What is Financial Planning Software Market Size?

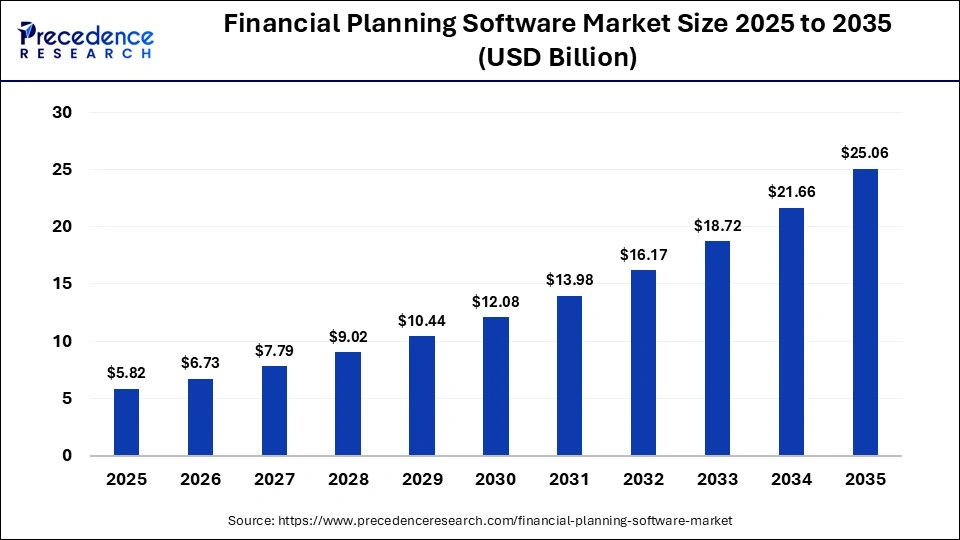

The global financial planning software market size was calculated at USD 5.82 billion in 2025 and is predicted to increase from USD 6.73 billion in 2026 to approximately USD 25.06 billion by 2035, expanding at a CAGR of 15.72% from 2026 to 2035. The financial planning software market is experiencing robust growth, driven by increasing data complexity and growing adoption of cloud and AI/ML-driven planning platforms.

Market Highlights

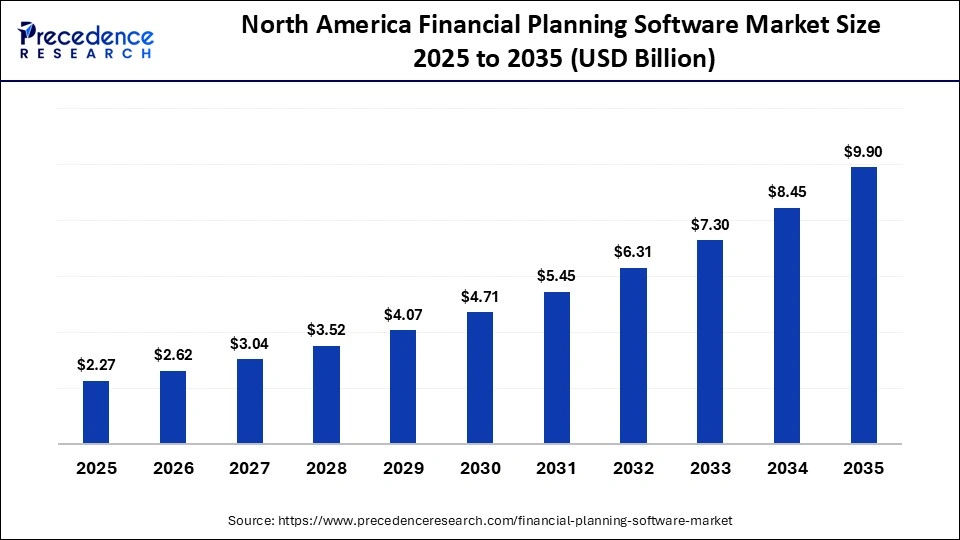

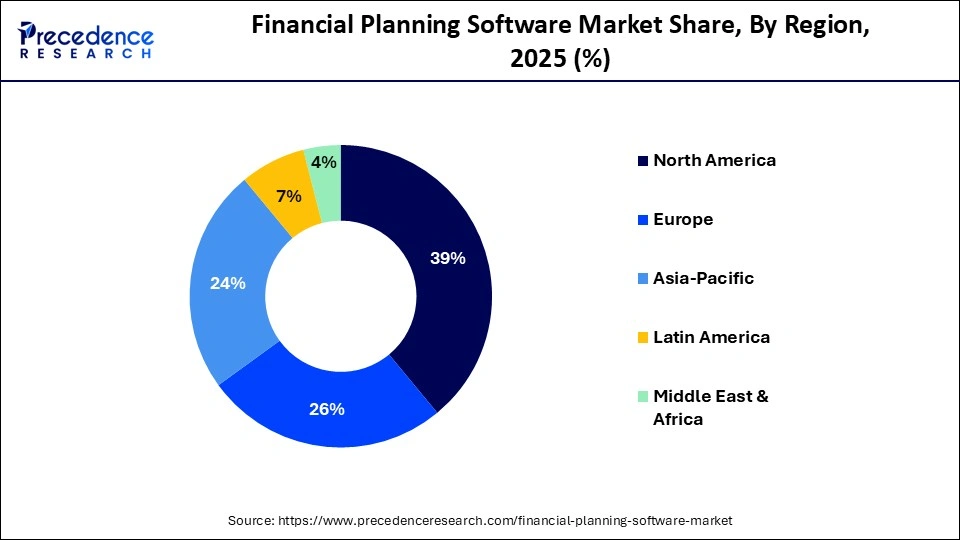

- North America dominated the market, holding the largest market share of approximately 39% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR in the financial planning software market between 2026 and 2035.

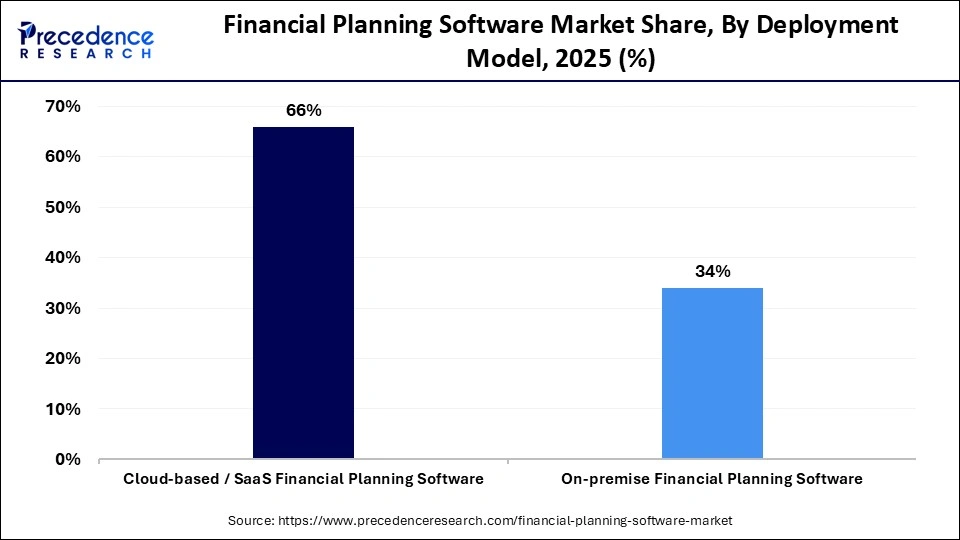

- By deployment model, the cloud-based/SaaS financial planning software segment held the largest market share of approximately 66% in 2025 and is expected to witness the fastest growth during 2026-2035.

- By deployment model, the on-premise financial planning software segment is expected to grow at a significant CAGR from 2026 to 2035.

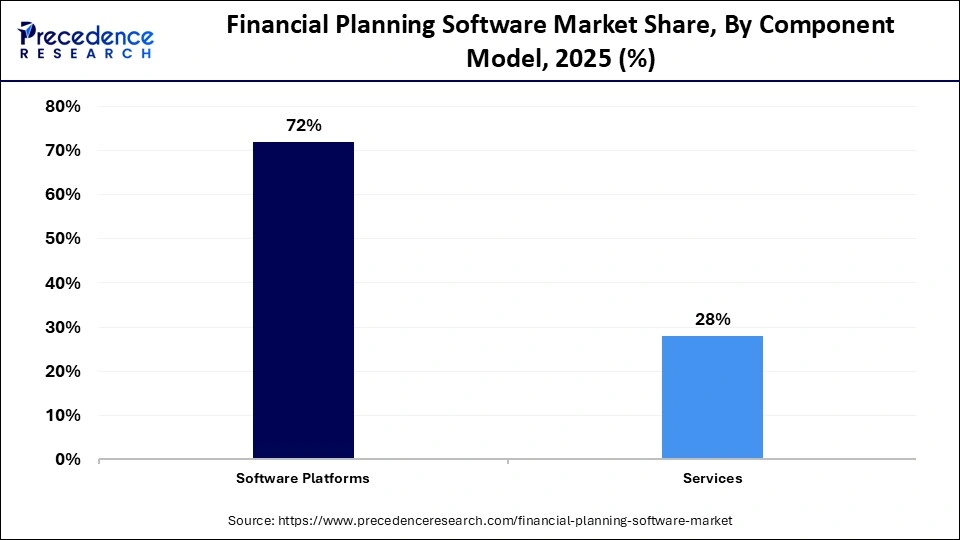

- By component, the software platforms segment held the largest market share of approximately 72% in 2025.

- By component, the services segment is expected to grow at a significant CAGR between 2026 and 2035.

- By functionality, the budgeting & forecasting segment held the largest market share of approximately 29% in 2025.

- By functionality, the risk & scenario analysis segment is expected to expand at a remarkable growth rate between 2026 and 2035.

- By end-user, the banking, financial services & insurance (BFSI) segment held the largest share, accounting for approximately 32% of the financial planning software market in 2025.

- By end-user, the healthcare & life sciences segment is set to grow at a remarkable CAGR between 2026 and 2035.

Market Overview

The global financial planning software market includes standalone and integrated software solutions that help businesses and individuals analyze financial data, forecast financial performance, budget, model scenarios, manage investments, support planning cycles, and drive decision-making. These solutions are deployed across enterprises, SMEs, wealth management firms, banks, insurance companies, and financial advisory practices.

How are AI-driven innovations reshaping the financial planning software market?

As AI technology continues to evolve, the integration of Artificial Intelligence (AI) is significantly accelerating the growth of the financial planning software market by providing data-driven insights, improving forecasting accuracy, and automating routine tasks. AI-driven financial planning software automates budgeting, forecasting, and risk management. AI tools also provide tailored investment strategies and financial advice. AI-powered solutions are being deployed across various businesses to handle high-volume tasks like anomaly detection and variance analysis, allowing skilled professionals to focus on strategic tasks. Companies are adopting AI-driven financial planning software to get a competitive advantage and benefit from automated financial processes, more accurate forecasts, seamless integration, and legally compliant AI technologies.

What are the emerging trends in the market?

- The increasing demand for real-time finance tracking is anticipated to promote the growth of the market during the forecast period.

- The rapid digital transformation across various sectors is expected to bolster the market's expansion in the coming years. Several businesses are widely adopting financial software tools to enhance the efficiency and accuracy in budgeting, forecasting, and investment planning.

- The rise in digital transformation and cloud-based platforms has expanded market accessibility, enabling real-time data analysis and improved decision-making

- The rising regulatory compliance pressures are anticipated to fuel the market's expansion during the forecast period. The rising focus on financial transparency encourages companies to adopt software that automates compliance reporting.

- The increasing need to track and manage the income of consumers, along with the rising penetration of high-speed internet, is expected to contribute to the overall growth of the market.

- The rising shift to digital financial services is spurring the demand for cloud-based platforms that offer real-time analytics, flexibility, and scalability for both companies and individuals, supporting the growth of the market.

- The rising consumer awareness regarding financial wellness and the increasing adoption of user-friendly mobile applications are expected to create significant growth opportunities for the financial planning software market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.82 Billion |

| Market Size in 2026 | USD 6.73 Billion |

| Market Size by 2035 | USD 25.06 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component,Deployment Type,Functionality,End-user, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

What has led the software platforms segment to dominate the financial planning software market?

The software platforms segment is dominating the financial planning software market by holding a share of approximately 72%. The segment includes core planning engines, forecasting & budgeting modules, scenario modeling tools, and dashboard & visualization. The growth of the segment is driven by the rising demand for automated and real-time financial tracking. Cloud-based software deployment has significantly increased among SMEs and large enterprises, owing to cost-efficiency, scalability, and accessibility for remote financial advisory services.

The services segment is expected to witness the fastest growth in the market with a CAGR over the forecast period. The segment includes implementation & integration, support & maintenance, and training & consultancy. The segment's growth is supported by the rising need for tailored implementation and seamless integration, stringent regulatory compliance, and the rising shift toward cloud-based subscription models. For the full utilization of the financial planning software, service providers often offer training that assists users in maximizing its functionality. The rapid adoption of AI, ML, and predictive analytics requires expert guidance to analyze data and maintain high accuracy in financial forecasts.

Deployment Type Insights

Which sub-segment is dominated by the deployment type in the financial planning software market?

The cloud-based/SaaS financial planning software segment is dominating the financial planning software market by holding a share of approximately 66% and is expected to grow at the fastest CAGR during the forecast period. Cloud-based deployment model offering various benefits such as cost-effectiveness, flexibility, and scalability. Cloud solutions enable faster deployment and access to real-time analytics, which makes them gain immense popularity in the financial planning software market. SaaS based platforms offer advanced capabilities by integrating AI and real-time data analysis, which enhance decision-making efficiency. Several organizations are increasingly shifting to SaaS for easy, remote, and mobile-first access to financial data.

The on-premise financial planning software segment is estimated to grow at a notable rate in the financial planning software market. The increasing need for direct control and stringent data privacy laws is anticipated to drive the growth of the on-premise deployment model. On-premises deployment mode is preferred where data privacy and compliance play a crucial role. On-premises allows for full data and security control to manage sensitive financial data, especially in sectors like BFSI, healthcare, and government organizations.

Functionality Insights

What factors are contributing to the dominance of the budgeting & forecasting segment in the financial planning software market?

Budgeting & Forecasting

The budgeting & forecasting segment held the largest market share of approximately 29% in 2025. The growth of the segment is driven by the increasing need for creating accurate and integrated financial projections. The rising technological integration of Artificial Intelligence (AI), Machine Learning (ML), and predictive analytics assists in automating data-heavy forecasting tasks with high accuracy. Moreover, the tightening regulatory regulations necessitate more transparent and auditable financial processes, driving the adoption of financial planning software during the forecast period.

Risk & Scenario Analysis

The risk & scenario analysis segment is expected to grow at a remarkable CAGR between 2026 and 2035. The growth of the segment is supported by the rising volatility of global markets, increasing need for complete portfolio protection, and stringent Regulatory Requirements (Basel III and IFRS 9). Financial environments are becoming more complex, encouraging firms to adopt AI-powered modeling to protect assets and ensure business continuity. Integration of AI and Machine Learning (ML) allows for predictive modeling and automated risk detection, which assists institutions in identifying threats before they escalate.

End-user Insights

What causes the banking, financial services & insurance (BFSI) segment to dominate the financial planning software market?

Banking, Financial Services & Insurance (BFSI)

The banking, financial services & insurance (BFSI) segment is dominating the financial planning software market by holding a share of approximately 32%. The Banking, Financial Services & Insurance (BFSI) sector requires financial planning software, owing to the increasing need for risk management, managing complex & high-volume data, strict regulatory compliance, and secure data handling. The rapid digital transformation and high adoption of AI assist in delivering personalized and real-time client experiences

Healthcare & Life Sciences

The healthcare & life sciences segment is expected to expand rapidly in the market with a CAGR in the coming years. The healthcare and life sciences sectors are rapidly adopting financial planning software to navigate rising operational costs, complex regulatory environments, unpredictable revenue streams, and the shift towards value-based care models. The sector is increasingly preferring cloud-based solutions as it offers real-time visibility into financial data.

Regional Insights

How Big is the North America Financial Planning Software Market Size?

The North America financial planning software market size is estimated at USD 2.27 billion in 2025 and is projected to reach approximately USD 9.90 billion by 2035, with a 15.87% CAGR from 2026 to 2035.

North America Financial Planning Software Market Analysis

North America dominates the financial planning software market, holding the highest market share of approximately 39% in 2025. The region has an advanced financial ecosystem and early technology adoption, such as AI-driven and cloud-based tools. The regional leadership position is attributed to the rising consumer awareness of financial management, rising consumer preference for user-friendly mobile applications, and strict regulatory frameworks. Moreover, the growing demand for efficient budgeting tools sought by individuals and institutions is anticipated to boost the growth of the market during the forecast period. Several companies across various sectors are making extensive investments in cloud-native platforms that provide automation and improved, secure, and personalized financial services.

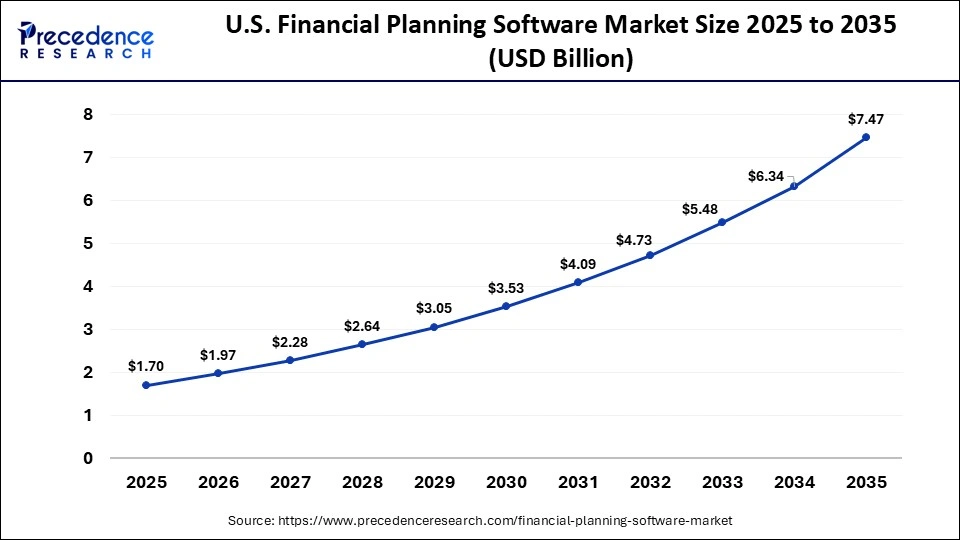

What is the Size of the U.S. Financial Planning Software Market?

The U.S. financial planning software market size is calculated at USD 1.70 billion in 2025 and is expected to reach nearly USD 7.47 billion in 2035, accelerating at a strong CAGR of 15.95% between 2026 to 2035.

The U.S. Financial Planning Software Market Analysis

The U.S. is a major contributor to the financial planning software market. The United States has a strong presence of major financial technology companies and a significant rise in digital literacy rates, which accelerate the adoption of advanced financial planning platforms. The country is home to the leading market players such as eMoney Advisor, MoneyGuidePro/Envestnet, RightCapital, Orion Advisor Technology, Quicken, Inc., and Moneytree Software. The country has a high number of high-net-worth individuals, which increases the demand for sophisticated, personalized, and secure wealth management software. The country is experiencing widespread adoption of cloud-based platforms, owing to the rising demand for digital transformation, improved security compliance, and support for remote work models.

Asia Pacific Financial Planning Software Market Analysis

Asia Pacific is s expected to witness the fastest growth in the market with a significant CAGR over the forecast period. The growth of the region is driven by a combination of factors, such as the strong presence of the fintech ecosystem, rapid digital transformation in wealth management, an increasing number of individuals with high-income levels, stricter regulatory compliance, and increasing adoption of AI for personalized financial advice. The adoption of cloud-based platforms in the region has significantly expanded market accessibility, enabling real-time data analysis and improved decision-making processes. Several individuals and businesses across various sectors are increasingly leveraging financial planning software to improve accuracy in forecasting, budgeting, risk management, and investment planning. These tools assist in automating complex workflows, enabling real-time adjustments and faster decision-making.

India's financial planning software market analysis

The country holds a substantial market share in the financial planning software market. The country is experiencing the high adoption of digital financial tools in numerous sectors such as BFSI, IT & Telecom, retail & consumer goods, healthcare & life sciences, and other industries. The growth of the country is largely driven by the strong presence of the financial services sector, rising consumer shift toward mobile apps and cloud-based platforms, well-established regulatory compliance, and the integration of AI, ML, and cloud-based platforms. Several SMEs are increasingly investing in financial planning software to streamline financial planning processes, gain real-time insights into budgeting, financial forecasting, and performance tracking, improve risk management, reduce operational costs, and make data-driven decisions. Moreover, the growing demand for real-time tracking, automated budgeting, and portfolio management tools is anticipated to drive the growth of the market during the forecast period.

Who are the Major Players in the Global Financial Planning Software Market?

The major players in the financial planning software market include Envestnet, eMoney Advisor, RightCapital, Advicent Solutions, Orion Advisor Solutions, Quicken Inc., Personal Capital, Moneytree Software, and SAP/Advicent

Recent Development

- In October 2025, Advyzon, a comprehensive technology platform and portfolio management solution for financial advisors and investment managers, today announced that financial planning will be a new offering on its platform and that Kevin Hughes, former executive at MoneyGuidePro, has joined as President of Financial Planning. (Source:https://www.businesswire.com)

- In July 2025, BMO joined forces with financial planning software company Conquest Planning to launch My Financial Progress, a new digital experience designed to help Canadians take greater control of their finances. Available via BMO's Mobile and Online Banking platforms, my financial progress is powered by Conquest's advanced planning engine and aims to provide users with hyper-personalised financial plans that update dynamically in real time.

Segments Covered in the Report

By Deployment Model

- Cloud-based / SaaS Financial Planning Software

- On-premise Financial Planning Software

By Component

- Software Platforms

- Core planning engines

- Forecasting & budgeting modules

- Scenario modeling tools

- Dashboard & visualization

- Services

- Implementation & integration

- Support & maintenance

- Training & consultancy

By Functionality

- Budgeting & Forecasting

- Financial Reporting & Analytics

- Risk & Scenario Analysis

- Cash Flow & Treasury Planning

- Tax Planning & Compliance Support

- Other Functionalities

By End-User

- BFSI (Banking, Financial Services & Insurance)

- IT & Telecom

- Manufacturing

- Retail & Consumer Goods

- Healthcare & Life Sciences

- Government & Public Sector

- Other Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting