What is District Heating Market Size?

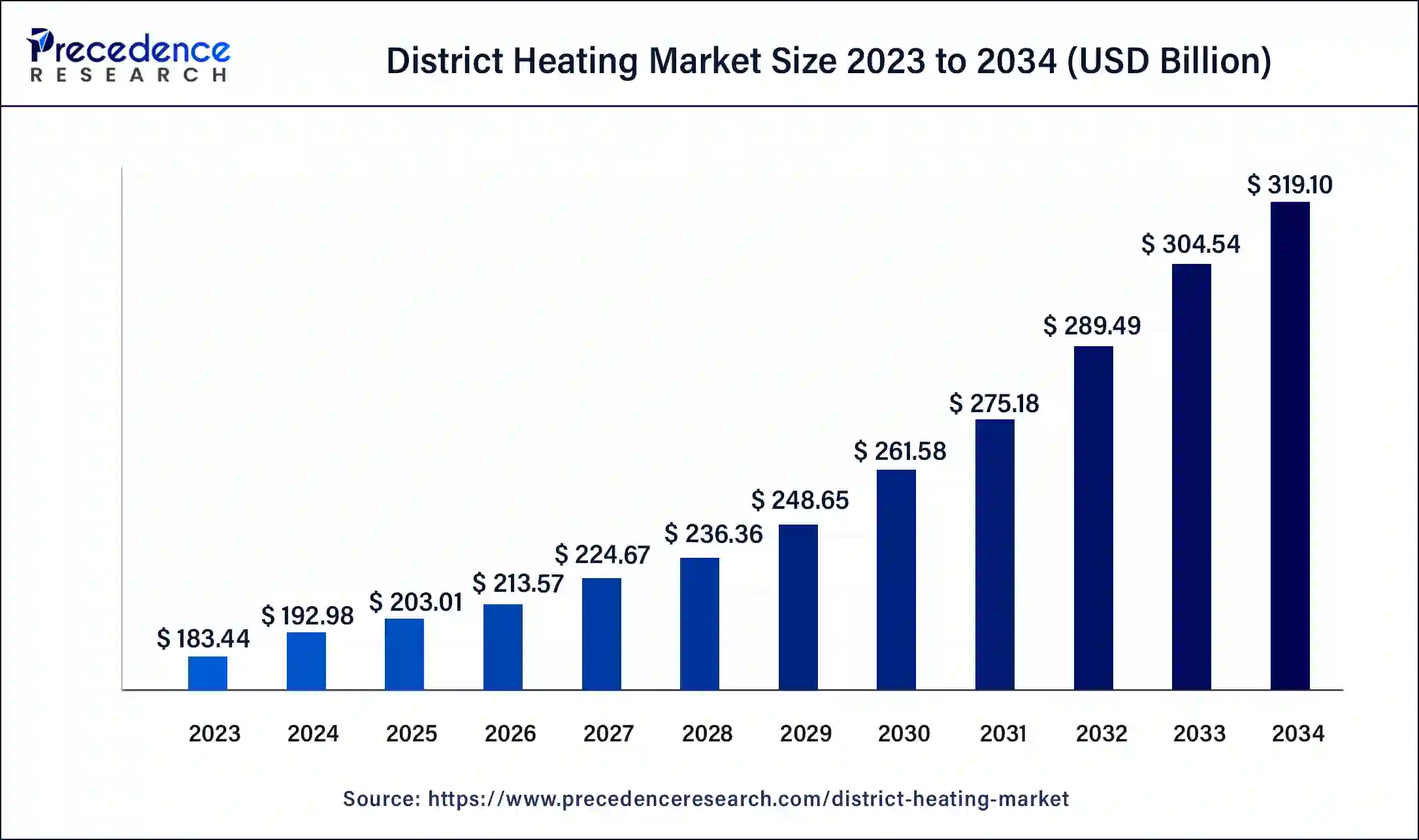

The global district heating market size is estimated at USD 203.01 billion in 2025 and is predicted to increase from USD 213.57 billion in 2026 to approximately USD 319.10 billion by 2034, expanding at a CAGR of 5.16% from 2025 to 2034.

Market Highlights

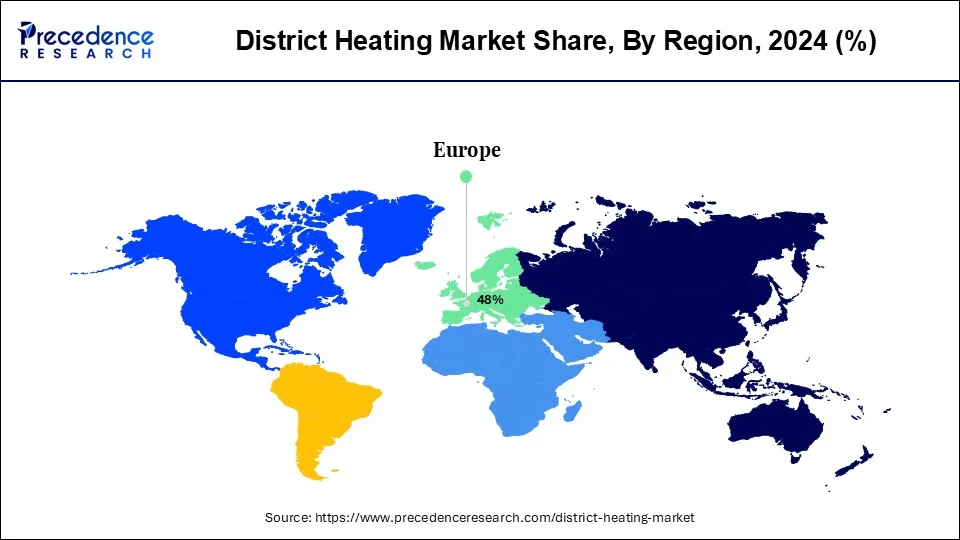

- Europe led the global market with the highest market share of 48% in 2024.

- Asia Pacific is projected to expand at the fastest CAGR during the forecast period.

- By Heat Source, the renewable segment captured the biggest revenue share in 2024.

- By Plant Type, the combined heat and power (CHP) segment is estimated to hold the highest market share in 2024.

- By Application, the residential segment generated over 60% of revenue share in 2024.

Market Overview

Increasing Urbanization Drives Demand for Energy-Efficient Heating

The district heating market is growing as more attention is turned to carbon emissions reduction and urban energy efficiency. District heating is a central thermal energy generation and distribution system that transports thermal energy through covered pipes for residential, commercial, and industrial use. District heating improves energy efficiency by making use of renewable and surplus heat. Furthermore, the market is growing due to more investments in sustainable infrastructure, and climate adaptation regarding aging heating systems. In addition, financial and policy incentives for low-carbon approaches to heating are increasing the uptake of district heating systems globally, within both advanced and developing economies.

District Heating Market Growth Factors

The district heating is a cost-effective method of transferring heat generated in a central place to multiple buildings such as companies, residences, and factories via a network of insulated pipes. The heat is employed in a variety of household and commercial applications including room and floor heating as well as water heating. The central solar heating, geothermal heating, and heat waste from nuclear power plants are the most common sources of heat. The district heating is particularly fuel efficient, and its flexibility allows for replacement of greener alternatives, both of which are anticipated to drive the growth of the district heating market during the forecast period.

The regulations aimed at reducing greenhouse gas emissions as well as increased awareness about the waste recycling will drive the greater demand for district heating in the market. The strict regulations aimed at improving building energy efficiency through the use of sustainable technologies will help the district heating market grow at a rapid pace. Due to its cost-effectiveness and environmental friendliness, the global district heating market has seen a substantial growth. The heat supply from district heating is produced in an environmentally sustainable manner, reducing greenhouse gas emissions and positively impacting the product demand globally. The government initiatives aimed at reducing carbon emissions as well as increased adoption of sustainable energy will help to boost the growth of the market.

The natural gas has steadily gained a healthy amount of market share in the global district heating industry as the trend toward power generation has switched away from fossil fuels, primarily due to environmental determinants. The natural gas' multiple advantages, including as lower costs and lower carbon emissions combined with outstanding efficiency, have aided the segment's expansion. The growing natural gas exploration activity in each region is also a factor in the growing popularity of these systems.

In recent years, non-conventional energy sources such as solar and wind have gained popularity. In various developed and developing countries, there has been a shift toward solar energy. However, since the district heat network serves a large number of people, and renewables are a newbie to the area, they have a limited market compared to natural gas. The natural gas-fired district heating has a higher established and installed capacity than renewable-fired district heating. However, due to the high cost of renewables, the money generated by using them surpasses that of natural gas. This trend is expected to continue, with the share of renewables increasing at a consistent rate.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 203.01 Billion |

| Market Size in 2026 | USD 213.57 Billion |

| Market Size by 2034 | USD 319.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.16% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Heat Source, By Plant Type, and By Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Heat Source Insights

In 2024, the renewable segment dominated the district heating market. As public and government concern about environmental safety has grown in recent years, power companies have shifted their attention from fossil fuels to renewable sources. This element boosts the use of renewable energy sources all over the world.

The natural gassegment, on the other hand, is predicted to develop at the quickest rate in the future years. Around the globe, the exploration efforts are increasing. In comparison to fossil fuels, natural gas plants are far more cost effective and have fewer negative environmental effects.

Plant Type Insights

In 2024, the combined heat and power (CHP) segment dominated the district heating market. The combined heat and power (CHP) systems allow for the production of both electricity and heat for the heating systems. This has been a major component in their growth in recent years.

The boiler segment, on the other hand, is predicted to develop at the quickest rate in the future years. Due to rising global demand for power, the boiler segment is also expected to rise during the forecast period. The installation of various energy plants is similarly on the rise all across the world.

Application Insights

The residential segment dominated the district heating market in 2024 and garnered a revenue share of 60%. Due to the rising need for heating networks at residential locations for diverse functions such as water heating and space heating, the residential category has the greatest market share during the forecast period.

The industrial segment is the fastest growing segment of the district heating market in 2023. With the current transformation, infrastructural development is also rising in the industrial sector. The use of heating spaces in the industrial sector is increasing as a result of this issue.

Regional Insights

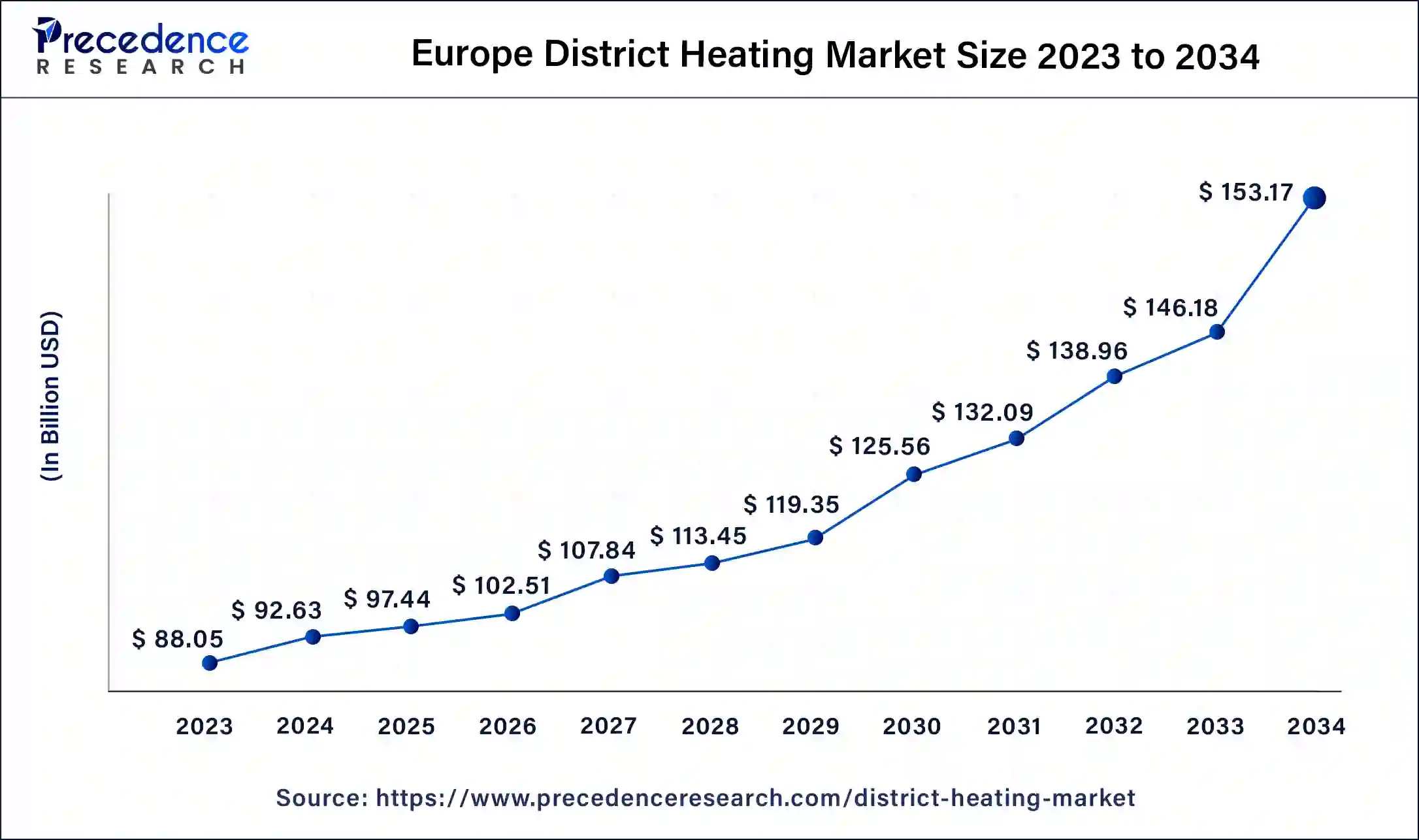

Europe District Heating Market Size and Growth 2025 to 2034

The Europe district heating market size is estimated at USD 97.44 billion in 2025 and is predicted to be worth around USD 153.17 billion by 2034, at a CAGR of 5.18% from 2025 to 2034.

Europe is the clear leader in the district heating market, driven by several interrelated factors. The continent boasts an established infrastructure that has evolved over decades, allowing for efficient and reliable heating solutions across densely populated urban areas.

- Stringent environmental regulations are a hallmark of European energy policy, resulting in a strong push toward reducing carbon emissions and enhancing energy security through diversified energy sources, particularly renewable energy.

- As many European nations have a longstanding commitment to sustainability, they have invested heavily in expanding and modernizing district heating systems, which are seen as integral to achieving energy efficiency and environmental goals.

Sweden District Heating Market Trends

Sweden is the undisputed district heating leader in Europe, with more than 60?% of urban households connected to nearly 300 district heating systems in Sweden. With aligned government policies and programs and carbon targets, district heating from combined heat and power (CHP) plants and waste-to-energy, generates around 10?TWh annually. The Swedish Energy Agency also reported an increase in renewable district heating, with more than 80?% fuel input based on biomass and bio-waste, largely because of subsidies and emission regulations. The model provides energy security, low emissions, and cost, making Sweden a model for the rest of Western Europe.

In contrast, the Asia-Pacific region is witnessing remarkable growth within the district heating market, fueled by rapid urbanization and industrialization. Countries like China and South Korea are experiencing unprecedented demands for energy-efficient and cost-effective heating solutions. The region's swift urban population growth and expansion of both residential and commercial infrastructures are contributing to a rising need for centralized heating networks. Furthermore, the industrial sector's significant energy consumption has made district heating an attractive option for meeting large-scale heating demands while integrating renewable energy sources.

China District Heating Market Trends

China is the world's largest district heating market by volume, heating over 100 million urban households, primarily in the northern provinces. Government data reports installed heat capacity is over 400?GW, with annual growth rates near 5?%. The recent 13th Five-Year Plan included "clean winter heating," encouraging a public transition away from coal-fired boilers and toward large-scale CHP, industrial waste heat recovery and electrification (including heat pumps into DH networks). With relevant state investments and vineyard of urbanization, China's district heating sector scales, announces modernization, and targets operational efficiency and lower emissions.

How North America Region has Growth Potential?

District heating is still considered a niche market in North America, with less than 2% of total heating demand in the region supplied through heat networks. However, urban redevelopment, aging heating infrastructure and goals for decarbonization are all contributing to renewed interest in district systems, particularly in urban centres with high densities where there is sense to retrofit or develop multi-building centralized heat distribution. Some projects are already underway to reuse industrial or waste-heat and distribute to provide thermal energy centrally to clusters of buildings.

United States

The United States has been the main driver for the broader development of district heating systems in North America, including in some areas the continuous operational status of long standing systems such as a large steam network across portions of Manhattan. In the U.S., utilities have been looking at means to incorporate waste heat, biomass, CHP and other technologies to develop district heating systems in an area of the market that has long supported self-contained hydronic boilers and natural gas-fired furnaces.

How Middle East & Africa Emerging as High-Potential Region?

The Middle East and Africa region is earlier in the development of district heating, but with opportunities for significant growth related to rapid urbanization, large-scale infrastructure development, and increasing demand for sustainable city-wide heating and cooling solutions. While cooling systems make up the vast majority of systems today, the idea of integrated heat/cool urban energy grids is coming to the forefront as a viable and critical alternative. Furthermore, the shift toward centralized systems is becoming evident in developing urban environments; that is, projects are advancing the use of these centralized systems.

Saudi Arabia

In Middle East and Africa region, Saudi Arabia is one of the leading countries currently progressing district energy systems. While current reports have focused more on cooling due to climate and infrastructure needs, the country boasts existing urban & commercial sectors that provide a solid foundation for district heating and cooling systems, as both systems will provide new developments in the country. An example of this is the large district cooling plants that have been developed in master-planned communities that can be further adapted or extended to even include a heating system when desired.

District Heating Market Companies

- Shinryo Corporation

- Ramboll

- Danfoss Group

- E. on Energy Services

- FVB Energy Inc.

- Dall Energy

- Statkraft

- Kelvion

- NRG Energy

- NextGen Heating

Recent Developments

- In May 2024, the citizen energy cooperative Egis has officially inaugurated the district heating system in Bundorf, located in the Bavarian district of Haßberge. The system, which went into operation, is part of a larger initiative that includes a photovoltaic power plant with 125 megawatts and electric car charging stations already in place. This sustainable heating solution serves 20 private households and several public properties, including the town hall, community center, and kindergarten.

(Source: https://solarquarter.com) - In February 2024, Evonik and Uniper officially launched the Technical Options for Thermal Energy Recovery (TORTE) project today in Gelsenkirchen. Herne Green Deal' to sustainably transform the Herne chemical site, the TORTE project will feed industrial waste heat from isophorone production into the district heating network. Around 1,000 homes in the Ruhr region will be supplied by the end of 2024.

(Source: https://www.evonik.com)

Uniper

Approval- In October 2024, Uniper launched the sale of its district heating business, according to the European Commission's state aid approval, since the heating business took place in the Ruhr area.

Vattenfall

Ownership- In March 2025, Vattenfall estimates the ownership of heating operations in the UK, Sweden, and the Netherlands, including potential divestment. The company is a supplier to both B2B and B2C customers.

Hungary

Initiative- In April 2025, the Hungarian Government launched the largest district heating development program under the initiative of replacing natural gas. The budget for heating service infrastructure was 45 billion forints (113 million euros). 25 billion forints (63 million euros) were spent on energy efficiency and 50 million euros on renewable energy-based heat sources.

Segments Covered in the Report

By Heat Source

- Coal

- Natural Gas

- Renewables

- Oil & Petroleum Products

- Others

By Plant Type

- Boiler

- Combined Heat and Power (CHP)

- Heat Exchangers

- Heat Meter

- Others

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting