What is the Distribution Transformer Market Size?

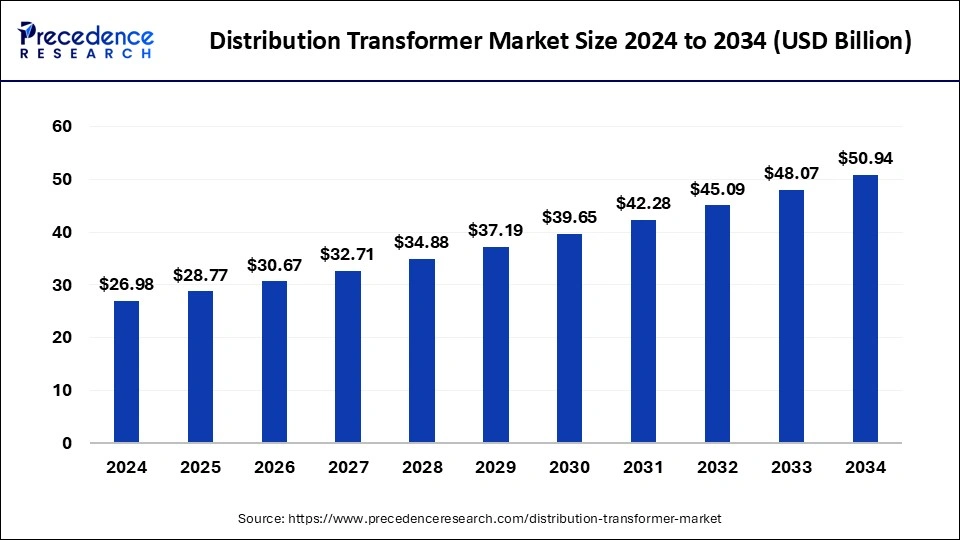

The global distribution transformer market size was estimated at USD 28.77 billion in 2024 and is predicted to increase from USD 30.67 billion in 2026 to approximately USD 50.94 billion by 2034, expanding at a CAGR of 6.56% from 2025 to 2034.

Distribution Transformer Market Key Takeaways

- Asia Pacific held the dominant share of the market in 2024.

- North America is observed to expand at a rapid pace during the forecast period.

- By phase, the three-phase segment accounted for the dominating share in 2024.

- By phase, the single-phase segment is expected to witness a significant share during the forecast period.

- By mounting, the pad-mounted segment accounted for the dominating position in 2024.

- By mounting, the pole-mounted segment is expected to witness a significant rate of growth during the forecast period.

- By power rating, the 2,501 kVA-10,000 kVA segment held the largest segment of the market in 2024.

- By power rating, the below 500 kVA segment is expected to grow significantly during the forecast period.

- By end-use industry, the industrial segment accounted for the largest share in 2024.

Market Overview

In the modern era, the world runs on electricity. Distribution transformers play a critical role in delivering electricity. Distribution transformers help in bringing light to the people. From big industrial complexes to small household appliances, all rely on a seamless power supply for heating, lighting, communication, transportation, computing, and several other applications. A distribution transformer is also known as a "typical isolation transformer". This transformer converts the high voltage into low voltage for use in power distribution. A distribution transformer generally reduces high-voltage electricity from power stations down to normal or lower levels for distribution to commercial, residential, and industrial customers. Distribution transformers are available in different standard sizes and power ratings to match different distribution voltage levels and load demands.

Distribution Transformer Market Trends

- In January 2023, CG Power and Industrial Solutions Limited, an India-based Murugappa Group company announced its investment worth $15 million to expand the manufacturing capacity of its power transformers and distribution transformer units. The company has decided to invest 15 million to expand the power transformers and distribution transformer units at Malanpur and Bhopal.

- In May 2022, Hitachi Energy announced its plans to invest over $10 million in the expansion and modernization of its distribution transformer facility in Jefferson City, Missouri, US to provide additional capacity and enhance its manufacturing capabilities.

- In February 2024, the Ministry of Energy in Romania signed 21 distribution modernization contracts worth $693 million from the Modernisation Fund for the expansion and modernization of the electricity distribution network.

- In April 2023, the Asian Development Bank (ADB) announced its plans to invest in non-convertible debentures valued at Rs 150 crore in Tata Power Delhi Distribution Ltd (TPDDL). The investment aims to improve Delhi's power distribution through grid enhancements.

Distribution Transformer Market Growth Factors

- The rising population coupled with rapid urbanization and industrialization are the major factors promoting the distribution transformer market's growth in the upcoming years.

- The rising investments and growing government initiatives for building electricity infrastructure are expected to boost the demand for distribution transformers.

- The rise in renewable energy projects to meet the rising electricity demand. It requires transmission and distribution infrastructure to accommodate these projects, which is projected to accelerate the growth of the distribution transformer market.

- The rising application of distribution transformers in power systems such as providing suitable voltages to supply electric railway systems, a seamless supply of power to agricultural areas located away from the main grid and catering to the temporary loads on construction sites.

- The rising adoption of smart grids for power distribution systems is expected to contribute towards the growth of the market during the forecast period.

- The rising innovations in distribution transformers are expected to fuel market growth.

Distribution Transformer Market Outlook:

- Industry Growth Overview:

The distribution transformer market is expected to experience strong growth between 2025 and 2034 due to increased electricity demand across residential, commercial, and industrial sectors. Furthermore, the utilities are also actively replacing the old fleets of transformers with new, low-loss units to improve the efficiency and reliability of operations, which drives the market. - Sustainability Trends:

Sustainability and energy efficiency are becoming more important in the distribution transformer market. Manufacturers are using amorphous core materials, low-loss steels, and eco-friendly insulating oils to reduce energy losses and greenhouse gas emissions. There is also a growing focus on transformers with minimal environmental impact throughout their lifecycle, such as recyclable parts and less risk of oil leaks. - Global Expansion:

Transformer manufacturers are strategically increasing production capacities and expanding service networks to meet the rising electricity demands worldwide. Modernized transformers used in smart grids and renewable energy integration are also utilized by North American utilities, prompting manufacturers like Wilson Power Solutions and Eaton to scale up. Increasing urbanization in Asian countries and the industrial electrification of North America and Europe are boosting the use of medium- and low-voltage distribution transformers. - Major Investors:

The distribution transformer sector is drawing significant interest from strategic and infrastructure-focused investors due to its long-term growth prospects and vital role in electrification. ABB, Schneider Electric, and Hitachi, the global leaders, have secured funding to expand their high-efficiency and digital transformer manufacturing lines. Infrastructure investment programs in Asia, Africa, and Latin America are fueling market consolidation and the development of new projects. - Startup Ecosystem:

The startup ecosystem in the market is evolving rapidly. Emerging companies are developing energy-efficient, low-loss transformer cores and environmentally friendly insulating materials, with utilities and industrial customers in mind. There is a surge of venture capital and corporate financing into those startups to modernize the electricity distribution infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.77 Billion |

| Market Size in 2026 | USD 30.67 Billion |

| Market Size by 2034 | USD 50.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.56% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phase, End-Use Industry, Mounting, Power Rating, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing consumption of electricity

The rising consumption of electricity electrification globally is expected to boost the growth of the distribution transformer market in the upcoming years. The rising electrification of remote or rural areas coupled with the expansion of power distribution networks is anticipated to boost the demand for distribution transformers. The spur in the urban population increases the demand for electricity consumption. Governments around the world are actively investing in several electrification projects to enhance access to electricity with an aim to improve the living standards of people. Several schemes increasing electrification in India such as Ujwal DISCOM Assurance Yojana (UDAY), Deen Dayal Upadhyay Gram Jyoti Yojana (DDUGJY), and Integrated Power Development Scheme (IPDS).

Restraint

Fluctuation in raw material prices

The volatility in raw material prices is anticipated to hamper the growth of the distribution transformer market. Distribution transformers use raw materials such as copper, steel, and insulating fluids. The volatility in the prices of these raw materials can adversely impact the overall cost of the transformer as well as the profitability of manufacturers as they find it difficult to pass on the increased costs to potential customers due to severe competitive pressures or contractual obligations. Such factors may restrict the expansion of the global distribution transformer market during the forecast period.

Opportunity

Increasing adoption of smart distribution transformers

The rising adoption of smart distribution transformers is projected to offer lucrative opportunities to the distribution transformer market during the forecast period. The rapid advancements in technology marked a remarkable evolution by offering smarter and more efficient energy distribution systems. The market has witnessed the rapid adoption of smart distribution transformers as they come with communication devices, sensors, and excellent monitoring systems that assist in real-time data collection and analysis and facilitate extremely useful insights into the functioning of the transformer and the overall power grid.

Its capability to collect data on parameters including voltage, load, and temperature aids in reducing downtime and predictive maintenance as well as helps in extending the lifespan of the transformer. Therefore, the use of smart distribution transformers provides remote monitoring, energy efficiency, fault detection, and load management facilities which is anticipated to boost the market's revenue during the forecast period.

Phase Insights

The three-phase segment accounted for the dominating share in distribution transformer market in 2024. The three-phase transformer is widely used in industries, large residential complexes, and others for higher capacities. The most common ratings for three-phase distribution transformers include 40kVA, 25kVA, 100kVA, 160kVA, 500kVA, 63kVA, 200kVA, and others. This three-phase transformer transmits the current to a secondary distribution circuit and reduces the voltage of the primary distribution circuit. Thereby driving the market's growth.

The single-phase segment is expected to witness a significant share during the forecast period. Single-phase is well suited for lower-capacity applications such as commercial spaces, residential complexes, and others. The most common ratings for single-phase are 10 kVA, 25 kVA, and 63kVA.

- In December 2023, Prolec GE, a Prolec subsidiary of a joint venture between GE and Xignux, a Mexico-based private company announced additional manufacturing investments of USD 85 million to meet unprecedented North American demand for single-phase pad-mount transformers.

Mounting Insights

The pad-mounted segment accounted for the dominating share in distribution transformer market in 2024. The segment is observed to grow at a notable rate during the forecast period. Pad-mounted transformers are mounted on a concrete pad, and they are most commonly found in outdoor areas such as industrial areas, suburban areas, and commercial areas. This transformer is an indispensable component of an electrical power distribution system and offers numerous benefits and applications. It has a dead front design and a weatherproof enclosure making it a safe and efficient power distribution choice.

The pole-mounted segment is expected to grow at a considerable rate in the global distribution transformer market over the forecast period. These transformers are widely used in rural areas ranging from 16 kVA to 100kVA and are available in small sizes which makes them easy to fit on single-pole structures. These transformers are resistant to harsh weather when they are used in remote locations. These transformers are generally mounted on an electrical service pole at the height of the overhead cables. Thereby driving the segment's growth.

- In April 2022, Siemens Energy launched the pole-mounted transformer CAREPOLE, an innovative dry-type single-phase transformer for pole applications. Designed for the technological requirements of the American grid, the new cast-resin distribution transformer provides a reliable and sustainable alternative to oil-filled transformers.

Power Rating Insights

The 2,501 kVA–10,000 kVA segment held the largest share of the distribution transformer market in 2024, the segment is expected to sustain the position throughout the forecast period. Distribution transformers with a 2,501 kVA to 10,000 kVA range are highly demanded in large residential buildings, infrastructure facilities, and commercial establishments. On the other hand, the Below 500 kVA segment is expected to grow significantly during the forecast period owing to the rising small power rating substation projects. Below 500 kVA are ideal for rural areas and households. As more rural households gain electricity, an increasing need for smaller distribution transformers for reliable and constant distribution of power in these areas.

End-use Industry Insights

The industrial segment accounted for the largest share in 2024 and is anticipated to grow at a robust CAGR over the forecast period. The growth of the segment is majorly driven by rapid industrialization. Distribution transformers are extensively used for the transmission and supply of electrical power to industries for performing several industrial applications. Distribution transformers facilitate ideal voltage levels to power motor-driven machinery, enabling them to operate efficiently and smoothly.

Regional Insights

What Made Asia Pacific the Dominant Region in the Distribution Transformer Market?

Asia Pacific held the dominant share of the distribution transformer market in 2024. The region is observed to witness prolific growth during the forecast period. The growth of the region is attributed to the presence of key market players, the rapid progress of industrialization & urbanization, increasing electrification, supportive government initiatives, andincreasing focus on renewable energy integration which results in creating significant growth opportunities for the distribution transformer market in the region.

In the Asia Pacific region, China and India are anticipated to contribute rapidly towards the growth of the market owing to rising populations and rapid growth of the commercial & industrial sectors which require a reliable supply of electricity. These countries have also witnessed growing investment in expanding the power structure to meet the ongoing electricity demand from both urban and rural areas in countries. The robust network of distribution transformers facilitates seamless power supply to industries, commercial centers, residents in urban areas, and remote villages and is expected to boost the growth of the distribution transformer market during the forecast period.

- Power Grid Corporation of India Limited (POWERGRID) holds a pivotal role in the bulk transmission of power across India. As of March31, 2024, the company's transmission network spans approximately 1,77,699 ckm of Extra High Voltage (EHV) transmission lines and comprises 278 EHV AC & HVDC Sub-stations, boasting a transformation capacity of 5,27,446 MVA.

In recent decades, the government of India has come up with numerous electrification initiatives that have resulted in increasing demand for distribution transformers in the region. As per the report published by India Brand Equity Foundation, India is the third-largest producer and consumer of electricity globally, with an installed power capacity of 416.59 GW as of April 30, 2023.

The Indian Government's initiative to provide electricity to each village and every household through various schemes of electrification including DDUGJY, RAPDRP, IPDS, and Saubhagya has significantly increased the demand for distribution transformers all over India.

What Makes North America the Fastest-Growing Region?

North America is observed to expand at a rapid pace during the forecast period. The growth of the region is attributed to the increasing investment in the development of infrastructure, favorable government policy, rapid industrialization, and robust growth of the economy. In addition, rising energy consumption across the region is expected to drive the growth of the distribution transformer market during the forecast period. For instance, in 2022, the United States electricity demand rose by 2.6 percent due to robust economic activity and higher residential use to meet both cooling and heating needs amid hotter summer weather and colder winter weather. As per the US Energy Information Agency (eia.gov), in 2022, about 4.24 trillion kWh of electricity was generated at utility-scale electricity generation facilities in the US.

U.S. Distribution Transformer Market Analysis

The U.S. is expected to maintain dominance in the North American distribution transformer market. The implementation of smart grid programs, especially in California and Texas, is likely to increase the adoption of digital transformers. The incorporation of renewable energy sources, such as distributed solar and wind farms, is expected to increase demand for transformers with on-load tap changers and flexible load management.

How is the Opportunistic Rise of Europe in the Market?

Europe is experiencing an opportunistic rise in the distribution transformer market, driven by stringent regulations focused on energy efficiency, sustainability, and grid resilience. EU regulations like the Eco-design Directive are pushing utilities to use low-loss, high-efficiency distribution transformers that decrease operational costs and prevent energy losses. Additionally, the shift toward renewable energy and decentralized generation in Germany, France, and other major European markets is accelerating transformer upgrades.

Germany Distribution Transformer Market Analysis

Germany is a major player in the European distribution transformer market and is expected to remain the main driver of growth in the region. Effective regulatory systems are encouraging utilities to adopt high-efficiency, low-loss transformers. Additionally, investment programs involving both private and public sectors are expected to further boost growth by funding high-efficiency transformer projects across the country.

What Potentiates the Growth of the Distribution Transformer Market in Latin America?

In Latin America, the market is driven by expanding power infrastructure and increasing deployment of renewable energy. Governments in the region are increasingly leveraging concessional financing and international funds to expand distribution networks in underdeveloped urban and rural areas. Furthermore, the market continues to grow steadily as utilities in Brazil, Mexico, and other Latin American nations invest in grid extension and modernization.

Brazil Distribution Transformer Market Analysis

Brazil leads the Latin American distribution transformer market and is projected to remain the dominant country in the region. The government's emphasis on increasing electrification in rural and semi-urban regions of the country is driving demand for pole-mounted and pad-mounted distribution transformers. Additionally, international development banks are expected to invest more in infrastructure modernization plans, which significantly boost market growth.

What Opportunities Exist in the Middle East & Africa (MEA)?

The Middle East & Africa (MEA) presents significant opportunities in the distribution transformer market, driven by rapid economic development, urbanization, and rising energy demand across the industrial and residential sectors. Furthermore, utilities are moving toward temperature-resilient design and digitally enabled smart transformers to withstand harsh climates, unstable voltage, and an ever-increasing grid complexity.

UAE Distribution Transformer Market Analysis

The UAE is the largest contributor to the market in the Middle East & Africa, and it is expected to lead regional growth in the coming years. It is estimated that infrastructure investments supported by the government and partnerships between government and business provide long-term market opportunities. Additionally, regulatory incentives and environmental standards are likely to encourage the adoption of energy-efficient and greener transformer technologies.

Distribution Transformer Market : Value Chain Analysis

Raw Material Sourcing

- The foundation of distribution transformer production lies in sourcing high-quality electrical steel (core laminations), copper/aluminum conductors (windings), insulating oils, resins, and other insulating materials. Reliable material quality is crucial for transformer efficiency, reliability, and lifespan.

Key Players: JFE Steel, Nippon Steel, Hindalco Industries, BHEL (materials supply division).

Component Fabrication

- Raw materials are processed into transformer components, including wound coils, laminated cores, tank enclosures, bushings, and cooling systems. Precision in this stage determines performance, thermal efficiency, and reliability.

Key Players: Crompton Greaves, Fuji Electric, ABB, Siemens Energy.

Transformer Assembly & Manufacturing

- Components are assembled into complete distribution transformers, following strict quality and safety standards, including insulation testing, temperature rise testing, and short-circuit performance evaluation.

Key Players:HD Hyundai Electric, Toshiba Corporation, Wilson Power Solutions, Transformers & Rectifiers India Ltd.

Testing & Quality Assurance

- Finished transformers undergo rigorous electrical and mechanical testing, including impulse, load, and partial discharge tests, to meet international standards (IEC, IEEE). Quality assurance ensures reliability in utility grids and industrial applications.

Key Players: SGB-SMIT Group, Hammond Power Solutions, Hitachi Ltd., Kirloskar Electric.

Distribution & Supply to Utilities / OEMs

- Completed transformers are distributed to power utilities, industrial end-users, and OEMs for grid integration, rural electrification, and industrial applications. Efficient logistics and after-sales service are key to market success.

Key Players: ABB, Schneider Electric, Eaton Corporation, Ormazabal.

Operation & Maintenance (O&M) Services

- Ongoing monitoring, preventive maintenance, and repair services extend transformer life and ensure reliability in electricity distribution networks. This stage increasingly includes digital monitoring solutions and predictive analytics.

Key Players:Siemens Energy, Fuji Electric, Crompton Greaves, Emerson Electric.

Top Companies in the Distribution Transformer Market

- Padmavahini Transformers Private Limited (India): Specializes in customized dry-type, oil-cooled, converter duty and distribution transformers up to 132 kV and 20 MVA.

- HD Hyundai Electric Co., Ltd. (South Korea): Global supplier of power transformers and electrical equipment, with more than 1.2 million kVA transformers shipped to over 70 countries.

- Siemens / Siemens Energy (Germany): Produces industrial and grid transformers, including large power transformers, and is expanding its transformer manufacturing capacity in Europe and the U.S.

- Toshiba Corporation (Japan): Manufacturer of power and distribution transformers with a focus on electrical grid and industrial applications.

- ABB (Switzerland): Offers a full range of transformers, including high-efficiency amorphous metal distribution transformers that significantly reduce no-load losses.

- Fuji Electric Co., Ltd. (Japan): Supplies power, traction, and distribution transformers for energy infrastructure and industrial systems.

- Crompton Greaves Ltd. (India): Known for manufacturing and distributing transformers and substations tailored for utilities and rural electrification.

- Eaton Corporation Plc (Ireland / U.S.): Provides power management equipment, including distribution transformers and modular substation solutions.

- General Electric (US): Through its grid business, it offers power and distribution transformers for transmission, generation, and industrial segments.

- Ormazabal (Spain): Delivers medium- and high-voltage distribution transformers and modular substation equipment for utilities.

- Transformers & Rectifiers India Limited (TRIL) (India): Specializes in designing and manufacturing distribution and rectifier duty transformers for industrial and utility applications.

- SGB SMIT Group (Germany / Global): A pure-play transformer specialist offering oil-immersed, dry type, and cast resin distribution transformers from 30 kVA to 1,200 MVA.

- Wilson Power Solutions (U.S.): (Also known as Wilson Transformer Co.) Manufacturer of distribution transformers, pad-mounted units, and specialty transformers for utilities and industrial customers.

- Lemi Trafo JSC (Bulgaria): Supplies power and distribution transformers, including custom-built units for Eastern European and global markets.

- Hyosung Corporation (South Korea): Produces large power and distribution transformers, keying into global transmission and distribution infrastructure needs.

- Schneider Electric (France): Offers distribution transformers as part of its energy management and grid automation solutions.

- Vantran Industries (India): Engages in low- and medium-voltage distribution transformer manufacturing for industrial and utility segments.

Recent Developments

- In February 2023, Servokon, leader in the manufacturing and supply of power conditioning equipment and power transformers unveiled a 16,000 KVA power transformer at Elecrama 2023.

- In November 2023, Hitachi Energy announced the launch of liquid-filled transformers with Transient Voltage Protection (TVP) technology.

Segments Covered in the Report

By Phase

- Single-phase

- Three-phase

By End-Use Industry

- Residential

- Commercial

- Industrial

- Power Utility

By Mounting

- Pad

- Pole

- Underground Vault

By Power Rating

- Below 500 kVA

- 501 kVA-2,500 kVA

- 2,501 kVA-10,000 kVA

- Above 10,000 kVA

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting