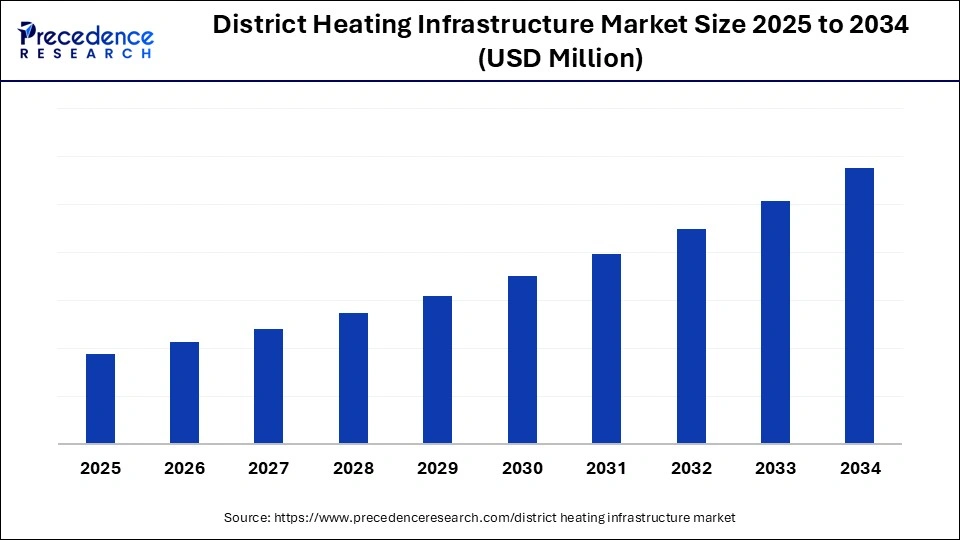

What is the District Heating Infrastructure Market Size?

The global district heating infrastructure market is witnessing strong growth as governments promote centralized heating systems powered by renewable and waste heat sources.This market is growing due to increasing demand for energy-efficient and sustainable heating solutions in urban areas.

District Heating Infrastructure Market Key Takeaways

- Europe dominated the market, holding the largest market share of 40% in 2024.

- The Asia Pacific region is expected to grow at a notable CAGR of 11% during the forecasted period in the district heating infrastructure market.

- By plant type, the combined heat and power segment held the largest share of the market for district heating infrastructure at 60% in 2024.

- By plant type, the boiler plants segment is expected to grow at the fastest rate during the forecast period.

- By application, the residential segment held the largest market share of 45% in 2024.

- By application, the commercial segment is expected to grow at ~7% CAGR during the forecast period.

- By technology, the hot water-based systems segment held the largest share of 70% in the district heating infrastructure market during 2024.

- By technology, the steam-based segment is expected to grow at the fastest rate during the forecast period

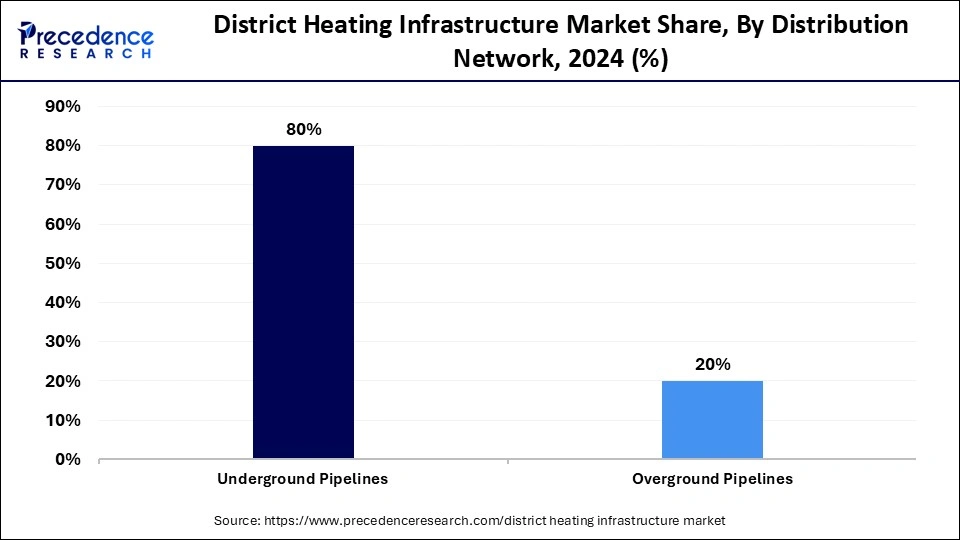

- By distribution network, the underground pipelines segment is expected to grow at the fastest rate of 80% in the district heating infrastructure market during 2024.

- By distribution network, the overground pipelines segment is predicted to witness significant growth in the market over the forecast period.

- By end-user, the municipal utilities segment held the largest share of 50% in the market for district heating infrastructure in 2024.

- By end-user, the private infrastructure operators segment is expected to grow at the highest CAGR during the forecast period.

Market Overview

What is the District Heating Infrastructure Market?

The district heating infrastructure market is witnessing strong growth because there is a growing need for low-carbon and energy-efficient heating systems. Key factors include rising urbanization initiatives to lower greenhouse gas emissions and supportive government policies encouraging the integration of renewable energy sources.

- In July 2025, the Tokyo Metropolitan Government launched Japan's first hydrogen co-firing boiler for district heating, marking a major step toward carbon-neutral urban heating.(Source: https://fuelcellsworks.com)

Key Technologies Shifts in the District Heating Infrastructure Market

- Integration of Renewable Heat Sources: Modern systems increasingly incorporate solar thermal, geothermal, biomass, and industrial waste heat to reduce carbon emissions and improve efficiency. These solutions help cities meet sustainability targets while lowering operational costs. They also encourage localized energy generation and reduce dependence on fossil fuels.

- Advanced Heat Pump Deployment: Traditional boilers are being replaced by high-capacity heat pumps, which allow for effective energy transfer and low-temperature networks. The amount of green energy used in district heating can be increased by integrating heat pumps with renewable electricity because they support both heating and cooling applications, and they increase system flexibility.

- Hydrogen and Hybrid Heating Solutions: District heating networks are being decarbonized through the testing and deployment of hybrid systems and boilers powered by hydrogen. The seamless transition to carbon-free energy can be ensured by integrating these systems with traditional gas networks. With minimal infrastructure modifications, they also facilitate peak demand management.

District Heating InfrastructureMarket Outlook

- Industry Growth Overview: Rising demand for low-carbon energy solutions and the modernization of existing networks are causing market expansion. Technological advancements in heat recovery and digital control systems are further accelerating adoption.

- Sustainability Trends: The market is moving toward carbon-neutral operations by using waste heat, geothermal, and biomass. Businesses are giving energy recycling and the circular economy top priority in order to reach emission reduction goals.

- Startup Ecosystem: New startups are emerging with smart heat metering, AI-driven energy optimization, and waste heat recovery technologies. These innovators are collaborating with governments and utilities to build decentralized, green heat networks.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Plant Type, Application, Technology, Distribution Network, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Focus on Decarbonization and Energy Efficiency

A key driver in the district heating infrastructure market is the global push toward decarbonization and improved energy efficiency. Governments and industries are increasingly adopting sustainable heating solutions to reduce carbon emissions and reliance on fossil fuels. The integration of renewable energy sources, such as biomass, geothermal, and waste heat, is further propelling the expansion of district heating networks. This shift aligns with climate targets and supports the transition to cleaner, more resilient urban energy systems.

Restraint

High Initial Capital Investment and Long Payback Periods

Large upfront expenditures for distribution infrastructure, boilers, and pipelines are necessary to establish district heating systems. Since it frequently takes years for these systems to recoup their investment, they deter new competitors and municipalities with a tight budget. Cost-sharing and financing schemes are still developing in many areas.

- In February 2024, Evonik and Uniper launched the TORTE waste heat recovery project in Gelsenkirchen to feed industrial waste heat into a district heating network.(Source: https://www.evonik.com)

Opportunity

Public-Private Partnerships (PPP) and Policy Support

Big investments are being driven by the government's growing emphasis on low-carbon heating, supported by strong financial incentives and public-private cooperation (PPC) models. These initiatives encourage collaboration between public authorities and private investors to accelerate sustainable infrastructure development. The partnership structure helps distribute financial and operational risks more evenly while ensuring long-term project stability. As a result, district heating systems are experiencing consistent growth and greater market confidence.

- In October 2025, Peel Group and Ener-Vate inaugurated the Mersey Heat Energy Center in Liverpool under a public-private partnership, supplying renewable heat to thousands of homes.(Source: https://www.publicsectorexecutive.com)

Segmental Insights

Plant Type Insights

What Made the Combined Heat and Power Plants Segment Dominate the District Heating Infrastructure Market in 2024?

The combined heat and power plants segment dominated the district heating infrastructure market with a 60% share in 2024, driven by their high energy efficiency capacity to generate electricity and heat simultaneously and reduce greenhouse gas emissions. These characteristics ensure steady demand in established markets and make them extremely advantageous for both urban and industrial applications.

The boiler plants segment is expected to be the fastest-growing in the market during the forecast period. The growth is driven by increasing investments in modern boiler technologies that offer improved efficiency, lower emissions, and compatibility with renewable energy sources. Additionally, many regions are upgrading aging infrastructure with new boiler systems to meet stricter environmental standards.

Application Insights

Why Did the Residential Segment Dominate the District Heating Infrastructure Market in 2025?

The residential segment dominated the district heating infrastructure market with approximately 45% share in 2024 due to the expansion of office complexes, shopping centers, and mixed-use developments are driving the demand for commercial district heating solutions. Additionally, businesses are increasingly seeking energy-efficient heating systems to reduce operational costs and comply with sustainability regulations.

The commercial segment is predicted to be the fastest-growing in the market during the forecast period, driven by its compatibility with contemporary energy-saving technologies, ease of use, reduced maintenance needs, and increased energy efficiency.

Technology Insights

What Made the Hot Water-Based Segment Dominate the District Heating Infrastructure Industry in 2024?

The hot water-based systems segment has dominated the district heating infrastructure market with approximately 70% share in 2024 due to their ability to deliver high-temperature heat over long distances, making them suitable for energy-intensive processes.

The steam-based segment is predicted to be the fastest-growing segment in the market during the forecast period because they are dependable, lose less heat, and have little aesthetic impact in cities. These pipelines also provide increased protection from environmental dangers.

Distribution Network Insights

Why Did the Underground Pipelines Segment Dominate the District Heating Infrastructure Market in 2024?

The underground pipelines segment dominated the market with approximately 80% in 2024, preferred for their reliability, reduced heat losses, and minimal visual impact in urban settings. These pipelines also offer enhanced safety against environmental hazards. Governments and city planners continue to prioritize underground infrastructure for long-term durability and energy efficiency.

The overground pipelines segment is predicted to be the fastest-growing segment in the market, driven by easier maintenance, quicker development times, and cheaper installation costs, especially in places where subterranean installation is difficult. Furthermore, modular overground networks enabled adaptable growth to satisfy expanding industrial and urban heating demands. In areas that are rapidly developing and have the subterranean infrastructure, they are especially beneficial.

End User Insights

What Made the Municipal Utilities Segment Dominate the District Heating Infrastructure Sector in 2024?

The municipal utilities segment has dominated the district heating infrastructure market with approximately 50% share in 2024, because of government funding, regulatory support, and its ability to effectively serve sizable residential and commercial populations. Large-scale heating network management is another area in which municipal utilities excel. Their supremacy guarantees dependable energy distribution and constant service quality.

The private infrastructure operators segment is predicted to be the fastest-growing in the market during the forecast period, driven by increasing privatization, investments in energy infrastructure by private firms, and the push for competitive, efficient, and sustainable heating solutions. Private operators also adopt advanced technologies faster to improve system efficiency and reduce operational costs.

Regional insights

What Made Europe Dominate the District Heating Infrastructure Market in 2024?

Europe dominated the district heating infrastructure market in 2024, accounting for approximately 40% of the global share due to its well-established district heating networks, strong government subsidies, and stringent energy efficiency regulations. The widespread use of combined heat and power (CHP) plants across the region further enhances energy utilization and sustainability. With decades of experience in building and operating efficient heating systems, Europe benefits from mature infrastructure and deep market penetration, making it a benchmark for other regions adopting similar models.

Asia Pacific is projected to be the fastest-growing market during the forecast period, driven by government initiatives promoting sustainable and energy-efficient heating solutions. Rapid industrialization, urbanization, and increasing energy demand are creating a strong need for reliable and centralized heating systems. Countries in the region are investing heavily in modernizing their infrastructure and adopting advanced heating technologies to enhance performance and reduce emissions. As urban population densities continue to rise, the demand for efficient district heating solutions is accelerating, positioning Asia Pacific as a key growth hub in the global market.

Country-Level Investments/Funding Trends for District Heating Infrastructure Market

| Country | Investment Shifts | Funding Trends | Government Initiatives & Policies |

| U.S. | Shift toward sustainable and increased efficiency in new systems. Integration of waste heat recapture from industries and data centers is also a rising trend. | Federal and local governments provide grants, tax credits, and financial incentives to help overcome high capital costs. | The Infrastructure Investment and Jobs Act allocate major funding for grid modernization, involving district energy systems. |

| Germany | Focus on developing and decarbonizing existing networks with renewable and waste heat sources. | The federal funding for the efficient heating networks scheme offers significant grants for feasibility studies, transformation plans, and new infrastructure. | The heat planning act mandates comprehensive heat plans for municipalities, setting targets for renewal and waste heat integration in networks. |

| India | Increasing focus on district heating and cooling systems to fight revolt temperatures and rapid urbanization. Pilot cities are being sued for initial district cooling and heating projects. | While the financing gap for climate resilience persists, government spending on schemes contributes to the broader transition. | The Bureau of Energy Efficiency has advanced policies and mechanisms to promote energy efficiency. |

| UAE | Significant investment in district cooling infrastructure, increasing the incorporation of renewable energy sources like geothermal. | Government support, subsidies, and incentives are elevating district energy projects. | Favorable government policies and rules are driving market growth. |

Top Companies in the District Heating Infrastructure Market

- Fortum Corporation: Fortum is a leading clean-energy company operating one of Europe's largest district heating networks, primarily across Finland, Sweden, and the Baltics. The company focuses on decarbonizing heat generation through bioenergy, waste heat recovery, and digitalized network optimization.

- Vattenfall AB: Vattenfall is one of Europe's biggest producers of heat and electricity, running extensive district heating systems in Sweden, Germany, and the Netherlands. It is investing heavily in fossil-free heat solutions, including geothermal, waste-to-energy, and large-scale heat pumps for carbon-neutral operations.

- ENGIE SA: ENGIE is a global leader in sustainable energy and urban infrastructure, managing over 320 district heating and cooling networks worldwide. The company focuses on integrating renewable energy, biomass, and waste heat sources to support low-carbon urban heating transitions.

- Danfoss Group: Danfoss is a key technology provider in district heating, supplying energy-efficient components like valves, substations, and control systems. It's smart heating and digital monitoring solutions enable cities to reduce heat losses and improve operational efficiency across networks.

- Stat Kraft AS: Statkraft, Europe's largest producer of renewable energy, operates district heating networks in Norway and Sweden powered by bioenergy and heat recovery. The company emphasizes sustainable urban heating solutions aligned with Europe's climate neutrality and energy transition goals.

District Heating Infrastructure Market Companies

- LOGSTOR Denmark Holding ApS (Kingspan Group PLC)

- Vital Energi Ltd.

- Alfa Laval AB

- SHINRYO CORPORATION

- NRG Energy, Inc.

Recent Developments

- In September 2025, Enwave Energy Corporation commissioned the Enwave Green Heat Plant at the Pearl Street Energy Center in Toronto, enabling low-carbon heating and cooling via heat pumps & waste heat.(Source: https://www.globenewswire.com)

- In September 2025, Statkraft AS announced it had sold its district heating business to a consortium of Patrizia SE and Nordic Infrastructure AG.

(Source: https://www.globenewswire.com) - In May 2025, Suma Capital and ENGIE inaugurated a new renewable district heating network in Zamora, Spain, powered mainly by local forest biomass with ~20km of pre-insulated pipes.(Source: https://sumacapital.com)

Segments Covered in the Report

By Plant Type

- Combined Heat and Power (CHP) Plants

- Boiler Plants

- Others (e.g., geothermal, solar thermal)

By Application

- Residential

- Commercial

- Industrial

By Technology

- Steam-Based Systems

- Hot Water-Based Systems

- Electrical-Based Systems

By Distribution Network

- Underground Pipelines

- Overground Pipelines

By End-User

- Municipal Utilities

- Private Infrastructure Operators

- Industrial Parks

- Residential Complexes

By Region

- Europe

- Asia-Pacific

- North America

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting