What is the Digital Fluoroscopy System Market Size?

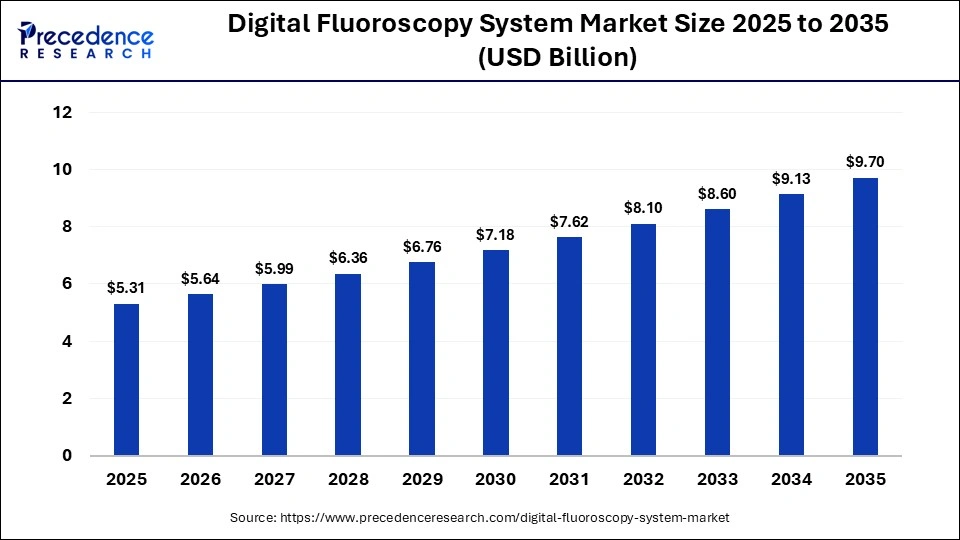

The global digital fluoroscopy system market size was estimated at USD 5.31 billion in 2025 and is predicted to increase from USD 5.64 billion in 2026 to approximately USD 9.70 billion by 2035, expanding at a CAGR of 6.21% from 2026 to 2035. The increasing rates of orthopedic surgeries and angiography, along with the ongoing innovation in fluoroscopy devices, are major reasons for the market's expansion.

Digital Fluoroscopy System Market Key Takeaways

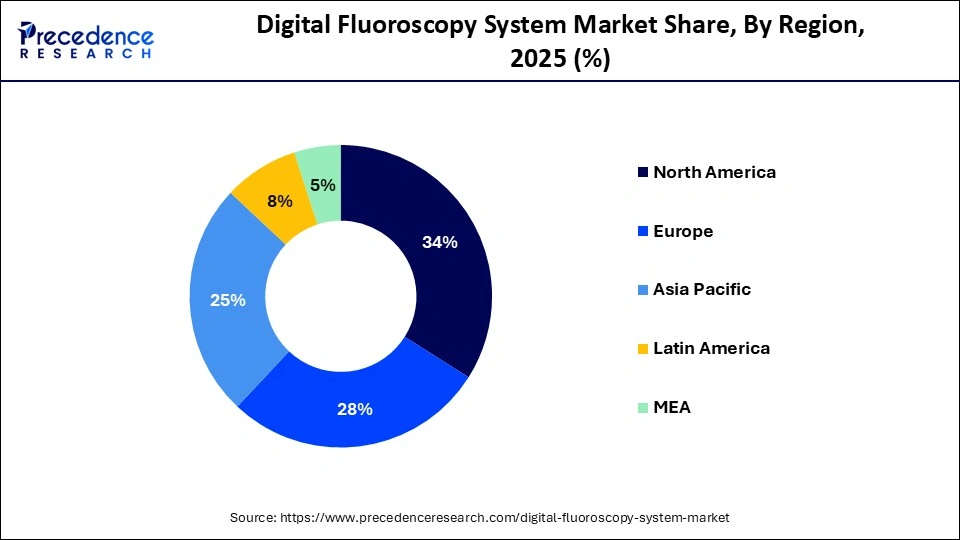

- North America held the largest digital fluoroscopy system market share of nearly 34% in 2025.

- The Asia Pacific is projected to grow at the fastest CAGR of 6.39% between 2026 and 2035.

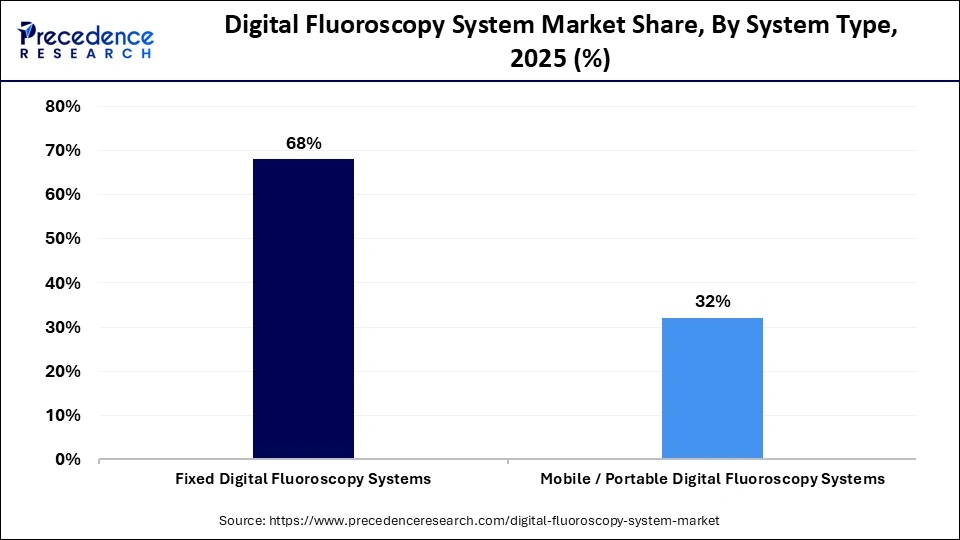

- By system type, the fixed digital fluoroscopy systems segment accounted for the biggest market share of nearly 68% in 2025.

- By system type, the mobile/portable digital fluoroscopy systems segment is projected to grow at the fastest CAGR between 2026 and 2035.

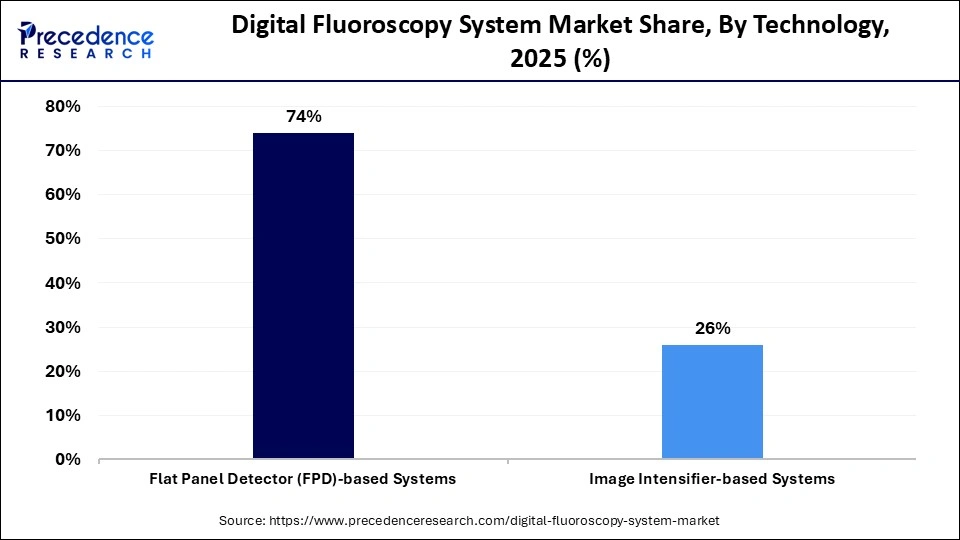

- By technology, the flat panel detector-based systems segment captured more than 74% of the market share in 2025, and is projected to grow at the fastest CAGR from 2026 to 2035.

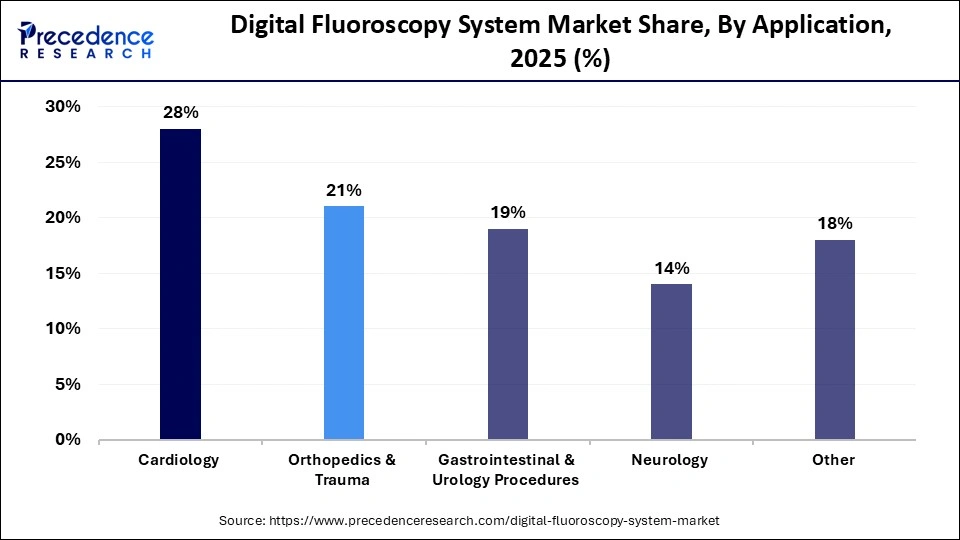

- By application, the cardiology segment contributed the largest market share of nearly 28% in 2025.

- By application, the orthopedics & trauma segment is projected to grow at the fastest CAGR between 2026 and 2035.

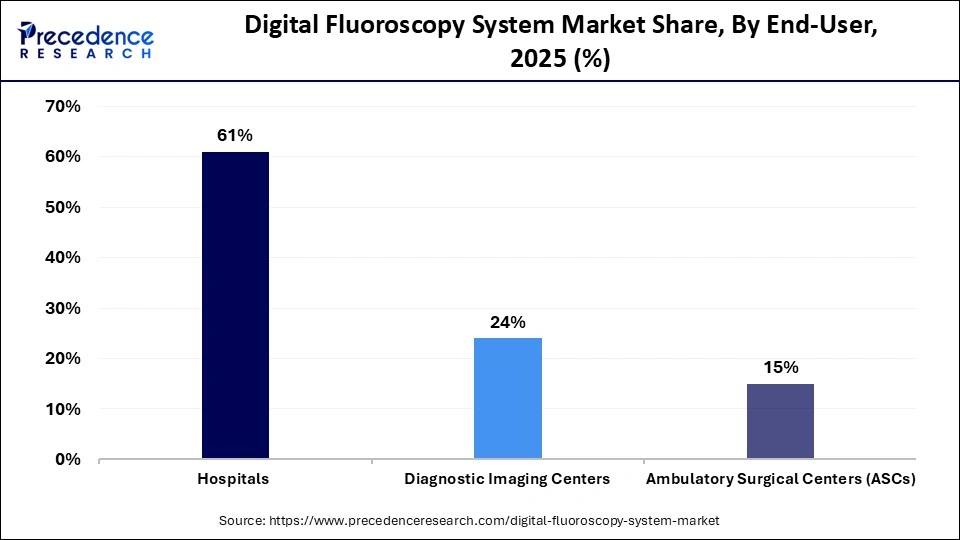

- By end user, the hospitals segment held the major market share of nearly 61% in 2025.

- By end user, the ambulatory surgical centers segment is projected to grow at the fastest CAGR between 2026 and 2035.

Digital Fluoroscopy System Market Means

The global digital fluoroscopy system market comprises advanced X-ray imaging systems that provide real-time dynamic visualization of internal anatomical structures using digital detectors and image processing technologies. These systems are widely used across diagnostic and interventional procedures in cardiology, orthopedics, gastroenterology, urology, and neurology. The market includes fixed and mobile systems deployed in hospitals, diagnostic imaging centers, and ambulatory surgical facilities, driven by demand for minimally invasive procedures, workflow efficiency, and dose-reduction technologies.

Digital Fluoroscopy System Market Trends

- The companies are rapidly adopting AI into processes to enable smarter decision-making, predictive analytics, and streamline operations to gain maximum competitive edge.

- The increasing shift towards sustainability practices to develop green products while aiming to reduce carbon footprints across the entire life cycle of digital fluoroscopy systems.

- Strategic collaboration among leading players and various sectors to utilize resources commonly, technology expertise, and leverage market access facilities, fueling the market's growth further.

- Leading firms are heavily investing in regional hubs to reduce dependency on cross-border logistics and improve market reach.

Key AI Shifts in the Digital Fluoroscopy System Market

The integration of AI and ML models with the market is rapidly changing the market dynamics by offering enhanced image quality, optimization of workflows, and reducing radiation exposure. AI algorithms can optimize parameters of images in real-time, aiming to minimize radiation dosage for patients and operators.

Moreover, leading companies are shifting towards data–powered imaging solutions like AI-driven technology for cardiology to increase imaging precision and efficient medical procedures. Innovations like Alpha Evolve Imaging for superior contrasts and a dynamic device stabilizer for real-time balloon marker detection are assisting in the automatic integration of fluoroscopy images.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.31 Billion |

| Market Size in 2026 | USD 5.64 Billion |

| Market Size by 2035 | USD 9.70 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.21% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By System Type, By Technology, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

By System Type

Why Do Fixed Digital Fluoroscopy Systems preferred in the Digital Fluoroscopy System Market?

The fixed digital fluoroscopy systems segment held the largest market share of nearly 68% in 2025 as they are majorly preferr for their superior image quality, high operational efficiency, and enhanced stability for critical and specialized procedures in clinical settings. After installation, these systems provide greater stability, which is highly anticipated in high-volume diagnostic centers and hospitals. Advanced features like hybrid functionality, dose optimization, and specialized applications like cardiac catheterization labs with features like digital subtraction angiography, are fueling the segment's growth.

The mobile/portable digital fluoroscopy systems segment is projected to grow at the fastest CAGR during the foreseeable period, owing to their flexibility, ability to offer point-of-care imaging, and minimal invasive procedures. Mobile systems can be easily moved and portable between various operating rooms, emergency wards, ICUs, and even to the outpatient clinics. This flexibility is highly crucial in the healthcare sector. These systems are cost-effective and support minimally invasive methods in cardiology, urology, and orthopedics.

By Technology

How is Flat Panel Detector-based Systems Technology Facilitating the Digital Fluoroscopy System Market?

The flat panel detector-based systems segment held the largest market share of nearly 74%, and the same segment is projected to grow at the fastest CAGR during the foreseeable period due to its unmatched offerings like excellent image quality, improved operational efficiency, and minimal radiation exposure. This technology offers high resolution and low-distorted images across an entire field of view that eventually enhances diagnostic precision even for the smallest anatomical details with a broader spectrum, fueling the segment's expansion in the digital fluoroscopy system market.

Moreover, flat panel detector-based systems allow immediate image acquisition and display that bypasses the need for analog-to-digital conversion steps needed by traditional systems, making it highly flexible and convenient for further treatment. FPD's design is further witnessing advancement like integration of advanced visualization tools, advanced materials, and AI integration, further fueling the segment growth.

By Application

Why is the Cardiology Segment Leading in the Digital Fluoroscopy System Market?

The cardiology segment held the largest market share of nearly 28% in 2025 due to the increasing cases of CVDs, making the digital fluoroscopy system a highly anticipated system to perform a wide range of minimally invasive heart surgeries. Cardiovascular diseases are one of the leading causes of mortality across the globe, eventually increasing the demand for diagnostic tools and treatment by patients and hospitals. Fluoroscopy provides real-time images of the heart and blood vessels around it, which is a critical aspect for diagnosing the real cause and assisting complex procedures like stent placements and coronary angiography.

The orthopedics & trauma segment is projected to grow at the fastest CAGR in the digital fluoroscopy system market during the foreseeable period, as digital fluoroscopy systems offer real-time imaging guidance, which is a vital part of treating musculoskeletal injuries and brittle bones in the elderly population. Mobile C-arm systems are highly compatible for minimally invasive orthopedic and trauma operations like fracture fixing, spinal surgery, and knee replacement. As these surgeries need extreme accuracy for proper bone alignment and implants, Digital Fluoroscopy offers a detailed view of body structures that allows surgeons to monitor progress in real time.

By End User

Why Do Hospitals Segment the Digital Fluoroscopy System Market?

The hospitals segment held the largest market share of nearly 61% in 2025 due to the huge volume of patient handling and the increasing demand for special diagnostic imaging systems with high precision. Many patients visiting hospitals are required to treat several complex issues, such as conditions of CVDs, gastrointestinal problems, and orthopedic diseases that require minimally invasive procedures. Also, hospitals possess the needed capital and huge investments for employing advanced digital systems that can be integrated into existing infrastructure for effective ways of handling large pools of patients.

The ambulatory surgical centers segment is projected to grow at the fastest CAGR in the digital fluoroscopy system market during the foreseeable period, owing to the increasing demand for minimally invasive and reliable procedures for health conditions like CVDs and pain management. The ambulatory surgical centers are heavily investing in mobile C-arm systems to support guided workflows and reduce overall procedural period, with live imagery guidance by using digital fluoroscopy systems. Also, the compact and portable nature of C-arms fulfils the operational requirements of ambulatory surgical centers.

Regional Analysis

How Big is the North America Digital Fluoroscopy System Market?

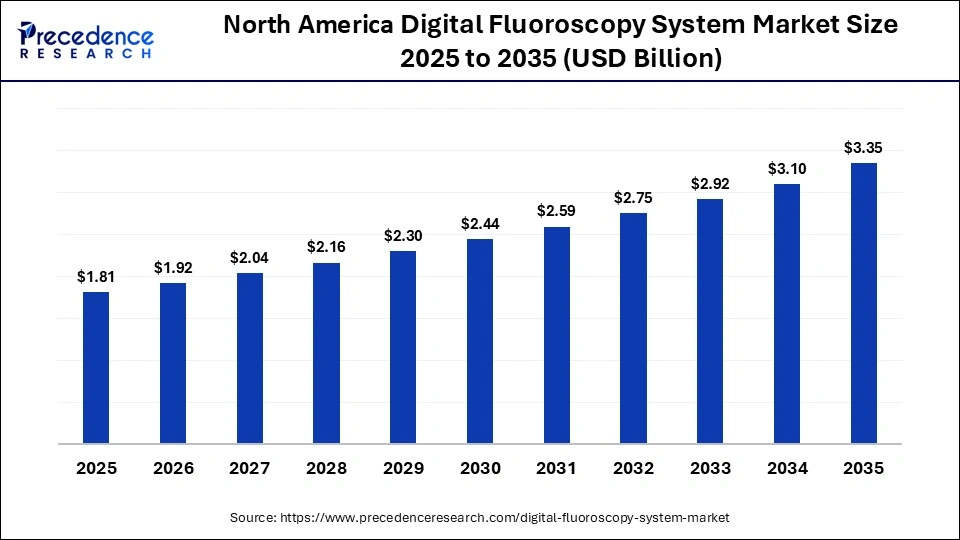

The North America digital fluoroscopy system market size is estimated at USD 1.81 billion in 2025 and is projected to reach approximately USD 3.35 billion by 2035, with a 6.35% CAGR from 2026 to 2035.

What Factors Made North America a Dominant Region in the Digital Fluoroscopy System Market?

North America held the largest market share of nearly 34% in 2025, owing to a couple of factors like highly advanced healthcare infrastructure with high expenditure, rapid adoption of technological advancements and innovation in medical imaging, along with supportive government regulations and reimbursement policies to propel technologically advanced healthcare settings in the region. The increasing geriatric population in North America with various chronic diseases like cancer, CVDs, and orthopedic issues often requires diagnostic and interventional procedures. This is possible by utilizing advanced imaging technology like a digital fluoroscopy system.

What is the Size of the U.S. Digital Fluoroscopy System Market?

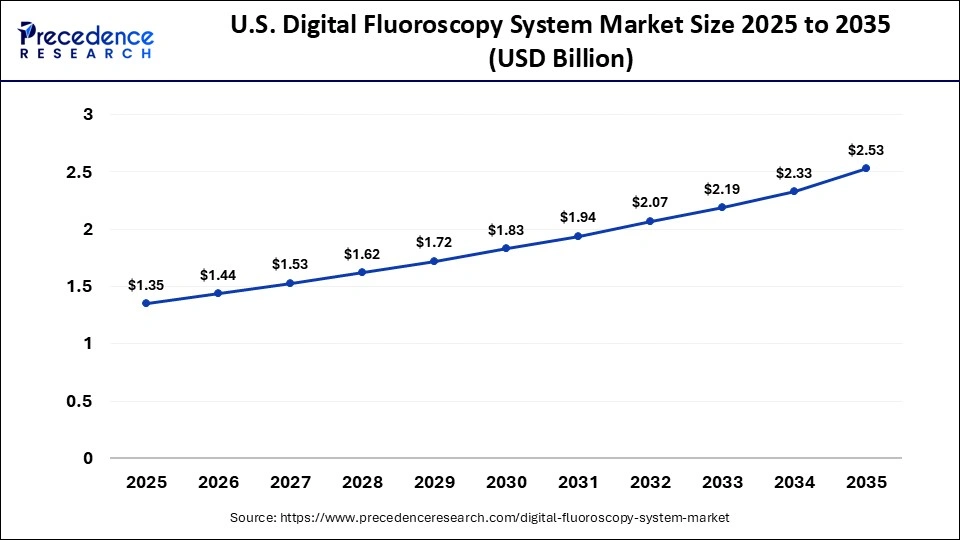

The U.S. digital fluoroscopy system market size is calculated at USD 1.35 billion in 2025 and is expected to reach nearly USD 2.53 billion in 2035, accelerating at a strong CAGR of 6.48% between 2026 and 2035.

U.S. Digital Fluoroscopy System Market Trends

The region is witnessing significant trends like the integration of AI/ML models with digital fluoroscopy systems, a focus on minimally invasive surgery, and increasing regulatory approvals by authorities like the U.S. FDA for novel technologies, recognizing the demand for minimally invasive surgeries for chronic diseases to reduce overall disease burden in the U.S.

Also, active marketers and manufacturers in the U.S are largely shifting their focus to adopt eco-friendly procedures for mass production of diagnostic imaging systems to reduce the carbon footprints while following safety standards with regulatory adherence.

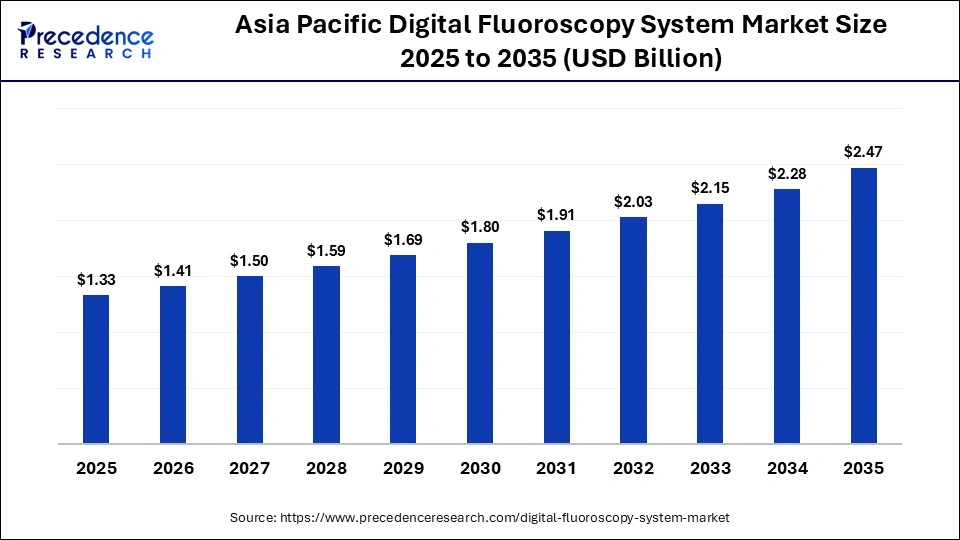

What is the Size of the Asia Pacific Digital Fluoroscopy System Market?

The Asia Pacific digital fluoroscopy system market size is evaluated at USD 1.33 billion in 2025 and is projected to reach approximately USD 2.47 billion by 2035, with a 6.39% CAGR from 2026 to 2035.

What are the Major Growth Factors of the Asia Pacific Digital Fluoroscopy System Market?

Asia Pacific is projected to grow at the fastest CAGR during the foreseeable period due to the major growth factors like expanding healthcare infrastructure as a crucial part of rapid economic development in leading Asian countries like India, China, Japan, Korea and others, government and public initiatives for preventive healthcare measures and growing shift towards integration of advanced imaging technologies to treat chronic disease with minimally invasive procedures.

All these factors eventually increase the demand for digital fluoroscopy systems in the Asia Pacific region, highlighting how technological advancements in healthcare have been prioritized by governments in the region to support a flourishing landscape of innovative technologies and their utility in crucial sectors.

China Digital Fluoroscopy System Market Analysis

The Chinese market is largely expanding due to the increasing healthcare expenditure to support an ageing population susceptible to chronic diseases and a growing shift to leverage advanced technologies for minimally invasive healthcare procedures in issues like intestinal disease, CVDs, orthopedic issues, and others.

China government is primarily focusing on modernizing the medical infrastructure to expand its market potential by leveraging advanced technologies like digital fluoroscopy systems and making it an indispensable tool for precise imaging results. By realizing the government's efforts and increasing demand for reliable imaging techniques by hospitals and patients in the region is encouraging leading marketers to actively invest in R&D for such technologies and develop minimally invasive procedures.

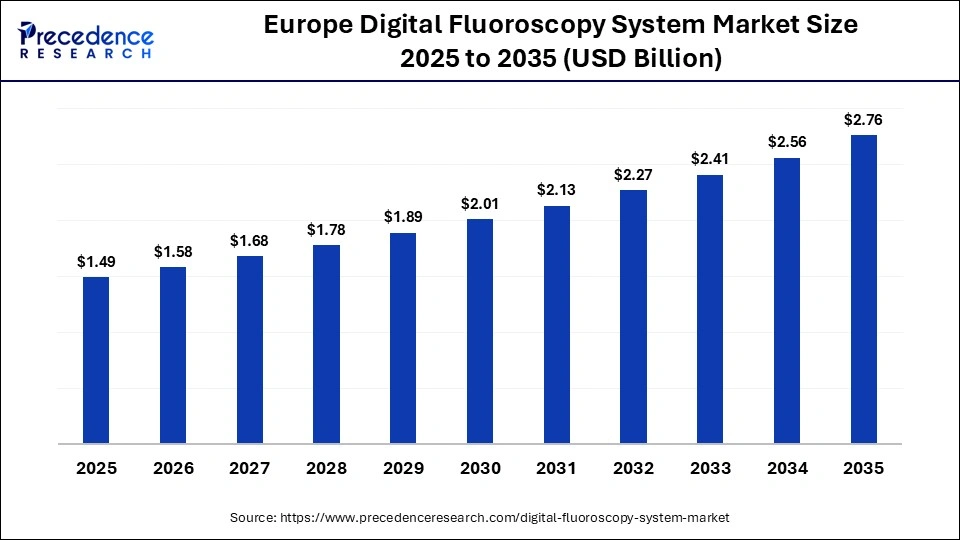

What is the Europe Digital Fluoroscopy System Market Size?

The Europe digital fluoroscopy system market size is evaluated at USD 1.49 billion in 2025 and is projected to reach approximately USD 2.76 billion by 2035, with a 6.36% CAGR from 2026 to 2035.

Why is the Digital Fluoroscopy System Market Growing in Europe?

Europe's demand for digital fluoroscopy systems grows as aging populations require complex diagnostics and chronic diseases rise, increasing procedural volumes. Technological improvements enhance image quality while lowering radiation exposure. Healthcare investment expansion and supportive government initiatives propel the adoption of advanced imaging modalities across clinical settings in continental Europe's medical landscape.

The UK Digital Fluoroscopy System Market Trends

UK healthcare providers invest in digital fluoroscopy to improve diagnostic accuracy across the NHS and private sectors. National funding supports equipment modernization, while favorable reimbursement policies reduce financial barriers. Technological integration with electronic records and artificial intelligence enhances workflow. Rising awareness of early disease detection accelerates adoption throughout clinical facilities nationwide.

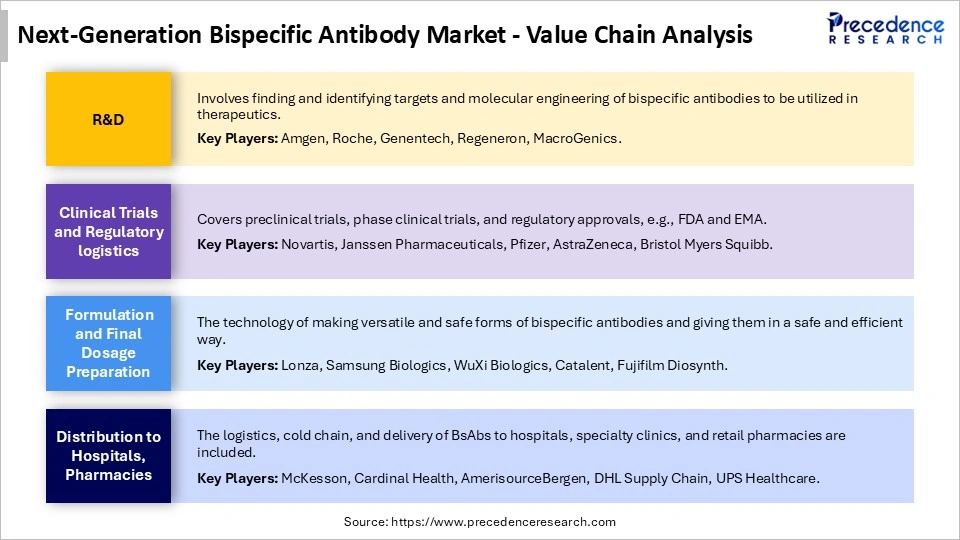

Value Chain Analysis in the Digital Fluoroscopy System Market

Who are the Major Players Operating in the Digital Fluoroscopy System Market?

The major players operating in the digital fluoroscopy system market are Siemens Healthineers AG, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, Shimadzu Corporation, Hologic, Inc., Ziehm Imaging GmbH, Carestream Health, Inc., Hitachi Medical Systems, Agfa-Gevaert Group, Fujifilm Holdings Corporation, Konica Minolta, Inc., Toshiba Medical Systems Corporation, Varian Medical Systems, Inc., Samsung Medison Co., Ltd., Mindray Medical International Limited, Esaote SpA, Villa Sistemi Medicali S.p.A., BMI Biomedical International, and ADANI Systems, Inc.

Recent Developments in the Digital Fluoroscopy System Market

- In July 2025, a leading player Simens healthineers systems namely, Luminos Q.namix and Luminos Q.namix T X-Ray, has gained clearance from the U.S. FDA due to its ability to avoid user radiation exposure. (Source:auntminnie.com)

- In November 2025, a leading marketer, Shimadzu Medical Systems USA, introduced a new mobile C-arm in the U.S., which can freely rotate around the patient during fluoroscopy procedures with flat panel detector technology. (Source: auntminnie.com)

Segments Covered in the Report

By System Type

- Fixed Digital Fluoroscopy Systems

- Mobile / Portable Digital Fluoroscopy Systems

By Technology

- Flat Panel Detector (FPD)-based Systems

- Image Intensifier-based Systems

By Application

- Cardiology

- Orthopedics & Trauma

- Gastrointestinal & Urology Procedures

- Neurology

- Other Applications

By End-User

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers (ASCs)

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting