Hardcopy Peripherals and Printing Consumables Market Size and Forecast 2025 to 2034

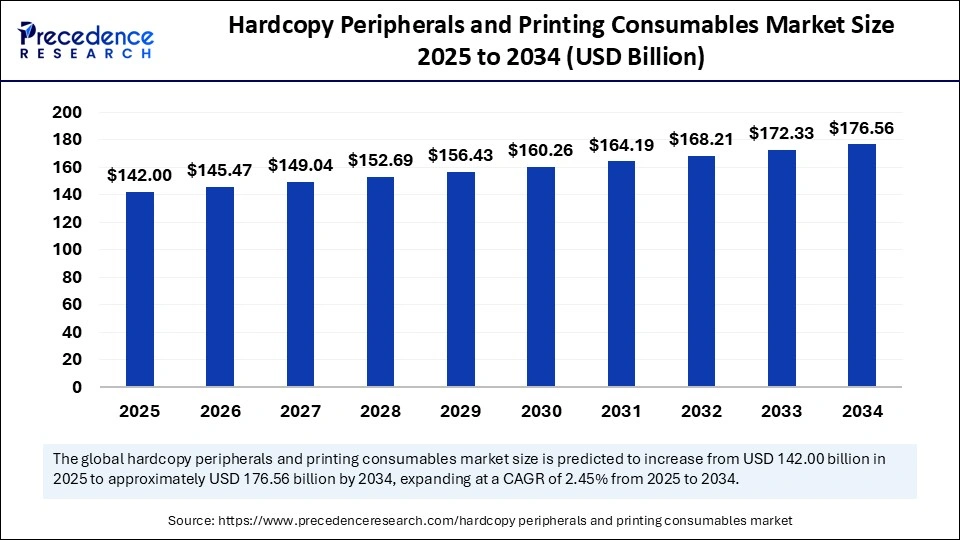

The global hardcopy peripherals and printing consumables market size accounted for USD 138.60 billion in 2024 and is predicted to increase from USD 142.00 billion in 2025 to approximately USD 176.56 billion by 2034, expanding at a CAGR of 2.45% from 2025 to 2034. The surge in demand for top-grade printing materials at work and at home is the key factor driving the growth of the market. Also, the increasing emphasis on subscription-based models coupled with the growing prevalence of remote work culture can fuel market growth further.

Hardcopy Peripherals and Printing Consumables Market Key Takeaways

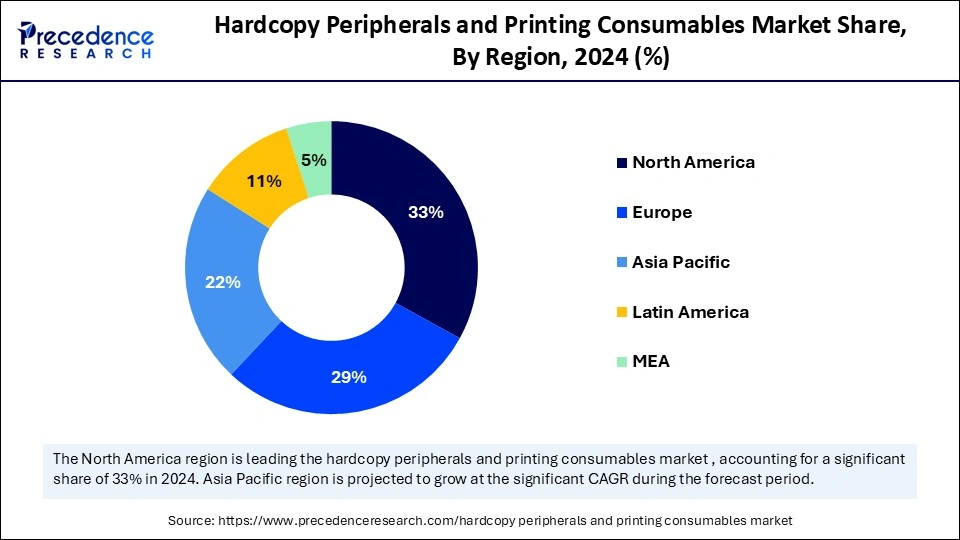

- North America dominated the market with the largest share of 33% in 2024.

- Asia Pacific is projected to grow at the fastest CAGR over the forecast period.

- By type, the printer segment dominated the market in 2024.

- By type, the multi-function devices segment is expected to grow at the fastest rate over the forecast period.

- By technology, the inkjet printers segment led the market in 2024.

- By technology, the laser technology segment is expected to grow at a significant rate over the forecast period.

- By consumables, the ink cartridges segment held the largest market share in 2024.

- By consumables, the toner cartridges segment is anticipated to grow at the fastest rate over the projected period.

- By end user, in 2024, the industrial segment dominated the market by holding the largest share.

- By end user, the commercial sector segment is estimated to grow at the fastest rate during the projected period.

Role of Artificial Intelligence (AI) in Hard Copy Printing

Artificial Intelligence plays a crucial role in hard copy printing by improving print quality, optimizing workflows, facilitating personalized experiences, and automating tasks, which can lead to decreased costs. Increased efficiency and enhanced customer satisfaction. Furthermore, AI algorithms can decide the most compatible printer for every task, optimizing resource utilization and balancing workloads.

- In September 2024, HP Inc. unveiled HP Print AI, the industry's first intelligent print experience designed to change how the world prints. HP Print AI's features make printing frictionless by eliminating common challenges from printer setup to support.

U.S. Hardcopy Peripherals and Printing Consumables Market Size and Growth 2025 to 2034

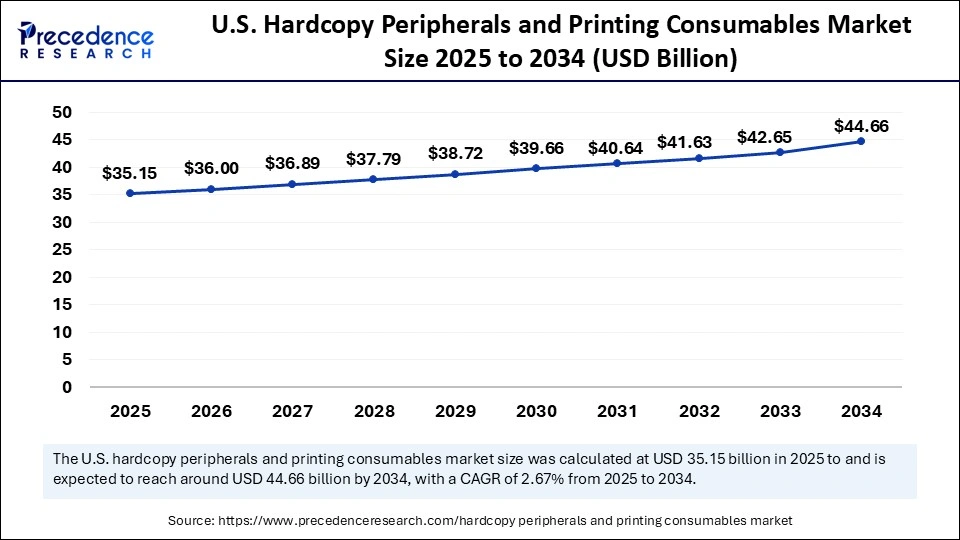

The U.S. hardcopy peripherals and printing consumables market size was exhibited at USD 34.30 billion in 2024 and is projected to be worth around USD 44.60 billion by 2034, growing at a CAGR of 2.67% from 2025 to 2034.

North America dominated the hardcopy peripherals and printing consumables market in 2024. The dominance of the region can be attributed to the presence of major market players in the region, coupled with the rapid adoption of innovative technology solutions. Moreover, the regional players are introducing eco-friendly consumables, like biodegradable inks and recycled paper, which aligns with customer preferences.

- In February 2024, HP launched a new range of OfficeJet Pro printers designed to meet the printing needs of small and medium businesses (SMBs) in India. The company claims that the latest line of printers offers convenient and durable printing solutions and helps businesses increase productivity even in remote work situations.

The U.S. Market Trends

In North America, the U.S. led the market owing to the well-developed manufacturing and distribution infrastructure for printing consumables and printers. Also, manufacturers and service providers in the country have the strong support of the government, which will impact positive market growth soon.

Asia Pacific is expected to experience the highest growth rate during the forecast period. This surge in the hardcopy peripherals and printing consumables market can be attributed to the increasing demand for digital printing solutions in developing nations like China and India. Furthermore, the increase in digital communications and remote work has propelled the demand for hardcopy materials in the region.

China Market Trends

In Asia Pacific, China dominated the hardcopy peripherals and printing consumables market. The dominance of the country is due to the rapidly increasing middle-class population, with the rapid adoption of technology across business and consumer segments, which fosters a huge demand for printing consumables and printers in the country.

Market Overview

The hardcopy peripherals and printing consumables market encompasses an extensive range of products such as multifunction devices, printers, and consumables like paper and cartridges. This market has experienced a substantial transformation in recent years, boosted by technological innovation, the increasing trend of digitalization across industries, and the need for high-quality printing. A crucial aspect of this industry is the printing process, which involves numerous stages from design to production.

Hardcopy Peripherals and Printing Consumables Market Growth Factors

- The increasing demand for personalized printing solutions is expected to boost market growth shortly.

- The growing utilization of printing consumables in organizations and educational institutes can propel market growth soon.

- The rising demand for digitally printed books will likely contribute to the market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 176.56 Billion |

| Market Size in 2025 | USD 142.00 Billion |

| Market Size in 2024 | USD 138.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.45% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, Consumables, End User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surge in the e-commerce sector

The expansion of the online and e-commerce retail sector is a major driver for the hardcopy peripherals and printing consumables market. There is an increasing need for organizations to print invoices, shipping labels, and promotional materials. This has fueled the demand for promising printing solutions that can handle high amounts of printed materials efficiently. In addition, the need for consumables such as packaging materials, labels, and promotional prints is increasing as retailers are capitalizing on the digital marketplace.

- In December 2024, The Virtual Foundry (TVF), a specialist in the bound metal 3D printing filaments category, introduced its Universal Metal Expansion strategy to make bound metal filament material extrusion 3D printing ubiquitous. As part of this plan, the Virtual Foundry signed a new distribution agreement with Bambu Lab, the renowned manufacturer of high-speed, user-friendly 3D printers.

Restraint

Growing shift towards digitalization

The major factor restraining the hardcopy peripherals and printing consumables market growth is the ongoing shift towards digitization. Many organizations are opting for electronic documents. This shift has led to a decrease in overall printing volumes. Moreover, environmental concerns associated with printing consumables have impelled consumers to search for more eco-friendly solutions.

Opportunity

Growing demand for high-grade printing solutions

The hardcopy peripherals and printing consumables market is witnessing a substantial surge in the demand for high-grade printing solutions. Organizations and consumers are increasingly becoming more dependent on innovative printing technologies that can create lucrative opportunities in the market. Furthermore, this trend is propelled by rising demand for professional prints in many sectors, such as education, healthcare, and advertising.

Type Insights

The printer segment dominated the hardcopy peripherals and printing consumables market in 2024. The dominance of the segment can be attributed to the growing demand for both commercial and personal printing solutions, which makes printers important tools across many sectors. Additionally, the printer segment is classified into two main types of multi-functional printers and standalone printers. Each of these types has different functions in various industries.

- In April 2024, Formlabs, the leader in 3D printing, unveiled the fastest, most reliable 3D printer for professionals with the launch of Form 4 and Form 4 B. The new flagship resin 3D printer sets a new standard for additive manufacturing with Formlabs' proprietary new Low Force Display™ (LFD) print engine.

The multi-function devices segment is projected to expand at the highest rate during the forecast period. The growth of the segment can be credited to the increasing shift toward multifunctionality, which is fueled by their space efficiency and versatility, convenient to both office and home users. Also, this device mainly combines printing, scanning, and copying in a single unit.

Technology Insights

The inkjet printer segment led the hardcopy peripherals and printing consumables market in 2024. The segment's dominance can be linked to its affordability and versatility, which appeal to both businesses and users. Inkjet printers use technologies such as drop-on-demand (DOD) and continuous inkjet (CIJ). These technologies provide cost-effectiveness and versatility for various applications, further impacting positive market expansion.

- In October 2024, Domino Printing Sciences (Domino) announced the introduction of a new, compact monochrome inkjet printer, the K300, to the Indian market. First introduced at Labelexpo Americas in September 2024, the K300 has been developed as a compact, flexible solution for converters looking to add variable data printing capabilities to analog printing lines.

The laser technology segment is expected to grow at a significant rate over the forecast period. The growth of the segment can be driven by the growing demand for high-grade and cost-efficient printing solutions, along with the surge of digital printing. In addition, laser printing technology is popular for its speed and capability to create clearer, sharper texts and graphics.

Consumables Insights

The ink cartridges segment held the largest hardcopy peripherals and printing consumables market share in 2024. The dominance of the segment is owing to the growing demand for color printing, which improves branding efforts and visual communications. Moreover, increasing environmental awareness can lead to the development of environmentally friendly ink technologies

The toner cartridges segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment is due to their increased use of offering high-quality print outputs. Furthermore, the increasing demand for high-quality printing in numerous applications such as catalogs, brochures, and signage is boosting the demand for toner cartridges over the study period.

End User Insights

- In 2024, the industrial segment dominated the hardcopy peripherals and printing consumables market by holding the largest share. The dominance of the segment can be linked to the increasing need for high-grade prints coupled with large-scale production. This segment encompasses printing for production and manufacturing, substrates, and applications such as labels, packaging, and product markings.

The commercial sector is projected to experience the highest growth rate during this period. The growth of the segment is because major market players are emphasizing manufacturing printed materials in huge quantities for marketing and business purposes, covering numerous technologies, regions, and applications.

Hardcopy Peripherals and Printing Consumables Market Companies

- HP Inc

- Epson

- Samsung Electronics

- Xerox Corporation

- Lexmark International

- Brother Industries

- Panasonic Corporation

- Canon Inc

- Sharp Corporation

- Pitney Bowes

- Ricoh Company

- Dell Technologies

Latest Announcement by Market Leaders

- In September 2024, Epson, a world leader in digital imaging and printing solutions, announced the launch of its latest campaign for EcoTank Printers featuring its brand ambassador, Rashmika Mandanna. The new campaign is focused on the core promise of hassle-free color printing at a very low cost.

- In September 2024, HP Inc. announced the company's newest innovations, including next-gen AI PCs, AI-enabled video conferencing solutions, and a scalable GPU performance-sharing solution for AI developers – all designed to transform the future of work.

Recent Developments

- In April 2024, Epson launched the new AM-C400 and AM-C550 MFP inkjet printers to offer better solutions for the A4 format market. These new products offer the energy-saving and productivity benefits of Epson's current inkjet printers but in a smaller A4 format.

- In February 2023, Seiko Epson Corporation announced two new inkjet print head models that support solvent inks in the first half of fiscal year 2023. The new I3200(8)-S1HD and S800-S1 are compatible with many inks used in industrial applications, in addition to water-based, UV-curable, and eco-soluble inks.

Segments Covered in the Report

By Type

- Printers

- Copiers

- Multi-Function Devices

- Scanners

By Technology

- Inkjet

- Laser

- Dot Matrix

- Thermal

By Consumables

- Ink Cartridges

- Toner Cartridges

- Paper

- Maintenance Kits

By End User

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content