Dysphagia Management Market Size and Forecast 2025 to 2034

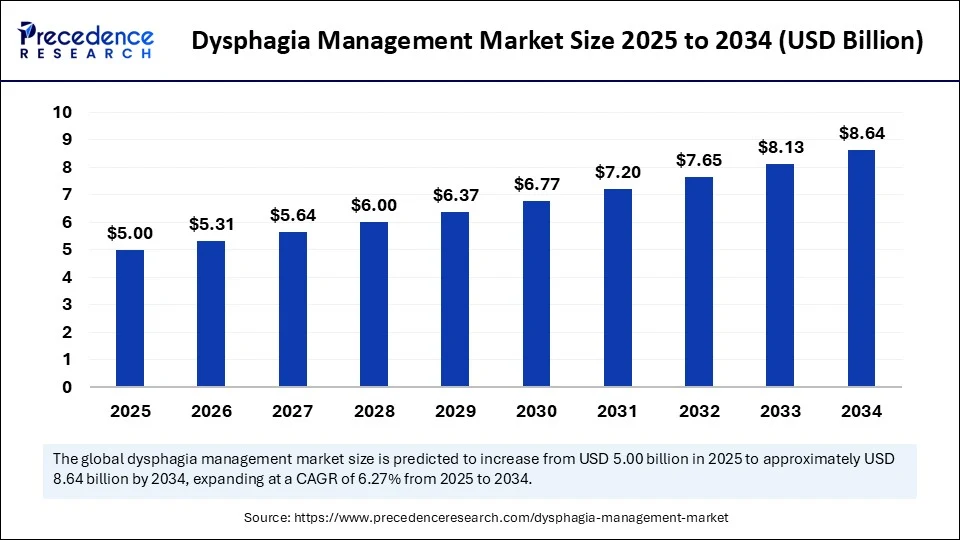

The global dysphagia management market size accounted for USD 4.71 billion in 2024 and is predicted to increase from USD 5.00 billion in 2025 to approximately USD 8.64 billion by 2034, expanding at a CAGR of 6.27% from 2025 to 2034. The growth of the market is attributed to the increasing prevalence of swallowing disorders among the aging population and patients with neurological conditions.

Dysphagia Management MarketKey Takeaways

- The global dysphagia management market was valued at USD 4.71 billion in 2024.

- It is projected to reach USD 8.64 billion by 2034.

- The market is expected to grow at a CAGR of 6.27 from 2025 to 2034.

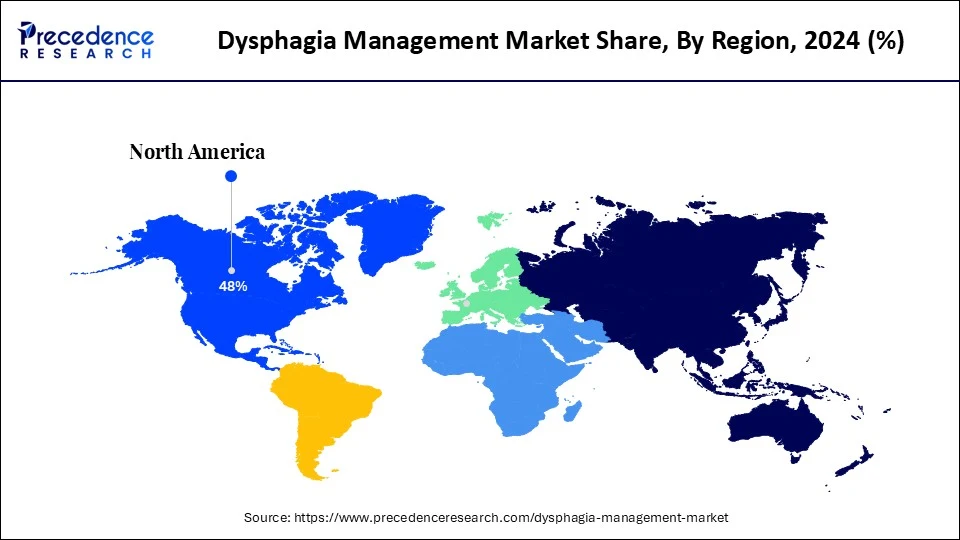

- North America dominated the dysphagia management market with the largest share of 48% in 2024.

- Asia Pacific is expected to grow at the fastest rate between 2025 and 2034.

- By product type, the drugs segment held the biggest market share in 2024.

- By product type, feeding tubes segment is expected to grow at the fastest CAGR during the forecast period.

- By indication, the oral dysphagia segment led the market in 2024.

- By indication, the esophageal dysphagia segment is expected to grow at the fastest CAGR in the upcoming period.

- By age group, the geriatric segment captured the highest market share in 2024.

- By age group, the adults segment is observed to grow at the fastest CAGR during the forecast period.

- By end-user, the hospitals and ambulatory surgical centers segment contributed the significant market share in 2024.

- By end-user, the homecare settings segment is expected to grow at the fastest CAGR in the coming years.

Impact of Artificial Intelligence on the Dysphagia Management Market

Artificial Intelligence (AI) is making a transformative impact on the dysphagia management market by enhancing diagnostic accuracy, personalizing treatments, and improving patient monitoring. AI-powered tools are being incorporated into fiberoptic endoscopic evaluations and video fluoroscopic swallow studies, assisting clinicians in more accurately and consistently identifying subtle abnormalities in swallowing function. The development of machine learning algorithms to evaluate speech voice and facial muscle movement data to anticipate swallowing difficulties early on is also underway. Furthermore, based on a patient's unique conditions and course, AI-driven decision support systems can suggest customized treatment regimens and dietary plans. Artificial intelligence is being used in home care beyond diagnostics through smart devices that monitor eating habits, identify choking hazards, and notify caregivers in real time.

Hospital visits have decreased, and proactive data-driven interventions are supported by these innovations. As AI develops, it is possible to improve clinical workflows, lower human errors, and increase access to specialized care, which benefits people with dysphagia and increases the effectiveness of healthcare delivery as a whole.

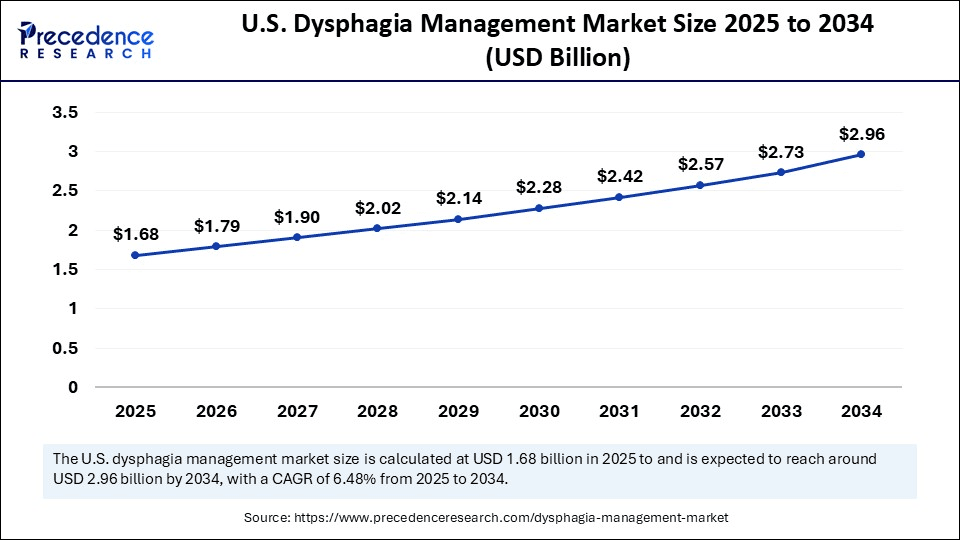

U.S. Dysphagia Management Market Size and Growth 2025 to 2034

The U.S. dysphagia management market size was exhibited at USD 1.58 billion in 2024 and is projected to be worth around USD 2.96 billion by 2034, growing at a CAGR of 6.48%from 2025 to 2034.

What Factors Contribute to North America's Dominance in the Dysphagia Management Market?

North America dominated the dysphagia management market by capturing the largest share in 2024. This is mainly due to its advanced healthcare infrastructure, high awareness levels, and early adoption of advanced diagnostic and therapeutic technologies. The availability of customized healthcare insurance and the presence of major industry players providing specialized products like feeding tubes, thickening agents, and AI-powered diagnostics are all advantages for the area. The high incidence of neurological conditions like Parkinson's disease and stroke, particularly in the elderly population, keeps demand high. Regular product launches and funding for clinical research further strengthen the region's leadership.

Asia Pacific is expected to expand at the fastest CAGR in the dysphagia management market, supported by the aging population, increased access to healthcare, and growing awareness of swallowing disorders. Investments in smart medical devices, post-stroke rehabilitation, and elder care facilities are rising in countries throughout the region. Demand for feeding aids and Nutritional support is rising as head and neck cancers and neurological disorders become more common. Additionally, telehealth rehabilitation programs and digital health platforms are speeding up market penetration by assisting in addressing the lack of qualified professionals in rural and semi-urban areas.

Europe is considered to be a significantly growing area. The growth of the dysphagia management market within Europe is attributed to its emphasis on individualized nutrition, high geriatric population, and robust regulatory frameworks. There is a high preference for thickening agents that are clinically approved, as well as robotic rehabilitation and portable diagnostic tools. Public health systems in several European nations are aggressively promoting early dysphagia screening, particularly for stroke and dementia patients. Europe is positioned as a stable and innovative market thanks to collaborations between academic institutions and medical technology companies.

Market Overview

The dysphagia management market is experiencing steady growth, driven by the increasing number of people who have swallowing problems, especially those who are older and suffer from neurological diseases like dementia, Parkinson's disease, and stroke. Thickening agents, nutritional supplements, feeding tubes, and diagnostic equipment are just a few of the many goods available in the market that help manage dysphagia. The demand for these solutions is rising as a result of increasing awareness of early screening programs and developments in assistive and rehabilitation technologies. Furthermore, the market is expanding due to the growing emphasis on home healthcare and the availability of foods with altered textures, which makes managing dysphagia more patient-centered and accessible.

Can Rising Neurological Disorders Influence the Demand for Dysphagia Management Solutions?

Yes, the increasing incidence of neurological disorders is significantly boosting the demand for dysphagia management solutions. Dysphagia is frequently caused by disorders that affect the muscles and nerves involved in swallowing, such as Parkinson's disease, multiple sclerosis, stroke, and Alzheimer's. Effective diagnostic tools, therapeutic devices, and nutritional interventions are becoming increasingly necessary for healthcare providers as the global burden of these disorders continues to rise, particularly among the aging population. In addition to promoting innovation in targeted therapies, this trend is propelling the creation of safer and more effective swallowing support products.

Dysphagia Management MarketGrowth Factors

- Rising Geriatric Population: Aging individuals are more prone to swallowing difficulties due to age-related muscle degeneration and neurological conditions.

- Increase in Neurological Disorders: Higher incidence of conditions like stroke, Parkinson's disease, Alzheimer and ALS significantly contributes to dysphagia cases.

- Advancements in Diagnostic and Therapeutic Devices: The development of smart feeding tubes, thickening agents, and portable diagnostic tools improves treatment outcomes.

- Growing Awareness and Screening Programs: Public health initiatives and clinical guidelines enhance early detection and management of dysphagia.

- Expansion of Post Acute and Home Healthcare: A shift toward home-based care is boosting demand for easy-to-use dysphagia products and dietary solutions.

- Rising demand for specialized nutrition: Increasing availability of texture-modified foods and beverages tailored for dysphagia patients supports market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.64 Billion |

| Market Size in 2025 | USD 5.00 Billion |

| Market Size in 2024 | USD 4.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.27% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Indication, Age Group, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in Diagnostic and Therapeutic Technologies

Advancements in diagnostic technologies and therapeutics drive the growth of the dysphagia management market. Technological innovations are improving both the accuracy and speed of dysphagia diagnosis and intervention. Numerous tools are being used, including AI-powered screening software for fiberoptic endoscopic evaluation of swallowing and video fluoroscopic swallowing studies. New biofeedback systems and wearable technology are improving home monitoring and recovery. Swallowing functions are being restored in both clinical and residential settings with the aid of robotic therapy platforms and portable neuromuscular stimulation devices. These developments are enabling more proactive and individualized treatment for dysphagia, leading to better results and earlier intervention. Enhancing treatment planning and lowering the risk of readmission are two more benefits of integrating data analytics into hospital processes.

Rise in Demand for Texture-Modified Foods

The demand for texture-modified foods is rising as they support dysphagia management. These foods are specifically designed for individuals with swallowing difficulties, making it easier for them to consume. Texture-modified foods, including pureed or soft, improve nutritional intake, which is critical in managing dysphagia. Businesses are creating fortified products, pre-thickened beverages, and simple-to-consume meals that are suited to varying degrees of dysphagia severity. Standards for food labeling have been put into place by regulatory agencies in North America, Europe, and Asia to guarantee patient safety and uniformity in preparation. There are also new developments in this field, such as customized meal plans. Patients with dysphagia are focusing on reducing the risks of weight loss, dehydration, and readmission to the hospital, increasing the demand for nutritional therapy.

Restraints

Lack of Awareness and Underdiagnosis

In many parts of the world, particularly in low- and middle-income nations, dysphagia is still underdiagnosed despite increased efforts. Intervention is often delayed because patients and even medical professionals frequently ignore early warning signs like coughing while eating. Malnutrition and aspiration pneumonia are among the complications that arise from inadequate screening at the primary care level, which also leads to lost opportunities for early management. The dangers of untreated dysphagia are often unknown to caregivers, especially when it comes to stroke and dementia patients. This ignorance hinders market potential and postpones the adoption of treatments.

High Cost of Advanced Diagnostic and Therapeutic Devices

High costs associated with diagnostic and therapeutic devices hamper the growth of the dysphagia management market. VFSS FEES and neuromuscular electrical stimulation devices are examples of modern diagnostic tools that can be costly and unavailable in certain healthcare settings. The infrastructure and skilled staff needed to operate such equipment may be lacking in long-term care facilities in smaller hospitals and rural clinics. Additionally, the high cost of advanced therapies such as AI-assisted monitoring or robotic rehabilitation makes them unaffordable for low-income patients and emerging markets. In addition to limiting equitable access to high-quality dysphagia care, this cost barrier prevents widespread adoption.

Opportunities

Integration of Artificial Intelligence Technology in Treatment

AI is opening up new avenues for dysphagia early detection and individualized care. Sucking patterns, speech signals, and video images can all be analyzed by sophisticated algorithms to instantly spot minute anomalies. This facilitates remote assessment, expedites diagnosis, and lessens the need for manual interpretation. AI-powered tools and applications also assist in monitoring treatment progress, which enhances patient outcomes. AI will be essential to scalable data-driven dysphagia management as healthcare systems adopt digital transformation.

Emergence of Telehealth and Remote Monitoring

The rising use of telehealth and remote patient monitoring opens new avenues for dysphagia management, as they enable remote monitoring, improve access to care, and facilitate timely intervention. With the growth of telehealth platforms, dietitians and speech-language pathologists can now provide therapy sessions, evaluations, and consultations remotely. Patients in underserved or rural areas who do not have access to specialized care will find this especially helpful. Continuous home monitoring of diet compliance and swallowing function is also made possible by wearable sensors and app-connected devices. This improves long-term patient engagement while lowering expenses and hospital visits. After COVID-19, remote care is becoming more and more popular due to its convenience and security.

Product Type Insights

Why Did the Drugs Segment Dominate the Dysphagia Management Market in 2024?

The drugs segment dominated the market with the largest share in 2024 because they play a crucial part in treating underlying causes and symptoms of dysphagia, including neurological disorders, acid reflux, and muscle spasms. Muscle relaxants, prokinetic agents, and proton pump inhibitors are commonly prescribed to reduce discomfort associated with swallowing and avoid complications. Pharmaceutical solutions have remained dominant in dysphagia management due to their easy availability and standardized dosing and physician preference for medication-based intervention.

The feeding tubes segment is expected to grow at the fastest rate during the forecast period because they play a crucial role in severe dysphagia. As severe dysphagia is becoming more common, particularly in older and neurologically impaired patients, the demand for feeding tubes is rising. When swallowing is unsafe, these tubes provide life-sustaining nutritional support. The adoption of nasogastric tubes and percutaneous endoscopic gastrostomy is accelerating in both home and hospital settings due to the rising demand for these procedures and technological advancements like anti-clogging devices and simple insertion techniques.

Indication Insights

What Made Oral Dysphagia the Dominant Segment in the Market?

The oral dysphagia segment dominated the dysphagia management market with a major share in 2024 since it is the most frequently diagnosed form, particularly in patients with dementia Parkinsons' disease, and stroke. It involves issues with chewing tongue control and bolus formation, all of which are oral swallowing difficulties that frequently arise early in many neurological conditions. As awareness and screening for oral dysphagia increase throughout healthcare systems, the focus shifts to early-stage management, supporting segmental growth.

The esophageal dysphagia segment is expected to grow at the fastest CAGR in the upcoming period, driven by the increasing prevalence of gastrointestinal conditions such as GERD, strictures, tumors, and motility disorders. Improved diagnostic capabilities like endoscopy and manometry help clinicians better identify and manage esophageal issues. In addition, aging-related anatomical changes are contributing to a rise in esophageal-related swallowing dysfunction, making this an area of growing clinical and commercial focus.

Age Group Insights

How Does the Geriatric Segment Dominate the Dysphagia Management Market in 2024?

The geriatric segment dominated the market with a significant share in 2024. This is mainly due to the increased risk of dysphagia in elderly adults brought on by comorbid conditions, neurodegenerative diseases, and impaired muscle coordination. Hospital admissions for swallowing disorders have increased as a result of the world's aging population, particularly in developed countries. Because elderly patients frequently need ongoing or permanent assistance with dysphagia, there is a greater need for medications, feeding tubes, and thickening agents to bolster segmental growth.

The adults segment is observed to grow at the fastest rate during the forecast period because lifestyle-related factors and the rising rates of strokes for autoimmune diseases and head and neck cancers are impacting younger populations. More adults are seeking treatment for swallowing problems as a result of improved accessibility to treatment, early screening, and raised awareness. Additionally, the availability of discreet customized solutions for managing dysphagia, like mobile therapy apps and foods with altered textures, is promoting adoption among this population.

End-User Insights

What Made Hospitals and Ambulatory Surgical Centers the Dominant Segment in the Market?

The hospitals and ambulatory surgical centers dominated the dysphagia management market with the biggest share in 2024 because they play an essential role in the diagnosis and treatment of acute dysphagia. These facilities are the main treatment centers for both newly diagnosed and severe cases because they provide multidisciplinary care, including feeding tube placements, advanced diagnostics, and speech-language therapy. In hospitals, the largest market share is maintained by the presence of specialized teams and instant access to life-saving interventions.

The homecare settings segment is expected to grow at the fastest rate in the coming years, driven by the rising trend toward home-based and outpatient care. Patients can safely manage dysphagia at home with the help of telehealth support and portable feeding equipment, which is beneficial, particularly for elderly patients. Additionally, the rising insurance coverage for home-based therapies is expected to drive the segment's growth.

Dysphagia Management Market Companies

- AstraZeneca

- Bayer AG

- Pfizer, Inc

- Takeda Pharmaceutical Company Limited

- Abbott

- Dr Reddy's Laboratories Ltd.

- Narang Medical Limited

- Advin Health Care

- Cardinal

Recent Developments

- In January 2025, Neurophet announced the commencement of clinical trial for its personalized AI-driven therapy for stroke-related dysphagia. The solution was designated as an innovative medical device last year for its use in recovering consciousness in patients with neurological disorders.

(Source: https://www.koreabiomed.com) - In February 2024, the U.S. FDA approved EOHILIA (budesonide oral suspension), the first and only FDA-approved oral therapy by Takeda. This therapy is intended for people 11 years and older with eosinophilic esophagitis (EoE). It is available in 2 mg/10 mL convenient, single-dose stick packs.

(Source: https://www.takeda.com)

Segments Covered in the Report

By Product Type

- Drugs

- Antimicrobials

- Proton pump inhibitors

- Others

- Feeding tubes

- Nasogastric tube

- Gastrostomy tube

- Jejunostomy tube

- Nutritional Solutions

- Thickeners

- Beverages

- Purees

- Others

By Indication

- Oral Dysphagia

- Oropharyngeal Dysphagia

- Esophageal Dysphagia

By Age Group

- Children

- Adults

- Geriatric

By End-User

- Hospitals and Ambulatory Surgical Centers

- Homecare Settings

- Long-term Care Facilities

- Outpatient Clinics

By Region

- North America

- Asia Pacific

- Europe

- North America

- MEA

Get a Sample

Get a Sample

Table Of Content

Table Of Content