What is the Expectorant Drugs Market Size?

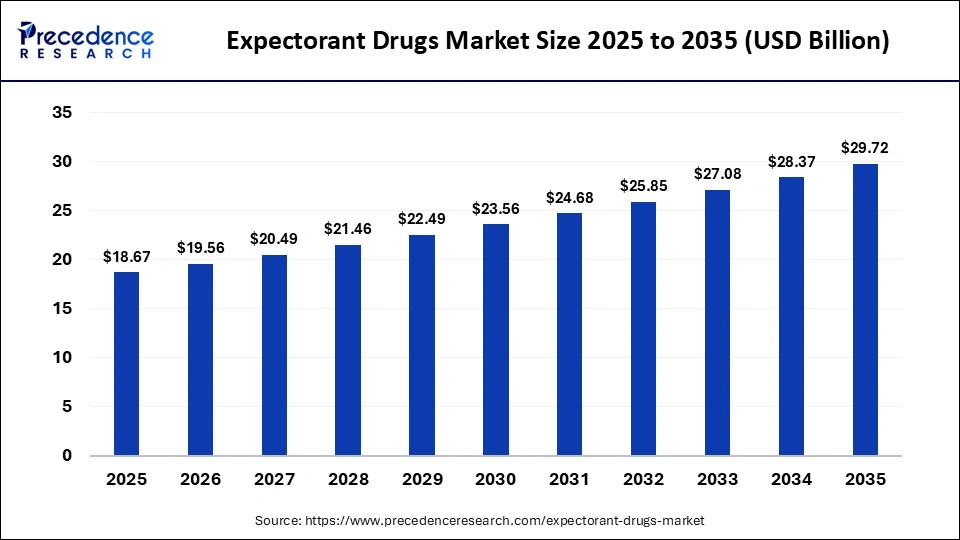

The global expectorant drugs market size was calculated at USD 18.67 billion in 2025 and is predicted to increase from USD 19.56 billion in 2026 to approximately USD 29.72 billion by 2035, expanding at a CAGR of 4.76% from 2026 to 2035. The market is expanding due to the rising prevalence of respiratory illnesses, increased air pollution, and growing demand for effective cough management therapies, especially in aging populations and emerging economies.

Market Highlights

- North America led the expectorant drugs market in 2025.

- Asia-Pacific is expected to expand the fastest CAGR in the market during the forecast period.

- By drug type, the secretion enhancers segment dominated the market in 2025.

- By drug type, the mucolytics segment is expected to grow at a strong CAGR during 2026 and 2035.

- By dosage form, the oral solid segment captured the highest market share in 2025.

- By dosage form, the oral liquid segment is expected to expand at a notable CAGR from 2026 to 2035.

- By type, the over-the-counter drugs segment led the market in 2025.

- By type, the prescription drugs segment is expected to grow at a solid CAGR between 2026 and 2035.

- By distribution channel, the retail pharmacies segment dominated the market in 2025.

- By distribution channel, the online pharmacies segment is growing at a strong CAGR over the studied period.

What are Expectorant Drugs?

Expectorants are medications that primarily help decrease the thickness of mucus to facilitate its clearance from the body by attaching themselves to the cells lining the respiratory tract and providing a source of water to hydrate the tissue. They are used in conjunction with other medications for cough relief, for the treatment of bronchitis and other types of respiratory infections, and more.

There are multiple factors driving growth within the global expectorant drugs market, including increasing incidence rates of respiratory disease triggered by environmental pollution; the increasing prevalence of self-medication; increasing ease of purchasing medications through both urban and suburban areas; and the focus of pharmaceutical companies on improving expectorant formulations and developing combination products. Overall, expectorant drugs are resilient to changes due to high volume sales across all age groups.

What is the Role of AI in the Expectorant Drugs Market?

Artificial Intelligence (AI) is transforming the market by introducing automation in drug discovery & development and clinical trials, as well as the diagnosis and treatment of respiratory disorders. AI and machine learning (ML) algorithms can analyze vast amounts of data and screen large datasets of drug-like candidates to generate highly efficacious drugs. They are used in clinical trials to streamline the entire process from subject selection to data analysis. AI can also be embedded in manufacturing to enhance efficiency, reproducibility, and productivity.

Moreover, AI and ML can aid in early diagnosis and screening of respiratory disorders at an early stage, preventing further disease complications. They can suggest appropriate, personalized treatment for patients based on the severity of the disease. AI can also predict potential adverse effects caused by expectorant drugs and assist patients and healthcare providers in managing those conditions.

Key Trends Driving the Expectorant Drugs Market

- Availability of OTC Medications: The availability of OTC drugs, including expectorant drugs from retail and hospital pharmacies, enhances the affordability and accessibility for patients from middle- and low-income groups.

- Novel Drug Delivery Systems: Scientists develop novel drug delivery systems (NDDS) to facilitate targeted delivery of expectorants directly into the lungs. These systems are developed to enhance patient convenience.

- Shifting Trend Towards Nutraceuticals: People are becoming increasingly aware of natural plant ingredients and herbal products for treating respiratory illnesses. Nutraceuticals are believed to be comparatively safer and cost-effective.

- Government Support: Government organizations from various countries launch initiatives to promote the diagnosis and treatment of respiratory disorders. They also provide funding for research activities and treating people from low-income groups.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.67 Billion |

| Market Size in 2026 | USD 19.56 Billion |

| Market Size by 2035 | USD 29.72 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.76% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Type, Dosage Form, Product Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Drug Type Insights

Which Drug Type Segment Dominated the Expectorant Drugs Market?

The secretion enhancers segment held a dominant position in the market in 2025 due to their proven efficacy in increasing secretions from the respiratory tract and facilitating clearance of mucous. Guaiphenesin, potassium citrate, and sodium citrate are examples of first-line medications that help with cough management due to safety, low cost, and compatibility with other pharmacologic agents. Their availability for strong OTC use enhances continued consumer acceptance.

The mucolytics segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 as a result of the increasing incidence of chronic and infectious respiratory diseases. Ambroxol, bromhexine, acetylcysteine, and carbocisteine are examples of agents that decrease the viscosity of secretions and allow for easier clearance of secretions from the airways. The increased use of prescription mucolytic agents is also promoting the growth in use of these agents in hospitals and specialty areas of care.

Dosage Form Insights

Why Did the Oral Solid Segment Dominate the Expectorant Drugs Market?

The oral solid segment registered its dominance over the global market in 2025 due to the growing demand for portable, easy-to-use, and longer-lasting dosage forms. Tablets, capsules, and granules have longer shelf lives than liquids and provide accurate dosing, so these advantages help to increase interest among working adults and those who use expectorants routinely. Increased new product development, such as flavored throat lozenges and effervescent powders, is driving an increase in consumer usage in developed markets as well as in emerging markets globally.

The oral liquid segment is expected to grow at a significant CAGR in the market during the studied years, as they are simple to take, act quickly, and have a high acceptance in both the child and the elderly population. As syrups and solutions offer precise dosing and superior taste, they are well-suited for the treatment of a short-term acute cough. There's broad acceptance of using oral liquids as part of combination therapy, and there's a very large number of different oral liquids available through retail pharmacies.

Product Type Insights

Which Product Type Segment Led the Expectorant Drugs Market?

The over-the-counter drugs segment led the global market in 2025 because many people treat their own everyday colds, which led to an increase in self-care. With OTC cough syrups and pills available easily and cheaply, along with little regulation of these products, more people are likely to use them when they have cold symptoms. Therefore, they account for the majority of cough/cold products sold.

The prescription drugs segment is expected to expand rapidly in the market in the coming years due to the increasing awareness for diagnosing chronic respiratory conditions (like bronchitis and COPD). Physicians are now using more advanced mucolytic therapy and combining it with other medications to reduce severe or persistent symptoms. The increase in hospital visits and the need for expert treatment and care further support the segment's growth.

Distribution Channel Insights

How the Retail Pharmacies Segment Dominated the Expectorant Drugs Market?

The retail pharmacies segment held the largest revenue share of the market in 2025, because they have a large number of physical locations, offer immediate access to a wide variety of products, and provide customers with a high level of trust. The majority of all non-prescription (OTC) expectorants are purchased at retail locations, with additional support from pharmacists, who provide recommendations by working directly with consumers. Retail pharmacies provide a wide range of brands and dosage forms, enabling patients to choose the desired product.

The online pharmacies segment is expected to witness the fastest growth in the market over the forecast period due to an increase in the use of electronic health solutions and consumers' desire for convenience when making purchases. Consumers are increasingly utilizing e-pharmacy services for home delivery, price comparisons, and subscription refills. Growth in the use of electronic payment systems and improved logistics will continue to enhance the online sales of OTC and prescription expectorants.

Regional Insights

Why North America Dominated the Expectorant Drugs Market?

North America held a major revenue share of the market in 2025 because of a developed healthcare system, a large knowledge base regarding respiratory disease, and the existence of large pharmaceutical-based research and development companies. The high prevalence of chronic bronchitis, combined with effective regulation, has allowed for rapid access to new expectorant drugs in North America. The existence of effective distribution channels and access to prescription and OTC expectorants has led to an ongoing Investment in respiratory health care, for the treatment of both acute and long-term mucus production.

U.S. Market Trends

The U.S. leads in North America as it has a strong clinical research community and Infrastructure that supports patient access. Expectorants are frequently recommended as a part of an overall integrated approach to respiratory medicine. There are adequate distribution channels for expectorants in the U.S. The culture of preventative medicine and the high level of health literacy drive consistent demand for pharmacological products to clear mucus, making the U.S. a centre of innovation for the introduction and adoption of expectorant products.

How is Asia-Pacific Growing in the Expectorant Drugs Market?

Asia-Pacific is expected to host the fastest-growing market in the coming years due to its increasing population, rising prevalence of respiratory diseases, and increasing health expenditure across developing countries. The increased accessibility of health services and improvements to the ability of providers to make diagnoses have resulted in an increased demand for symptomatic relief from respiratory problems.

A large and expanding population, combined with growing awareness of patients towards their own health care, has led to increased use of traditional and modern expectorant products. Additionally, strong competition in manufacturing and the variety of product offerings have opened up new markets for expectorant drugs in this dynamic region.

China Market Trends

China is the leading country in the Asia-Pacific region, with health care being made accessible to all residents of the country and significant emphasis placed on respiratory wellness. The local drug manufacturers have developed expectorant formulations that take advantage of their manufacturing capabilities and creativity. Increasing healthcare-related initiatives within the country have helped to improve the distribution of expectorant drugs to secondary and tertiary markets. Additionally, both patients and physicians have increased their awareness of expectorant drugs, enabling their increased use and development.

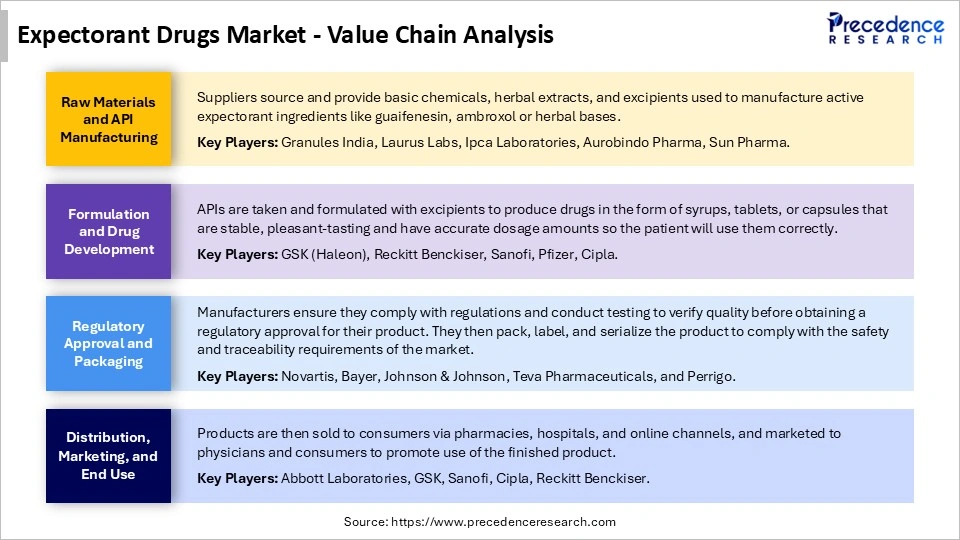

Expectorant Drugs Market Value Chain Analysis

Who are the Major Players in the Global Expectorant Drugs Market?

The major players in the expectorant drugs market include Merck, Sun Pharmaceuticals Limited, Abbott Laboratories, Astrazeneca plc, Glenmark Pharmaceuticals, Cipla Ltd., Johnson & Johnson, Bayer AG, Lupin Pharmaceuticals, Aster Medipharm Pvt. Ltd., Sanofi, Perrigo Company plc, and Acella Pharmaceuticals LLC.

Recent Developments

- In October 2025, Reckitt, manufacturer of Mucinex, announced positive results of its extended-release guaifenesin (Mucinex) that shows significant reduction in cough and sputum severity, improving quality of life and boosting patient satisfaction in stable chronic bronchitis.(Source: https://www.prnewswire.com)

- In August 2025, Mucinex Children's launches its first chewable cold & flu medicine, Mighty Chews Cold & Flu, offering easy, mess-free relief of multiple symptoms like fever, cough, sore throat, and runny nose for kids six and older. The product provides symptom relief without the mess and stress of traditional liquid medications.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Drug Type

- Secretion Enhancers

- Potassium Citrate

- Sodium Citrate

- Guaiphenesin

- Others (Ammonium Chloride, etc.)

- Mucolytics

- Bromhexine

- Amroxol

- Acetyl Cysteine

- Carbocisteineurine

By Dosage Form

- Oral Solid

- Powder & Granules

- Tablet

- Capsule

- Lozenge

- Oral Liquid

- Syrup

- Solution

- Suspension

- Elixir

- Inhalant

By Product Type

- Over-the-Counter Drugs

- Prescription Drugs

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting