What is Direct-to-Chip Liquid Cooling Market Size?

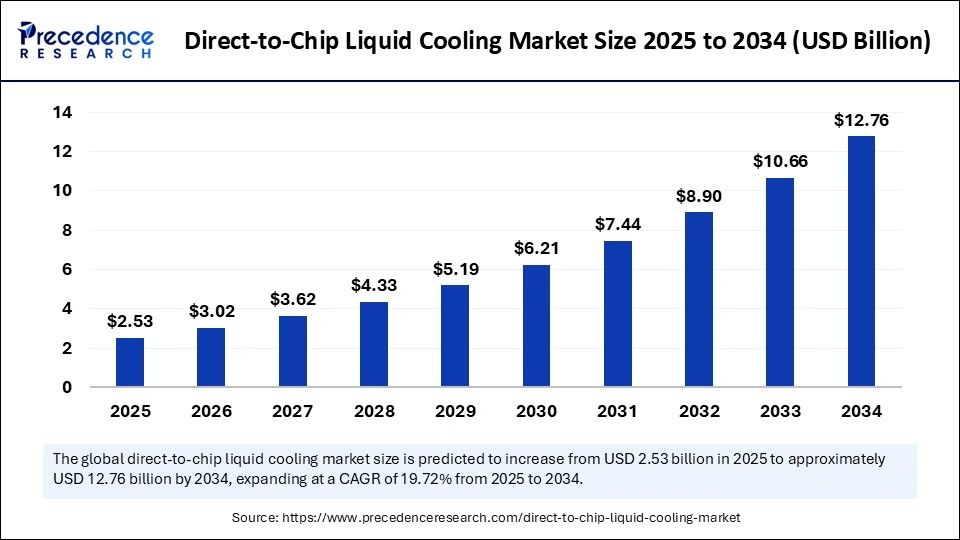

The global direct-to-chip liquid cooling market size is calculated at USD 2.53 billion in 2025 and is predicted to increase from USD 3.02 billion in 2026 to approximately USD 12.76 billion by 2034, expanding at a CAGR of 19.72% from 2025 to 2034. The demand for high-performance computing, like data analytics, machine learning, and AI, has increased, driving the global direct-to-chip liquid cooling market. Government initiatives in promoting energy efficiency and investments in data center infrastructures are expected to boost the market in the coming period.

Market Highlights

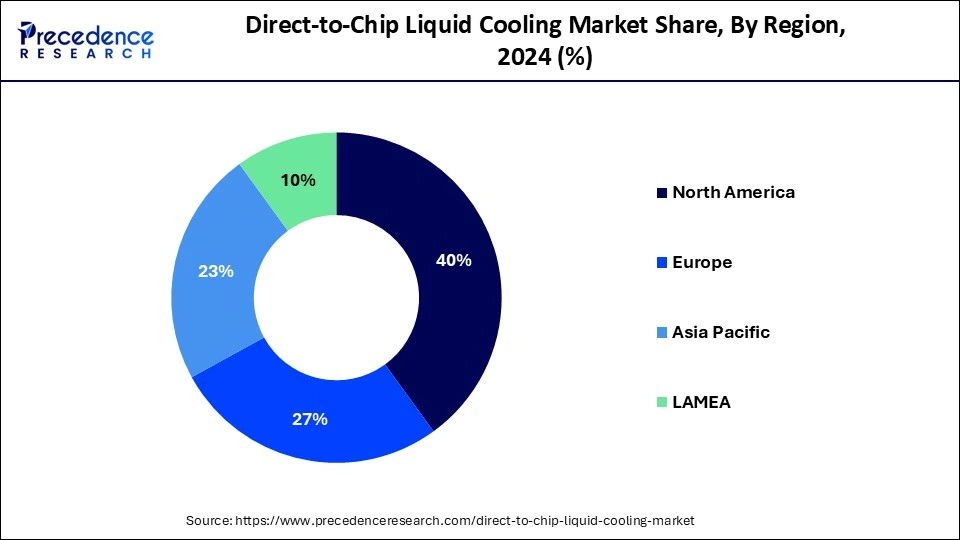

- North America dominated the global market with the largest market share of 40% in 2024.

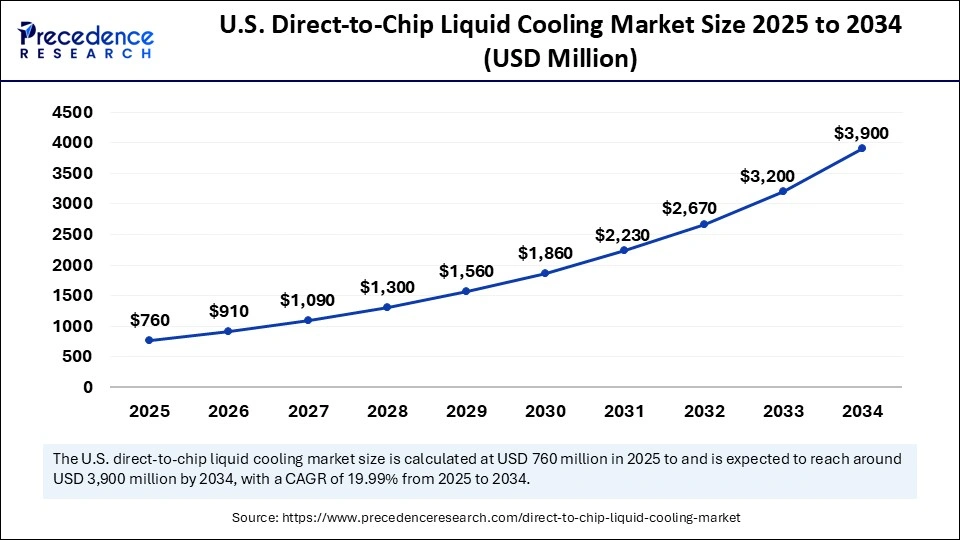

- The U.S. direct-to-chip liquid cooling market is poised to grow at a solid CAGR of 21.8% from 2025 to 2030.

- Asia Pacific is projected to grow at the fastest CAGR of 22.7% during the forecast period.

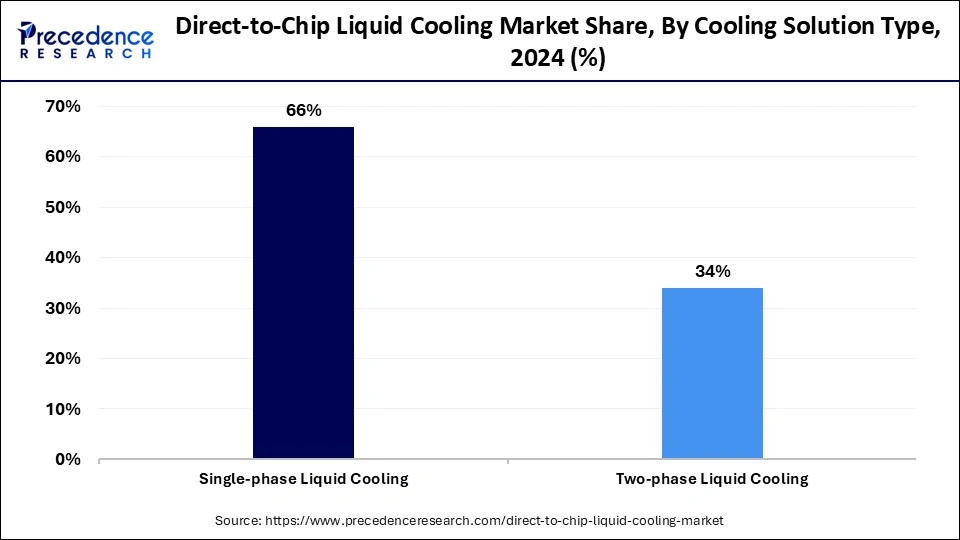

- By cooling solution type, the single-phase liquid cooling segment contributed the highest market share of 66% in 2024.

- By cooling solution type, the two-phase liquid cooling segment is expected to witness the fastest growth during the predicted timeframe.

- By component cooling, the CPU cooling segment captured the biggest market share in 2024.

- By component cooling, the memory cooling segment will expand rapidly in the coming years.

- By liquid coolant type, the water-based coolants segment contributed the highest market share in 2024.

- By liquid coolant type, the dielectric fluids segment is expected to witness the fastest growth during the predicted timeframe.

- By application, the data center segment captured the biggest market share in 2024.

- By application, the high-performance computing (HPC) segment will expand rapidly in the coming years.

- By end-use, the telecommunications segment held a significant market share in 2024.

- By end-use, the oil and gas segment is projected to grow with the fastest CAGR during the forecast period.

Market Overview

Direct-to-Chip Liquid Cooling: Key Optimization in Data Center Efficiency

The direct-to-chip liquid cooling market has witnessed significant growth due to increased adoption of energy-efficient and sustainable liquid cooling technologies in data centers and high-performance computing ecosystems. Government support and investment in data center infrastructure have boosted the required for advanced cooling solutions, including direct-to-chip liquid cooling solutions. Additionally, the use of high-performance computing and AI has increased, leading to the production of high heat, driving the need for the adoption of advanced direct-to-chip liquid cooling solutions to improve performance, efficiency, reduce heat, and operational cost. As the growth of digital transformation is being seen, the growth of adoption of direct-to-chip liquid cooling market will take place.

How is AI Impacting the Adoption of Direct-to-Chip Liquid Cooling Solutions?

The rising utilization of Artificial Intelligence technology is the major influencer driving demand for direct-to-chip liquid cooling systems. AI workloads need high-performance computing, which generates excessive heat. Direct-to-chip liquid cooling solutions help to maintain performance and reliability, as well as efficiency in managing the heat. Companies are focusing on implementing advanced direct-to-chip liquid cooling solutions, such as single-phase solutions, to manage excessive heat produced by the AI workloads.

- In April 2025, the industry experts discussed AI's impact on DC power needs and liquid cooling innovation, and predictions about hyperscalers, CAPEX investments, and revenue, at Data Center World 2025. According to Vlad Galabov, Omdia's Research Director for Digital Infrastructure, AI is likely to boost more than 50% of global data center capacity and more than 70% of revenue opportunity.

Government Initiatives to Influence the Direct-to-Chip Liquid Cooling Market in 2025

- In April 2025, to respond to President Trump's 25% steel and aluminum tariffs, the EU approved retaliatory tariffs on €21 billion (USD 23.2 billion) in U.S. goods. The tariffs are likely to increase the cost associated with equipment and construction and improve trade tensions, potentially affecting tech supply chains and investor confidence. The cost of liquid cooling solutions is likely to touch the sky shortly.

- In December 2024, Mitsubishi Heavy Industries, Ltd. (MHI), NTT Communications Corporation (NTT Com), and NEC Networks & System Integration Corporation (NESIC), demonstrated testing to improve the cooling capacity of data centers without major changes to existing facilities; to respond, Tokyo Metropolitan Government's Bureau of Industrial and Labor Affairs supports the early practical application of technologies for the GX-related industries project, established in October 2024.

What are the Major Trends of the Global Direct-to-Chip Liquid Cooling Market?

- Expanding Data Centers: Rapid expansion of data centres across the globe is driving the necessity for efficient cooling solutions for the management of heat loads and improving energy efficiency, contributing to the growth of the direct-to-chip liquid cooling market.

- Increase Consumer Demand: Consumers worldwide have increased demand for advanced computing solutions like AI, machine learning, and data analytics, driving demand for advanced and efficient cooling solutions, including direct-to-chip liquid cooling.

- Government Regulations: The government is focusing on implementing regulations to reduce energy and water consumption to reduce the carbon footprint, driving the surge toward direct to cheap liquid cooling solutions.

- Technological Innovations: Ongoing innovations and directed chip liquid cooling technology, such as single-phase and two-phase cooling, to improve efficiency and reduce cost burden, contributing a significant impact on market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 2.53 Billion |

| Market Size in 2026 | USD 3.02 Billion |

| Market Size in 2034 | USD 12.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Cooling Solution Type, Component Cooling, Liquid Coolant Type, Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Sustainability Demand in Data Centers

The rapid expansion of data centers has increased the need for sustainable solutions. Liquid cooling solutions help to reduce energy consumption and carbon footprints. Data centers are adopting direct-to-chip liquid cooling solutions to reduce energy consumption, for water conservation, heat, and to reduce greenhouse gas emissions produced by the data centers. Additionally, the ability of direct-to-chip liquid cooling enables higher compute densities and enhances reliability and performance, helping to reduce the need for additional data center space and consistency in temperatures. Government worldwide is investing in improving energy efficiency, driving innovation, and developments of more efficient direct-to-chip liquid cooling solutions.

Restraints

High Cost

The direct-to-chip liquid cooling solutions required high investments in installation, infrastructure, and maintenance. The solutions required specialized liquid fluids, which increased their upfront cost. Additional infrastructure requirements like leak detection, monitoring systems, hardware like cold plates, heat exchangers, and pumps can increase cost compared to conventional air-cooling systems. Additionally, direct-to-chip liquid cooling systems can be complex, require customized designs and installation, leading to higher cost. The high cost can hamper adoption in some organizations.

Opportunity

Hyperscale and Edge Data Centers

The establishment of Hyperscale and Edge Data Centers is rising, driven by increased demand for 5G networking, use of AI and IoT, cloud computing, and growing need for low-latency applications. These technologies require spectacular computing power and data storage, driving demand for hyperscale and edge data centers, which drives the requirement for efficient cooling solutions to support high-density computing and energy efficiency. Rising investments in hyperscale and edge data centers are driving investments in cutting-edge cooling solutions, including direct-to-chip liquid cooling systems.

Segment Insights

Cooling Solution Type Insights

The single-phase liquid cooling segment dominated the global market by holding more than 66% in 2024, driven by wide adoption due to their efficient heat dissipation, cost-effectiveness, and simplicity, making them ideal for high-performance computing and data centers. Technological advancements in single-phase liquid cooling systems are enhancing their efficiency and reliability, driving wide adoption in high-performance computing, IT enterprises, and edge data centers.

The two-phase liquid cooling segment is anticipated to grow fastest over the forecast period due to its increased adoption in high-performance computing. The two-phase liquid cooling system enhances high-density computing application performance and improves energy efficiency. The ability of solutions to handle high heat loads makes them ideal for facilities that require efficient thermal management solutions.

- In February 2025, ZutaCore, a trailblazer in waterless direct liquid cooling, appointed two seasoned executives to its leadership team to accelerate global demand for companies' two-phase direct liquid cooling technology for AI data centers

(Source: https://www.prnewswire.com)

Component Cooling Insights

In 2024, the CPU cooling segment dominated the market. The heat generation of CPU components is high due to the use of higher core counts and clock speeds. The rapid adoption of AI, IoT devices, cloud computing, and high-performance computing is increasing the power consumption of CPUs, driving the need for advanced and more efficient cooling solutions, including direct-to-chip liquid cooling. The ability of these solutions to efficiently cool high-density computing applications makes them more sustainable solutions.

The memory cooling segment is witnessing significant growth due to increased use of memory chips in modern computing, including servers, HPC systems, AI, and machine learning workloads. The application requires high-performance memory solutions with higher speeds and capacities, generates significant heat, and drives the requirement for efficient thermal management cooling solutions to maintain stability and performance.

Liquid Coolant Type Insights

The water-based coolants segment generated the largest market share in 2024. Water-based coolants provide high thermal conductivity, making them an ideal choice for heat dissipation. water-based coolants are effective in reducing energy consumption while maintaining high-performance standards, increasing their use in sustainability-conscious enterprises. The cost-effectiveness of these coolants has led to rapid adoption in various industries like data centers and high-performance computing.

The dielectric fluids segment is the second-largest segment, leading the market due to wide adoption for their efficient heat transfer, energy-saving, and sustainable benefits. Dielectric fluid coolants provide major electric installations, making them efficient for direct-to-chip liquid cooling applications. The ability of dielectric fluids to prevent electric shorts and safe operational standards makes them suitable for efficient heat management for high-density electronics.

Application Insights

In 2024, the data center segment captured the largest market share due to the wide adoption of direct-to-chip liquid cooling solutions for data centers. Data centers generate high power densities and heat loads. The traditional air-cooling methods face challenges in managing complex and power-intensive workloads of data centers. Rising adoption of cloud services is driving the requirement for an efficient cooling solution in data centers.

However, the high-performance computing (HPC) segment is expected to lead the market in the forecast period. The use of high-performance computing applications, including AI, IoT, and machine learning, has increased, generating high heat loads, driving demand for efficient thermal management solutions. The high-performance computing ecosystem is expanding in various industries, including research, healthcare, and finance, experiencing the generation of high-power densities and heat generation from CPUs and GPUs. The need for efficient solutions to maintain stable performance and prevent thermal throttling, increasing the adoption of direct-to-chip liquid cooling in high-performance computing (HPC) applications.

End-use Insights

The telecommunications segment accounted largest market share in 2024. The expansion for the use of 5G, data centers in the telecommunication industries, contributes to the adoption of direct-to-chip liquid cooling solutions. The edge infrastructure and data center of the telecommunication industry are driving the need for a liquid cooling system to manage heat. Telecommunication has increased adoption of 5G networks for extensive video streaming and massive data generation, driving demand for direct-to-chip liquid cooling to manage sustainability, reduce energy consumption, and maintain optimal performance.

- In January 2025, ZutaCore showcased its HyperCool technology at the 2025 Pacific Telecommunications Council (PTC) in Honolulu, Hawaii. The company aims to improve energy efficiency, cost-effectiveness, and sustainability of AI factories and data centres.

(Source- https://blog.zutacore.com)

The oil and gas segment is the second largest, leading the market, due to increased use of digital oilfield technologies, including downhole and subsea applications, driving the need for liquid cooling solutions to maintain high temperature and improve reliability and performance. The ability of direct-to-chip liquid cooling solutions to offer more efficient and space-saving solutions makes them suitable for high-performance computing used in the oil and gas industry.

Regional Insights

U.S. Direct-to-Chip Liquid Cooling Market Size and Growth 2025 to 2034

The U.S. direct-to-chip liquid cooling market size is exhibited at USD 760 million in 2025 and is projected to be worth around USD 3,900 million by 2034, growing at a CAGR of 19.99% from 2025 to 2034.

Surge for High-Performance Technology: Key Trend of the North America Market

North America held the major market share of 40% in 2024 with the region's robust growth in data centers, increased use of high-performance computing, and companies' investments in innovation and technological advancements. North America is the hub for well-established research institutions, universities, and industries, contributing to major adoption of high-performance computing, driving the need for advanced cooling solutions. Additionally, ongoing investments in data center infrastructure are fostering the adoption of direct-to-chip liquid cooling solutions to enhance performance efficiency and reduce the cost burden.

The U.S. is a major player in the regional market, growth driven by a rise in adoption of high-performance technologies, government support for exascale efforts, and growing demand for sustainable and energy-efficient solutions.

How Does U.S. Traffic Impact Direct-to-Chip Cooling Areas?

U.S. manufacturers and suppliers are facing challenges due to US tariffs. The wide-ranging “liberation day” tariffs sent by US President Donald Trump to the global financial market have created a significant impact on the data center industry.

- In April 2025, US President Donald Trump announced new sanctions, according to that the baseline tariff placed in imported goods coming into the US is 10%. While some countries like the UK will face the basic level of tax. However, Chinese imports will face 54% tariffs.

The US tariffs are significantly impacting sectors, including data center construction, hardware manufacturing, software development, supply chains, user demand, and energy consumption.Despite these economic challenges for the data center liquid cooling sector, the high demand for high-performance computing, cloud services, and AI adoption is expected to continuously foster direct-to-chip liquid cooling in the US data centers.

Digital Transformation Fueling Asian Adoption of Direct-to-Chip Liquid Cooling

Asia Pacific is representing a double-digit CAGR of 22.7% over the forecast period, driven by regional rapid digital transformation, increased adoption of cutting-edge technologies, and demand for energy-efficient and sustainable solutions. The Government of Asian is promoting sustainable infrastructure, encouraging initiatives in innovation and development of advanced direct-to-chip liquid cooling solutions in countries like China, India, Japan, and Singapore. Ongoing US traffic is expected to boost the market significantly in Southeast Asia.

China and Japan are leading countries in the Asian market, with growth driven by China's robust cloud applications market and Japan's high-value data centers. The countries are witnessing significant investments in data center advancements, fueling the adoption of the direct-to-chip liquid cooling market.

Rise in Demand for Energy-Efficient Solutions: to fuel the European Market

The European direct-to-chip liquid cooling market has witnessed transformative growth due to an increase in demand for energy-efficient solutions and high-density computing solutions. The Government of Europe is promoting the adoption of green technologies. Stringent regulatory encouragement and companies' heavy investments in research and development, enabling access to advanced direct-to-chip liquid cooling solutions in the region.

Germany is a significant player in the regional market, growth driven by the country's robust focus on sustainability and energy efficiency. Rising data center infrastructure in Germany, contributing to the adoption of direct-to-chip liquid cooling solutions for the management of high heat loads and enhancing renewable power use.

Nvidia's Major Initiatives in 2025: Direct-to-Chip Liquid Cooling Technology and Sustainability

Nvidia is the major player in 2025 innovation in direct-to-chip liquid cooling solutions. The company has set a goal to resolve AI's water consumption problems with direct-to-chip cooling and reported a 300X improvement with closed-loop systems.

Navida has claimed its GB200 NVL72 and GB300 NVL72 machines to be 25 times more energy-efficient and 300 times more water-efficient than coolers, which use direct-to-chip liquid cooling systems.(Source: https://www.tomshardware.com)

What Potentiates the Growth of the Direct-to-Chip Liquid Cooling Market in Latin America?

The market in Latin America is expected to grow at a steady rate during the forecast period. This is mainly due to the region's increasing adoption of high-performance computing, data centers, and AI workloads that demand efficient thermal management. Rising investments in hyperscale and enterprise data center infrastructure, coupled with the need for energy-efficient cooling solutions to reduce operational costs, are further accelerating market adoption. Additionally, technological advancements and growing awareness of sustainable cooling practices are creating significant opportunities for D2C liquid cooling solutions across the region. The leading investment firms are also focusing on developing data centers in this region, supporting market growth.

Brazil is a major contributor to the market in Latin America. This is due to its rapidly expanding data center infrastructure and growing demand for high-performance computing across industries. Strong investments in cloud services, AI applications, and energy-efficient cooling solutions further position Brazil as a key driver of regional market growth.

- In October 2024, the Brazil Climate and Ecological Transformation Investment Platform (BIP) was launched to promote international green investments. The government's initiatives for ecological and digital transformation foster a supportive environment for such advanced technologies.

How is the Opportunistic Rise of the Middle East & Africa in the Direct-to-Chip Liquid Cooling Market?

The Middle East & Africa (MEA) is experiencing an opportunistic rise in the market, driven by accelerated investment in data centre infrastructure across the Gulf Cooperation Council region and North Africa, coupled with harsh ambient climates that make traditional air cooling systems less viable. Additionally, government-driven initiatives, including smart city rollouts, digital transformation programmes, and sustainability mandates (such as PUE targets for new facilities), are creating compelling demand for high-efficiency liquid-cooling systems capable of managing high-density workloads and extreme thermal environments.

- In August 2025, Ecolab introduced a new cooling technology to improve the performance of Middle Eastern data centers. Carrier Global Corporation partnered with Strategic Thermal Labs to integrate data center solutions and develop direct-to-chip liquid cooling technology with their launch in Saudi Arabia and other African facilities.

Saudi Arabia is considered a major player in the market in MEA. The national data center strategy aims to increase and expand data center capacity by encouraging environmentally friendly data centers that will attract more investments in technology. Rising demand for AI applications and high-performance computing significantly drives the market.

Direct-to-Chip Liquid Cooling Market Companies

- ZutaCore

- Advanced Micro Devices, Inc.

- Schneider Electric

- JetCool Technologies

- LiquidStack

- Iceotope Technologies

- CoolIT Systems

- Asetek

- Fujitsu

- Chilldyne, Inc.

- Vertiv Holdings Co

Recent Developments

- In April 2025, direct-to-chip liquid cooling was demonstrated at its flagship STT Bangkok 1 data centre facility by a leading data centre service provider in Asia, ST Telemedia Global Data Centres (STT GDC). The cutting-edge technology has recently achieved certification in the NVIDIA DGX-Ready Data Center programme and is already being used in the facility.(source: https://www.sttelemediagdc.com)

- In March 2025, Accelsius presented its innovative NeuCool™ two-phase direct-to-chip liquid cooling technology in Data Centre World London at Booth DC715. The company showcased its latest innovation through a live tabletop demo and multiple server configurations, including a multi-GPU solution.(source: https://www.linkedin.com)

Segment Covered in the Report

By Cooling Solution Type

- Single-phase liquid cooling

- Two-phase liquid cooling

By Component Cooling

- CPU cooling

- GPU cooling

- ASIC cooling

- Memory cooling

- Other

By Liquid Coolant Type

- Water-based coolants

- Dielectric fluids

- Mineral oils

- Engineered fluids

By Application

- Datacenter

- Workstations

- High-performance computing (HPC)

- Edge computing devices

- Supercomputers

- Others

By End Use

- Telecommunications

- Financial services

- Healthcare and life sciences

- Oil and gas

- Aerospace and defense

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content