Mounjaro Market Size and Forecast 2025 to 2034

The global mounjaro market size accounted for USD 14.18 billion in 2024 and is predicted to increase from USD 16.82 billion in 2025 to approximately USD 78.51 billion by 2034, expanding at a CAGR of 18.67% from 2025 to 2034.

Mounjaro MarketKey Takeaways

- In terms of revenue, the global mounjaro market was valued at USD 14.18 billion in 2024.

- It is projected to reach USD 78.51 billion by 2034.

- The market is expected to grow at a CAGR of 18.67% from 2025 to 2034

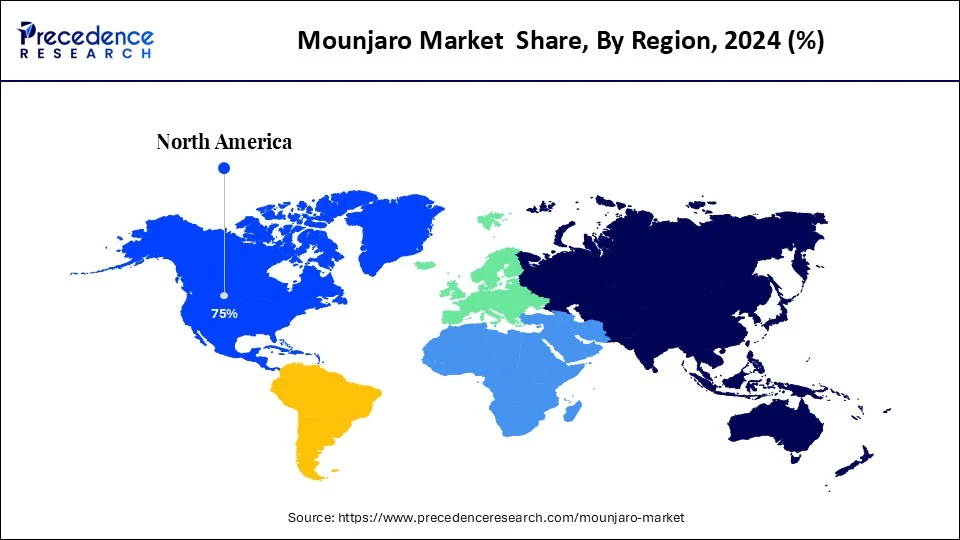

- North America dominated the mounjaro market with the largest market share of 75% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By indication type, the type 2 diabetes segment contributed the highest market share of 60% in 2024.

- By Indication type, the obesity/weight management segment is expected to grow at a significant CAGR between 2025 and 2034.

- By route of administration, the injectable segment captured the biggest market share of 93% in 2024.

- By route of administration, the oral segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By distribution channel, the retail pharmacies segment generated the major market share of 55% in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By dosage strength, the 5 mg segment held the highest market share of 55.58% in 2024.

- By dosage strength, the 5-15 mg segment is expected to grow at a remarkable CAGR between 2025 and 2034.

How is AI Revolutionizing the Mounjaro Market?

Artificial intelligence is significantly reshaping the Mounjaro market by accelerating drug development pipelines and optimizing clinical trial designs. Predictive analytics enabled by AI help to forecast patient responses and adherence, thereby enhancing personalized treatment approaches. AI-driven diagnostics are also aiding in the early detection of obesity and diabetes, expanding the eligible treatment population. Real-time data from wearable devices is being used to adjust treatment strategies and improve patient outcomes. Moreover, AI models are helping the pharmaceutical market target the right demographics with greater precision. Collectively, AI is enhancing both the operational efficiency and commercial success of Mounjaro across the globe.

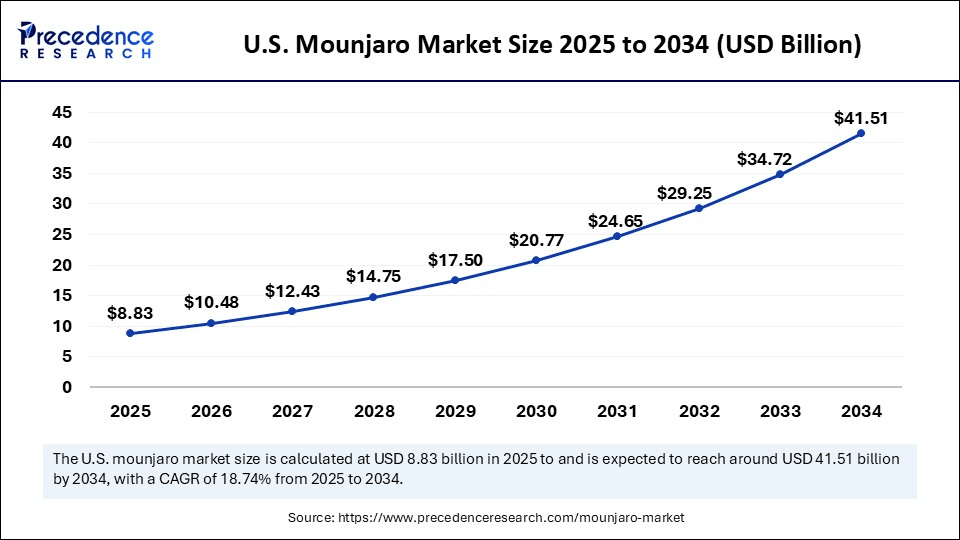

U.S. Mounjaro Market Size and Growth 2025 to 2034

The U.S. mounjaro market size was exhibited at USD 7.45 billion in 2024 and is projected to be worth around USD 41.51 billion by 2034, growing at a CAGR of 18.74% from 2025 to 2034. The Mounjaro market is gaining traction due to rising obesity rates and the prevalence of type 2 diabetes. Mounjaro injections offer relief and are associated with a 20% reduction in obesity, along with the potential to prevent related side effects.

What Made North America the Dominant Region in the Mounjaro Market?

North America dominated the Mounjaro market by capturing the largest revenue share of 75% in 2024 due to the increased awareness of the benefits of Mounjaro among both patients and healthcare providers and strong healthcare infrastructure. With obesity and type 2 diabetes rates soaring, there is an urgent demand for innovative therapies like Mounjaro. The region benefits from rapid regulatory approvals, concerns over weight management, and a high level of trust among physicians in next-generation therapeutics. Insurance coverage and government health programs further support the early adoption of this approach. Additionally, the presence of major market players, such as Eli Lilly, and the advanced R&D ecosystem enhance local market penetration. Strategic partnerships and growing investment in metabolic health keep North America firmly in the lead.

What Factors Contribute to the Mounjaro Market Growth in Asia Pacific?

Asia Pacific is emerging as the fastest-growing region in the market, driven by shifting lifestyles and increasing urbanization. A surge in obesity and diabetes cases, especially in countries like India and China, has highlighted the urgent need for effective treatments. As healthcare systems modernize and awareness spreads, acceptance of metabolic therapies is rapidly rising. Government-backed screening programs and the expansion of private healthcare facilities are increasing access to drugs.

Pharmaceutical companies are also localizing manufacturing and partnerships to improve reach and affordability. Additionally, ongoing research and clinical trials in the region are paving the way for new therapeutic approaches, supporting market growth. Patient education initiatives are enhancing acceptance and adherence to treatment regimens, ensuring long-term market growth.

- In July 2025, Mounjaro saw remarkable success in India, surpassing rupees 50 crore in sales within just three months. In June alone, the drug generated 26 crores, twice the amount recorded in May. This rapid growth aligns with the arrival of rival drug Wegovy in the Indian market, signaling a fierce battle ahead in the obesity and diabetes treatment space.

(source: https://www.business-standard.com)

Market Overview

The Mounjaro Market refers to the commercial ecosystem surrounding tirzepatide, a dual GIP and GLP-1 receptor agonist developed by Eli Lilly. Initially approved for Type 2 diabetes, it has since gained accelerated traction as an anti-obesity drug (under the name Zepbound). This market encompasses drug development, commercial sales, regulatory approvals, dosage forms, patient access, and competition within the broader GLP-1 receptor agonist segment.

Tirzepatide has become one of the fastest-growing biopharmaceutical brands in history, largely driven by the rising prevalence of metabolic disorders and demand for effective weight loss pharmacotherapy. Mounjaro's dual-action mechanism and weekly injectable format make it a standout in the incretin-based therapy space. The market is experiencing rapid growth, driven by rising healthcare investments and an increasing emphasis on preventive care for chronic diseases. Moreover, the growing demand for effective, long-term weight management solutions further supports market growth.

Key Market Trends

- Dual agonist therapies are increasingly favored over single-acting drugs due to their potential for better efficacy and patient outcomes. This shift reflects a broader trend toward combination treatments to effectively address complex health conditions.

- There is a growing off-label interest in dual agonist therapies, indicating that clinicians are exploring their benefits outside approved indications, which could lead to expanded use, but also raises regulatory considerations.

- The preference for dual agonist treatments is driven by advancements in drug technology, allowing for more targeted and effective combinations that may reduce side effects compared to traditional single drugs.

- Increased research and clinical trials are supporting the safety and efficacy of dual agonist therapies, helping to establish them as a viable alternative in treatment protocols.

- The pharmaceutical industry is investing heavily in the development of dual agonist drugs, signaling a strategic shift toward multi-targeted therapies for chronic and complex diseases.

- Patient demand for more effective and personalized therapies is driving the trend, with dual agonists providing tailored treatment options that can enhance quality of life.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 78.51 Billion |

| Market Size in 2025 | USD 16.82 Billion |

| Market Size in 2024 | USD 14.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.67% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Indication, Route of Administration, Dosage Strength,Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Burden of Metabolic Diseases

The soaring global prevalence of metabolic disorders, such as type 2 diabetes and obesity, is the most compelling driver of the Mounjaro market. Lifestyle changes, sedentary behavior, and poor dietary habits have escalated the demand for innovative therapeutic solutions. Monujaro's superior efficacy in reducing both blood glucose and body weight makes it highly attractive to healthcare providers. Governments and private organizations are increasingly investing in chronic disease management programs, which indirectly boost demand. Furthermore, the product's once-weekly dosage enhances patient compliance. As awareness spreads, more physicians are adopting Mounjaro as a frontline treatment option.

Restraint

High Costs and Potential Side Effects

Despite its strong potential, Mounjaro market faces challenges such as high treatment costs and limited access in low-income regions. Insurance coverage inconsistencies can deter widespread patient adoption, particularly in countries with weak reimbursement systems. Additionally, global supply constraints of injectable therapies may restrict availability. Concerns over long-term safety in non-diabetic populations still exist, which may delay broader regulatory approvals. The complexity of cold-chain logistics adds another layer of difficulty, especially in remote areas. Moreover, potential side effects associated with Mounjaro, such as diarrhea, vomiting, and nausea, limit the market penetration.

Opportunity

Regulatory Approvals and Expanding Applications

There is a significant opportunity for Monujaro market in the obesity segment, which remains largely under-treated. As regulatory pathways for anti-obesity drugs become more favorable, mounjaro's potential expands beyond diabetes management. With a growing emphasis on holistic metabolic care, combination therapies and extended indications may emerge. Emerging markets present untapped potential due to shifting lifestyles and increasing access to healthcare. Additionally, its applicability in non-diabetic populations for weight loss is expected to be a major revenue stream. The growing demand for effective, long-term pharmacological weight solutions creates a robust landscape for Mounjaro's expansion.

IndicationInsights

How Does the Type 2 Diabetes Segment Maintained Dominance in the Market?

The type 2 diabetes segment dominated the Mounjaro market with the largest share of 60% in 2024. This is mainly due to its widespread prevalence and proven effectiveness of Mounjaro in treating chronic diseases. Physicians are increasingly opting for Mounjaro due to its dual action and robust glycemic control, offering advantages over traditional GLP-1 agonists. The clinical evidence supporting its use in diabetic care remains consistently high. Moreover, the well-established diagnostics and treatment infrastructure for diabetes ensures seamless integration of Mounjaro into standard care.

On the other hand, the obesity/weight management segment is expected to grow at the fastest rate in the upcoming period due to a sharp rise in global awareness and demand for medical weight loss solutions. With more people seeking sustainable alternatives to surgery and fad diets, Mounjaro's proven weight-reduction effects are boosting its demand. Off-label usage in obese patients is surging even in the absence of full approvals in some markets. As clinical trials continue to validate its benefits in weight management, regulatory bodies are showing a favorable stance. The growing burden of obesity is pushing healthcare providers to embrace pharmacological solutions, boosting the adoption of Mounjaro as a first-line treatment.

Route of Administration Insights

Why Did the Injectables Segment Dominate the Mounjaro Market in 2024?

The injectables segment dominated the Mounjaro market with a major share of 93% in 2024, as they offer controlled delivery and proven bioavailability. Mounjaro's once-weekly injectable format significantly improves compliance compared to daily medications. Healthcare providers are familiar with injectable administration, making it easier to integrate into treatment plans. Patient satisfaction is also growing as the injections are convenient and require minimal lifestyle disruptions. The injectable route remains the backbone of Mounjaro's clinical and commercial deployment. The rising demand for targeted delivery ensures the long-term growth of the segment.

Meanwhile, the oral segment is expected to expand at the highest CAGR over the projection period as patients are increasingly seeking needle-free alternatives. Advances in drug delivery technologies are making oral versions of peptides more feasible and effective. The convenience of daily tablets or capsules can appeal to broader demographics, especially needle-averse populations. Pharmaceutical companies are exploring oral tirzepatide derivatives, suggesting a potential shift in the administration landscape. Regulatory bodies are also beginning to favor innovative oral treatments that reduce the burden on healthcare facilities. While still in the early development stages, the momentum toward oral delivery is unmistakable.

Distribution Channel Insights

What Made Retail Pharmacies the Dominant Segment in the Market in 2024?

Retail pharmacies dominated the Mounjaro market with share of 55% in 2024 due to their easy accessibility and patient engagement capabilities. Patients often rely on pharmacies for education, reminders, and follow-up care, especially in chronic conditions like diabetes. These pharmacies also facilitate smoother insurance processing and prescription refills. Their physical presence allows face-to-face consultations, building patient confidence in injectable therapies. With consistent inventory and logistical capabilities, retail pharmacies are key to maintaining treatment adherence. Their deep integration into local communities cements their role as primary distribution points.

On the other hand, the online pharmacies segment is expected to expand at the fastest CAGR over the projection period, as they offer unmatched convenience and privacy. As digital healthcare gains momentum, more patients are ordering medications from their homes. Online platforms allow for automated refills, home delivery, and teleconsultation linkages. Younger and tech-savvy patients are particularly drawn to the seamless experience online pharmacies provide. The digital model also helps manufacturers reach remote areas without a physical retail presence. This trend is transforming how patients access chronic disease treatments, including Mounjaro.

Dosage Strength Insights

Why Did the 5 mg Segment Dominate the Mounjaro Market in 2024?

The 5 mg segment dominated the market with share of 55.58% in 2024. The 5 mg dosage is the most prescribed strength of Mounjaro, especially as a starting dose in treatment protocols. It allows healthcare providers to evaluate patient tolerance and initial response before escalation. This dosage minimizes the risk of side effects and encourages adherence among first-time users. From a safety and comfort perspective, physicians prefer to initiate therapy conservatively. Additionally, clinical guidelines often recommend starting low and titrating up based on individual needs. As a result, the 5 MG variant remains the foundation of most Mounjaro treatment plans.

Meanwhile, the 15 mg segment is expected to grow at a rapid pace in the coming years as more patients require optimal results. Physicians are increasingly adjusting doses based on response and tolerability, making the full range essential. Higher doses are associated with improved outcomes in weight loss and glycemic control. Patients who tolerate initial doses well are often moved up to 15 mg for maximum benefit. Hence, the broader dosing spectrum is becoming central to effective chronic disease management.

Mounjaro Market Companies

- Eli Lilly

- Novo Nordisk

- Amgen

- Pfizer

- AstraZeneca

- Boehringer Ingelheim

- Sanofi

- Merck & Co.

- Johnson & Johnson

- Bayer AG

- Roche

- Takeda Pharmaceutical

- Biocon

- Innovent Biologics

- Dr. Reddy's Laboratories

- Hanmi Pharmaceutical

- Zealand Pharma

- LG Chem

- Cipla

- Teva Pharmaceutical

- Sun Pharma

- Abvee

Recent Developments

- In July 2025, Eli Lilly is set to broaden the global reach of Mounjaro with strategic launches planned across key emerging markets, including India, Brazil, Mexico, and China by the end of 2025. These expansions aim to address an estimated global patient base of approximately 900 million individuals affected by obesity and type 2 diabetes. The company has already initiated large-scale deployment in India, with similar rollouts progressing in Brazil and Mexico. This move aligns with Eli Lilly's efforts to scale up global manufacturing capabilities and meet the rising demand for advanced metabolic treatments.

(source: https://www.reuters.com) - In March 2025, Eli Lilly and Company launched its diabetes and obesity management drug Mounjaro (tirzepatide) in India. The company launched the drug in a single-dose vial following marketing authorisation from the Central Drugs Standard Control Organisation (CDSCO).

(Source: https://www.thehindu.com)

Segments Covered in the Report

By Indication (Therapeutic Area)

- Type 2 Diabetes

- Obesity / Weight Management

- Prediabetes / Metabolic Syndrome

- Others (e.g., PCOS, cardiovascular protection - off-label use)

By Route of Administration

- Injectable (Subcutaneous Pen)

- Weekly Dosing Pen (autoinjector)

- Prefilled Disposable Pen

- Oral (Under Development)

- Tablet (future potential based on orforglipron-type formulations)

- Capsule (in early pipeline)

By Dosage Strength

- 2.5 mg

- 5 mg

- 7.5 mg

- 10 mg

- 12.5 mg

- 15 mg

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Specialty Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting