Automotive Simulation Software Market Size and Forecast 2025 to 2034

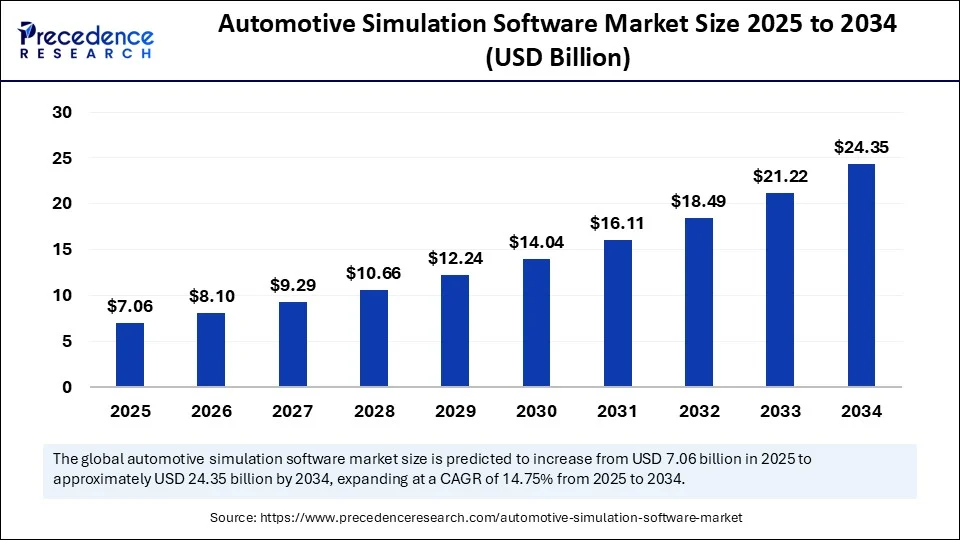

The global automotive simulation software market size accounted for USD 6.15 billion in 2024 and is predicted to increase from USD 7.06 billion in 2025 to approximately USD 24.35 billion by 2034, expanding at a CAGR of 14.75% from 2025 to 2034. The rising complexity of automotive systems, cloud-based simulation platforms, and technological innovation in electric and autonomous vehicles contribute to the growth of the market.

Automotive Simulation Software Market Key Takeaways

- In terms of revenue, the global automotive simulation software market was valued at USD 6.15 billion in 2024.

- It is projected to reach USD 24.35 billion by 2034.

- The market is expected to grow at a CAGR of 14.75 % from 2025 to 2034.

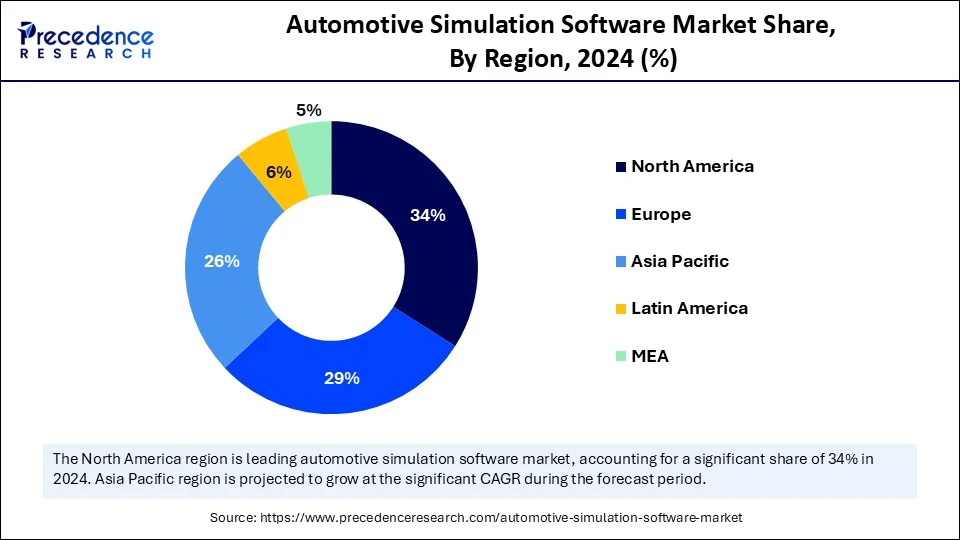

- North America dominated the automotive simulation software market with the largest market share of 34% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest of CAGR 15.80% during the forecast period.

- By simulation type, the structural simulation segment captured the biggest market share of 24% in 2024.

- By simulation type, the ADAS & autonomous systems simulation segment is expected to grow at the fastest CAGR of 17.20% during the forecast period.

- By deployment mode, the on-premises segment contributed the highest market share of 55% in 2024.

- By deployment mode, the cloud-based segment is projected to experience the highest growth CAGR of 18.40% between 2025 and 2034.

- By application, the design validation segment held the largest market share of 28% in 2024.

- By application, the electrification & battery simulation segment is set to experience the fastest CAGR of 16.50% in 2024.

- By end-use vehicle type, the passenger vehicles segment held captured the maximum market share of 46% in 2024.

- By end-use vehicle type, the electric vehicles segment is anticipated to grow with the highest CAGR of 19.60% during the forecast period.

- By component, the body & chassis segment generated the major market share of 25% in 2024.

- By component simulation, the battery & thermal systems segment is predicted to witness significant growth of 18.20% over the forecast period.

- By technology used, the finite element analysis (FEA) segment accounted for the significant market share of 30% in 2024.

- By technology used, the AI/ML integrated simulation segment is predicted to witness significant growth of 20.40% over the forecast period.

- By software type, the CAE software segment held the highest market share of 40% in 2024.

- By software type, the real-time 3D simulation software segment is expected to grow fastest CAGR of 17.80% during the forecast period.

- By service type, the support & maintenance segment captured the major market share of 38% in 2024.

- By service type, the consulting & integration segment is expected to grow fastest CAGR of 15.60% during the forecast period.

- By end-user, the automotive OEMs segment accounted for the largest market share of 48% in the market in 2024.

- By end-user, the engineering service providers segment is projected to experience the highest growth rate of 14.90% between 2025 and 2034.

How Is Artificial Intelligence (AI) Transforming the Automotive Simulation Software Market?

Artificial intelligence (AI) is transforming the field of automotive simulation by offering innovative solutions for generating 3D environments, automating scenario creation, and creating realistic surrogate models. These innovations and their integration in simulation software like SCANeR will not only reduce the workload of engineers but also improve the realism and accuracy of simulations. AI can analyze driving patterns and provide real-time feedback to drivers, promoting safer driving habits. Additionally, carmakers can utilize AI to enhance their production processes, thereby reducing costs and increasing efficiency.

AI use cases in the automotive industry include personalized in-vehicle experiences, marketing and localization, manufacturing, supply chain optimization, digital twins & autonomous driving simulation, customer support & service, and advanced driving assistance systems (ADAS). AI offers powerful benefits that enhance the efficiency, safety, and personalization of various automotive activities.

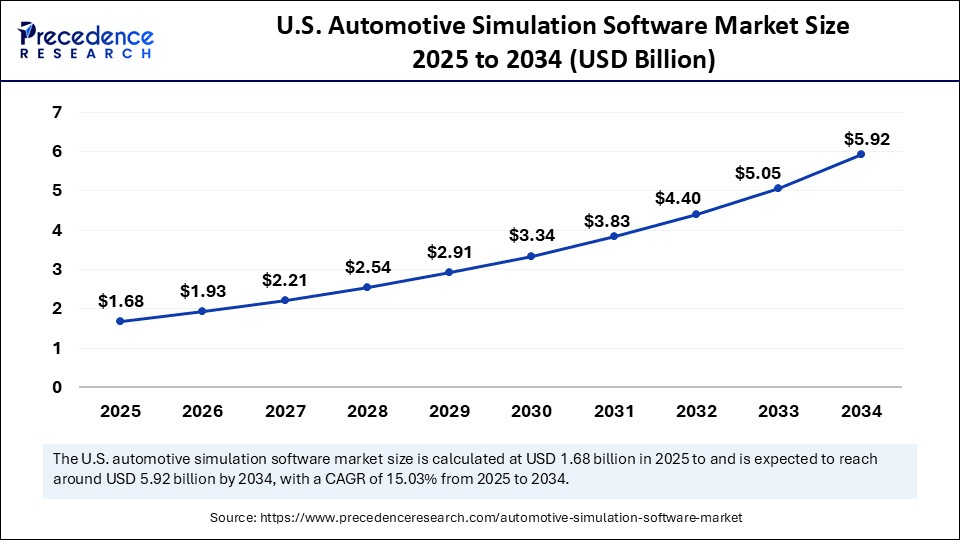

U.S. Automotive Simulation Software Market Size and Growth 2025 to 2034

The U.S. automotive simulation software market size was exhibited at USD 1.46 billion in 2024 and is projected to be worth around USD 5.92 billion by 2034, growing at a CAGR of 15.03% from 2025 to 2034.

North America held a significant share of 34% in the automotive simulation software market in 2024. Rising complexity of automotive systems, stringent environmental and safety regulations, technological innovation in autonomous and electric vehicles, and cloud-based simulation platform adoption are driving the growth of the market in the North American region.

One of the primary growth drivers is the increasing complexity of modern automotive systems, especially with the integration of electronic control units (ECUs), advanced driver-assistance systems (ADAS), and in-vehicle infotainment systems. These advancements necessitate sophisticated simulation tools to ensure seamless integration, real-time validation, and cost-effective testing during the early stages of vehicle design.

Asia Pacific is anticipated to grow at the fastest rate of CAGR 15.80% in the market during the forecast period. Automotive innovation, digital transformation, development of industry-specific innovations, and the promotion of sustainable mobility are contributing to the growth of the automotive simulation software market in the Asia Pacific region.

Market Overview

Automotive simulation tools are software applications/engines used to model, stimulate, and visualize or test many aspects of automotive design. A simulation is a realistic representation of real-life events. In the vehicle development process, simulation methods are used very effectively to develop and validate controller software by simulating the controlled components. Automotive software is a broad term that includes all the software applications and systems used in modern vehicles. It plays an important role in the functionality, safety, and performance of trucks, cars, and other motor vehicles.

Automotive simulation software is experiencing situations in real-world scenarios and tackling high development costs. Simulation plays an important role in the development phase of automobiles. It helps to reduce costs, time, and energy by allowing engineers to test and validate systems in a virtual environment.

What Factors Are Fueling the Rapid Expansion of the Automotive Simulation Software Market?

- Rising complexity of automotive systems: The growing complexity of automotive systems is driven largely by the demand for feature-rich infotainment systems, increased connectivity, advanced driver assistance systems (ADAS), and the transition to electric and hybrid powertrains. As software complexity increases, automotive players must upgrade their performance management systems using standardized, data-driven metrics for productivity, project maturity, and quality. With increased systems fragmentation, connectivity comes a fast growth of cybersecurity vulnerabilities.

- Cloud-based simulation platforms adoption: Cloud computing gives businesses more flexibility. We can quickly scale resources and storage up to meet business demands without having to invest in physical infrastructure. Companies do not need to pay for or build the infrastructure needed to support their highest load levels. A cloud simulator helps to model many kinds of cloud applications by creating data centers, virtual machines, and other utilities that can be configured appropriately, thus making it easier to analyze.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 24.35 Billion |

| Market Size in 2025 | USD 7.06 Billion |

| Market Size in 2024 | USD 6.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Simulation Type, Development Mode, Application, End-Use Vehicle Type, Component Simulated, Technology Used, Software Type, Service Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cloud-based simulation platforms adoption

Cloud-based simulation provides a new way to use computing resources in the simulation, which means infrastructure, platform, and software for researchers and scientists that they use as a service. A cloud simulator helps to model many kinds of cloud applications that can be configured appropriately, thus making it easier to analyze. Cloud access removes the IT friction from training, making simulation faster to deploy, easier to use, and available when it matters most.

Restraint

Complexity of simulation tools

The complexity of simulation tools includes the cost of the simulation model can be high. The cost of running many different simulations can be high. More time can be required to make sense of the results. People's reactions to the model or simulation may not be realistic or reliable. When dealing with critical tasks, virtual simulation technology still has shortcomings in meeting the needs of high-accuracy actions and is accompanied by errors.

Opportunity

Focus on digital transformation

Digital transformation in automotive allows companies to meet and surpass tailored demands by using advanced technologies that improve efficiency. These tools empower engineers to design, conceptualize, and refine automobile prototypes in virtual environments, reducing the need for physical prototypes and accelerating the development cycle. Digital transformation in automotive technology has transformed the driving experience, helping in the brand-new generation of safety, comfort, and connectivity on the roads.

Simulation Type Insights

The structural simulation segment dominated the automotive simulation software market with the largest market share of approximately 24% in 2024. Structural simulation is important for meeting important business goals, cutting risks, guaranteeing standards compliance, and shortening time to market. With the use of structural simulation software, users can accelerate the release of new products, meet business or governmental needs, boost their position against the competition, reduce the likelihood of failure, and reduce product complexity and expenses.

The ADAS & autonomous systems simulation segment is expected to grow at the fastest rate of 17.20% in the market during the forecast period of 2025 to 2034. ADAS & autonomous systems benefits include preventing/reducing the severity of crashes. By using technologies like adaptive cruise control, blind-spot detection, and emergency braking, ADAS can help to reduce human error, which is a leading cause of accidents. ADAS offers a powerful adaptive cruise control, lane keeping assistance, and predictive braking, which reduces fuel consumption.

Deployment Mode Insights

The on-premises segment peaked with the largest share of 55% of the automotive simulation software market in 2024. With on-premises solutions, we are in charge of infrastructure and the software we depend on. On-premises software or hardware has more control and security, but it requires maintenance and infrastructure costs. It also provides scalability, flexibility, and reduced costs.

The cloud-based segment is projected to experience the highest growth rate of 18.40% in the market between 2025 and 2034. The cloud-based deployment mode delivers more flexibility, reliability, increased performance and efficiency, and helps to lower IT costs. It also enhances innovation, enabling organizations to achieve faster time to market and incorporate AI and machine learning use cases into their strategies.

Application Insights

The design validation segment held the largest share of 28% in the autonomous simulation software market in 2024. Design validation is performed to provide objective evidence that device specifications conform to user needs and intended use. Design validation involves checking that the design outputs meet the design inputs and that the product is built according to specifications. It includes testing and evaluating the final product to ensure it meets the needs of the end-user.

The electrification & battery simulation segment is set to experience the fastest rate of 16.50% of the market in 2024. Streamlining electric vehicle battery production using multiphysics simulation can help drive down costs and increase consumer sales. Some specific benefits include fault simulation, exploring different design choices, setting control parameters, benchmarking against the requirements, logic validation, assuring the passing of functional safety, and compliance with standards and overall simulation in the entire vehicle system.

End-use Vehicle Type Insights

The passenger vehicles segment held the largest share of the market at around 46% in 2024. Passenger vehicles are motor vehicles with at least four wheels, used for the transport of passengers, and comprising no more than 8 seats in addition to the driver's seat.

The electric vehicles segment is anticipated to grow with the highest CAGR of 19.60% of the market during the forecast period. Electric vehicles are more effective, and that, combined with the electricity costs, means that charging an electric vehicle is cheaper than filling petrol or diesel for our travel needs. Using renewable energy sources can make the use of electric vehicles more eco-friendly.

Component Simulation Insights

The body & chassis segment registered its dominance over the automotive simulation software market with a share of 25% in 2024. Multi-material assemblies are key to producing vehicle bodies with the most effective cost/lightweight ratio. Improving chassis design with simulation helps to deliver the next generation of safe, lightweight, low-cost, durable, reliable, and high-performance vehicles.

The battery & thermal systems segment is predicted to witness significant growth of 18.20% in the market over the forecast period. The new integrated thermal management system (ITMS) for electric vehicles aims to address the cooling issues of power battery packs. Simulation can speed the development of robust and long-life EV battery packs.

Technology Used Insights

The finite element analysis (FEA) segment led the market with a share of 30% in 2024. The benefits of finite element analysis (FEA) include the visual representation of stress or temperature gradients throughout the part, and also allow the designer to rapidly analyze modifications in the product or process.

The AI/ML integrated simulation segment is predicted to witness significant growth of 20.40% the market over the forecast period. AI/ML integrated simulation forms a powerful feedback loop; it generates synthetic data from millions of potential scenarios. Machine learning models use these data to learn patterns, detect anomalies, and improve performance. AI/ML can allow a designer to start with a high-level specification, auto-generate 10000 design options, and more.

Software Type Insights

The CAE software segment enjoyed a prominent position in a market share of 40% in 2024. CAE (Computer-aided engineering) software is used in a wide range of engineering applications whenever there is a need to understand or predict how many kinds of physics will affect the performance of a product design or system. CAE gives analytical predictions to support automotive product designs, showing which method achieves the best performance.

The real-time 3D simulation software segment is expected to grow fastest rate of 17.80% in the market during the forecast period of 2025 to 2034. 3D simulation software refers to the modeling of real physical processes in three dimensions, allowing for more accurate predictions and information on various conditions, albeit with increased computational demands and complexity.

Service Type Insights

The support & maintenance segment dominated the market with the largest automotive simulation software market share of approximately 38% in 2024. The benefits of automotive simulation software in support & maintenance include software and algorithm modeling and development, semiconductor simulation, functional safety analysis, electronics hardware simulation, mission scenario system, and sensor performance simulation.

The consulting & integration segment is expected to grow fastest rate of 15.60% in the market during the forecast period of 2025 to 2034. Simulation modeling for integrated system benefits includes it allows for testing and evaluating the impact of changes in demand, inventory mix, peak volumes, order types, resources, and more on performance.

End-user Insights

The automotive OEMs segment peaked with the largest share of 48% in the market in 2024. Simulation plays an important role in the development phase of automobiles. It helps to reduce costs, time, and energy by enabling engineers to test and validate systems in a virtual environment. These simulations can range from testing individual components, like engines or braking systems, to analyzing the performance of the entire vehicle.

The engineering service providers segment is projected to experience the highest growth rate of 14.90% in the market between 2025 and 2034. Simulation in engineering product development provides many benefits that improve accuracy, efficiency, and innovation. Simulation is a key enabler in shortening engineering processes and making them more effective.

Automotive Simulation Software Market Companies

- Gamma Technologies

- ESI Group

- dSPACE

- Design Simulation Technologies

- Dassault

- AVL List

- Autodesk

- Anthony Best Dynamics

- Ansys

- Altair Engineering

Recent Developments

- In May 2025, the launch of LeddarSim, a next-generation simulation platform purposely built to reduce the gap between virtual testing and real-world deployment, was announced by LeddarTech Holdings Inc., an AI-powered software company recognized for its innovation in advanced driver assistance systems (ADAS) and autonomous driving (AD). (Source:https://telematicswire.net)

- In March 2025, XSG Power Electronics Systems software to support the simulation of highly dynamic switching frequencies of up to 500 kHz was released by Germany-based dSPACE, a provider of automotive simulation and validation solutions. (Source:https://chargedevs.com)

Segment Covered in the Report

By Simulation Type

- Structural Simulation

- Crash Simulation

- Durability Simulation

- Vibration Simulation

- Fluid Dynamics Simulation (CFD)

- Aerodynamics

- Thermal Management

- HVAC Simulation

- Electromagnetic Simulation

- EMC/EMI Analysis

- Sensor/ADAS Radar Simulation

- Multibody Dynamics

- Suspension System Simulation

- Powertrain Simulation

- Acoustic Simulation

- NVH (Noise, Vibration, Harshness)

- Cabin Acoustics

By Development Mode

- On-Premise

- Cloud-Based

- Hybrid

By Application

- Design Validation

- Performance Testing

- Safety and Crash Testing

- Thermal and Fluid Analysis

- Manufacturing Process Simulation

- Electrification & Battery Simulation

- Human Machine Interface (HMI) Simulation

By End-Use Vehicle Type

- Passenger Vehicles

- Hatchbacks

- Sedans

- SUVs

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles

- BEVs

- PHEVs

- FCEVs

By Component Simulated

- Body & Chassis

- Powertrain

- Electronics & Control Systems

- Interior Systems

- Battery & Thermal Systems

- Suspension & Braking Systems

By Technology Used

- Finite Element Analysis (FEA)

- Computational Fluid Dynamics (CFD)

- Multibody Dynamics (MBD)

- 1D/0D Simulation

- Real-Time Simulation

By Software Type

- CAE Software

- CAD Integrated Simulation Tools

- PLM Integrated Simulation Platforms

- Virtual Prototyping Tools

- Real-Time 3D Simulation Software

By Service Type

- Consulting & Integration

- Support & Maintenance

- Custom Development

- Training & Education

By End-User

- Automotive OEMs

- Tier 1 & Tier 2 Suppliers

- Engineering Service Providers

- Testing and Certification Bodies

- Research Institutions

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting