What is Drug Discovery Informatics Market Size?

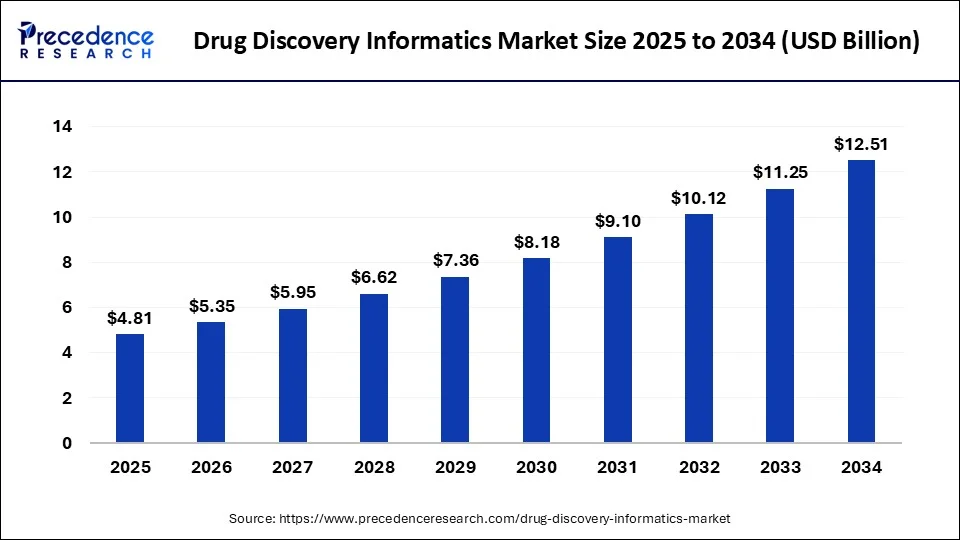

The global drug discovery informatics market size is USD 4.81 billion in 2025, accounted for USD 5.35 billion in 2026, and is expected to reach around USD 12.51 billion by 2034, expanding at a CAGR of 11.19% from 2025 to 2034. The increasing prevalence of chronic diseases and the rising use of informatics solutions in drug discovery are driving the growth of the drug discovery informatics market.

Market Highlights

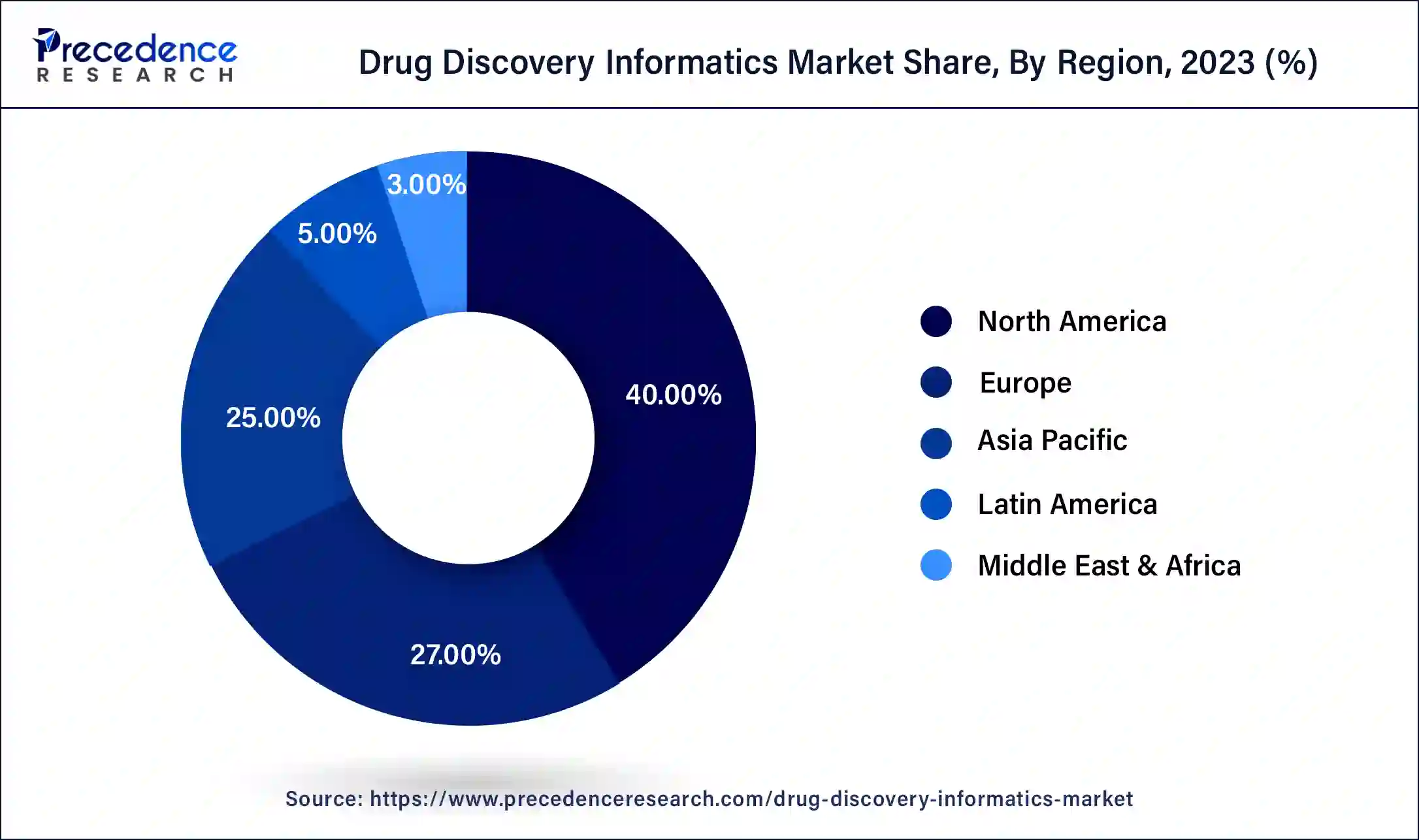

- North America held the dominating share of 40% in 2024.

- Asia Pacific is observed to witness the fastest growth at a CAGR of 11.9% during the forecast period.

- By service, the sequence analysis platform segment dominated the market with the highest share in 2024.

- By service, the molecular modeling segment is observed to witness a significant rate of expansion during the forecast period.

- By end-user, pharmaceutical and biotechnology companies dominated the market in 2024.

- By end-user, the contract research organization segment is expected to witness the fastest rate of expansion during the forecast period.

How does the Drug Discovery Informatics Transform?

Discovering treatments for certain diseases or patient demographics generates massive data for medical scientists. The drug discovery informatics market focuses on developing systems that can handle enormous amounts of clinical trial and treatment data more effectively. Such services enable more effective handling of large datasets from diverse sources by academics. This ultimately results in a quicker cycle time for the development of effective therapies.

The developments in web services and high-performance computing, the expanding use of in-silico modeling tools, the volume of drug discovery data, and the growing need for novel therapeutic compounds are all expected to propel the market's growth. Increasing cases of chronic diseases and the demand for precision medicines drives the growth of the drug discovery informatics market.

Market Trends

- Growing research and development spending: The growing investment of biotechnology and pharmaceutical companies in the development of new drugs for personalised medicine, rare diseases, and various types of diseases. The growing demand for reducing development timelines and fast identification of potential drug candidates increases the demand for drug discovery informatics.

- Growing demand for personalised medicine: The growing healthcare industry increases demand for personalised treatments. The growing demand for personalised treatment increases demand for an informatics system to analyze clinical, genomic, and proteomic data. A drug discovery informatics system helps to identify gene variations and biomarkers to create personalised medicine for individual patients.

- Increasing technological advancements: The growing adoption of technologies like cloud computing and AI predict drug resistance, accelerate drug discovery, and enhance safety evaluations. AI technology is widely used to accelerate drug discovery process and it automates workflows. The technological advancements like integration of various technologies helps in the drug discovery informatics market.

Drug Discovery Informatics Market Growth Factors

- The rising volume of data in the drug development sector, innovation in drug discovery, web services, and advancements in high-performance computing drive the growth of the drug discovery informatics market.

- The market is further driven by rising technological advancements and increasing investment in the drug discovery platforms.

- The increasing research and development activities in the pharmaceutical and biotechnological firms and the strategic collaboration between the major market players for the technological advancements in the healthcare and pharmaceutical industry are driving the growth of the market.

- The increasing demand for the personalization of medicines and the technological advancements increased the volume of data storage, processing, analysis, and management driving the growth of the market.

- The emergence of cloud-based technology and new analytics is fueling the growth of the market.

Drug Discovery Informatics Market Outlook:

- Global Expansion: The respective progression is influenced by the increasing R&D investment and the broader adoption of AI, cloud-based solutions, and advanced analytical tools.

- Major Investor:In October 2025, Predictive Oncology secured $343.5 million investment to unveil the world's first strategic compute reserve and boost AI-enabled drug discovery efforts.

- Startup Ecosystem: Isomorphic Labs, a startup that emphasizes AI-assisted structural biology, co-established AlphaFold3 with Google DeepMind.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 4.81 Billion |

| Global Market Size in 2026 | USD 5.35 Billion |

| Global Market Size by 2034 | USD 12.51 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service and By End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

AI in drug discovery and development

Artificial intelligence is the most emerging technology that is gearing up applications in various sectors, including the pharmaceutical industry. There are various uses of AI in pharmaceutical applications such as drug repurposing, improving pharmaceutical productivity, drug discovery and development, clinical trials, etc. AI algorithms optimize experimental design and parameter selection in drug discovery workflows, reducing the time and resources required for preclinical and clinical studies. Through adaptive learning and optimization techniques, AI expedites the iterative process of hypothesis testing and validation, accelerating drug development timelines. Artificial intelligence used in drug discovery and development opens potential for the drug discovery informatics market.

Restraint

Higher cost

The increased cost and setup of the informatics software are restraining from adopting the market by middle and small-scale firms limiting the growth of the drug discovery and informatics market. The implementation of informatics solutions in drug discovery processes often requires substantial financial investments, including the acquisition of software, hardware, and specialized expertise. Additionally, the integration of informatics platforms with existing research infrastructure and workflows can further escalate expenses. These higher costs pose a barrier for many organizations, particularly smaller biotech firms and academic institutions with limited budgets.

Opportunity

Advancements in cloud computing

Increasing technological advancements such as new analytics and cloud-based technology open multiple opportunities for drug discovery informatics market. Cloud-based technology enables low-cost storage, analysis of larger data, and processing. Additionally, computational drug discovery uses the integration of artificial intelligence and cloud computing to enhance the drug discovery process in cost cost-effective manner. Major pharmaceutical companies have recently planned using cloud computing for the storage of data, management, and processing which is accelerating the growth of the market.

Segment Insights

Services Insights

The sequence analysis platform segment dominated the drug discovery informatics market with the largest share in 2024. The increasing use of sequence analysis in drug discovery informatics for target discovery sequencing accelerated the demand for the segment in the market. Bioinformatics solution is highly adopted for the development of primary and secondary databases of proteins, nucleic acids, and other biomolecular sequences.

Sequence analysis platforms are indispensable tools in drug discovery, allowing researchers to analyze genetic sequences and identify potential drug targets, biomarkers, and therapeutic interventions. These platforms play a crucial role in understanding disease mechanisms and designing targeted therapies, driving their widespread adoption in drug discovery informatics.

- In February 2024, Quantum-Si Incorporated or the Protein Sequencing Company™, launched its latest platform for the expansion for Platinum, with the introduction of its latest V2 Sequencing Kits. Integrated with the next-generation protein sequencer™.

The molecular modeling segment is observed to witness a significant growth rate during the forecast period of 2025 to 2034. Molecular modeling techniques offer a cost-effective alternative to traditional drug discovery methods by significantly reducing the need for experimental assays and laboratory testing. This allows researchers to explore a wide range of drug candidates in silico before investing resources in experimental validation.

Molecular modeling accelerates the drug discovery process by rapidly screening and prioritizing potential drug candidates based on their molecular interactions with target proteins. This enables researchers to identify promising leads more efficiently and expedite the development timeline.

End-User Insights

The pharmaceutical and biotechnology companies segment dominated the drug discovery informatics market in 2024. The dominance of the segment is attributed to the wider adoption of informatics in the pharmaceutical industries for target identification, processing, compound screening, and maintaining the drug development process. The increasing research and development activities and the strategic partnership between the major market players for innovation in drug discovery and development are contributing to the growth of the segment.

The contract research organization segment is expected to grow in the market during the forecast period. The contract research organization is the company that offers clinical trial services for the biotechnology, pharmaceutical, and medical devices industries. The CRO offers the services of several applications in the healthcare industry such as clinical trial planning, regulatory affairs, recruitment support, site selection and initiation, data management, clinical monitoring, biostatistics, trail logistics, project management, and medical writing.

- Instances: In February 2024, Fluence, a major market player in LED-lighting solutions for commercial food and cannabis production extended its strategic partnership with Dutch organization Innexo BV (Innexo), a specialized contract research organization that works on medicinal plants and molecular farming.

- In February 2024, Divergent CRO, a major industry player for clinical services to devices and biotech organizations announced the launch of its latest CRO (contract research organization). The latest venture launch for working on the research and development process by enabling a personalized and comprehensive service to meet the demand for the biotech and devices sector.

- In January 2024, a DEA-licensed cannabis grower “Maridose” announced the launch of a Contract Research Organization (CRO) group dedicated to partnering with researchers working on cannabis-based drug development, pre-clinical trials, and clinical trials and helping in the commercialization process.

Regional Insights

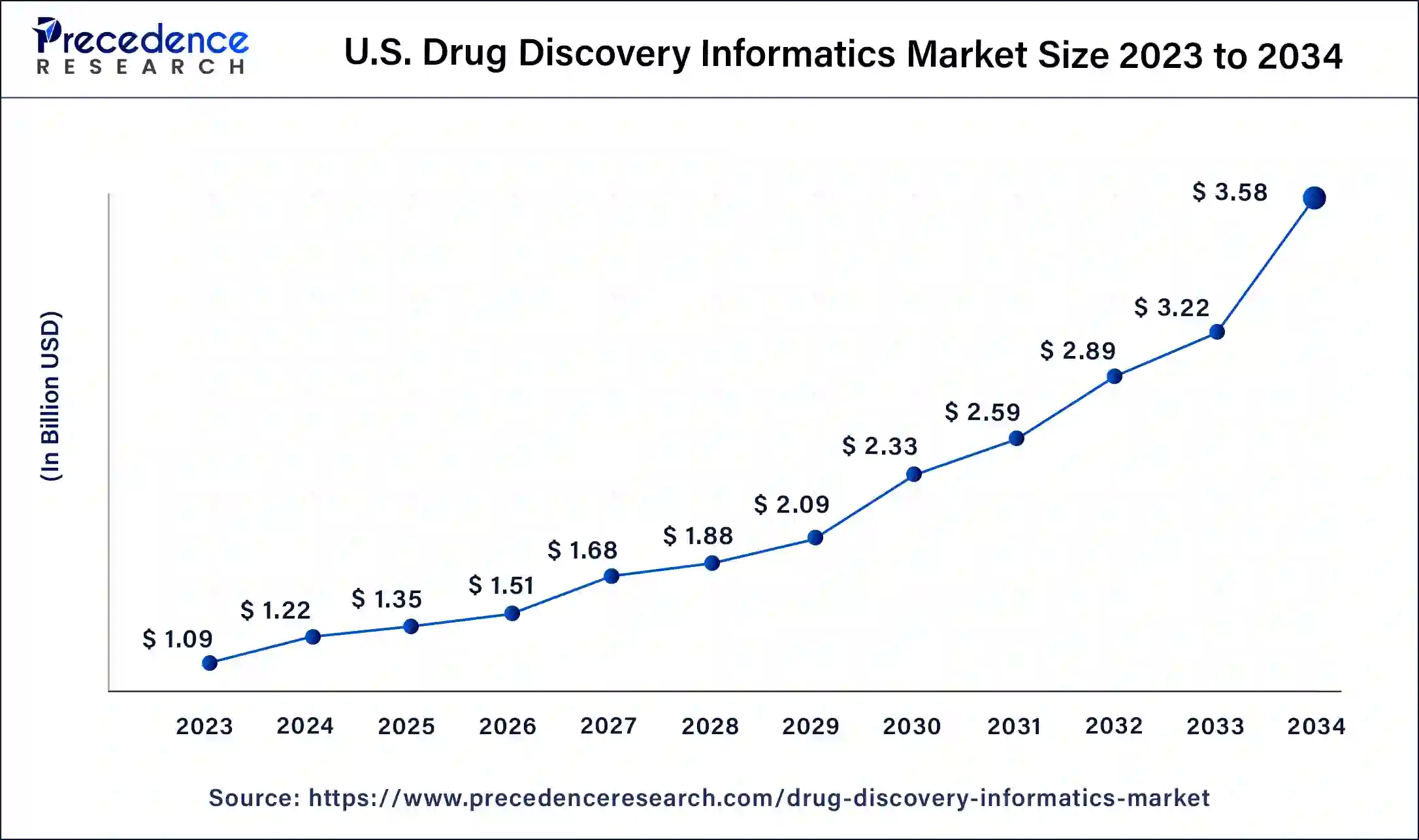

U.S. Drug Discovery Informatics Market Size and Growth 2025 to 2034

The U.S. drug discovery informatics market size is estimated at USD 1.51 billion in 2025 and is predicted to be worth around USD 3.58 billion by 2034, at a CAGR of 11.4% from 2025 to 2034.

How did North America hold a Major Share of the Market in 2024?

North America dominated the drug discovery informatics market with a 40% market share in 2024. The dominance of the region in the market is attributed to the established healthcare infrastructure, and investment in the research and development activities on drug development and the advancement in the data mining, analytics technologies. Technological developments in the area have enhanced the analysis quality of the large volume of data which accelerated the growth of the drug discovery informatics market. The increasing demand for precision medicines in North America has also contributed to the growth of the market in the region.

The presence of a robust pharmaceutical industry helps in the market growth. The extensive investment in research & development increases demand for drug discovery informatics. The strong presence in technology like data analytics and data mining helps in the market growth. The growing adoption of technologies like big data and AI in drug discovery and the integration of cloud computing encourage the adoption of drug discovery informatics. Additionally, the presence of well-established biotech companies drives the overall market growth.

Enhancements in Pharmaceutical & Biotechnology Industries are Driving the Asia Pacific

Asia Pacific is expected to witness significant growth in the market at a CAGR of 11.9% during the forecast period. The growth of the market in the region is attributed to the rising population and the increasing demand for the healthcare services. Many major market players and the regional governments are significantly investing the technological development in the pharmaceutical as well as in the biotechnological industries for efficiency in drug development and discovery which accelerates the growth of the market. The rise in the geriatric population and increasing prevalence of chronic diseases among the people leads to a higher demand for precision medicines which is fueling the demand for the drug discovery informatics market across the region.

Robust Healthcare System & Government Support: Propels the Chinese Market

China is a major contributor to the drug discovery informatics market. The well-established healthcare system and large population in the region increase demand for drug discovery informatics. The strong government support focuses on pharmaceutical innovations and investment in research & development helps in the market growth. The growing adoption of technological advancements like cloud computing and AI increases demand for drug discovery informatics. The growing foreign & domestic investment and partnerships between international & Chinese companies support the overall market growth.

Involvement of Academic and Research Institutions: Fuels the Canadian Market

Currently, many research activities are bolstered by the immersion of significant universities, particularly the University of Toronto, McGill University, and others. They have worked together with industry partners, such as GSK Canada and the Quebec Consortium for Drug Development (CQDM), to encourage innovation and commercialize new technologies.

Foundational AI Tool is Impacting Europe

The transformation of the drug discovery informatics market in Europe has been leveraged by the evolution of AI from a new concept to a foundational capability across the R&D pipeline. For this, European companies and research institutes, like BenevolentAI (UK) and BioNTech (Germany), are exploring rigorous machine learning to determine potential drug candidates and design tailored treatments, especially mRNA-based cancer vaccines.

Extensive Support & Transition: Fosters the UK Market

An eventual expansion of the UK market is mainly assisted by the UK government, by investing £82.6 million in AI drug discovery companies and research projects through programs, including the Research Ventures Catalyst (RVC). Alongside, the UK has made a plan to combat the use of animal testing for inventive agent testing and employ only DNA-based approaches by 2027.

Key Players in Drug Discovery Informatics Market and Their Offerings

- Collaborative Drug Discovery, Inc.- It has leveraged CDD Vault for chemical registration, structure-activity relationship (SAR) analysis, inventory management, data visualization, and an electronic lab notebook (ELN).

- Eurofins DiscoverX Products- This company primarily facilitates biological products and laboratory services.

- Jubliant Biosys- A leading company offers custom data curation, pathway analysis, biomarker discovery, genomic analysis, and pharmacovigilance.

- Selvita- It executes complete services in bioinformatics, computer-aided drug design (CADD), and the application of artificial intelligence (AI) and machine learning (ML).

- Novo Informatics Pvt. Ltd.- A major player provides services and software for in silico computational drug design, including its flagship software suite, Inventus.

Recent Developments

- In April 2025, Revvity Signals Software launched the Signals One platform to accelerate drug discovery. The platform is designed to streamline data management across the drug discovery lifecycle and addresses the complexity of drug modalities.

- In February 2024,Aspen Biosciences, a leading player in custom software, and integration launched the drug discovery program management software platform “Pipeline”. The latest launch is built for intricate high-volume data management for drug discovery endeavors.

- In January 2024,Protagonist Therapeutics, Inc., and Takeda announced the signing of a collaboration agreement and global license for the commercialization and the development of rusfertide, VERIFY for the treatment of Polycythemia Vera (PV) which is currently under the Phase 3 trial.

- In January 2024,Bio-Techne Corporation announced its spatial biology brands Advanced Cell Diagnostics (ACD), and Lunaphor, launched its fully automated spatial multiomics workflow with the protein biomarkers and detection of RNA.

- In January 2024,Molecule AI, a leading player in artificial intelligence and life science launched Molecule GEN, a revolutionary platform for redefining AI-driven drug discovery. This Software-as-a-Service (SaaS) solution, design to serve seamlessly integrates the expertise of biologists, automated drug discovery, and AI enthusiasts for innovatory ideas and innovations.

- In February 2024,SPOC Proteomics, Inc, a life science company located in Menlo Park California, and Scottsdale Arizona (HQ) commercially launched their personalized sensor-combined proteome on chip for limited beta testing at SLAS2024.

- In January 2024,Opentrons Labworks, Inc., a leading provider of lab automation and accessible lab robotics, launched its automation marketplace, from the Operations tools and software which can easily combined with the Opentrons robotics systems, for serving expanding industries like microbiome research and drug discovery.

- In January 2024,XtalPi Inc. a globally recognized research and development platform company that used the power of quantum physics-based computation, artificial intelligence (AI), and robotic automation for the advancement and discovery of revolutionary therapeutics and the latest material, announced the launch of Ailux Biologics ("Ailux"), biologics discovery division as a distinct brand.

- In January 2024, Oncodesign Services (ODS), a major CRO (Contract Research Organization) specialty in preclinical services and drug discovery collaborated with the ZoBio, a CRO specialist in biophysics-based small molecule drug discovery.

- In January 2024, NetraMark Holdings Inc. a leader in generative AI in clinical trial analysis announced its signing of third contract with the listed biopharmaceutical company, agreeable to the Master Service Agreement.

Segments Coverd in the Report

By Service

- Sequence Analysis Platform

- Molecular Modeling

- Clinical Trial Data Management

- Docking

By End-User

- Pharmaceutical and Biotechnological Companies

- Contract Research Organization (CRO)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting