What is the GaN Transistor Market Size?

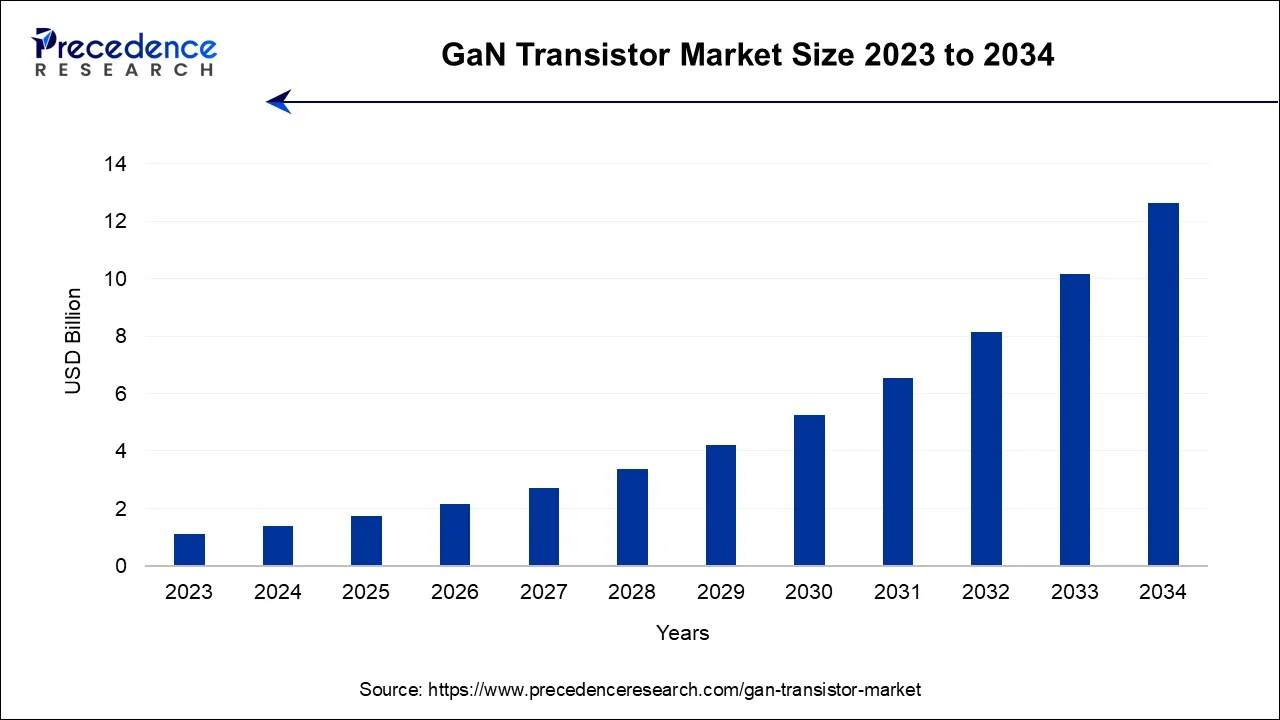

The global GaN transistor market is surging, with an overall revenue growth expectation of hundreds of millions of dollars during the forecast period from 2026 to 2035.

GaN Transistor Market Key Takeaways

- North America is anticipated to dominate the market over the forecast period.

- Asia Pacific is expected the expand at the fastest CAGR from 2026 to 2035.

- By Type, the Enhancement mode GaN Transistor is equivalent to the “Normally Open” switch (normally OFF) are dominating the market during the forecast period.

- Based on Wafer size, the 4-inch segment dominated the market in 2022 and the 6-inch segment is anticipated to expand at the highest CAGR over the forecast period.

- Based on End Use, the Information & Communication Technology (ICT) segment dominated the market in 2022.

Strategic Overview of the Global GaN Transistor Industry

The market for GaN transistors is anticipated to expand significantly over the next several years as the need for high-performance power electronics raises. Radar, military communications, wireless communication, and other uses use GaN transistors. High-speed, high-performance GaN (gallium nitride) transistors have revolutionized power electronics. Compared to more conventional materials like silicon, they are formed of semiconductor material, which has various benefits such as faster switching rates, higher power densities, and improved efficiency.

- For instance, these devices provide:

- High exchange frequencies and better power thickness.

- Enabling transistors to operate freely at high voltage levels thanks to their high conductivity.

- High voltage potential.

- Significant primary fields.

GaN transistors are widely used in telecommunications, power supplies, and electric cars. They also aid in developing cutting-edge new technologies like 5G networks and wireless power transfer. GaN power electronics devices are increasingly in demand in applications such as power grid systems, power supply, electric vehicles, aerospace, and defense, primarily driving the market's growth. GaN transistors are becoming increasingly popular among manufacturers and customers due to their advantages over conventional silicon-based transistors, including excellent heat dissipation, higher efficiency, and faster switching rates.

Artificial Intelligence: The Next Growth Catalyst in GaN Transistors

AI is significantly boosting the GaN transistor market by driving demand for highly efficient, high-density power solutions that traditional silicon cannot provide. The immense power consumption of AI workloads in data centers and high-performance computing requires advanced power delivery systems that GaN's faster switching speeds and lower energy losses enable.

This need for smaller, cooler, and more energy-efficient power components extends to "always-on" edge AI devices, robotics, and electric vehicles, where GaN technology is a key enabler of new, compact designs.

Breakthrough by Infineon Technologies AG

| Company name | Infineon Technologies AG |

| Headquarters | Neubiberg, Germany |

| Recent developments | In September 2024, Infineon Technologies AG announced launching of world's first 300 mm power gallium nitride (GaN) wafer technology in November at electronica trade show in Munich. Aim of this production to provide enhance production capability, high power density, high switching speed and ability of cost reductions compared to 200 mm wafers. |

GaN Transistor Market Growth Factors

- Demand of GaN transistor has increased in data centers due to its characteristics of producing less heat to reduce the risk of process failures.

- GaN transistors are useful to create synthetic images, that can be uses in object detection and image understanding.

- GaN transistor also uses in high-power applications like in Active Electronically Scanned Array (AESA) radars, due to its vast bandwidth, high output power, and effectiveness.

- An instance would be a 200 kW inverter that is 95% efficient instead of 99% efficient. The cooling system's size and rating must be significantly reduced because the full-load power loss at full load is reduced from 10 kW to 2 kW, or by nearly one-fifth.

Market Outlook

- Market Growth Overview: The GaN transistor market is expected to grow significantly between 2025 and 2034, driven by the high efficiency, which reduces power loss, high performance, and high frequency communication, and efficient power conversion for AI services.

- Sustainability Trends: Sustainability trends involve the inherent efficiency, reduced system footprint, and ESG integration and reporting.

- Major Investors: Major investors in the market include Infineon Technologies AG, Qorvo, Inc., Wolfspeed, Inc., and Texas Instruments Incorporated.

- Startup Economy: The startup economy is focused on innovation and niche specialization, acquisitions and consolidation, and regional ecosystems.

Market Scope

| Report Coverage | Details |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Wafer Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Supportive government initiatives and regulations

Government's worldwide support and finance innovations that advance sustainability and energy efficiency. Growth in the industry is further fueled by incentives, subsidies, and laws that encourage the use of GaN technology in various industries, including telecommunications, power electronics, and transportation. GaN (gallium nitride) transistor adoption and development in multiple markets depend heavily on favorable government policies and regulations. The following are a few examples of programs and laws supporting the demand for GaN transistors:

Energy Efficiency Standards: Governments worldwide have put energy efficiency standards and regulations into place to encourage energy-efficient technologies. GaN transistors fit these objectives thanks to their excellent efficiency and power density.

Promotion of electric cars: To lessen greenhouse gas emissions and reliance on fossil fuels, governments worldwide encourage using electric vehicles (EVs). GaN transistors are essential for EV power electronics, enhancing power density, energy efficiency, and charging infrastructure. Governments frequently provide research money and encourage business, academic, and research institution collaboration to improve semiconductor technologies.

- For instance, the 'Make in India' initiative of the Indian government supports the development of GaN transistors. The Department of Science & Technology (DST), Government of India, helped develop the novel technology and device architecture employing an aluminum titanium oxide gate.

These accommodative government policies and activities facilitate GaN transistor development, adoption, and market expansion. Governments encourage energy efficiency, promote the integration of renewable energy sources, and fund research and collaboration, all of which substantially impact the evolution of GaN transistor technology across various industries.

Restraint

Standards and regulations

GaN technology standards and regulations are still being created. It is vital to standardize testing procedures, performance measures, and safety criteria to assure consistency, dependability, and compatibility as the use of GaN transistors expands across different sectors and applications. GaN transistors must abide by several standards and guidelines.

- For instance, the European Union's RoHS (Restriction of Hazardous Substances) regulation forbids using hazardous substances in electronic equipment. The International has produced IEC 62932-2-2, a standard for GaN power transistors that describes the requirements for evaluating and rating GaN power transistors. The International Electrotechnical Commission (IEC) regarding standards and laws.

- Some challenges that GaN transistors encounter include normally-on operation, heating by itself effects, current collapse, peak field electrical distribution, gate leakages, and high ohmic contact resistance.

Opportunity

Advancements in GaN technology

Continuous advancements in GaN transistor technology, including improvements in material quality, manufacturing processes, and device designs, have enhanced performance and increased reliability. These developments have increased the potential uses for GaN transistors and created new market niches. Some advanced developments.

Higher quality GaN materials: Higher-purity GaN substrates are now possible due to crystal growth processes and material quality advances. The performance, dependability, and manufacturing yield of devices are improved by high-quality GaN materials with fewer flaws.

GaN transistors with enhancement mode (E-mode): GaN transistors primarily operated in the depletion mode (D-mode), which required a negative voltage bias. E-mode GaN transistors have, however, been made possible by improvements in the designs and manufacturing techniques for GaN transistors. Circuit design is made simpler by the ability of E-mode transistors to operate with a positive voltage bias, which increases their compatibility with standard CMOS (Complementary Metal-Oxide-Semiconductor) technologies.

Faster Switching Speeds: Compared to conventional silicon-based devices, GaN transistors offer much quicker switching speeds. Higher-frequency operation and effective power conversion are now possible because of improvements in GaN transistor architectures and device design optimization.

- For instance, GaN transistors with normally-off and normally-on states are shown; depending on the technology used, the dynamic on-state resistance rise decreases to 2.5 for 500 V, switching from the off-state drain bias. For switching at 400 V drain bias, normally-off transistors with p-GaN gate technology showed an R on xQ g product of 0.4 nC.

These developments improve performance, reliability, and manufacturing viability for GaN technology. They have increased the range of industries in which GaN transistors can be applied, including power electronics, wireless communication, renewable energy, and others. Due to ongoing research and development initiatives, GaN technology is anticipated to grow and become more widely used.

Type Insights

The Type E-mode or enhancement mode dominates the market during the forecast period. GaN transistors are a particular variety of materials that function with a positive voltage bias, making them compatible with standard CMOS (Complementary Metal-Oxide-Semiconductor) technologies and streamlining circuit design. Depletion mode (D-mode) was the most common operating mode for GaN transistors, necessitating a negative voltage bias. E-mode GaN transistors have, however, been made possible by improvements in the designs and manufacturing techniques for GaN transistors.

Circuit design is made simpler by the ability of E-mode transistors to operate with a positive voltage bias, which increases their compatibility with standard CMOS (Complementary Metal-Oxide-Semiconductor) technologies. Except for the maximum permitted gate voltage, enhancement mode GaN transistors, like the eGaN FETs from Efficient Power Conversion Corporation (EPC), have similar maximum ratings to commercial power MOSFETs. VGS (the voltage applied between the gate and source) has a maximum of 6 V in the positive direction and 5 V in the adverse order.

- E-mode GaN transistors are used in various industries, such as power electronics, RF amplifiers, motor drives, inverters, and other high-frequency applications.

They are excellent for multiple applications that need high efficiency, high power density, and quick switching rates due to their high-speed switching capabilities, high breakdown voltages, and compatibility with existing CMOS technology.

However, switching devices for managing electrical power include direct drive D-mode gallium nitride (GaN) transistors. The term "depletion mode," which describes how the transistor functions, is represented by the prefix "D-mode" in the name. A negative voltage must be provided to the gate of a depletion-mode transistor to switch it off; otherwise, the transistor usually operates. In contrast, an enhancement-mode transistor must be turned on by a positive voltage and is typically off. Better efficiency, quicker switching times, and better power densities are just a few benefits that GaN transistors have over conventional silicon-based transistors. Since digital signals can drive direct drive D-mode GaN transistors without analog signal processing, this has simplified driver circuitry.

Wafer Size Insights

The wafer size, In 2023, the market will be dominated by the 4-inch category based on wafer size. 4-inch wafers are more popular than one- and two-inch wafers in the power electronics sector because they have greater mechanical strength. The most popular power supply components employing 4-inch wafers are semiconductors made of gallium nitride (GaN). Another material utilized in high-power power electronics applications is silicon carbide (SiC). The 4-inch industry uses the semiconductor wafer to create a range of electrical products. The wafer is a thin slice of silicon or another semiconductor material fabricating microelectronic circuits.

- The 4-inch wafer, which has a diameter of around 100mm (3.94 inches), has a sizable surface area that makes it possible to produce numerous electronic devices on a single wafer.

Microprocessors, memory chips, and power devices are among the many electronic devices built on wafers that are 4 inches in size. The 4-inch wafer size continues to be a crucial standard in the manufacture of electronic devices, despite the industry's increasing usage of larger wafer sizes.

Although, during the forecast period, a greater CAGR is anticipated for the 6-inch and more significant wafer sector. The growing use of this wafer in defense equipment for its high breakdown voltage and low current leakage is driving this increase. A 6-inch wafer is intended to provide higher voltage uniformity and more precise current regulation. It is extensively used in consumer electronics and defense equipment because it has high breakdown voltage and negligible current leakage. The growing commercial applications of this technology, such as wireless cellular base stations and auto accident avoidance systems, also support growth.

End Use Insights

The Information & Communication Technology (ICT) sector led the market in 2025 regarding End Use. The expanding applications of the GaN technology market throughout the projected period may be due to the rise of the defense and aerospace segment. The information and communication technology sector is anticipated to gain a significant share. GaN (Gallium Nitride) transistors are thriving in a large industry called information and communication technology (ICT). GaN transistors have several benefits that make them ideal for various ICT applications. It would take place as Internet-of-Things (IoT) technology is increasingly used for industrial and commercial purposes. GaN (Gallium Nitride) transistors are thriving in a large industry called information and communication technology (ICT). GaN transistors have several benefits that make them ideal for various ICT applications.

GaN transistors are being investigated as a potential data center power electronics option. Due to the rising demand for data processing and storage, data centers need effective power management strategies. GaN transistors meet the power requirements of high-performance computing and data storage applications by providing larger power densities, faster switching rates, and enhanced energy efficiency.

- Power electronics in the aerospace and defense industries use gallium nitride (GaN) transistors. They are employed in processes including communications and electronic warfare (1-2700 MHz), HF, VHF, and UHF radar (1-1000 MHz), avionics (960–1215 MHz), L-band radar (1200–1400 MHz), and S-band radar (2700–3500 MHz).

Due to their superior gain and drain efficiency and sophisticated manufacturing, design, and technological capabilities, GaN transistors are favored over other types of defense electronics.

- Similar to the MMRF5018HS wideband 125 W CW GaN on SiC RF power transistor that NXP is pleased to introduce. A low-Rth NI-400HS air cavity ceramic package holds the MMRF5018HS.

For radar systems used in defense and aerospace, GaN transistors are an excellent choice. They make it possible to process signals effectively when operating at high frequencies and with high power. GaN transistors offer increased thermal performance and power density, enabling more compact, powerful radar systems with greater detection ranges and improved target recognition. Solid and secure communications systems are essential for defense aerospace applications. GaN transistors provide highly effective signal processing and amplification in communication systems, resulting in dependable and confident voice, data, and video transmission. GaN's high-frequency capabilities facilitate cutting-edge communication protocols and techniques like satellite communication and connectivity for unmanned aerial vehicles (UAVs).

Regional Insights

North America dominates the market of GaN Transistor Market, and the market of Asia Pacific is expected the witness the fastest growth during the forecast period. The North American GaN (Gallium Nitride) transistor market has seen rapid expansion in recent years. The market expansion in the area is being fueled by the defense and aerospace industry's growing spending in R&D. The defense and aerospace industries in North America are robust, and they offer a sizable market for GaN transistors. The requirement for sophisticated radar, electronic warfare, and communication systems in defense aerospace drives GaN transistor adoption. GaN technology can meet these applications' needs for high-frequency operation, high power density, and increased efficiency. When it comes to building and implementing 5G wireless networks, North America is leading the way. GaN transistors benefit 5G base stations and other wireless infrastructure components, including better power density, wider bandwidth, and improved efficiency. The requirement for fast data transmission, expanded network capacity, and enhanced network coverage drives the need for GaN transistors in the area.

U.S. GaN Transistor Market Trends

The U.S. region's market growth is driven by superior efficiency, making it ideal for power adapters, EV charging, and renewable energy systems. The integration of 5G/6G and telecommunications and rising applications in radar and data centers leverages GaN's high power handling and thermal performance.

On the other hand, The Asia-Pacific GaN market is driven by rising production and exports of consumer electronics and vehicles from China, Japan, and India. Due to the considerable technological advancements, the Asia-Pacific region is anticipated to have the highest CAGR throughout the projection period. This is due to the rising demand for high-performance RF components.

- According to the MIT study, China has 330,000 public charging stations, compared to 67,500 in the US. The Indian government formally approved a 15% lithium import subsidy on March 7, 2019. This demonstrates how simple it is to produce electric vehicles in the United States.

- Using their patented X-GaN technology, Panasonic developed GaN-based transistors for various applications, including up to 99% efficient power converters and transistor replacements in motor configurations. RAVPower unveiled a new line of 45W GaN PD wall chargers to provide faster charging in the consumer electronics market in 2018.

APAC:

- To boost domestic semiconductor manufacturing, including GaN-based components, the Indian government launched the PLI scheme, which provides financial incentives to companies involved in semiconductor production.

- Companies that invest in GaN technology for power electronics and RF (radio frequency) applications benefit from subsidies and financial support, thus encouraging local production.

- The Indian government has been focusing on the use of GaN transistors in defense applications like radar systems, satellite communications, and electronic warfare, due to their high power efficiency and capability to operate at higher temperatures.

China GaN Transistor Market Trends

China's transition toward GaN-on-Silicon substrates is enabling mass-market scaling across critical sectors, including energy-saving 5G infrastructure and high-voltage power conversion for the country's booming electric vehicle industry. However, challenges like manufacturing complexity, supply chain constraints for raw materials, and evolving quality standards remain to be addressed as the technology matures.

How Did Europe Notably Grow in the GaN Transistor Market?

Europe's aggressive "Green Deal" policies and energy efficiency mandates are driving widespread adoption of GaN technology to achieve regional decarbonization goals. By leveraging a robust industrial base, particularly in Germany and France, the region is integrating GaN into high-growth sectors such as electric vehicles, 5G infrastructure, and renewable energy to enhance performance and sustainability.

Value Chain Analysis of the GaN Transistor Market

- Raw Material & Equipment Supply

This foundational stage involves sourcing the necessary elements like gallium, nitrogen, and the base substrates on which GaN layers are grown.

Key Players: Sumitomo Chemical Co., Aixtron SE, and Applied Materials - Wafer & Epitaxial Production

In this stage, GaN layers are grown onto the substrate wafers through a complex and highly technical process called epitaxy to ensure high crystalline quality.

Key Players: Wolfspeed, Inc. and Sumitomo Electric Industries - Device Design & Manufacturing (Fabrication)

This stage involves the design and fabrication of the actual GaN transistors or integrated circuits in specialized foundries (fabs).

Key Players: TSMC., Infineon Technologies AG, Efficient Power Conversion (EPC), and Navitas Semiconductor. - Distribution & Sales

This stage focuses on getting the finished GaN transistors to the end customers, including original equipment manufacturers (OEMs) in various sectors.

Key Players: Qorvo, Inc. and Texas Instruments Incorporated

Top Companies in the GaN Transistor Market & Their Offerings:

- Cree, Inc.: Cree (via its spin-off Wolfspeed) is a key developer of GaN-on-SiC (gallium nitride on silicon carbide) technology, focusing on high-power radio frequency (RF) and wireless communication applications like 5G infrastructure and radar systems.

- Efficient Power Conversion Corporation: Efficient Power Conversion (EPC) pioneered the development and commercialization of enhancement-mode GaN-on-silicon (eGaN) FETs and integrated circuits, which are designed as high-performance, cost-effective replacements for traditional silicon MOSFETs.

- Fujitsu Ltd.: Fujitsu is a market player that focuses on developing GaN High Electron Mobility Transistors (HEMTs) for high-frequency and high-power applications, particularly in wireless communication infrastructure and radar systems.

- GaN Systems: GaN Systems develops and provides high-performance GaN power transistors and integrated circuits used in a wide range of power conversion applications, including consumer electronics, electric vehicles, and industrial power supplies.

- Infineon Technologies AG: Infineon is a leading force in the power semiconductor market that significantly bolstered its GaN capabilities with the strategic acquisition of GaN Systems.

- Nexgen Power Systems: Nexgen is working on vertical GaN transistors, an innovative approach that promises even greater performance advantages over traditional lateral GaN-on-silicon designs.

GaN Transistor Market Companies

- Cree, Inc.

- Efficient Power Conversion Corporation

- Fujitsu Ltd.

- GaN Systems

- Infineon Technologies AG

- Nexgen Power Systems

- NXP Semiconductor

- Qorvo, Inc.

- Texas Instruments Incorporated

- Toshiba Corporation

Recent Developments

- February 2023, In a series of connectivity tests with Microsoft, Fujitsu has accelerated its attempts to commercialize private 5G and edge computing services. In a series of connectivity tests done in collaboration with Microsoft Corporation (hereafter referred to as Microsoft) to confirm the connectivity between Fujitsu's 5G network technology and Microsoft Azure private MEC, Fujitsu announced its accomplishments at MWC Barcelona 23.

- March 2023, GaN Systems presents the revolutionary new GaN-based 800V On-Board Charger (OBC) Reference Design. The GaN (gallium nitride) power semiconductors market leader unveiled a new GaN-based 11kW/800V On-Board Charger (OBC) reference design at APEC 2023. It offers 36% higher power density and up to 15% lower bill of materials (BOM) costs than silicon carbide (SiC) transistors. This 11kW/800V solution distinguishes itself from rivals due to a ground-breaking innovation: using GaN transistors in an 800V OBC.

- In October 2025, Infineon launched the industry's first 100V GaN transistor family. The family is qualified to AEC-Q101 standards, targeting 48V electrical architectures and software-defined vehicles.

Segment Covered in the Report

By Type

- Enhancement Mode GaN Transistor

- Depletion Mode GaN Transistor

By Wafer Size

- 2-inch

- 4-inch

- 6-inch

- 8-inch

By End-use

- Automotive

- Consumer Electronics

- Defense & Aerospace

- Healthcare

- Industrial & Power

- Information & Communication Technology

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting