- By application, the 3D imaging and visualization segment dominated the market in 2024.

- By application, the pre-surgical planning segment is expected to grow the fastest throughout the forecast period.

- By end user, the individual dental clinics segment led the market in 2024.

- By end user, the multi-practice dental networks segment is anticipated to grow rapidly in the coming years.

How is AI Revolutionizing Dental Implantology Software?

Artificial intelligence-based research on dental implantology enhances efficiency in diagnosis and clinical decision-making. AI plays a significant role in implant identification, implant planning, prediction, and peri-implantitis management. AI models, such as deep learning and machine learning, help to identify dental implant brands accurately. In the dental implantology software market, AI can evaluate bone dimensions, and AI-driven prediction models can predict implant success. AI also helps in the early identification of complications like biotribocorrosion and fractured implants.

Market Overview

The dental implantology software market is growing remarkably by providing flexible dental and oral surgical services and products. The availability of multiple dental implant procedures, treatments, and designs fuels the expansion of advanced technologies. Patients can receive care through predictable implant planning with the assistance of advanced tools and techniques. Dental healthcare professionals are increasingly adopting cost-efficient surgical guides and artificial intelligence technology to provide same-day implant dentistry treatment. The open, integrated workflows enable professionals to enhance their collaborations with manufacturers by offering flexibility to modify workflows.

- In September 2024, Dentis announced the launch of an Indian subsidiary in Gurgaon for its principal dental products. In November 2024, the Renew Dental Implant Centers announced a revolutionary initiative to transform its business model into the Renew Affiliate Program to encourage dental implant practices through local and national advertising.

Dental Implantology Software Market Growth Factors

- The digital planning software empowered individuals and organizations with the skills to manage their tasks and projects efficiently.

- The key features of software, such as 3D visualization, virtual implant placement, prosthetic-driven planning, simulations, and predictive tools, accelerate the growth of the dental implantology software market.

- The major technical developments, such as cone beam computed tomography (CBCT), intraoral optical scanners (IOS), surgical implant planning software, and guided instrumentation, empowered people with new skills and knowledge.

- The virtual visualization of the implant site, clinicians can meet the anatomical challenges and decide precise treatment strategies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 393.57 Million |

| Market Size in 2025 | USD 243.08 Million |

| Market Size in 2024 | USD 230.41 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Imaging, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Versatility of digital planning software applications

The growing need for on-demand 3D software is driven by its easy integration with CAD/CAM systems, intuitive navigation, and comprehensive customer support. Moreover, the dental wings DWOS implant software provides a user-friendly interface. The dental wings DWOS implant software shows a seamless integration with dental wings CAD/CAM systems. This software expands comprehensive implant planning capabilities by ensuring efficient and accurate treatment workflows.

Restraint

Growing concerns about adequate technical skills and expertise

The digital planning software for dental practices also showcases certain limitations. The accuracy and reliability of this software rely on the quality of the input data, such as intraoral impressions and CBCT scans. Clinicians are strictly expected to ensure the acquisition of high-quality images and correct digital impressions to improve the accuracy of the virtual models. There must be sufficient knowledge and proficiency in the interpretation of virtual models and software manipulation.

Opportunity

Robust origins of software programs across the world

Several countries, such as the United States, Germany, South Korea, Canada, Denmark, Italy, etc., are driving innovations in digital planning software that are commercially available. These software programs include Keystone Dental's 3D Diagnostix, 3Shape Implant Studio, Noble Clinician, CoDiagnostiX, Blue Sky Plan, Simplant software, R2Gate software, etc. The software is easy to navigate, customisable, user-friendly, intuitive, and streamlined. They can integrate with various systems such as intraoral scanners and CAD/CAM systems.

Solution Insights

The complete integrated solutions segment led the dental implantology software market in 2024. The integrated solutions help to manage business activities by reducing the use of a large number of software programs, which increases immediate accessibility to information. These solutions deliver an improved experience to the users by meeting their emerging needs. The assurance of data reliability through integrated solutions drives the business and financial management of companies. The accuracy in the analysis of project profitability is delivered by integrating expense and purchase management, subcontracting, etc., into a single business management solution.

The stand-alone implant planning segment is anticipated to expand rapidly in the coming years due to its assistance to dentists in planning and designing implant placement procedures. The versatile features of these software programs driving segmental growth include virtual surgery and the integration with different implant systems and scanners. These software systems enable dentists to implement virtual implant placement and prosthetic-driven planning, ensuring accuracy. Integrating several intraoral scanners and implant systems enables seamless data transfer and compatibility. The utilization of 3D imaging technologies like CBCT enables accuracy and precision in 3D imaging and visualization.

Imaging Insights

The 3D imaging segment dominated the dental implantology software market in 2024. The extraction of data from clinical examinations like CT scans, MR, etc. enables 3D imaging to generate precise anatomical visualizations. This advanced technology offers several benefits to the radiologists, physicians, and patients, with a reduced cost for the healthcare system. Moreover, 3D imaging delivers improved confidence to patients during clinical examinations, along with reduced risk of complications. It drives the best options by replacing more invasive and expensive diagnostic procedures. It also facilitates non-invasive surgical planning, reduces operating time, minimizes damage to healthy tissues, and improves patient communication.

The 2D imaging solutions segment is expected to grow rapidly during the forecast period. The major rationales behind the growth of 2D imaging are cost-effective solutions, quick and simple procedures, low radiation exposure, and diagnostic versatility. The wide use of 2D imaging in routine dental practices fosters the growth of 2D imaging solutions. The beneficial applications of intraoral X-rays, such as bitewings, periapicals, and occlusals, and extraoral panoramic X-rays, boost their preference for general diagnosis and treatment planning. These X-rays are useful types of 2D imaging that ensure a precise capture of 2D images of the mouth and surrounding structures.

Application Insights

The 3D imaging and visualization segment dominated the dental implantology software market in 2024. The 3D imaging and visualization software offers tools to create excellent visuals and enhances the workflow with integrated features. The insertion of excellent features such as extensive libraries of materials and textures, user-friendly interfaces, and strong support for several file formats upholds segmental progress. The better maintenance of seamless data processing enables professionals to achieve creativity. Moreover, the useful techniques such as photorealistic rendering, physically based rendering, and global illumination help to achieve realistic 3D visualizations.

The pre-surgical planning segment is expected to grow the fastest throughout the forecast period. The increased awareness among healthcare providers to reduce the risk of infections and treat the oral cavity precisely drives the significance of pre-surgical planning. The significant role of pre-surgical dental evaluation and prophylaxis in surgical outcome and overall well-being of patients boosts segmental growth. The emerging need of dentists and related medical staff to better know dental complications and systemic well-being of patients accelerates improved surgical outcomes. The communication and planning among medical professionals help to achieve holistic patient care.

End User Insights

The individual dental clinics segment led the dental implantology software market in 2024. The various benefits delivered by private dental clinics allow patients to book fast appointments and reduce waiting times. A wide range of treatments offered by individual dental clinics includes cosmetic dentistry and advanced procedures like dental implants, which offer patients greater choice and flexibility. Patients can have long discussions about their concerns and treatment options with doctors through private appointments. The state-of-the-art technology invested by private practices provides improved access to the latest treatment methods and diagnostic tools, delivering optimal results.

The multi-practice dental networks segment is anticipated to grow rapidly in the coming years. The excellent dental and oral services, along with high-quality patient care delivered by multi-location dental networks, drive their growth trajectory in the market. The flexibility of treatments irrespective of dental office locations, while dealing with personal and professional schedules, boosts the adoption of multi-practice dental networks among people. The highly skilled dental professionals offer convenient and accessible dental care to patients. The adoption of advanced technology for better patient care also fosters the expansion of the multi-practice dental networks.

Regional Insights

North America dominated the dental implantology software market in 2024 due to various initiatives for dental implants and oral care. The Smiles for Everyone Foundation announced the launch of a new program known as ‘Implanting Inspiration' in the U.S. This program aims to offer free dental implants for underinsured individuals and people with low income across the nation. The emerging need for dental implants as the new standard of care for permanent treatment in the U.S. drives the market's growth significantly.

The most cost-effective options of dental implants and the alternative treatments like bridges and crowns boost the market's expansion notably. The supportive programs reduce the financial burden of dental and oral treatments for middle-class people, ensuring promising care. The U.S. Food and Drug Administration (USFDA) plays a major role in receiving the reporting of adverse events and understanding the risks associated with medical products.

Research Grants and Associations for Implant Dentistry in the U.S.

The American Academy of Implant Dentistry provides research grants and funding to researchers who are dedicated to driving innovations to advance implant dentistry. Moreover, the post-graduate dental students and residency programs also receive the David Steflik Memorial Student Research Grants for dental implantology research. However, the AAIDF Steflik Grants are well-suitable for new investigators, research careers, and post-graduate students.

The American Dental Association (ADA) is the largest dental association in the United States, representing over 159,000 dental members. The ADA is the principal source of oral health information and holds state-of-the-art research facilities. These facilities of the ADA aim to develop and test dental materials and products that have proven the importance of dentistry and delivered better patient care.

- In September 2024, DEXIS announced the launch of a new digital ecosystem, including tools and software to connect and streamline the implant workflow from diagnosis to delivery.

Asian Market Growing with Innovations

Asia Pacific is estimated to grow at the fastest CAGR in the dental implantology software market between 2025 and 2034. The Indian Dental Association (IDA) and the Digital Dentistry Society organized the International Digital Dentistry Congress (IDDC) from May to June 2025 in Mumbai. This congress aims to highlight the advantages of digital dentistry in the life of a digital practitioner. Moreover, the Asia Pacific Society of Osseointegration (APSO) is a non-profit organization focusing on delivering successful implant dentistry by sharing knowledge through learning.

- In November 2024, Dentsply Sirona held the first DS World event in Tokyo and Japan. The event named ‘Dentsply Sirona World Tokyo 2024' marked success in Japan by investing in cutting-edge clinical education, vibrant experiences, and networking opportunities.

Dentistry Health Education Initiatives in Japan

- In January 2024, Fujitsu announced the launch of a large-scale health education initiative for its 70,000 employees in Japan. This initiative aims to encourage Fujitsu's employees to improve and maintain their oral and dental health. These efforts focus on spreading more awareness about dental and oral health and dental care methods through modules. It also aims to educate people about the importance of receiving professional care at dental clinics. Moreover, Fujitsu also upholds its preventive dentistry cloud service, dental caries susceptibility check function, and preventive dentistry clinic renovation.

General Awareness Creating Considerable Growth in Europe

Europe is considered to be a notably growing dental implantology software market in the upcoming period. The European Association for Osseointegration conducts research on dental implant dentistry by using the Delphi methodology for the year 2030. This event aims to explore the latest trends in dentistry by providing a global platform to address the existing and new challenges in dental education, oral health, surgery, and the exchange of dental expertise. The presence of a target audience, such as oral and dental surgeons, dental radiologists, dental officers, orthodontists, etc., drives the success of such events.

Expansive Reach of Government Grants for Dental Implants in the UK

The government grants in the UK provide financial assistance to people in need to receive essential dental care. These grants focus on improving oral health and enhancing the quality of life for people with missing teeth due to illness, injury, or decay. The NHS Low Scheme, the NHS Dental Treatment Grants, the Access to Work Grant, the Social Fund Budgeting Loan, the Disability Allowance, etc., are some of the major grants approved by the UK government. Moreover, the Personal Independence Payment (PIP) Program is offered by the government to offer financial assistance to people having long-term illness or disability.

- In March 2025, RevBio Inc. announced the approvals from the regulatory and ethics committee to conduct an important clinical trial for its dental implant stabilization product in multiple European countries.

Dental Implantology Software Market Companies

- Dentsply Sirona

- BioHorizons

- Implant Direct

- Dentalcorp

- MegaGen Implant Co. Ltd.

- Osstem Implant

- Nobel Biocare

- Zimmer Biomet

- MIS Implants Technologies Ltd.

- HIOSSEN

Latest Announcements by Leaders

- In June 2024, Tony Susino, Group Vice President of Implant and Prosthetic Solutions at Dentsply Sirona, announced that the company feels honored to host the Implant Solutions World Summit in 2024, which showcases its commitment to achieving success in implant dentistry through innovation, education, and collaboration.

- In June 2024, Steve Boggan, President and CEO of BioHorizons, announced that the unique laser-lok microchannels of Tapered Pro Conical can potentially create a connective tissue attachment and retain crestal bone, which allows better control of clinical and esthetic outcomes.

Recent Developments in the Dental Implantology Software Market

- In February 2025, Dentsply Sirona announced the launch of its new MIS LYNX implant, which is a reliable and versatile choice for several clinical applications.

- In June 2024, BioHorizons announced the launch of its first dental implant, named Tapered Pro Conical, with a deep conical connection.

Segments Covered in the Report

By Solution

- Stand-Alone Implant Planning Solutions

- Modular Implant Planning Solutions

- Complete Integrated Solutions

By Imaging

- 3D Imaging Solutions

- 2D Imaging Solutions

By Application

- Pre-Surgical Planning

- Surgical Navigation and Guides

- 3D Imaging and Visualization

- Prosthetic-driven Implant Planning

By End User

- Hospitals

- Ambulatory Surgical Centers

- Individual Dental Clinics

- Multi-Practice Dental Networks

- Dental Laboratories

- Academic Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting