What is Green Food Market Size?

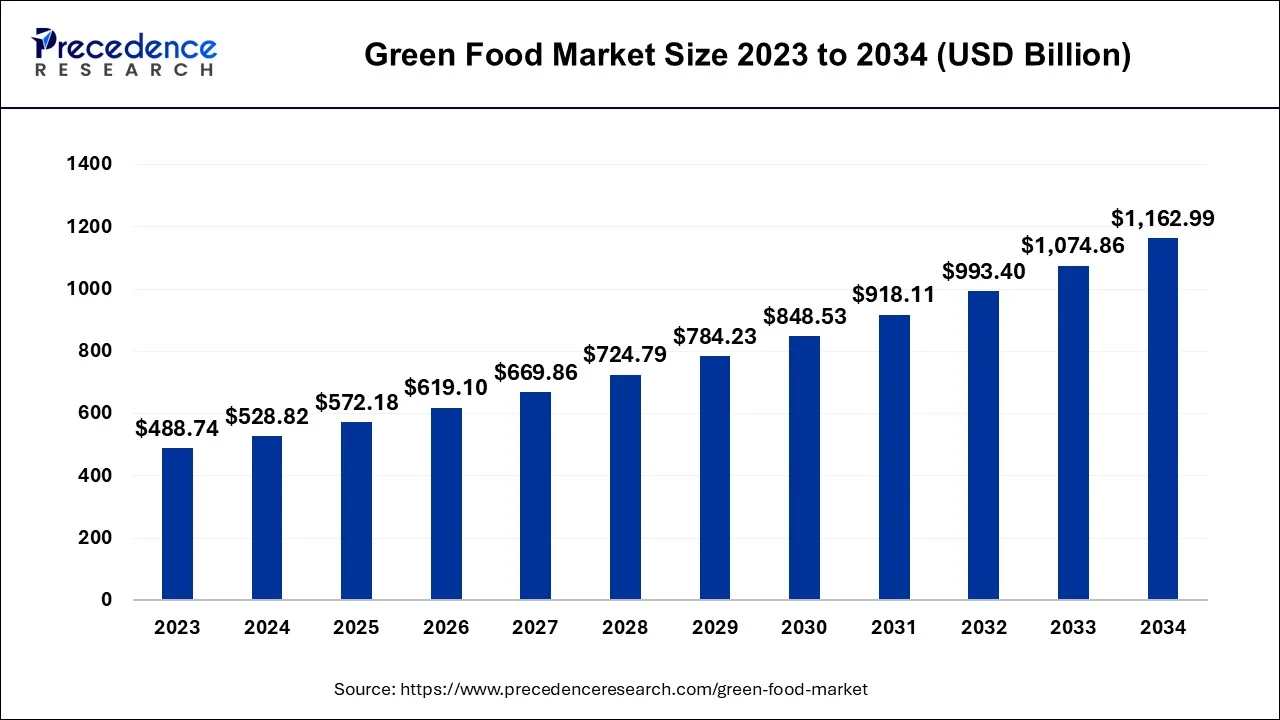

The global green food market size accounted for USD 572.18 billion in 2025 and is anticipated to reach around USD 1,246.67 billion by 2035, growing at a CAGR of 8.1% between 2026 to 2035.

Market Highlights

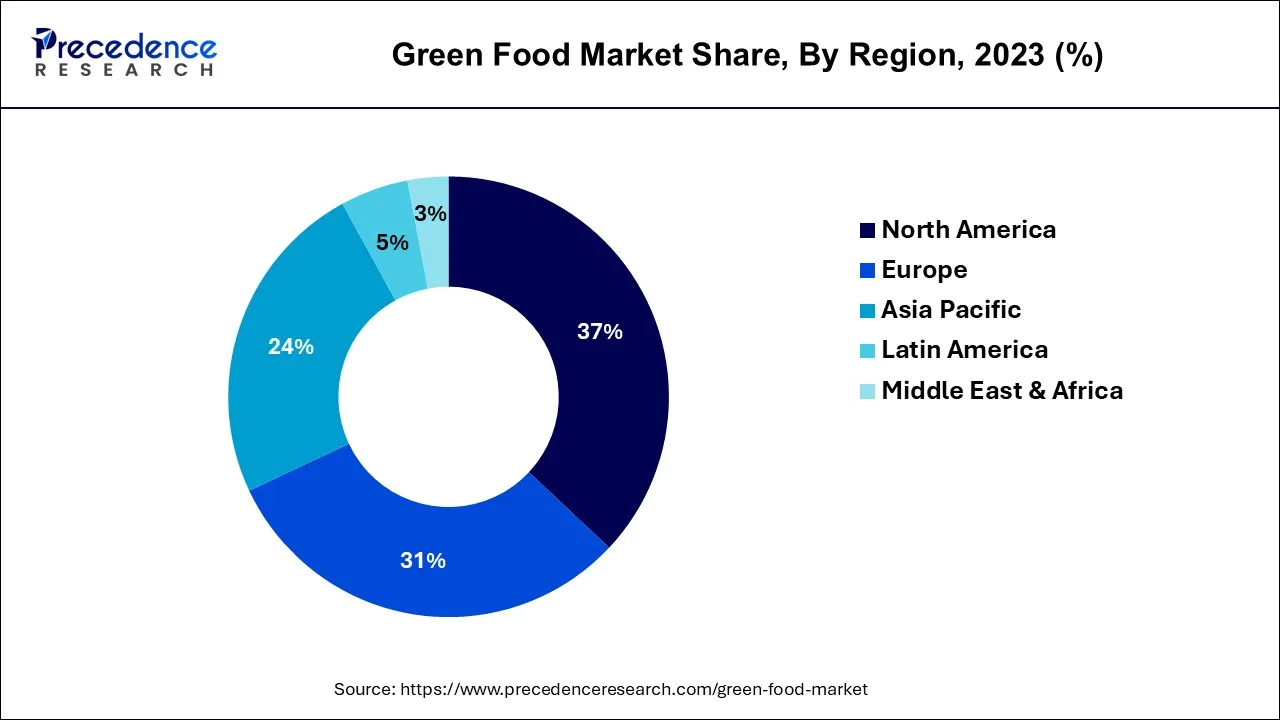

- North America contributed more than 37% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 to 2035

- By type, the organic food segment has held the largest market share of 46% in 2025.

- By type, the plant-based food segment is anticipated to grow at a remarkable CAGR of 10.2% between 2026 to 2035

- By application, the retail segment generated over 42% of revenue share in 2025.

- By application, the food service segment is expected to expand at the fastest CAGR over the projected period.

- By distribution channel, the supermarkets and hypermarkets segment had the largest market share of 38% in 2025.

- By distribution channel, the online retail segment is expected to expand at the fastest CAGR over the projected period.

MarketOverview

The green food market encompasses a range of sustainable, eco-friendly, and health-conscious food products that prioritize environmental and ethical considerations. It includesorganic foodproduced without synthetic pesticides or fertilizers, natural food with minimal processing, plant-based options that reduce the carbon footprint, locally sourced food supporting regional economies, and sustainable seafood choices.

This market caters to consumers seeking healthier, environmentally responsible food options and aligns with the growing trend of ethical and sustainable food production. As awareness of sustainability and health consciousness increases, the green food market offers a diverse range of products to meet these demands while promoting ecological and ethical practices in food production.

Green Food Market Growth Factors

- Consumers are becoming more health-conscious, leading to a demand for natural and organic food products.

- Growing awareness of climate change and sustainability drives consumers to choose eco-friendly and locally sourced options.

- The rise of plant-based diets and meat alternatives contributes to the growth of this market.

- Government regulations and certifications support the production and sale of green food.

- Organic farming practices are gaining momentum as consumers seek pesticide-free options. Ongoing innovation in plant-based food technology is expanding product offerings.

- The emphasis on supporting local economies drives the popularity of locally sourced food.

- Transparency and Labeling: Consumers demand transparency in food labeling, pushing for clear information on the origin and sustainability of products.

- Companies can create new, sustainable food products to meet evolving consumer preferences.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 572.18 Billion |

| Market Size in 2026 | USD 528.82 Billion |

| Market Size by 2035 | USD 1,246.67 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.1% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By Distribution Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising health consciousness and plant-based movement

The surging wave of health consciousness among consumers is a primary driver behind the increasing demand for the green food market. In today's age, individuals are becoming increasingly mindful of the nutritional content of their diets. Green food, notably organic and natural products, have emerged as favored choices due to their perception as healthier options. These selections are often lauded for their reduced use of synthetic pesticides and artificial additives, aligning with consumers' desires for well-being and the minimization of potential health risks linked to conventional alternatives. This heightened health awareness is compelling people to turn to green food in their quest for a more nutritious and balanced diet.

Simultaneously, the remarkable ascent of the plant-based movement is a potent factor propelling the demand for green food. As a growing number of consumers embrace vegetarian, vegan, or flexitarian lifestyles, the need for plant-based alternatives has surged. These alternatives not only bring health benefits but also harmonize with sustainability and ethical considerations, given their typically lower environmental footprint compared to animal-based products. The appeal of the plant-based movement extends well beyond vegetarians and vegans, attracting a broader audience in search of innovative, plant-derived, and nutrient-rich food options. As this dietary transformation reshapes consumption patterns, the green food market thrives by offering a diverse array of plant-based choices to meet the evolving preferences of consumers.

Restraint

Consumer misconceptions and higher costs

Major significant restraint in the green food market is consumer misconceptions. Some consumers may have misunderstandings about green food, including their cost, taste, and nutritional value. There is a misconception that all green food is substantially more expensive than conventionally produced counterparts. While certain green food products can be pricier due to sustainable and organic farming practices, not all are beyond the reach of the average consumer. These misconceptions can deter potential buyers from exploring and embracing green food choices, limiting market growth.

The higher production costs associated with green food production can act as a restraint. Sustainable farming practices, organic certification, and eco-friendly packaging often incur greater expenses. These costs can be passed on to consumers, making green food seem less affordable in comparison to conventionally produced alternatives. The perception of a price premium can discourage budget-conscious consumers from adopting green food options. Moreover, some food producers and retailers may be hesitant to invest in green food production due to concerns about profitability and potential losses in a price-sensitive market. Balancing the goal of sustainability with cost-effective production remains a challenge for the green food industry and can hinder market expansion.

Opportunity

Innovative product development and educational initiatives

The evolving preferences of consumers are fostering a demand for distinctive and eco-conscious food options. In response, food companies are at the forefront of developing innovative products that align with these evolving tastes. These innovations encompass a spectrum of offerings, from plant-based substitutes for conventional meat and dairy products to organic and natural food selections, as well as sustainable packaging solutions. This continuous stream of inventive products not only engages consumers but also propels market expansion by diversifying the array of green food choices accessible to the public.

Educational initiatives play a pivotal role in surging market demand for green food. As consumers become more health and environmentally conscious, they seek information about the benefits of green food and sustainable practices. Educational campaigns, both by food producers and environmental organizations, raise awareness about the positive impact of green food choices on personal well-being and the planet. Moreover, transparent labeling and clear communication about a product's sustainability and sourcing further empower consumers to make informed choices. These educational efforts not only drive demand but also foster a sense of responsibility and accountability in consumers, resulting in a sustained interest in green food options.

Segment Insights

Type Insights

According to the type, the organic food segment has held a 46% revenue share in 2025. Organic food in the green food market refers to products grown and processed without synthetic pesticides or fertilizers, genetically modified organisms (GMOs), or irradiation. They align with consumer demands for healthier and environmentally responsible choices. Current trends show a continued preference for organic food due to their perceived health benefits and lower environmental impact. This includes organic fruits and vegetables, dairy, and meat products, with increased availability and certification playing a role in their sustained popularity.

The plant-based food segment is anticipated to expand at a significant CAGR of 10.2% during the projected period. Plant-based food is derived from plant sources and excludes animal ingredients. This category includes items like meat substitutes, dairy alternatives, and plant-based snacks. The trend toward plant-based diets has fueled the growth of this segment. Innovations in plant-based food technology, flavor, and texture continue to make plant-based options more appealing, contributing to their increasing presence in the green food market. These trends underscore the market's responsiveness to evolving consumer preferences and ethical considerations.

Application Insights

Based on the application, the retail segment is anticipated to hold the largest market share of 42% in 2025. Within the green food market, the segment pertains to the direct sale of eco-conscious food products to individual consumers. This occurs through various channels such as mainstream supermarkets, specialty stores, online platforms, and farmers' markets. An important trend in this sector is the expanding presence of green food choices in conventional supermarkets. This trend makes eco-friendly options increasingly accessible to a broader audience of consumers. Moreover, individuals are displaying a growing preference for clear product labeling and recognizable certifications, which simplify the process of identifying and purchasing green food products aligned with their values and health-conscious lifestyles.

On the other hand, the food service segment is projected to grow at the fastest rate over the projected period. The food service application involves providing green food options in restaurants, cafes, and other dining establishments. A notable trend is the incorporation of plant-based and sustainable dishes on food service menus, catering to the rising demand for eco-conscious dining experiences. Many restaurants are also adopting farm-to-table concepts, sourcing ingredients locally, and promoting the sustainable and ethical aspects of their food offerings to attract environmentally conscious diners. This trend emphasizes the growing integration of green food choices into the food service industry.

Distribution Channel Insights

In 2025, the supermarkets and hypermarkets segment had the highest market share of 38% on the basis of the distribution channel. Supermarkets and hypermarkets play a central role in the green food market, offering a diverse range of eco-friendly products to a broad consumer base. These retail channels are witnessing a growing trend towards dedicated sections for organic, natural, and sustainable food products. Consumers appreciate the convenience and variety offered by these stores, making it easier to access green food, aligning with their health and sustainability goals.

The online retail segment is anticipated to expand at the fastest rate over the projected period. Online retail has become an increasingly significant distribution channel for green food, with consumers turning to e-commerce platforms to access eco-conscious products. This trend surged during the COVID-19 pandemic, and it continues to grow as consumers value the convenience, wide selection, and contactless shopping experience provided by online retailers. Green food brands are also leveraging this channel to reach a broader audience, and as a result, online sales of green food are on the rise.

Regional Insights

U.S. Green Food Market Size and Growth 2026 to 2035

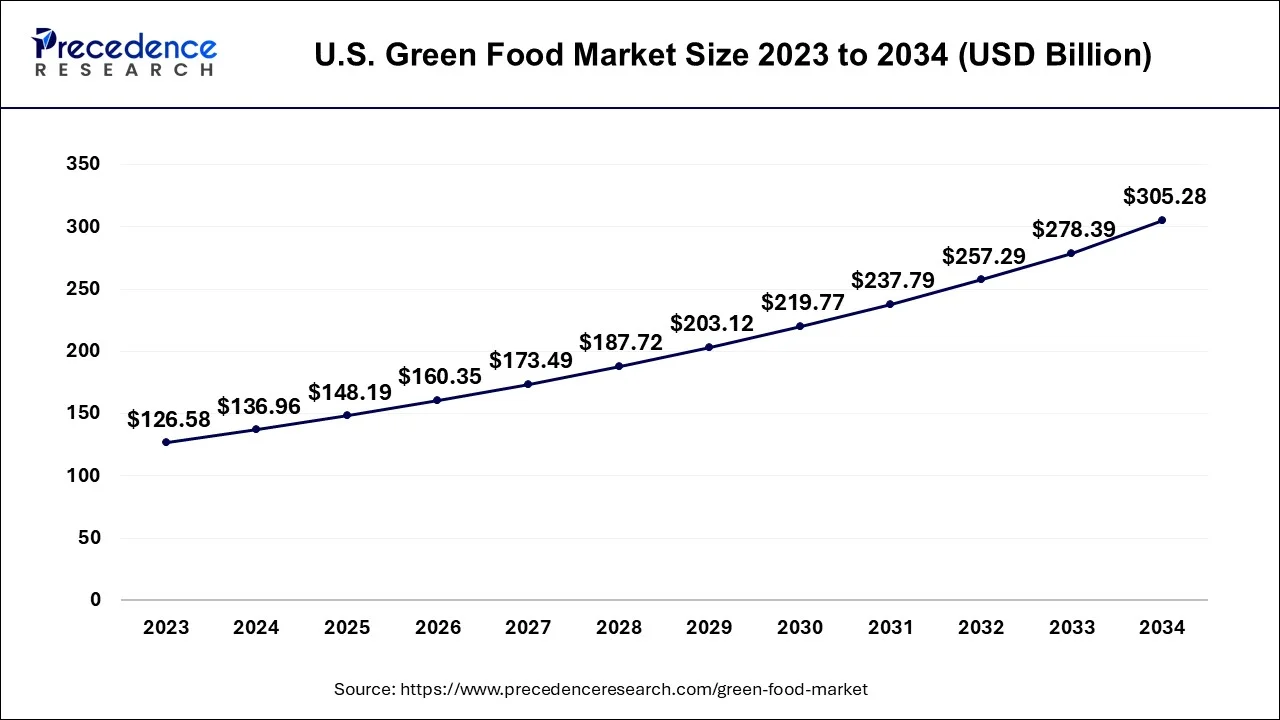

The U.S. green food market size is estimated at USD 148.19 billion in 2025 and is expected to be worth around USD 328.31 billion by 2035, at a CAGR of 8.28% between 2026 to 2035.

U.S. Green Food Market Analysis

The U.S. market is growing due to rising consumer awareness of health, wellness, and environmental sustainability. Increasing demand for organic, plant-based, and locally sourced products, coupled with e-commerce expansion, government certifications, and eco-friendly practices, is driving market growth. The pandemic further accelerated online purchasing of green food products, boosting accessibility and adoption nationwide.

North America has held the largest revenue share 37% in 2025. In North America, the green food market showcases a robust shift towards sustainability and health-conscious choices. Consumers increasingly favor organic, plant-based, and locally sourced products, motivated by concerns for both personal health and environmental well-being. The pandemic accelerated online shopping for green food, with e-commerce becoming a significant distribution channel. Regulatory support and certifications bolster the industry's growth. Notably, the United States is a key player in the market, with a burgeoning market for eco-friendly and health-centric food options.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is estimated to observe the fastest expansion. The region is witnessing a surge in demand for green food, driven by the growth of the pharmaceutical and biotechnology sectors in countries like India and China. The adoption of plant-based diets and meat alternatives is on the rise. Furthermore, the region's robust scientific research activities, coupled with the expansion of the healthcare and biopharmaceutical sectors, contribute to the increasing demand for green food products. Sustainable and eco-friendly practices are gaining prominence, making green food a crucial element in environmentally responsible processes across research and industry.

Why is Europe Considered a Significant Market for Green Food?

In Europe, the green food market reflects a strong emphasis on sustainability and ethical food practices. Consumers are increasingly drawn to organic, natural, and locally sourced products, driven by concerns for personal well-being and environmental preservation. The region is known for its stringent regulations and certifications supporting the green food industry. Sustainability practices are deeply ingrained, and innovative eco-friendly food options continue to find favor among European consumers, making it a key market for green food products.

India Green Food Market Analysis

India's market is growing as consumers increasingly prioritize safe, chemical-free, and nutrient-rich food products. Rising disposable incomes, rapid urbanization, and greater exposure to global health and wellness trends are driving demand for organic and sustainably produced foods. Additionally, the expansion of organized retail, the growth of online grocery platforms, and strong government support for organic farming are accelerating the nationwide adoption of eco-friendly and healthy food options.

UK Green Food Market Analysis

The UK market is growing due to growing consumer demand for organic, locally sourced, and sustainably produced foods. Rising awareness of health, environmental impact, and ethical consumption drives purchases. Government regulations, certifications, and initiatives promoting eco-friendly agriculture, along with the popularity of plant-based diets and convenient green food options, further support market growth.

Value Chain Analysis

- Raw Material Procurement: This stage focuses on sourcing fresh, organic, and high-quality produce from trusted suppliers to ensure product integrity and sustainability.

Key Players: Cargill, Archer Daniels Midland (ADM), Olam International, and Bühler Group. - Packaging and Branding : Designing eco-friendly packaging and promoting brand identity to attract environmentally conscious and health-focused customers.

Key Players: Tetra Pak, Amcor, Huhtamaki, and UFlex. - Distribution: Transporting products efficiently to retail stores, markets, and customers while maintaining freshness and timely delivery.

Key Players: Logistics companies, cold chain distributors, delivery service providers, warehousing staff, and e-commerce platforms.

Top Companies in the Market & Their Offerings

- Whole Foods Market Inc.: Retailer specializing in organic, natural, and sustainably sourced foods, offering fresh produce, packaged goods, and eco-friendly products while promoting health-conscious and environmentally responsible choices.

- Organic Valley: Cooperative producing organic dairy, eggs, and plant-based products, emphasizing sustainable farming, animal welfare, and high-quality natural ingredients for health-conscious consumers.

- Nature's Path Foods: Offers organic cereals, granolas, and snacks made from non-GMO and sustainably sourced ingredients, focusing on health, nutrition, and environmentally responsible practices.

- Danone: Global food company providing organic and plant-based dairy alternatives, bottled water, and specialized nutrition products, with a strong commitment to sustainability and health-focused innovations.

- General Mills Inc.: Manufactures and markets organic, natural, and plant-based foods, including cereals, snacks, and packaged goods, focusing on health, sustainability, and environmentally friendly practices.

- The Hain Celestial Group: Produces organic, natural, and plant-based products across beverages, snacks, and personal care, emphasizing sustainability, ethical sourcing, and health-conscious offerings.

Other Green Food Market Companies

- United Natural Food Inc.

- SunOpta Inc.

- Amy's Kitchen

- Naturex

- Eden Food

- Clif Bar & Company

- WhiteWave Food Company

- Hain Celestial

- Earth's Best

Recent Developments

- In 2022,Amul, an Indian dairy company, diversified into the organic food market with a range of products, including organic rice, flour, honey, chocolates, and potato items. They also initiated plans to establish a "green college" to educate young farmers about natural and organic farming practices and create "organic haats" for selling organic products.

- In 2022,Organic India, a renowned organic tea and wellness brand, introduced Tulsi Detox Kahwa and Peppermint Refresh teas. These certified organic and vegan teas come in loose-leaf and teabag options, aligning with the brand's commitment to providing healthy and sustainable wellness products.

Segments Covered in the Report

By Type

- Organic Food

- Natural Food

- Plant-Based Food

- Locally Sourced Food

- Others

By Application

- Retail

- Foodservice

- Food Processing

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting