What is Energy as a Service Market Size?

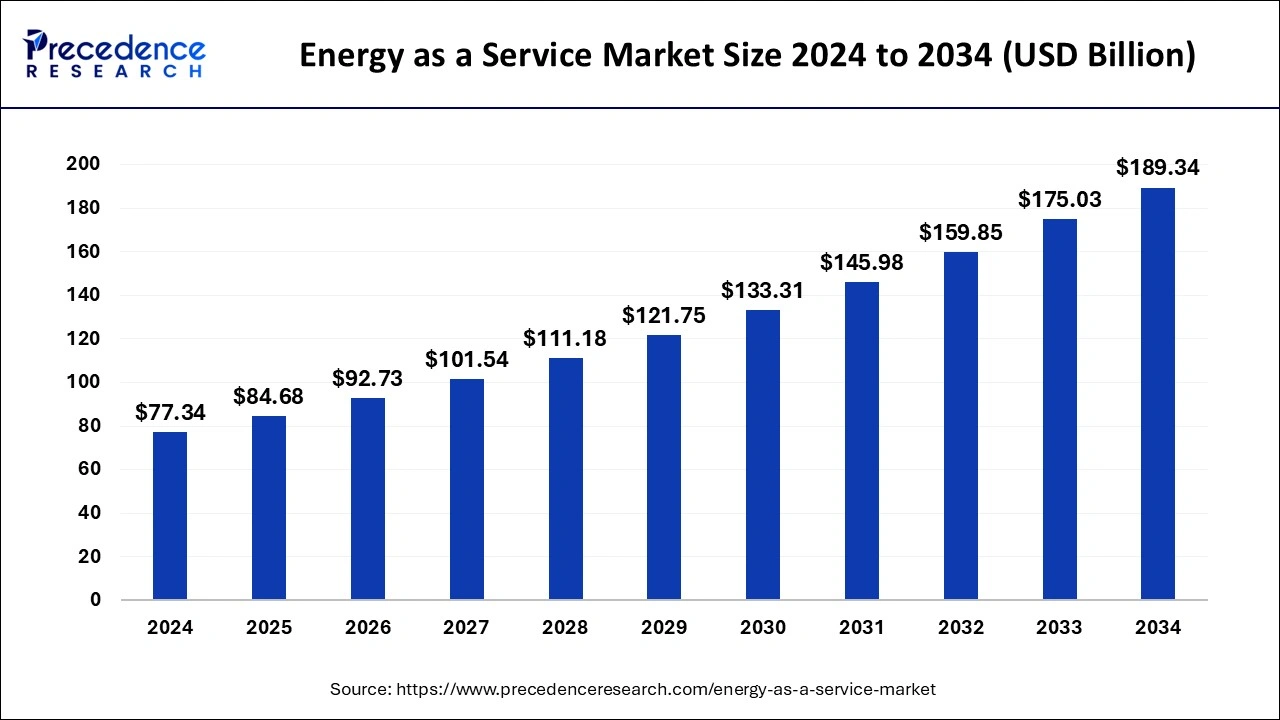

The global energy as a service market size is accounted for USD 84.68 billion in 2025, and is expected to reach around USD 204.23 billion by 2035, expanding at a CAGR of 9.2% from 2026 to 2035.

Market Highlights

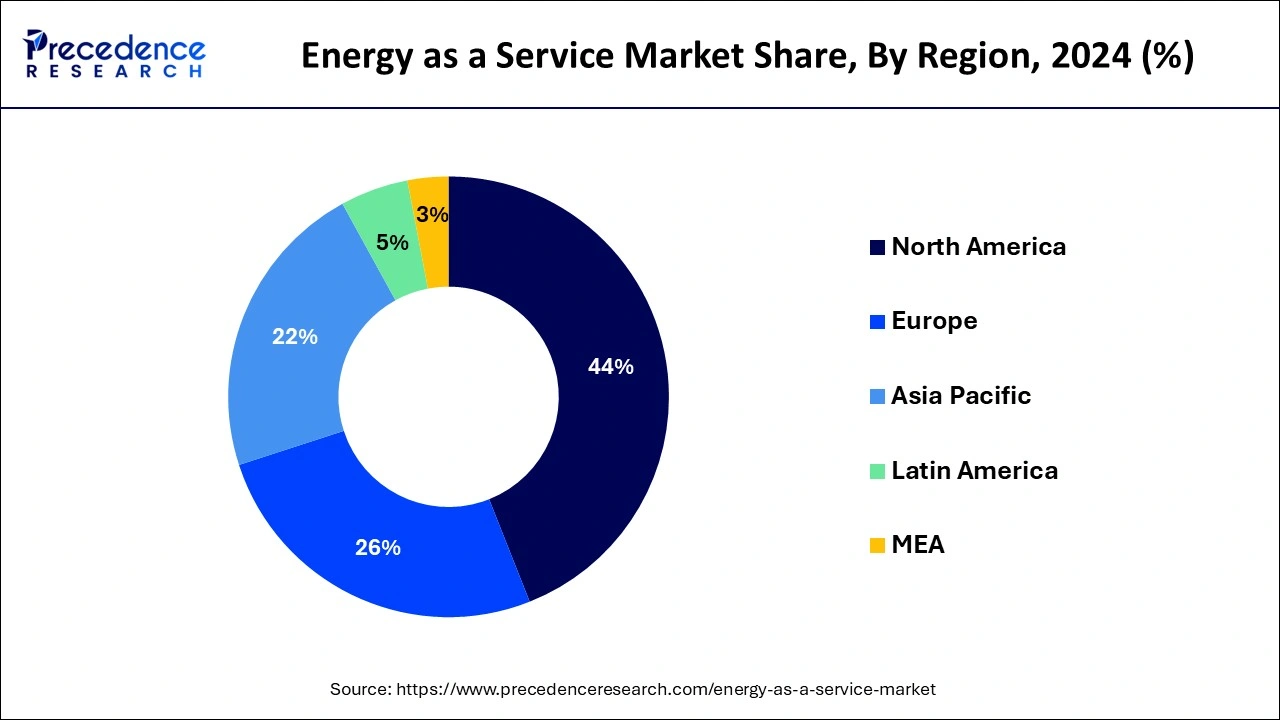

- North America region accounted for 44% of revenue share in 2025.

- By service type, the energy supply service segment hit a 42.4% market share in 2025.

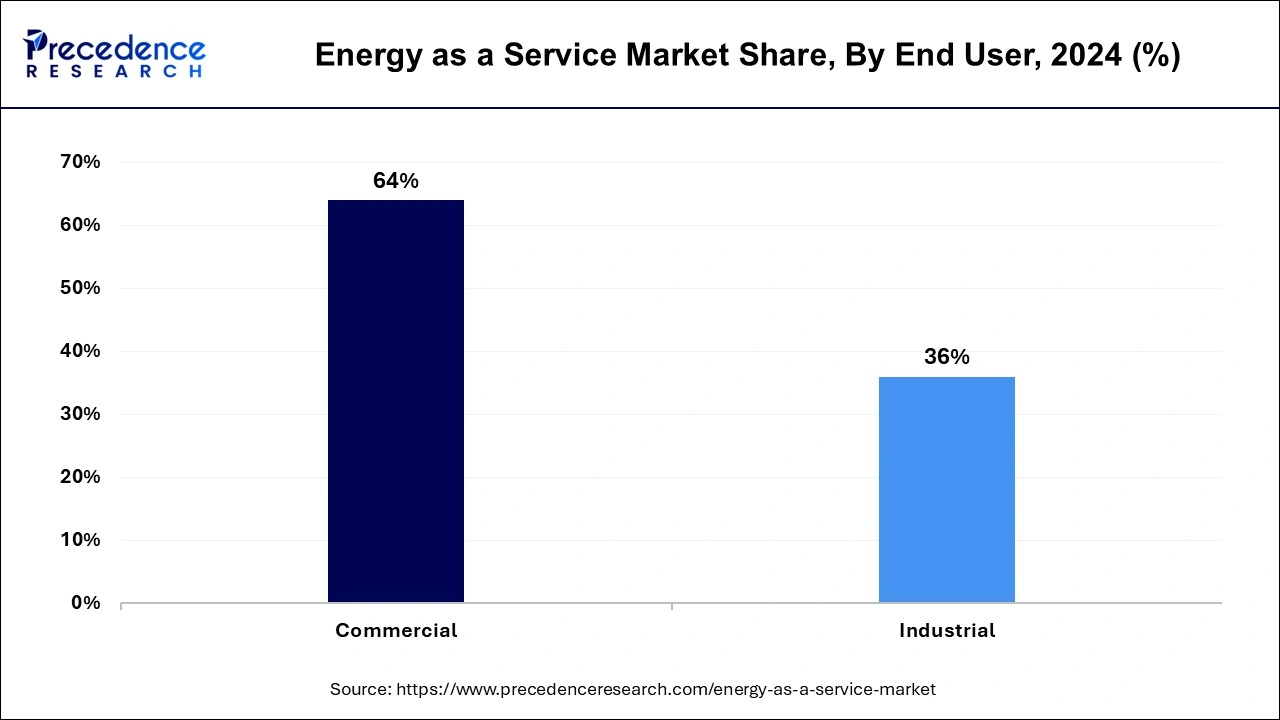

- By end user, the commercial segment held 64% market share in the year 2025.

- The industrial segment generated a 36% market share in 2025.

Market Overview

The centralized, asset-focused method of generating electricity to passive consumers is replaced by the energy-as-a-service model. Instead, it provides total administration of a customer's energy resources and services. EaaS providers are able to merge markets, provide predictable load balancing, and update the grid in a variety of ways by pooling the resources of their clients into a sizable smart energy community. A rapidly expanding and recently created business model called energy as a service offers a range of energy-related services and offers energy optimization solutions for small, medium-sized, and big organizations.

Additionally, it raises awareness of better management practices and enhanced distributed generation source installations. Different service types employ energy as a service, and the market analysis provides a full review of these areas. On the end use category, which includes commercial and industrial uses, the EaaS market offers comprehensive information.

Energy as a Service Market Growth Factors

The growing emphasis on developing federal rules and standards to meet the need for energy solutions supports the size of the EaaS industry. Market shares are boosted by the growing use of distributed energy resources (DER) and the decarburization of the world economy. Additionally, the booming global transportation industries, the spread of electric vehicles (EVs), and a greater emphasis on sustainable energy all have an impact on market expansion.

All industries have been severely harmed by the COVID-19 epidemic. Since 2020, most nations have noticed a significant increase in the number of impacted cases. Unrest in the economies of numerous rapidly emerging nations was caused by the pandemic's conclusion.

- Many countries and regions have seen a sharp reduction in commercial and industrial activity, which has decreased many vertical energy demands. The sharp decline in energy intake has limited the adoption of new technology around the world.

- Almost every sector has been affected due to pandemic and production and manufacturing sector has been stopped for a long duration due to restrictions, that effected the electricity consumption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 84.68 Billion |

| Market Size in 2026 | USD 92.73 Billion |

| Market Size by 2035 | USD 204.23 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.2% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, and End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Trends

- Diverse applications: Due to rising per capita income, a growing global population, and an increase in the number of electrical equipment, the usage of electricity in the commercial construction sector is rising quickly worldwide. Campaigns to preserve energy must consider how energy is used in the home and business sectors.

- Growing economy: Due to growing infrastructural requirements and a burgeoning economy, both energy demand and expense are increasing. Prices and demand often fall when the economy is struggling. Burning fossil fuels like coal and natural gas generates the majority of our energy. This is typically the least expensive way to produce energy. In the event that these fossil fuels become limited, the necessity for new, more expensive methods of energy generation will eventually lead to higher energy prices.

Market Dynamics

Drivers

- Increasing adoption of renewable sources: The principal goals of governing authorities in nations all over the world are to reduce greenhouse gas (GHG) emissions and the rising demand for energy. Following this, the installation of renewable energy sources is anticipated to increase significantly during the following ten years, which will result in the market's rise. The market size has been positively impacted by new energy targets that have been introduced by various governments to encourage the tendency toward sustainable electricity. For instance, by the end of 2023, Brazil hopes to have 42.5% of its primary energy supply come from renewable sources. Similar to this, the UK government plans to have around 50% of its electricity come from renewable sources by 2025, according to the carbon brief analysis. Germany is on track to generate 65% of its energy from renewable sources by 2032. By 2032, China wants to have 16% of its energy sources be renewable. After the country's investment and expansion, it is anticipated that renewable energy would hold a 26% share and surpass the goal set.

- Rise in demand from end user sector: To accommodate employees' necessary output and working hours, commercial buildings, residential structures, and industries need a constant supply of energy. Because of the rising demand for backup power systems in data centers in these industries in the event of mainline outages, the industry has seen investments. The demand for energy will increase as more and more automobiles that currently rely on fossil fuels switch entirely to electricity. For the EaaS market, new charging stations and higher manufacturing rates will present opportunities. The manufacture of textiles, chemicals, pharmaceuticals, and other industries is one that is anticipated to increase at a healthy rate. In the upcoming years, it is anticipated that industries like the automobile sector's production and working rate would increase. A key factor in the market's expansion is the world's rising energy consumption. Numerous software and technical solutions are provided by energy as a service provider so that businesses can comprehend the patterns of power consumption.

Challenges in the IoT Battery Market

- High capital investment - Investment is necessary to produce electricity from renewable sources. Therefore, assistance from government companies is required to complete the majority of the projects. Governments only contribute a small portion of the entire investment; the remainder is up to the enterprise. The installation of smart equipment is necessary for grid upgrading, which is extremely expensive and may restrain the expansion of the EaaS market.

- High deployment costs - The high implementation costs of upgrading the existing utility infrastructure. The real-time information and data analysis of consumer energy consumption and electricity market conditions forms the foundation of the energy business model as a service. This will spur additional investments and raise demand for utility infrastructure upgrades, while also slowing market growth.

Segment Insights

Service Type Insights

According to service type, the energy supply segment is in the lead and is anticipated to contribute most to the energy as a service market. Consumers are searching for a reliable energy supply to ensure that they can function off the grid in the face of rising rates. Additionally, energy as a service models primarily support renewable energy due to its lower costs, smaller carbon footprint, higher energy efficiency, and environmental friendliness. This is because renewable energy is increasingly being focused on as a variety of energy supply sources, including biomass, renewable, fossil fuels, nuclear, and biofuels.

The segment is expanding as a result of each region having more clients due to the growing population. The implementation of these services is cost-effective in the long run because the customer makes service payments based on actual energy savings or other equipment performance metrics, which leads to a reduction in operating costs right away.

End User Insights

The services offered by an EaaS company to conserve energy or deliver electricity for various needs are included in the commercial sector. EaaS providers provide a range of technical and software solutions that help businesses comprehend the patterns of power consumption. With energy service implementations being required in the business sector across all worldwide regions, the commercial segment is anticipated to have the greatest market share and the fastest expanding market. This is primarily due to important structural effects, specifically, economic expansion. Additionally, energy as a service will give commercial users access to their energy efficiency, which will assist them reduce their energy use. A sizeable portion of the worldwide market is controlled by the industrial sector.

A sizeable portion of the worldwide market is controlled by the industrial sector. Production facilities and manufacturing facilities are included in the industrial sector. These facilities depend on a steady supply of electricity and cannot tolerate disruptions in energy storage or delivery. As a result, these elements are anticipated to fuel market growth in this sector.

Segment Insights

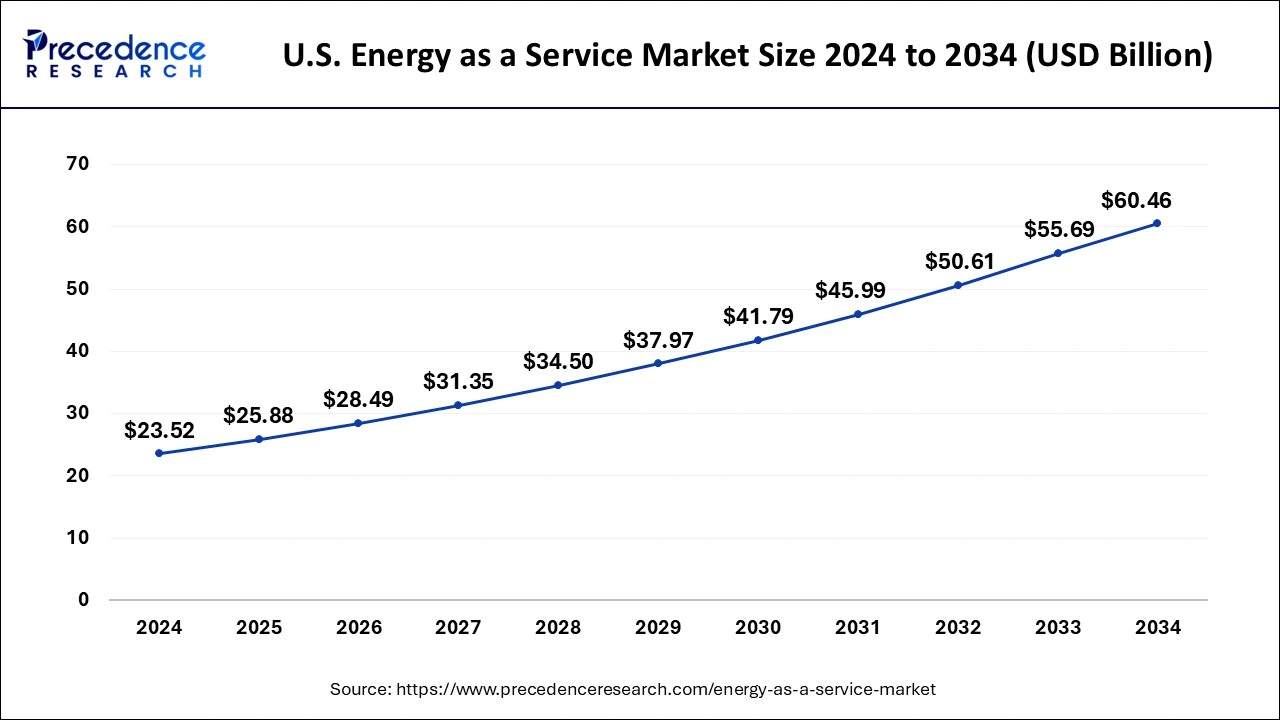

U.S. Energy as a Service Market Size and Growth 2026 to 2035

The U.S. energy as a service market size is estimated at USD 25.88 billion in 2025 and is predicted to be worth around USD 65.43 billion by 2035, at a CAGR of 9.72% from 2026 to 2035

U.S. Energy as a Service Market Trends

With rising pressure from investors and regulators to reduce carbon footprints, businesses are increasingly adopting Energy-as-a-Service (EaaS) to integrate renewable energy sources into their operations. This approach enhances energy efficiency and helps companies achieve their ESG (Environmental, Social, and Governance) targets. Additionally, favorable government initiatives and policies, such as tax credits and grants promoting clean energy and efficiency, are creating a supportive environment for the adoption of EaaS solutions.

Energy as a service is predicted to be dominated by North America during the forecasted period, with the U.S. accounting for the majority of demand. The nation stands out among others for having used Energy as a service in a number of industries. Particularly in the commercial sector, the area has embraced a number of initiatives that are anticipated to boost energy storage efficiency and assist reduce operational costs. The region has also seen notable investment in the exploration, production, and refining sectors, which is expected to increase demand for the energy as a service model in the upcoming years. Moreover, energy efficiency projects are being implemented by utilities in the U.S., Canada, and Mexico in an effort to lower the cost of energy production. In the U.S., fresh strategies like pay-for-performance are being adopted to boost business energy efficiency on a bigger scale. The energy as a service market in this region is also anticipated to be driven by a rise in the share of renewable power generation and energy efficiency efforts.

How is the Opportunistic Rise of Europe in the Energy as a Service Market?

Europe region will grow at a significant rate during the projected period. By supporting governmental and organizational policy frameworks to implement green energy solutions and significantly installing power production technology in various places, Europe's market is benefited. At the moment, the main nations making a significant contribution to the market for energy as a service in the area include Germany, the UK, and Italy, among others. Additionally, it is projected that rising investments and plans to strengthen and expand grid infrastructure networks to support the rising installation of renewable energy will further advance the business.

The necessity to address the demand & supply gap as well as the region's growing interest in clean energy will support the industry outlook in Asia Pacific. The establishment of new industrial gas facilities and the construction of new homes and businesses facilitated the acceptance of these models in the area.

Germany Energy as a Service Market Trends

Germany aims to source 80% of its electricity from renewable sources, primarily solar and wind, by 2030. Energy-as-a-Service (EaaS) models play a key role in this transition by facilitating the integration of variable renewable energy into the grid through solutions such as energy storage, on-site generation, and virtual power plants, ensuring reliability and efficiency in the evolving energy landscape.

What Drives the Market in Asia Pacific?

The energy as a service market in Asia Pacific is expected to grow at a significant rate during the forecast period. The market in the region is driven by rapidly expanding cities and increasing commercial infrastructure that are creating substantial energy demand. Investments in smart grid technologies and digitization are enhancing operational efficiency and energy management. EaaS solutions help bridge the gap between rising energy needs and existing supply, ensuring reliable, cost-effective, and sustainable energy for businesses across the region.

India Energy as a Service Market Trends

India's market is driven by the rapid adoption of solar and wind energy, which reduces reliance on the traditional grid and lowers carbon footprints, making EaaS models increasingly viable. Advanced technologies such as smart energy management systems, AI, IoT, and battery storage enable real-time monitoring, predictive analytics, and enhanced grid stability, further improving operational efficiency and energy optimization.

What Potentiates the Market in Latin America?

Latin America's energy as a service market is expected to grow at a notable rate during the forecast period, driven by high energy costs in certain areas and the push for net-zero emissions. EaaS solutions help reduce energy waste, optimize consumption, and lower operational expenses. Additionally, growing populations, expanding urban centers, and large infrastructure projects are increasing power demand, creating opportunities for EaaS to provide reliable and efficient energy management solutions across the region.

Brazil Energy as a Service Market Trends

Brazil's abundant solar and wind resources, along with national goals for a diversified and climate-resilient energy matrix, are driving the adoption of EaaS solutions that integrate renewables and enable energy trading. The rapid expansion of data centers from companies like Microsoft and AWS is creating substantial new energy demand, presenting both challenges for grid stability and opportunities for EaaS providers to offer efficient, reliable, and flexible energy management solutions.

What Opportunities Exist in the Middle East & Africa for the Energy as a Service Market?

The Middle East & Africa (MEA) presents immense opportunities for the market. These opportunities arise from the rising energy costs and volatile tariffs that encourage businesses to adopt EaaS for predictable monthly expenses and reduced operational costs, while avoiding large upfront investments. Supportive government policies, financial incentives, and initiatives promoting private sector participation in energy projects are creating a favorable environment for service-driven energy solutions across the region.

UAE Energy as a Service Market Trends

The UAE's commitment to reducing emissions and expanding clean energy, along with its push for smart city development, is driving demand for EaaS to support national energy strategies. The integration of AI, IoT, and smart grid technologies enables predictive analytics, real-time monitoring, and automation, enhancing the efficiency and appeal of EaaS solutions. Additionally, high energy consumption in sectors such as commercial, industrial, and infrastructure makes them key adopters of EaaS for both cost savings and compliance with sustainability mandates.

Energy as a Service Market Companies

- Schneider Electric

- Honeywell International Inc.

- Entegrity

- Enel SpA

- Siemens

- Engie

- NORESCO, LLC

- Centrica plc

- Veolia

- Johnson Controls

- Bernhard

- General Electric

- Wendel

Recent Developments

- In May 2025, GridBeyond, a global smart energy company, and ABB a world technology leader in electrification and automation, are announcing a strategic partnership, to deliver ABB's newly launched Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service) offering. The service is designed to help businesses lower energy costs, reduce carbon emissions, and improve resilience without the need for upfront capital investment. (Source: https://www.energylivenews.com)

- In May 2025, Huawei International Pte. Ltd. and Keppel Ltd.'s Infrastructure Division, have signed a non-binding Memorandum of Understanding (MOU) to collaborate on renewable energy solutions, focusing on photovoltaic (PV) systems and Battery Energy Storage System (BESS) technologies. These include interconnected power grids across the ASEAN region, low-carbon data centres and industrial parks, and digital energy management for hybrid energy systems. (Source: https://govinsider.asia)

- In February 2025, Energy efficiency developer Sustainable Development Capital LLP (SDCL) and Schneider Electric have teamed up to provide energy-as-a-service in UK and Ireland. SDCL, which is pursuing the venture as part of its energy-as-a-service initiative, said the partnership will primarily serve heavy energy users like data centres, business parks, industrial sites and universities. (Source: https://realassets.ipe.com)

- In May 2025, Redaptive, a leading Energy-as-a-Service (EaaS) provider, announced the successful closing of a US$650 million (CAD 903 million) credit facility from CDPQ, a global investment group, and Nuveen, the investment manager of TIAA. Redaptive continues to set benchmarks in energy efficiency, sustainability innovation, and scalable energy solutions for their customers through their Energy-as-a-Service solution and the Redaptive ONE data platform. (Source: https://www.cdpq.com)

- The largest privately-owned provider of energy as a service (EaaS) solutions in the US, Bernhard LLC, will be acquired by DIF Capital Partners, a top worldwide independent infrastructure investment fund manager, from a Bernhard Capital Partners subsidiary in October 2021.

Segments Covered in the Report

By Service Type

- Energy Supply Services

- Operational and Maintenance Services

- Energy Efficiency and Optimization Services

By End User

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting