What is the Finished Vehicle Logistics Market Size?

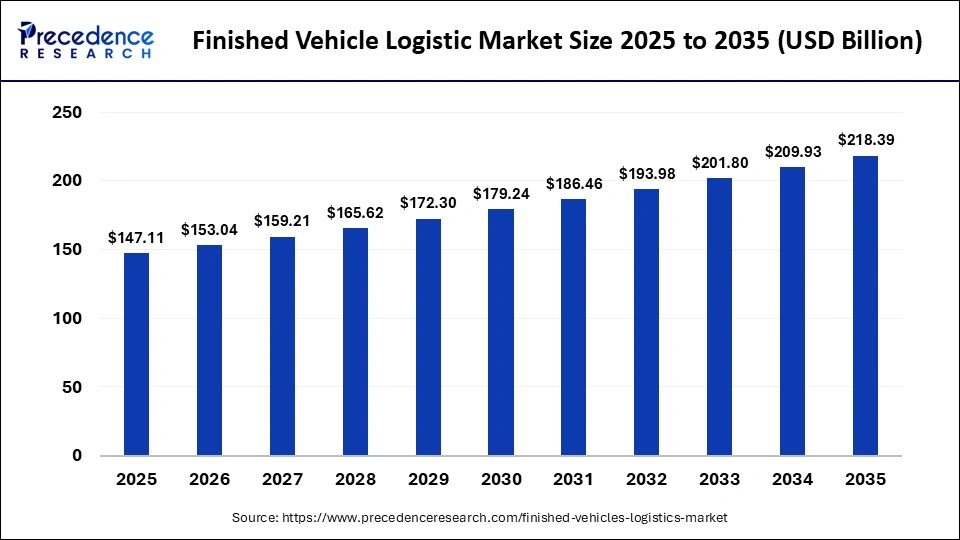

The global finished vehicle logistics market size accounted for USD 147.11 billion in 2025 and is predicted to increase from USD 153.04 billion in 2026 to approximately USD 218.39 billion by 2035, expanding at a CAGR of 4.03% from 2026 to 2035. The market growth is attributed to increasing global vehicle production, rising EV adoption, and the expansion of advanced, technology-driven logistics infrastructure.

Market Highlights

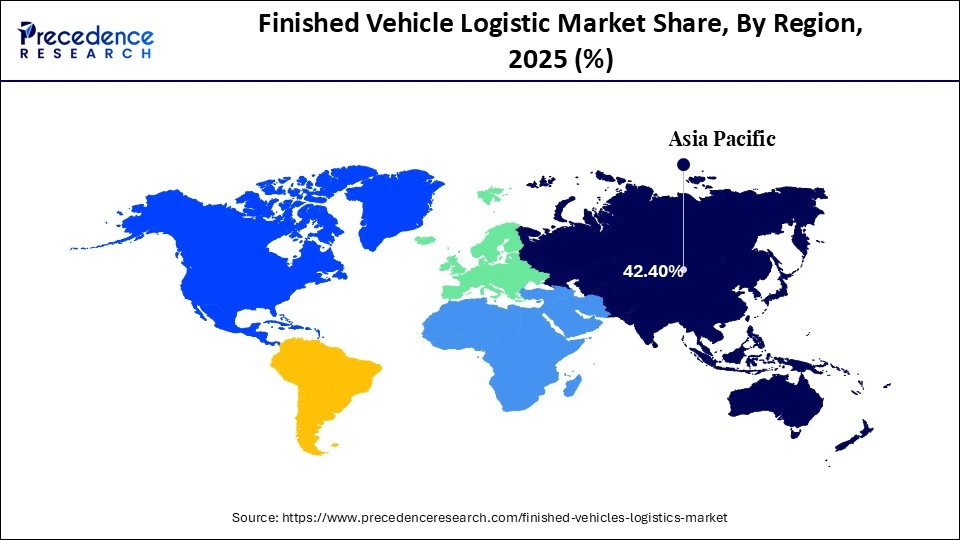

- Asia Pacific dominated the market with a 42.4% share in 2025 and is expected to grow at a 6.0% CAGR from 2026 to 2035.

- By transport mode, the road segment accounted for the major market share of 46.8% in 2025.

- By transport mode, the marine segment is growing at a CAGR of 5.3% from 2026 to 2035.

- By service type, the transportation segment led the market, accounting for an estimated 41.3% share in 2025.

- By service type, the pre-delivery inspection (PDI) segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By vehicle type, the passenger cars segment held the biggest market share of 45.3% share in 2024.

- By vehicle type, the electric vehicles (EVs) segment is growing at a CAGR of 5.3% from 2026 to 2035.

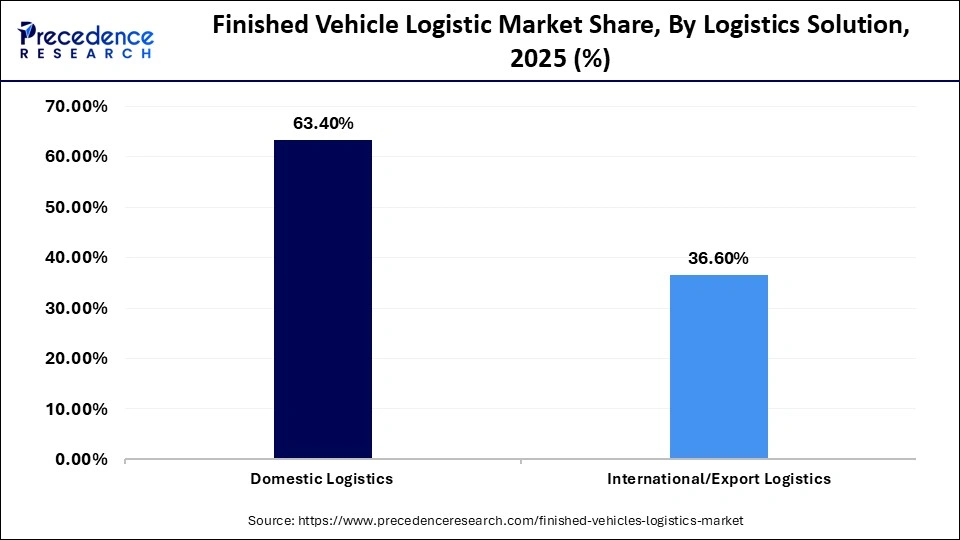

- By logistics solution, the domestic logistics segment captured more than 63.4% of the market share in 2025.

- By logistics solution, the international/export logistics segment is expanding at a CAGR of 5.5% from 2026 to 2035.

- By end-user, the OEMs segment accounted for the highest market share of 42.4% in 2025.

- By end-user, the fleet owners segment is expected to grow at a 5.5% CAGR from 2026 to 2035.

Market Overview

The finished vehicle logistics market refers to the transportation, handling, storage, and distribution of fully assembled vehicles from manufacturing plants to dealerships, export hubs, fleets, and end customers. It includes multimodal transport, plus port terminal operations, pre-delivery inspection (PDI), yard management, and value-added services. The market is driven by global vehicle production, rising automotive exports, electrification, and digital logistics platforms, requiring highly coordinated, cost-efficient, and time-sensitive logistics networks to ensure on-time vehicle delivery.

Growing global vehicle production and increasing consumer demand drive more cross-border shipments of finished vehicles, prompting growth in global finished vehicle logisticss. Major automotive exporters like Toyota Motor Corporation, Volkswagen Group, and Hyundai Motor Group, especially in Asian and European manufacturing centers, are creating a need for efficient finished vehicle logistics services.

Impact of Artificial Intelligence on the Finished Vehicle Logistics Market

Artificial intelligence (AI) is transforming the finished vehicle logistics market by streamlining operations and increasing overall efficiency across the global supply chain. Logistics providers utilize AI-driven route optimization to find the fastest and most fuel-efficient routes for transporting vehicles. These technologies are also used in predictive analytics to forecast demand changes and help allocate fleets across ports, terminals, and distribution centers. Additionally, predictive maintenance tools monitor transport fleets continuously, preventing breakdowns and ensuring consistent delivery schedules.

Finished Vehicle Logistics MarketGrowth Factors

- Rising Adoption of Electric Vehicles (EVs): Growing production and consumer preference for EVs are boosting demand for specialized logistics solutions and battery-safe transport.

- Expansion of Global Trade Routes: Increasing international vehicle exports are propelling investments in Ro-Ro shipping, port infrastructure, and multimodal logistics networks.

- Integration of Artificial Intelligence in Logistics: Advancements in AI-driven fleet management and predictive analytics are driving operational efficiency and route optimization.

- Growing Demand for Just-in-Time Delivery: Rising OEM emphasis on minimizing inventory and reducing dwell times is fueling high-frequency, time-sensitive transport operations.

- Development of Smart Ports and Automated Terminals: Investments in automated loading systems and digital terminal management are boosting handling capacity and turnaround efficiency.

Global Vehicle Trade and Logistics Analysis that Influence the Market

- In 2023, China exported approximately 5.171 million vehicles (passenger cars and trucks) and became the world's largest vehicle exporter by volume. China's growing export dominance significantly boosts demand for high-capacity Ro-Ro shipping, expanded port handling, and long-distance outbound vehicle logistics networks.

- Japan exported approximately 4.42 million vehicles in 2023, ranking second globally in volume. Its robust export industry continues to support major Asia–Europe and Asia-North America vehicle trade routes, underscoring its vital role in global FVL capacity planning.

- Mexico exported approximately 3.48 million light vehicles in 2024, with most going to the United States, directly boosting cross-border rail and trucking volumes and increasing demand for integrated North American finished-vehicle logistics.

- Germany exported roughly 3.4 million passenger cars in 2024 with an export value of about €135 billion, reinforcing Europe's position as a premium automotive logistics hub and driving sustained pressure on EU Ro-Ro ports and inland distribution systems.

- Shanghai Port alone handled about 167,000 NEV export units in Q1 2023. High EV movement through major Chinese ports boosts terminal congestion and drives the need for dedicated EV-handling yards, chargers, and hazard-compliance storage.

- Port of Shanghai (China) shipped over 1.2 million vehicles via Ro-Ro in 2023, including NEVs and ICE vehicles. Large Ro-Ro volumes at Shanghai boost port operations, yard storage, and scheduling for global vehicle distribution networks.

- China's major OEM hubs (SAIC, BYD, Geely in Shanghai, Shenzhen, Hangzhou) produced over 27 million vehicles in 2023, including about 5 million for export. China's huge export output fuels global Ro-Ro demand, port capacity growth, and supply-chain planning challenges across multiple continents.

Finished Vehicle Logistics Market Outlook

- Industry Growth Overview: The finished vehicle logistics market is growing rapidly due to rising vehicle production, increasing consumer demand, and the accelerating adoption of electric vehicles (EVs). The need for efficient logistics, optimized supply chains, and advanced pre-delivery services is driving the market's expansion.

- Global Expansion: Emerging regions, particularly in Asia Pacific and Latin America, present significant opportunities owing to expanding automotive manufacturing hubs, rising vehicle exports, and ongoing infrastructure development that supports efficient finished vehicle logisticss.

- Major Investors: Key investors include automotive OEMs, logistics service providers, and private equity firms who invest in infrastructure, Ro-Ro terminals, automated storage, and technology-driven solutions. Their contributions enhance supply chain efficiency, support EV logistics, and enable scalable, high-performance operations across global markets.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 147.11 Billion |

| Market Size in 2026 | USD 153.04 Billion |

| Market Size by 2035 | USD 218.39 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.03% |

| Dominating Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Transport Mode, Service Type, Vehicle Type, Logistics Solution, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment insights

Transport Mode Insights

Why Did the Road Segment Dominate the Market in 2025?

The road segment led the finished vehicle logistics market in 2025, holding an estimated 46.8% share, thanks to its flexibility, quick delivery, and extensive domestic and regional coverage. Major OEMs used trucking to access ports, rail terminals, and dealership networks.

Road networks facilitated on-demand delivery, reduced vehicle hold-up time, and lowered inventory holding costs. The International Road Transport Union 2024 report states that the world's commercial road freight in vehicle logistics has increased in volume and efficiency, reflecting a growing reliance on road transport. Additionally, the developed infrastructure in Europe, North America, and parts of Asia has supported high-volume transportation, further driving segment growth.

The marine segment is expected to grow at the fastest CAGR of 5.3% during the forecast period, owing to the rising exports from China, Japan, Germany, and South Korea to Europe, North America, and emerging markets. The Ro-Ro vessels provided safe, high-capacity transport for both standard and electric cars, enabling OEMs to expand to long-distance destinations effectively. Additionally, the deep-water Ro-Ro ports, including Bremerhaven, Zeebrugge, and Shanghai, increased throughput, contributing to a rise in global vehicle trade.

Service Type Insights

What Made Transportation Services the Leading Segment in the Finished vehicle logistics Market?

The transportation segment led the market while holding the largest revenue share of 41.3% in 2025. This is mainly due to the high demand for timely and secure delivery of vehicles from manufacturers to dealerships and end customers. Efficient transport solutions, including road, rail, and sea logistics, ensure minimal damage, faster turnaround, and reduced lead times, which are critical for maintaining customer satisfaction. Additionally, the growth of e-commerce and global vehicle sales has further increased the reliance on specialized transportation services, solidifying their dominance in the market.

The pre-delivery inspection (PDI) segment is expected to grow at the fastest rate in the coming years as manufacturers and dealers increasingly emphasize quality assurance and customer satisfaction before vehicles reach end users. PDI services ensure that each vehicle is thoroughly inspected, tested, and made delivery-ready, reducing the risk of defects or recalls. Additionally, the rising complexity of modern vehicles and stringent regulatory standards have increased the demand for systematic pre-delivery checks, making PDI a critical part of the logistics process.

Vehicle Type Insights

How Does the Passenger Cars Segment Dominate the Market in 2025?

The passenger cars segment dominated the finished vehicle logistics market in 2025, holding an estimated 45.3% of the market share due to the increasing demand for a steady supply of compact, mid-size, and luxury cars through ports, rail, and road networks. Data from ACEA shows that over 67.7 million passenger cars were produced in 2024. Additionally, port authorities and inland distribution hubs improved yard layouts and scheduling for high-volume passenger car flow, reinforcing the segment's dominance.

The electric Vehicles (EVs) segment is expected to grow at a 5.3% CAGR in the coming years. According to CAAM and ACEA, global EV production increased to more than 10 million units between 2024 and 2026, led by China, South Korea, and Europe. Incentives given to consumers and the rising environmental awareness encouraged the shift to EVs, which increased the demand for special logistics services. Additionally, specialized EV logistics hubs and expanded Ro-Ro capacity made it easier to connect to global trade routes, supporting segment's growth.

Logistics Solution Insights

How Does the Domestic Logistics Segment Lead the Market in 2025?

The domestic logistics segment led the finished vehicle logistics market by capturing a 63.4% share in 2025, as major companies use this type of logistics to move vehicles in their assembly plants, regional distribution centers, and dealership networks. Furthermore, the increasing urbanization and the development of the dealership system only heightened the need for efficient domestic vehicle transportation, thereby continuing to put domestic logistics in the leading role.

The international/export logistics segment is expected to grow at the fastest CAGR of 5.5% during the forecast period, driven by increases in vehicle production and exports from China, Japan, Germany, and South Korea. In 2024, ports in Shanghai handled over 1.66 million exported vehicles to support both traditional and electric vehicle shipments internationally. Additionally, growing interest in trade, bilateral agreements, and EV development in Asia boosted vehicle movement across borders, creating a demand for international/export logistics solutions.

Regional Insights

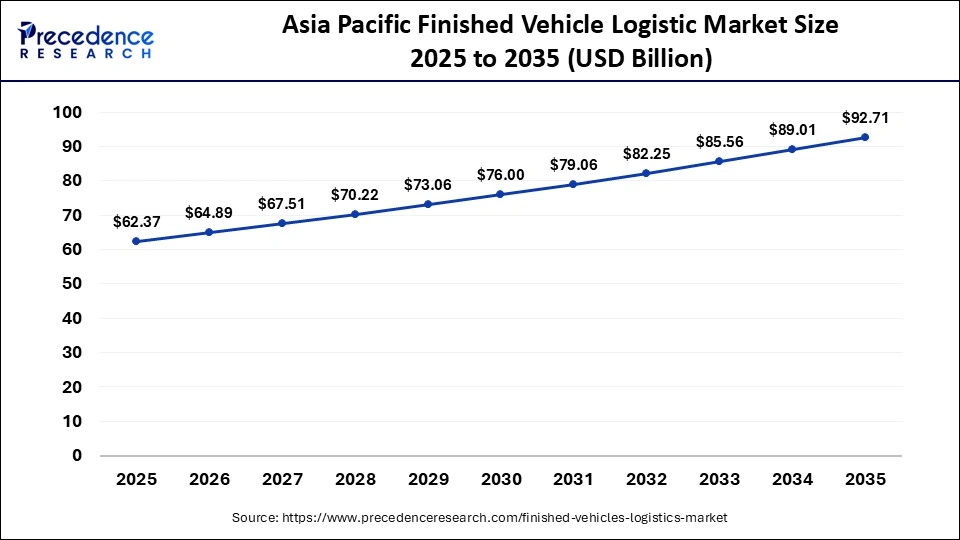

What is the Asia Pacific Finished Vehicle Logistics Market Size?

The Asia Pacific finished vehicle logistics market size is expected to be worth USD 92.71 billion by 2035, increasing from USD 62.37 billion by 2025, growing at a CAGR of 4.04% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Finished Vehicle Logistics Market?

Asia Pacific dominated the finished vehicle logistics market with a 42.4% share and is expected to grow at a CAGR of 6.0% over the forecast period. This is mainly due to high vehicle production and rising exports in key automotive hubs such as China, Japan, South Korea, and India. In 2024, China alone produced 13,522,338 cars, according to the OICA report. The surge in electric vehicle (EV) manufacturing in China and South Korea has further increased logistics demand, prompting upgrades to Ro-Ro terminals and automated storage facilities. Additionally, government investments in deep-water ports such as Shanghai, Busan, and Yokohama are driving market growth by enhancing infrastructure and export capabilities.

What Makes Europe a Notably Growing Area?

Europe is expected to grow at a notable rate in the market during the forecast period due to its high concentration of leading OEMs, including Volkswagen, BMW, Mercedes-Benz, Stellantis, and Renault, which drive strong production volumes and export activities. Efficient coordination between production hubs in Germany, France, Italy, and Spain and key global markets, such as North America, Asia, and the Middle East, further strengthens its logistics operations. Additionally, the rising manufacturing of electric vehicles is increasing logistics complexity and demand, fueling continued growth in the region.

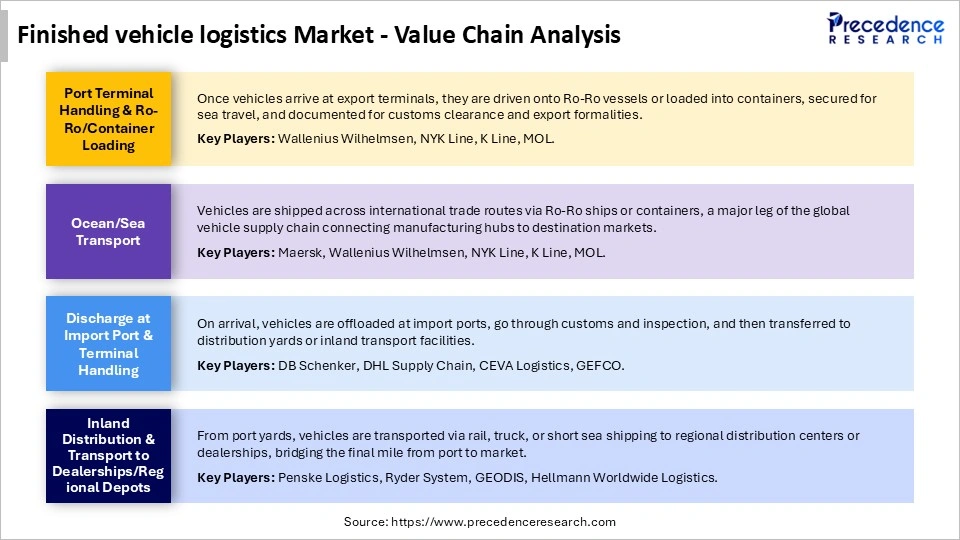

Finished vehicle logistics Market Value Chain

Top Companies in the Finished Vehicle Logistics Market

- Maersk (Denmark): Maersk is a global leader in integrated transport and logistics, offering end-to-end vehicle shipping solutions, port handling, and supply chain management for automotive OEMs.

- Wallenius Wilhelmsen (Norway): Specializing in Ro-Ro shipping, Wallenius Wilhelmsen provides vehicle transportation, terminal services, and tailored logistics solutions for international automotive trade.

- NYK Line (Japan): NYK Line delivers comprehensive finished-vehicle logistics services, including ocean transport, inland distribution, and specialized handling for electric and conventional vehicles.

- K Line (Japan): K Line offers global Ro-Ro and logistics services with a focus on secure, timely, and high-capacity vehicle transport across major trade routes.

- MOL (Mitsui O.S.K. Lines) (Japan): MOL provides end-to-end automotive logistics, combining shipping, port operations, and supply chain solutions for OEMs worldwide.

- DB Schenker (Germany): DB Schenker is a leading logistics provider offering vehicle transport, multimodal distribution, and integrated supply chain solutions across international markets.

- DHL Supply Chain (Germany): DHL delivers specialized automotive logistics services, including warehousing, distribution, and vehicle handling, tailored for OEM and EV supply chains.

- CEVA Logistics (France): CEVA provides global finished-vehicle logistics, including ocean freight, customs clearance, and inland distribution for automotive manufacturers.

- GEODIS (France): GEODIS offers comprehensive automotive logistics solutions, from shipping and storage to last-mile delivery and specialized vehicle handling.

Latest Announcement by Industry Leader

- In October 2025, Toll China officially introduced its new Finished Vehicle (FV) logistics service in China, representing a key milestone in its automotive supply chain strategy. The inauguration ceremony took place at the YunPu Warehouse in Guangzhou, attended by Toll employees and senior leadership from Toll China. This launch marks Toll's first foray into the finished vehicle logisticss market in China, with operations commencing in Guangdong province and planned expansion into the East, North, and West regions in the coming years. The initiative aligns with Toll's broader strategy to establish end-to-end export logistics services throughout the automotive supply chain. “Our goal is to deliver comprehensive automotive logistics solutions, beginning with domestic transportation and extending into export, aftermarket, and inbound manufacturing logistics,” stated Morris Ong, Toll Group Regional General Manager of Greater China, at the ceremony.

Recent Developments

- In December 2025, Motherson, via its joint venture SAMRX, announced a partnership with Dighi Port Limited (DPL) to establish a dedicated Ro-Ro terminal at Dighi Port, Maharashtra. The terminal will handle end-to-end finished vehicle logisticss, offering multimodal connectivity and streamlining export and import operations for automotive OEMs. This strategic location on India's west coast positions it as a key hub for vehicle distribution. The initiative marks a significant step in enhancing India's automotive logistics infrastructure.(Source: https://mediabrief.com)

- In September 2025, CEVA Logistics signed a multi-year contract with General Motors Europe to prepare and directly deliver luxury Cadillac vehicles in France and Germany. The agreement covers all-electric Cadillac models and integrates finished vehicle logisticss into the customer delivery journey. CEVA's expertise ensures timely, safe, and high-quality deliveries across these key European markets. This partnership strengthens GME's customer-focused vehicle distribution strategy.(Source: https://www.cevalogistics.com)

- In December 2025, RPM Freight Systems announced its acquisition of Professional Automotive Relocation Services (PARS), combining two leaders in vehicle logistics. The acquisition expands RPM's service portfolio to include corporate fleet solutions such as driveaway, storage, and titling & registration. PARS customers gain access to RPM's carrier network and OEM relationships, enhancing logistics efficiency and capacity. This strategic move creates a comprehensive platform for the management of the finished vehicle lifecycle.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Transport Mode

- Road

- Rail

- Marine (Ro-Ro)

- Air

By Service Type

- Transportation

- Warehousing & Yard Management

- Pre-Delivery Inspection (PDI)

- Customization & Value-Added Services

- Distribution & Delivery

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

By Logistics Solution

- Domestic Logistics

- International/Export Logistics

By End User

- OEMs

- Fleet Owners

- Dealerships

- Rental Companies

By Distribution Channel

- OEM-Led

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content