Genetic Engineering in Agriculture Market Size and Forecast 2025 to 2034

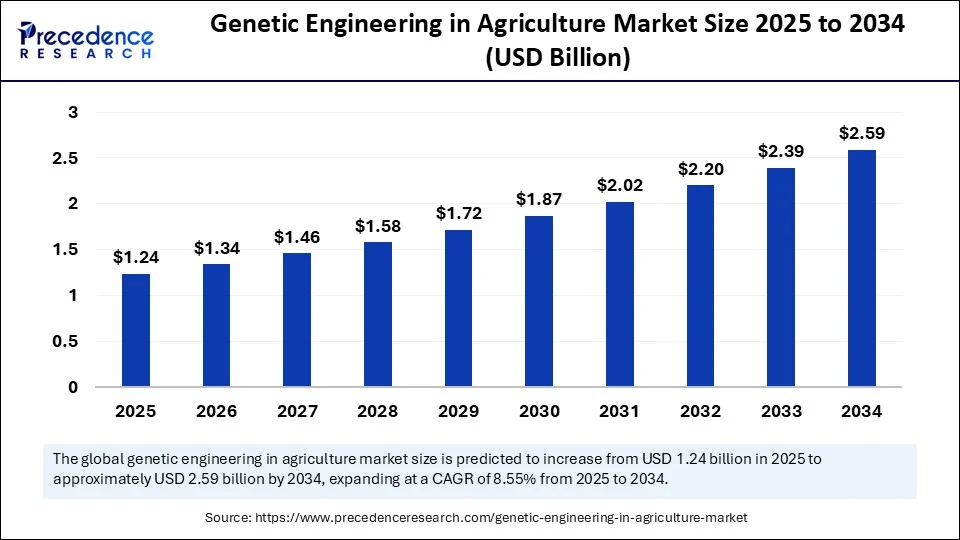

The global genetic engineering in agriculture market size accounted for USD 1.14 billion in 2024 and is predicted to increase from USD 1.24 billion in 2025 to approximately USD 2.59 billion by 2034, expanding at a CAGR of 8.55% from 2025 to 2034. The growing emphasis on sustainable farming is driving the global market. The increased global food demands are driving the need for agricultural productivity, contributing to the market growth.

Genetic Engineering in Agriculture Market Key Takeaways

- In terms of revenue, the global genetic engineering in agriculture market was valued at USD 1.14 billion in 2024.

- It is projected to reach USD 2.59 billion by 2034.

- The market is expected to grow at a CAGR of 8.55 % from 2025 to 2034.

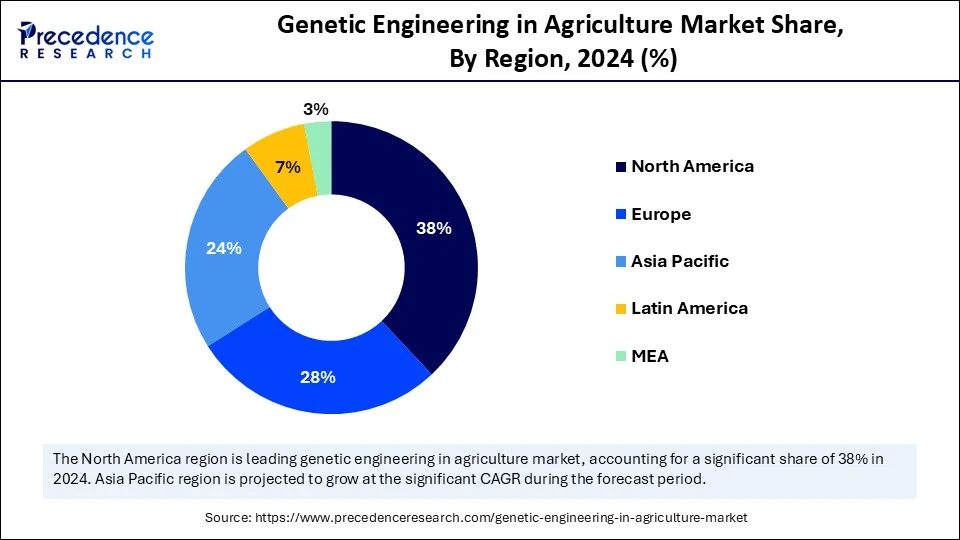

- North America dominated the global genetic engineering in agriculture market with the largest share of 38% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

- By technology/technique, the transgenic (conventional GM) techniques segment contributed the biggest market share of 40% in 2024.

- By technology/technique, the gene editing (CRISPR/Cas, TALENs, ZFNs) segment is expected to grow at a notable CAGR at a significant CAGR between 2025 and 2034.

- By trait/solution, the herbicide tolerance segment captured the highest market share of 35% in 2024.

- By trait/solution, the abiotic stress tolerance (drought, heat, salinity) segment will grow at a notable CAGR between 2025 and 2034.

- By crop type, the row crops (maize/corn, soybean, cotton) segment led the market while holding the largest share of 50% in 2024.

- By crop type, the horticulture (fruits and vegetables) segment will grow rapidly between 2025 and 2034.

- By application/offering, the seed and trait licensing (commercial seeds with engineered traits) segment held the maximum market share of 55% in 2024.

- By application/offering, the trait discovery and R&D services (CRISPR libraries, phenotyping platforms) segment will grow at a CAGR between 2025 and 2034.

- By end-user, the seed companies/agri-biotech firms segment generated the major market share of 48% in 2024.

- By end-user, the farmers and growers (commercial agriculture) segment will grow at a CAGR between 2025 and 2034.

AI Impact on the Genetic Engineering in Agriculture Market

Artificial Intelligence is transforming the global agriculture sector that adoptinggenetic engineering in applications. An AI algorithm enables the fastest and most precise analysis of complex genomic data that helps in the development of crops with improved traits. Disease resistance and enhancements of crop yields are significantly growing with the integration of AI. The development of crops with desired traits like enhanced yield, climate adaptability, and disease resistance is driving the adoption of AI in the firm. For instance, the AI-enabled SynBio is gaining traction in the market for crop breeding through precise identification of genetic elements and desirable modified proteins screening.

U.S. Genetic Engineering in Agriculture Market Size and Growth 2025 to 2034

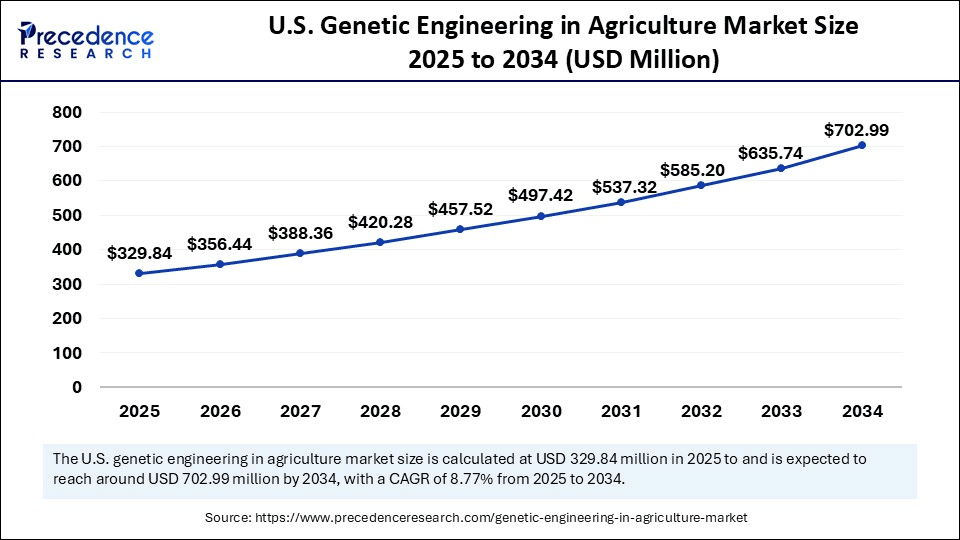

The U.S. genetic engineering in agriculture market size was evaluated at USD 303.24 million in 2024 and is projected to be worth around USD 702.99 million by 2034, growing at a CAGR of 8.77% from 2025 to 2034.

North America Genetic Engineering in Agriculture Market

North America is dominating the global genetic engineering in agriculture market, driven by a strong regional focus on high-yielding crops. The existence of key market players and supportive regulations is enabling innovations and developments of genetic engineering traits in agriculture. The presence of strong agricultural biotech firms in the U.S. and Canada is contributing to rapid innovations. Additionally, robust investments in R&D are enabling modern agriculture practices, including the adoption of genetic engineering.

Regulatory Support: To Lead the U.S. Market

The U.S. is a major player in the regional market, contributing to growth due to the country's strong pharmaceutical industry and focus on technological advancements. The U.S. regulatory revisions are the key factors leveraging the adoption of genetic engineering in the agriculture sector. With strong approval and regulatory processes focusing on the safety of the final product and its compliance with non-GM food are, transforming innovations and acceptance of genetic engineering in agriculture. The U.S. Food and Drug Administration, the U.S. Department of Agriculture (USDA), and the U.S. Environmental Protection Agency carry out the major functions in the country.

Asia Pacific the Genetic Engineering in Agriculture Market

Asia Pacific is the fastest-growing region in the global market, growth driven by a large population, increasing food demands, and climate change concerns. Regulatory revisions and advancements are key factors enabling the adoption of modern technologies in farming, including genetic engineering. Strong investments in regional R&D, especially in pest resistance and drought tolerance traits, are fostering this growth. Countries like China and India are the major investors in modern farming technologies and GMO technologies.

China is a major player in the regional market, contributing to growth due to the country's large population, high demand for food, and strong focus on research and development. Significant government investments and regulatory support for genetic engineering applications in crops are transforming this growth. Chinese biotech companies are investing heavily in genetic engineering research and development, enabling comprehensive discoveries in gene editing and gene therapy.

India is the second-largest country, leading the regional market with countries large population and a strong agricultural base. India has a large demand for food, which requires genetic engineering to improve crop yields. The government initiatives and funding for agriculture, and the adoption of innovative technologies in framing and supporting the market dominance. Additionally, supportive regulatory environments for agricultural products and advanced technologies contribute to the increased adoption of genetic engineering applications for farming.

- In May 2025, India became the world's first country to develop genome-edited rice varieties. These novel genome varieties have the potential of changes revolutionize major production, climate adaptation, and water conservation. (Source: https://icar.org.in)

Market Overview

The global genetic engineering in agriculture market covers technologies, products, and services that modify plant (and to a lesser extent animal) genomes to improve crop traits, productivity, resilience, and nutritional quality. It includes transgenic (GM) crops, gene-editing (CRISPR/Cas and others), RNA interference (RNAi), marker-assisted selection integrated with biotech, and trait discovery platforms. Applications span pest and disease resistance, herbicide tolerance, abiotic stress tolerance (drought, salinity), yield enhancement, nutrient fortification, and specialty traits for industrial feedstocks. Market growth is driven by the need for higher crop yields, climate resilience, precision breeding, regulatory approvals, and investment in ag-biotech R&D and seed pipelines.

The growing collaborations and joint ventures between major companies are transforming the innovative capacity of genetic engineering in agriculture. For instance, the joint venture between Genetics Australia Cooperative (GAC) and URUS Group LP in July 2023 granted Genetics Australia access to GENEX's products and services and provided URUS with Genetics Australia's grazing genetic and semen production capabilities. This joint venture led to expanding both companies' global reach and industry advancements. (Source: https://hoards.com)

What are the Key Trends of the Genetic Engineering in Agriculture Market?

- Increased Global Food Demand: The growing population across the world has increased the need for crop yields and enhanced agricultural productivity, driving the necessity of genetic engineering to develop crops with desirable needs and traits.

- Climate Resilience: The use of genetic engineering increases designed thrives in challenging environmental conditions, including high temperature, and enhances crop resilience.

- Resistance to Pest and Disease: Genetic engineering is significant in reducing pests and disease while developing crops, making them ideal to reduce the need for pesticides and crop losses.

- Nutrient Content Enhancements: Genetic engineering is playing an essential role in enhancing the nutritional value of crops that help to reduce micronutrient deficiencies and promote health benefits.

- Government Initiatives: The government support and funding in genetic engineering research and regulatory support for novel innovations and developments are empowering farmers to adapt genetic engineering technology in farming.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.59 Billion |

| Market Size in 2025 | USD 1.24 Billion |

| Market Size in 2024 | USD 1.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology/Technique, Trait/Solution, Crop Type, Application/Offering, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological Advancements

The ongoing advancements in technologies like gene editing, including CRISPR-Cas9, are enabling precise genetic modification. Technological advancements enable the identification and selection of specific genetic markers associated with trial benefits. Biotechnology evolution in agriculture is transforming farming practices to modern strategies for meeting increased global food demands and food safety concerns. The use of CRISPR-Cas9 enhances the precision, efficiency, and cost-effectiveness of the modification of the crop genome for introducing desired traits.

- Biotech crops are expected to cover more than 220 million hectares globally by 2025, driving significant innovations in agriculture. Biotech agriculture is one of the leading and most transformative industries, leveraging modern farming practices. (Source: https://farmonaut.com)

Restraint

Strict Challenges

The strict rules on genetically modified organisms are the major challenges for the global market. Lengthy and complex approval processes for genetically engineered products and diverse regulations are hampering market growth. Some countries across the world have implemented their own regulations on genetically engineered farming, making it difficult to comply with regulations. The strict EU guidelines for governing GMO use in research and agriculture hinder approvals for novel products. These complex and diverse regulations

Opportunity

Growing Adoption of Sustainable Farming Practices

The awareness of sustainability and environmental impact has increased, driving a shift toward the adoption of eco-friendly and sustainable farming practices. Genetic engineering is an essential tool to help farming for the production of food by using fewer resources and reducing environmental impacts. The growing modernization in agriculture has led to high use of chemicals. However, with training in sustainable agriculture, the farming practices seem to grow toward organic and natural standards. The growing focus on food security is another factor driving a surge in sustainable farming practices, making genetic engineering crucial in the sector.

Technology/Technique Insights

What Made Transgenic Techniques Lead the Genetic Engineering in Agriculture Market in 2024?

The transgenic (conventional GM) techniques segment led the market in 2024, due to its wide use in faster and more efficient desirable traits. The herbicide tolerance and pest resistance applications are the major adopters of this technology, which helps to improve crop yields and food security. Crops with are highly susceptible to environmental stressors such as pests and drought require transgenic techniques, particularly conventional GM technology, to enhance their resistance properties and increase yields. For the creation of herbicide-tolerant crops, enhancing farmer profits, and reducing the use of pesticides, the transgenic techniques are a significant saviour.

The gene editing segment is growing rapidly in the market due to its ability to enable high-yielding, nutritious food product developments and disease resistance in crops. The use of gene editing tools, including CRISPR, allows scientists to modify specific crop genes to limit water survival or high temperature stress is increasing. The development of climate-resilient crops and health tolerance capacity is driving a shift toward these gene editing tools. Building drought-resistant maize, wheat, and rice has boosted the adoption of CRISPR/Cas, ZFNs, and TALENs across farmers globally.

Trait/Solution Insights

Which Trait/Solution Dominates the Genetic Engineering in Agriculture Market?

The herbicide tolerance segment dominated the market in 2024, due to its high effectiveness and broad-spectrum weed control, with labor-saving and enhancing crop yields. The herbicide-tolerant crops are engineered to resist herbicides such as glyphosate, which allows farmers to apply chemicals without harming crops. The herbicide tolerance ability ofc crops helps fr weed management with more affordability and improves soil health through less plowing. Maize, cotton, and soybeans are the widely modified crops for herbicide tolerance traits.

The abiotic stress tolerance segment is expected to grow fastest over the forecast period, due to increased global focus on food security and the development of resilient crops. Climate change threats are growing in the agriculture sector, driving the need for abiotic stress tolerance traits from drought, heat, and salinity. Use of CRISPR-Cas9 is increasing for comprehensive manipulation of stress-related genes and control traits like ion transport, osmolyte production, and rewatering. The abiotic stress tolerance is essential to stem from the emergency adaptation in agriculture to cope with environmental challenges.

Crop Type Insights

Which Crop Type Dominated the Genetic Engineering in Agriculture Market in 2024?

In 2024, the row crops (maize/corn, soybeans, and cotton) segment dominated the genetic engineering in agriculture market, driven by high global demand for these crops, including soybeans, cotton, and maize/corn. These row crops are highly demanded as staple foods and animal feed. The large use of these crops as ingredients in industrial products and processed foods further contributes to their increased demand. The need for GE traits like pest resistance and herbicide tolerance has increased for extensive cultivation of these crops. The use of genetic engineering for row crops is widespread in the U.S., Brazil, and Argentina.

The horticulture (fruits and vegetables) segment is expected to grow fastest over the forecast period, driven by widespread demand for fruits and vegetables. The growing vegan and vegetarian populations are further adding to the demand for horticulture. The increased demand and need for high crop yields on limited land are driving the need for genetic engineering. The recombinant DNA technology, or genetic engineering, enables the production of large crop yields with high pesticide resistance and excellent safety standards.

Application/Offering Insights

How the Seed and Trait Licensing Segment Dominates the Genetic Engineering in Agriculture Market?

The seed and trait licensing (commercial seeds with engineered traits) segment dominated the market in 2024, due to increased use of engineered traits such as pest resistance and herbicide tolerance. The use of engineered traits is increasing the demand for GM seeds. Numerous seed companies are acquiring Tarit developers' license for these patented technologies, generating revenue, and gaining access to novel innovations. The growing emphasis on food security and enhancing agricultural efficiency, demand for commercial seeds with engineered traits.

The trait discovery and R&D services (CRISPR libraries, phenotyping platforms) segment is expected to lead the market over the forecast period, driven by the increased need for precise and efficient developments of high-performing crops. The use of advanced tools such as phenotyping platforms and CRISPR libraries provides cost-effective, versatile, and precise genome editing, helping enhance the performance of the crops. These tools help to overcome regulatory hurdles and enable fast development of desirable traits, including climate resilience and disease resistance.

End-User Insights

Which End-user Dominates the Genetic Engineering in Agriculture Market?

The seed companies/agri-biotech firms segment dominated the market in 2024, due to high development and licensing of genetically modified (GM) seeds in these companies. The seed companies/agri-biotech firms help to offer creation with desirable traits such as herbicide tolerance, enhanced yields, and pest resistance properties. This end-user creates highly consolidated and competitive areas for large-scale R&D investments. The widespread activities of vertical integrations of chemicals, seeds, and biotechnology operations are contributing to the segment's growth.

The farmers and growers (commercial agriculture) segment is expected to lead the market in the forecast period, driven by the increased need for higher yields and nutrition-based food. Genetic engineering technology helps farmers and growers to improve their crop yields with increased pest and disease resistance, nutritional content, and reduced input costs. For cost-effective, organic, and highly safe farming, driving the demand for genetic engineering among farmers and growers. The economic incentives and practical benefits provided by this technology make it crucial in farming.

Value Chain Analysis

- Harvesting and Post-Harvest Handling

The harvesting and post-harvest handling in genetic engineering in agriculture refers to the process of collecting crops and managing them through sorting, grading, storage, packaging, and transportation.

Key Players: Syngenta, Bayer, and Corteva Agriscience.

- Distribution to Wholesalers/Retailers

The distribution to wholesalers and retailers is the phase of the supply chain that moves processed food or seeds from manufacturers.

Key Players: Bayer Crop Science, Syngenta, Corteva Agriscience, and Kaveri Seed Company.

- Export and Trade Compliance

In genetic engineering in agriculture, the export and trade companies include a set of international and domestic regulations that refer to the transportation and utilization of genetically engineered crops across borders. This trade complaint includes agreements such as the Cartagena Protocol on biosafety and the World Trade Organization (WTO) agreements.

Key Players: Bayer Crop Science, BASF, and Benson Hill.

Genetic Engineering in Agriculture Market Companies

- Corteva Agriscience

- Bayer AG

- Syngenta AG

- BGI

- Illumina

- NRGene

- Eurofins Scientific

- Neogen Corporation

- Keygene

- Editas Medicine

Recent Developments

- In August 2025, the “Genetic Engineering in Agriculture, 2nd Edition” event was held as a webinar by MDPI. This webinar was part of the promotion of an upcoming MDPI special issue. The event was he continuation of their previous collection of genetic engineering in agriculture and featured a researcher's presentation on advancements in plant genome editing. (Source: https://www.mdpi.com)

- In August 2025, researchers at the Chinese Academy of Science Headquarters developed a novel, powerful tool allowing for the editing of large chunks of DNA with excellent accuracy. Researchers have overcome older gene editing methods by using a combination of cutting-edge protein design, AI, and clever genetic tweaks. To prove that tools work, researchers have engineered rice resistant to herbicides by modifying a specific section of its DNA. (Source:https://www.sciencedaily.com)

Segment Covered in the Report

By Technology/Technique

- Transgenic (Conventional GM) Techniques

- Gene Editing (CRISPR/Cas, TALENs, ZFNs)

- RNA Interference (RNAi) and Gene Silencing

- Marker-Assisted Selection and Genomic Selection (biotech-enabled)

- Synthetic Biology and Pathway Engineering

By Trait/Solution

- Pest and Insect Resistance (Bt and others)

- Herbicide Tolerance

- Abiotic Stress Tolerance (drought, heat, salinity)

- Yield and Biomass Enhancement

- Nutritional Fortification (biofortification: vitamins, amino acids)

- Quality and Shelf-Life Traits

- Industrial/Feedstock Traits (oil composition, polymer precursors)

By Crop Type

- Row Crops (Maize/Corn, Soybean, Cotton)

- Cereals and Grains (Wheat, Rice)

- Horticulture (Fruits and Vegetables)

- Oilseeds (Canola, Sunflower)

- Forage and Pasture Crops

- Specialty Crops (Sugarcane, Potato, Others)

By Application/Offering

- Seed and Trait Licensing (commercial seeds with engineered traits)

- Trait Discovery and R&D Services (CRISPR libraries, phenotyping platforms)

- Contract Research and Development (CROs/CDMOs for ag-biotech)

- Regulatory and Stewardship Services (data packages, field trials)

- Biopesticides/RNAi-based Crop Protection Products

By End-User

- Seed Companies/Agri-biotech Firms

- Farmers and Growers (commercial agriculture)

- Food and Feed Manufacturers (sourcing engineered crops)

- Seed and Trait Developers (startups, research institutions)

- Government and Public Breeding Programs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting