What is the Dental Preventive Supplies Market?

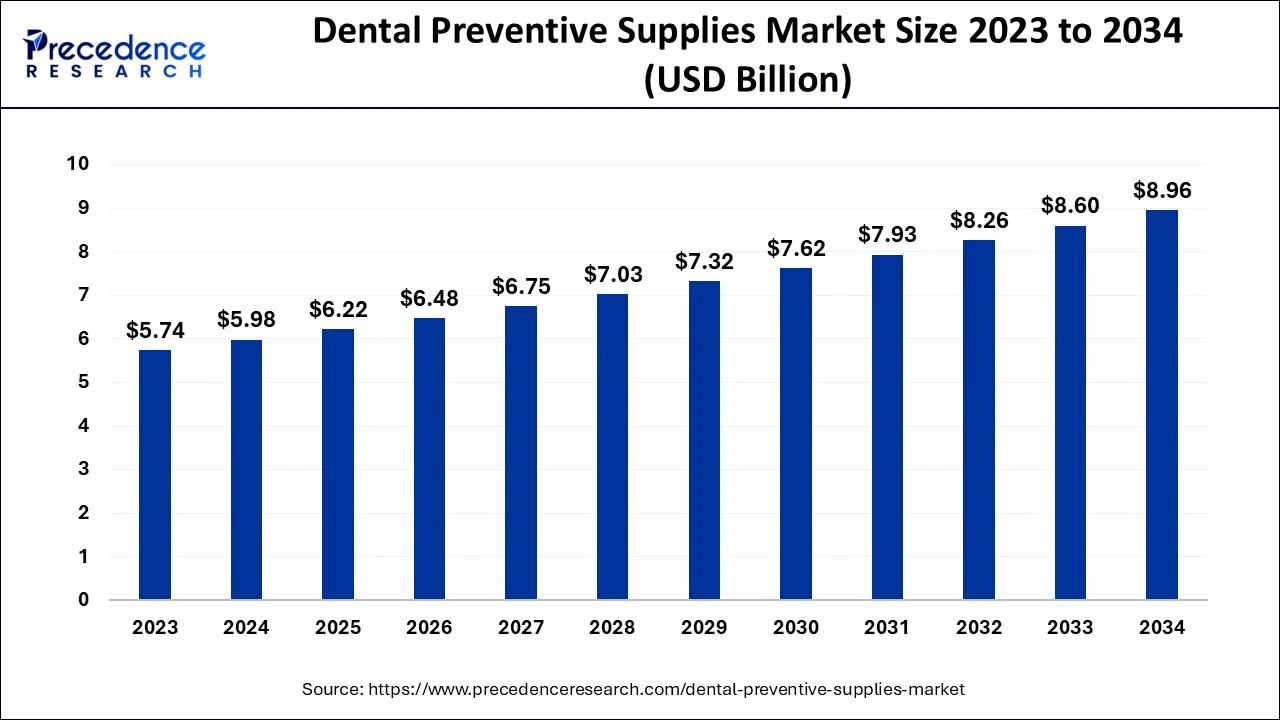

The global dental preventive supplies market size is calculated at USD 6.22 billion in 2025 and is predicted to increase from USD 6.48 billion in 2026 to approximately USD 9.31 billion by 2035, expanding at a CAGR of 4.12% from 2026 to 2035.

Dental Preventive Supplies Market Key Takeaways

- The global dental preventive supplies market was valued at USD 5.98 billion in 2025.

- It is projected to reach USD 9.31 billion by 2035.

- The dental preventive supplies market is expected to grow at a CAGR of 4.12% from 2026 to 2035.

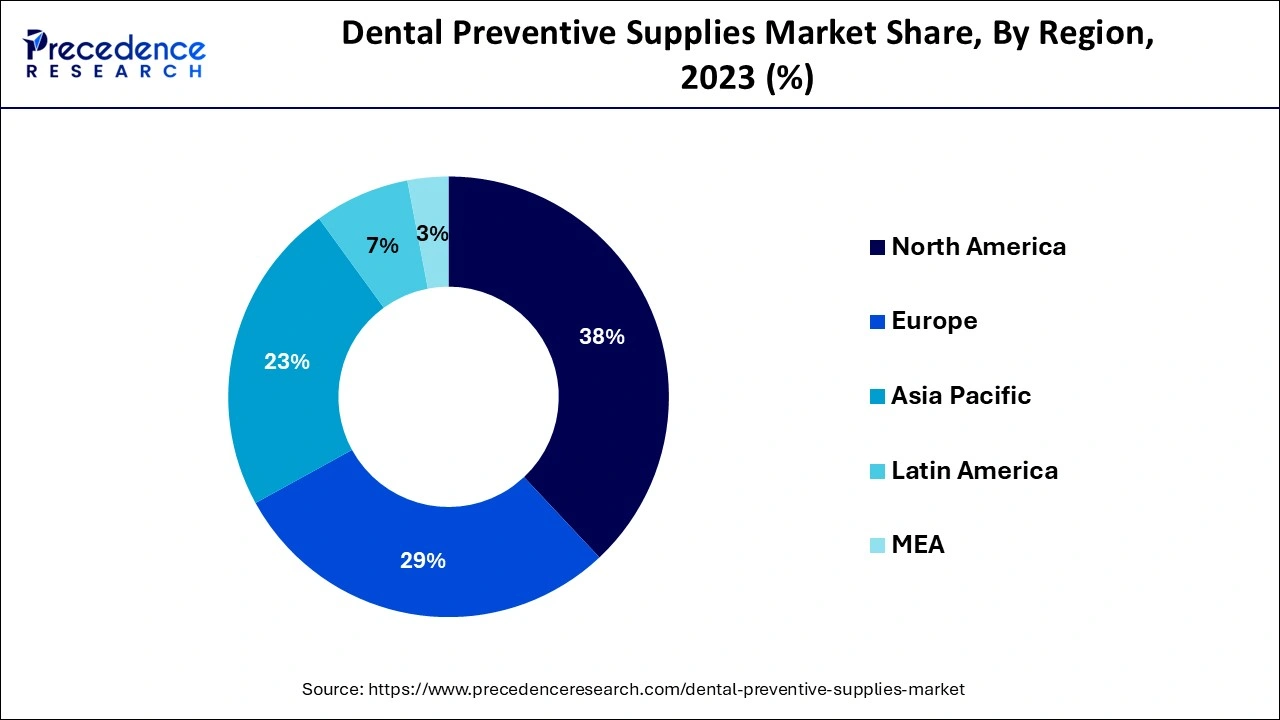

- North America dominated the global dental preventive supplies market with the largest market share of 38% in 2025.

- Asia Pacific is expected to be the fastest-growing region in the market throughout the forecast period.

- By product type, the dental fluorides and varnish segment held the largest market share of 24% in 2025.

- By product type, the tooth whitening and desensitizers segment is expected to grow rapidly during the forecast period.

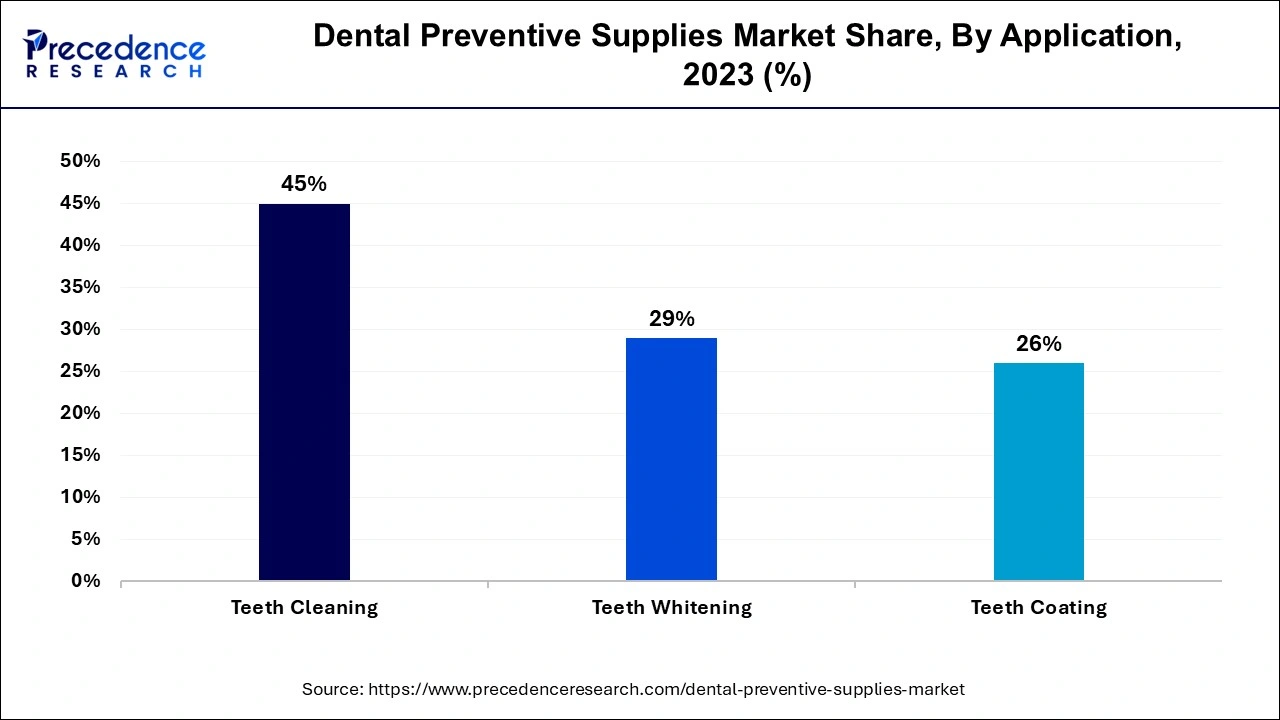

- By application, the teeth cleaning segment accounted for the largest share market at 45% in 2025.

- By application, the teeth whitening segment is anticipated to witness significant growth in the market over the studied period.

- By distribution channel, the retail pharmacies segment contributed the highest market share of 43% in 2025.

What are Dental Preventive Supplies?

Dental preventive supplies refer to tools and products used to prevent dental diseases such as caries or tooth decay. Some of the everyday items include fluorides, toothpaste, mouthwash, dental sealants, and mouthguards. Dental preventive supplies are used to maintain oral hygiene and prevent dental problems. These supplies help in preventing cavities, gum diseases, and other oral ailments. These products are used by patients as well as dental health care to enhance proper dental care in the home as well as in clinical settings. The increasing geriatric population contributes to market growth. Older people are more prone to oral diseases. Moreover, the rising number of government programs aimed at spreading awareness among the public about oral care, expanding medical tourism in emerging economies, and the availability of advanced dental treatments boost the growth of the market.

Dental Preventive Supplies Market Growth Factors

- Health Consciousness: Rising health consciousness and awareness about oral hygiene encourage individuals to turn to preventive dental products.

- Preventive Healthcare: The shift toward a preventative and precautionary approach boosts market prospects.

- Technological Innovations: Advances in technology led to the development of smart toothbrushes, which have caught the attention of tech-savvy people.

- Insurance Expansion: Increased insurance plans for dental care encourage the purchase of dental products.

Dental Preventive Supplies Market Outlook

Between 2025 and 2030, this market is expected to rise significantly due to the growing use of tooth preventive solutions around the globe, coupled with rapid investment by market players for opening up new production centres to increase the manufacturing of dental items.

Numerous dental preventive suppliers are actively entering this market, drawn by partnerships, R&D, and business expansion. Numerous market players, such as Kerr Corporation, Hu-Friedy, Ivoclar Vivadent, Johnson & Johnson, and others, have started investing rapidly in developing high-quality dental care products in different parts of the world.

Various startup brands are engaged in developing high-quality dental solutions across the world. The prominent startup companies dealing in dental preventive supplies comprises of Perfora, DentalKart, Sonendo, and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 8.96 Billion |

| Market Size in 2025 | USD 6.22 Billion |

| Market Size in 2026 | USD 6.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.12% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Rising Incidence of Dental Disorders to Boost the Dental Preventive Supplies Market

The incidence of dental disorders is rapidly growing due to several factors. Tooth decay, gum diseases, cavities, and other oral health problems are rising worldwide. The main reasons contributing to this rise are the high intake of sugar, consumption of tobacco products, and poor dental care. Caries mostly affect children and adolescents after 60 years of age, with root caries being more frequent at this age. Oral diseases are widespread throughout the world due to the changing lifestyles. However, dental preventive supplies will help decrease the possibility of such conditions and improve dental health. With the emergence and higher incidence of dental diseases, the need for products that prevent dental diseases is rising among the public and dental care providers.

- According to the World Health Organization's Global Oral Health Status Report of 2022, almost 3.5 billion people have some form of oral disease, with 75% of those affected living in middle-income countries. Approximately 2 billion adults worldwide develop caries of permanent teeth, with 514 million people having caries of primary teeth.

Restraint

High Cost of Dental Procedures

The overall cost associated with dental procedures includes all staff wages, taxes, health insurance, supplies, and many others. It also depends on the nursing team's experience and level of training. Moreover, rising healthcare costs significantly hamper the dental preventive supplies market growth.

Opportunity

Rising healthcare programs fuel the growth of the market. Awareness about the importance of oral hygiene has increased significantly due to educational campaigns by governments, cooperative health institutions, and dentists. The increased awareness about the availability of advanced dental care solutions contributed to the advocacy of early management of dental conditions. People understand the need to use dental products that include toothpaste, mouthwash, and dental floss daily to help maintain oral health, reducing the risk of diseases such as cavities and gingivitis.

- In 2024, Dentsply Sirona joined its long-time partner FDI World Dental Federation to promote World Oral Health Day (WOHD) and contribute to raising global awareness for the importance of good oral health.

- In 2023, the US House of Representatives approved the Action for Dental Health Act of 2023. The objectives of this legislation are to build the dental workforce and enhance the availability of oral health care, especially in underserved communities.

Dental Preventive Supplies Market Segment Insights

Product Type Insights

The dental fluorides and varnish segment dominated the global dental preventive supplies market in 2025. This is due to the increased demand for fluoride-based products. Fluoride varnish is a resin that protects teeth from tooth cavities and makes the enamel of a tooth stronger. It is often prescribed for kids, babies, older people, and individuals with special healthcare requirements. It is a fast-drying varnish with a sticky property, which forms a sticky coat on the teeth. Fluoride varnish is most effective when used in combination with other products, such as fluoridated toothpaste. Fluoride-containing agents serve to improve the hardness of tooth enamel, reduce bacterial growth, and stimulate the process of demineralization.

The tooth whitening and desensitizers segment is expected to grow rapidly during the forecast period. Tooth desensitizers quickly relieve sensitivity resulting from tooth whitening, heat, and chemical alterations, exposed roots, and toothbrush damage. Toothpaste, mouth rinses, or gums are types of desensitizing agents and work on the principle that one either seals the dentinal tubules or interferes with neural conduction.

Application Insights

The teeth cleaning segment led the dental preventive supplies market with the largest share in 2025 due to the growing desire for white teeth. Cleansing of the teeth is a dental process through which the dental expert removes the plaque, tartar, and bacteria from teeth to maintain healthy gums and teeth. It is also referred to as topical prophylaxis. Different types of teeth cleaning products are easily available in pharmacies, supermarkets, and online shops, and consumers find it convenient to purchase the necessary products. Furthermore, the rising focus on personal appearance contributed to segmental dominance.

The teeth whitening segment is anticipated to witness significant growth in the market over the studied period, owing to the rising desire for white teeth. Tooth bleaching is the process by which the natural color of a person's teeth is improved. This is achieved by applying a whitening gel or product to the teeth; at times, a light or laser is used. Chemicals such as hydrogen peroxide or carbamide peroxide are often used in whitening products, resulting in enhanced effectiveness.

- In January 2022, Colgate-Palmolive Company and 3Shape entered into a partnership to introduce the Colgate Illuminator, an exclusive, tailored-to-patient teeth whitening tool, to dental clinics across the U.S.

Distribution Channel Insights

The retail pharmacies segment led the global dental preventive supplies market in 2025. This is mainly due to the easy availability of over-the-counter products in these pharmacies. Dental preventive supplies are readily accessible and directly sold to consumers by retail pharmacies for self-care. Additionally, there has been a steady shift in patients' attitudes regarding the importance of spoken and preventive medicine. With the increasing awareness of dental care among the population, the trend of self-care is rising, contributing to segmental expansion.

Dental Preventive Supplies Market Regional Insights

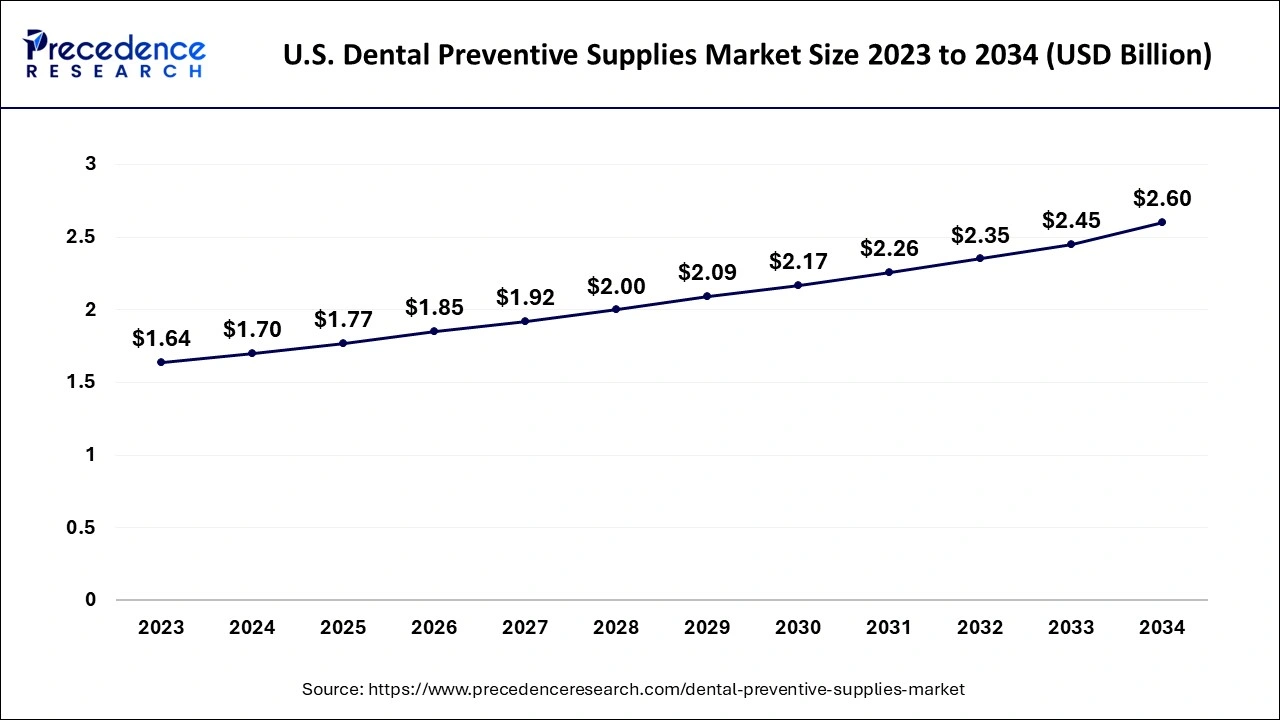

The U.S. dental preventive supplies market size is evaluated at USD 1.77 billion in 2025 and is projected to be worth around USD 2.72 billion by 2035, growing at a CAGR of 4.39% from 2026 to 2035.

North America led the global dental preventive supplies market in 2025. This is due to an increase in the geriatric population, the availability of skilled medical facilities, clear reimbursement regimes, a large number of key players, and improvements in the existing preventive and reconstructive dental care treatments. Strong emphasis on preventive measures and the rising demand for early diagnosing contributed to regional dominance. Furthermore, due to the better knowledge about oral health's correlation with general health conditions, patients choose dental examinations and treatments more frequently. The rising healthcare expenditure further bolstered the regional market.

Asia Pacific is expected to be the fastest-growing region in the market throughout the forecast period. Factors such as government support to advance the healthcare system, the increasing geriatric population, and the increasing demand for cosmetic dental surgeries are major factors boosting the market in the region. Medical tourism is also growing in this region because of the availability of affordable treatments, skilled dental professionals, and increasing acceptance of advanced technologies. Furthermore, the increasing occurrence of dental problems and rising government initiatives to promote oral health contribute to regional market growth.

- The Ministry of Health, Labour and Welfare in Japan launched a national health promotion program called ‘Health Japan 21 (the second term)' that contains specific objectives for oral health promotion.

Europe held a significant share of the market. The increasing focus of people to visit dental clinics for regular teeth cleaning and teeth whitening has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the healthcare sector across numerous countries, including Germany, France, Italy, the UK, and some others, is expected to propel the growth of the dental preventive supplies market in this region.

Latin America held a considerable share of the industry. The growing sales of mouth gels and dental fluorides in several nations, including Brazil, Argentina, Venezuela, and some others, has driven the industrial growth. Moreover, the surging emphasis of consumers to purchase dental items from online platforms is expected to boost the growth of the dental preventive supplies market in this region.

The Middle East and Africa held a notable share of the market. The rising popularity of teeth coating in various countries such as South Africa, the UAE, Qatar, and some others has propelled the market expansion. Also, the presence of numerous dental providers, coupled with technological advancements in the healthcare sector, is expected to drive the growth of the dental preventive supplies market in this region.

Dental Preventive Supplies Market Companies

Church & Dwight is an American consumer goods company founded in 1846, known for household and personal care products, including Arm & Hammer, Trojan, and OxiClean. The company's operations are divided into three segments such as consumer domestic, consumer international, and specialty products.

Colgate-Palmolive is a multinational consumer goods company headquartered in New York City that specializes in oral care, personal care, home care, and pet nutrition products. This company's mission is to provide quality products and maintain a strong commitment to sustainability and community outreach.

Dentsply Sirona is the world's largest manufacturer of professional dental products and technologies, formed from the 2016 merger of DENTSPLY International and Sirona Dental Systems. The company develops, manufactures, and markets a wide range of dental products and equipment, including digital imaging, CAD/CAM systems, and consumables.

GC International is a leading global dental company dedicated to improving oral health worldwide by providing high-quality, innovative dental products and solutions. This brand manufactures more than 600 different product types marketed in more than 100 countries, covering the entire range of consumable materials, devices, and equipment for dental practices and laboratories.

Henry Schein, Inc. is an American global provider of health care products and services, primarily for office-based dental, medical, and animal health practitioners. The company distributes over 300,000 branded and corporate brand products, offers technology solutions, and provides value-added services, including equipment repair and supply chain management.

HuFriedyGroup is a global leader in manufacturing dental instruments and supplies, offering a wide range of products for every stage of a dental procedure, including instrumentation, infection prevention, and operatory supplies. The company is known for its high-quality, ergonomic products designed to enhance clinician performance, ensure patient safety, and streamline dental workflows.

Ivoclar is a global company that provides integrated solutions, products, and systems for the dental industry. It offers products and systems for both dentists and dental technicians across four key areas, including digital dentistry, direct restoratives, fixed prosthetics, and removable prosthetics.

Other Major Key Players

- Johnson & Johnson

- Kerr Corporation

- Sunstar Suisse

- The Procter & Gamble Company

- Ultradent Products

- Young Innovations

- 3M Company

Recent Developments

- In September 2025, Opalescence launched new whitening strips. These strips are designed for removing dental stains in people.

(Source: www.prnewswire.com) - In August 2025, Natureoroma launched Squacare Oral Gel. This gel is designed for patients suffering from oral submucous fibrosis.

(Source: theindianpractitioner.com) - In August 2025, Ivoclar launched VivaDent in the U.S. VivaDent is a polishing paste designed for dental patients in this nation.

(Source: insidedentalhygiene.com)

Segments Covered in the Report

By Product Type

- Dental Fluorides and Varnish

- Tooth Whitening and Desensitizers

- Prophylactic Paste and Powder

- Sealant

- Dental Floss

- Mouth Gels

- Other

By Application

- Teeth Cleaning

- Teeth Whitening

- Teeth Coating

By Distribution Channel

- Retail Pharmacies

- Drug Stores

- E-Commerce

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting