What is the Green Mining Market Size?

The global green mining market size is calculated at USD 13.55 billion in 2025 and is predicted to increase from USD 14.03 billion in 2026 to approximately USD 18.53 billion by 2034, expanding at a CAGR of 3.54% from 2025 to 2034. The market growth is attributed to the increasing adoption of renewable energy technologies and strengthened regulatory frameworks, which drive low-impact mining practices.

Market Highlights

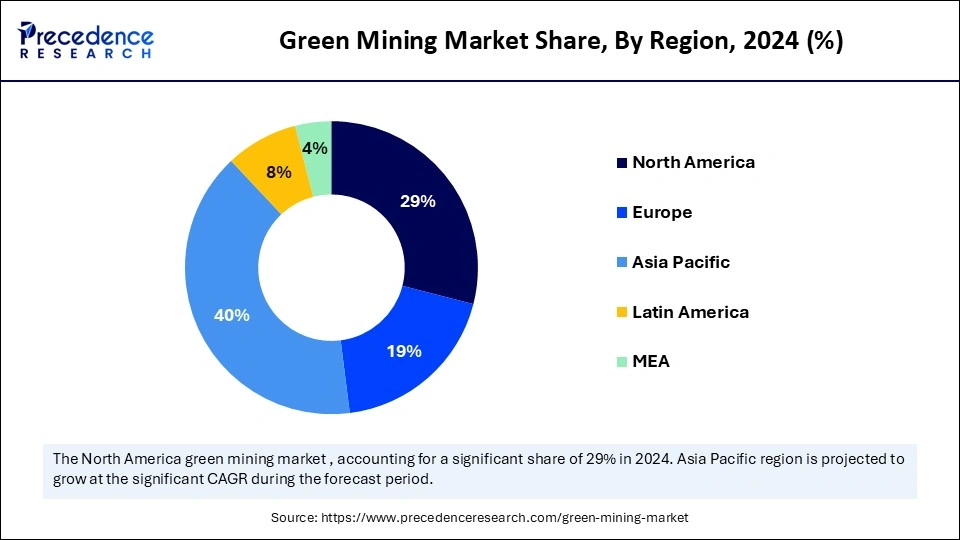

- Asia Pacific dominated the global green mining market with the largest share of 40% in 2024.

- By mining method, the open-pit mining segment accounted for a considerable share of 40% in 2024.

- By mining method, the longwall mining segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By sustainable technology, the energy-efficient communication & sorting segment captured the biggest market share of 30% in 2024.

- By sustainable technology, the emission reduction systems segment is set to experience the fastest CAGR from 2025 to 2034.

- By mineral type, the coal segment contributed the maximum market share of 35% in 2024.

- By mineral type, the lithium segment is anticipated to grow with the highest CAGR during the studied years.

- By equipment type, the electric haul trucks segment generated the major market share of 45% in 2024.

- By equipment type, the battery-powered drills segment is projected to expand rapidly in the coming years.

Market Size and Forecast

- Market Size in 2025: USD 13.55 Billion

- Market Size in 2026: USD 14.03 Billion

- Forecasted Market Size by 2034: USD 18.53 Billion

- CAGR (2025-2034): 3.54%

- Largest Market in 2024: Asia Pacific

What Encompasses the Green Mining Market?

The introduction of renewable energy into the mining system is a key factor driving the green mining market toward sustainable mining. Under this technological change, the inclusion of solar, wind, and hydrogen power supplies aims to substitute traditional fossil fuels, thereby reducing greenhouse gas emissions and operational expenses. The use of technologies like solar mining gear, wind power to process plants, and hydrogen-powered fuel cells to haul trucks are all signs of the industry being sustainable.

- According to the International Energy Agency (IEA), the mining sector should transition to renewable energy sources to achieve the goal of net-zero emissions by 2050, aligning with global climate objectives. Moreover, the Organisation for Economic Co-operation and Development (OECD) also stresses that introducing renewables to the mining process can minimise environmental effects. These inventions will help considerably reduce the carbon footprint and operational costs.

Impact of Artificial Intelligence on the Green Mining Market

Artificial intelligence enhances green mining by making it more efficient and reducing environmental impact throughout the entire value chain. To reduce drilling impacts on the land and preserve resources, companies use AI in the exploration of the geological data to detect deposits with minimal drilling. Furthermore, the AI-controlled autonomous trucks, drilling rigs, and sorting systems for ore allow companies to consume less energy and water while recovering as many useful minerals as possible.

Significant Technology Changes On The Green Mining Market

The green mining market is undergoing a disruptive technological change, influenced by the pressing need to minimize environmental impacts and the adoption of stringent global sustainability regulations. The adoption of renewable-powered mining activities, with firms installing solar, wind, and hybrid energy sources, reduces the use of fossil fuels and carbon emissions. Significant changes are being made through the use of artificial intelligence (AI), automation, and digital twins to optimize mine planning, predictive maintenance, and energy consumption, thereby reducing waste and operational inefficiencies.

Anglo American and other companies are testing the use of hydrogen to operate haul trucks and employing AI systems that manage water, reducing resource usage. There is a growing trend in bioleaching and green chemistry to extract metals such as copper, nickel, and cobalt. They produce fewer toxic byproducts, which provide cleaner alternatives to traditional smelting. The recycling and urban mining technologies are also on the rise, enabling the recovery of important minerals from electronic waste and secondary sources, which relieves pressure on virgin mining.

Green Mining Market: Trade, Policy & Investment Shifts in 2024-2025

Democratic Republic of Congo (DRC) has replaced its cobalt export ban with quota limits starting October 2025, setting export ceilings of 18,125 tons for the remainder of 2025 and 96,600 tons annually in 2026-2027, aiming to improve price stability and traceability (Source: https://www.reuters.com)

Forests & Finance coalition reports that between 2016-2024, banks invested US$493 billion into transition mineral mining while investors held US$289 billion in related bonds/shares. However, the report highlights gaps in ESG and human rights safeguards. (Source: https://www.theguardian.com)

The Intergovernmental Forum on Mining, Minerals, Metals & Sustainable Development (IGF) in its 2024 Annual Report added Chile, Comoros, and Timor-Leste to its membership, reaching 85 countries, and ran 24 capacity-building programs for over 1,200 participants, focusing on sustainable and fair mining governance. (Source: https://evolutionautoindia.in)

India's 2024 Budget introduces a “Critical Minerals Mission” and waives customs duty on 25 critical minerals, including lithium and cobalt, to drive domestic production, recycling, and processing of those resources.(Source: https://commission.europa.eu)

The European Union enforced the Critical Raw Materials Act on 23 May 2024, aimed at securing a sustainable supply of raw materials by boosting extraction, processing, and recycling capacities within the EU. The Act aligns with EU goals to reduce strategic dependencies and enhance resilience in energy transition supply chains.(Source: https://vajiramandravi.com)(Source: https://www.unido.org)

Lloyds Metals & Energy Ltd. (India) moves to establish the Surjagarh Iron Ore Mine as India's first “green mine” in Maharashtra by adopting multiple green-technology measures. The annual CO? emissions reduction achieved amounts to ~32,000 tonnes initially, with an expected rise in emissions after the full transition.

UNIDO launched the Global Alliance for Responsible and Green Minerals in January 2024, uniting governments, mining companies, academic institutions, NGOs, financial institutions, labor unions, and affected communities to promote responsible mineral extraction, higher local value-addition, and adherence to human rights and ESG standards.

Green Mining Market Outlook

- Industry Growth Overview: The green mining market is expected to expand rapidly from 2025 to 2034, driven by increasing environmental regulations, the push for sustainable mining practices, and growing demand for eco-friendly extraction technologies. Key growth drivers include innovations in energy-efficient mining processes, waste reduction techniques, and the adoption of renewable energy sources in mining operations.

- Automation and Digital Transformation: With the growing trend of digitization, mining companies are increasingly implementing autonomous vehicles, IoT sensors, and AI to simultaneously optimize extraction, reduce energy use, and enhance safety and efficiency.

- Global Expansion: The market is expanding globally as governments and industries adopt stricter environmental regulations and embrace sustainable mining practices to reduce carbon footprints and environmental degradation. Emerging regions, particularly in Latin America, Africa, and Asia-Pacific, present opportunities as they focus on developing eco-friendly mining technologies and exploring renewable energy solutions to meet growing demand for minerals while minimizing environmental impacts.

- Major Investors:Major investors in the market include multinational corporations like Rio Tinto, BHP, and Anglo American, which are funding research and implementing sustainable mining technologies to reduce environmental impact and improve resource efficiency. Additionally, venture capital firms and private equity investors are backing startups and emerging companies developing innovative green technologies, such as renewable energy integration, waste management solutions, and sustainable extraction methods.

- Startup Ecosystem: The ecosystem is maturing, focusing on AI-powered solutions, real-time IoT environmental monitoring, and advanced processing technologies like bioleaching. Emerging firms are attracting funding for scalable solutions that enhance efficiency and ensure regulatory compliance.

Green Mining MarketGrowth Factors

- Driving Technological Innovation in Low-Impact Extraction: Advancements in automation, AI, and robotics are driving efficiency and reducing environmental impacts in mineral extraction processes.

- Growing Integration of Circular Economy Practices: The adoption of recycling and waste recovery techniques is increasing, promoting resource efficiency and reducing dependence on virgin materials.

- Rising Government Incentives for Sustainable Mining: Governments worldwide are implementing policy frameworks and offering subsidies to encourage the adoption of cleaner mining technologies.

- Boosting Research in Eco-Friendly Mineral Processing: Increased R&D investments are boosting the development of greener processing methods that reduce energy and water consumption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.55 Billion |

| Market Size in 2026 | USD 14.03 Billion |

| Market Size by 2034 | USD 18.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.54% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mining Method, Sustainable Technology, Mineral Type, Equipment Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Increasing Demand for Sustainable Mineral Extraction Driving Growth in the Green Mining Market?

Increasing demand for sustainable mineral extraction is expected to drive market growth. According to the IEA data on the Global Critical Minerals Outlook 2024, lithium demand has increased by 30% in 2023. In the case of high-ambition scenarios, nearly all key energy-transition minerals are expected to have nearly tripled in value by 2030, which puts additional pressure on producers to rely on less impactful mining techniques.

Governments and companies focus on sustainable remedies to lower carbon intensity and decrease land disturbance, large miners. They allocate funds to electric haulage, renewable power processing, and accurate sorting of ore to boost energy productivity and recoveries. Furthermore, the high focus on corporate social responsibility and investor-driven sustainability targets is estimated to strengthen market momentum.

Restraint

High Capital Investment Requirements Hamper Adoption of Green Mining Solutions

High capital investment requirements are expected to slow the adoption of green mining solutions, further hindering the market. Electric haul trucks, renewable energy-powered processing facilities, and AI-controlled ore sorting are the most challenging to implement due to their high initial costs. Furthermore, the restraint due to technological limitations is anticipated to challenge the rapid deployment of green mining techniques.

Opportunity

How is Growing Regulatory Pressure on Emissions and Resource Efficiency Accelerating the Adoption of Green Mining Technology?

Growing regulatory pressure on emissions and resource efficiency is expected to create significant opportunities for market players. Environmental regulators are implementing more stringent controls on carbon intensity, water discharge, and waste management to demand real-time emissions and resource-use reporting. To comply with these standards and minimize operational risk, companies incorporate low-emission sources of power, such as solar arrays and hydrogen-fueled tools.

Public access to permit and emissions data, as well as the encouragement of operators to install continuous-monitoring systems, are the results of regulations such as the EU Industrial Emissions Portal Regulation, which became effective on 22 May 2024. In 2024, the ICMM announced that more than 25 member companies are committed to achieving net-zero Scope 1 and Scope 2 emissions by 2050, with targets to be met by 2030. Additionally, the surging demand for critical minerals used in renewable energy technologies is projected to propel industry expansion. (Source: https://www.icmm.com)

Segment Insights

Mining Method Insights

Why Is Open-Pit Mining Dominating the Green Mining Market?

The open-pit mining segment dominated the green mining market in 2024, accounting for an estimated 40% market share, due to the high throughput and reduced unit extraction costs associated with large near-surface deposits. This favours open-pit methods for operators, which are suitable for bulk commodities such as copper, iron ore, and lithium.

Current open-pit mining operations combine electric haul fleets and new high-scale renewable generation power plants. This diminishes Scope 1 emissions and enhances the cost-effectiveness of benign mining. The IEA emphasised in 2024 that investment inflows in critical minerals supply slowed to 5% in 2024, or 14% in 2023. Those majors are focusing on open-pit projects that utilize capital and renewable energy integration most effectively. Furthermore, the ore-sorting and in-pit crushing technologies enhance recovery and reduce energy consumption, further fuelling the segment. (Source: https://www.iea.org)

The longwall mining segment is expected to grow at the fastest rate in the coming years, owing to the expansion of the underground mining technique. Mining companies use the longwall method because it achieves high resource recovery and minimal disturbance to the surface land compared to large open pits.

This meets the more rigid permitting and community-acceptance standards. Additionally, the large miners also associated nature-positive and net-zero pledges with a greater use of underground technologies that restrict land perturbation, consistent with the adoption of longwall mining.

Sustainable Technology Insights

What Makes Energy-Efficient Comminution & Sorting the Largest Sub-Segment in Green Mining?

The energy-efficient comminution & sorting segment held the largest revenue share in the green mining market in 2024, accounting for approximately 30% of the market, as it reduced overall site energy intensity and decreased operational costs.

Optical, XRF, and LIBS sensor-based ore sorting and conveyor delivery elevate feed grade to processing plants and increase recoveries, and reduce haulage volumes and tailings. Moreover, the increased investment in comminution and sorting upgrades will further facilitate the segment in the coming years.The emission reduction systems segment is expected to grow at the fastest CAGR in the coming years, owing to the increased implementation of emission control mechanisms.

Operators are accelerating the electrification of mobile fleets and testing hydrogen-fueled heavy haulage to reduce the number of diesel combustion and Scope 1 emissions at the source. Furthermore, to reduce direct emissions caused during the refining and processing phases, smelters and concentrators further increase their demand for emission reduction systems.

Mineral Type Insights

Why Does Coal Remain the Dominant Mineral Type in Green Mining?

The coal segment dominated the green mining market in 2024, accounting for 35% of the market share, as coal continues to be a significant source of energy in the developing economies and industrial centres. According to the International Energy Agency (IEA), global coal power generation increased by nearly 1% in 2024, underscoring its robustness in energy reserves.Electrified haulage, methane capture systems, and other green mining technologies help alleviate the environmental impacts of coal mining activities. Thus, allowing coal mining projects to comply with more stringent environmental standards further propels the green mining technology market.

The lithium segment is expected to grow at the fastest rate in the coming years, driven by the unique applications of lithium in the production of electric cars, grid-scale storage, and electronic devices.

- In 2023, the USGS reported that the world had almost 180,000 metric tons of lithium production, a 23% increase from the previous year, driven by the rapid adoption of battery electric vehicles and renewable energy storage systems. Moreover, the growth of lithium mining makes it the most rapidly expanding sub-industry within green extraction, which is relatively close to the overall process of decarbonization globally.(Source: https://pubs.usgs.gov)

Equipment Type Insights

How Are Electric Haul Trucks Leading the Green Mining Market?

The electric haul trucks segment held the largest revenue share in the green mining market in 2024, with a market share of about 45%, as they are quickly replacing fossil-fueled trucks in mining companies. Thus, decreasing carbon emissions, lowering fuel prices, and enhancing efficiency.

The International Council on Mining and Metals (ICMM) also reported that mining activities using electric haul trucks have recorded a reduction of up to 30% in greenhouse-gas emissions compared to the use of diesel vehicles. Furthermore, programs funded by governments and development agencies, such as the World Bank and the International Energy Agency (IEA), aim to incentivize the use of zero-emission haulage, thereby strengthening their dominance in the market.(Source: https://theicct.org)

The battery-powered drills segment is expected to grow at the fastest CAGR in the coming years, as they are less noisy, cleaner, and efficient than the pneumatic or diesel-powered ones. This addresses the environmental and safety concerns associated with mining activities.

The International Labour Organisation (ILO) argues that noise reduction and better air quality in the mines can promote the health of workers, motivating them to purchase battery-powered tools. Additionally, the battery-powered drills are becoming the most dynamic sub-segment of the equipment category, driven by both sustainability goals and technological advancements.

Regional Insights

Asia Pacific Green Mining Market Size and Growth 2025 to 2034

The Asia Pacific green mining market size is exhibited at USD 5.42 billion in 2025 and is projected to be worth around USD 7.50 billion by 2034, growing at a CAGR of 3.65% from 2025 to 2034.

What Factors Make Asia-Pacific the Largest Region in the Green Mining Market?

The Asia Pacific dominated the global market with the largest share in 2024, accounting for an estimated 40% market share, and is expected to maintain this position in the coming years, driven by rapid industrialization, abundant mineral resources, and substantial investments in sustainable mining technologies.

In 2024, the Asia-Pacific region supplied 62.4% of the world's energy and contributed 52.2% of the total CO2 emissions from energy, with coal accounting for 56% of the energy mix. The governments of Australia, China, and Indonesia have enacted strict sustainability policies and incentives for low-carbon mining projects, which have increased the use of green technologies. BHP, Rio Tinto, and Vale, the other key mining companies, have declared their intentions to use an electrified haul fleet and battery-operated devices to enhance their Asia-Pacific regional dominance.

India Green Mining Market Trends

India is rapidly emerging as a key player in the green mining market, driven by government initiatives aimed at achieving sustainability goals and reducing dependency on imported minerals. With a strong emphasis on sustainable resource management, waste recycling, and land reclamation, the country is striving to integrate eco-friendly mining practices while fostering economic growth and environmental protection.

What Potentiates the Growth of the Green Mining Market in North America?

The growth of the green mining market in North America is primarily fueled by increasing regulatory pressures, government incentives, and a strong focus on sustainability across the mining industry. North American countries, particularly the U.S. and Canada, are adopting greener mining practices to meet stricter environmental regulations, reduce carbon footprints, and enhance resource efficiency. Additionally, the rising demand for ethically sourced and environmentally friendly minerals for electric vehicle batteries, renewable energy infrastructure, and high-tech industries further propels investment in sustainable mining technologies.

U.S. Green Mining Market Trends

The U.S. leads the market thanks to its emphasis on technological innovation, strict environmental regulations, and substantial investments in sustainable practices. This strategy, backed by government initiatives and major tech firms, concentrates on developing advanced, sustainable methods for extracting critical minerals and maintaining a secure supply chain.

How is the Opportunistic Rise of Europe in the Green Mining Market?

Europe is experiencing an opportunistic rise in the market, driven by strict environmental regulations, high public awareness, and a commitment to achieving net-zero emissions. The market emphasizes circular economy principles, with significant investment in developing technologies for resource efficiency, reprocessing tailings, and urban mining. Leading mining equipment manufacturers in countries like Sweden, Finland, and Germany are developing advanced, automated, and electric machinery to meet the needs of a globally conscious market.

Germany Green Mining Market Trends

Germany acts as a key innovation hub in Europe's green mining sector, especially in producing high-tech mining equipment and engineering solutions that support sustainable practices. Although domestic mining is limited, Germany's strength is in engineering expertise, exporting advanced automation systems, water management technologies, and energy-efficient machinery worldwide. German companies are leading the way with zero-waste mining ideas and digital solutions to enhance operational transparency and lower environmental impact.

What Opportunities Exist in Latin America for the Green Mining Market?

Latin America presents significant opportunities for the green mining market, fueled by stricter regulations, community demands for sustainable practices, and a global push for ethical sourcing of minerals crucial for the energy transition. Countries such as Chile, Peru, and Brazil are leading the adoption of eco-friendly technologies to lessen the environmental impact of extensive mining activities. The emphasis is on boosting energy efficiency, conserving water, and implementing advanced waste management techniques to meet international sustainability standards and preserve social licenses to operate.

Brazil Green Mining Market Trends

Brazil plays a key role in the green mining market, driven by its abundant mineral resources and a complex regulatory landscape that increasingly focuses on sustainable practices. Major mining companies in Brazil are investing heavily in technologies like renewable energy integration, electric vehicles for hauling, and advanced water treatment facilities aimed at improving environmental performance and efficiency. These initiatives aim to balance the economic importance of mining with environmental protection and community engagement.

What Factors Contribute to the Growth of the Green Mining Market in the Middle East and Africa?

The market in the Middle East and Africa is fueled by the strong mineral extraction industries in South Africa and Middle Eastern countries, helping diversify their economies. The push for green mining practices is driven by the need to attract foreign investments, which often now require meeting environmental, social, and governance (ESG) standards. The region aims to capitalize on abundant solar energy to power operations and employs modern water management methods to address water scarcity issues native to the climate.

UAE Green Mining Market Trends

The UAE leads the market in the MEA, driven by a strategic focus on economic diversification and sustainable development. While mineral extraction isn't its main industry, the country invests in innovative solutions and research & development to support sustainable practices within quarrying and extraction sectors. The focus is on technology that improves efficiency, minimizes water use, and meets high environmental standards, aligning with the UAE's broader efforts toward a circular economy and greater environmental stewardship.

Green Mining Market: Regulatory Landscape

| Country / Region | Regulatory Body | Key Regulations / Frameworks | Focus Areas |

Notable Notes |

| United States | .S. EPA (Environmental Protection Agency), U.S. Department of Energy (DOE) | Clean Air Act & Clean Water Act (for emissions & discharges) - Inflation Reduction Act (2022), sustainability incentives | Emission reduction - Wastewater treatment - Critical minerals funding | The DOE announced $3.5 billion in 2024 for battery material processing projects to encourage low-carbon mining practices. |

| European Union | European Commission + European Chemicals Agency (ECHA) + DG GROW | EU Critical Raw Materials Act (2023) - EU Green Deal - Industrial Emissions Directive | Sustainable sourcing - Supply chain traceability - Low-carbon extraction | The Critical Raw Materials Act sets a target for 10% of raw materials to be mined within the EU by 2030, adhering to strict environmental standards. |

| China | Ministry of Ecology and Environment (MEE) + Ministry of Natural Resources (MNR) | Green Mine Construction Guidelines - 14th Five-Year Plan for Green Mining (2021–2025) | Energy efficiency - Land restoration - Tailings & waste reduction | China designated over 1,000 green mines by 2024, aiming for nationwide adoption of eco-mining standards by 2035. |

| India | Ministry of Mines + MoEFCC (Environment, Forest, and Climate Change) | Sustainable Development Framework (SDF) for Mining - Star Rating of Mines Scheme | Biodiversity conservation - Mine closure planning - Energy efficiency | By 2024, over 150 mines achieved 4–5 star ratings, reflecting compliance with green benchmarks in resource efficiency and environmental care. |

| Australia | Department of Industry, Science and Resources (DISR) + Minerals Council of Australia (MCA) | Towards Sustainable Mining (TSM) Program - EPBC Act (Environment Protection and Biodiversity Conservation) | ESG transparency - Water use management - Community engagement | Australia's TSM framework aligns with ICMM standards, requiring miners to publish annual sustainability performance from 2025 onward. |

Value Chain Analysis

Research, Exploration, and Innovation

This focuses on identifying mineral deposits using advanced techniques and developing sustainable technologies.

- Key Players: BHP, Rio Tinto, Anglo American plc, and Vale S.A.

Technology and Equipment Manufacturing

This involves designing and producing specialized, energy-efficient, and low-emission mining equipment.

- Key Players: Caterpillar, Komatsu, Liebherr Group, Sandvik AB, Epiroc, and Hitachi Construction Machinery.

Mining Operations and Processing

This is the core stage of extracting and processing minerals using green practices like renewable energy and advanced water recycling.

- Key Players: BHP, Anglo American plc, Rio Tinto, Vale S.A., Glencore, and Antofagasta plc.

Waste Management and Resource Recovery

This focuses on managing and reprocessing waste products to minimize environmental impact and create a circular economy model.

- Key Players: Vale S.A. and Sika AG.

Top Vendors in Green Mining Market & Their Offerings

- Rio Tinto (UK/Australia): Rio Tinto, a global mining leader, is deploying electric haul trucks, renewable-powered smelters, and AI-driven ore processing to cut carbon intensity and improve efficiency.

- BHP Group (Australia): BHP has accelerated green mining initiatives by integrating renewable energy across its operations, while also advancing water recycling technologies.

- Vale S.A. (Brazil): Vale is a frontrunner in green mining practices, implementing dry stacking of tailings and electrification programs across its nickel and iron ore projects.

- Newmont Corporation (USA): The world's largest gold producer, Newmont emphasizes carbon reduction through the integration of renewable power and advanced mine closure planning to minimize its environmental footprint.

- Teck Resources (Canada): Teck has committed to achieving carbon neutrality by 2050, deploying autonomous electric drills, entering into renewable energy supply agreements, and implementing biodiversity-focused land rehabilitation programs.

- Caterpillar Inc. (USA): A key supplier of mining equipment, Caterpillar develops electric haul trucks, autonomous machines, and advanced energy storage solutions that are central to enabling low-carbon mining operations.

Green Mining Market Companies

- Anglo American PLC

- BHP Billiton

- Caterpillar Inc.

- Doosan Corporation

- Dundee Precious Metals

- Epiroc AB

- Exxaro Resources

- First Quantum Minerals Ltd.

- Freeport-McMoRan Inc.

- Glencore PLC

- Jiangxi Copper Corporation Limited

- Komatsu Ltd.

- Liebherr

- Ma'aden (Saudi Arabian Mining Company)

- Rio Tinto Group

- Sandvik AB

- SANY Group

- Tata Steel Limited

- VALE S.A.

- Wheaton Precious Metals

Recent Developments

- In April 2025, the Government of India launched the National Critical Mineral Mission (NCMM) to strengthen self-reliance in the critical minerals sector essential for clean energy technologies. The NCMM aligns with India's climate ambitions, including lowering emissions intensity, expanding non-fossil fuel power capacity, and achieving net-zero emissions by 2070. The initiative aims to secure the country's critical mineral supply chains through exploration of domestic reserves and strategic acquisition of overseas assets.

(Source: https://www.pib.gov.in) - In June 2025, the Union Cabinet, chaired by Prime Minister Shri Narendra Modi, formally approved the NCMM with an allocation of ?16,300 crore and an anticipated investment of ?18,000 crore by PSUs and other stakeholders. Under the umbrella of the Atmanirbhar Bharat initiative, the government recognises the crucial role of critical minerals in high-tech industries, clean energy systems, and national defence. This mission represents a comprehensive, multi-year effort to address sectoral challenges and position India as a strategic leader in the production of critical minerals.

(Source: https://www.mining-technology.com)

(Source:https://www.pib.gov.in)

Segments Covered in the Report

By Mining Method

- Open-pit Mining

- Strip Mining

- Room and Pillar Mining

- Longwall Mining

- Cut and Fill Mining

- Placer Mining

- Quarrying

By Sustainable Technology

- Energy-efficient Comminution & Sorting

- Hydrometallurgical Processes

- Emission Reduction Systems

- Dust & Ventilation Management

- Water Recycling & Tailings Management

- Renewable Energy Integration

By Mineral Type

- Gold

- Silver

- Platinum Group Metals

- Copper

- Zinc

- Nickel

- Aluminum

- Lithium

- Cobalt

- Rare Earth Elements (Neodymium, Dysprosium)

- Coal

- Uranium

- Industrial Minerals (Limestone, Gypsum, Potash, Phosphate)

By Equipment Type

- Electric Haul Trucks

- Battery-Powered Drills

- Electric Excavators

- High-Efficiency Crushers

- Variable Frequency Drives

- LED Lighting Systems

- Closed-Loop Water Systems

- Waterless Drilling Techniques

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting