What is Feline Vaccines Market Size?

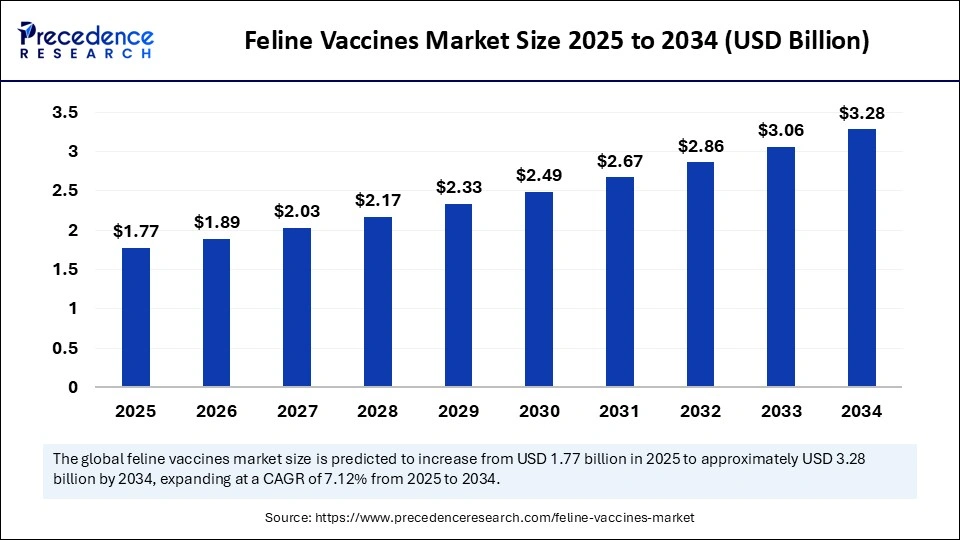

The global feline vaccines market size is calculated at USD 1.77 billion in 2025 and is predicted to increase from USD 1.89 billion in 2026 to approximately USD 3.28 billion by 2034, expanding at a CAGR of 7.12% from 2025 to 2034. The global feline vaccines market is witnessing robust growth, driven by rising pet humanization trends, rising pet ownership, increasing awareness of preventative healthcare for cats, and significant investments in veterinary healthcare infrastructure. This report covers market trends, production volumes, technological developments, and competitive dynamics across North America, Europe, and APAC between 2025 and 2030.

Major Key Insights of the Feline Vaccines Market

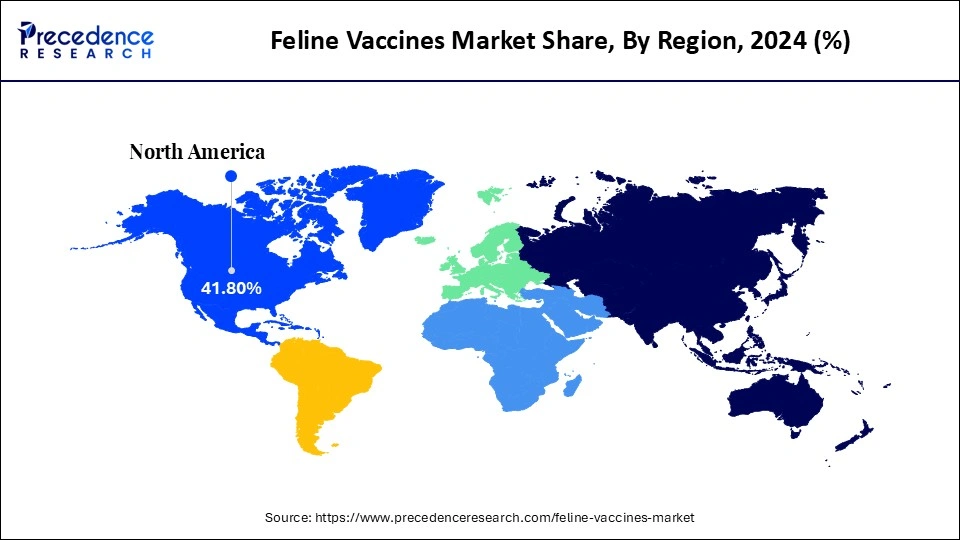

- By region, North America accounted for the largest market share of 41.8% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest rate in the market with an 8% CAGR from 2025 to 2034.

- By vaccine type, the inactivated (killed) vaccines segment accounted for the dominating share of 56.4% in 2024.

- By vaccine type, the recombinant vaccines segment is expected to witness a CAGR of 7.4% from 2025 to 2034.

- By disease type, the feline panleukopenia virus (FPV) segment held a dominant presence in the market in 2024, with 40.4% share.

- By disease type, the feline herpesvirus type 1 (FHV-1) segment is set to growing at a solid CAGR of 7.8% from 2025 to 2034.

- By technology, the live attenuated segment registered its dominance with 44.4% over the global feline vaccines market in 2024.

- By technology, the inactivated segment is expected to grow significantly at a CAGR of 7.3% from 2025 to 2034.

- By route of administration, the injectable vaccines segment accounted for the highest market share of 55.5% in 2024.

- By route of administration, the intranasal vaccines segment is expected to witness remarkable growth with a 7.1% CAGR from 2025 to 2034.

- By end-user, the veterinary hospitals segment held the major market share of 52.4% in 2024.

- By end-user, the veterinary clinics segment is projected to grow at a CAGR of 7.6% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 1.77 Billion

- Market Size in 2026: USD 1.89 Billion

- Forecasted Market Size by 2034: USD 3.28 Billion

- CAGR (2025-2034): 7.12%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Are Feline Vaccines?

The rapid advancements in vaccine technology, leading to safer and more effective formulations, are expected to boost the expansion of the feline vaccines market during the forecast period. The feline vaccines market includes biological preparations that stimulate immune responses in cats to prevent infectious diseases such as rabies, feline leukemia, calicivirus, and panleukopenia. These vaccines are classified as core and non-core, and they are administered through various routes and forms, including injectable and intranasal.

Feline Vaccines Market Outlook:

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth, owing to the increasing pet ownership, awareness of feline health, and advancements in veterinary biotechnology. Continuous innovation in multivalent and recombinant vaccines supports improved efficacy and longer protection.

- Global Expansion: Leading players are expanding their geographical presence. For instance, in July 2025, Czech-based Bioveta announced the launch of new lines of its Biofel feline vaccines in Venezuela, in partnership with the domestic company Seprogan. This expansion is part of the company's strategic move to strengthen its position in Latin American markets. (Source: https://www.bioveta.e)

- Major Investors: Several strategic investors are actively engaged in the market, accelerating its growth during the forecast period. For instance, in May 2025, Merck Animal Health and the State of Kansas announced a USD 895 million investment in manufacturing and research & development facilities in De Soto. The $895 million capital expansion will be constructed on an existing Merck-owned property that is the site of its biologics facility in De Soto, Kansas. It includes an $860 million investment in the site's existing manufacturing facility and a further $35 million investment in its research and development laboratories. The 200,000-square-foot manufacturing facility project will expand the capacity for filling and freeze-drying large molecule vaccines and biologic products for Merck Animal Health. (Source: https://www.merck.com)

AI Shifts in the Feline Vaccines Market:

In the rapidly evolving technological landscape, Artificial Intelligence (AI) and machine learning (ML) emerge as transformative forces, driving growth and significant innovation in the feline vaccines market by accelerating vaccine development and improving the design of new vaccines to optimize their delivery and distribution. AI-driven solutions can effectively analyze massive biological datasets to identify potential antigens, which are components of a pathogen that trigger an immune response. Using Machine Learning (ML) enables researchers to predict the effectiveness and safety of a vaccine candidate before clinical trials, facilitating the selection of antigens that create a durable immune response. AI generative models and molecular dynamics simulations assist in optimizing vaccine components to improve stability and effectiveness.

Major trends in the Feline Vaccines Market:

- In September 2024, MSD Animal Health, a division of Merck & Co., Inc., Rahway, N.J., USA, announced the expansion of the newly USDA-approved NOBIVAC NXT vaccine platform to include a best-in-class solution to protect cats against one of the most common feline infectious diseases, feline leukemia virus (FeLV). (Source: https://www.msd-animal-health.com)

- In May 2025, Alley Cat Allies reached a milestone of 5000 cats helped in its latest Trap-Neuter-Return (TNR) collaboration with the Humane Society of Atlantic County (HSAC). To continue the lifesaving momentum, Alley Cat Allies has issued a new grant to help 1000 more cats and kittens in the next months. The grant is focused on Atlantic County's community cats, or unowned cats who live outdoors. Alley Cat Allies, the leader of the global movement to protect cats and kittens, will help fund spaying, neutering, and vaccination as part of TNR. It will also provide further support for the county's first-of-its-kind community cat food bank, which serves more than 800 cats every day. (Source:https://finance.yahoo.coml)

- In August 2025, Monroe County Humane Association (MCHA) is pleased to announce the event to help local cat and dog owners keep their animals safe and healthy. The Dog House hosted MCHA's walk-in mobile vaccine clinic at 1999 S Yost Avenue, Bloomington, IN 47403. MCHA's dedicated veterinary team of volunteers and staff was available without the need for an appointment. (Source: https://www.idsnews.com)

- In September 2025, Virbac, a French veterinary pharmaceutical laboratory, announced the European launch of Vikaly, the world's first medicated feed for cats. This breakthrough innovation creates a new therapeutic approach for companion animals, facilitating administration and improving treatment follow-up. (Source:https://corporate.virbac.com/home)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.77 Billion |

| Market Size in 2026 | USD 1.89 Billion |

| Market Size by 2034 | USD 3.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vaccine Type, Disease Type, Application,Route of Administration, End user and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Feline Pet Ownership Data in the United States (2024)

| Statastics | Cats |

|

Percentage of U.S. households owning |

32.1 |

|

Total number of U.S. households owning |

42.2M |

|

Average number per pet-owning household |

1.8 |

|

Total number in the U.S. |

73.8M |

|

Average spending on veterinary care per household per year |

$433 |

(Source: 2024 AVMA Pet Ownership)

(https://www.avma.org)

Value Chain Analysis

Antigen & Raw Material Procurement (Biological Inputs & Adjuvants)

The chain begins with sourcing pathogen strains, cell culture media, adjuvants, stabilizers, and excipients, all critical to vaccine efficacy. These biological inputs are obtained from certified laboratories and bioreactor suppliers under strict biosafety and regulatory protocols. Consistency, purity, and cold-chain handling are key differentiators. Upstream value capture is dominated by suppliers with proprietary antigen libraries, GMP-certified bioreactors, and adjuvant innovations that enhance immune response.

Vaccine Manufacturing & Quality Control

This is the core value-creation stage, involving antigen cultivation, inactivation or attenuation, formulation, filling, and packaging under GMP conditions. Manufacturers invest heavily in bioprocess technology, sterile manufacturing, and batch testing to meet stringent veterinary regulatory standards (e.g., USDA, EMA, or OIE). Product differentiation occurs through multivalent formulations, extended duration of immunity, and safety optimization. Value capture lies in R&D, IP-protected strains, and regulatory compliance expertise, which create barriers to entry and sustain premium pricing.

Distribution & Veterinary End-Use Delivery

Vaccines are distributed through wholesalers, veterinary clinics, hospitals, and pet health networks, requiring reliable cold-chain logistics to maintain product viability. Education and awareness campaigns targeting veterinarians and pet owners play a crucial role in adoption. Digital platforms and data-driven inventory systems streamline distribution and demand forecasting. Downstream value capture comes from brand trust, distribution efficiency, and practitioner loyalty, often strengthened through training, bundled health programs, and long-term service contracts.

Segmental Insights

Vaccine Type Insights

Which Segment Is Dominating the Feline Vaccines Market by Vaccine Type?

The inactivated (killed) vaccines segment dominated the global feline vaccines market with a share of 56.4% in 2024, owing to their safety and stability for immunocompromised cats. Inactivated (killed) vaccines are widely utilized for core diseases, making them ideal for combination vaccines with other pathogens.

On the other hand, the recombinant vaccines segment is expected to witness remarkable growth with a 7.4% CAGR during the forecast period. Recombinant vaccines use genetic engineering to create safer, effective, and more targeted vaccines with reduced side effects. They are extensively available for diseases like feline leukemia virus (FeLV).

Disease Type Insights

What Causes the Feline Panleukopenia Virus (FPV) Segment to Dominate the Feline Vaccines Market?

The feline panleukopenia virus (FPV) segment held a dominant presence in the feline vaccines market with a 40.4% share in 2024. Feline panleukopenia is also known as feline distemper. FPV is everywhere in the environment, and almost all cats are exposed to it at some point in their lives. Feline panleukopenia is a highly contagious, potentially fatal disease of cats caused by the feline panleukopenia virus. Infected cats can pass FPV in their stool and body fluids like urine and nasal secretions.

On the other hand, the feline herpesvirus type 1 (FHV-1) segment is expected to grow at a notable rate with a 7.8% CAGR. Feline viral rhinotracheitis (FVR) is an infectious disease which is caused by feline herpesvirus type-1. It is a major cause of upper respiratory disease in cats and the common cause of conjunctivitis. The FVR symptoms include the nose, throat, and eyes, and include sneezing, nasal congestion, conjunctivitis, excessive blinking, and others.

Technology Insights

How Did the Live Attenuated Segment Dominate the Market for Feline Vaccines in 2024?

The live attenuated segment held the majority of the market share of 44.4% in 2024, primarily due to its superior efficacy and long-lasting protection against major feline diseases such as feline panleukopenia, calicivirus, and herpesvirus. Live attenuated vaccines, also known as modified live vaccines (MLVs), use weakened forms of pathogens that closely mimic natural infections, thereby eliciting a strong and comprehensive immune response. Unlike inactivated vaccines, they effectively stimulate both humoral (antibody-mediated) and cell-mediated immunity, offering robust protection with fewer booster requirements. Furthermore, their proven safety profile and ability to induce rapid immune memory have made them the preferred choice among veterinarians and pet owners, particularly in preventive healthcare programs for companion animals.

On the other hand, the inactivated segment is projected to grow at a 7.3% CAGR between 2025 and 2034. Inactivated vaccines are vaccines in which the target pathogen is killed and unable to replicate. Inactivated vaccines produce weaker immune responses of shorter duration when compared with attenuated live vaccines, and more frequent booster immunizations may be required.

Route of Administration Insights

How Injectable Vaccines Segment Dominate the Feline Vaccines Market in 2024?

The injectable vaccines segment held the largest share in the feline vaccines market, accounting for 55.5%. Injectable vaccines are the standard route of administration, with the market focusing on combined vaccines like FVRCP for convenience. Combined vaccines protect against multiple diseases in a single injection, like FVRCP, which protects against feline viral calicivirus, rhinotracheitis, and panleukopenia. They are highly popular for their efficiency, convenience, and significant reduction of stress for cats.

On the other hand, the intranasal vaccines segment is anticipated to grow with a 7.1% CAGR during the forecast period, owing to the increasing importance of preventing various diseases such as calicivirus, panleukopenia, and rabies. The intranasal route provides a direct local immune response in the respiratory tract. Intranasal vaccines are highly effective for respiratory diseases.

End-User Insights

How Did the Veterinary Hospitals Segment Dominate the Feline Vaccines Market in 2024?

The veterinary hospitals segment held the majority of the market share in 2024. The rising pet ownership and a rising focus on preventive healthcare drive the growth of the segment. Veterinary hospitals are the primary channel for distribution and administration. Moreover, rapid advancements in vaccine technology and the presence of regulatory standards have contributed to the growth of the segment in the coming years. They provide a wide range of healthcare services, such as physical exams before vaccination, vaccine administration, and tracking vaccination history.

On the other hand, the veterinary clinics are anticipated to grow at a significant CAGR. Veterinary clinics are considered the crucial point of sale and administration for feline vaccines. Veterinarians in clinics provide expert advice on which vaccines are necessary based on the cat's lifestyle, age, past medical history, and disease prevalence. Veterinary clinics are where vaccines are generally administered, often following a recommended specific schedule.

Regional Insights

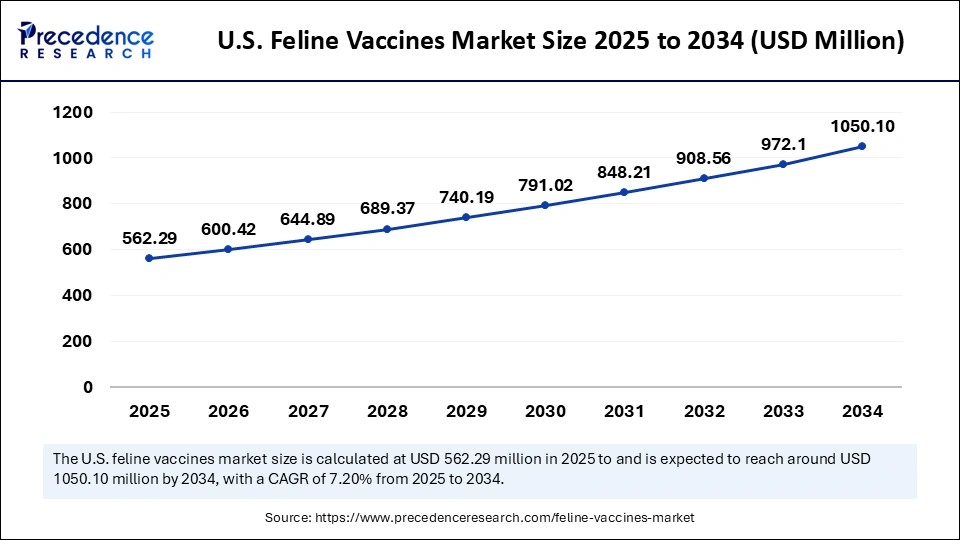

U.S. Feline Vaccines Market Size and Growth 2025 to 2034

The U.S. feline vaccines market size is exhibited at USD 562.29 million in 2025 and is projected to be worth around USD 1050.10 million by 2034, growing at a CAGR of 7.20% from 2025 to 2034.

What Made North America Dominate the Feline Vaccines Market in 2024?

North America held the dominant share of the feline vaccines market in 2024. The region's growth is attributed to higher healthcare spending and the increasing number of people who consider cats as family members, which spurs the demand for preventative healthcare and vaccinations. Moreover, technological innovations in vaccine development, such as mRNA technology, are significantly improving vaccine efficacy and safety. The market is witnessing the increasing preference for combination vaccines that offer robust protection against various diseases. An increasing number of veterinary clinics and hospitals, along with the stringent regulatory standards in North America, have contributed to the strong demand for feline vaccines, gaining consumer trust.

Feline Vaccines Market Trends in the United States

The country accounted for the majority of market revenue share in 2024, driven by the increasing adoption of pet cats, rising government funding for R&D activities, higher disposable incomes for pet healthcare, and the growing shift to combination vaccines. Moreover, the increasing awareness of feline diseases, increasing demand for effective prevention methods, and advancements in veterinary science are anticipated to propel the market's expansion in the coming years.

The Asia Pacific Is Expected to Grow at the Fastest Rate in the Market

The Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The rise in global pet ownership mainly fuels the fastest growth in the region, driven by the increasing trend of viewing cats as family members, the demand for preventing infectious diseases in cats, and the growing demand for combination vaccines that offer robust protection against numerous feline diseases. In addition, the rising incidence of feline diseases such as Feline Panleukopenia Virus (FPV), Feline Calicivirus (FCV), Feline Herpesvirus Type 1 (FHV-1), Feline Immunodeficiency Virus (FIV), rabies, feline leukemia virus (FeLV), and others is significantly leading to the increasing demand for preventive care, encouraging pet owners to vaccinate their cats. The well-established veterinary facilities and availability of veterinary professionals allow for simplified vaccination schedules, resulting in higher convenience for cat owners. The market is also experiencing growth in the region due to rapid advancements in vaccine technology and an increasing focus on improving vaccine efficacy and safety.

Feline Vaccines Market Trends in India

India is a major contributor to the growth of the market. The growth of the country is driven by the increasing awareness of feline diseases, rising pet humanization trends, advancements in vaccine technology, and the growing demand to prevent cats from infectious diseases. Additionally, the rising government investment in veterinary facilities is expected to propel the regional growth during the forecast period. For instance, in November 2024, the West Bengal Livestock Development Corporation (WBLDC) started a diagnostic service for pets, especially dogs and cats, in the city and suburbs. The corporation, a state govt undertaking at Salt Lake, has engaged its unit, the Center for Laboratory Animal Research and Training (CLART) at Kalyani, to conduct tests on animals for diagnosis and treatment.

Top Key Players in the Feline Vaccines Market & Their Offerings:

- Virbac: Virbac is constantly exploring new ways to prevent, diagnose, and treat the majority of animal pathologies. They develop care, hygiene, and nutrition products to offer complete solutions to veterinarians, farmers, and pet owners around the world. The company is focusing on advancing the health of animals with those who care for them every day.

- Merck Animal Health (MSD Animal Health): Merck Animal Health is the global animal health business of Merck & Co., Inc., Kenilworth, N.J., USA. Merck Animal Health develops and offers a wide range of veterinary medicines, vaccines, technology, and health management solutions for both companion animals and livestock.

- Boehringer Ingelheim Animal Health GmbH:Boehringer Ingelheim Animal Health GmbH is a global leader in the animal health industry. More than 10,000 employees serve more than 150 markets worldwide. We are one of the largest providers of vaccines, parasiticides, and therapeutics, complemented by diagnostics and monitoring platforms, with a strong presence in the companion animal and livestock segments.

- Elanco Animal Health Incorporated:Elanco Animal Health Incorporated is a global pharmaceutical company that develops products and services for both farm animals and pets. Elanco is one of the world's largest animal health companies. Elanco's portfolio includes medicines, vaccines, and supplements designed to prevent and treat disease.

- Ceva Santé Animale: Ceva Santé Animale is the leading French company in the animal health sector, headquartered in Libourne, France, with more than 7,000 employees located in 47 countries. Their 21 R&D centers and 33 production sites worldwide attest to our commitment to research and the development of increasingly innovative solutions.

Recent Developments:

- In April 2025, the Texas A&M Gastrointestinal Laboratory (GI Lab) announced a partnership with feline virologist Dr. Julia A. Beatty to study viral causes of liver diseases, including cancer, in cats.

Beatty, whose team recently discovered the feline “cousin” of the hepatitis B virus, a major cause of liver cancer in humans, is the Chair Professor of Veterinary Medicine and Infectious Diseases at the City University of Hong Kong.(Source: https://stories.tamu.edu) - In July 2025, MSD Animal Health, a division of Merck & Co., Inc., Rahway, N.J., USA, announced the U.S. Food and Drug Administration (FDA) approval of BRAVECTO QUANTUM (fluralaner for extended-release injectable suspension), a new, once-yearly injectable product to treat and protect dogs from fleas and ticks. (Source:https://www.msd-animal-health.com)

Other Companies in the Market

- Zoetis Inc.

- Vetoquinol S.A.

- Indian Immunologicals Ltd.

- HIPRA S.A.

- Dechra Pharmaceuticals PLC

- Bioveta, a.s.

- Bimeda Holdings PLC

- Neogen Corporation

- Bayer Animal Health (now part of Elanco)

- Huvepharma EOOD

Segments Covered in the Report

By Vaccine Type

- Inactivated (Killed) Vaccines

- Live Attenuated Vaccines

- Recombinant Vaccines

By Disease Type

- Feline Panleukopenia Virus (FPV)

- Feline Calicivirus (FCV)

- Feline Herpesvirus Type 1 (FHV-1)

- Feline Leukemia Virus (FeLV)

- Rabies

- Feline Immunodeficiency Virus (FIV)

- Others

By Technology

- Live Attenuated

- Inactivated

- Recombinant DNA

- Subunit

- Toxoi

By Route of Administration

- Injectable Vaccines

- Intranasal Vaccines

- Oral Vaccines

By End-User

- Veterinary Hospitals

- Veterinary Clinics

- Animal Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content