What is Feed Acidifiers Market Size?

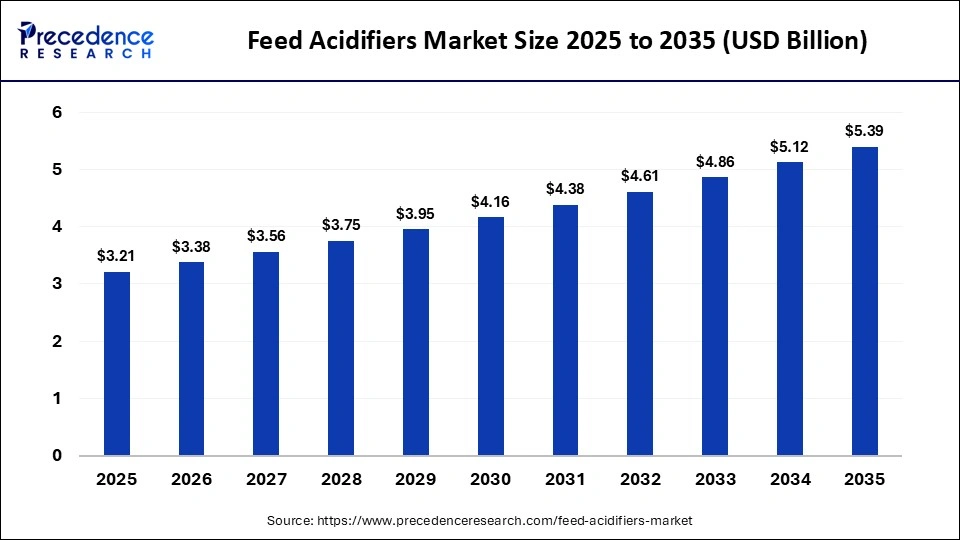

The global feed acidifiers market size was calculated at USD 3.21 billion in 2025 and is predicted to increase from USD 3.38 billion in 2026 to approximately USD 5.39 billion by 2035, expanding at a CAGR of 5.32% from 2026 to 2035. The growth of the market is driven by the increasing global meat consumption, rising demand for antibiotic-free feed additives, and rising awareness of feed hygiene and animal health improvement.

Market Highlights

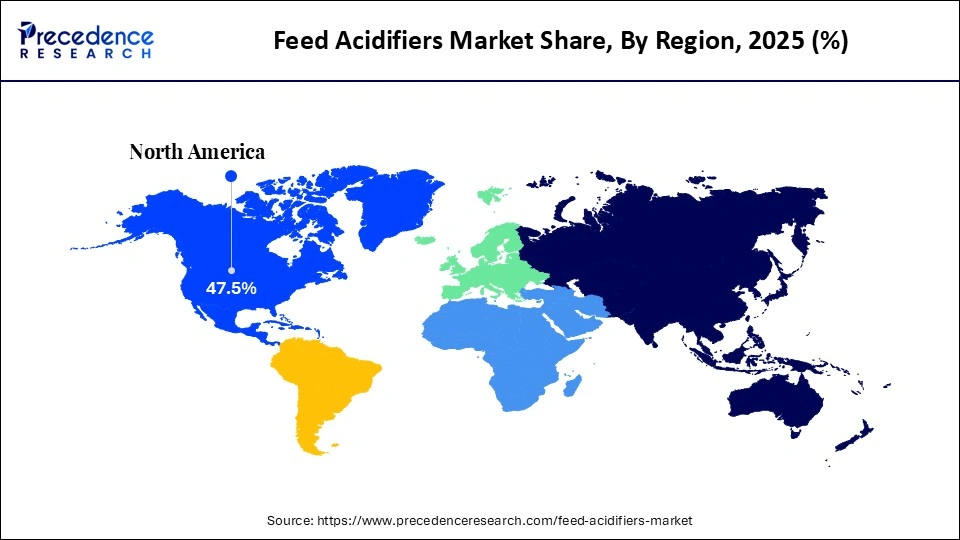

- Asia Pacific dominated the feed acidifiers market with a major share of 47.5% in 2025.

- North America is expected to grow at the fastest CAGR of approximately 9.8% from 2026 to 2035.

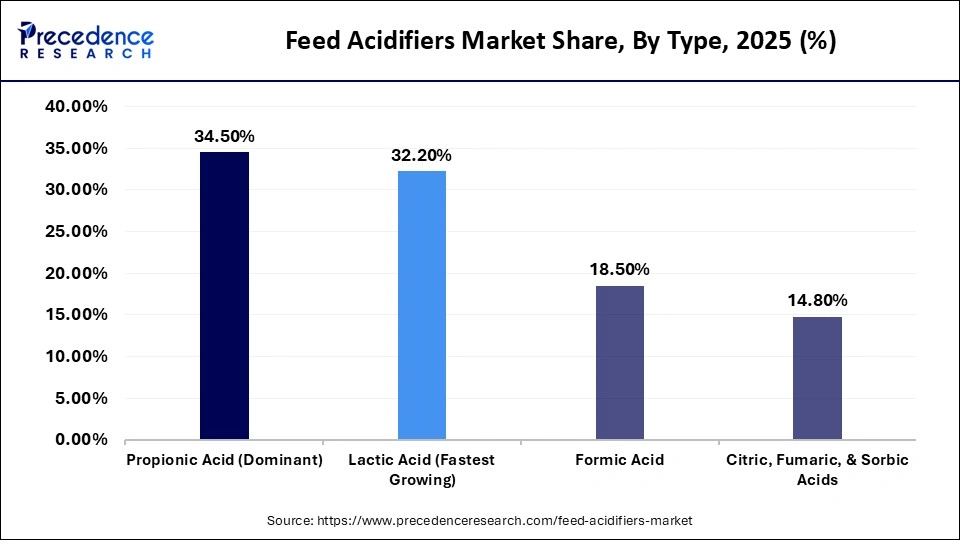

- By type, the propionic acid segment dominated the market with a share of approximately 34.5% in 2025.

- By type, the lactic acid segment is expected to grow at a CAGR of approximately 6.5% over the projected period.

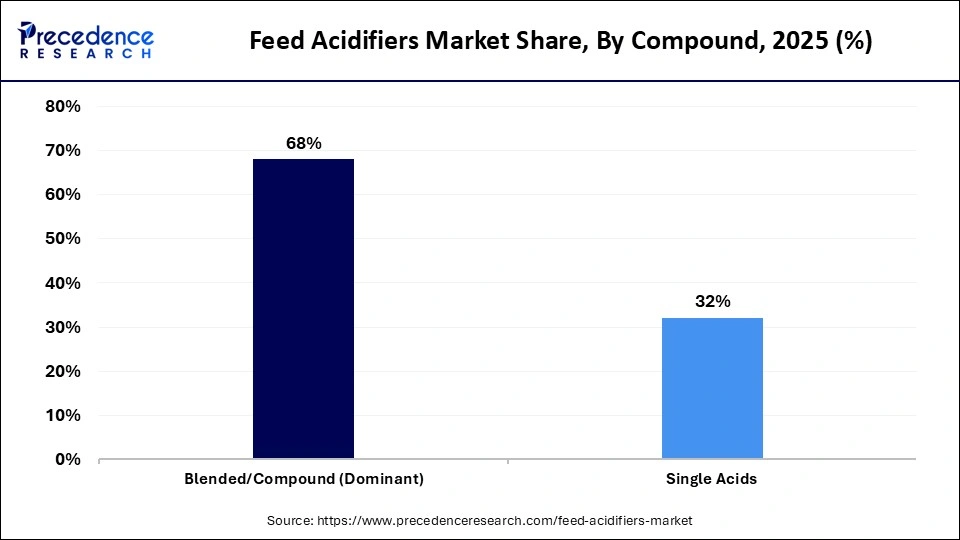

- By compound, the blended / compound segment accounted for the biggest market share of approximately 68% in 2025.

- By compound, the single acids segment is expected to grow at the highest CAGR over the projected period.

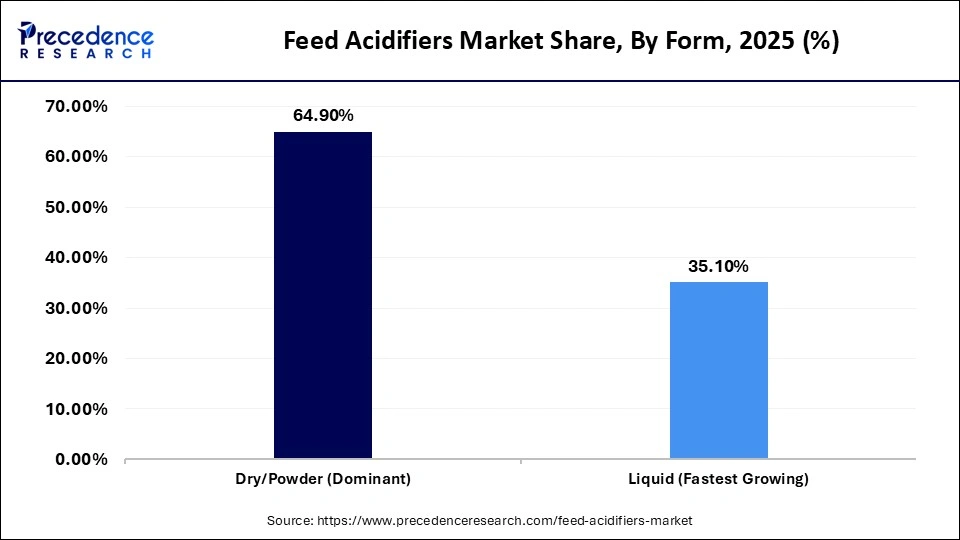

- By form, the dry/powder segment led the market with a share of approximately 64.9% in 2025.

- By form, the liquid segment is expected to expand at the highest CAGR over the projected period.

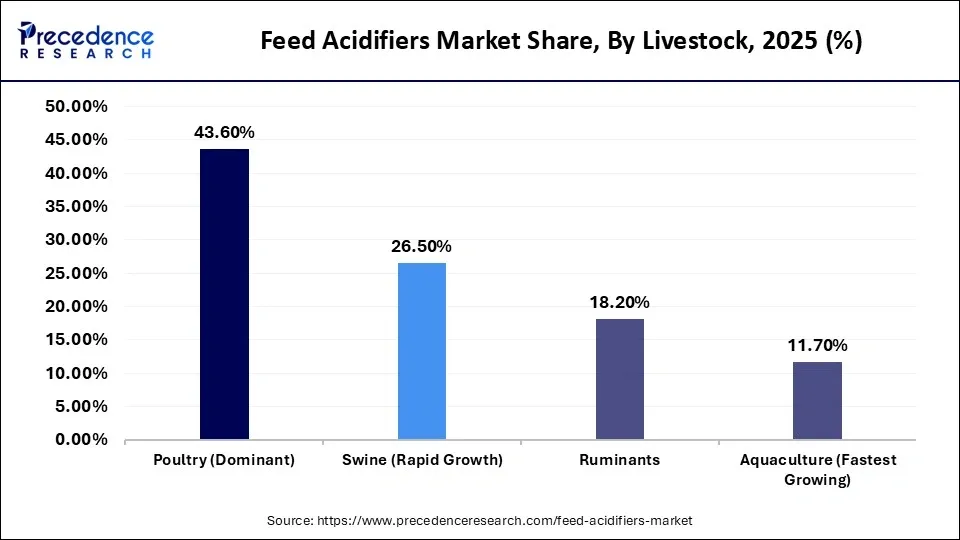

- By livestock, the poultry segment led the market with a share of approximately 43.6% in 2025.

- By livestock, the aquaculture segment is observed to grow at the fastest CAGR of approximately 7.8% over the projected period.

Market Overview

Feed acidifiers are a key segment of the animal feed additives industry. These are the organic (formic acid, lactic acid, citric acid, propionic acid, and benzoic acid) or inorganic acids (phosphoric acid). These acids and their salts are used to lower the gastrointestinal pH of the animal and improve digestion in livestock. These acidifiers play a crucial role in animal nutrition by balancing the intestinal microbiota and suppressing pathogenic bacteria like E. coli and Salmonella. Feed acidifiers, therefore, improve intestinal health, increase efficiency, and improve the performance of livestock, contributing to safe and high-quality animal products.

With a growing emphasis on antibiotic-free production and rising food safety standards, feed acidifiers are preferred over traditional antibiotic growth promoters. The importance of feed acidifiers is increasing in animal health, as they contribute to higher feed ratios and productivity. Increased demand for sustainable and high-performance feed and rising adoption across poultry, swine, ruminant, and aquaculture are driving the market growth. Ongoing research and development investments, government funding, innovations in the formulation, such as coated and liquid acidifiers, and strict compliance with regulations are boosting the market.

How is AI Impacting the Market of Feed Acidifiers?

Artificial intelligence integration is rapidly transforming the feed acidifiers market by enhancing feed formulation, efficiency, and animal health outcomes. AI enables precision nutrition, data-driven decision making, and smarter livestock management. Advanced AI machine learning algorithms and real-time data from farms can identify animal performance, feed intake patterns, and feed conversion ratio to determine the optimal type and dosage of feed acidifiers. With AI-enabled precision nutrition, this approach also reduces over-or under-dosing, minimizes waste, and improves growth rate and disease prevention. AI-assisted predictive analysis predicts disease outbreaks, indicating timely adjustments in the composition of acidifiers.

Furthermore, advanced digital technologies such as sensors and automated quality control systems ensure high-quality formulation and maintain safety standards throughout the feed production. AI models enhance productivity, support antibiotic-free feeding programs, and accelerate research and development, driving innovation and sustainability in the market. The integration of AI strengthens the feed acidifiers market and ensures delivery of precise, efficient, and nutritional solutions for livestock production.

What are the Major Trends Influencing the Feed Acidifiers Market?

- Focus on Sustainability: The global market is growing rapidly, driven by evolving livestock nutrition practices and increasing demand for sustainable, natural, and non-antibiotic feed additives. Restrictions on antibiotic use have boosted the adoption of feed acidifiers, which support gut health, nutrient absorption, and feed efficiency.

- Advanced Formulations and Technology Integration: Manufacturers are increasingly adopting innovative products, such as encapsulated and controlled-release acidifiers, which enhance stability and efficacy in promoting digestive health.

- Awareness of Food Safety: Growing awareness of food safety and natural alternatives is fueling demand for organic and natural feed acidifiers, reflecting a broader trend toward sustainability in the livestock and feed industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.21 Billion |

| Market Size in 2026 | USD 3.38 Billion |

| Market Size by 2035 | USD 5.39 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.32% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type,Compound,Form,Livestock, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Analysis

Type Insights

Propionic Acid: This segment dominated the market with approximately 34.5% share in 2025. This is due to its ability to curb the growth of bacteria in molds, hence used as a preservative to enhance nutrient absorption. This acid, being organically obtained, with the USFDA compliance, is considered a safe substance (GRAS), hence used as a feed additive.

Lactic Acid: This segment is expected to grow at a CAGR of approximately 6.5% in the coming years. The growth of the segment is driven by its effective antimicrobial activity and superior gut pH regulation. The segmental growth is also supported by the rising demand for antibiotic-free and natural acidifiers.

Compound Insights

Blended / Compound: This segment dominated the feed acidifiers market while holding approximately 68% share in 2025. This is because it combines multiple acidifiers to provide synergistic effects that improve gut health, nutrient absorption, and feed efficiency more effectively than single compounds. Farmers increasingly use blended feed acidifiers due to their synergistic effect, having broad-spectrum of antimicrobial activity, and enhanced gut health.

Single Acids: This segment is expected to experience exponential growth in the market due to its cost-effectiveness, ease of use, and targeted functionality for specific digestive or nutritional needs. Producers prefer single acids when precise control over gut pH or nutrient absorption is required, and these acids often offer predictable performance and simpler formulation compared to blended options.

Form Insights

Dry/Powder: This segment dominated the feed acidifiers market with a major share of approximately 64.9% in 2025 due to its easier transportation and storage, longer shelf life, and compatibility with dry feed formulations. Their versatility across different feed types and animal species further reinforces their dominance in the market.

Liquid: This segment is expected to grow at the fastest rate during the forecasted period due to its rapid absorption, uniform distribution in feed or water, and higher bioavailability compared to dry forms. Liquid acidifiers are especially favored for young animals or poultry, where precise dosing and quick gut pH regulation are critical. Additionally, the rising adoption of automated feeding systems and liquid feed formulations is driving increased demand for liquid acidifiers.

Livestock Insights

Poultry: This segment led the market with a major share of approximately 43.6% in 2025. This is because feed acidifiers play a crucial role in improving feed efficiency, maintaining gut health, and reducing the risk of pathogenic infections in poultry. Additionally, the large-scale and intensive nature of the poultry industry makes it a major adopter of feed acidifiers compared to other livestock segments.

Aquaculture: This segment is expected to grow at the fastest CAGR of approximately 7.8% during the forecasted period. This is due to the rising intensity of fish farming. Feed acidifiers improve feed utilization and improve the water quality, therefore supporting the healthy growth of fish. Feed acidifiers also help control pathogenic bacteria and optimize nutrient absorption, which is critical for high-density aquaculture systems.

Regional Insights

How Big is the Asia Pacific Feed Acidifiers Market Size?

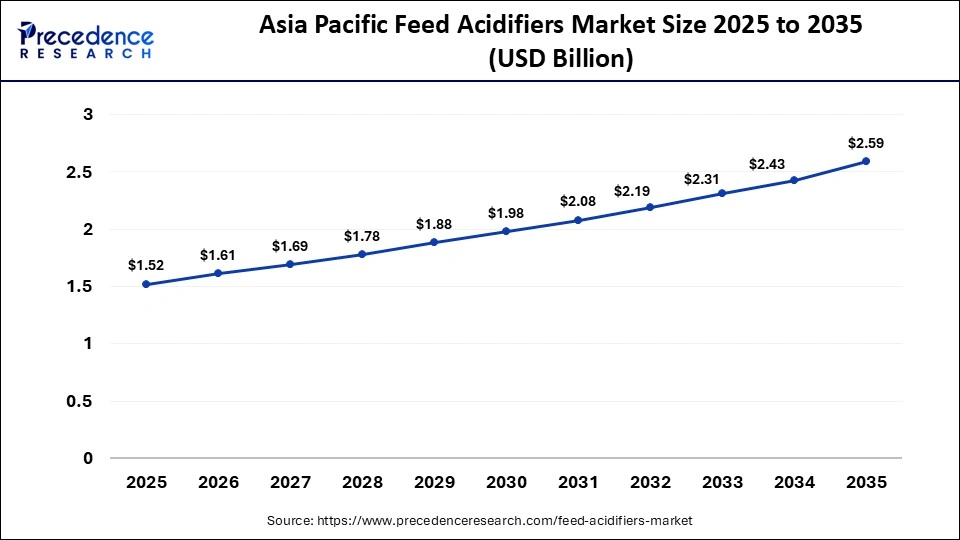

The Asia Pacific feed acidifiers market size is estimated at USD 1.52 billion in 2025 and is projected to reach approximately USD 2.59 billion by 2035, with a 5.47% CAGR from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Market?

Asia Pacific dominated the feed acidifiers market by capturing approximately 47.5% share in 2025. This is because of the high concentration of poultry and swine and the increased demand for animal protein. Due to the region's large and rapidly growing livestock and aquaculture industries, there is a significant increase in demand for feed acidifiers. The region's dominant position in the market is also reinforced by rising population and urbanization, which drives the need for high-quality meat, dairy products, and seafood.

The region is expected to sustain its position in the market, driven by rapid industrialization and commercialization of livestock farming, driving sustained demand for feed acidifiers. Growing emphasis on antibiotic-free animal production and heightened awareness of food safety have encouraged the adoption of natural and organic feed acidifiers. As the global leader in aquaculture, particularly fish and shrimp farming, the region widely uses acidifiers to improve digestion and maintain water quality. Government initiatives supporting modern farming practices and livestock production, along with increased focus on feed efficiency, are further fueling market growth in Asia Pacific.

What Makes North America the Fastest-Growing Region in the Feed Acidifiers Market?

North America is expected to grow at the fastest CAGR of approximately 9.8% over the projection period due to its well-developed livestock industry, rapid adoption of antibiotic-free production, and strong regulatory frameworks. There is significant demand for feed acidifiers due to large-scale poultry and swine production. Adoption of innovative feed production technologies is further driving the market. Rising food safety awareness and growing consumer demand for high-quality, safe meat and dairy products are driving increased adoption of efficient and high-quality feed acidifiers. Market growth is further fueled by the demand for sustainable and eco-friendly acidifiers, improved livestock performance, intensive farming practices, and expanding feed production.

U.S. Feed Acidifiers Market Trends

The U.S. feed acidifiers market is growing, driven by its robust livestock industry and demand for antibiotic-free animal production. There is a strong focus on improving gut health, nutrient absorption, and feed efficiency. Compliance with strict regulatory guidelines mandates antibiotic-free production in the country. One of the major trends in the country is the adoption of advanced formulation technologies, such as blended and controlled-release feed acidifiers that enhance feed efficiency and pathogen control.

Technological advancements such as automated dosing systems and digital monitoring of animal health are influencing the market. Growing awareness amongst consumers regarding food safety and the importance of protein, feed hygiene, and sustainability is driving producers to adopt organic and natural feed acidifiers.

Europe Feed Acidifiers Market Trends

The market in Europe is characterized by strict regulatory guidelines from the European Food Safety Authority (EFSA) limiting antibiotic use in animal feed, which has increased demand for safe and natural alternatives that support gut health. The region emphasizes innovation, including coated and blended acidifiers, to enhance feed efficiency and animal performance. A growing focus on sustainable and organic livestock production is driving adoption of advanced, natural feed acidifiers, particularly in countries like Italy, Germany, and France, where antibiotic-free solutions are increasingly favored.

Who are the Major Players in the Global Feed Acidifiers Market?

The major players in the feed acidifiers market includes Yara International ASA (Norway), Kemin Industries, Inc. (USA), Kemira Oyj (Finland), Perstorp Holding AB (PETRONAS) (Sweden), Biomin Holding GmbH (dsm-firmenich) (Austria), Novus International, Inc. (USA), Cargill, Inc. (USA), Nutreco N.V. (Selko) (Netherlands), Adisseo France SAS (France), Corbion N.V. (Netherlands), Alltech, Inc. (USA), Eastman Chemical Company (USA), ADDCON GmbH (Germany), and Impextraco NV (Belgium)

Recent Developments

- In January 2025, Jones-Hamilton launched BeefUp, an acidifier that controls pH, eliminates ammonia, and reduces bacteria in manure.

- In August 2025, dsm-firmenich Animal Nutrition & Health (ANH) inaugurated a new feed production plant in Hyderabad, India.

Segments Covered in the Report

By Type

- Propionic Acid

- Lactic Acid

- Formic Acid

- Citric, Fumaric and Sorbic Acid

By Compound

- Blended/Compound

- Single Acids

By Form

- Dry/Powder

- Liquid

By Livestock

- Poultry

- Swine

- Ruminants

- Aquaculture

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting