What is the Green Building Materials Market Size?

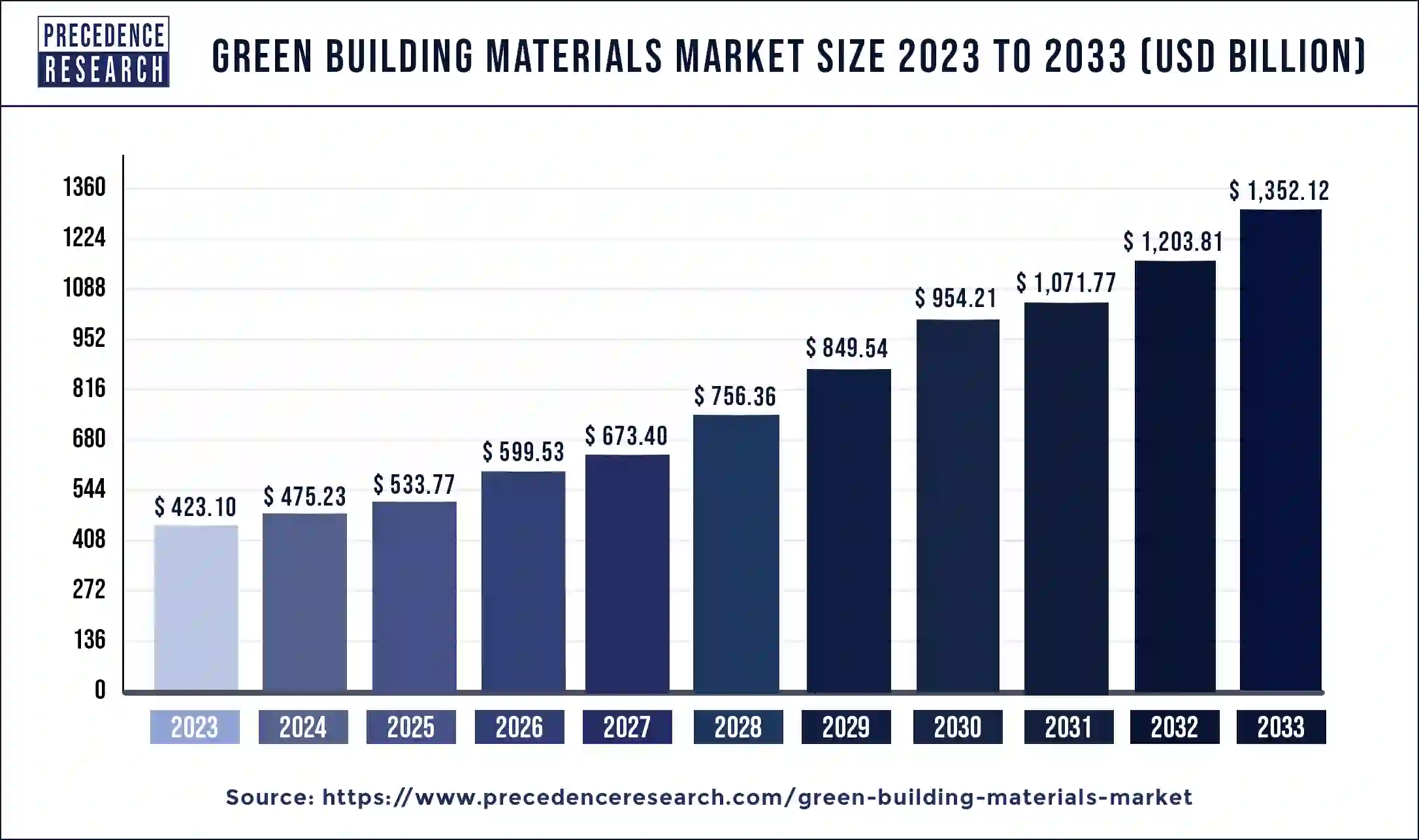

The global green building materials market size is calculated at USD 533.77 billion in 2025 and is predicted to increase from USD 599.53 billion in 2026 to approximately USD 1,648.74 billion by 2035, expanding at a CAGR of 11.94% from 2026 to 2035.The increasing awareness about energy conservation coupled with rising demand for green building materials in residential and commercial buildings is expected to accelerate the green building materials market's growth in the coming years.

Green Building Materials Market Key Takeaways

- The global green building materials market was valued at USD 533.77billion in 2025.

- It is projected to reach USD 1,648.74billion by 2035.

- The market is expected to grow at a CAGR of 11.94% from 2026 to 2035.

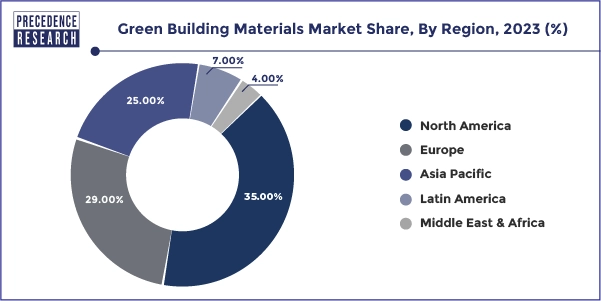

- The North America green building material market size accounted for USD 153.87 billion in 2025 and is expected to attain around USD 223.43 billion by 2035.

- North America led the market with the largest market share of 35% in 2025.

- Asia Pacific is observed to expand at a rapid pace during the forecast period.

- By application, the insulation segment accounted for the dominating share in 2025.

- By application, the roofing segment is expected to witness a significant share during the forecast period.

- By end-use industry, the residential segment held the largest share of the market in 2025.

- By end-use industry, the commercial segment is expected to grow significantly during the forecast period.

Market Overview

Green building materials are eco-friendly construction material s that have a low environmental impact. A sustainable architecture uses energy and natural resources. They are generally composed of renewable resources rather than non-renewable resources. Green building materials are widely used due to their energy efficiency, and ecologically beneficial qualities, and produce a lower carbon footprint during their entire life cycle.

The use of green building materials improves a building structure's sustainability and efficiency in terms of construction, maintenance, design, and renovation. These materials are durable, reusable, or recyclable materials. These materials can be wood, cork, bamboo, soil, adobe, sawdust, straw, recycled plastic , straw bales, and others, which are not adversely affected by heat, cold, or humidity. Green building materials offer various benefits including reduced maintenance costs, energy conservation, flexibility for greater design, and improved occupant health and productivity.

Green Building Material Market Growth Factors

- The declining operation costs of green buildings over time and the rising trends in recycled construction are majorly boosting the demand for green building materials during the forecast period.

- The presence of stringent government regulations and the existence of building codes compelling the use of green building materials in construction projects as sustainable and eco-friendly materials. The market has experienced significant demand due to rise in green-certified buildings, with developers embracing rating systems such as LEED, GRIHA, and WELL.

- The rising application of green building materials in energy-efficient buildings is anticipated to spur the demand for green building materials during the forecast period.

- The rising preference for green building materials over traditional construction materials is expected to offer significant growth opportunities for the green building materials market during the forecast period.

Green Building Material Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 11.94% |

| Green Building Material Market Size in 2025 | USD 533.77 Billion |

| Green Building Material Market Size in 2026 | USD 599.53 Billion |

| Green Building Material Market Size by 2035 | USD 1,648.74 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Application and By End-use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Marke Dynamics

Driver

Increasing focus on environmental sustainability

The rising environmental awareness is expected to boost the growth of the green building materials market during the forecast period. The use of green building materials reduces the burden on natural resources and increases the use of renewable products to curb carbon emissions. The significance of green building materials enables greater design flexibility, low maintenance cost, energy conservation, and others. Several environmental issues such as air pollution, freshwater resource contamination, biodiversity loss resource depletion, and others can be resolved by the utilization of eco-friendly and sustainable building materials.

Bamboo, cork, and other recycled materials are highly used to maintain environmental sustainability as they have a low impact on the environment. Therefore, pollution, emissions, and the depletion of natural resources increase the use of renewable resources and promote the development of a more circular economy.

Restraint: High cost

The high cost of green building materials is projected to hamper the growth of the green building materials market. The high cost associated with green building materials may result in reducing the adoption of green building materials in construction activities in middle-lower income countries. In addition, the lack of awareness among builders and contractors regarding the benefits of green building materials particularly in undeveloped countries is also likely to limit the expansion of the global green building materials market during the forecast period.

Opportunity: Robust growth of the construction sector

The rise in the number of construction activities across the globe is projected to offer a lucrative opportunity for the growth of the green building materials market during the forecast period. Green building materials are well-suited replacements for traditional construction materials due to various benefits. Environmentally friendly construction materials are critical in mitigating global warming. In the construction sector, developers and consumers are emphasizing environmentally friendly, cost-saving, and energy-efficient structures.

The energy efficiency of buildings is improved by the use of these materials as they can regulate the temperature inside, reflective surfaces, offer insulating properties, and others. In addition, favorable government measures to promote the use of green building materials in the construction industry are likely to contribute to the growth of the market. Furthermore, advancements in technology and innovation in materials science have significantly increased the development of new green building materials with improved performance and durability. Thus, the massive shift towards renewable green building materials is expected to bolster the market's expansion in the coming years.

Segment Insights

Application Insights

The insulation segment accounted for the dominating share in 2025 in the green building materials market. The segment's growth is attributed to the owing to the ongoing construction activities in emerging economies, particularly the residential and commercial sectors. Wool is a considered reliable insulator and a rapidly renewable resource. It is commercially available and is abundant in nature. These eco-friendly insulations are made from renewable resources or recycled materials and aim to reduce energy costs significantly by improving home insulation.

The roofing segment is expected to witness a significant share during the forecast period in the green building materials market owing to the increasing use of green roof infrastructure in buildings. This roofing has a positive impact on the environment. In addition, the rising popularity of non-toxic recycled rubber roofing due to its weather resistance and superior durability properties is expected to propel the segment's growth.

End-Use Industry Insights

The residential segment held the largest share of the green building materials market in 2025, the residential segment is expected to sustain the position throughout the forecast period. The growth of the segment is driven by the increasing construction of residential buildings. Residential green building materials prefer products that consume less energy, water, and have a lower environmental impact as well as offer a healthy interior environment. Governments in various countries are offering green housing incentives to promote the construction of green residential projects. Such factors drive the segment's growth.

- In June 2021, the Japanese government announced the green growth strategy, for which a green innovation fund of US$ 15 billion was allocated. Apart from that, even the Tokyo Metropolitan Assembly announced that all the buildings in Tokyo should be enhanced with solar panels by April 2025. Thereby, driving the sales of green building materials in Japan.

The commercial segment is expected to grow significantly during the forecast period owing to the rising use of green building materials in commercial buildings to reduce emissions and maintenance costs. Green buildings can reduce emissions by 35% and maintenance costs by 20%. The use of green building materials has a lower environmental impact when it is installed and maintained as well as ensures an overall improvement in sustainability. The U.S. Green Building Council calls these materials environmentally preferable products for their Leadership in Energy and Environmental Design (LEED) program and as part of their ESG Green Buildings criteria.

Regional Insights

What is the U.S. Green Building Materials Market Size?

The U.S. green building materials market size was estimated at USD 153.87 billion in 2025 and is predicted to be worth around USD 223.43 billion by 2035, at a CAGR of 3.80% from 2026 to 2035.

North America held the dominant share of the green building materials market in 2025. The region is observed to witness prolific growth during the forecast period. The region's growth due to the increasing construction activities, increasing energy demand, rapid urbanization, rising demand for environmentally friendly materials, increasing preference for these materials over conventional construction materials, rising efforts to reduce carbon emissions, and rising awareness regarding the benefits of green building materials. The robust growth of the construction industry in the United States and Canada has considerably increased the demand for green building materials due to the diverse climatic conditions including cold winters and humid summers.

- According to the International Energy Agency (IEA), In August 2022, the U.S. Congress approved the Inflation Reduction Act (IRA) of 2022, combining the objectives of reducing domestic inflation - notably brought by the global energy crisis while tackling climate change. A key stated goal of the act is to reduce carbon emissions by around 40 percent by 2030.

- In March 2024, Canada's federal budget is likely to allocate billions of dollars for investing in building homes and low-cost housing programs according to Housing Minister Sean Fraser. Canada faces a housing affordability crisis as a rapidly increasing immigrant population has far outpaced the number of available homes.

- In June 2023, Eco Material Technologies and Hive 3D unveiled the first 3D-printed homes using near zero–carbon cement as part of The Casitas @ The Halles, a collection of homes ranging from 400 to 900 square feet. PozzoCEM Vite replaces 100% of Portland cement with 92% fewer emissions, according to the company. The advanced material also sets much faster than traditional Portland cement—in 2 to 3 minutes in the formulation used by Hive 3D—allowing rapid printing of sustainable homes. The benefits of 3D-printing buildings include rapid building, reduced construction costs, increased worker safety, and decreased waste. When you add low-carbon cement to the process, the gains grow further.

Asia Pacific is observed to expand at a rapid pace during the forecast period in the green building materials market owing to the presence of prominent market participants, rising use of eco-friendly materials in the construction industries, increasing focus to reduce maintenance and operational costs of the structure, increasing use of renewable products, growing awareness about energy conservation. The growth of the region is attributed to the rapid pace of urbanization in developing countries such as China, Japan, and India, Moreover, rising investment in the infrastructure sector by the government coupled with the construction of residential houses and buildings, is expected to drive the growth of the green building materials market during the forecast period.

- In March 2022, according to the India Report Indian Real Estate's ESG landscape and its progress to a sustainable future, in India the past 5 years have seen a pronounced push towards green buildings; the period saw a 37% increase in the supply of certified buildings, with the addition of ~ 78 million sq. ft. of certified stock, compared with the previous five years (2012-2016).

- According to the IBEF report 2024, FDI in construction development (townships, housing, built-up infrastructure, and construction development projects) and construction (infrastructure) activity sectors stood at US$ 26.42 billion and US$ 32.08 billion, respectively, between April 2000-September 2023.

What are the Advancements in the Green Building Materials Market in Europe?

Europe is expected to have significant growth in the market. This growth is driven by the region's stringent environmental regulations and a strong commitment to sustainability. The EU Green Deal aims to make Europe climate-neutral by the year 2050, which is a major driver for driving up the adoption of green building practices and materials. Countries such as Germany, France, and the UK are leading players.

Germany Green Building Materials Market Trends: The country is characterized by rapid innovation in sustainable materials, with companies investing heavily to meet regulatory standards. This focus on sustainability not only enhances market growth but also positions the region as a leader in green building technologies. Additionally, increasing awareness among consumers and industry stakeholders about health, indoor air quality, and long-term cost savings is further propelling market growth in Germany.

What are the Key Trends in the Green Building Materials Industry in Latin America?

Latin America is expected to witness substantial growth in the market, driven by rapid urbanization efforts, increasing awareness of environmental issues, and government initiatives promoting sustainable construction. Countries like Brazil and Mexico are leading players as they are seen investing heavily in green infrastructure, supported by policies aimed at reducing carbon footprints and enhancing energy efficiency.

Brazil Green Building Materials Market Trends: The demand for innovative and sustainable building solutions is on the rise, which is helping in creating opportunities for growth and collaboration among stakeholders, thus enhancing market dynamics.

How is the Middle East and Africa Region Growing in the Green Building Materials Industry?

The Middle East and Africa are expected to witness steady growth in the upcoming years. This growth is driven by increasing urbanization and the growing emphasis on sustainable development. Governments in the region are increasingly implementing initiatives to promote green building practices, aligning with global sustainability goals and enhancing energy efficiency in the construction sector. Countries like the UAE and South Africa are leading players.

Saudi Arabia Green Building Materials Market Trends: The country's market landscape is characterized by a mix of established players and new startups, all competing to meet the rising demand for eco-friendly materials. This presents significant opportunities for innovation and collaboration, leading to market growth.

Value Chain Analysis of the Green Building Materials Market

- Raw Material Sourcing: This initial stage deals with the sourcing and selection of raw materials such as recycled steel, fly ash, slag cement, bamboo, reclaimed wood, recycled aggregates, and bio-based polymers.

Key Players: Holcim, Tata, BASF - Manufacturing Process: In this stage, the collected raw materials are processed into low-carbon concrete, panels, coatings, eco-friendly paint, and other composite materials.

Key Players: Sika, BASF, Saint-Gobain - Distribution Process: Here, the finished building materials are packed and distributed through construction material distributors, EPC contractors, and real estate developers.

Key Players: Kingspan Group, Holcim, Rockwool International

Green Building Material Market Companies

- BASF SE

- Binderholz GmbH

- Dupont

- Interface Inc.

- Owens Corning

- Saint-Gobain

- Sika AG

- Soben International (Asia-Pacific) Ltd

- Alumasc Group plc.

- Bauder Ltd.

- Wienerberger AG

- Binderholz GmbH

- Homasote Company

- CertainTeed Corporation

- RedBuilt LLC

- Forbo International SA

- PPG Industries, Inc.

- LG Hausys Ltd.

- Kingspan Limited

- Lafarge Company

- Holcim

Recent Developments

- In October 2022, A significant provider of building solutions and material circularity in the UK, Wiltshire Heavy Building Materials was acquired by Holcim. The green building materials market in the United Kingdom will benefit from Holcim's increased market position through this acquisition.

- In April 2023, T2EARTH LLC, the breakthrough, science-based, and innovation-driven manufacturer of sustainable, toxic-chemical free, and superior-performance forest products in the green building world with its focus on eco-wood products, debuts OnWoodTM as the Earth's first ever circular economy, sustainable, Class A, high performance, eco-fire-retardant treated wood (eco-FRTW).

- In August 2022, A manufacturer and distributor of external building materials in Canada and the US, Kaycan, was purchased by Saint-Gobain. With this acquisition, Saint-Gobain increased its market dominance in light and sustainable building, taking over as the dominant siding provider in Canada and broadening its vinyl product line across the United States with complementing solutions in aluminum and engineered wood.

Segments Covered in the Report

By Application

- Framing

- Insulation

- Roofing

- Exterior Siding

- Interior Finishing

- Other Applications

By End-use Industry

- Residential

- Commercial

- Industrial and Institutional

- Infrastructure

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting