What is the GMC-Based Motion Controller Market Size?

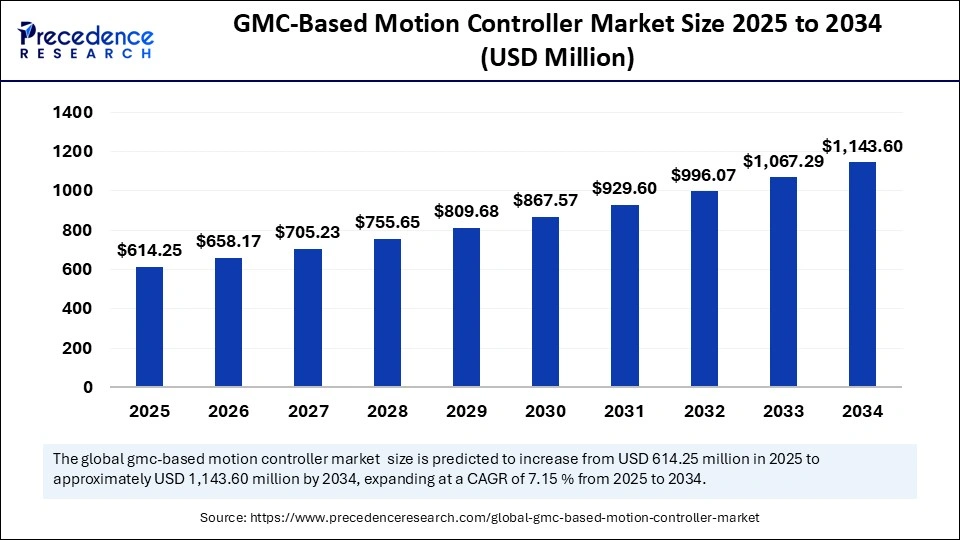

The global GMC-based motion controller market size was calculated at USD 573.26 million in 2024 and is predicted to increase from USD 614.25 million in 2025 to approximately USD 1,143.60 million by 2034, expanding at a CAGR of 7.15% from 2025 to 2034. The market is experiencing significant growth due to the rising demand for automation, particularly in robotics and smart manufacturing. Advances in AI and ML are enhancing controllers through adaptive control, predictive maintenance, and optimized performance. Additionally, the increasing application of these technologies in robotics, electronics, and the automotive sector is expected to accelerate market expansion in the coming years.

Market Highlights

- Asia Pacific held the largest GMC-based motion controller market share in 2024.

- North America is expected to witness the fastest CAGR during the foreseeable period.

- By axis type, the multi-axis motion controller segment held the largest market share in 2024.

- By axis type, the single-axis motion controller segment is expected to witness the fastest CAGR during the foreseeable period.

- By offering, the hardware segment dominated the market in 2024.

- By offering, the software segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By communication protocol, the EtherCAT segment led the market in 2024.

- By communication protocol, the PROFINET segment is expanding at a significant CAGR from 2025 to 2034.

- By control method, the coordinated motion control segment held the major market share in 2024.

- By control method, the interpolated control segment is expected to witness the fastest CAGR during the foreseeable period.

- By machine type, the CNC machines segment led the market in 2024.

- By machine type, the robotics segment is projected to grow rapidly between 2025 and 2034.

- By industry vertical, the automotive segment dominated the market in 2024.

- By industry vertical, the electronics and semiconductor segment is anticipated to grow at a significant CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2024: USD 573.26 Million

- Market Size in 2025: USD 614.25 Million

- Forecasted Market Size by 2034: USD 1,143.60 Million

- CAGR (2025-2034): 7.15%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is a GMC-based Motion Controller?

A GMC-based motion controller is a flexible control system designed for common automation tasks. It can accurately manage the movement, speed, and position of one or more electromechanical devices, whether linear or rotational. GMCs are designed to be adaptable and user-friendly, featuring intuitive programming and compatibility with a wide range of sensors and actuators.

How Can AI Impact the GMC-based Motion Controller Market?

Artificial intelligence (AI) is transforming the GMC-based motion controller market by enabling real-time adaptive motion control, predictive maintenance, and improved efficiency through machine learning algorithms embedded in hardware. This leads to self-optimizing trajectories, reduced equipment downtime, and improved product quality in industries such as semiconductor manufacturing. Additionally, AI-driven systems can learn from their environment and adjust their movements to maintain optimal performance and minimize energy consumption, resulting in little to no unplanned downtime.

What Are the Key Trends in the GMC-based Motion Controller Market?

- Smart Manufacturing and Industrial Automation:The ongoing digitalization and implementation of Industry 4.0 technologies are driving the demand for GMCs. These systems enhance process quality, reduce downtime, and improve overall efficiency in manufacturing, resulting in better product outcomes and increased productivity.

- Increased Demand for Productivity: Industries are seeking more sophisticated automation solutions to meet growing demands, which is resulting in a higher need for motion controllers that provide flexible, agile, and seamless operations aimed at boosting productivity.

- Flexibility and Versatility:GMCs are adaptable and can be utilized for a wide range of automation tasks. This makes them ideal for complex applications and industries that require flexible control solutions to accommodate evolving requirements.

- Emphasis on Safety: Growing concerns about operator safety in industrial environments are driving the adoption of automated systems like GMCs. These systems help reduce human intervention and minimize the risk of errors or accidents, making them an appealing investment for companies looking to optimize their operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 573.26 Million |

| Market Size in 2025 | USD 614.25 Million |

| Market Size by 2034 | USD 1,143.60 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Axis Type, Offering, Communication Protocol, Control Method, Machine Type, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Widespread Push for Industrial Automation and Industry 4.0 Integration

The main driver for the GMC-based motion controller market is the widespread push for industrial automation and Industry 4.0 integration, which boosts demand for intelligent, networked systems for precise control, energy efficiency, and operational effectiveness across industries. The core driver is the ongoing adoption of automation in different sectors, with manufacturers moving toward smart factories that rely on connected and intelligent systems for precision control and efficiency to support safe drive functions, reducing accidents and enhancing machine safety.

Restraint

High Initial Cost of Implementation

The primary barrier in the GMC-based motion controller market is the high initial cost of implementation, which acts as a significant obstacle for small and medium-sized enterprises with limited budgets. The large upfront investment needed to integrate advanced GMC systems into existing infrastructure is a major challenge for many companies. Implementing these systems requires specialized knowledge and skilled technicians, adding to the cost and complexity, which can discourage smaller firms from adopting them, making it easier and potentially cheaper to deploy GMC systems.

Opportunity

Integration of Advanced Technologies

The key future opportunity in the GMC-based motion controller market is the integration of advanced technologies like AI and ML, which allow for more intelligent, autonomous, and adaptive control systems. This drives growth in areas such as predictive maintenance, energy-efficient operation, and the increasing use of collaborative robots in industrial automation and logistics. Motion controllers can analyze operational data to predict potential machinery failures, enabling proactive repairs and reducing costly downtime. Built-in safety features can be managed directly by the controller, ensuring safe operation even while machinery is active.

Segments Insights

Axis Type Insights

What Made the Multi-Axis Motion Controllers Segment Lead the GMC-based Motion Controller Market in 2024?

The multi-axis motion controllers segment led the market in 2024. This is due to the growing demand for complex, synchronized control in modern manufacturing, especially in robotics, CNC machines, and automated assembly lines, which need multi-axis systems for precise and efficient operation. Robotics, a major driver of the market, relies heavily on multi-axis control for complex and coordinated movements. Systems are heavily relied upon for complex, coordinated movements in sectors such as electronics and semiconductor manufacturing, packaging, and machine tools.

The single-axis motion controller segment is expected to grow the fastest. This is because of its simplicity, affordability, and suitability for high-volume applications in electronics and automotive manufacturing, driven by Industry 4.0, smart factories, and the need for precision and efficiency. Advances in modular, intelligent, and networked single-axis controllers aim to boost productivity and meet safety standards.

Offering Insights

How Did the Hardware Segment Lead the GMC-based Motion Controller Market in 2024?

The hardware segment led the market in 2024 primarily because it forms the essential physical foundation for all motion control systems, providing critical precision and coordination through specialized components like controllers, motors, and sensors. Hardware enables precise, real-time control loops and multi-axis coordination, which are vital for high-performance industrial applications. Since hardware supplies the physical structure and connectivity, it integrates seamlessly with higher-level control systems and communication protocols.

The software segment is expected to see the fastest growth. This is because it offers advanced analytics, predictive maintenance, and process optimization through AI, ML, and IoT integration. Software provides insights into motion control systems for fine-tuning parameters, leading to better productivity and reduced energy consumption. These capabilities meet the rising demand for higher operational efficiency, improved effectiveness, and safer manufacturing conditions, supporting better decision-making, compliance, and safety.

Communication Protocol Insights

How Did the EtherCAT Segment Dominate the GMC-based Motion Controller Market in 2024?

EtherCAT maintained its market dominance in 2024. This is mainly due to its superior real-time performance, deterministic clock technology for precise synchronization, high bandwidth, flexible network topology, and overall cost-effectiveness through an open-standard architecture with a wide variety of compatible hardware. EtherCAT's daisy-chain topology minimizes wiring and hardware costs. Being an open standard with broad vendor support results in competitively priced, readily available components and lower total ownership costs.

The PROFINET segment is experiencing the fastest growth. This is driven by its real-time deterministic performance, flexible Ethernet-based network architecture, seamless IT integration, and strong support for Industry 4.0 features like diagnostics, safety, and energy management. Device integration is simplified through GSD files, and its intelligent diagnostics help users access network status, demonstrating ongoing development and support for advanced diagnostics.

Control Method Insights

Why Did the Coordinated Motion Control Segment Lead the GMC-based Motion Controller Market in 2024?

The coordinated motion control segment led the market in 2024. This is because it boosts overall equipment efficiency, enhances productivity, and reduces costs through seamless multi-axis coordination and integrated safety features. These capabilities meet the rising demands for safer, more automated work environments. Optimizing machine performance and integrating safety functionalities into a single platform helps lower total ownership costs and facilitate safe human-robot interactions.

The interpolated control segment is projected to grow the fastest. This is because it enables synchronized, multi-axis motion for complex tasks such as 3D printing, robotics, and automated manufacturing, which are booming due to Industry 4.0 and automation trends. Advances in combining motion control with vision-guided systems are expanding capabilities. Interpolated control plays a key role by allowing systems to perform multiple actions simultaneously while guiding robot movements accurately.

Machine Type Insights

How Did the CNC Machines Segment Dominate the GMC-based Motion Controller Market in 2024?

The CNC machines segment dominated the market in 2024. This is due to the widespread demand for high-precision, automated manufacturing across industries like automotive and aerospace, which depend heavily on complex, multi-axis CNC systems operations. Advancements in integrated, intelligent, and cost-effective motion control chip-based controllers further drive this dominance by enabling high accuracy and efficiency in CNC operations. The shift towards more powerful, cost-effective motion control chip-based controllers has made them ideal for complex CNC operations.

The robotics segment is experiencing the fastest growth in the market. This growth is primarily driven by the increasing adoption of automation for precision tasks in industries such as manufacturing and logistics. The need for efficiency, flexibility, and adaptability in complex production environments is a key factor in this trend. Advanced algorithms and technological improvements in robotics enable more complex tasks with greater accuracy and adaptability by achieving precise movement and synchronization within robotic systems.

Industry Vertical Insights

What Made the Automotive Segment Dominate the GMC-based Motion Controller Market in 2024?

The automotive segment captured market dominance, largely due to the high demand for automation in the production of electric, autonomous, and connected vehicles. These vehicles require precise, efficient, and adaptable manufacturing processes. Motion controllers allow automotive manufacturers to enhance production efficiency, improve product quality, and reduce operational costs, all of which are crucial for meeting the global demand for vehicles. The automotive sector is a leader in adopting Industry 4.0 technologies, driving the demand for GMC-based motion controllers that integrate with other smart factory systems.

The electronics and semiconductor segment is projected to be the fastest-growing in the market. This growth is driven by the semiconductor industry's reliance on advanced motion control for complex manufacturing processes and its rapid adoption of automation. Both semiconductors and motion controllers are essential for the accuracy and precision needed in fabricating advanced electronics. Continuous technological innovation, the demand for smart technologies across various industries, and the push for higher performance and efficiency in automated systems with reduced network traffic and enhanced system resilience.

Regional Insights

How Did the Asia Pacific Region Dominate the GMC-based Motion Controller Market in 2024?

The Asia Pacific region dominated the GMC-based motion controller market in 2024. This dominance stems from rapid industrialization, the establishment of manufacturing hubs, and supportive government initiatives promoting automation and Industry 4.0 integration. These factors create a strong demand for precision automation in electronics, automotive, and robotics, particularly in countries like China, Japan, and South Korea. The widespread adoption of Industry 4.0 principles and smart factory initiatives further boosts the need for advanced automation, precision, and reduced human error, all enabled by sophisticated GMC-based motion controllers.

India GMC-based Motion Controller Market Trends

India is playing a significant role in the global market, driven by rapid industrial automation and increasing demand from key sectors such as automotive, electronics, and food and beverage. Supportive government initiatives like Make in India and Industry 4.0 programs are also major contributors. India is projected to become increasingly influential as multinational corporations invest significantly and domestic robotics adoption expands, fueling the growth of motion control technologies.

China GMC-based Motion Controller Market Trends

China is evolving as a major player in the global market, predominantly due to its massive manufacturing sector, robust industrial automation policies, and substantial investments in robotics and electronics. As the largest producer and consumer of motion control equipment, domestic manufacturers are gaining market share in medium and low-end segments against established international brands, due to an expanding industrial base and continuous technological advancements.

Why is North America Considered the Fastest-Growing Region in the GMC-based Motion Controller Market?

North America is expected to be the fastest-growing market during the forecast period. This is attributed to high demand for advanced automation, smart manufacturing, robotics, and AI-driven solutions in key sectors such as electronics, automotive, and healthcare, alongside significant investments in research and development. Notable advancements in robotics and the integration of AI are increasing the demand for precise motion control solutions, which are core applications of GMC controllers. The region's strong electronics and semiconductor industries also require highly accurate and reliable motion controllers for their precision manufacturing processes.

GMC-Based Motion Controller Market Companies

- Siemens AG

- Rockwell Automation

- Mitsubishi Electric Corporation

- Omron Corporation

- Schneider Electric

- ABB Ltd.

- Delta Electronics

- Beckhoff Automation

- Bosch Rexroth AG

- Yaskawa Electric Corporation

- National Instruments

- Galil Motion Control

- Aerotech Inc.

- Parker Hannifin Corporation

- Kollmorgen

Leaders' Announcement

- In September 2023, Allient Inc. acquired Sierramotion Inc. With this acquisition, Sierramotion's engineering team brings extensive experience that aligns with Allient's strategy for integrated motion solutions. The aim is to enhance rapid product development and production capabilities by leveraging Allient's global manufacturing network, as stated by Dick Warzala, Chairman and CEO.(Source: https://www.businesswire.com)

Recent Development

- In March 2024, FANUC unveiled its new combined PLC/CNC motion controller, the Power Motion i-MODEL A Plus (PMi-A Plus). This controller enhances FANUC's trusted technology for CNC machine tools, enabling its use for general motion control. This launch exemplifies how FANUC's factory automation and collaborative robot solutions create a comprehensive automation solution for the supply chain, as stated by Jon Heddleson, General Manager of FANUC America's Factory Automation.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Axis Type

- Single-Axis Motion Controllers

- Multi-Axis Motion Controllers

By Offering

- Hardware

- Software

- Services

By Communication Protocol

- EtherCAT

- Ethernet/IP

- PROFINET

- SERCOS III

- CANopen

- Others

By Control Method

- Point-to-Point Control

- Interpolated Control

- Coordinated Motion Control

By Machine Type

- CNC Machines

- Robotics

- Packaging and Labeling Machines

- Semiconductor Equipment

- Printing and Textile Machinery

- Others

By Industry Vertical

- Automotive

- Electronics and Semiconductor

- Food and Beverage

- Aerospace and Defense

- Healthcare and Medical Devices

- Packaging and Printing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting