Digital Utility Market Size and Forecast 2025 to 2034

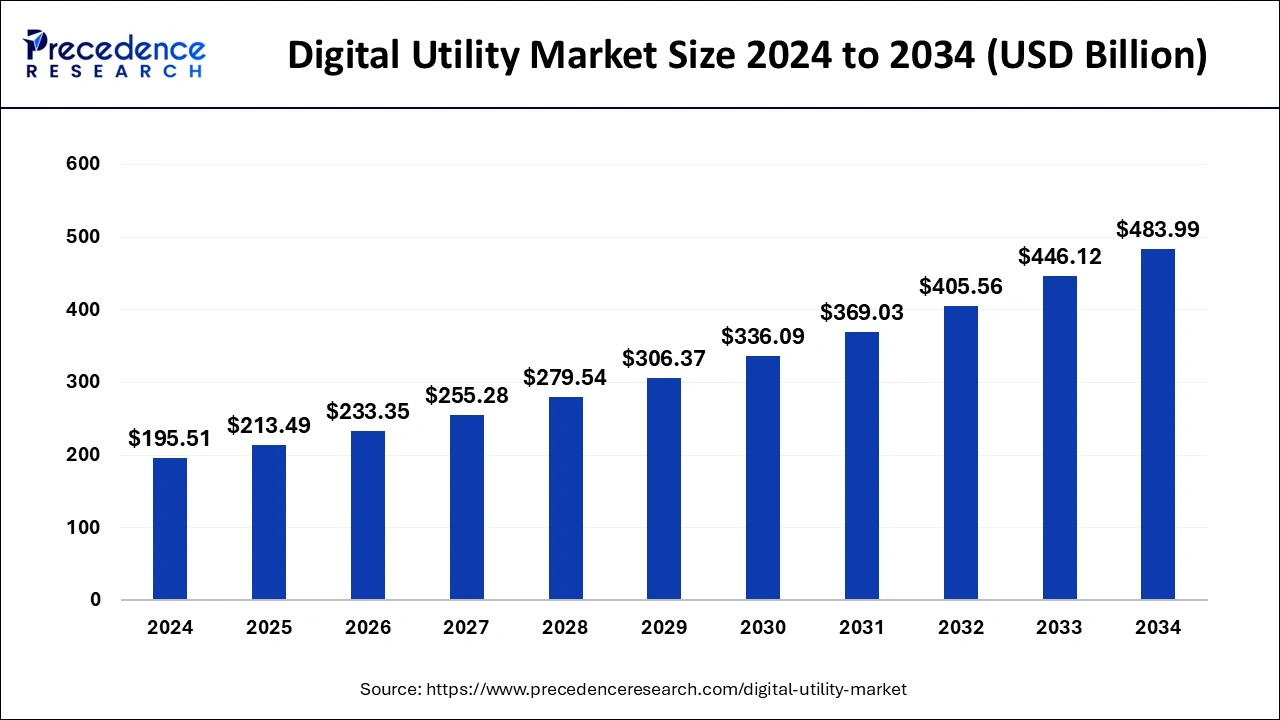

The global digital utility market size was estimated at USD 195.91 billion in 2024 and is predicted to increase from USD 213.49 billion in 2025 to approximately USD 483.99 billion by 2034, expanding at a CAGR of 9.49% from 2025 to 2034.

Digital Utility MarketKey Takeaways

- The global digital utility market was valued at USD 195.91 billion in 2024.

- It is projected to reach USD 483.99 billion by 2034.

- The digital utility market is expected to grow at a CAGR of 9.49% from 2025 to 2034.

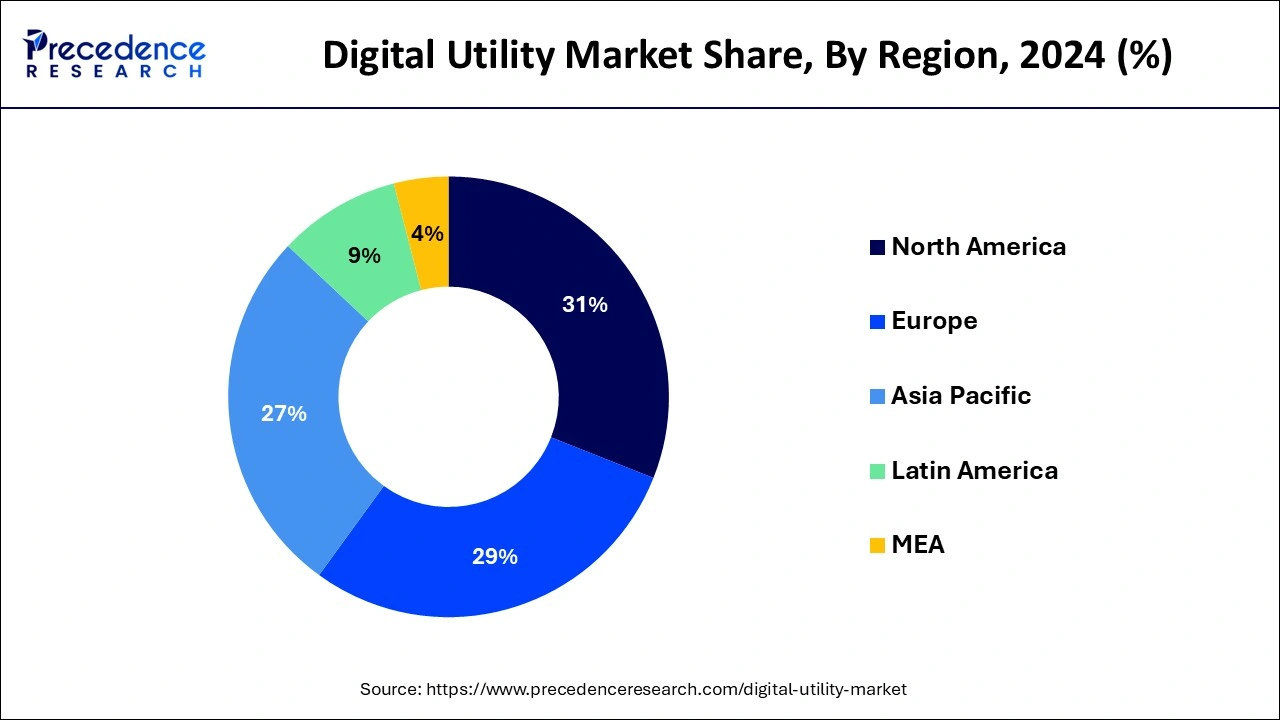

- North America contributed more than 31% of market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By network, the transmission & distribution segment has held the largest market share of 47% in 2024.

- By network, the retail segment is anticipated to grow at a remarkable CAGR of 12.9% between 2025 and 2034.

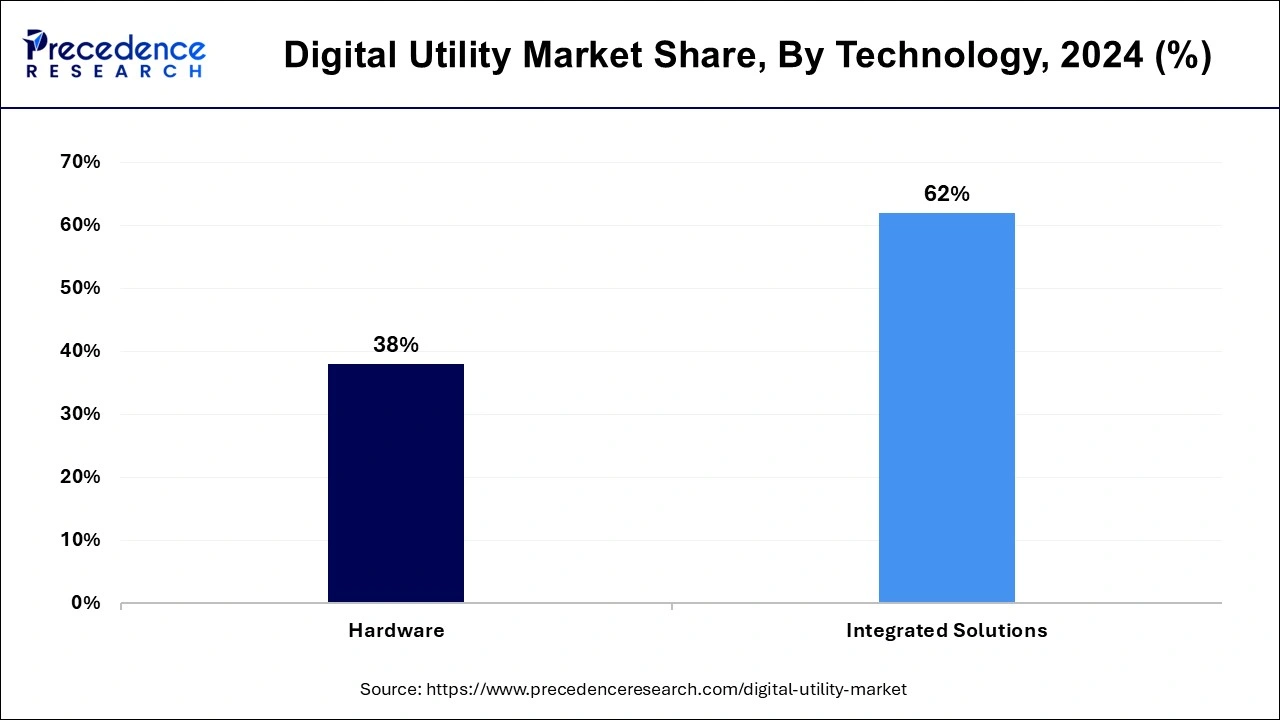

- By technology, the hardware segment generated over 62% of market share in 2024.

- By technology, the integrated solutions segment is expected to expand at the fastest CAGR over the projected period.

U.S.Digital Utility Market Size and Growth 2025 to 2034

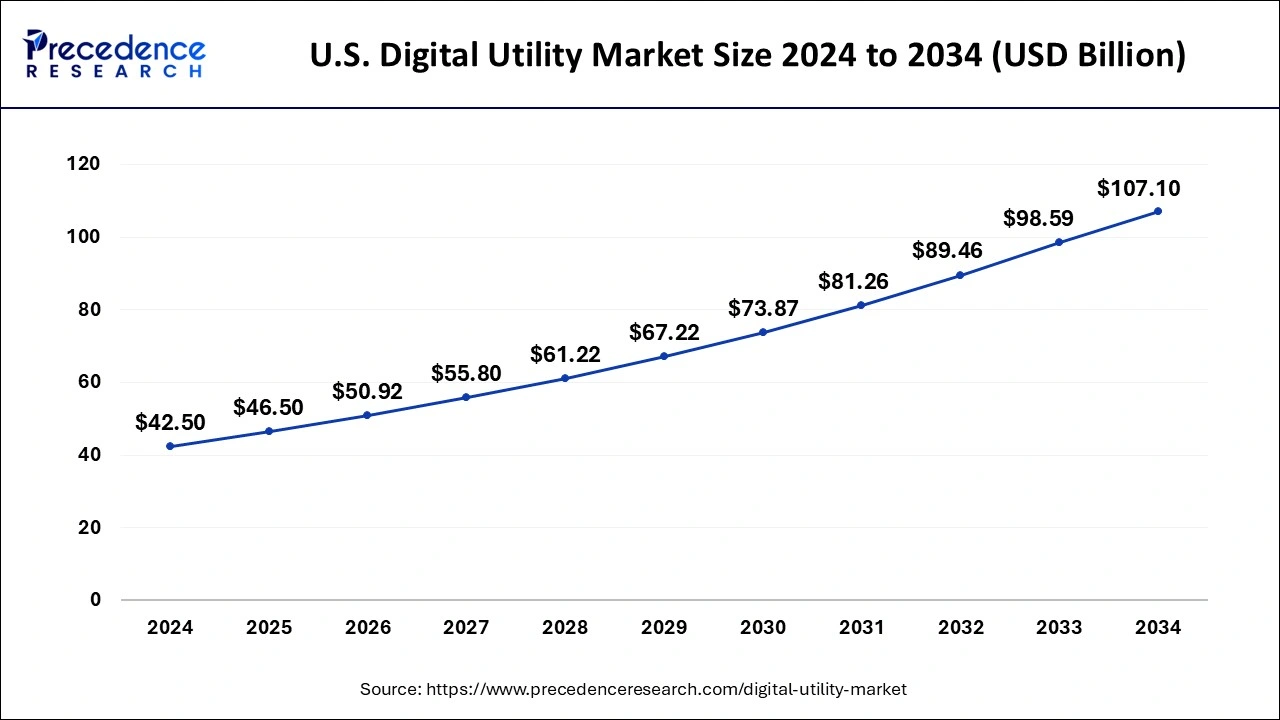

The U.S. digital utility market size was evaluated at USD 42.50 billion in 2024 and is projected to be worth around USD 107.10 billion by 2034, growing at a CAGR of 9.68% from 2025 to 2034.

North America held the dominating share of 31% in the digital utility market due to robust technological infrastructure, early adoption of smart grid technologies, and a strong emphasis on grid modernization. The region's utilities prioritize digitalization to enhance operational efficiency, grid reliability, and sustainability. Favorable government initiatives, stringent regulatory frameworks, and significant investments in research and development further contribute to North America's major market share. The presence of key industry players and a proactive approach toward embracing innovative technologies solidify the region's leadership in shaping the landscape of the digital utility market.

Asia-Pacific is poised for accelerated growth in the digital utility market due to rapid urbanization, increasing energy demand, and government initiatives promoting smart infrastructure.

- In February 2022, the Indian government unveiled plans to allocate INR 19,500 crore to enhance solar module manufacturing through the flagship Production Linked Incentive (PLI) scheme.

The region's expanding population and industrialization drive the need for efficient energy management solutions. Investments in smart grids, renewable energy integration, and digital technologies are on the rise, fostering a conducive environment for the digital utility market. The commitment to sustainability and the implementation of advanced technologies position Asia-Pacific as a key player in driving innovation and reshaping the future of utility operations in the digital landscape.

Meanwhile, Europe is witnessing substantial growth in the digital utility market due to several factors. The region's commitment to renewable energy integration, smart grid advancements, and stringent environmental regulations are driving the adoption of digital utility solutions. Increasing investments in grid modernization, along with government initiatives promoting sustainable energy practices, contribute to the market's notable expansion. Additionally, a focus on enhancing energy efficiency, coupled with a supportive regulatory framework, positions Europe as a key player in the ongoing digital transformation of the utility sector.

Market Overview

Digital utility refers to the integration of advanced technologies, data analytics, and communication systems within the traditional utilities infrastructure to enhance efficiency, reliability, and sustainability. In the context of electricity, water, and gas services, digital utility solutions leverage smart meters, sensors, and IoT devices to gather real-time data on consumption patterns and grid performance. This wealth of information enables utilities to optimize resource allocation, detect faults promptly, and respond to demand fluctuations in a more agile manner.

Additionally, digital utility initiatives often incorporate predictive analytics and machine learning algorithms to forecast potential issues, enabling proactive maintenance and reducing downtime. By embracing digital transformation, utilities aim to create more resilient, responsive, and intelligent infrastructures capable of meeting the evolving demands of modern societies while promoting resource conservation and environmental sustainability.

Digital Utility MarketGrowth Factors

- The growth of the digital utility market is fueled by the adoption of smart grid technologies. These systems enhance the efficiency of electricity delivery, providing real-time monitoring and enabling effective communication between utilities and consumers.

- The widespread implementation of AMI, including smart meters, is a key driver for digital utility market expansion. Smart meters allow utilities to gather real-time data on energy consumption, empowering them to optimize distribution, detect faults, and enhance overall grid reliability.

- With the increasing use of renewable energy sources, digital utility solutions play a crucial role in integrating solar and wind power into the grid. These technologies manage the variability of renewable sources, ensuring grid stability.

- The utilization of data analytics, machine learning, and artificial intelligence enables utilities to proactively conduct predictive maintenance. This approach helps identify potential issues before they cause system failures, reducing downtime and operational costs.

- As utilities embrace digital transformation, ensuring cybersecurity becomes essential. The digital utility market growth is closely linked to the development and implementation of robust cybersecurity solutions, safeguarding critical infrastructure against cyber threats.

- The digital utility market is positively influenced by government initiatives and regulations encouraging the adoption of digital technologies in the utility sector. Incentives and regulatory frameworks promoting the modernization of utility infrastructure play a pivotal role in shaping the market landscape.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.49% |

| Market Size in 2025 | USD 213.49 Billion |

| Market Size by 2034 | USD 483.99 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Network and Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Smart grid adoption

- As of 2020, global smart grid investments were estimated at $31.9 billion, showcasing a growing commitment to modernize utility infrastructure.

The surge in smart grid adoption has become a catalyst for the escalating demand in the digital utility market. Smart grids, characterized by advanced communication and automation capabilities, enhance the efficiency and reliability of electricity distribution. With real-time data monitoring, grid optimization, and bidirectional communication between utilities and consumers, smart grids necessitate sophisticated digital solutions. The deployment of smart grid technologies not only addresses the challenges of traditional grids but also drives the need for digital utility solutions that can seamlessly integrate and manage complex data streams.

As utilities worldwide transition towards smart grid architectures, the digital utility market experiences a parallel surge in demand. The momentum is further propelled by the growing acknowledgment of the benefits, including improved grid resilience, reduced downtime, and enhanced operational efficiency. With utilities embracing smart grid technologies as a strategic imperative, the digital utility market is positioned at the forefront, providing innovative solutions to meet the evolving demands of a modernized and interconnected energy landscape.

Restraint

Skills and workforce challenges

Skills and workforce challenges present significant restraints to the market demand for digital utility solutions. The evolving nature of digital technologies in the utility sector requires a skilled workforce proficient in areas such as data analytics, cyber security, and smart grid management. However, there is a noticeable shortage of professionals with the necessary expertise, hindering the seamless implementation and operation of digital utility systems.

The rapid pace of technological advancements compounds the challenge, as it necessitates continuous training and upskilling of the existing workforce. Utilities face the dilemma of recruiting and retaining talent capable of navigating the complexities of digital utility infrastructure. These skills gap not only impedes the deployment of innovative solutions but also poses operational risks, as inadequately trained personnel may struggle to optimize and secure digital systems effectively. Addressing these challenges requires strategic investments in workforce development and education programs to cultivate a skilled talent pool capable of steering the digital transformation in the utility sector.

Opportunity

Data analytics and predictive maintenance

- As of 2021, utility companies implementing predictive maintenance reported a 25% reduction in downtime and a 30% decrease in maintenance costs, highlighting the tangible benefits of these technologies.

Data analytics and predictive maintenance are pivotal in creating significant opportunities within the digital utility market. The integration of advanced analytics allows utilities to derive actionable insights from vast amounts of data, optimizing operational efficiency and grid performance. This presents an opportunity for solution providers to offer innovative data analytics platforms tailored to the unique needs of utility companies.

Moreover, predictive maintenance, enabled by machine learning and artificial intelligence, revolutionizes asset management in the utility sector. By forecasting equipment failures before they occur, utilities can minimize downtime, reduce maintenance costs, and enhance overall system reliability. This opens avenues for companies specializing in predictive maintenance solutions to play a central role in the digital transformation of utility infrastructure. As the industry recognizes the value of proactive asset management, the demand for sophisticated data analytics and predictive maintenance technologies is set to grow, offering a promising market landscape for innovative and forward-thinking digital utility solutions.

Network Insights

The transmission & distribution segment had the highest market share of 47% in 2024. Within the digital utility market, the transmission and distribution segment pertains to the modernization of energy transmission networks and distribution systems. This involves adopting advanced technologies like smart grids and real-time monitoring to improve the efficiency and reliability of electricity delivery. A notable trend in this segment is the integration of digital solutions for grid optimization, predictive maintenance, and real-time data analytics. These advancements empower utilities to enhance energy flow, minimize losses, and address issues promptly, contributing to the development of a more resilient and responsive energy infrastructure.

The retail segment is anticipated to witness rapid growth at a significant CAGR of 12.9% during the projected period. In the digital utility market, the retail segment refers to the integration of digital technologies to enhance customer-facing operations in the energy retail sector. This involves leveraging smart meters, data analytics, and customer engagement platforms to provide consumers with real-time insights into their energy consumption, personalized services, and efficient billing processes. Trends in the retail segment include the adoption of customer-centric platforms, demand response programs, and the integration of e-commerce elements, reflecting a shift towards a more consumer-centric and digitally driven energy retail experience.

Technology Insights

The hardware segment has held a 62% market share in 2024. In the digital utility market, the hardware segment encompasses the physical components and equipment integral to the functioning of digital utility solutions. This includes smart meters, sensors, communication devices, and other hardware infrastructure supporting the deployment of advanced technologies within utility grids. Recent trends indicate a surge in demand for robust and scalable hardware solutions to enable the seamless integration of smart grid technologies. As utilities worldwide embark on digital transformation journeys, hardware innovations are pivotal in enhancing grid reliability, optimizing resource utilization, and facilitating real-time communication in the evolving landscape of digital utilities.

The integrated solutions segment is anticipated to witness rapid growth over the projected period. The integrated solutions segment in the digital utility market refers to comprehensive technological offerings that seamlessly combine various components, such as smart grid systems, data analytics, and communication platforms. These solutions streamline utility operations, enhance grid management, and optimize resource allocation. Trends indicate a growing preference for integrated solutions that provide end-to-end capabilities, fostering efficiency and reliability. As utilities seek cohesive and interoperable technologies, the integrated solutions segment is witnessing increased adoption, reflecting a broader industry shift towards holistic digital platforms in the realm of utility management.

Recent Developments

- In May of 2023, Siemens, the renowned German manufacturing company, unveiled its latest offering, Industrial Operations X. This innovative portfolio empowers users to effortlessly integrate hardware and software components, enabling operational technology (OT) to adapt swiftly to the pace of software advancements.

- In September 2021, Innowatts, an artificial intelligence firm, joined forces with Amazon Web Services to propel the digital transformation of energy providers. By harnessing the full potential of cloud-based and highly scalable data analytics, Innowatts aims to process over 4 billion data points per hour. This initiative seeks to provide the utility industry with enhanced transparency in their operations.

Digital Utility Market Companies

- General Electric

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- Oracle Corporation

- Itron, Inc.

- Honeywell International Inc.

- Eaton Corporation

- Landis+Gyr AG

- Sensus (Xylem Inc.)

- Huawei Technologies Co., Ltd.

- Toshiba Corporation

- Aclara Technologies LLC

Segments Covered in the Report

By Network

- Generation

- Transmission & Distribution

- Retail

By Technology

- Hardware

- Integrated Solutions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting